In the competitive landscape of the uranium industry, two notable players stand out: Cameco Corporation (CCJ) and Ur-Energy Inc. (URG). Both companies operate in a sector that is increasingly pivotal to the global energy transition, yet they take different approaches to innovation and market engagement. While Cameco is a well-established leader with a robust operational framework, Ur-Energy focuses on niche projects in the U.S. As we delve deeper, I will help you determine which of these companies holds the most promise for your investment strategy.

Table of contents

Company Overview

Cameco Corporation Overview

Cameco Corporation (Ticker: CCJ) is a leading player in the uranium sector, dedicated to producing and selling uranium concentrate. With a market capitalization of approximately 38B, the company operates through two primary segments: Uranium and Fuel Services. The Uranium segment focuses on the exploration, mining, and milling of uranium, while the Fuel Services segment specializes in the refining, conversion, and fabrication of uranium for nuclear utilities across the Americas, Europe, and Asia. Incorporated in 1987 and headquartered in Saskatoon, Canada, Cameco plays a pivotal role in the nuclear energy supply chain, aiming to support the global transition to cleaner energy sources.

Ur-Energy Inc. Overview

Ur-Energy Inc. (Ticker: URG), with a market capitalization of around 458M, is a smaller but strategic player in the uranium industry. The company is primarily engaged in the acquisition, exploration, development, and operation of uranium mineral properties, with a focus on its flagship Lost Creek project in Wyoming. This project encompasses approximately 48,000 acres and reflects Ur-Energy’s commitment to sustainable resource management. Founded in 2004 and based in Littleton, Colorado, Ur-Energy is focused on advancing its projects to meet growing global uranium demand.

Key similarities and differences in their business models: Both companies operate in the uranium sector, focusing on production and exploration. However, Cameco is much larger, with a diversified business model that includes both mining and fuel services, while Ur-Energy is more concentrated on exploration and development of specific properties, notably in the U.S.

Income Statement Comparison

The following table compares the most recent income statements of Cameco Corporation (CCJ) and Ur-Energy Inc. (URG), highlighting key financial metrics for analysis.

| Metric | Cameco Corporation (CCJ) | Ur-Energy Inc. (URG) |

|---|---|---|

| Revenue | 3.14B | 33.71M |

| EBITDA | 789.34M | -59.97M |

| EBIT | 474.91M | -63.09M |

| Net Income | 171.85M | -53.19M |

| EPS | 0.40 | -0.17 |

Interpretation of Income Statement

In the latest fiscal year, Cameco Corporation (CCJ) demonstrated solid growth, with revenue increasing by approximately 21% year-over-year, contributing to a net income of 171.85M CAD. In contrast, Ur-Energy Inc. (URG) faced continued challenges, reporting negative figures across all key metrics, including a significant drop in revenue compared to the previous year. The gross margins and expenses indicate that while CCJ’s margins improved slightly, URG’s operational inefficiencies are a concern. The stark contrast in performance highlights the importance of evaluating both growth potential and risk management when considering investments in these companies.

Financial Ratios Comparison

The following table provides a comparative analysis of financial metrics for Cameco Corporation (CCJ) and Ur-Energy Inc. (URG), focusing on key ratios to help assess their financial health and operational efficiency.

| Metric | Cameco Corporation (CCJ) | Ur-Energy Inc. (URG) |

|---|---|---|

| ROE | 2.70% | -40.05% |

| ROIC | 3.79% | -36.01% |

| P/E | 187.01 | -13.06 |

| P/B | 5.05 | 5.35 |

| Current Ratio | 1.62 | 5.99 |

| Quick Ratio | 0.80 | 6.09 |

| D/E | 0.20 | 0.09 |

| Debt-to-Assets | 0.13 | 0.05 |

| Interest Coverage | 3.98 | 0.00 |

| Asset Turnover | 0.32 | 0.17 |

| Fixed Asset Turnover | 0.95 | 0.00 |

| Payout ratio | 40.52% | 0% |

| Dividend yield | 0.22% | 0% |

Interpretation of Financial Ratios

Cameco Corporation demonstrates solid performance metrics, particularly in ROE and interest coverage, indicating efficient use of equity and ability to manage debt. In contrast, Ur-Energy shows significant losses with negative margins, raising concerns about its operational viability. Its high current and quick ratios suggest liquidity, but overall financial health remains precarious. Investors should weigh these factors carefully when considering investments in these companies.

Dividend and Shareholder Returns

Cameco Corporation (CCJ) offers dividends with a payout ratio of 40.52% and a dividend yield of 2.17%, reflecting a trend of sustainable returns. The company also engages in share buybacks, enhancing shareholder value. In contrast, Ur-Energy Inc. (URG) does not pay dividends due to its negative net income and focus on reinvestment for growth. While CCJ’s distributions suggest a commitment to long-term value, URG’s strategy may align with future potential but carries inherent risks.

Strategic Positioning

Cameco Corporation (CCJ) holds a dominant market share in the uranium sector, leveraging its extensive operational capabilities and established relationships with nuclear utilities across multiple continents. The company’s market cap stands at 37.8B, reflecting strong investor confidence. In contrast, Ur-Energy Inc. (URG) is a smaller player with a market cap of 458M, focusing on domestic uranium projects. Both companies face competitive pressure from emerging technologies and fluctuating demand in the energy market, necessitating vigilance in strategic positioning and risk management.

Stock Comparison

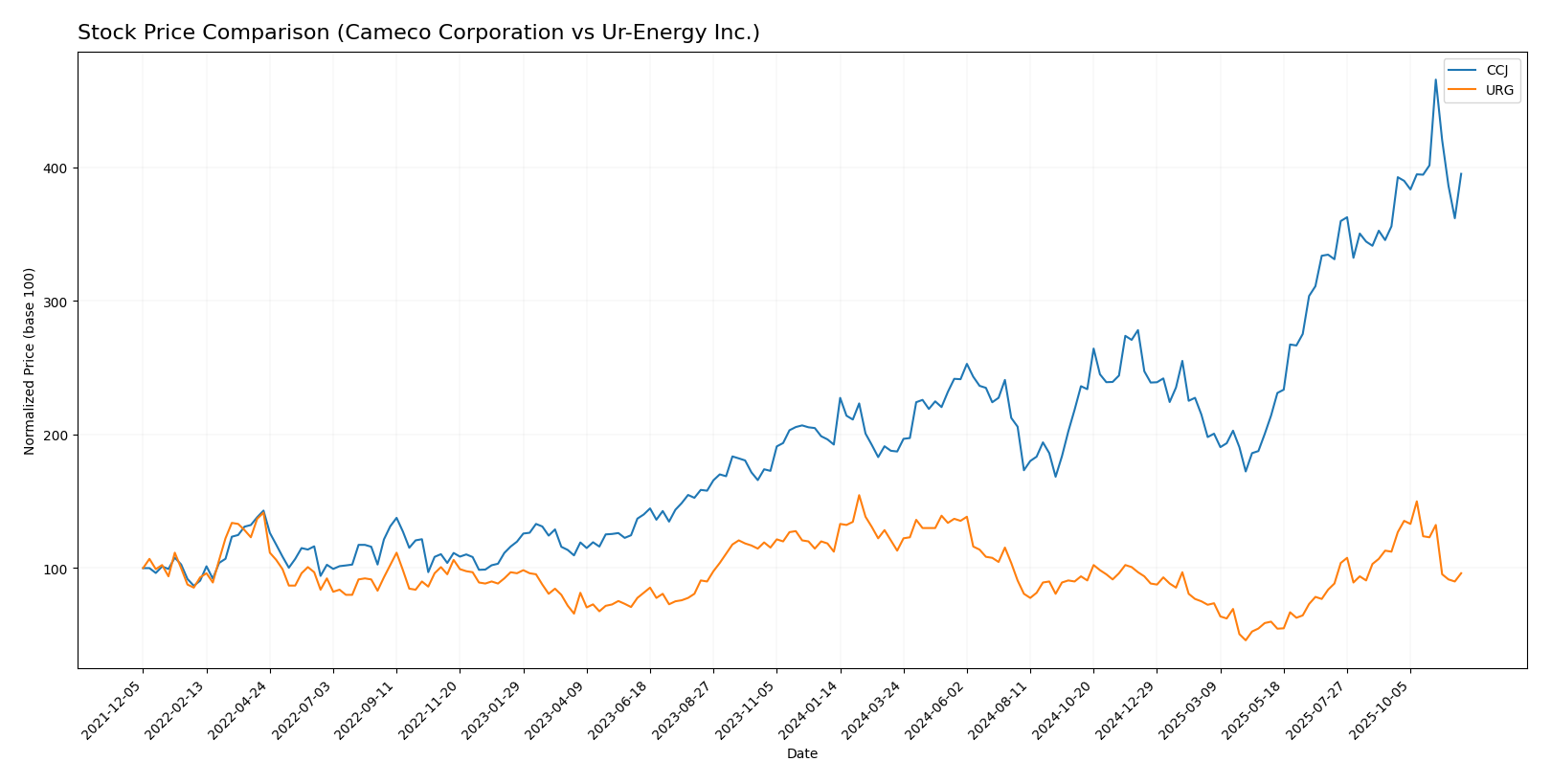

In this section, I will analyze the recent trading dynamics and price movements of Cameco Corporation (CCJ) and Ur-Energy Inc. (URG) over the past year, focusing on key trends and price changes.

Trend Analysis

Cameco Corporation (CCJ): Over the past year, CCJ has exhibited a remarkable price change of +105.28%, indicating a strong bullish trend. Throughout this period, the stock reached notable highs of 102.21 and lows of 36.96, showing signs of acceleration in its upward movement. The standard deviation of 15.32 highlights a moderate level of volatility, which is typical for a stock experiencing significant price increases.

Ur-Energy Inc. (URG): In contrast, URG has faced a downturn with a price change of -14.38%, marking a bearish trend. The stock’s highest price was 2.01, while it fell to a low of 0.60, reflecting a deceleration in its price movement. The standard deviation of 0.33 suggests low volatility, which aligns with the recent trend’s stability.

In summary, while CCJ shows a robust and accelerating bullish trend, URG is experiencing a notable bearish trend with signs of deceleration. Investors should consider these dynamics as they make portfolio decisions.

Analyst Opinions

Recent analyst recommendations indicate a cautious approach towards Cameco Corporation (CCJ) and Ur-Energy Inc. (URG). Analysts rate CCJ with a B-, suggesting a hold stance, supported by its decent return on assets and equity scores, despite lower price-to-earnings metrics. In contrast, URG receives a C-, indicating a sell recommendation due to weak performance across multiple financial metrics. Overall, the consensus for CCJ leans towards a buy, while URG is perceived as a sell for this year.

Stock Grades

I have reviewed the stock grades for Cameco Corporation (CCJ) and Ur-Energy Inc. (URG) and found reliable ratings from recognized grading companies.

Cameco Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | maintain | Outperform | 2025-11-13 |

| RBC Capital | maintain | Outperform | 2025-10-31 |

| Goldman Sachs | maintain | Buy | 2025-10-29 |

| RBC Capital | maintain | Outperform | 2025-08-01 |

| RBC Capital | maintain | Outperform | 2025-06-20 |

| GLJ Research | maintain | Buy | 2025-06-12 |

| Goldman Sachs | maintain | Buy | 2025-06-11 |

| GLJ Research | maintain | Buy | 2025-03-12 |

| RBC Capital | maintain | Outperform | 2025-03-04 |

| Scotiabank | maintain | Outperform | 2024-08-19 |

Ur-Energy Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | maintain | Buy | 2025-11-04 |

| B. Riley Securities | maintain | Buy | 2025-09-25 |

| Roth Capital | maintain | Buy | 2025-09-23 |

| HC Wainwright & Co. | maintain | Buy | 2025-04-15 |

| HC Wainwright & Co. | maintain | Buy | 2025-02-11 |

| Roth MKM | maintain | Buy | 2024-10-23 |

| B. Riley Securities | maintain | Buy | 2024-08-20 |

| HC Wainwright & Co. | maintain | Buy | 2024-08-14 |

| HC Wainwright & Co. | maintain | Buy | 2024-07-17 |

| Roth MKM | maintain | Buy | 2024-05-09 |

Overall, both companies show a strong trend of “Buy” and “Outperform” ratings, indicating positive sentiment among analysts. This suggests that both stocks may present good opportunities for investors looking to add to their portfolios. However, as always, I recommend careful consideration of your investment strategy and risk tolerance.

Target Prices

The current consensus among analysts for Cameco Corporation (CCJ) and Ur-Energy Inc. (URG) reflects positive outlooks for both companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cameco Corporation | 109 | 70 | 95.75 |

| Ur-Energy Inc. | 2.6 | 2.15 | 2.38 |

Analysts expect Cameco Corporation to have a target consensus of 95.75, which is significantly higher than its current price of 86.78. Ur-Energy Inc. shows a consensus of 2.38, also above its current price of 1.255, indicating a generally optimistic market sentiment towards both companies.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Cameco Corporation (CCJ) and Ur-Energy Inc. (URG) based on the most recent data.

| Criterion | Cameco Corporation (CCJ) | Ur-Energy Inc. (URG) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Positive (Net Margin: 5.48%) | Negative (Net Margin: -1.57%) |

| Innovation | High | Moderate |

| Global presence | Strong | Limited |

| Market Share | Significant | Niche |

| Debt level | Low (Debt to Equity: 0.20) | Very Low (Debt to Equity: 0.01) |

Key takeaways indicate that Cameco Corporation exhibits stronger profitability, a more extensive global presence, and significant market share compared to Ur-Energy Inc., which struggles with profitability but maintains a very low debt level.

Risk Analysis

In this section, I provide an overview of the potential risks associated with two companies in the uranium sector: Cameco Corporation and Ur-Energy Inc.

| Metric | Cameco Corporation (CCJ) | Ur-Energy Inc. (URG) |

|---|---|---|

| Market Risk | High | Medium |

| Regulatory Risk | Medium | High |

| Operational Risk | Medium | High |

| Environmental Risk | Medium | High |

| Geopolitical Risk | Medium | Medium |

Both companies face significant risks, particularly in regulatory and operational areas. Cameco’s stronger market position and diversified operations may mitigate some risks, while Ur-Energy’s high operational risk stems from its reliance on fewer projects and lower market capitalization.

Which one to choose?

In comparing Cameco Corporation (CCJ) and Ur-Energy Inc. (URG), key metrics suggest a clear distinction in their investment potential. CCJ shows a robust growth trend, boasting a market cap of approximately 32.14B CAD and a bullish stock trend with a 105.28% price increase over the past year. With a B- rating, solid profit margins (net profit margin of 5.48%), and a forward-looking strategy, it appears favorable for long-term investors. In contrast, URG, with a market cap of 365.31M USD, is struggling with a bearish trend and a C- rating, reflecting significant operational losses and negative margins.

Investors focusing on growth may prefer CCJ, while those prioritizing stability might consider other options. The primary risk for both companies lies within the competitive nature of the uranium sector, where market fluctuations can impact performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Cameco Corporation and Ur-Energy Inc. to enhance your investment decisions: