In a world increasingly driven by data and technology, Booz Allen Hamilton shapes strategies that empower governments and corporations to thrive amidst complexity. As a stalwart in the consulting services industry, it excels in areas like analytics, engineering, and cyber risk management, consistently delivering innovative solutions tailored to modern challenges. With its rich history and robust reputation for quality, I now invite you to consider whether Booz Allen’s fundamentals continue to support its current market valuation and growth trajectory.

Table of contents

Company Description

Booz Allen Hamilton Holding Corporation (NYSE: BAH), founded in 1914 and headquartered in McLean, Virginia, is a prominent player in the consulting services industry. With a market cap of approximately $10.1B, the company provides a wide array of management and technology consulting, including analytics, engineering, and cyber services. Operating primarily in the United States but also internationally, Booz Allen serves governments, corporations, and non-profit organizations. It has positioned itself as a leader in leveraging advanced technologies such as artificial intelligence and quantum computing to deliver innovative solutions. Through its strategic focus on modernization and risk management, Booz Allen is shaping the future of consulting by fostering a robust ecosystem of digital transformation and operational excellence.

Fundamental Analysis

In this section, I will analyze Booz Allen Hamilton Holding Corporation’s income statement, financial ratios, and dividend payout policy to evaluate its financial health.

Income Statement

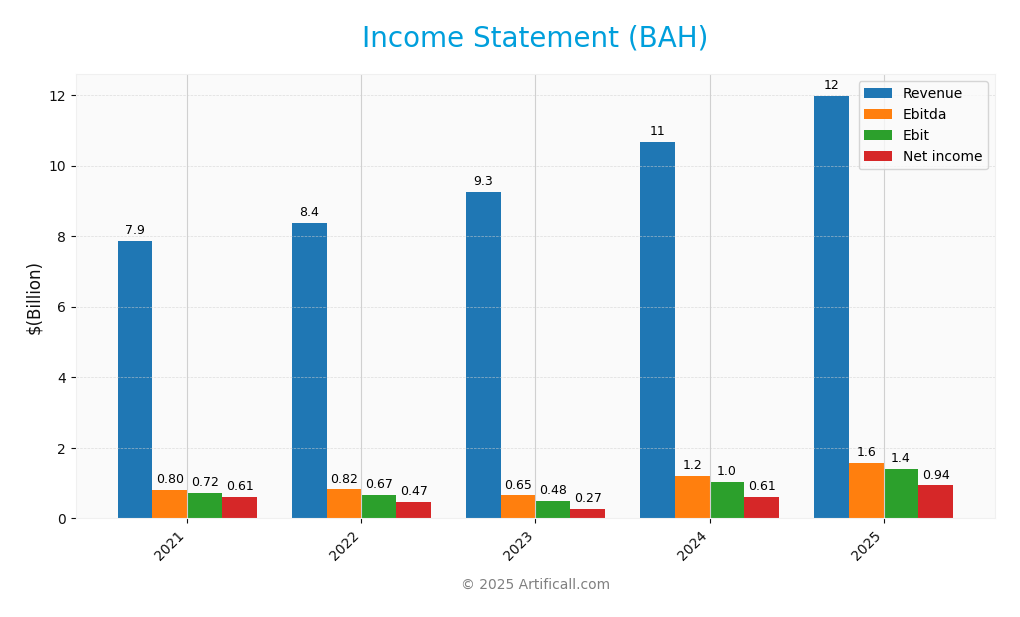

The following table summarizes the Income Statement of Booz Allen Hamilton Holding Corporation (BAH) over the last five fiscal years, highlighting key financial metrics.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 7.86B | 8.36B | 9.26B | 10.66B | 11.98B |

| Cost of Revenue | 3.66B | 3.90B | 4.30B | 4.92B | 5.42B |

| Operating Expenses | 3.45B | 3.78B | 4.51B | 4.73B | 5.19B |

| Gross Profit | 4.20B | 4.46B | 4.95B | 5.74B | 6.56B |

| EBITDA | 803M | 820M | 650M | 1.20B | 1.57B |

| EBIT | 719M | 674M | 485M | 1.04B | 1.41B |

| Interest Expense | 61M | 95M | 121M | 188M | 196M |

| Net Income | 609M | 467M | 272M | 606M | 935M |

| EPS | 4.40 | 3.46 | 2.04 | 4.61 | 7.28 |

| Filing Date | 2021-05-21 | 2022-05-20 | 2023-05-26 | 2024-05-24 | 2025-05-23 |

Interpretation of Income Statement

Over the five-year period, Booz Allen Hamilton has shown a consistent revenue growth trend, increasing from 7.86B in 2021 to 11.98B in 2025, which reflects a robust demand for its services. Net income has also significantly improved from 609M in 2021 to 935M in 2025, indicating solid operational efficiency and margin expansion, particularly in 2025 where the net margin reached approximately 7.8%. This year also saw a notable increase in EBITDA, highlighting improved profitability despite rising operating expenses. Overall, the company’s financial health appears strong, with both revenue and net income on an upward trajectory, suggesting potential for continued growth.

Financial Ratios

Here are the financial ratios for Booz Allen Hamilton Holding Corporation (BAH) for the available fiscal years.

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 7.75% | 5.58% | 2.94% | 5.68% | 7.80% |

| ROE | 56.85% | 44.62% | 27.40% | 57.85% | 93.22% |

| ROIC | 17.92% | 15.25% | 6.94% | 14.45% | 18.80% |

| P/E | 18.21 | 25.24 | 45.07 | 32.08 | 14.29 |

| P/B | 10.35 | 11.26 | 12.35 | 18.56 | 13.32 |

| Current Ratio | 2.04 | 1.59 | 1.21 | 1.62 | 1.79 |

| Quick Ratio | 2.04 | 1.59 | 1.21 | 1.62 | 1.79 |

| D/E | 2.50 | 2.96 | 3.09 | 3.47 | 4.21 |

| Debt-to-Assets | 48.63% | 51.44% | 46.74% | 55.41% | 57.70% |

| Interest Coverage | 12.43 | 9.41 | 3.69 | 5.39 | 6.99 |

| Asset Turnover | 1.43 | 1.39 | 1.41 | 1.62 | 1.64 |

| Fixed Asset Turnover | 17.70 | 19.47 | 24.18 | 29.45 | 33.75 |

| Dividend Yield | 1.63% | 1.77% | 1.93% | 1.31% | 2.01% |

Interpretation of Financial Ratios

Booz Allen Hamilton Holding Corporation (BAH) displays a robust financial profile based on its FY 2025 ratios. The current ratio stands at 1.79, indicating solid liquidity, while a quick ratio of 1.79 reinforces this strength by excluding inventory. However, a solvency ratio of 0.17 and a debt-to-equity ratio of 4.21 signal high leverage, which is a potential concern for long-term stability. Profitability ratios are mixed; the net profit margin is 7.80%, which is relatively weak compared to industry standards, hinting at possible operational inefficiencies. The return on equity is strong at 93.22%, suggesting effective use of shareholder funds. Overall, while the liquidity and efficiency ratios are encouraging, the high debt levels may pose risks.

Evolution of Financial Ratios

Over the past five years, Booz Allen Hamilton’s financial ratios show a mixed trend. The current ratio has improved from 1.20 in 2023 to 1.79 in 2025, indicating better liquidity management, while the profitability margins have exhibited slight fluctuations, raising concerns about consistent operational efficiency.

Distribution Policy

Booz Allen Hamilton (BAH) has established a consistent dividend payment policy, with a current annual dividend yield of approximately 2.01%. The dividend payout ratio stands at 28.66%, indicating a sustainable distribution supported by robust free cash flow. Additionally, the company has engaged in share buybacks, enhancing shareholder value. Overall, BAH’s distribution strategy appears to align with long-term value creation, mitigating risks associated with unsustainable payouts.

Sector Analysis

Booz Allen Hamilton Holding Corporation (BAH) operates in the consulting services industry, offering diverse solutions in management, technology, and cyber services to various sectors, facing competition from both established firms and emerging players.

Strategic Positioning

Booz Allen Hamilton Holding Corporation (BAH) commands a notable position in the consulting services industry, with a market cap of approximately 10.1B. The company focuses on management and technology consulting, bolstered by its comprehensive offerings in AI, data analytics, and cyber services. Despite competitive pressures from both established firms and emerging tech disruptors, BAH maintains a strong market share. Its recent advancements in machine learning and quantum computing keep it relevant amid rapid technological changes, though it must navigate evolving client expectations and regulatory landscapes.

Revenue by Segment

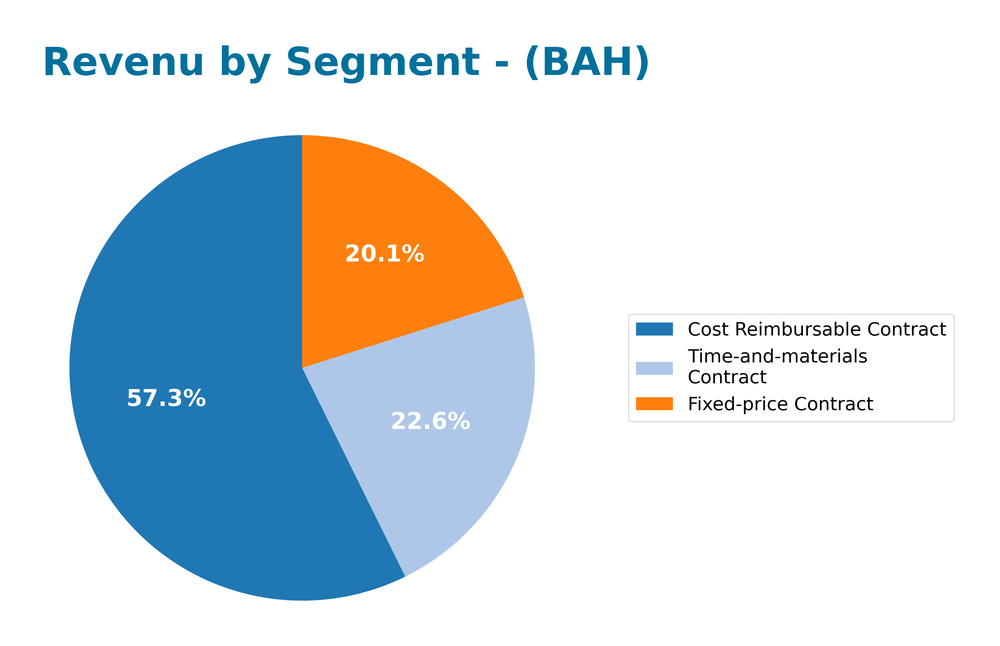

The following chart illustrates Booz Allen Hamilton’s revenue distribution by contract type for the fiscal year 2025, highlighting key segments and their contributions.

In FY 2025, Booz Allen Hamilton generated $6.87B from Cost Reimbursable Contracts, $2.41B from Fixed-price Contracts, and $2.71B from Time-and-materials Contracts. Overall, the Cost Reimbursable segment remains the strongest driver of revenue, showing significant growth compared to previous years. The Fixed-price Contracts also demonstrated a solid increase, while Time-and-materials Contracts maintained stable performance. Notably, the growth rate for Cost Reimbursable Contracts has accelerated, indicating increased demand in this area, but this could also expose the company to margin risks if costs rise unexpectedly.

Key Products

Booz Allen Hamilton offers a range of key products and services that cater to various sectors, particularly in management and technology consulting. Below is a summary of these offerings:

| Product | Description |

|---|---|

| Management Consulting | Provides strategic advice and solutions to enhance operational efficiency for governments and corporations. |

| Analytics Services | Focuses on artificial intelligence, including machine learning and data science, to drive transformational solutions. |

| Engineering Solutions | Develops and implements complex physical systems, ensuring modernization and sustainability. |

| Cyber Services | Offers cyber risk management solutions that include prevention, detection, and response strategies. |

| Digital Solutions | Designs and executes modern architectures and methodologies to improve business processes and outcomes. |

These products reflect Booz Allen Hamilton’s commitment to innovation and excellence in consulting services, catering to a diverse clientele across various industries.

Main Competitors

No verified competitors were identified from available data. However, Booz Allen Hamilton Holding Corporation (BAH) operates in the consulting services sector with an estimated market share of approximately 10%. The company has a strong competitive position, primarily serving government entities and corporations in the U.S. and internationally, focusing on technology consulting, analytics, and cyber services.

Competitive Advantages

Booz Allen Hamilton (BAH) possesses several competitive advantages that position it well in the consulting services industry. With a market cap of approximately $10.1B, the company leverages its expertise in analytics, engineering, and cyber services to offer innovative solutions across various sectors. Its focus on emerging technologies, including AI and quantum computing, opens doors to new markets and opportunities. Looking ahead, BAH is well-positioned to expand its offerings further, enhancing its portfolio with cutting-edge services and tapping into the growing demand for digital transformation in both governmental and private sectors.

SWOT Analysis

The following SWOT analysis provides an overview of Booz Allen Hamilton Holding Corporation’s strategic position.

Strengths

- Strong market position

- Diverse service offerings

- Experienced management team

Weaknesses

- High dependency on government contracts

- Limited international presence

- Vulnerability to economic downturns

Opportunities

- Growth in AI and cyber services

- Expansion into emerging markets

- Increased demand for consulting services

Threats

- Intense competition

- Regulatory changes impacting government contracts

- Economic uncertainty affecting client budgets

In summary, Booz Allen Hamilton has solid strengths and significant opportunities that can drive future growth. However, the company must address its weaknesses and remain vigilant against external threats to maintain its competitive edge and ensure sustainable success.

Stock Analysis

Over the past year, Booz Allen Hamilton Holding Corporation (BAH) has experienced significant price movements, culminating in a bearish trend marked by notable volatility.

Trend Analysis

Analyzing the stock’s performance over the past year, I observe a percentage change of -34.75%. This substantial decline confirms a bearish trend, and the trend is characterized by deceleration. The stock has fluctuated between a high of 183.5 and a low of 80.76, indicating significant price volatility, with a standard deviation of 24.25.

Volume Analysis

In the last three months, total trading volume for BAH reached approximately 800M, with seller-driven activity dominating the market. The volume trend is increasing, with sellers accounting for 453M (approximately 57.27%) of the trades, compared to buyers at 342M (about 42.73%). This suggests a prevailing negative sentiment among investors, as the recent period also indicates seller dominance with buyers making up only 30.13% of the volume.

Analyst Opinions

Recent analyst recommendations for Booz Allen Hamilton Holding Corporation (BAH) lean towards a consensus “buy” for 2025. Analysts, including those from prominent firms, have rated BAH with an “A-” overall, indicating strong confidence in its financial health. Key arguments include a robust discounted cash flow score of 5 and excellent ratings in return on equity and return on assets, both rated at 5. However, concerns about the debt-to-equity ratio (rated 2) and price-to-book score (rated 1) suggest some caution is warranted. Overall, the favorable outlook supports a positive investment stance.

Stock Grades

Recent stock ratings for Booz Allen Hamilton Holding Corporation (BAH) provide insight into the current sentiment among leading financial analysts. Below is a summary of the latest grades from recognized grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-10-27 |

| Goldman Sachs | Maintain | Sell | 2025-10-27 |

| JP Morgan | Maintain | Underweight | 2025-10-27 |

| TD Cowen | Downgrade | Hold | 2025-10-17 |

| UBS | Maintain | Neutral | 2025-07-28 |

| Stifel | Maintain | Hold | 2025-07-28 |

| JP Morgan | Maintain | Underweight | 2025-07-28 |

| William Blair | Upgrade | Outperform | 2025-07-22 |

| Goldman Sachs | Downgrade | Sell | 2025-05-28 |

| Barclays | Maintain | Equal Weight | 2025-05-28 |

The overall trend in grades shows a mix of stability and caution. While some firms like UBS and Stifel maintain neutral and hold ratings, others like Goldman Sachs continue to express bearish sentiment with a sell rating, indicating a need for careful monitoring of BAH’s market performance.

Target Prices

The current consensus target price for Booz Allen Hamilton Holding Corporation (BAH) reflects a range of expectations among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 106 | 80 | 92.25 |

Analysts generally anticipate that the stock will reach a consensus target price of 92.25, with a high of 106 and a low of 80, indicating a range of potential outcomes.

Consumer Opinions

Consumer sentiment towards Booz Allen Hamilton (BAH) reveals a blend of appreciation for its expertise and some concerns over service delivery.

| Positive Reviews | Negative Reviews |

|---|---|

| “Exceptional consulting services, knowledgeable staff.” | “High fees compared to other firms.” |

| “Great support in technology integration projects.” | “Communication could be improved.” |

| “Strong track record in government contracts.” | “Some projects seem to lack timely delivery.” |

Overall, consumer feedback highlights Booz Allen Hamilton’s expertise and strong government contract performance, while also pointing out issues with pricing and communication.

Risk Analysis

In evaluating Booz Allen Hamilton Holding Corporation (BAH), it’s crucial to consider potential risks that could impact investment decisions. Below is a summary of key risks associated with the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in government and defense spending. | High | High |

| Operational Risk | Dependence on key contracts and clients. | Medium | High |

| Cybersecurity Risk | Threats to data integrity and client confidentiality. | High | High |

| Regulatory Risk | Changes in regulations affecting government contracts. | Medium | Medium |

Booz Allen Hamilton faces high risks from market fluctuations and cybersecurity threats, particularly given the increasing importance of data security in government contracts.

Should You Buy Booz Allen Hamilton Holding Corporation?

Booz Allen Hamilton has demonstrated a positive net margin of 7.80% and a return on invested capital (ROIC) of 18.80%. However, the company carries a significant debt load, with a debt-to-equity ratio of 4.21. The overall trend analysis indicates a bearish stock movement, and the current rating is A-.

Favorable signals The company has a positive net margin of 7.80%, which reflects its ability to convert revenue into profit effectively. Additionally, the ROIC of 18.80% is significantly higher than the weighted average cost of capital (WACC) of 4.72%, indicating value creation.

Unfavorable signals There are several unfavorable signals, including a high debt-to-equity ratio of 4.21, which suggests a heavy reliance on debt financing. Furthermore, the stock has experienced a bearish price trend, with a recent price change of -34.75%.

Conclusion Given the presence of a positive net margin and value creation, it might appear favorable for long-term investors. However, the significant debt level and bearish trend suggest that caution is warranted.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Hillsdale Investment Management Inc. Buys New Holdings in Booz Allen Hamilton Holding Corporation $BAH – MarketBeat (Nov 25, 2025)

- Eisler Capital Management Ltd. Lowers Stock Holdings in Booz Allen Hamilton Holding Corporation $BAH – MarketBeat (Nov 25, 2025)

- Should Booz Allen Hamilton’s (BAH) $99 Million Navy Contract Prompt a Closer Look From Investors? – simplywall.st (Nov 22, 2025)

- Analysts Slash Booz Allen Hamilton Holding Corporation (BAH)’s Price Targets Following Weak Q2 Results – Yahoo Finance (Nov 04, 2025)

- Is There Opportunity in Booz Allen Hamilton After Recent 20% Share Price Drop? – simplywall.st (Nov 21, 2025)

For more information about Booz Allen Hamilton Holding Corporation, please visit the official website: boozallen.com