In the competitive landscape of application software, two companies stand out: Autodesk, Inc. (ADSK) and Bentley Systems, Incorporated (BSY). Both firms operate within the technology sector, focusing on innovative software solutions for design and engineering. Their overlapping markets—civil engineering and infrastructure development—make this comparison particularly relevant. As we delve into their performance and strategies, I’ll help you determine which company may be the more compelling investment choice for your portfolio.

Table of contents

Company Overview

Autodesk, Inc. Overview

Autodesk, Inc. is a leading provider of 3D design, engineering, and entertainment software solutions globally. Founded in 1982 and headquartered in San Rafael, California, Autodesk specializes in software applications tailored for industries such as architecture, engineering, and construction, as well as product design and manufacturing. Their flagship products include AutoCAD, BIM 360, and Fusion 360, which facilitate efficient and innovative design processes. With a market capitalization of approximately $65B and over 15K employees, Autodesk serves a diverse clientele through direct sales and a robust reseller network.

Bentley Systems, Incorporated Overview

Bentley Systems, Incorporated, established in 1984 and based in Exton, Pennsylvania, offers comprehensive infrastructure engineering software solutions. Their product portfolio includes applications for infrastructure design and simulation, such as MicroStation and OpenRoads. Bentley emphasizes collaboration and project delivery through systems like ProjectWise, appealing to civil engineers, planners, and contractors worldwide. With a market cap of around $12B and a workforce of approximately 5.5K employees, Bentley Systems demonstrates a strong commitment to enhancing infrastructure projects globally.

Key Similarities and Differences

Both Autodesk and Bentley Systems operate within the software application industry, focusing on engineering and design solutions. However, Autodesk primarily targets a broader range of industries, including entertainment, while Bentley focuses specifically on infrastructure engineering. Their business models differ in customer engagement, with Autodesk leveraging both direct sales and reseller networks, whereas Bentley emphasizes collaboration and project delivery systems tailored for infrastructure projects.

Income Statement Comparison

The following table compares the Income Statements of Autodesk, Inc. (ADSK) and Bentley Systems, Incorporated (BSY) for their most recent fiscal years, providing insight into their financial performance.

| Metric | Autodesk, Inc. | Bentley Systems, Inc. |

|---|---|---|

| Revenue | 6.13B | 1.35B |

| EBITDA | 1.55B | 382M |

| EBIT | 1.37B | 318M |

| Net Income | 1.11B | 235M |

| EPS | 5.17 | 0.75 |

Interpretation of Income Statement

In the most recent fiscal year, Autodesk experienced robust growth in both revenue and net income, reflecting a solid increase of approximately 12.7% in revenue from the previous year. This growth is accompanied by stable margins, with EBITDA margin remaining healthy. Bentley Systems also demonstrated growth, with revenue increasing by about 10% year-over-year, but the net income margin has seen slight fluctuations, indicating some pressure on profitability. Overall, Autodesk’s results indicate stronger momentum compared to Bentley’s more moderate performance, highlighting the need for cautious investment decisions based on individual company trajectories.

Financial Ratios Comparison

The table below presents a comparative analysis of key financial ratios for Autodesk, Inc. (ADSK) and Bentley Systems, Incorporated (BSY) based on the latest available data.

| Metric | Autodesk (ADSK) | Bentley Systems (BSY) |

|---|---|---|

| ROE | 42.43% | 22.55% |

| ROIC | 18.01% | 9.30% |

| P/E | 60.20 | 62.63 |

| P/B | 25.54 | 14.13 |

| Current Ratio | 0.68 | 0.54 |

| Quick Ratio | 0.68 | 0.54 |

| D/E | 0.98 | 1.37 |

| Debt-to-Assets | 23.62% | 41.96% |

| Interest Coverage | N/A | 12.20 |

| Asset Turnover | 0.57 | 0.40 |

| Fixed Asset Turnover | 21.44 | 20.47 |

| Payout Ratio | 0% | 30.72% |

| Dividend Yield | 0% | 0.49% |

Interpretation of Financial Ratios

Both companies exhibit strong performance in specific areas. Autodesk shows superior returns on equity (ROE) and invested capital (ROIC), indicating effective management of resources. However, its high P/E and P/B ratios suggest that it may be overvalued relative to its earnings. Bentley Systems, while having a lower ROE and ROIC, has a more manageable debt-to-equity ratio and offers a dividend yield, which may appeal to income-focused investors. Caution is advised, particularly regarding Autodesk’s high valuation metrics.

Dividend and Shareholder Returns

Autodesk, Inc. (ADSK) does not pay dividends, opting instead to reinvest profits for growth, evidenced by a consistent free cash flow coverage ratio. However, it actively engages in share repurchase programs, which can enhance shareholder value if executed prudently.

On the other hand, Bentley Systems, Incorporated (BSY) maintains a modest dividend payout ratio of 18% with a yield of 0.49%, suggesting a balanced approach between rewarding shareholders and supporting growth initiatives. This dual strategy could foster sustainable long-term value creation for investors.

Strategic Positioning

Autodesk (ADSK) commands a significant market share in the 3D design and engineering software sector, boasting a market cap of approximately $65B. Its competitive edge lies in its extensive product suite and innovative solutions, like AutoCAD and Fusion 360. Bentley Systems (BSY), valued at around $12B, faces challenges from Autodesk’s technological advancements while focusing on infrastructure engineering software. Both companies are navigating a landscape marked by rapid technological disruption and increasing competitive pressure, necessitating agility and strategic innovation.

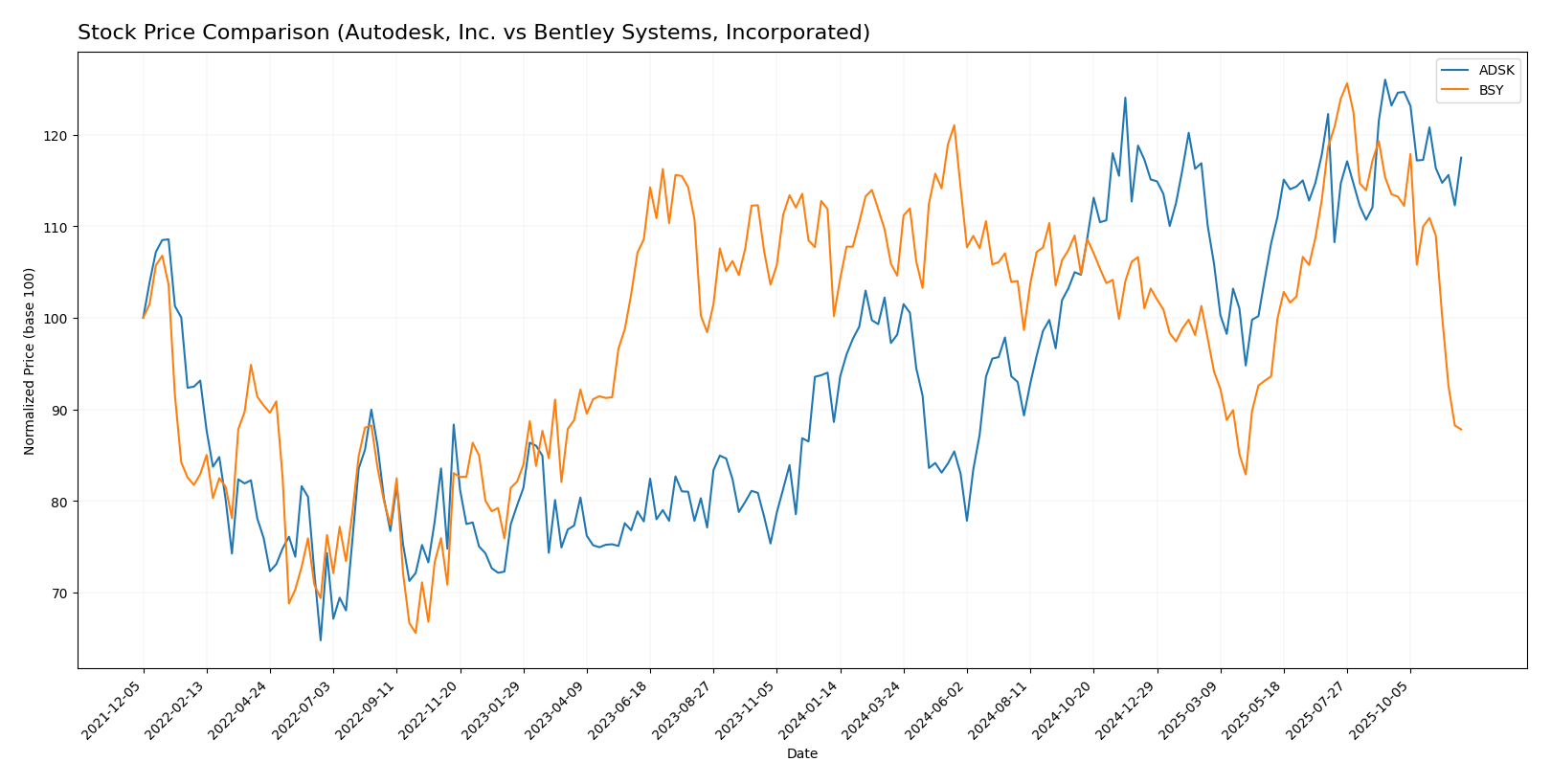

Stock Comparison

In this section, I will analyze the weekly stock price movements and trading dynamics of Autodesk, Inc. (ADSK) and Bentley Systems, Incorporated (BSY) over the past year, highlighting key price fluctuations and trends.

Trend Analysis

For Autodesk, Inc. (ADSK), the overall trend over the past year shows a price increase of 32.58%, indicating a bullish trend. The stock reached a notable high of $326.37 and a low of $201.60. However, in the recent period from September 14, 2025, to November 30, 2025, there has been a decline of -4.62%, with a standard deviation of 10.35, suggesting some volatility. The trend is currently showing deceleration.

On the other hand, Bentley Systems, Incorporated (BSY) has experienced a price decrease of -12.35% over the past year, reflecting a bearish trend. The stock’s highest price was $58.59, while it dropped to a low of $38.66. In the recent analysis period from September 14, 2025, to November 30, 2025, BSY’s price has further declined by -22.63%, with a standard deviation of 4.64, indicating lower volatility compared to ADSK. The trend for BSY is also in a state of deceleration.

In summary, ADSK appears to be in a stronger position with a notable increase over the year, despite recent declines, while BSY is facing a significant downward trend.

Analyst Opinions

Recent recommendations for Autodesk, Inc. (ADSK) indicate a “Buy” rating with analysts highlighting strong return on equity and assets as key strengths. The overall score of 3 reflects solid fundamentals. Similarly, Bentley Systems, Incorporated (BSY) received a “Hold” rating, with a score of B-, suggesting investors should be cautious due to mixed performance indicators. Currently, the consensus leans towards a “Buy” for ADSK, while BSY is seen as a more neutral position.

Stock Grades

Recent stock ratings for Autodesk, Inc. (ADSK) and Bentley Systems, Incorporated (BSY) indicate a generally positive outlook, particularly for Autodesk, which has received several upgrades.

Autodesk, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Deutsche Bank | upgrade | Buy | 2025-11-26 |

| Rosenblatt | maintain | Buy | 2025-11-26 |

| Rosenblatt | maintain | Buy | 2025-11-24 |

| Baird | maintain | Outperform | 2025-11-18 |

| Citigroup | maintain | Buy | 2025-11-14 |

| RBC Capital | maintain | Outperform | 2025-10-06 |

| HSBC | upgrade | Buy | 2025-10-01 |

| Morgan Stanley | maintain | Overweight | 2025-09-02 |

| Citigroup | maintain | Buy | 2025-09-02 |

| B of A Securities | maintain | Neutral | 2025-08-29 |

Bentley Systems, Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | maintain | Outperform | 2025-11-06 |

| Piper Sandler | maintain | Overweight | 2025-11-06 |

| JP Morgan | maintain | Neutral | 2025-11-06 |

| Rosenblatt | maintain | Buy | 2025-11-06 |

| Rosenblatt | upgrade | Buy | 2025-10-17 |

| Goldman Sachs | maintain | Sell | 2025-08-07 |

| Rosenblatt | downgrade | Neutral | 2025-08-07 |

| Piper Sandler | maintain | Overweight | 2025-08-07 |

| UBS | maintain | Neutral | 2025-08-07 |

| Oppenheimer | maintain | Outperform | 2025-08-07 |

In summary, Autodesk is showing a strong upward trend with multiple upgrades to “Buy,” reflecting positive sentiment among analysts. Meanwhile, Bentley Systems has maintained stable grades, indicating a steady outlook but with some mixed signals.

Target Prices

The consensus target prices for Autodesk, Inc. and Bentley Systems, Incorporated reflect optimistic projections from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Autodesk, Inc. (ADSK) | 400 | 343 | 373.4 |

| Bentley Systems, Inc. (BSY) | 64 | 57 | 60.5 |

Analysts expect Autodesk’s shares to reach a consensus target of 373.4, significantly higher than its current price of 303.79, indicating strong potential upside. Meanwhile, Bentley Systems has a target consensus of 60.5, which also suggests a positive outlook compared to its current price of 41.09.

Strengths and Weaknesses

Below is a comparative analysis of the strengths and weaknesses of Autodesk, Inc. (ADSK) and Bentley Systems, Incorporated (BSY):

| Criterion | Autodesk, Inc. | Bentley Systems, Inc. |

|---|---|---|

| Diversification | Strong product range across industries | Focused on infrastructure engineering solutions |

| Profitability | High net profit margin (18.1%) | Moderate net profit margin (17.4%) |

| Innovation | Leader in design software innovation | Strong in infrastructure modeling technology |

| Global presence | Established in multiple global markets | Broad reach, strong in Americas and Europe |

| Market Share | Significant share in design software | Growing presence in infrastructure software |

| Debt level | Moderate debt-to-equity ratio (0.98) | Higher debt-to-equity ratio (1.37) |

Key takeaways indicate that Autodesk has a well-diversified product line and a solid profitability margin, while Bentley Systems is specialized but has a higher debt level. Investors should carefully weigh these factors against their risk tolerance when considering these companies.

Risk Analysis

The following table summarizes the key risks associated with Autodesk, Inc. (ADSK) and Bentley Systems, Incorporated (BSY) as of the latest fiscal year.

| Metric | Autodesk, Inc. (ADSK) | Bentley Systems, Incorporated (BSY) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market volatility, particularly Autodesk, which operates in a highly competitive tech sector. Regulatory pressures are also pronounced for both firms, particularly in the context of data privacy and environmental standards, impacting operational flexibility.

Which one to choose?

In comparing Autodesk, Inc. (ADSK) and Bentley Systems, Incorporated (BSY), I find that Autodesk shows stronger fundamentals. ADSK boasts a higher gross profit margin of 90.6% against BSY’s 80.9%, and its return on equity is notably higher at 42.4% compared to BSY’s 22.6%. While ADSK’s price-to-earnings ratio stands at 60.2, BSY’s is slightly lower at 62.6, indicating that both stocks are valued at a premium, but Autodesk seems to offer better growth potential.

Analysts give Autodesk a solid rating of B, while Bentley has a slightly lower B- rating. The recent stock trend for ADSK is bullish with a 32.6% increase, whereas BSY’s trend is bearish with a decline of 12.4%.

Investors focused on growth may prefer Autodesk, while those prioritizing stability might consider Bentley Systems. However, be cautious of potential risks related to market dependence and competition in the software sector.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Autodesk, Inc. and Bentley Systems, Incorporated to enhance your investment decisions: