In the dynamic landscape of industrial automation and machinery, two notable players emerge: ATS Corporation and Columbus McKinnon Corporation. While both companies operate within the industrial sector, they cater to different niches—ATS focuses on automation solutions, whereas Columbus McKinnon excels in material handling technologies. This comparison will explore their innovation strategies, market overlaps, and potential for growth. As an investor, understanding which company aligns best with your portfolio objectives is vital, and I aim to guide you in making that determination.

Table of contents

Company Overview

ATS Corporation Overview

ATS Corporation, headquartered in Cambridge, Canada, specializes in automation solutions globally. Founded in 1978, the company has cemented its position in the industrial machinery sector by offering comprehensive services, including the planning, designing, and commissioning of automated manufacturing systems. ATS focuses on a range of industries, such as life sciences, transportation, and food and beverage, providing tailored solutions that enhance operational efficiency. The firm has also expanded its offerings to include digital solutions, leveraging real-time data to optimize processes and minimize equipment downtime. With a market cap of 2.51B USD and a robust workforce of 7,500 employees, ATS is committed to driving innovation in automation.

Columbus McKinnon Corporation Overview

Columbus McKinnon Corporation, based in Buffalo, New York, has been a key player in the agricultural machinery industry since 1875. The company designs and manufactures intelligent motion solutions to facilitate the ergonomic movement, lifting, and securing of materials. Their portfolio includes a wide array of products, such as hoists, crane systems, and material handling solutions, catering to diverse sectors, including transportation, energy, and life sciences. With a market cap of 475M USD and approximately 3,515 employees, Columbus McKinnon emphasizes safety and efficiency in its operations, making it a trusted name in motion technology.

Key similarities between ATS and Columbus McKinnon include their focus on industrial applications and the provision of tailored solutions to enhance efficiency. However, they differ in their core areas of expertise, with ATS centered on automation systems and Columbus McKinnon specializing in motion solutions and material handling equipment.

Income Statement Comparison

The following table summarizes the most recent income statement metrics for ATS Corporation and Columbus McKinnon Corporation, allowing for a comparative analysis of their financial performance.

| Metric | ATS Corporation | Columbus McKinnon Corporation |

|---|---|---|

| Revenue | 2.53B | 963M |

| EBITDA | 168M | 75M |

| EBIT | 15M | 27M |

| Net Income | -28M | -5M |

| EPS | -0.29 | -0.18 |

Interpretation of Income Statement

Over the recent fiscal period, ATS Corporation experienced a decline in revenue from 3.03B in 2024 to 2.53B in 2025, reflecting a significant downturn. Concurrently, its net income transitioned from a profit of 193.7M to a loss of 28M, indicating substantial margin compression. Columbus McKinnon Corporation also faced challenges, with revenues slightly decreasing from 1.01B to 963M. Despite this, its net losses were smaller relative to its size, suggesting better relative stability. Overall, both companies displayed declining performance, with ATS facing a sharper deterioration in margins and profitability.

Financial Ratios Comparison

The table below compares the most recent financial ratios of ATS Corporation (ATS) and Columbus McKinnon Corporation (CMCO). This can help you assess their financial health and operational efficiency.

| Metric | ATS | CMCO |

|---|---|---|

| ROE | -1.64% | -0.58% |

| ROIC | 0.09% | 3.30% |

| P/E | -125.28 | -94.69 |

| P/B | 2.06 | 0.55 |

| Current Ratio | 1.69 | 1.81 |

| Quick Ratio | 1.41 | 1.04 |

| D/E | 0.99 | 0.61 |

| Debt-to-Assets | 0.37 | 0.31 |

| Interest Coverage | 0.09 | 1.68 |

| Asset Turnover | 0.55 | 0.55 |

| Fixed Asset Turnover | 5.66 | 9.07 |

| Payout Ratio | 0% | -156.52% |

| Dividend Yield | 0% | 1.65% |

Interpretation of Financial Ratios

ATS displays concerning financial health, indicated by negative ROE and P/E ratios, reflecting losses. The current and quick ratios suggest adequate liquidity, but the high debt-to-equity ratio raises red flags. In contrast, CMCO shows better profitability and efficiency, with positive returns on invested capital and equity, though still facing challenges with debt levels and profitability margins. Investors should proceed cautiously with ATS, while CMCO appears comparatively stronger but still has areas requiring attention.

Dividend and Shareholder Returns

ATS Corporation does not pay dividends, and its focus appears to be on reinvestment and growth, as indicated by the negative net income. The company engages in share buybacks, which may enhance shareholder value, yet caution is warranted given its financial metrics. Columbus McKinnon Corporation, however, offers a modest dividend yield of 1.65% and a payout ratio of approximately 17%, reflecting a sustainable approach to returning capital. Both strategies could foster long-term shareholder value, albeit with varying degrees of risk and potential.

Strategic Positioning

ATS Corporation and Columbus McKinnon Corporation operate in the industrial machinery sector, yet they focus on different niches within it. ATS, with a market cap of 2.5B, specializes in automation solutions, holding a significant market share among life sciences and consumer products. Conversely, CMCO, valued at 475M, is a key player in intelligent motion solutions and material handling, facing competitive pressure from emerging technologies and evolving market demands. Both companies must navigate technological disruptions to maintain their competitive edge.

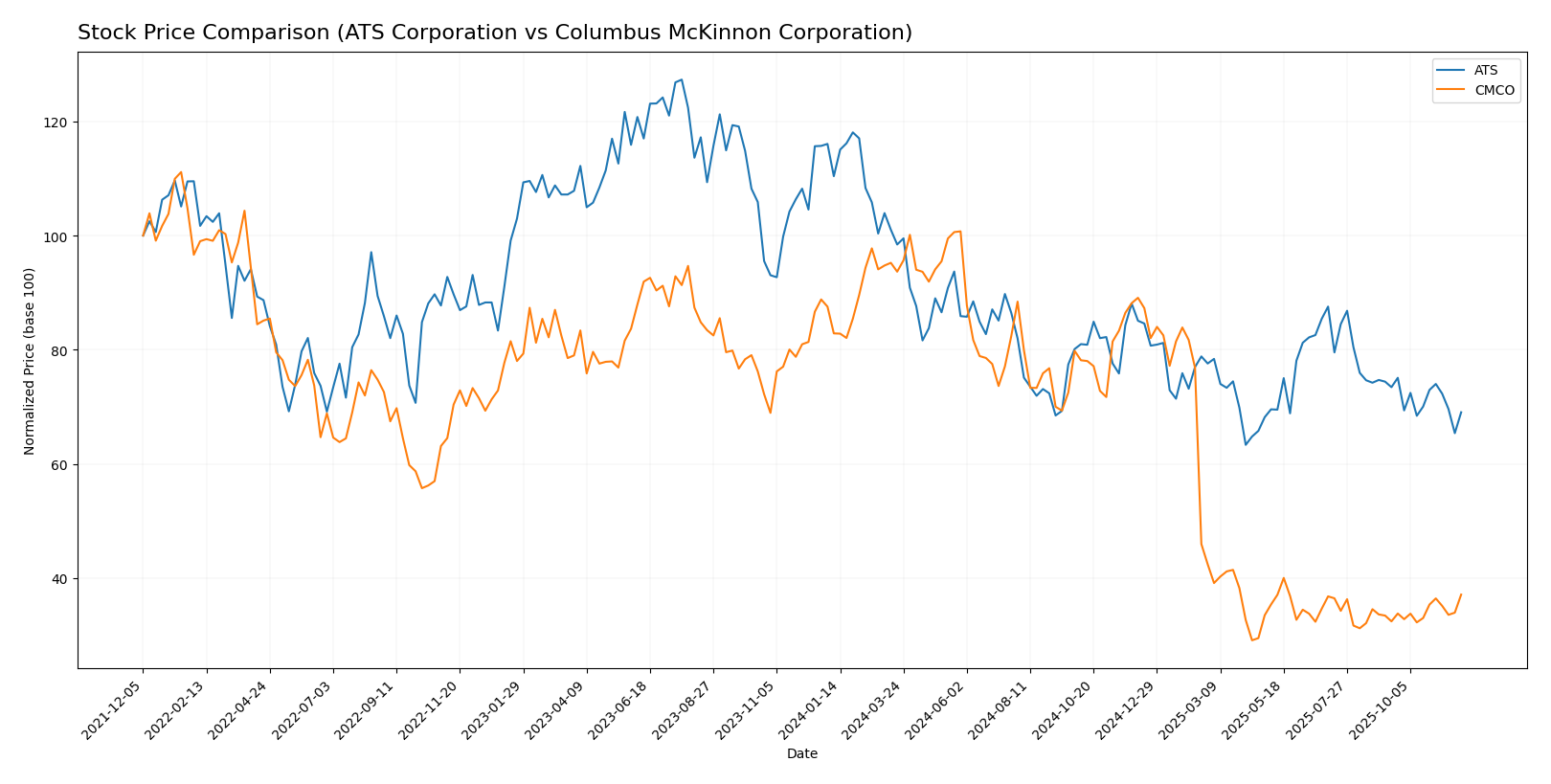

Stock Comparison

The stock price performance of ATS Corporation and Columbus McKinnon Corporation over the past year has been marked by significant declines, reflecting broader market dynamics and company-specific challenges.

Trend Analysis

ATS Corporation (ATS) has experienced a price change of -37.47% over the past year, indicating a bearish trend. The stock’s highest price was 43.82, while the lowest was 23.5, showing notable volatility with a standard deviation of 4.44. In the recent analysis from September 14 to November 30, 2025, the price further declined by -5.98%, with a standard deviation of 1.0, suggesting a deceleration in the downward trend.

Columbus McKinnon Corporation (CMCO) has faced a larger decline of -55.24% over the past year, also confirming a bearish trend. The stock hit a high of 44.9 and a low of 12.96, with a higher volatility indicated by a standard deviation of 11.25. However, in the recent period from September 14 to November 30, 2025, CMCO’s price saw a rebound of 14.47%, with a standard deviation of 0.67, indicating a slight acceleration in its recovery.

Both stocks exhibit significant bearish trends, but CMCO shows early signs of a potential recovery, while ATS continues to face challenges.

Analyst Opinions

Recent analyst recommendations for ATS Corporation (ATS) indicate a cautious stance, with a rating of “C” reflecting concerns over its return on equity and assets. Analysts suggest a hold position, mainly due to its underwhelming financial metrics. In contrast, Columbus McKinnon Corporation (CMCO) has garnered a more favorable “B+” rating, with analysts recommending a buy based on strong discounted cash flow and price-to-book ratios. Currently, the consensus leans toward a buy for CMCO, while ATS is viewed more neutrally.

Stock Grades

In this section, I will present the latest stock grades for ATS Corporation and Columbus McKinnon Corporation, based on reliable data from recognized grading companies.

ATS Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Neutral | 2024-08-13 |

| Goldman Sachs | Maintain | Sell | 2024-08-13 |

| JP Morgan | Maintain | Neutral | 2024-05-24 |

Columbus McKinnon Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Downgrade | Neutral | 2025-02-11 |

| DA Davidson | Maintain | Buy | 2024-02-05 |

| DA Davidson | Maintain | Buy | 2022-10-04 |

| DA Davidson | Maintain | Buy | 2022-10-03 |

| Barrington Research | Maintain | Outperform | 2022-07-29 |

| Barrington Research | Maintain | Outperform | 2022-07-28 |

| JP Morgan | Downgrade | Neutral | 2022-05-26 |

| Barrington Research | Maintain | Outperform | 2022-05-26 |

| JP Morgan | Downgrade | Neutral | 2022-05-25 |

Overall, ATS Corporation’s grades indicate a stable outlook with a consistent neutral rating, while Columbus McKinnon Corporation has experienced a recent downgrade to neutral, suggesting a shift in investor sentiment. This reflects a cautious approach to CMCO’s stock performance moving forward.

Target Prices

Currently, reliable target price data is available for both ATS Corporation and Columbus McKinnon Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| ATS Corporation (ATS) | 34 | 34 | 34 |

| Columbus McKinnon Corporation (CMCO) | 50 | 48 | 49 |

The consensus target price for ATS Corporation suggests a strong outlook at $34, which is significantly above its current price of $25.62. For Columbus McKinnon, the consensus of $49 indicates positive expectations compared to its current price of $16.53, reflecting substantial growth potential.

Strengths and Weaknesses

Below is a comparative overview of the strengths and weaknesses of ATS Corporation and Columbus McKinnon Corporation.

| Criterion | ATS Corporation | Columbus McKinnon Corporation |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Low (negative margins) | Moderate (positive margins) |

| Innovation | High | Moderate |

| Global presence | Moderate | High |

| Market Share | Moderate | High |

| Debt level | Moderate | High |

Key takeaways from the table indicate that while ATS excels in innovation, its profitability remains weak. Conversely, Columbus McKinnon showcases a stronger market presence and profitability, making it a compelling option for investors seeking stability.

Risk Analysis

The table below outlines the primary risks associated with ATS Corporation and Columbus McKinnon Corporation.

| Metric | ATS Corporation | Columbus McKinnon Corporation |

|---|---|---|

| Market Risk | Medium | High |

| Regulatory Risk | Medium | Medium |

| Operational Risk | High | Medium |

| Environmental Risk | Low | Medium |

| Geopolitical Risk | Medium | High |

In summary, ATS faces significant operational risks, particularly related to its automation solutions, while Columbus McKinnon is exposed to higher market and geopolitical risks, which could impact its market competitiveness. Recent supply chain disruptions and regulatory changes further amplify these concerns.

Which one to choose?

In comparing ATS Corporation (ATS) and Columbus McKinnon Corporation (CMCO), several key factors emerge. ATS has struggled with profitability, evidenced by a negative net profit margin (-1.1%) and a bearish stock trend, down 37.47% over the past year. Its rating sits at a “C,” indicating potential concerns regarding financial health. Conversely, CMCO, rated “B+,” shows a healthier gross profit margin (33.8%) and experienced a recent stock price increase of 14.47%. CMCO’s debt-to-equity ratio is moderate (0.61), and its market cap stands at $486M.

For growth-oriented investors, CMCO may offer more attractive prospects, while those who value stability might find ATS’s lower market cap and recent struggles concerning. However, both companies face risks related to intense industry competition and fluctuating market conditions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of ATS Corporation and Columbus McKinnon Corporation to enhance your investment decisions: