In the fast-evolving landscape of technology, Ambarella, Inc. (AMBA) and MicroVision, Inc. (MVIS) stand out as two innovative companies within the semiconductor and hardware industries, respectively. Both firms are at the forefront of developing advanced solutions that cater to emerging markets like autonomous vehicles and augmented reality. This comparison delves into their distinct innovation strategies and market overlaps, helping you, the investor, determine which company presents the most promising opportunity for your portfolio.

Table of contents

Company Overview

Ambarella, Inc. Overview

Ambarella, Inc. is a leading developer of semiconductor solutions specializing in video compression, image processing, and artificial intelligence. Founded in 2004 and headquartered in Santa Clara, CA, the company has carved a niche in high-definition (HD) and ultra HD video technology. Ambarella’s products are integral to a variety of applications, including automotive cameras for advanced driver assistance systems, security cameras, and consumer electronics such as drones and action cameras. With a market capitalization of approximately $3.25B, Ambarella is well-positioned in the technology sector, leveraging its innovative designs to cater to original equipment manufacturers and design manufacturers globally.

MicroVision, Inc. Overview

MicroVision, Inc., established in 1993 and based in Redmond, WA, specializes in lidar sensor technology, primarily serving the automotive industry for safety and autonomous driving applications. The company is known for its cutting-edge laser beam scanning technology, which underpins its various products, including micro-displays and interactive display modules. With a market cap of around $278M, MicroVision is an emerging player in the hardware and equipment industry, focusing on developing advanced scanning technologies and augmented reality solutions to meet the growing demands of smart devices and autonomous systems.

Key Similarities and Differences

Both Ambarella and MicroVision operate in the technology sector, focusing on innovative semiconductor solutions. However, while Ambarella’s expertise lies in video processing and image quality for diverse applications, MicroVision is concentrated on lidar and interactive display technologies for automotive and smart device markets. This distinction highlights their unique business models and target markets.

Income Statement Comparison

The following table summarizes the income statements of Ambarella, Inc. and MicroVision, Inc. for their most recent fiscal years, highlighting key financial metrics.

| Metric | Ambarella, Inc. | MicroVision, Inc. |

|---|---|---|

| Revenue | 285M | 4.7M |

| EBITDA | -101M | -71M |

| EBIT | -127M | -75M |

| Net Income | -117M | -97M |

| EPS | -2.84 | -0.46 |

Interpretation of Income Statement

In the most recent fiscal year, Ambarella experienced a revenue increase to 285M from 226M, yet still reported a negative net income of 117M, indicating ongoing struggles with profitability despite higher sales. MicroVision’s revenue remained modest at 4.7M, down from 7.3M, with net losses increasing to 97M, suggesting challenges in scaling operations. Both companies face significant negative EBITDA, reflecting high operational costs. Ambarella’s improved revenue does not translate to better margins, while MicroVision’s declining revenue raises concerns about its growth trajectory.

Financial Ratios Comparison

Below is a comparative table showcasing the most recent revenue and financial ratios for Ambarella, Inc. (AMBA) and MicroVision, Inc. (MVIS).

| Metric | AMBA | MVIS |

|---|---|---|

| ROE | -20.86% | -198.72% |

| ROIC | -21.96% | -83.29% |

| P/E | -27.05 | -2.83 |

| P/B | 5.64 | 5.63 |

| Current Ratio | 2.65 | 1.79 |

| Quick Ratio | 2.36 | 1.74 |

| D/E | 0.01 | 1.06 |

| Debt-to-Assets | 0.01 | 0.43 |

| Interest Coverage | 0 | -19.19 |

| Asset Turnover | 0.41 | 0.04 |

| Fixed Asset Turnover | 19.96 | 0.20 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

Both companies exhibit significant challenges reflected in their negative ROE and ROIC, indicating poor performance in generating profits from equity and invested capital. AMBA shows a healthier current and quick ratio compared to MVIS, suggesting better short-term liquidity. However, MVIS has a considerably higher debt-to-equity ratio, indicating increased leverage and potential risk. Overall, both companies present concerns, particularly regarding profitability and financial stability, which investors should carefully consider.

Dividend and Shareholder Returns

Both Ambarella, Inc. (AMBA) and MicroVision, Inc. (MVIS) do not pay dividends, primarily due to their focus on reinvesting for growth rather than distributing profits. AMBA’s financials indicate significant negative net income, while MVIS shows high operational losses. Despite this, both companies engage in share buybacks, which may enhance shareholder value in the long run. However, caution is warranted, as their current strategies may not support sustainable value creation amidst ongoing financial challenges.

Strategic Positioning

Ambarella, Inc. (AMBA) holds a significant market share in the semiconductor industry, particularly in high-definition video processing for automotive and security applications. Competitive pressure is mounting from emerging technologies and firms specializing in AI and image processing. In contrast, MicroVision, Inc. (MVIS) focuses on lidar sensors for automotive safety and autonomous driving, facing challenges from larger players in the lidar space. Both companies must navigate technological disruptions to maintain their positions in these rapidly evolving markets.

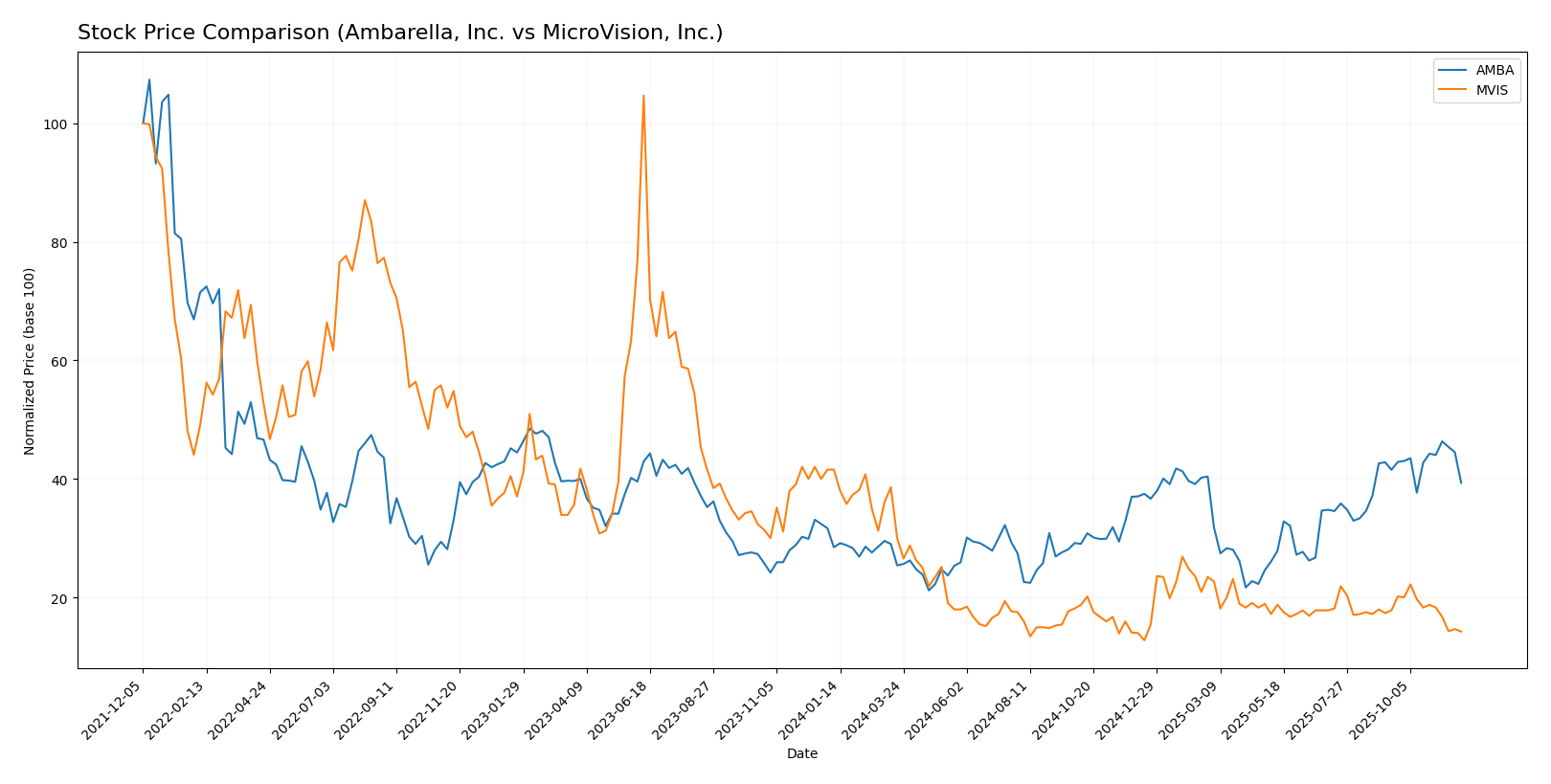

Stock Comparison

Over the past year, the stock prices of Ambarella, Inc. (AMBA) and MicroVision, Inc. (MVIS) have exhibited significant movements and trading dynamics that are crucial for investors to consider.

Trend Analysis

Ambarella, Inc. (AMBA)

- Percentage Change (12 months): +38.24%

- Trend Direction: Bullish

- Notable Highs/Lows: Highest Price: 89.67, Lowest Price: 40.99

- Acceleration Status: Acceleration

- Volatility: Standard Deviation: 12.7

Ambarella has shown a strong bullish trend over the past year, indicating robust growth in its stock price. The notable increase of 38.24% reflects a positive market sentiment. The stock has also experienced acceleration, suggesting that the growth is gaining momentum.

However, in the recent period (from 2025-09-14 to 2025-11-30), the stock has decreased by 5.28%, indicating a potential short-term pullback or correction. The standard deviation in this timeframe is 4.54, which suggests moderate volatility.

MicroVision, Inc. (MVIS)

- Percentage Change (12 months): -65.74%

- Trend Direction: Bearish

- Notable Highs/Lows: Highest Price: 2.66, Lowest Price: 0.82

- Acceleration Status: Deceleration

- Volatility: Standard Deviation: 0.42

MicroVision’s stock has faced a severe bearish trend, with a substantial decline of 65.74% over the past year. This indicates significant challenges and negative investor sentiment. The trend is characterized by deceleration, which may suggest that the rate of decline is slowing, but the overall outlook remains unfavorable.

In the recent period (from 2025-09-14 to 2025-11-30), MVIS has also decreased by 20.07% with a lower standard deviation of 0.16, indicating less volatility compared to the overall trend, yet still reflects a seller-dominant market behavior.

In conclusion, while AMBA presents a relatively favorable investment opportunity with a bullish trend, MVIS seems to be struggling significantly, warranting caution for potential investors.

Analyst Opinions

Recent recommendations for Ambarella, Inc. (AMBA) show a mixed but cautious outlook, with analysts giving it a rating of C+. The strengths lie in its debt management, while concerns about profitability metrics are noted. Analysts suggest a hold position for now. In contrast, MicroVision, Inc. (MVIS) has received a D+ rating, indicating significant challenges, particularly in financial performance, leading analysts to recommend a sell. Overall, the consensus for AMBA is to hold, while for MVIS, it leans toward sell.

Stock Grades

I have analyzed the latest stock grades provided by reputable grading companies for Ambarella, Inc. (AMBA) and MicroVision, Inc. (MVIS). Here are the findings:

Ambarella, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | maintain | Buy | 2025-11-26 |

| Stifel | maintain | Buy | 2025-11-26 |

| Needham | maintain | Buy | 2025-11-26 |

| Rosenblatt | maintain | Buy | 2025-11-24 |

| Oppenheimer | maintain | Perform | 2025-08-29 |

| Needham | maintain | Buy | 2025-08-29 |

| Stifel | maintain | Buy | 2025-08-29 |

| Morgan Stanley | maintain | Overweight | 2025-08-29 |

| Northland Capital Markets | maintain | Outperform | 2025-08-29 |

| B of A Securities | maintain | Neutral | 2025-08-29 |

MicroVision, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| D. Boral Capital | maintain | Buy | 2025-11-12 |

| WestPark Capital | maintain | Buy | 2025-10-21 |

| WestPark Capital | maintain | Buy | 2025-09-05 |

| D. Boral Capital | maintain | Buy | 2025-09-02 |

| WestPark Capital | maintain | Buy | 2025-08-27 |

| D. Boral Capital | maintain | Buy | 2025-08-11 |

| D. Boral Capital | maintain | Buy | 2025-05-21 |

| D. Boral Capital | maintain | Buy | 2025-05-13 |

| WestPark Capital | maintain | Buy | 2025-03-27 |

| D. Boral Capital | maintain | Buy | 2025-03-25 |

Overall, both AMBA and MVIS maintain strong “Buy” ratings from multiple reputable grading companies, indicating positive sentiment and confidence in their future performance. The consistency in ratings suggests stability and a favorable outlook for investors considering these stocks for their portfolios.

Target Prices

The latest consensus target prices for Ambarella, Inc. and MicroVision, Inc. indicate varying levels of expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Ambarella, Inc. | 115 | 80 | 97.5 |

| MicroVision, Inc. | 5 | 5 | 5 |

For Ambarella, the consensus target price of 97.5 suggests a significant upside potential compared to its current price of approximately 76.16. Meanwhile, MicroVision’s target consensus aligns directly with its current trading price of around 0.91, reflecting a more subdued outlook.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Ambarella, Inc. (AMBA) and MicroVision, Inc. (MVIS) based on the most recent data.

| Criterion | Ambarella, Inc. (AMBA) | MicroVision, Inc. (MVIS) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Negative margins | Negative margins |

| Innovation | Strong in video tech | Emerging lidar technology |

| Global presence | Moderate | Limited |

| Market Share | Niche | Niche |

| Debt level | Very low | High |

Key takeaways from the analysis indicate that while Ambarella shows strength in innovation and a stable debt level, MicroVision is currently facing challenges regarding profitability and high debt. Choosing between these companies will depend on your risk tolerance and investment strategy.

Risk Analysis

In the table below, I outline the key risks associated with Ambarella, Inc. (AMBA) and MicroVision, Inc. (MVIS) based on the most recent fiscal year data.

| Metric | Ambarella, Inc. (AMBA) | MicroVision, Inc. (MVIS) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant operational and regulatory risks, particularly MVIS, which is under pressure from high operational costs and stringent regulations in the tech sector. Recent financial struggles further amplify these risks, making careful consideration essential for potential investors.

Which one to choose?

When comparing Ambarella, Inc. (AMBA) and MicroVision, Inc. (MVIS), I find that AMBA shows stronger fundamentals and market positioning. AMBA’s recent bullish stock trend reflects a 38.24% price increase, despite a slight recent decline of 5.28%. It holds a market cap of 3.17B and a C+ rating, indicating moderate potential. In contrast, MVIS has experienced a significant downturn of 65.74%, with a bearish trend and a D+ rating, suggesting poor performance metrics and high risk.

Investors focused on growth may prefer AMBA for its potential upside and improving market sentiment, while those prioritizing low risk might still find AMBA a better option over MVIS, given MVIS’s significant operational losses and ratings. It’s crucial to consider both companies’ exposure to intense competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Ambarella, Inc. and MicroVision, Inc. to enhance your investment decisions: