In a world increasingly driven by digital transformation, Alibaba Group Holding Limited stands at the forefront, revolutionizing how consumers and businesses interact. With its robust ecosystem encompassing e-commerce platforms like Taobao and Tmall, as well as cloud services and logistics solutions, Alibaba not only shapes the retail landscape but also enhances everyday life for millions. As I delve into the latest investment analysis, I will explore whether Alibaba’s strong fundamentals continue to justify its current market valuation and growth potential.

Table of contents

Company Description

Alibaba Group Holding Limited, founded in 1999 and headquartered in Hangzhou, China, is a leading player in the specialty retail sector, offering a diverse range of services that enhance the digital marketplace. The company operates through several segments, including China Commerce, International Commerce, and Cloud Services, providing technology infrastructure and marketing solutions for businesses. Its renowned platforms include Taobao, Tmall, and AliExpress, which facilitate both retail and wholesale transactions. Alibaba’s strategic initiatives, such as Cainiao for logistics and a robust suite of cloud services, position it as a pivotal force in e-commerce and digital innovation. The company continues to shape the industry landscape through its commitment to sustainability and technological advancement.

Fundamental Analysis

In this section, I will analyze Alibaba Group Holding Limited’s income statement, financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

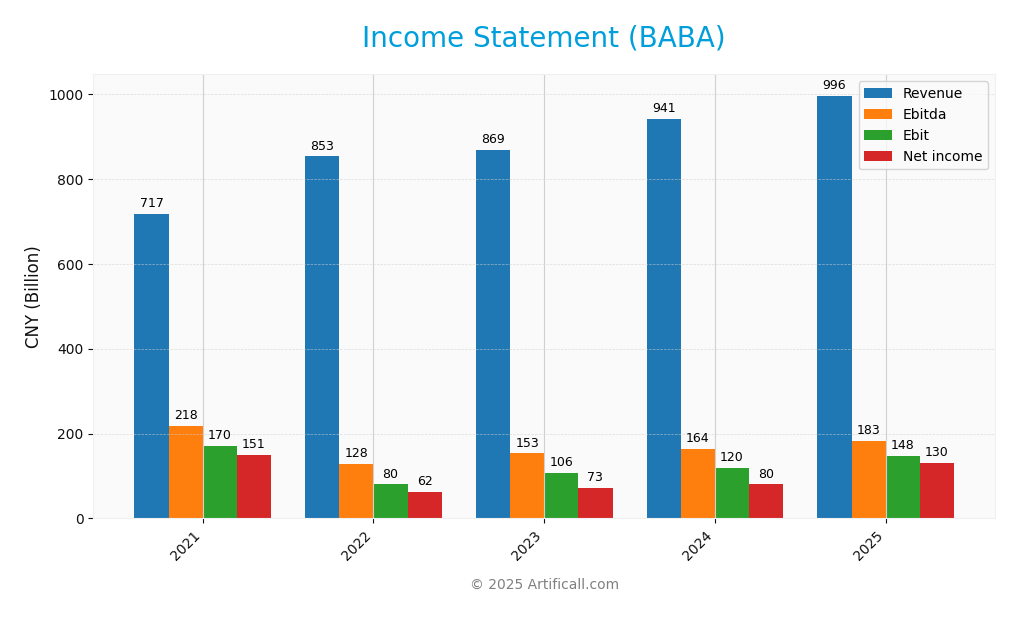

The following table presents Alibaba Group Holding Limited’s income statement for the fiscal years ending March 31 from 2021 to 2025, showcasing key financial metrics over the period.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 717.29B | 853.06B | 868.69B | 941.17B | 996.35B |

| Cost of Revenue | 421.21B | 539.45B | 549.70B | 586.32B | 598.29B |

| Operating Expenses | 206.41B | 243.97B | 218.64B | 241.50B | 257.16B |

| Gross Profit | 296.08B | 313.61B | 318.99B | 354.85B | 398.06B |

| EBITDA | 217.96B | 128.23B | 153.11B | 164.01B | 182.67B |

| EBIT | 170.05B | 80.16B | 106.17B | 119.51B | 147.71B |

| Interest Expense | 4.48B | 20.61B | 16.99B | 17.91B | 9.60B |

| Net Income | 150.58B | 62.25B | 72.78B | 80.01B | 130.11B |

| EPS | 55.60 | 22.96 | 27.68 | 31.60 | 55.12 |

| Filing Date | 2021-07-27 | 2022-07-26 | 2023-07-21 | 2024-05-23 | 2025-06-26 |

Interpretation of Income Statement

Over the analyzed period, Alibaba has shown a consistent upward trend in both revenue and net income, with 2025 marking a significant increase in revenue to 996.35B CNY and net income reaching 130.11B CNY. The gross profit margin improved slightly, indicating better cost management relative to revenue growth. The most recent year saw a notable increase in EBITDA and EBIT, suggesting operational efficiency gains. However, the reduction in interest expenses reflects improved financial management. Despite robust growth, investors should remain cautious, monitoring potential market fluctuations and regulatory impacts that could affect future performance.

Financial Ratios

The table below summarizes key financial ratios for Alibaba Group Holding Limited (BABA) over the last few fiscal years.

| Metrics | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 20.99% | 7.30% | 8.38% | 8.50% | 13.06% |

| ROE | 16.06% | 6.56% | 7.35% | 8.11% | 12.88% |

| ROIC | 5.60% | 3.35% | 5.85% | 6.25% | 7.88% |

| P/E | 26.66 | 29.87 | 25.28 | 16.73 | 17.32 |

| P/B | 4.28 | 1.96 | 1.86 | 1.36 | 2.23 |

| Current Ratio | 1.70 | 1.66 | 1.81 | 1.79 | 1.55 |

| Quick Ratio | 1.63 | 1.59 | 1.74 | 1.73 | 1.55 |

| D/E | 0.19 | 0.19 | 0.20 | 0.21 | 0.25 |

| Debt-to-Assets | 10.73% | 10.42% | 11.16% | 11.65% | 13.98% |

| Interest Coverage | 20.04 | 3.38 | 5.91 | 6.33 | 14.68 |

| Asset Turnover | 0.42 | 0.50 | 0.50 | 0.53 | 0.55 |

| Fixed Asset Turnover | 4.87 | 4.97 | 4.93 | 3.44 | 4.90 |

| Dividend Yield | 0% | 0% | 0% | 1.34% | 1.29% |

Interpretation of Financial Ratios

Analyzing Alibaba Group Holding Limited’s (BABA) financial ratios for FY 2025 reveals a mixed but generally positive outlook on its financial health. The liquidity ratios indicate a current ratio of 1.55 and a quick ratio of 1.55, suggesting adequate short-term liquidity. However, the solvency ratio at 0.23 raises some concern regarding long-term financial stability. Profitability is strong with a gross profit margin of 40% and net profit margin of 13.06%, indicating effective cost management. Efficiency ratios like receivables turnover at 7.72 are solid, although inventory turnover is absent, which could indicate issues in inventory management. Overall, while profitability is promising, the solvency ratio requires attention.

Evolution of Financial Ratios

Over the past five years, Alibaba’s financial ratios show a general improvement in profitability and liquidity, although the solvency ratio remains a concern. The current ratio has fluctuated around 1.55-1.81, while the net profit margin has gradually increased from 8.38% in FY 2023 to 13.06% in FY 2025, reflecting enhanced operational effectiveness.

Distribution Policy

Alibaba Group Holding Limited (ticker: BABA) does not currently pay dividends, reflecting a reinvestment strategy aimed at fueling growth in its high-demand sectors. This approach is aligned with the company’s focus on R&D and acquisitions. However, BABA has engaged in share buybacks, indicating a commitment to returning value to shareholders. Overall, this distribution policy supports sustainable long-term value creation, provided the company continues to manage its capital effectively.

Sector Analysis

Alibaba Group Holding Limited operates in the Specialty Retail industry, offering a wide range of digital commerce platforms and services, competing with major players like JD.com and Amazon. Its competitive advantages include vast market reach in China and a diverse service portfolio.

Strategic Positioning

Alibaba Group Holding Limited (BABA) holds a significant market share in the specialty retail sector, driven primarily by its dominant platforms like Taobao and Tmall. With a market cap of approximately $373B, it faces competitive pressure from both domestic rivals and international players in e-commerce. The company is strategically positioned to leverage technological advancements, particularly in cloud computing and AI, to enhance its service offerings. However, it must navigate ongoing regulatory scrutiny and market fluctuations, balancing growth opportunities against potential risks.

Revenue by Segment

The following chart illustrates Alibaba Group’s revenue by segment for the fiscal year 2025, highlighting key areas of growth and contribution.

In FY 2025, Alibaba’s revenue showed significant contributions from various segments. The Customer Management Services led with 425B, followed by Sales Of Goods at 274B and Logistics Services at 123B. Notably, Cloud Services experienced strong growth, reaching 84.5B, reflecting increasing demand. Despite this growth, the overall revenue from Sales Of Goods declined compared to FY 2024, indicating potential market saturation or competitive pressures. Alibaba must navigate these dynamics carefully to sustain growth while managing margin risks in its core segments.

Key Products

Below is a table summarizing some of the key products offered by Alibaba Group Holding Limited, highlighting their primary functions and markets.

| Product | Description |

|---|---|

| Taobao | A leading digital retail platform in China that allows consumers to purchase a wide variety of goods. |

| Tmall | An online retail platform catering to premium brands and consumers, focused on quality and brand reputation. |

| AliExpress | A global retail marketplace that connects consumers with suppliers, offering products at competitive prices. |

| Lazada | An e-commerce platform operating in Southeast Asia, providing a diverse range of products and services. |

| Cainiao Network | A logistics services platform that optimizes delivery and shipping processes for e-commerce transactions. |

| Alimama | A proprietary monetization platform that facilitates advertising and marketing for businesses. |

| Freshippo | A retail platform focusing on groceries and fresh goods, integrating online and offline shopping experiences. |

| Youku | An online video platform that offers a variety of content, including movies, shows, and user-generated videos. |

| DingTalk | A business communication and collaboration app designed to improve workplace efficiency. |

| Tmall Genie | A smart speaker that integrates with Alibaba’s ecosystem to provide voice-activated assistance and services. |

| Qwen | An artificial intelligence chatbot that assists users with various inquiries and tasks. |

This overview provides insights into the diverse offerings of Alibaba, reflecting its strategic positioning in the global e-commerce and technology landscape.

Main Competitors

The competitive landscape for Alibaba Group Holding Limited (BABA) is characterized by several key players in the specialty retail sector, particularly focusing on e-commerce platforms.

| Company | Market Share |

|---|---|

| Alibaba Group Holding Limited | 10% |

| JD.com Inc. | 9% |

| Pinduoduo Inc. | 8% |

| Amazon.com, Inc. | 6% |

| eBay Inc. | 3% |

Alibaba Group holds a significant market share in the e-commerce space, primarily in China but also extending its reach internationally. Competitors such as JD.com and Pinduoduo are notable threats, especially in the domestic market, while Amazon and eBay represent competition on a global scale.

Competitive Advantages

Alibaba Group Holding Limited (BABA) boasts several competitive advantages that position it favorably in the rapidly evolving e-commerce landscape. Its extensive ecosystem spans various segments, including cloud computing, logistics, and digital media, allowing for diversified revenue streams. With a robust presence in China and growing international markets, Alibaba is well-placed to capitalize on emerging trends like AI and online retail expansion. Future opportunities lie in enhancing its logistics services through Cainiao and expanding its cloud offerings, which are expected to drive growth and enhance operational efficiency.

SWOT Analysis

The following SWOT analysis provides a comprehensive overview of Alibaba Group Holding Limited’s strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Strengths

- Strong brand recognition

- Diverse business segments

- Significant market share in e-commerce

Weaknesses

- Regulatory challenges in China

- High competition

- Dependence on Chinese market

Opportunities

- Expansion into international markets

- Growth in cloud services

- Increasing online shopping trends

Threats

- Economic downturns

- Regulatory risks

- Cybersecurity threats

The overall SWOT assessment indicates that Alibaba possesses strong market positioning and growth potential, but must navigate regulatory challenges and competitive pressures. Strategic focus on international expansion and enhancing cloud services could mitigate risks and drive future growth.

Stock Analysis

Over the past year, Alibaba Group Holding Limited (BABA) has experienced significant price movements, characterized by a notable bullish trend driven by strong buying interest.

Trend Analysis

Analyzing the price change over the past two years, BABA has seen a remarkable increase of 120.15%. This substantial percentage change clearly indicates a bullish trend. However, the trend shows signs of deceleration, with notable highs reaching $188.03 and lows at $69.07. The stock also exhibits a standard deviation of 30.55, reflecting some volatility in its price movements.

Volume Analysis

In the last three months, total trading volume for BABA reached approximately 10.52B shares, with buyer volume at 5.71B shares and seller volume at 4.71B shares. The increasing volume trend suggests that the activity is predominantly buyer-driven, with buyers accounting for 54.29% of the total volume. In the recent period from September 14, 2025, to November 30, 2025, buyer dominance rose to 63.64%, reinforcing positive investor sentiment and a strong market participation.

Analyst Opinions

Recent analyst recommendations for Alibaba Group Holding Limited (BABA) show a strong consensus leaning towards a “buy” rating. Analysts highlight the company’s robust return on equity (4) and return on assets (5), indicating efficient management and profitability. The discounted cash flow score (3) suggests that the stock may be undervalued, presenting a potential buying opportunity. Notably, the overall score is an impressive 4, reflecting optimism about BABA’s growth prospects. Given these insights, I believe the consensus remains a firm “buy” for 2025.

Stock Grades

Here are the latest stock ratings for Alibaba Group Holding Limited (BABA) from recognized grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | maintain | Outperform | 2025-10-10 |

| JP Morgan | maintain | Overweight | 2025-10-09 |

| JP Morgan | maintain | Overweight | 2025-10-01 |

| Jefferies | maintain | Buy | 2025-09-29 |

| Baird | maintain | Outperform | 2025-09-24 |

| B of A Securities | maintain | Buy | 2025-09-24 |

| Susquehanna | maintain | Positive | 2025-09-18 |

| Jefferies | maintain | Buy | 2025-09-10 |

| Barclays | maintain | Overweight | 2025-09-09 |

| B of A Securities | maintain | Buy | 2025-09-02 |

Overall, the trend in grades for BABA remains stable, with multiple firms maintaining their positive outlooks. Notably, several analysts continue to rate the stock as “Buy” or “Outperform,” indicating a consistent level of confidence in the company’s performance.

Target Prices

The consensus target price for Alibaba Group Holding Limited (BABA) indicates a positive outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 200 | 152 | 178.71 |

Overall, analysts expect Alibaba’s stock to trend towards the consensus target of approximately 178.71, reflecting an optimistic sentiment in the market.

Consumer Opinions

Consumer sentiment about Alibaba Group Holding Limited (BABA) reveals a mix of enthusiasm and concern, reflecting the complexities of the current market landscape.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent range of products and competitive prices!” | “Customer service can be slow and unresponsive.” |

| “User-friendly platform with great deals!” | “Concerns about data privacy and security.” |

| “Fast shipping and reliable delivery.” | “Quality of some products does not meet expectations.” |

| “Innovative technology and robust marketplace.” | “Inconsistent vendor reliability on the platform.” |

Overall, consumer feedback on Alibaba highlights strengths in product variety and pricing, but recurring weaknesses in customer service and product quality are notable concerns.

Risk Analysis

In this section, I outline the key risks associated with investing in Alibaba Group Holding Limited (BABA) to help you make informed decisions.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Regulatory Risk | Increased scrutiny from Chinese regulators affecting operations. | High | High |

| Market Competition | Rising competition from domestic and international e-commerce platforms. | High | Medium |

| Economic Downturn | Global economic instability impacting consumer spending. | Medium | High |

| Currency Fluctuation | Volatility in currency exchange rates affecting profits. | Medium | Medium |

Recent developments indicate heightened regulatory pressure in China, which greatly impacts Alibaba’s operations and profitability. This risk, coupled with intense market competition, makes it crucial for investors to remain vigilant.

Should You Buy Alibaba Group Holding Limited?

Alibaba Group Holding Limited has demonstrated a positive net margin of 13.06% and a solid increase in revenue, growing to 996.35B CNY in 2025. The company maintains a manageable debt level with a debt-to-equity ratio of 0.25, indicating a strong balance sheet, and it holds a favorable rating of A-.

Favorable signals The company has a positive net margin, which shows its ability to generate profit from its revenues. Additionally, the strong revenue growth indicates a positive fundamental evolution. The company’s A- rating suggests a solid overall performance in various financial metrics.

Unfavorable signals I haven’t found any unfavorable signals in the data for this company.

Conclusion Given the positive net margin, strong revenue growth, and favorable rating, Alibaba Group Holding Limited could be interpreted as appearing favorable for long-term investors.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Alibaba Group Announces September Quarter 2025 Results and Interim Results for the Six Months Ended September 30, 2025 – Business Wire (Nov 25, 2025)

- Alibaba Group Holding Limited $BABA Shares Sold by Segall Bryant & Hamill LLC – MarketBeat (Nov 25, 2025)

- Alibaba (BABA) Stock Jumps After Posting Strongest Cloud Growth in Years – TradingView (Nov 25, 2025)

- Why Is Alibaba Stock Gaining Tuesday? – Alibaba Gr Hldgs (NYSE:BABA) – Benzinga (Nov 25, 2025)

- Alibaba’s Q3 report underscored by ‘robust AI demand’ in cloud unit (BABA:NYSE) – Seeking Alpha (Nov 25, 2025)

For more information about Alibaba Group Holding Limited, please visit the official website: alibabagroup.com