Tesla, Inc. stands at a crossroads, grappling with the ambitious goal of achieving full autonomy for its Robotaxi service. The challenges are formidable: regulatory hurdles, necessary hardware upgrades, and the critical need to sustain consumer trust. As we delve into this complex landscape, I aim to shed light on the implications for investors navigating Tesla’s evolving narrative.

Table of contents

Key Points

- Tesla is advancing towards full-scale robotaxi production by 2026.

- Regulatory changes may favor Tesla’s autonomous technology deployment soon.

- Investor interest in Tesla’s robotics initiatives is significantly increasing.

Challenges in Achieving Full Autonomy for Tesla’s Robotaxi Service

Tesla, Inc. operates in the electric vehicle industry, focusing on electric cars, energy storage, and solar products, with a global reach. Recently, the company has been working towards the launch of its Robotaxi service, slated for 2026, amidst regulatory scrutiny and necessary hardware upgrades. Despite a mixed market sentiment, analysts project significant growth for Tesla, with estimates suggesting fourth-quarter revenue will exceed prior figures. Strategic developments include the testing of driverless vehicles in Austin and ongoing advancements in autonomous technologies, which are seen as critical for the company’s future.

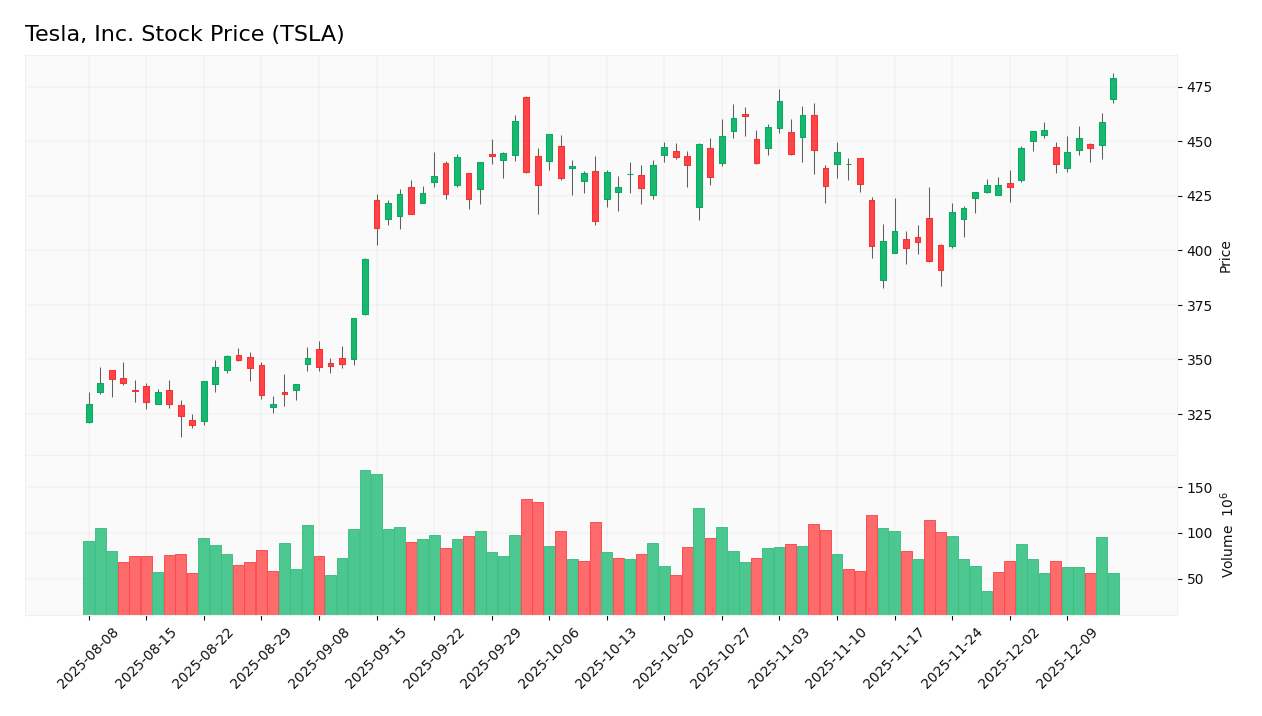

Market Reaction

Tesla, Inc. (TSLA) saw its stock price increase by 4.83% following news regarding its ongoing challenges with the Robotaxi service.

Target Prices

Analysts have a consensus target price for Tesla, Inc. (TSLA) that reflects their expectations amid significant challenges. The target prices indicate a range of expectations regarding Tesla’s potential market performance.

| Target High | Target Low | Consensus |

|---|---|---|

| 600 | 247 | 433.31 |

Impacts on the Income Statement

Tesla, Inc. (TSLA) is experiencing challenges reflected in its income statement, with revenues increasing modestly and margins under pressure.

The regulatory and operational hurdles surrounding its Robotaxi service could further hinder revenue growth, potentially exacerbating net margin declines by over 52%.

Stock Grades

Tesla, Inc. (TSLA) has received various ratings from credible grading companies recently, reflecting the ongoing challenges the company faces in achieving full autonomy for its Robotaxi service amid regulatory scrutiny and consumer trust issues.

Here are the five most recent grades for Tesla:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Overweight | 2025-12-09 |

| Morgan Stanley | Downgrade | Equal Weight | 2025-12-08 |

| Mizuho | Maintain | Outperform | 2025-11-25 |

| Stifel | Maintain | Buy | 2025-11-17 |

| Wedbush | Maintain | Outperform | 2025-11-07 |

Conclusion

Tesla, Inc. (NASDAQ: TSLA) is at a critical juncture as it aims to transition into the realm of full autonomy with its Robotaxi service. While the company has made significant strides, it faces considerable hurdles, including regulatory scrutiny, hardware upgrade requirements, and the need to sustain consumer trust. These challenges are compounded by the necessity of ensuring that its existing fleet is equipped for upcoming autonomous standards, which could impact customer satisfaction and overall market perception.

Despite these obstacles, analysts like Dan Ives maintain an optimistic outlook, projecting that Tesla’s innovations in AI and robotics could propel its market capitalization to as high as $3T by 2026. The anticipated easing of federal regulations could further enhance Tesla’s strategic initiatives. In conclusion, while the road ahead is fraught with challenges, Tesla’s strong fundamentals and commitment to innovation position it as a key player in the evolving landscape of autonomous technology. Investors should weigh these factors carefully as they consider their positions in TSLA.

Sources

I wrote this article from the following sources. I encourage you to consult these sources to delve deeper into the subject.

- This Golden Goose Could Make Tesla A $3 Trillion Giant – Benzinga discusses Tesla’s transformative phase with robotaxi production set to begin in 2026.

- Tesla shares jump as Musk confirms driverless robotaxi testing – Reuters reports on Tesla shares hitting their highest in nearly a year following CEO Elon Musk’s confirmation of driverless robotaxi testing.

- Tesla’s Robotics Rally Gets A Trump Tailwind— And Meme Squeezes Follow – Benzinga analyzes how Tesla’s rally is increasingly viewed as a venture into robotics and autonomy.

- Tesla starts testing robotaxis in Austin with no safety driver – TechCrunch covers Tesla’s latest development in testing its Robotaxi service in Austin without a safety driver.

- Investors Heavily Search Tesla, Inc. (TSLA): Here is What You Need to Know – Zacks Investment Research provides insights into the recent interest in Tesla among investors.

Tesla, Inc. Analysis

I encourage you to read the comprehensive analysis of Tesla, Inc. to enhance your investment decisions: Tesla, Inc. Analysis