Procter & Gamble’s stock faces a paradox as its strong market presence contrasts with recent declines in share price. This tension raises questions about the sustainability of its current market valuation amid broader consumer trends. Understanding the factors behind this decline is crucial for investors evaluating the company’s future prospects. The analysis will explore the underlying causes and potential implications for Procter & Gamble’s stock trajectory.

Table of contents

Key Points

- Highlight Cerity Partners’ $944M stock position in Procter & Gamble.

- Show Procter & Gamble’s EPS surpasses analysts’ expectations.

- Note institutional investors hold a significant 65.77% stake in PG.

Procter & Gamble’s Business and Financial Performance

Procter & Gamble operates in the global consumer packaged goods industry, focusing on product categories such as Beauty, Grooming, Health Care, Fabric & Home Care, and Baby, Feminine & Family Care. The Cincinnati-based company develops, manufactures, and markets household and personal care products worldwide. It recently reported a 3.0% revenue increase to $22.39B and strong profitability, while maintaining solid financial health and paying a quarterly dividend.

Recent Stock Price Movement and Institutional Activity

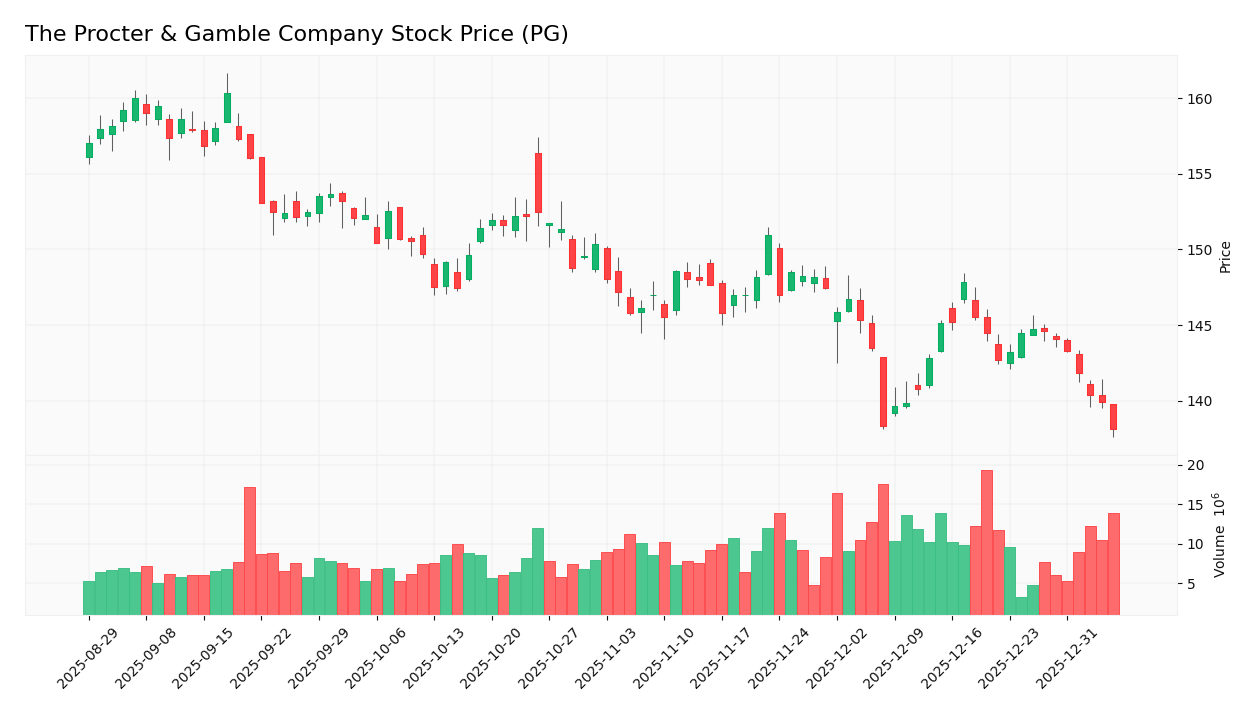

Procter & Gamble’s stock price has experienced moderate fluctuations, trading near $140, with a 52-week range of $138.14 to $179.99. Institutional investors hold 65.77% of the stock, with some recent portfolio adjustments, including Cerity Partners, reducing its stake by 6%. Insider selling has also been noted, alongside analyst target price revisions and a consensus rating of Moderate Buy.

Recent Market Moves

The recent developments related to The Procter & Gamble Company could impact investor sentiment and influence the stock price movement. Over one trading day, the stock price experienced a decline of -1.29%:

Target Prices

There is a clear consensus among analysts on Procter & Gamble’s target price. The target range reflects expectations for the stock’s potential price movement according to recognized analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 179 | 150 | 164.83 |

Latest Insider Trading

In December 2025, several Procter & Gamble directors acquired shares through awards totaling over 1,500 common stocks at no cost. These acquisitions occurred primarily on December 9, with notable directors including Joseph Jimenez, Christine McCarthy, and Christopher Kempczinski receiving shares as awards.

This insider activity reflects routine equity compensation rather than open-market purchases or sales, with no reported insider buying or selling transactions in the quarters through 2026. The absence of insider transactions in 2026 suggests no new insider trading signals related to the stock’s recent price movements.

What about the fundamentals?

The income statement shows generally favorable margins, with gross margin at 51.16%, EBIT margin at 25.0%, interest expense at 1.08%, and net margin at 18.95%. Overall, the income statement is considered favorable to investors based on these metrics.

Revenue growth over the past year was 0.29%, and gross profit growth was -0.16%, both unfavorable. However, EBIT, net margin, and EPS growth rates over one year were favorable, indicating mixed impacts on income statement metrics.

Stock Grades

Current verified stock grades for The Procter & Gamble Company are available from recognized financial institutions. The most recent grades show a mixture of maintained and upgraded ratings reflecting varied analyst perspectives.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | maintain | Overweight | 2026-01-05 |

| JP Morgan | maintain | Neutral | 2025-12-18 |

| Jefferies | upgrade | Buy | 2025-12-17 |

| JP Morgan | maintain | Neutral | 2025-10-27 |

| Raymond James | maintain | Outperform | 2025-10-20 |

Why has Procter & Gamble’s stock fallen? Will this continue?

Procter & Gamble (P&G) reached a 52-week low of $138.13 in January 2026, reflecting a 14.84% annual decline. This downward trend was fueled by analyst skepticism regarding organic growth, retailer destocking, and U.S. market volatility. External factors, including trade tariffs and supply chain disruptions, further forced the company to lower its 2025 forecasts.

While P&G’s Q1 2026 financial results exceeded expectations—reporting $1.99 EPS on $22.4 billion in revenue—the market remains cautious. Persistent bearish technical indicators continue to overshadow strong earnings, limiting near-term recovery.

Procter & Gamble’s overall financial results are favorable, showing strong profitability metrics and consistent earnings growth despite recent declines in stock price. The company’s solid net margin, return on equity, and revenue performance confirm its robust financial standing.

Long-term, Procter & Gamble demonstrates a durable competitive advantage with very favorable moat ratings and growing profitability. Key elements to monitor include institutional ownership levels, insider activity, and analyst price target adjustments, which reflect ongoing market sentiment.

Investors should remember that all investments carry risk, and this article does not constitute investment advice.

Sources

I wrote this article based on information from the following sources. I encourage you to consult them to deepen your understanding of recent developments involving The Procter & Gamble Company (PG).

- Cerity Partners LLC Has $944.13 Million Stock Position in Procter & Gamble Company (The) $PG

This article details Cerity Partners LLC’s recent reduction of its stake in Procter & Gamble, highlighting a 6.0% decrease in holdings.

- Asset Advisors Investment Management LLC Sells 6,300 Shares of Procter & Gamble Company (The) $PG

This piece covers how Asset Advisors Investment Management LLC lowered its position in Procter & Gamble by 12.6% during the last quarter.

The Procter & Gamble Company Analysis

I encourage you to read the comprehensive analysis of The Procter & Gamble Company to enhance your investment decisions: The Procter & Gamble Company Analysis