NVIDIA Corporation, a titan in AI technology, now grapples with substantial risks stemming from market volatility and uncertainties, particularly in the Chinese market. As the potential for an AI bubble looms, understanding these dynamics is crucial for evaluating NVIDIA’s future stock performance. Let’s delve into the complexities ahead.

Table of contents

Key Points

- NVIDIA is leading advancements in AI with its Blackwell architecture.

- Investor caution is needed due to potential market volatility risks.

- Analysts project significant growth potential for NVIDIA’s stock value.

NVIDIA Faces Market Volatility and AI Bubble Concerns

NVIDIA Corporation (NVDA) is a leader in the technology sector, specializing in accelerated computing and artificial intelligence (AI), with key business segments including data center GPUs and networking equipment. The company operates globally but is particularly focused on the Asia-Pacific market, including China, a significant region for its growth.

Recently, NVIDIA has showcased innovative advancements at the NeurIPS conference, especially its Blackwell architecture, which enhances AI model performance. Despite this, the company faces significant risks, including uncertainties in the Chinese market and potential concerns over an AI bubble. Analysts remain optimistic, projecting substantial growth in earnings, but caution investors about the volatility linked to market perceptions and external factors.

Market Reaction

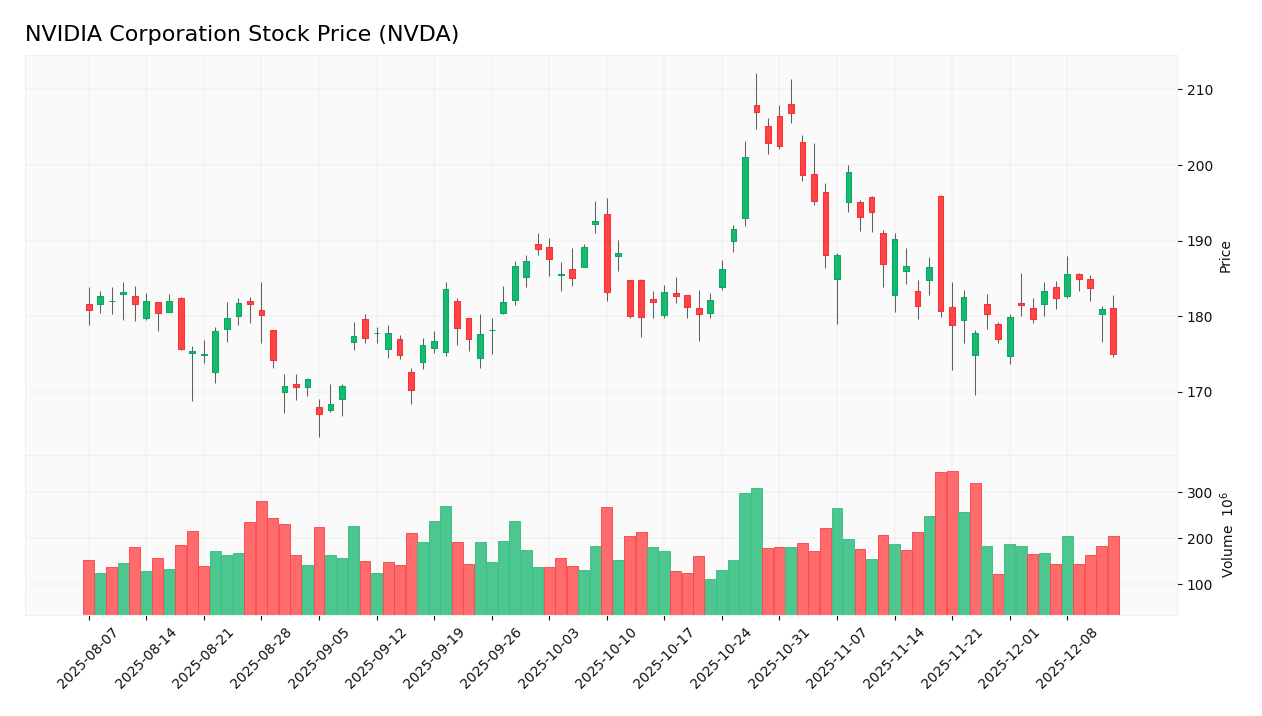

The stock price of NVIDIA Corporation (NVDA) reacted negatively to recent news, declining by 3.23% in the last day.

Target Prices

Analysts have reached a consensus on NVIDIA’s target prices, reflecting a range of expectations amid market uncertainties. The overall target prices indicate that while risks persist, there is a potential for growth in NVIDIA’s stock.

| Target High | Target Low | Consensus |

|---|---|---|

| 352 | 140 | 257.81 |

Impacts on the Income Statement

NVIDIA Corporation (NVDA) demonstrates robust financial health, with strong revenue growth and high gross margins contributing to its overall financial performance.

Despite favorable metrics, market volatility and uncertainties, especially in China, may affect NVIDIA’s income, potentially leading to fluctuations in revenue and profit margins.

Stock Grades

NVIDIA Corporation (NVDA) continues to receive strong support from analysts despite facing significant risks related to market volatility and uncertainties, particularly concerning the Chinese market and the potential for an AI bubble. Here are the most recent grades from reputable grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Overweight | 2025-12-01 |

| Melius Research | maintain | Buy | 2025-11-20 |

| Truist Securities | maintain | Buy | 2025-11-20 |

| Oppenheimer | maintain | Outperform | 2025-11-20 |

| Wedbush | maintain | Outperform | 2025-11-20 |

These consistent ratings indicate that analysts maintain a positive outlook on NVIDIA’s performance, even as it navigates potential market challenges.

Summary

NVIDIA Corporation (NVDA) is currently trading at $175.08, with a market capitalization of approximately $4.26T. The company has established itself as a leader in artificial intelligence (AI) technology, particularly after showcasing its innovative Blackwell architecture at the recent NeurIPS conference. This new platform aims to enhance AI model efficiency and accessibility, which could significantly boost investor interest and stock value. However, investors should remain cautious due to significant risks, particularly uncertainties in the Chinese market and concerns about an AI bubble that could lead to increased volatility.

In conclusion, while NVIDIA presents a compelling investment opportunity with strong growth potential, particularly in the AI sector, the associated risks necessitate a thoughtful approach. Investors should weigh the promising developments against market uncertainties to make informed decisions regarding their portfolios.

Sources

I wrote this article from the following sources. I invite you to consult them to delve deeper into the subject.

- Massive News for Nvidia: A NeurIPS Reveal Could Accelerate the Next Wave of AI (Published by The Motley Fool on 2025-12-13)

Nvidia (NVDA 3.27%) is pushing open AI at NeurIPS and demonstrating why Blackwell is becoming a significant platform for running frontier mixture-of-experts models efficiently. However, uncertainties regarding China and fears of an AI bubble persist, which could lead to volatile stock movements.

- 2 Magnificent Stocks to Buy Before They Soar 95% and 215% in 2026, According to Wall Street Analysts (Published by The Motley Fool on 2025-12-13)

According to Mark Lipacis at Evercore, Nvidia stock could rise 95% in the next year. Its robust software ecosystem and superior chip performance make it the gold standard in AI infrastructure.

I also published a complete review of NVIDIA: NVIDIA in 2025: Navigating Opportunities and Risks Ahead