Micron Technology, Inc. has recently captured market attention with a remarkable surge in its stock price following an impressive earnings beat. As a key player in the semiconductor memory and storage sector, the company’s performance invites a deeper look into the drivers behind this rally. Understanding these factors is essential to assess the sustainability of Micron’s growth in a highly competitive and cyclical industry.

Table of contents

Key Points

- Micron’s stock rose significantly after beating earnings expectations.

- Institutional investors increased holdings, showing growing market confidence.

- The company maintains strong financial health with positive growth prospects.

Factors Behind Micron Technology’s Recent Stock Surge

Micron Technology, Inc., a major semiconductor manufacturer specializing in memory and storage products, reported a 56.7% year-over-year revenue increase to $13.64B and strong profitability with a 28.15% net margin. The company’s diversified segments include Compute and Networking, Mobile, Embedded, and Storage. Recent developments include an earnings beat with EPS of $4.78 and positive guidance for Q2 2026.

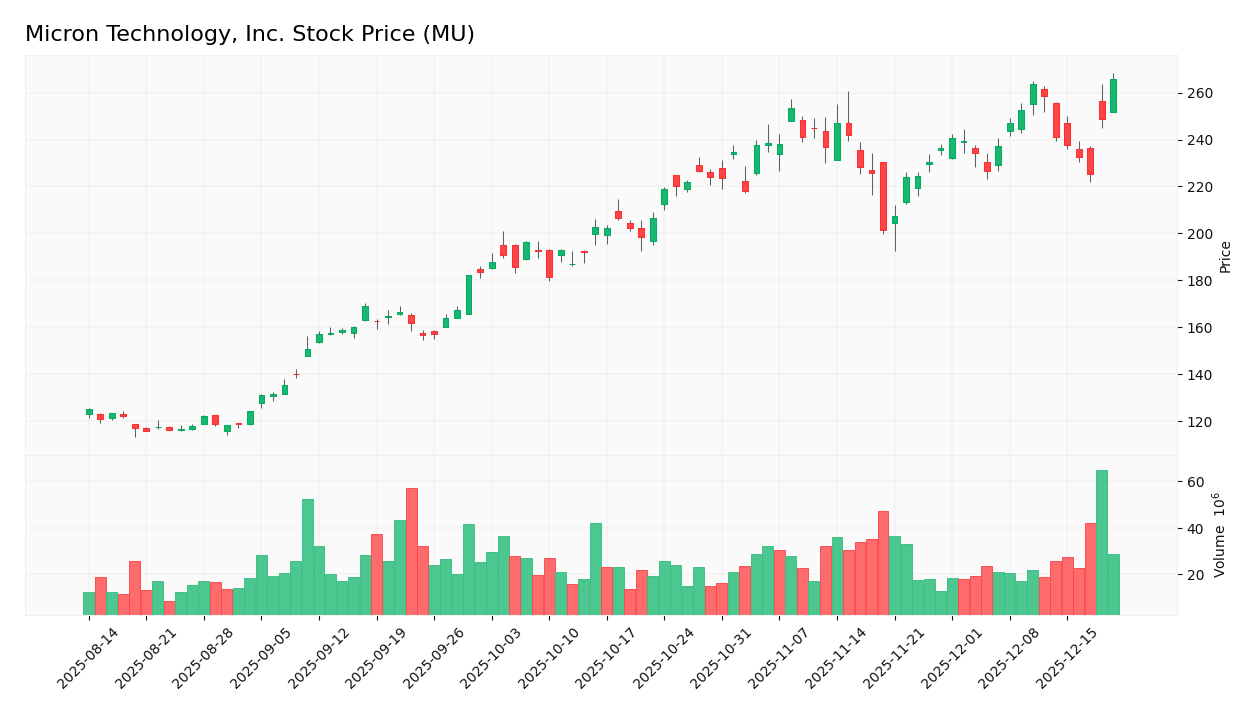

The stock price jumped 10.2% following the earnings beat, closing at $248.55 on heightened trading volume. This surge reflects investor reaction to robust financial results and optimistic future outlook. The current market interest centers on understanding the drivers behind this growth and evaluating its sustainability in the competitive semiconductor memory and storage industry.

Market Reaction

Micron Technology’s significant earnings beat likely boosted investor confidence in its growth prospects within the semiconductor memory and storage market, driving demand for its shares. The stock price reacted strongly, rising by 6.82% on the day:

Target Prices

Analysts present a cautiously optimistic consensus on Micron Technology’s stock price following its recent earnings beat. The target prices reflect expectations of continued growth potential in the semiconductor memory and storage market, balanced by inherent industry volatility.

| Target High | Target Low | Consensus |

|---|---|---|

| 443 | 190 | 298.52 |

Impacts on the Income Statement

Micron Technology, Inc. reported a highly favorable income statement for fiscal years 2024 to 2025, highlighted by a 48.85% revenue growth and a gross margin of 39.79%. The company’s net margin rose 22.84%, with earnings per share growing by 984.29%, indicating strong profitability and operational efficiency.

The sustainability of Micron’s growth outlook in the semiconductor memory and storage market could influence future income performance. Market demand, competitive dynamics, and technological advancements will be critical factors impacting the company’s ability to maintain these impressive financial results.

Stock Grades

Investors looking for insights on Micron Technology’s stock will find a consistent outlook from leading analysts following its recent earnings beat. The consensus suggests a stable to positive stance, reflecting confidence in its growth prospects within the semiconductor memory and storage market.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Maintain | Neutral | 2025-12-18 |

| Raymond James | Maintain | Outperform | 2025-12-18 |

| B of A Securities | Upgrade | Buy | 2025-12-18 |

| UBS | Maintain | Buy | 2025-12-18 |

| Morgan Stanley | Maintain | Overweight | 2025-12-18 |

These grades underline a cautiously optimistic market view, with most firms maintaining positive ratings and B of A Securities upgrading to a Buy, indicating potential upside. As always, I advise balancing such expert opinions with your own risk tolerance and market conditions before making investment decisions.

Conclusion

Micron Technology’s overall results are favorable, driven by a significant earnings beat, strong revenue growth, and robust profitability metrics. The stock price increase followed clear factors such as an EPS of $4.78 surpassing expectations, revenue of $13.64B, and positive forward guidance with an EPS range of $8.220 to $8.620 for Q2 2026.

Looking ahead, the company’s diversified memory and storage portfolio and solid institutional backing suggest sustained growth potential in the semiconductor market. Investors should closely monitor Micron’s upcoming earnings and market dynamics, especially given its beta of 1.54 indicating relatively high volatility.

Investments carry inherent risks and this article does not constitute investment advice.

Sources

I wrote this article based on the following sources to provide you with accurate and up-to-date market insights. I encourage you to consult these references to deepen your understanding of Micron Technology’s recent performance and market movements.

- Micron Technology (NASDAQ:MU) Trading Up 10.2% Following Earnings Beat – Defense World reports on Micron’s stock surge after surpassing earnings expectations, highlighting trading volume spikes and price movements.

Micron Technology, Inc. Analysis

I encourage you to read the comprehensive analysis of Micron Technology, Inc. to enhance your investment decisions: Micron Technology, Inc. Analysis