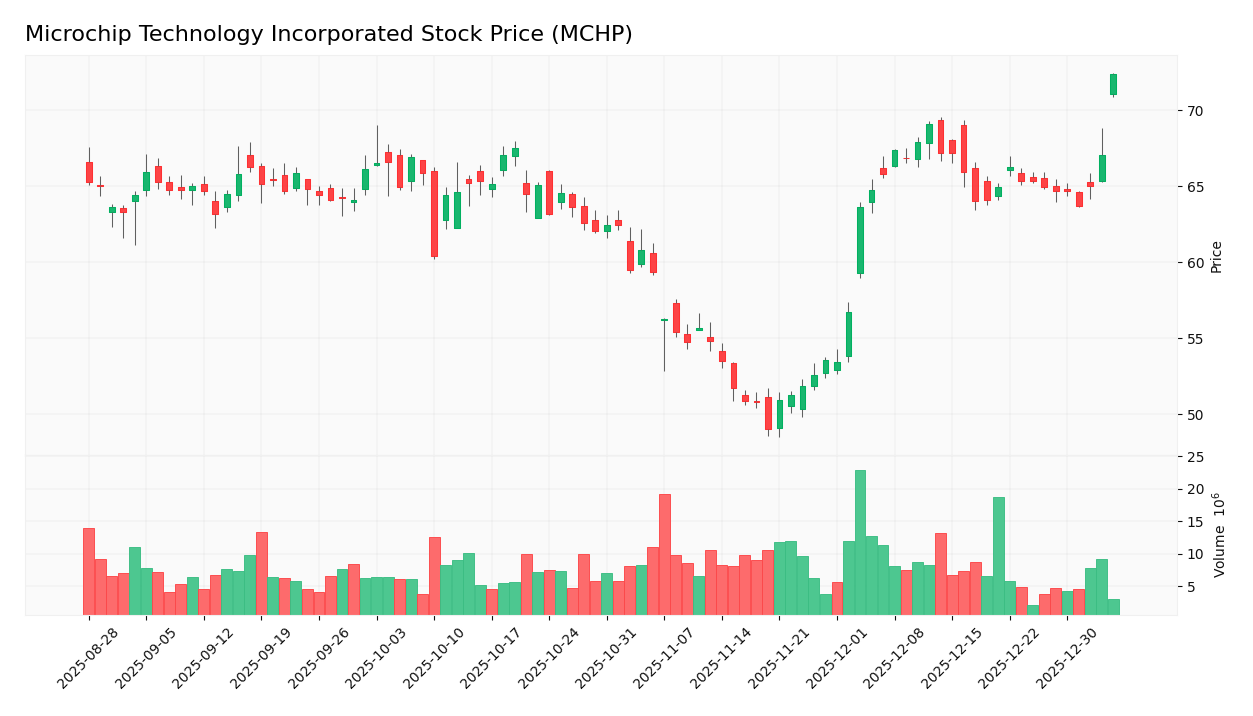

Microchip Technology’s recent upward revision of its sales forecast contrasts sharply with the cautious investor sentiment amid its stretched stock price momentum. This tension raises a critical question: can the company’s financial performance justify its elevated valuation without exposing investors to disproportionate risk? Understanding this balance is essential as we analyze how Microchip’s optimistic outlook might translate into sustainable growth or potential volatility ahead.

Table of contents

Key Points

- Highlight Microchip’s upward revision of Q3 fiscal 2026 net sales forecast.

- Showcase the stock’s strong price trend despite a poor value ranking.

- Warn that high valuation may limit upside and increase investment risk.

Microchip Business Overview and Recent Performance

Microchip Technology Incorporated operates in the semiconductor industry, focusing on microcontroller, mixed-signal, analog, and Flash-IP solutions. The company serves a global market with a diverse product portfolio across multiple sectors. It recently revised its third-quarter fiscal 2026 net sales forecast to approximately $1.185B, up from a prior range of $1.109B to $1.149B, and saw its stock price rise by about 3.2%.

Revised Sales Forecast and Stock Price Momentum Impact

Microchip Technology updated its third-quarter fiscal 2026 sales guidance, exceeding previous estimates, and experienced a corresponding stock price increase reflecting positive investor sentiment. The issue under consideration is how this revised higher sales forecast and strong stock price momentum will affect the company’s future financial performance and the risk of investor valuation at this point.

Market Reaction

Microchip Technology Incorporated’s revised higher sales forecast could influence the stock price by reflecting improved business prospects and potentially increasing investor interest. The stock price increased by 7.85% over one trading day:

Ratings analysis

The insider transactions show a near balance in acquisitions and disposals during late 2025, with a slight tilt toward acquisitions overall. This trading pattern aligns with the company’s revised higher sales forecast and strong stock momentum, indicating active insider management of holdings amid evolving investor valuation risk.

Target Prices

There is an analyst consensus on the target prices for Microchip Technology Incorporated. The target range reflects the expected stock price movement based on current market analysis.

| Target High | Target Low | Consensus |

|---|---|---|

| 85 | 60 | 76 |

Insider Trades

Recent insider trading at Microchip Technology Incorporated included notable acquisitions and dispositions by key executives, particularly between November and December 2025. The CEO, President, and Chair of the Board, Steve Sanghi, disposed of 138K shares via gift at $65.81 each, while the COO, Richard J Simoncic, engaged in multiple small acquisitions and dispositions around $51.70 per share. CFO James Eric Bjornholt sold 4.3K shares at $50.39, reflecting mixed insider activity.

Impacts on the Income Statement

The income statement shows a gross margin of 56.07% rated favorable, an EBIT margin of 6.6% rated neutral, and a net margin of -0.01% rated unfavorable. Overall, the income statement is unfavorable due to significant declines in revenue and earnings.

The revised higher sales forecast and strong stock price momentum could influence revenue and profitability metrics by affecting reported sales and margins, as indicated by the focus on these factors in the evaluation. However, the provided data does not detail specific impacts on income statement figures.

Stock Grades

Current stock ratings for Microchip Technology Incorporated (MCHP) are available from recognized financial institutions. The most recent grades reflect a mix of maintained and upgraded recommendations from established firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | upgrade | Overweight | 2025-12-16 |

| B of A Securities | maintain | Neutral | 2025-12-05 |

| Needham | maintain | Buy | 2025-12-04 |

| Rosenblatt | maintain | Buy | 2025-12-03 |

| Wells Fargo | maintain | Equal Weight | 2025-11-07 |

Conclusion

Microchip Technology Incorporated’s overall financial results are unfavorable, despite the recent upward revision in its third-quarter fiscal 2026 sales forecast and strong stock price momentum. The company faces significant declines in revenue growth and net margin, with ongoing challenges reflected in its income statement and valuation metrics.

Looking ahead, the most critical elements to monitor include the company’s ability to sustain its revised sales guidance and manage valuation risks amid its unfavorable profitability trends. Continued market confidence as shown by positive stock price momentum contrasts with deteriorating financial health indicators and shareholder value destruction.

Investors should remember that all investments carry risk and this article does not constitute investment advice.

Sources

I wrote this article using information from the following sources. I encourage you to consult these references to gain a deeper understanding of the market context and company specifics.

- Stock Market Today: Dow Jones Futures Drop After Scaling Record Highs—CoreWeave, Vistra, Microchip Technology In Focus — A summary of U.S. stock futures movements highlighting Microchip Technology among key stocks.

- AngioDynamics, Microchip Technology And 3 Stocks To Watch Heading Into Tuesday — Insights into stock futures and earnings reports focusing on Microchip Technology and other notable companies.

Microchip Technology Incorporated Analysis

I encourage you to read the comprehensive analysis of Microchip Technology Incorporated to enhance your investment decisions: Microchip Technology Incorporated Analysis