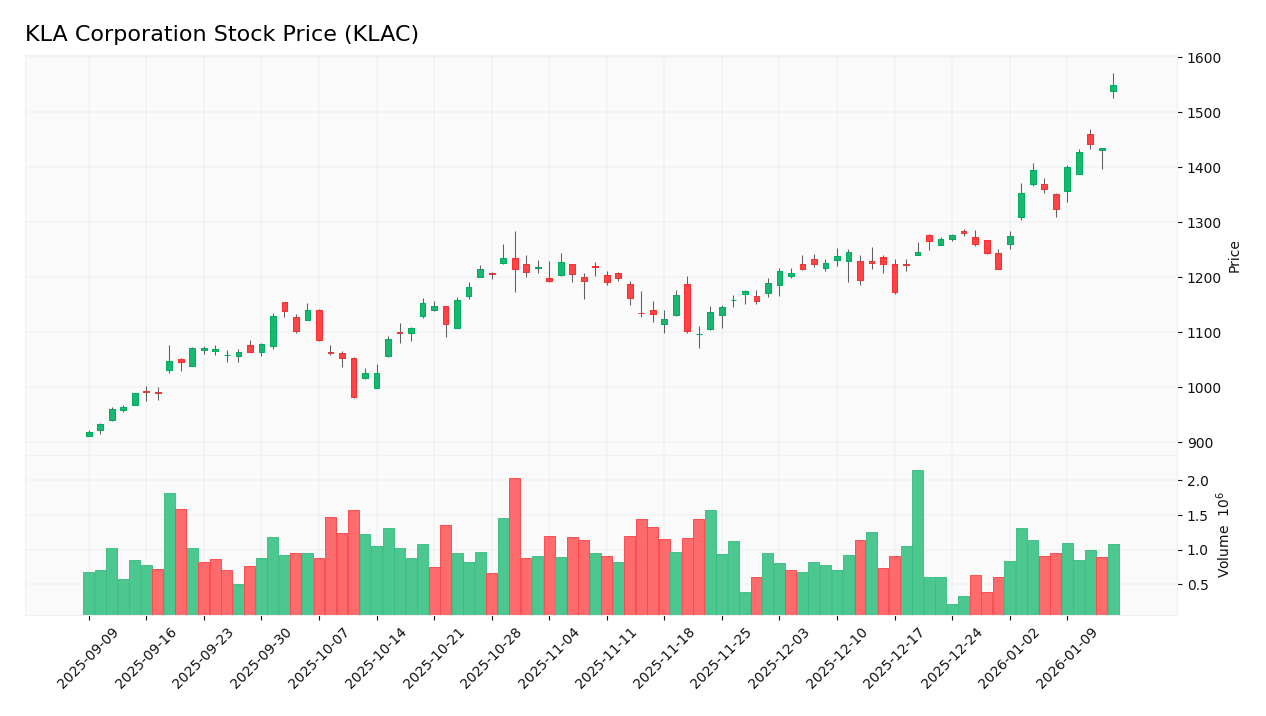

KLA’s stock surged 8% today, reaching near its yearly high despite ongoing market volatility and semiconductor sector challenges. This sharp rise raises questions about whether the current valuation accurately reflects the company’s fundamental performance and growth prospects. Understanding the balance between market enthusiasm and intrinsic value is crucial for investors assessing KLA’s potential risks and rewards. The forthcoming analysis will explore these valuation dynamics and their implications for portfolio decisions.

Table of contents

Key Points

- Highlight KLA’s stock surged due to TSMC’s strong quarterly earnings.

- Emphasize analyst upgrade based on growth in 2nm semiconductor technology demand.

- Note KLA’s high valuation despite robust growth and solid financial metrics.

KLA Corporation’s Business Operations and Recent Performance

KLA specializes in semiconductor manufacturing equipment, focusing on process control and inspection technologies. It serves major semiconductor companies primarily in North America and Asia. The company reported strong growth driven by demand for advanced semiconductor technologies, including new 2nm chip manufacturing. Its recent strategic emphasis has included expanding business with key clients such as TSMC and Intel.

Current Market Valuation and Stock Performance Debate

KLA’s stock surged over 8% following robust earnings reports from TSMC, a major customer, highlighting strong sector demand. Despite positive sales growth and earnings outlooks, the stock’s high valuation—with a P/E ratio of 45 and a PEG ratio above 3—has raised questions about potential overvaluation in the current market environment.

Is KLA Stock Overvalued After Today’s Rise?

KLA stock surged 9.2% following strong Q4 2025 results from TSMC, a major customer, signaling robust demand for semiconductor equipment. Analyst upgrades and forecasts for 2nm chip technology expansion support growth, with KLA’s revenue expected to rise from $12.7B in 2025 to $15.7B in 2027 and EPS growing from $35.36 to $45.17.

Despite positive fundamentals and a 60.67% gross margin, KLA trades at a high valuation with a P/E ratio of 45 and a PEG above 3. This elevated valuation leads some analysts to view the stock as overvalued relative to its growth potential, suggesting caution despite the company’s strong market position and growth outlook.

Recent Market Moves

KLA Corporation’s stock price increased significantly, reflecting positive investor sentiment or developments related to the company. The stock price rose by 8.33% over one trading day:

Target Prices

There is an analyst consensus on the target prices for KLA Corporation. The target range indicates expectations for the stock price movement relative to its current valuation.

| Target High | Target Low | Consensus |

|---|---|---|

| 1750 | 1260 | 1519.93 |

Latest Insider Trading

Recent insider activity at KLA Corporation shows significant stock disposals by executives in late 2025, including sales by the CFO and CEO. Multiple officers reported selling thousands of shares at prices above $1,200, alongside smaller gift transactions and stock awards to directors.

This insider selling contrasts with frequent stock acquisitions earlier in 2025, reflecting a quarterly disposed-to-acquired ratio of 2.25 in Q4. The activity indicates a notable shift in insider transactions during the period leading up to the current 8% stock price increase.

What about the fundamentals?

KLA Corporation’s income statement shows favorable financial metrics, including a gross margin of 62.32%, an EBIT margin of 40.69%, an interest expense at 2.49%, and a net margin of 33.41%. All key margins and growth rates over one year and the overall period are reported as favorable.

The subject identified could influence the income statement by affecting revenue growth, gross profit growth, operating expenses relative to revenue, EBIT growth, net margin growth, and EPS growth, all of which have demonstrated favorable performance in the provided data.

Stock Grades

Current verified stock grades for KLA Corporation are available from recognized financial institutions. The most recent grades show a general consensus to maintain or upgrade the stock with buy or overweight ratings.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | maintain | Buy | 2026-01-14 |

| TD Cowen | upgrade | Buy | 2026-01-13 |

| B of A Securities | maintain | Buy | 2026-01-13 |

| Cantor Fitzgerald | maintain | Overweight | 2026-01-08 |

| Cantor Fitzgerald | upgrade | Overweight | 2025-12-16 |

Conclusion

KLA Corporation’s overall results are favorable, showing strong financial performance and growth. The company benefits from robust demand in the semiconductor industry, supported by key clients like TSMC, but its current stock valuation appears high relative to earnings growth.

Longer-term developments include expected revenue and EPS growth through 2027, driven by the adoption of advanced technologies, including 2nm chips. Investors should closely monitor KLA’s valuation metrics and demand trends in semiconductor manufacturing equipment.

Investments involve risks, and readers should consider this article as informational, not investment advice.

Sources

I wrote this article based on information from the following sources. To deepen your understanding of KLA Corporation and its market dynamics, I encourage you to consult these references directly.

- Why KLA Corp Stock Popped Today – The Motley Fool explains the recent upgrade by Wells Fargo analyst Joseph Quatrochi, highlighting strong sales growth prospects driven by expanding demand for 2nm chip technology.

KLA Corporation Analysis

I encourage you to read the comprehensive analysis of KLA Corporation to enhance your investment decisions: KLA Corporation Analysis