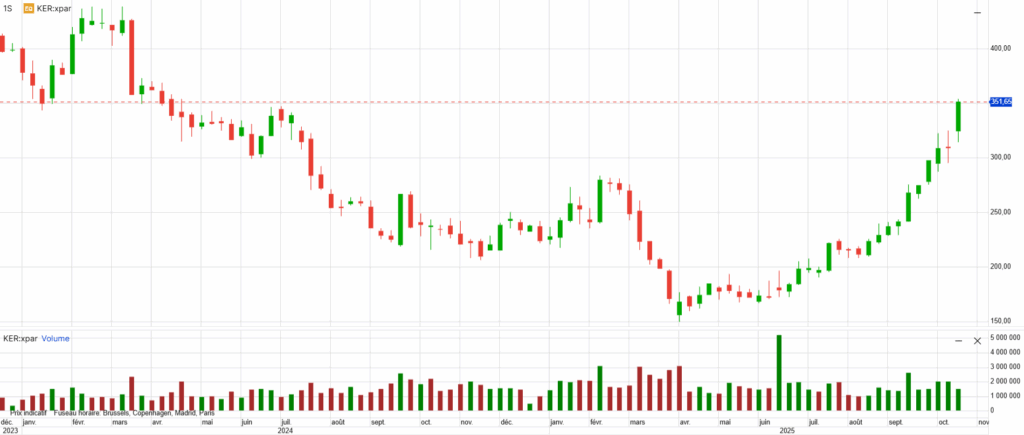

Kering SA (EPA: KER), the French luxury conglomerate, saw its share price rise by over 9% following the release of its third-quarter 2025 revenue report. The company reported earnings of €3.42 billion, reflecting a 5% decline on a comparable basis, but showcasing a significant sequential improvement compared to the 15% drop in the previous quarter. This movement is significant for investors as it reflects a potential turnaround under new CEO Luca de Meo, amidst ongoing challenges in the luxury sector.

Table of Contents

Key Facts and Data

Analysts had anticipated a steeper decline, with predictions of approximately 9.6% for Kering and 15.34% for Gucci. The company’s stock has surged about 85% since de Meo’s appointment in June, compared to a 12% increase in the Stoxx Europe Luxury 10 index.

| Q3 2025 | Q3 2024 | Change (%) | |

|---|---|---|---|

| Total Revenue | €3.42 billion | €3.60 billion | -5% |

| Gucci Revenue | €1.34 billion | €1.55 billion | -14% |

- Kering’s Q3 revenue: €3.42 billion, down 5% year-over-year on a comparable basis.

- Gucci revenue: €1.34 billion, a 14% decline, but an improvement from a 25% drop in Q2.

Market and Analyst Reactions

Investors and analysts reacted positively to Kering’s latest results, interpreting the sequential improvement as a sign of potential recovery. Deutsche Bank raised its price target for Kering from €290 to €300, reflecting a favorable outlook for the company’s earnings. Analysts from TD Cowen also increased their target from €260 to €345, while JP Morgan maintained an ‘underweight’ rating but raised its target from €145 to €200.

Analyst Commentary

Adam Cochrane from Deutsche Bank noted, ‘The improved sales performance was evident across all major brands, and we maintain a favorable outlook for EBIT forecasts.’ TD Cowen commented, ‘The sequential improvement signals a potential turning point for Kering, particularly under the new leadership.’

Market Behavior

Kering’s stock traded at around €340.45 following the announcement, reflecting a strong bullish sentiment among investors. Trading volumes surged, indicating increased interest and confidence in Kering’s strategic direction.

Underlying Reasons Behind the Move

The rise in Kering’s stock can be attributed to several key factors:

- Earnings-driven: The reported revenue, although lower than last year, showed substantial improvement from previous quarters, suggesting a recovery trajectory.

- Strategic or External Factors: The announcement of the sale of Kering’s beauty division to L’Oréal for €4 billion is seen as a pivotal move to reduce debt and focus on core fashion brands.

Financial Drivers

Kering’s Q3 results indicate a narrowing sales decline, which is a positive sign compared to previous quarters. The sequential improvement from a 15% drop to a 5% decline demonstrates the brand’s resilience and potential for recovery.

Strategic or External Factors

The sale of the beauty division not only alleviates financial pressure but also allows Kering to concentrate on its luxury fashion brands. This strategic pivot is expected to enhance Kering’s operational focus and long-term market positioning.

Broader Market Context

Kering’s recent performance is set against a backdrop of mixed results in the luxury sector. While Kering faced challenges with Gucci’s ongoing sales decline, competitors like LVMH reported better-than-expected quarterly sales, creating a competitive landscape.

The overall luxury market shows signs of resilience, but Kering’s ability to navigate its challenges will be critical for its recovery.

What’s Next?

Looking forward, Kering’s strategic focus on revitalizing its brands and addressing debt will be crucial. Upcoming events include the anticipated completion of the L’Oréal beauty division sale in H1 2026, which is expected to further bolster Kering’s financial stability.

Short-Term Outlook

In the short term, investors should watch for further developments in Kering’s restructuring efforts and any updates on brand performance.

Long-Term View

Kering’s long-term success will depend on its ability to enhance brand performance and leverage strategic partnerships, particularly in the luxury fashion space.

Conclusion

Kering’s share price rise reflects a cautious optimism following its Q3 results and strategic moves under new CEO Luca de Meo. While challenges remain, particularly with Gucci’s sales, the company’s efforts to streamline operations and focus on core brands may position it for future growth.

- https://www.kering.com/en/news/revenue-for-the-third-quarter-of-2025/

- https://www.boursorama.com/bourse/actualites/kering-baisse-moins-marquee-que-prevu-du-chiffre-d-affaires-au-t3-52ec5c52dd865d87be72008cc4455031

- https://www.boursedirect.fr/fr/actualites/categorie/divers/kering-accelere-encore-apres-les-annonces-boursier-6fff630fe940c98db9cf351e4b097c5f3a77e85a

- https://www.cnbc.com/2025/10/23/kering-shares-pop-as-gucci-sees-sharp-sequential-improvement.html