Colgate-Palmolive stock surged despite a relatively stable market environment, raising questions about the drivers behind this sudden rise. This unexpected movement contrasts with the company’s steady performance in the consumer defensive sector, creating uncertainty about the sustainability of the rally. Understanding the factors that fueled today’s gains is crucial for investors assessing the stock’s near-term trajectory and potential risks.

Table of contents

Key Points

- Highlight Cerity Partners lowered stake while others increased holdings.

- Report quarterly earnings exceeding estimates with steady revenue growth.

- Show significant institutional ownership with mostly positive analyst ratings.

Institutional Investor Activity and Stock Performance of Colgate-Palmolive

Colgate-Palmolive is a global consumer products company operating in oral care, personal care, home care, and pet nutrition markets. It offers a diverse portfolio including deodorants, dishwashing liquids, surface cleaners, and pet foods. The company reported a 1.9% revenue increase to $5.13B and earnings of $0.91 per share, slightly above estimates. Institutional investors adjusted holdings, with some reducing positions and others increasing stakes.

Recent institutional trading activity shows mixed adjustments, including a 3.3% stake reduction by Cerity Partners and a 20.6% reduction by Birch Hill Investment Advisors. Other investors have increased their positions, with institutional ownership totaling 80.41%. This activity coincides with a stock price around $77.06 and a consensus analyst price target near $88.33, reflecting ongoing market interest and evaluation.

Why Did Colgate-Palmolive Stock Rise Today?

Colgate-Palmolive stock rose amid strong institutional interest despite some investors like Cerity Partners LLC and Birch Hill Investment Advisors reducing their stakes by 3.3% and 20.6%, respectively. Financially, the company reported earnings of $0.91 per share, surpassing expectations, with $5.13B revenue, reflecting steady growth and profitability metrics including a 14.47% net margin and 333.39% return on equity.

Will the stock rebound continue? Institutional investors hold 80.41% of shares, signaling confidence, supported by a 2.7% dividend yield and a moderate P/E ratio of 21.59. Analyst consensus is moderately positive, with ten buys, four holds, and one sell rating, and an average price target of $88.33, suggesting cautious optimism despite some concerns around leverage and valuation.

Recent Market Moves

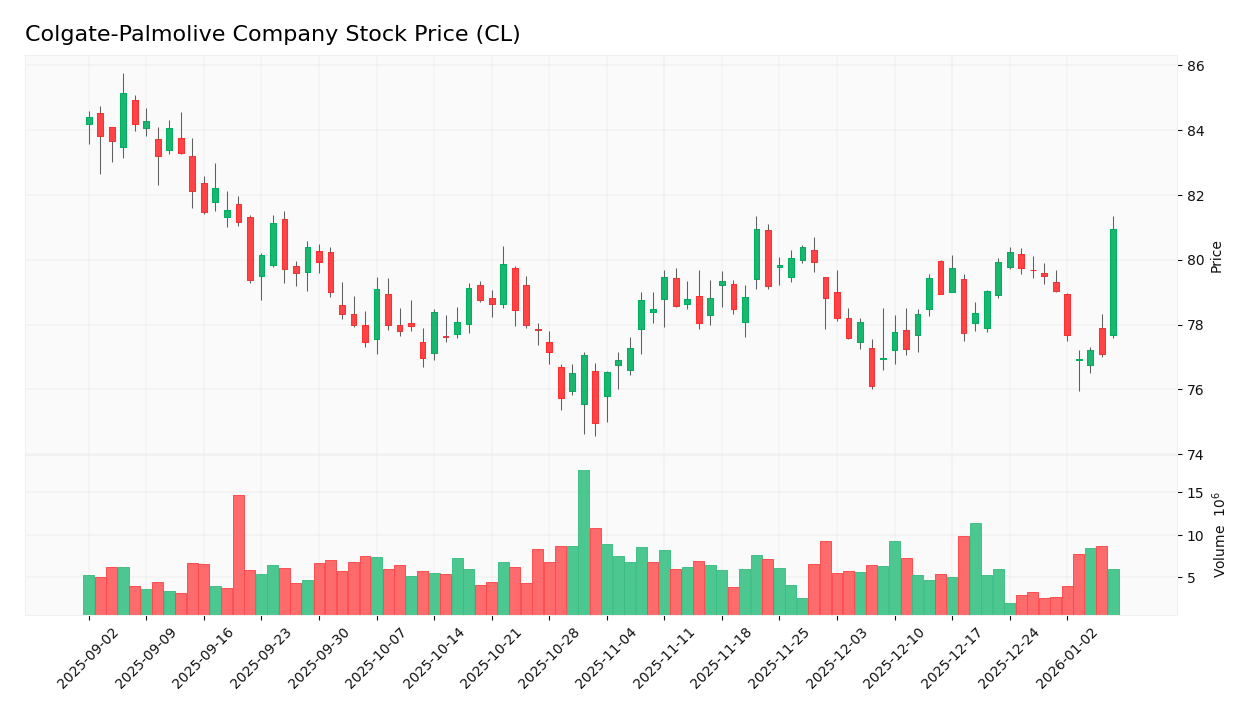

The announcement regarding Colgate-Palmolive Company could influence investor sentiment and trading activity, potentially impacting the stock price. The stock price increased by 4.93% over one trading day (1D change):

Target Prices

There is an analyst consensus on the target prices for Colgate-Palmolive Company. The target range indicates the expected price movement based on current analyst evaluations.

| Target High | Target Low | Consensus |

|---|---|---|

| 94 | 82 | 87.75 |

Latest Insider Trading

Recent insider trading at Colgate-Palmolive involved directors acquiring shares through awards on January 2, 2026. Three directors—Brian Newman, Lorrie M. Norrington, and John P. Bilbrey—each received between 238 and 333 shares at a price of $78.66 per share.

These acquisitions come amid a broader trend of more dispositions than acquisitions in late 2025, with a total of 836 shares acquired and 3,560 shares disposed in Q4 2025. This activity reflects a typical pattern of stock awards to directors, aligning with ongoing company equity compensation practices.

What about the fundamentals?

Colgate-Palmolive’s income statement shows generally favorable metrics, with a gross margin of 60.23%, EBIT margin of 21.13%, interest expense at 1.45%, and net margin of 14.37%. These indicators suggest a solid profitability profile for the fiscal year 2024. The overall income statement evaluation rates 78.57% of metrics as favorable, supporting a positive income statement view.

The stock rise could affect income statement metrics by influencing operating expense growth relative to revenue, which is currently unfavorable at 3.31%. While revenue growth over one year is neutral at 3.31%, gross profit and EBIT growth are favorable, at 7.6% and 15.47%, respectively. Changes in these factors may impact net margin and earnings per share growth as recorded.

Stock Grades

Current verified stock grades for Colgate-Palmolive Company are available from recognized financial institutions. The most recent grades show a mix of maintained, upgraded, and downgraded ratings from various reputable firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Overweight | 2025-12-18 |

| Argus Research | downgrade | Hold | 2025-12-11 |

| RBC Capital | upgrade | Outperform | 2025-12-09 |

| Barclays | maintain | Equal Weight | 2025-11-04 |

| Wells Fargo | maintain | Underweight | 2025-11-03 |

Conclusion

Colgate-Palmolive Company’s overall financial results are favorable, supported by solid profitability metrics and a steady earnings growth. The stock’s recent rise reflects institutional interest and a generally positive analyst consensus, despite some concerns over leverage and valuation.

Longer-term developments indicate a durable competitive advantage with increasing profitability and a diversified product portfolio. Investors should monitor the company’s debt-to-equity ratio and evolving analyst price targets to assess ongoing financial risk and valuation dynamics.

Investments involve risks, and this article does not constitute investment advice.

Sources

I wrote this article based on the following sources. I encourage you to consult them to deepen your understanding of the latest developments regarding Colgate-Palmolive Company (NYSE: CL).

- Cerity Partners LLC Lowers Stock Position in Colgate-Palmolive Company $CL — This article details how Cerity Partners LLC reduced its holdings in Colgate-Palmolive by 3.3% during Q3, reflecting a cautious stance from this institutional investor.

- Colgate-Palmolive Company $CL Shares Sold by Birch Hill Investment Advisors LLC — This report covers the significant 20.6% reduction in shares by Birch Hill Investment Advisors LLC, signaling a notable shift in their investment strategy toward CL stock.

Colgate-Palmolive Company Analysis

I encourage you to read the comprehensive analysis of Colgate-Palmolive Company to enhance your investment decisions: Colgate-Palmolive Company Analysis