Chevron Corporation stands at a critical crossroads, facing both immense challenges and promising opportunities in Venezuela’s oil sector. The company’s ability to navigate geopolitical risks and rebuild aging infrastructure will be pivotal. How Chevron manages these complexities will define its growth trajectory in the years ahead.

Table of contents

Key Points

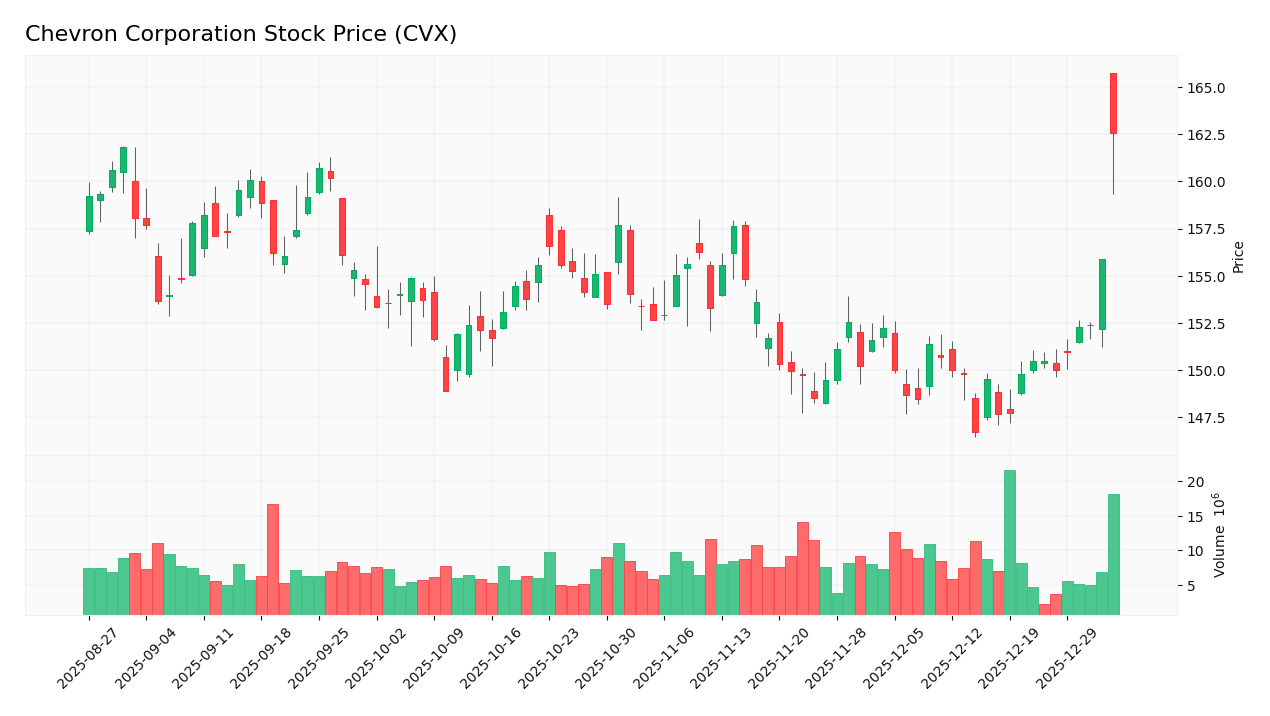

- Chevron’s stock surged on U.S. plans to rebuild Venezuelan oil infrastructure.

- Chevron uniquely operates in Venezuela, positioning for potential market growth.

- Oil prices remain steady despite Chevron’s stock rally and geopolitical events.

Chevron’s Strategic Challenge in Venezuela’s Oil Sector

Chevron Corporation is a leading integrated energy company operating globally across upstream exploration, midstream transportation, downstream refining, and petrochemical manufacturing. Recently, Chevron reported quarterly revenues of $48.17B, slightly surpassing estimates, with EPS of $1.85 despite a 1.9% revenue decline year-over-year. The company maintains strong institutional investor support and a 4.4% dividend yield, reflecting steady performance amid market fluctuations.

Chevron faces the challenge of leveraging its unique position as the sole major U.S. oil company currently operating in Venezuela to rebuild the country’s deteriorated oil infrastructure. This opportunity arises amid significant geopolitical risks, ongoing U.S. sanctions, and infrastructure decay, complicating efforts to increase Venezuela’s oil production. The situation is timely due to recent political changes and U.S. government signals favoring renewed involvement in Venezuela’s energy sector.

Market Reaction

The prospect of Chevron leveraging its expertise to rebuild Venezuela’s oil infrastructure presents a significant growth opportunity but is tempered by geopolitical risks and sanctions that could impact operational stability and capital allocation. Chevron’s stock price responded positively to this news, rising by 4.93% on the day:

Target Prices

Analysts present a cautiously optimistic outlook for Chevron Corporation as it navigates the complexities of rebuilding Venezuela’s oil infrastructure. The consensus target price reflects expectations of moderate upside potential despite geopolitical risks and operational challenges.

| Target High | Target Low | Consensus |

|---|---|---|

| 206 | 158 | 174.25 |

Impacts on the Income Statement

Chevron Corporation’s income statement shows a favorable overall profit and loss profile for investors, with key margins such as gross margin at 29.43%, EBIT margin at 14.53%, and net margin at 9.13% all marked as favorable. Despite a 1.78% revenue decline over the past year, the period from 2020 to 2024 reflects strong growth, including a 418.62% increase in net income.

The challenge of capitalizing on Venezuela’s oil infrastructure rebuilding amid geopolitical risks and sanctions could weigh on Chevron’s future results. These factors may increase operational complexity and costs, potentially impacting revenue growth and net margins if risks are not effectively managed.

Stock Grades

The latest analyst ratings for Chevron Corporation reflect a cautiously optimistic stance amid the challenges and opportunities in Venezuela’s oil sector. Recent grades show a mix of steady endorsements with a notable upgrade signaling confidence in Chevron’s strategic positioning.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Market Perform | 2026-01-05 |

| Mizuho | Maintain | Outperform | 2025-12-12 |

| B of A Securities | Maintain | Buy | 2025-12-11 |

| HSBC | Upgrade | Buy | 2025-12-01 |

| Wells Fargo | Maintain | Overweight | 2025-11-14 |

These grades suggest that while risks remain, especially geopolitical and infrastructural, major analysts see value in Chevron’s potential to capitalize on rebuilding Venezuela’s oil infrastructure. Investors should weigh these perspectives carefully, balancing opportunity with the inherent risks.

Conclusion

Chevron’s overall results regarding its opportunity to rebuild Venezuela’s oil infrastructure are favorable. The company’s unique position as the sole major U.S. operator in Venezuela, combined with recent geopolitical developments, places it at the forefront of potential growth despite persistent sanctions, infrastructure decay, and political risks.

In the long term, Chevron could benefit from increased Venezuelan oil production, which could expand global supply and influence market dynamics. Investors should closely monitor the geopolitical situation, U.S. policy shifts, and the progress of infrastructure rehabilitation, as these factors will critically shape Chevron’s ability to capitalize on this opportunity.

Investors should remember that all investments carry risks, and this article does not constitute investment advice.

Sources

I wrote this article based on the following sources. I encourage you to consult them directly to deepen your understanding of the recent developments affecting Chevron Corporation and the broader energy sector.

- Chevron, Oil Stocks Soar as Trump Promises Revival of Venezuelan Oil Industry – Investopedia

Analysis of how political changes in Venezuela are impacting energy companies, highlighting Chevron’s position.

- Chevron, energy stocks soar after US capture of Nicolás Maduro – but oil prices barely move – New York Post

Coverage of Chevron’s stock reaction following the US operation in Venezuela, with insights on oil price movements.

- Woodward Diversified Capital LLC Has $7.14 Million Stock Position in Chevron Corporation $CVX – Defense World

Details on institutional investment activity in Chevron, reflecting confidence from large investors.

- Chevron, Exxon and SLB Stocks Are Surging But Oil Prices Aren’t Moving. What’s Up. – Barrons

Insight into the divergence between oil stock performance and crude prices amid geopolitical events.

- Chevron, US refiners’ shares surge after Trump’s move toward Venezuela oil – Reuters

Report on market reactions to US policy shifts affecting access to Venezuelan oil reserves.

- Cynosure Group LLC Buys Shares of 3,429 Chevron Corporation $CVX – Defense World

Information on recent stock purchases by institutional investors, signaling market sentiment.

Chevron Corporation Analysis

I encourage you to read the comprehensive analysis of Chevron Corporation to enhance your investment decisions: Chevron Corporation Analysis