AppLovin Corporation stands out as a dynamic force in mobile app marketing and monetization, driving innovation with its cutting-edge software platform. However, recent significant insider stock sales and mixed institutional investor activity raise important questions. I will explore how AppLovin can maintain its robust financial health and competitive edge in this evolving landscape.

Table of contents

Key Points

- AppLovin shows strong financial growth with impressive quarterly earnings.

- Institutional investors hold a significant portion of the company’s stock.

- Analyst consensus rates AppLovin as a Moderate Buy with positive outlook.

Sustaining Financial Strength Amid Insider and Institutional Trading Dynamics

AppLovin Corporation operates in mobile technology, offering software and services to app developers for growth and monetization via a data-driven advertising platform. The company reported a 68.2% revenue increase to $1.41B, with a net margin of 51.27% and strong returns on equity. Institutional investors hold 41.85%, with recent stake increases by several funds.

Insider selling has been significant, with over 340K shares sold worth $200M in recent months, including sales by the CEO and CTO. Meanwhile, some institutional investors adjusted holdings, raising questions about the company’s ability to maintain its financial momentum and market position amid this varied insider and institutional stock activity.

Market Reaction

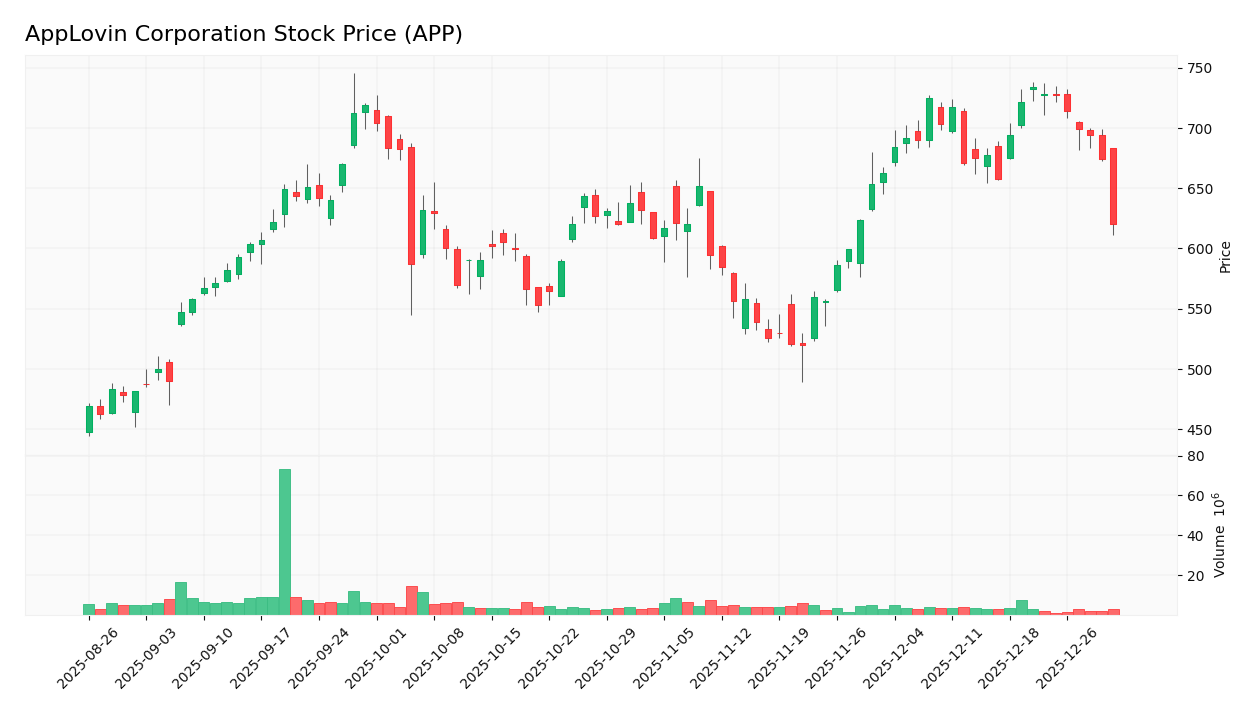

The significant insider stock sales combined with fluctuating institutional investor activity have raised concerns about AppLovin Corporation’s ability to maintain its robust financial performance and market position, potentially undermining investor confidence and putting downward pressure on the stock price. The stock price reacted sharply to these developments, declining by 7.05% on the day:

Target Prices

The consensus target prices for AppLovin Corporation indicate cautious optimism among analysts. Overall, the target range suggests that while some risks remain due to insider stock sales and fluctuating institutional interest, the company is expected to maintain solid financial performance and market position.

| Target High | Target Low | Consensus |

|---|---|---|

| 860 | 630 | 737.64 |

Impacts on the Income Statement

AppLovin Corporation displays a favorable income statement with a gross margin of 75.22%, EBIT margin of 40.22%, and net margin of 33.55%. Revenue and net income growth are strong, with 43.44% and 1361.93% increases respectively, indicating solid financial performance for investors.

Significant insider stock sales and varying institutional investor activity could influence the company’s ability to sustain this strong financial performance and market position, potentially affecting future revenue, profit margins, and overall investor confidence.

Stock Grades

AppLovin Corporation has maintained a generally positive outlook from several reputable grading companies in its most recent evaluations. The latest grades reflect a consensus to hold steady on previous recommendations, signaling confidence in the company’s ongoing financial performance despite recent insider stock sales and mixed institutional activity.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2025-12-11 |

| Jefferies | Maintain | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| Goldman Sachs | Maintain | Neutral | 2025-11-07 |

| Wells Fargo | Maintain | Overweight | 2025-11-07 |

These grades suggest a balanced perspective with a tilt toward buying or holding the stock, underlining the importance of monitoring insider transactions and institutional moves as part of a disciplined risk management strategy.

Conclusion

AppLovin Corporation’s overall results are favorable, demonstrating strong financial performance with significant revenue growth, high return on equity, and robust institutional investor interest. However, ongoing insider stock sales and mixed institutional activity present challenges to sustaining its market position.

Long-term, the company’s ability to maintain growth depends on balancing insider share reduction with continued innovation and institutional confidence. Investors should closely monitor insider ownership trends and analyst revisions as key indicators of future stability.

Investment risks remain inherent in the market, and this article does not constitute investment advice.

Sources

I wrote this article based on information from the following sources. I encourage you to consult them directly to deepen your understanding of the recent movements in AppLovin Corporation’s stock and investor activities.

- Cwm LLC Acquires 1,010 Shares of AppLovin Corporation $APP – Details on Cwm LLC increasing its stake in AppLovin by 25.3%, reflecting institutional confidence in the company’s prospects.

- AppLovin Corporation $APP Stock Position Cut by Braun Stacey Associates Inc. – Coverage of Braun Stacey Associates reducing its position by 5.9%, indicating a more cautious stance from this investor.

AppLovin Corporation Analysis

I encourage you to read the comprehensive analysis of AppLovin Corporation to enhance your investment decisions: AppLovin Corporation Analysis