Apple Inc. stands at a technological crossroads, facing challenges that could reshape its financial landscape. While the allure of S&P 500 index funds tempts investors, understanding Apple’s unique market strategies and financial performance is crucial. Let’s delve into the key factors influencing Apple’s investment potential.

Table of contents

Key Points

- Apple Inc. is a significant component of the Vanguard S&P 500 ETF.

- Warren Buffett endorses S&P 500 index funds for average investors.

- The text lacks specific information about Apple Inc.’s performance.

Lack of Insight into Apple Inc.’s Financial Performance

Apple Inc. is a key player in the technology sector, primarily known for its consumer electronics, software, and services. The company operates globally, with significant markets in North America, Europe, and Asia. Recently, Apple has been acknowledged as a major component of the Vanguard S&P 500 ETF, indicating its substantial influence in the broader market.

However, recent discussions have not provided specific insights into Apple’s financial performance, including revenue or profitability trends. Instead, attention has shifted toward the advantages of investing in S&P 500 index funds, where Apple’s role is highlighted but lacks detailed context regarding its own strategic developments or market position. This lack of focus comes amidst a backdrop of broader market sentiment favoring diversified investment strategies, as advocated by prominent investors.

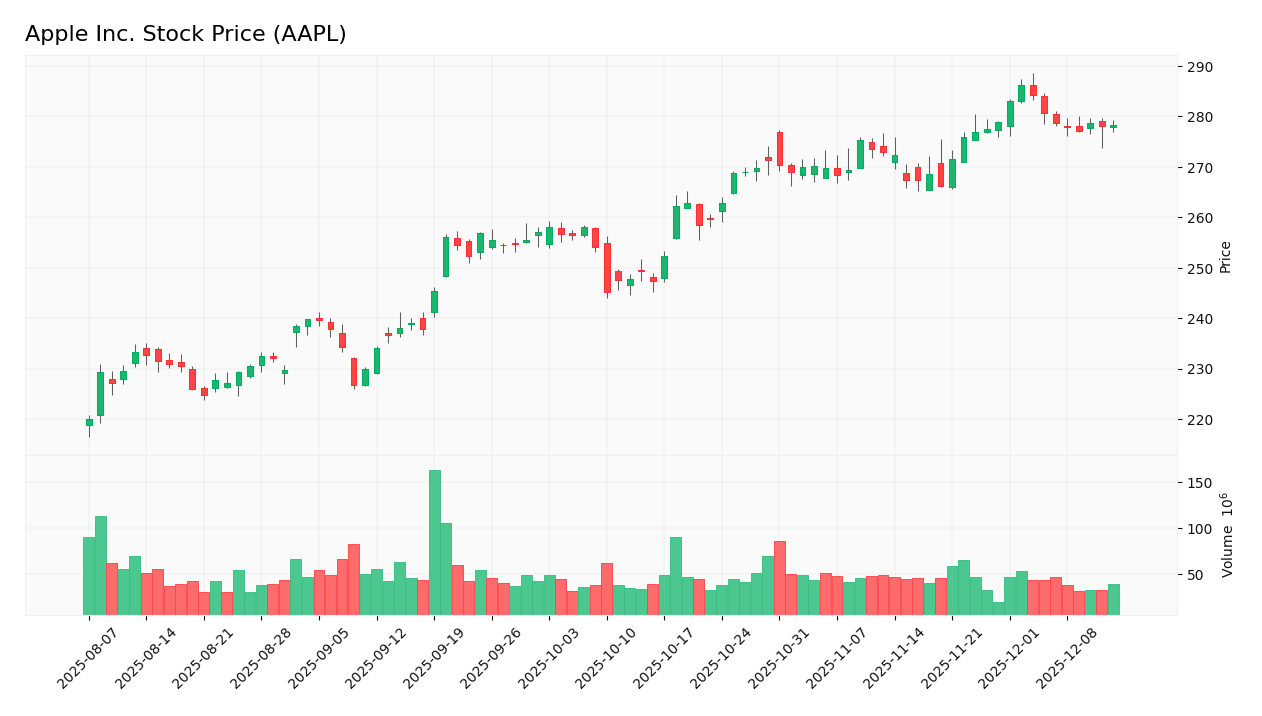

Market Reaction

The stock price of Apple Inc. (AAPL) reacted positively to the news, increasing by 0.11% in the last trading day.

Target Prices

The consensus among analysts indicates a positive outlook for Apple Inc. (AAPL). Analysts expect the stock to perform within a range reflecting their confidence in the company’s market position.

| Target High | Target Low | Consensus |

|---|---|---|

| 350 | 220 | 292.37 |

Impacts on the Income Statement

Apple Inc. (AAPL) has demonstrated strong financial health, with a revenue growth of 6.43% and a favorable net margin of 26.92%.

Recent developments may positively influence income by enhancing revenue streams and maintaining robust margins, potentially leading to higher EPS growth of 22.7%.

Stock Grades

The latest stock ratings for Apple Inc. (AAPL) reflect a consistent sentiment among analysts, indicating stability in their outlook.

Here are the most recent grades for AAPL:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-12-09 |

| Evercore ISI Group | maintain | Outperform | 2025-12-08 |

| Wedbush | maintain | Outperform | 2025-12-08 |

| CLSA | maintain | Outperform | 2025-12-05 |

| Loop Capital | maintain | Buy | 2025-12-02 |

These grades suggest that analysts maintain a positive outlook on AAPL, with several firms reiterating their “Buy” and “Outperform” ratings, indicating confidence in the company’s performance amidst the broader market conditions.

Conclusion

In examining the current landscape of investing in Apple Inc. (AAPL), it is crucial to acknowledge that while Apple is a significant component of the S&P 500, the recent analysis lacks specific insights into its financial performance and market strategies. As of now, AAPL’s stock price is at 278.34, with a market cap of 4.11T. While it is clear that Apple contributes substantially to the S&P 500 index, representing 6.8% of it, the absence of detailed metrics regarding its individual performance leaves investors with questions about its potential as a standalone investment.

The endorsement of S&P 500 index funds by investment experts like Warren Buffett highlights the advantages of diversifying through such vehicles. However, without understanding Apple’s own operational metrics—like its return on equity or debt to equity ratios—investors may find it challenging to gauge its true value in the current market. In conclusion, while Apple stands as a key player in the market, investors should seek detailed financial insights and consider the broader context of index fund investing to make informed decisions.

Sources

I wrote this article from the following sources. I invite you to consult them to delve deeper into the subject.

1. The Zacks Analyst Blog: Apple, Alphabet, Amazon and Microsoft – AAPL is up more than 40% in six months, driven by iPhone and Services strength, but valuation concerns and rising AI competition cloud the 2026 outlook. *(Published on 2025-12-15 by Zacks Investment Research)*

2. Warren Buffett Says Buy This Vanguard Index Fund — It Could Turn $400 Per Month Into $835,000 With Help From Nvidia, Apple, and Microsoft – Warren Buffett has frequently recommended that non-professional investors periodically buy shares of an S&P 500 index fund. The Vanguard S&P 500 ETF offers easy exposure to many of the most influential companies in the world, including Nvidia, Apple, and Microsoft. *(Published on 2025-12-15 by The Motley Fool)*