Advanced Elliott Wave Indicator for ProRealTime

Advanced Elliott Wave Indicator for ProRealTime

Anticipate Market Cycles Before They Unfold

The Advanced Elliott Wave Indicator for ProRealTime automatically identifies Elliott impulsive and corrective waves in real-time. It highlights key market turning points and Fibonacci-based targets — helping you anticipate new bullish trends and upcoming corrections with precision.

✅ Benefit from powerful market movements while improving your timing and risk management.

Try the indicator for Free

Start a FREE TRIAL with the Advanced Elliott Wave indicator today. You will access the indicator’s complete functionalities for two weeks.

Install the indicator on Prorealtime

Get instant access to the Advanced Elliott Wave indicator and its real-time screener on your ProRealTime platform. Acquire your license today and start detecting market cycles with precision.

Key Features

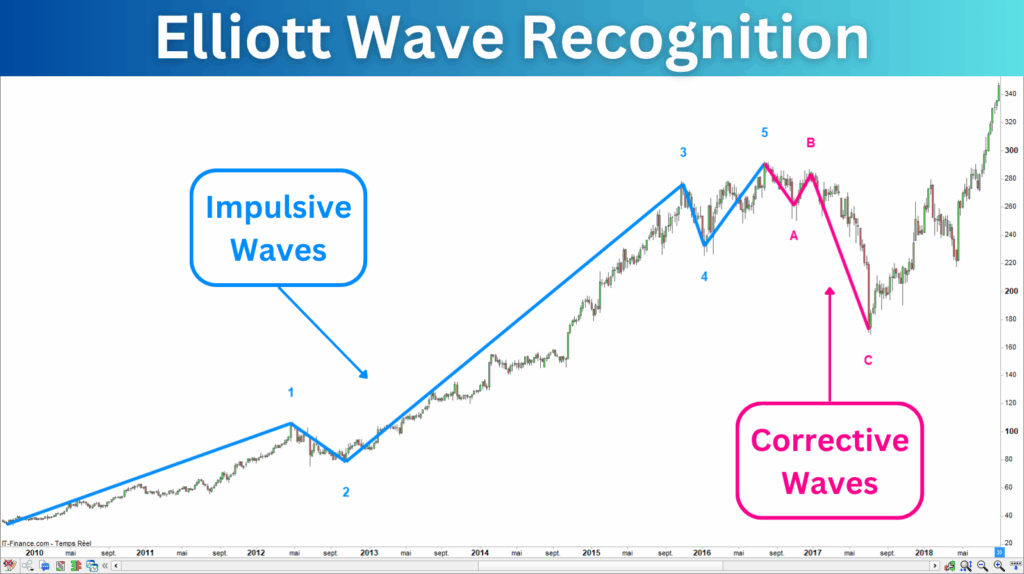

Elliott Wave Detection

Automatically detect impulsive and corrective Elliott Waves on any chart. You’ll identify market phases instantly without manual labeling.

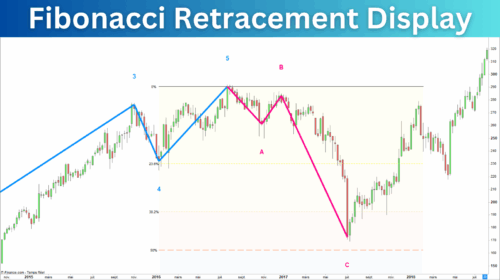

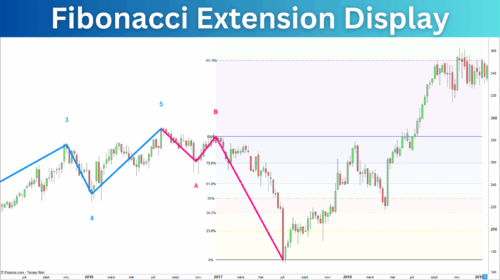

Fibonacci Level Display

Visualize Fibonacci retracements and extensions for each wave. Anticipate correction depth and set accurate profit targets.

Cycle Anticipation

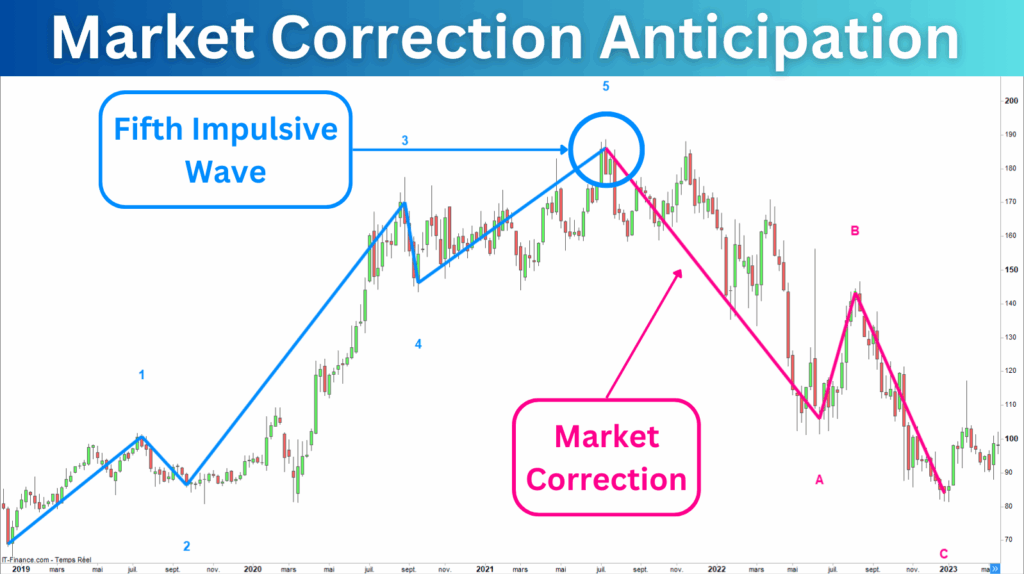

When wave 5 appears, a correction phase often follows. You’ll anticipate market reversals before most traders react.

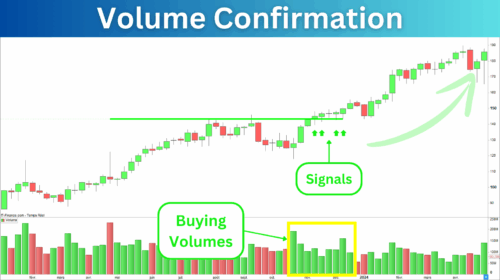

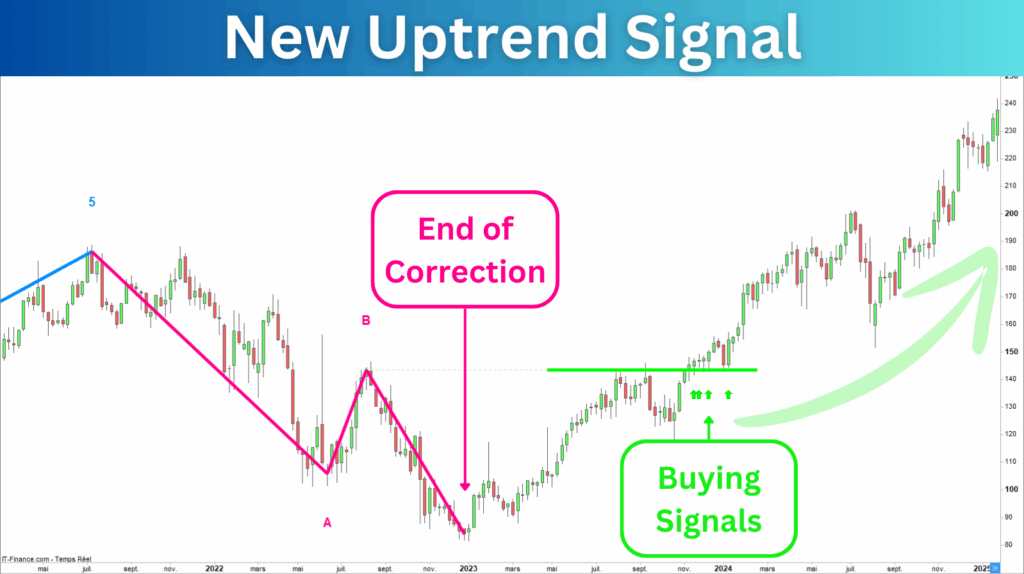

Buying Signals

Detect the beginning of new bullish cycles — including wave (C) and post-correction breakouts — to capture the entire uptrend.

Signal Confirmation

Activate validation filters based on volume, trend strength, or divergence to focus only on high-probability trades.

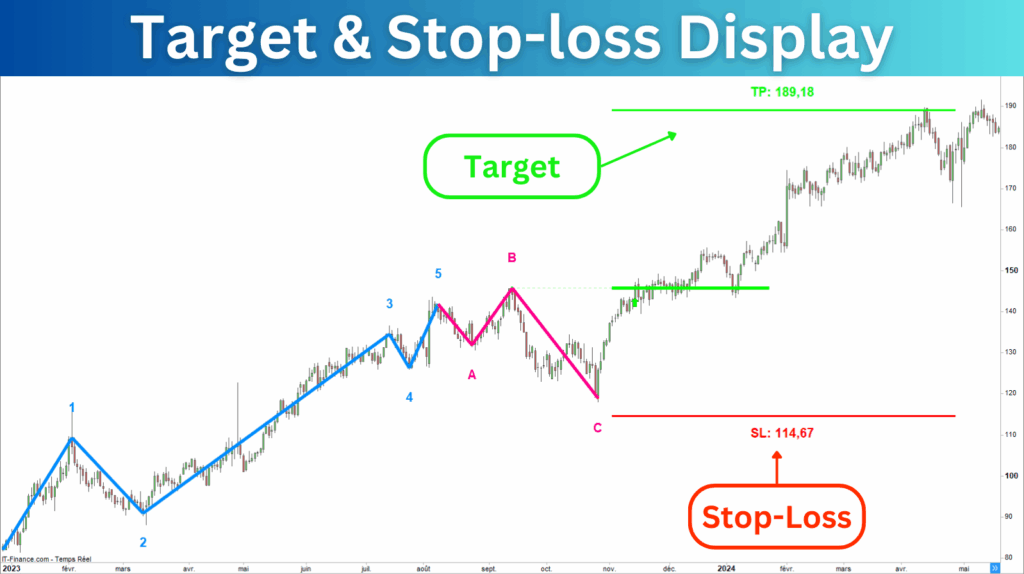

Risk Management

The indicator automatically displays targets and stop-loss levels on your chart, helping you secure profits and control losses.

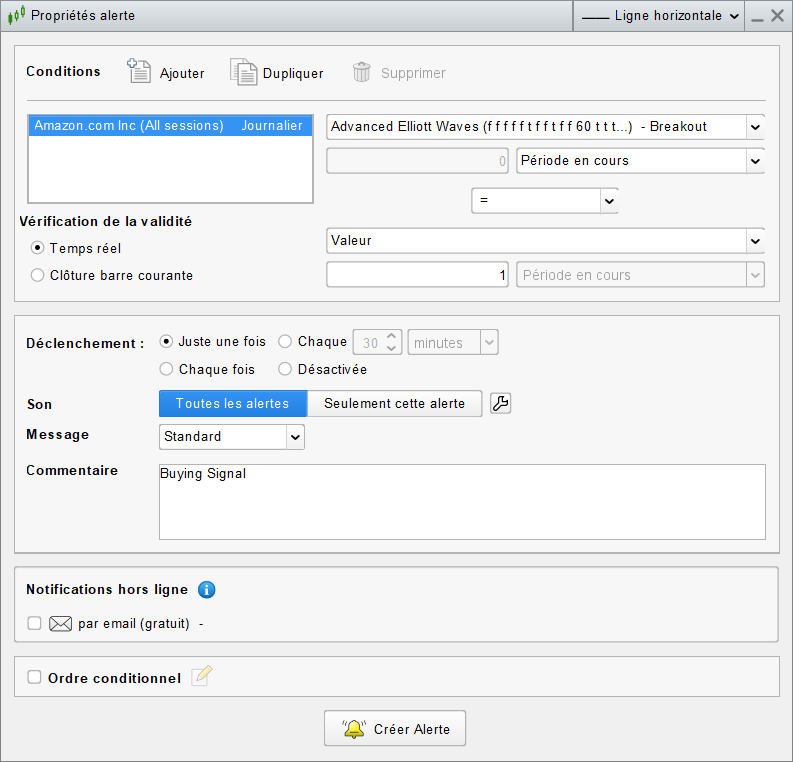

Trading Alerts

Set custom alerts on ProRealTime for wave completions or breakout signals. You’ll never miss a setup again — on any market or timeframe.

Full Customization

Adjust wave colors, pattern types, signal triggers, Fibonacci zones, or stop-loss levels. Adapt the indicator entirely to your strategy.

Automated Trading

Integrate the indicator into your ProBuilder backtests to validate and automate your Elliott-based strategies.

Why Use Elliott Waves?

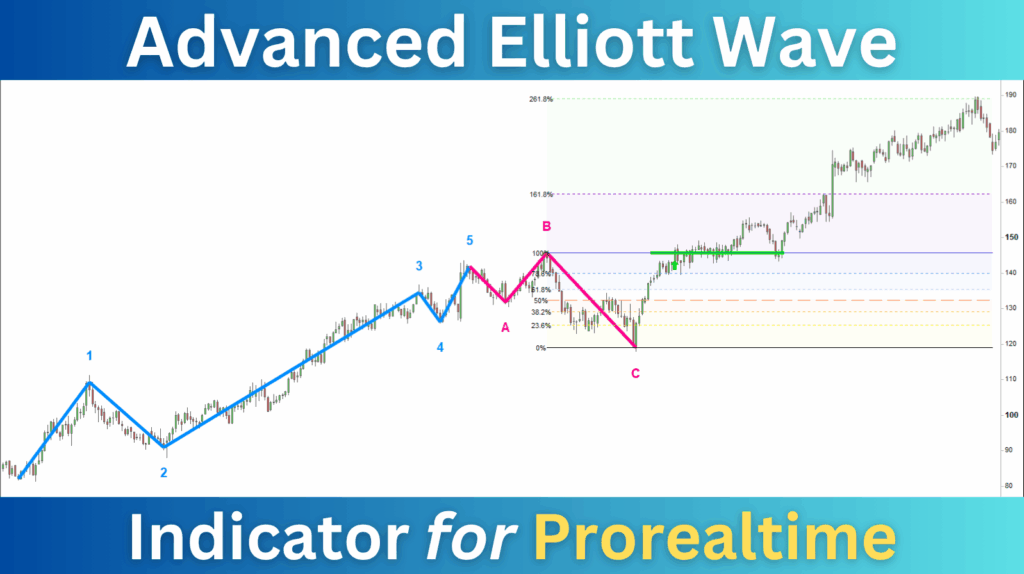

The Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, reveals how markets move in repetitive psychological cycles. Understanding these cycles helps you anticipate the beginning and end of major trends — whether bullish or corrective.

Detect the End of Bullish Cycles

When the fifth impulsive wave completes, a market correction is often imminent. Use this signal to secure profits or hedge positions.

Identify the Start of New Trends

The formation of wave (C) typically marks the end of a correction and the start of a new uptrend. Take advantage of early entries on major reversals.

The following image shows the three Elliott cycles, consisting of a bullish cycle, a correction phase, and the emergence of a new uptrend:

Why use the Advanced Elliott Wave indicator?

Trading Elliott Waves manually requires deep expertise and time. The Advanced Elliott Wave Indicator automates detection, confirmation, and visualization — providing a clear structure to your charts.

It’s ideal for swing traders, position traders, and algorithmic strategies.

1. Automatic Elliott Wave Recognition

Any trader who has ever used the Elliott Wave method knows it can be time-consuming to plot waves on a chart correctly.

Automatically displaying Elliott Waves will save you valuable time. You’ll detect the beginning of corrective phases and new bullish cycles at a glance:

You will spot Elliott Waves at a glance on your charts

2. Fibonacci Levels Display

The indicator allows the display of Fibonacci retracements and extensions on each wave. The retracements will help you anticipate the depth of the correction. The extensions will help you set your price target.

You will evaluate the coming key price levels

3. Anticipate the Market Corrections

A market correction often follows five impulsive waves. The Advanced Elliott Wave indicator displays the waves when the algorithm recognizes a complete impulsive cycle.

When you see the indicator drawing the fifth impulsive wave, you can consider that a correction may occur.

You will cover or secure your long positions

4. Profit from the Start of the Uptrend

Bear markets can provide opportunities, but no one can say how far they will fall. Even if the third corrective wave often indicates the correction’s end, this is insufficient to buy the market.

The Advanced Elliott Wave indicator provides consistent buying signals. It detects the breakout and retest of waves (5) and (B) and displays the signal on your chart.

You will benefit from the whole coming uptrend

5. Improve your Performance

Although key-level breakouts provide excellent signals, you can improve the performance of this strategy. The Advanced Elliott Wave indicator allows for signal confirmation.

You will activate breakout and retest validation or apply volume and divergence filters. Thanks to these built-in filters, you will increase the success rate of your trades.

You will focus on the best trade opportunities

6. Manage Risk with Target and Stop-loss

Risk management is essential in trading. Often neglected by traders, limiting losses and securing profits will determine your trading performance.

The Advanced Elliott Wave indicator displays the targets and stop-losses on the price chart.

You will maximize your profits and control your risk

7. Trading Alerts

The Advanced Elliott Wave indicator allows for trading alert activations. The Prorealtime platform will notify you when the price breaks a key level.

You will create an alert on all assets in all timeframes.

You will never miss a trade opportunity again

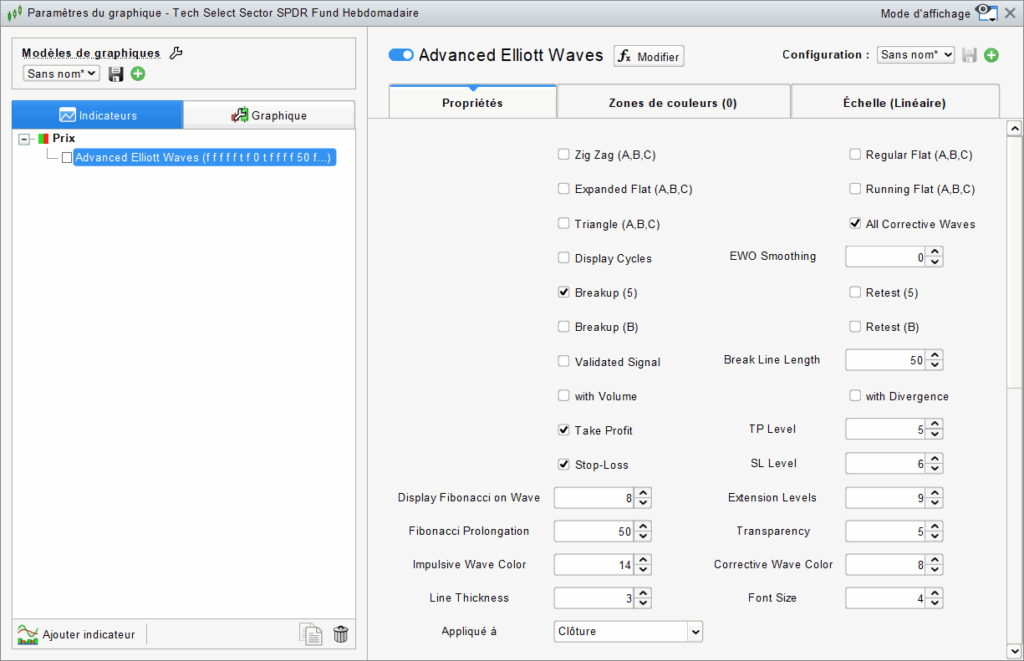

8. Adapt the Indicator to Your Needs

The indicator is fully customizable. You can select the type of corrective waves, choose the signals, apply filters, display Fibonacci levels, and customize the display.

Type of Corrective Waves

- Zig Zag

- Regular Flat

- Expanded Flat

- Running Flat

- Triangle

- All Corrective Waves

Type of Signals

- Breakup of Wave 5

- Retest of Wave 5

- Breakup of Wave B

- Retest of Wave B

Signal Confirmation

- Signal Validation

- Volume Confirmation

- Strength Confirmation

Fibonacci Display

- Select the Wave for Display

- Determine the Extension Levels

- Length of Fibonacci Lines

- Transparency of Fibonacci Area

Risks Management

- Target Display

- Target Level Setting

- Stop Loss Display

- Stop Loss Level Setting

Waves Display

- Impulsive Wave Colors

- Corrective Wave Colors

- Line Thickness

- Elliott Wave Oscillator Smoothing

You will adapt the indicator to your trading style

9. Backtest and Automated trading

The Advanced Elliott Wave indicator is perfectly integrable in a backtest.

The following strategy opens a long entry after the breakout of the B Wave with volumes and strength. It closes the entry on the 261.8% Fibonacci level:

The following gallery shows the strategy run on all the Nasdaq 100 index stocks in the weekly timeframe:

You will backtest your strategies and create trader bots

Online Documentation

I provide complete documentation describing the usage and settings of the indicator. I also provide an example of code you can use to backtest your strategies and create an automated trading system. You can consult this documentation at any time on these pages:

Available Brokers

The Bullish Harminics indicator is compatible with all versions of Prorealtime. You can install the indicator on any broker that provides this platform. The brokers with which you can use the indicator are Interactive Brokers, IG, Saxo Bank, and Boursorama:

Try the indicator for Free

Start a FREE TRIAL with the Advanced Elliott Wave indicator today. You will access the indicator’s complete functionalities for two weeks.

Install the indicator on Prorealtime

Get instant access to the Advanced Elliott Wave indicator and its real-time screener on your ProRealTime platform. Acquire your license today and start detecting market cycles with precision.