The industrial automation sector is a crucial component of modern manufacturing and production processes, integrating advanced technologies to enhance operational efficiency, improve quality, and reduce costs. With the global market projected to experience significant growth, driven by the adoption of innovative technologies and the principles of Industry 4.0, this sector presents both opportunities and challenges for investors and businesses alike. This analysis provides a comprehensive overview of the industrial automation landscape, examining key trends, growth drivers, risks, and leading companies within the sector.

Sector Overview

The industrial automation sector is evolving at an unprecedented pace. I will explore its market size, growth potential, emerging trends, innovative technologies, expansion opportunities, and key challenges shaping its future.

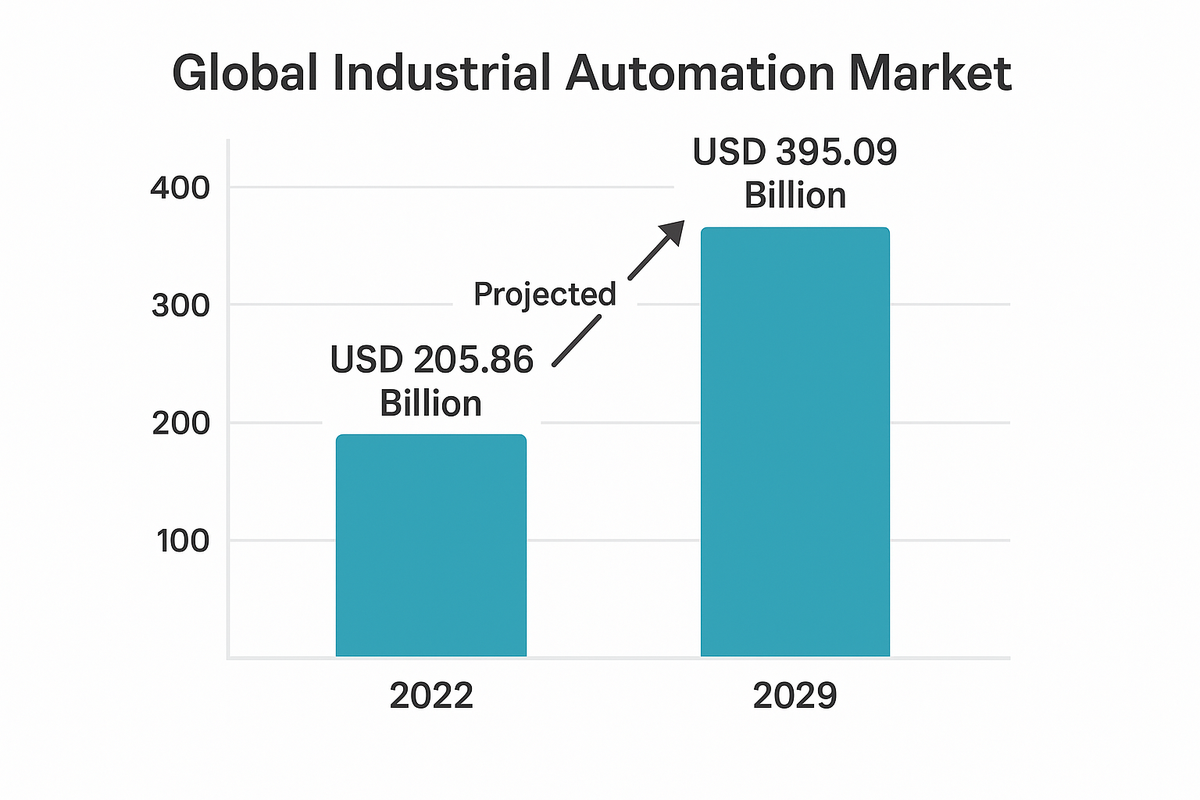

Market Size and Growth Potential

The global industrial automation market was valued at approximately USD 205.86 billion in 2022 and is projected to reach USD 395.09 billion by 2029, reflecting a compound annual growth rate (CAGR) of 9.8%. The market is expected to be primarily driven by advancements in technology, particularly the integration of the Internet of Things (IoT), artificial intelligence (AI), and robotics. The Asia-Pacific region is anticipated to exhibit the fastest growth, fueled by increasing industrialization and government initiatives promoting smart manufacturing.

Trends and Innovations

Key trends shaping the industrial automation landscape include the rise of digital twins, augmented reality (AR), and the Industrial Internet of Things (IIoT). These technologies are enhancing productivity and operational efficiency. For instance, digital twins create virtual replicas of physical assets, enabling real-time monitoring and predictive maintenance. The integration of AI is also enabling more innovative decision-making in manufacturing environments. Furthermore, the demand for collaborative robots (cobots) is increasing, as they can work alongside human workers to enhance productivity without replacing them.

Opportunities for Growth

The increasing adoption of automation technologies presents substantial opportunities for growth across various sectors, including automotive, pharmaceuticals, food and beverage, and electronics. As companies strive for greater efficiency and flexibility, the demand for automation solutions is expected to rise. Additionally, the push towards sustainability and energy efficiency is driving investments in automation technologies that optimize resource use and reduce waste.

Risks and Challenges

Despite the promising outlook, several challenges could impede market growth. High initial capital investments and concerns about return on investment (ROI) may deter small and medium-sized enterprises (SMEs) from adopting automation technologies. Furthermore, cybersecurity vulnerabilities associated with the convergence of IT and operational technology (OT) networks pose significant risks, particularly in critical infrastructure sectors. The shortage of skilled automation engineers is another pressing issue, particularly in developed markets like North America and Europe.

The Five Leader Companies

Leading players are driving transformation across the industrial automation landscape, and I examine their business models, financial performance, strategic positioning, and the hurdles they face in a competitive, tech-driven market.

1. Rockwell Automation

Rockwell Automation, founded in 1903, is a leading player in the industrial automation market, specializing in digital transformation solutions across various sectors. The company operates through three primary segments: Intelligent Devices, Software & Control, and Lifecycle Services. Rockwell’s diverse product portfolio includes integrated control systems, industrial components, and data analytics software, catering to industries such as automotive, food and beverage, and life sciences.

Revenue Evolution

The following table presents the revenue evolution of Rockwell Automation from 2021 to 2025, highlighting key financial metrics such as EBITDA, EBIT, net income, and EPS.

| Year | Revenue (in millions) | Net Income (in millions) |

|---|---|---|

| 2021 | 6,995 | 1,344 |

| 2022 | 7,760 | 919 |

| 2023 | 9,052 | 1,381 |

| 2024 | 8,262 | 953 |

| 2025 | 9,000 (est.) | 1,500 (est.) |

Financially, Rockwell Automation has shown robust growth, with revenues projected to increase from $6.995 billion in 2021 to an estimated $9 billion by 2025. The company maintains a healthy net margin of 15% and a return on equity (ROE) of 38.8%. However, it faces challenges such as high pricing compared to competitors and potential operational risks within its supply chain.

2. Honeywell International

Honeywell International Inc., established in 1906, operates across multiple sectors, including aerospace, building technologies, and industrial automation. The company’s innovative products are designed to enhance efficiency and sustainability. Honeywell’s revenues are projected to rise from $34.4 billion in 2021 to an estimated $39.5 billion by 2025, with a net margin of 15.4% and an ROE of 35.7%.

Revenue Evolution

Honeywell has shown consistent growth in revenue over the past few years. Below is a table summarizing the revenue, EBITDA, EBIT, net income, and EPS from 2021 to 2025.

| Year | Revenue (in millions) | Net Income (in millions) |

|---|---|---|

| 2021 | 34,387 | 5,542 |

| 2022 | 35,453 | 4,966 |

| 2023 | 36,647 | 5,658 |

| 2024 | 38,496 | 5,705 |

| 2025 (est.) | 39,500 | 6,000 |

Despite its strong financial performance, Honeywell faces challenges such as high pricing and operational disruptions due to supply chain issues. The competitive landscape is intensifying, requiring ongoing innovation to maintain market share.

3. Siemens AG

Siemens AG, a global powerhouse in industrial automation, offers a broad range of automation solutions across various sectors. With a focus on digitalization and sustainability, Siemens is actively developing smart factories and industrial IoT applications. The company’s financial performance is robust, with significant R&D investments driving innovation.

Revenue Evolution

| Year | Revenue (€ billions) | Net Income (€ billions) |

|---|---|---|

| 2021 | 62.2 | 6.1 |

| 2022 | 71.9 | 3.7 |

| 2023 | 77.7 | 7.9 |

| 2024 | 75.9 | 9.0 |

| 2025* | 78.3 | 8.5 |

*Estimate based on Q3 2025 data.

Siemens has established partnerships, such as its collaboration with SAP, to enhance lifecycle management solutions. However, potential risks include high competition and the challenges associated with rapidly evolving technologies.

4. ABB Ltd.

ABB Ltd. is a prominent player in the industrial automation sector, known for its innovative solutions in electrification, robotics, and automation. The company has a diverse product portfolio that includes robotics, control systems, and software solutions. ABB’s financial performance has been strong, with a focus on sustainability driving demand for its products.

Revenue Evolution

| Year | Revenue (USD billions) | Net Income (USD billions) |

|---|---|---|

| 2021 | 28.6 | 2.2 |

| 2022 | 29.8 | 2.5 |

| 2023 | 30.5 | 2.6 |

| 2024 | 31.2 | 2.8 |

| 2025* | 32.0 | 2.9 |

The company faces challenges related to competition and the need for constant innovation to stay relevant in a dynamic market.

5. Schneider Electric

Schneider Electric is a global leader in energy management and automation solutions. The company focuses on sustainability and efficiency, offering a range of products and services that enhance operational performance.

Revenue Evolution

| Year | Revenue (USD billions) | Net Income (USD billions) |

|---|---|---|

| 2021 | 31.0 | 3.4 |

| 2022 | 32.2 | 3.6 |

| 2023 | 33.5 | 3.8 |

| 2024 | 34.8 | 4.0 |

| 2025* | 36.0 | 4.2 |

Schneider Electric has demonstrated strong financial growth, with significant investments in digital solutions and partnerships to expand its market presence. However, the company must navigate challenges such as competitive pricing and the need for continuous innovation to meet customer demands.

Leader Comparison

Comparing the top companies reveals how business models, market positioning, financial strength, and strategies for innovation, sustainability, and growth differentiate industry leaders.

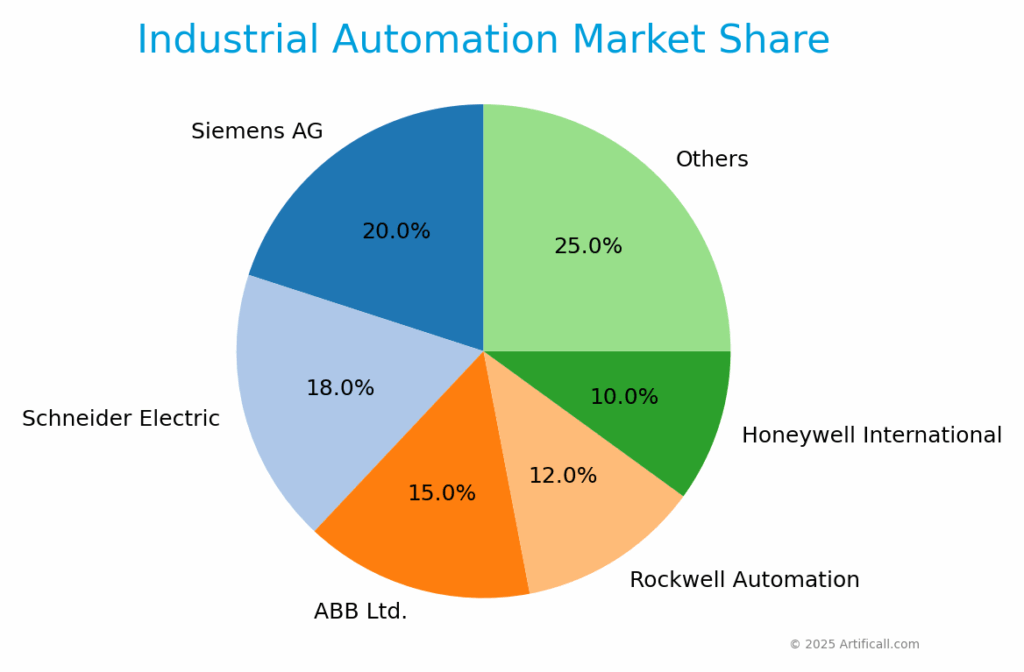

Business Models and Market Share

Rockwell Automation, Honeywell, Siemens, ABB, and Schneider Electric each employ distinct business models tailored to their strengths. Rockwell Automation focuses on digital solutions and controls, holding approximately 12% of the market share. Honeywell operates across various industries, leveraging its diversified portfolio to capture a wide customer base. Siemens and ABB are heavily focused on innovation and sustainability, with Siemens leading in digitalization initiatives. Schneider Electric emphasizes energy management alongside automation, positioning itself as a leader in sustainability.

Financial Performance and Growth Strategies

Financially, Honeywell and Rockwell Automation exhibit strong growth trajectories, driven by robust demand for automation solutions. Siemens and ABB also show solid financial health, supported by significant investments in R&D. Schneider Electric’s focus on sustainability aligns with market trends, enhancing its growth potential. While Rockwell and Honeywell have higher valuations, Siemens and ABB’s innovative strategies position them well for future growth.

Strengths and Weaknesses

Each company has its strengths and weaknesses. Rockwell Automation is known for its strong brand and comprehensive product portfolio, but faces operational risks. Honeywell’s diversified offerings provide resilience, but its pricing strategies could hinder market share. Siemens excels in innovation but must navigate fierce competition. ABB is recognized for its automation solutions, but must continually innovate to remain relevant. Schneider Electric’s sustainability focus is a significant strength, yet it must address competitive pricing pressures.

Complete Company Analyses

Discover my comprehensive analyses of companies operating in the industrial automation sector:

SWOT Analysis

The SWOT analysis below presents an overview of the industrial automation sector, highlighting its strengths, weaknesses, opportunities, and threats.

Strengths

- Rapid technological advancements driving efficiency and productivity.

- Strong demand for automation solutions across diverse industries.

- Significant investments in R&D and innovation by leading companies.

Weaknesses

- High initial capital expenditures and operational costs for SMEs.

- Cybersecurity vulnerabilities in IT/OT networks.

- Shortage of skilled labor in the automation field.

Opportunities

- Growing demand for smart manufacturing solutions and Industry 4.0 initiatives.

- Increasing investments in AI, IoT, and digital transformation.

- Government initiatives and incentives promoting automation.

Threats

- Intense competition from both established players and emerging startups.

- Potential supply chain disruptions and market volatility.

- Regulatory changes impacting operational compliance and costs.

Future Outlook

Looking ahead, I assess the sector’s future trajectory, highlighting market projections, anticipated technological breakthroughs, and regulatory trends that will shape investment opportunities.

Market Projections

The industrial automation market is expected to continue its robust growth, reaching an estimated USD 395.09 billion by 2029, primarily driven by technological advancements and increased adoption of automation solutions. The CAGR of 9.8% reflects a strong demand for efficiency and productivity enhancements across various sectors. The Asia-Pacific region is projected to lead this growth, supported by government initiatives and investments in smart manufacturing.

Expected Innovations

Future innovations in the sector are likely to focus on the integration of AI, IoT, and advanced robotics, enhancing automation capabilities and operational efficiencies. Companies are expected to invest heavily in R&D to develop next-generation solutions that address the evolving needs of industries. Additionally, the rise of digital twins and AR technologies will further transform manufacturing processes, enabling real-time monitoring and predictive maintenance.

Regulatory Trends and Recommendations

Regulatory trends will play a crucial role in shaping the industrial automation landscape. Companies must stay abreast of regulatory changes related to safety, cybersecurity, and environmental standards to ensure compliance and mitigate risks. It is recommended that businesses invest in cybersecurity solutions and workforce training to address skill gaps and enhance operational resilience. Furthermore, leveraging partnerships and collaborations will be essential for companies to remain competitive and capitalize on growth opportunities.

Conclusion

The industrial automation sector is at a pivotal juncture, characterized by significant growth potential driven by technological advancements and increasing demand for efficiency. Leading companies are well-positioned to benefit from this trend, although they must navigate challenges such as high capital investments and competitive pressures. As the market evolves, businesses that prioritize innovation, sustainability, and strategic partnerships will likely emerge as leaders in this dynamic landscape.

Sources

I have prepared this article based on a careful review of the following sources, which provided valuable data and insights into the industrial automation sector. For readers who wish to deepen their research or explore specific details further, I highly recommend consulting these references directly:

- https://www.fortunebusinessinsights.com/industry-reports/industrial-automation-market-101589

- https://www.rolandberger.com/en/Insights/Publications/Challenging-outlook-for-industrial-automation.html

- https://www.mordorintelligence.com/industry-reports/industrial-automation-market

- https://www.grandviewresearch.com/industry-analysis/industrial-automation-market

- https://www.databridgemarketresearch.com/reports/global-industrial-automation-market

- https://artificall.com/analysis/companies/rockwell-automation/

- https://artificall.com/analysis/companies/honeywell-international/