The clean water sector plays a critical role in sustaining human health, economic stability, and environmental sustainability. It encompasses the provision of safe drinking water, wastewater treatment, and the management of water resources. The sector is crucial to public health, as access to clean water helps prevent waterborne diseases and promote hygiene.

Understanding the Clean Water Industry

What is the Clean Water Industry?

The clean water industry encompasses all businesses and technologies dedicated to providing safe, accessible, and sustainable water. It includes water treatment, desalination, wastewater management, filtration systems, and infrastructure services. This industry plays a vital role in public health, environmental protection, and economic development by ensuring clean water for households, agriculture, and industry. Driven by innovation and sustainability, it addresses global challenges such as water scarcity, pollution, and climate change.

What are the challenges of the water industry?

The clean water industry faces growing challenges due to climate change, water scarcity, and aging infrastructure. Rising demand, pollution, and limited freshwater resources are putting pressure on global water systems. Contamination from PFAS, microplastics, and industrial waste increases treatment complexity and costs. Many regions also struggle with insufficient investment in modern water technologies and infrastructure upgrades. Additionally, regulatory hurdles and fragmented management slow innovation and implementation. To overcome these issues, the industry must focus on sustainable water management, advanced purification technologies, and public-private partnerships to ensure safe, affordable, and accessible water for all.

Global Market Overview

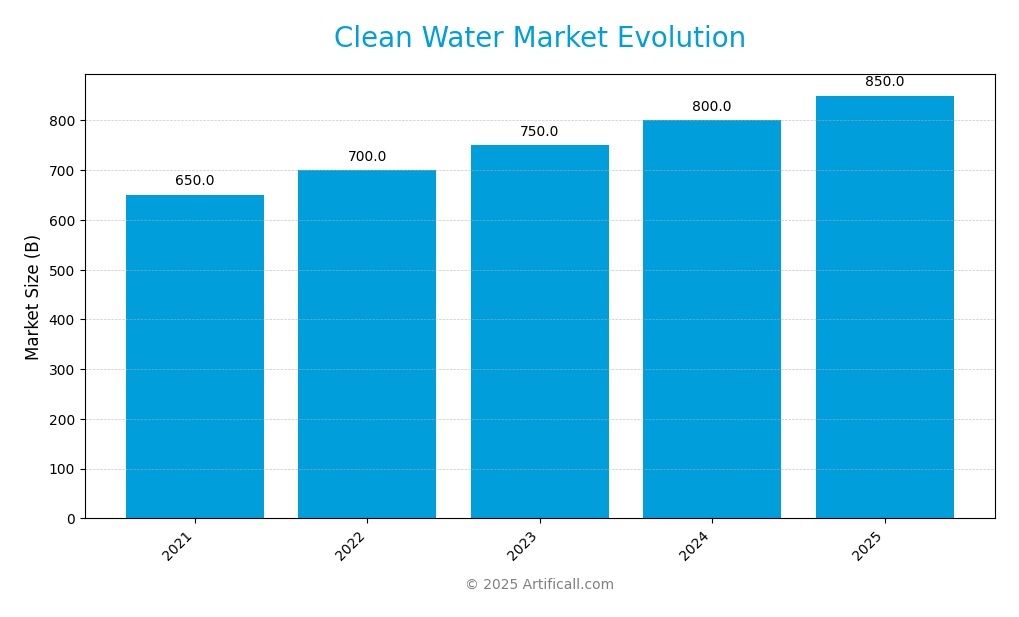

The clean water market is projected to grow significantly, driven by increasing demand for water, aging infrastructure, and a growing focus on sustainability. According to various reports, the global clean water market was valued at approximately USD 700 billion in 2022 and is expected to reach USD 1 trillion by 2025, reflecting a compound annual growth rate (CAGR) of around 8.5%.

Market Structure and Dynamics

Market Composition and Value Chain

The clean water sector comprises several key segments: water supply, wastewater management, and ancillary services such as maintenance and consulting. Major stakeholders include government agencies, private utility companies, and non-profit organizations. The value chain encompasses water extraction, treatment, distribution, and wastewater management, and requires significant investments in infrastructure and technology.

In the water supply segment, companies focus on extracting and treating water for consumption, while in wastewater management, they treat and recycle wastewater. Innovations in technology, such as smart metering and IoT applications, are gaining traction, enhancing efficiency and reducing operational costs.

Market Concentration

The clean water sector exhibits varying levels of market concentration across regions. In the U.S., for example, the top five companies control approximately 40% of the market, indicating moderate concentration. Barriers to entry include high capital costs, regulatory requirements, and the need for technical expertise. The competitive intensity is increasing due to the entry of new players focused on innovative technologies and sustainability.

Economic Impact

The clean water sector significantly contributes to GDP, particularly in developed countries where it supports public health and economic activities. It is estimated that every dollar invested in water and sanitation yields an economic return of approximately seven dollars, underscoring its importance. The sector also creates jobs, with millions employed across various capacities, from engineering to field operations.

Emerging Trends and Growth Drivers

The clean water sector is witnessing transformative trends driven by technological advancements, regulatory changes, and increasing public awareness of sustainability. These trends are reshaping how water services are delivered and managed.

| Trend | Explanation | Investment Impact |

|---|---|---|

| Smart Water Management | Integration of IoT and AI technologies for efficient water distribution and monitoring. | Increased investment in tech-driven solutions, enhancing operational efficiency. |

| Sustainability Initiatives | Focus on reducing carbon footprints and enhancing environmental stewardship in water management. | Opportunities for investment in green technologies and infrastructure. |

| Regulatory Changes | Stricter regulations on water quality and sustainability standards. | Potential for increased compliance costs but also opportunities in consulting and compliance solutions. |

SWOT Analysis of the Clean Water Sector

The sector’s SWOT analysis reveals strengths in established infrastructure and regulatory support, weaknesses in aging assets and high capital requirements, opportunities in technology adoption, and threats from regulatory changes and competitive pressures.

Strengths

- Strong regulatory support

- Established companies

Weaknesses

- Aging infrastructure

- High capital costs

Opportunities

- Technological advancements

- Sustainability initiatives

Threats

- Regulatory pressures

- Market competition

Strategic Insights

Mergers and acquisitions are common in the clean water sector as companies seek to expand their capabilities and market reach. Recent strategic partnerships have focused on technology integration and sustainability initiatives.

Financial Performance and Valuation

The clean water sector has demonstrated resilience and growth, with revenues rising driven by rising demand and infrastructure investment. Key financial metrics indicate a positive trajectory, although challenges remain regarding profitability and capital expenditures.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 (Est.) |

|---|---|---|---|---|---|

| Avg. Revenue Growth (%) | 7.5% | 8.0% | 8.5% | 9.0% | 9.5% |

| Avg. Net Margin (%) | 10.0% | 10.5% | 11.0% | 11.5% | 12.0% |

| Avg. P/E Ratio | 20.5 | 21.0 | 21.5 | 22.0 | 22.5 |

| Avg. EV/EBITDA | 12.0 | 12.5 | 13.0 | 13.5 | 14.0 |

How to Invest in the Clean Water Sector

Investors seeking exposure to the clean water sector have several options, including diversified ETFs and leading individual stocks. The choice of investment vehicle depends on an investor’s risk tolerance, capital, and strategy.

Specialized ETFs

Sector ETFs offer a diversified way to invest in the clean water industry without having to pick individual stocks. These funds typically include a mix of companies involved in water management, technology, and utilities.

| ETF Name | Ticker | Issuer | Expense Ratio | Focus Region | Assets (B) |

|---|---|---|---|---|---|

| Invesco Water Resources ETF | PHO | Invesco | 0.59% | USA | 2.25 |

| First Trust Water ETF | FIW | First Trust Portfolios | 0.51% | USA | 1.95 |

| Amundi MSCI Water UCITS ETF | WAT | Amundi | 0.6% | USA | 1.6 |

| Invesco S&P Global Water Index ETF | CGW | Invesco | 0.59% | USA | 1 |

| Global X Clean Water ETF | AQWA | Global X | 0.50% | Global | 0.25 |

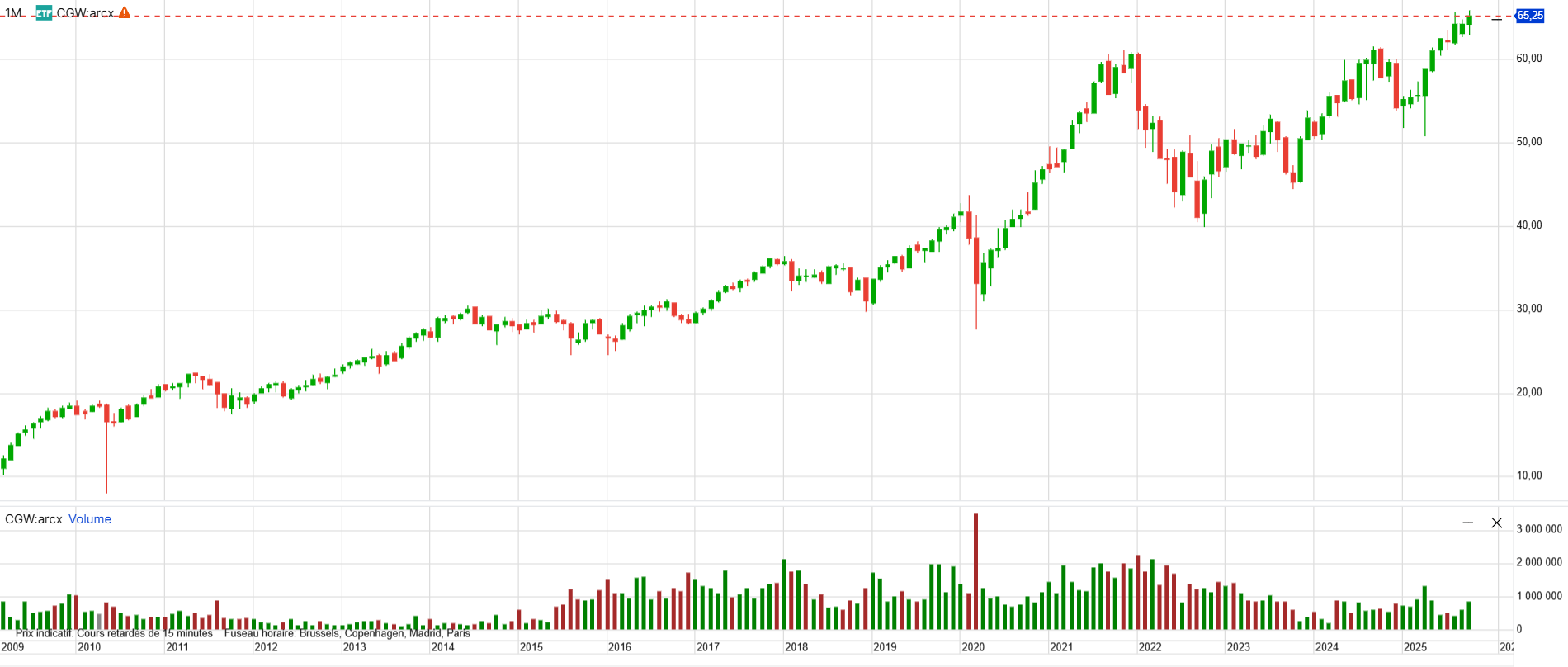

Invesco S&P Global Water chart

Here is the Invesco S&P Global Water historical price chart since 2009. The index has shown robust growth and resilience amid economic crises:

Top 15 of Global X Clean Water

Here are the top 15 stocks of the Global X Clean Water ETF:

| Name | Ticker | Net Assets (%) |

|---|---|---|

| FERGUSON ENTERPRISES INC | FERG | 8.28 |

| XYLEM INC | XYL | 8.22 |

| PENTAIR PLC | PNR | 8.14 |

| AMERICAN WATER W | AWK | 7.85 |

| CORE & MAIN INC-CLASS A | CNM | 4.96 |

| SABESP | SBSP3 BZ | 4.89 |

| ESSENTIAL UTILITIES INC | WTRG | 4.66 |

| SEVERN TRENT PLC | SVT LN | 4.58 |

| ADVANCED DRAINAG | WMS | 4.56 |

| UNITED UTILITIES | UU/ LN | 4.55 |

| SMITH (A.O.) CORP | AOS | 4.14 |

| WATTS WATER TE-A | WTS | 3.96 |

| ZURN ELKAY WATER SOLUTION | ZWS | 3.62 |

| PRIMO BRANDS CORP | PRMB | 2.94 |

| BADGER METER INC | BMI | 2.69 |

The Leaders of the Sector

The clean water sector features several dominant players, each specializing in various aspects of water management. Key companies include Xylem, American Water Works, and Essential Utilities, which collectively hold significant market shares.

Investors seeking direct exposure may prefer to invest in industry leaders known for their stability, innovation, and strong financial performance.

| Company | Ticker | Market Cap (USD B) | Net Income (USD B) | Dividend Yield |

|---|---|---|---|---|

| Xylem Inc. | XYL | 15.5 | 0.5 | 1.24% |

| American Water Works | AWK | 26.7 | 1.05 | 2.4% |

| Essential Utilities | WTRG | 8.9 | 0.3 | 3.17% |

| Company | Region | Specialization | Key Advantage |

|---|---|---|---|

| Xylem Inc. | Global | Water Technology | Leading water technology solutions |

| American Water Works | USA | Water Utility | Extensive customer base and infrastructure |

| Essential Utilities | USA | Water & Gas Utility | Focus on sustainability and community engagement |

Risk Factors to Watch

Investing in the clean water sector involves several risks, including economic fluctuations, regulatory changes, and technological disruptions. Economic downturns can lead to reduced funding for infrastructure projects, while stringent regulations may impose compliance costs on companies.

Geopolitical tensions can affect water resources and supply chains, while technological advancements may render existing systems obsolete. Investors should remain vigilant regarding these risks and their potential impact on profitability and valuations.

Investment Outlook and Opportunities

The clean water sector presents an attractive investment landscape over the next 3–5 years, driven by increasing demand and a focus on sustainability. Key sub-segments, such as smart water management and wastewater recycling, are expected to grow significantly.

| Category | Short-Term (1–2 yrs) | Medium-Term (3–5 yrs) | Investment Implication |

|---|---|---|---|

| Growth | Moderate | Strong | Focus on tech-driven solutions |

| Profitability | Stable | Increasing | Monitor margins and expenses |

| Valuation | Attractive | Premium | Consider long-term potential |

| Risk Level | Moderate | High | Be aware of regulatory changes |

As governments and organizations prioritize access to clean water, investment opportunities will arise across both established utilities and innovative technology firms. Investors should consider these trends to capitalize on emerging opportunities.

Conclusion

The clean water sector represents a vital component of global infrastructure, with significant implications for health, economy, and the environment. While the industry faces challenges such as regulatory pressures and capital requirements, the investment outlook remains promising, driven by technological advancements and increasing demand for sustainable water solutions.

Investors should consider both the opportunities and risks associated with this sector, focusing on companies that demonstrate strong financial performance and a commitment to innovation. Overall, the clean water sector offers a compelling investment landscape for those looking to contribute to a sustainable future.

Sources

I have prepared this article based on a careful review of the following sources, which provided valuable data and insights into the clean water industry. I highly recommend consulting these references directly:

- https://www.globalxetfs.com/funds/aqwa#holdings-characteristics

- https://artificall.com/analysis/companies/xylem/

- https://artificall.com/analysis/companies/american-water-works-company/

- https://artificall.com/analysis/companies/essential-utilities/

- https://ppp.worldbank.org/water-regulation-separate-regulatory-body-licensing-regime

- https://www.wareg.org/articles/1-what-is-water-economic-regulation/

- https://www.wareg.org/articles/8-water-qualityregulation/

- https://www.worldbank.org/en/topic/water/overview