Home > Analyses > Industrials > Zurn Elkay Water Solutions Corporation

Water flows through every facet of modern infrastructure, and Zurn Elkay Water Solutions Corporation engineers the systems that ensure its purity, safety, and efficiency. This industrial innovator dominates pollution control and plumbing solutions, offering trusted products like stainless steel sinks and advanced water control fittings. Known for precision and durability, ZWS shapes environments in education, healthcare, and hospitality. As we evaluate its growth prospects, the key question remains: do Zurn Elkay’s solid fundamentals justify its current market valuation?

Table of contents

Business Model & Company Overview

Zurn Elkay Water Solutions Corporation, founded in 2006 and headquartered in Milwaukee, WI, leads the industrial pollution and treatment controls sector. It delivers a comprehensive ecosystem of water system solutions designed to enhance water quality, safety, flow control, and conservation across non-residential buildings. Its portfolio spans finish plumbing, drainage, fire protection, and stainless steel products, integrating brands like Zurn, World Dryer, and Just Manufacturing to serve diverse markets including healthcare, education, and hospitality.

The company’s revenue engine balances durable hardware—such as plumbing fixtures and fire protection systems—with specialized products like hand dryers and ADA-compliant stainless steel sinks. Zurn Elkay maintains a strategic footprint across the Americas, Europe, and Asia, capitalizing on global infrastructure demand. Its strong brand portfolio and integrated solutions create a durable economic moat, positioning it as a key architect in the future of sustainable water management.

Financial Performance & Fundamental Metrics

I will analyze Zurn Elkay Water Solutions Corporation’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

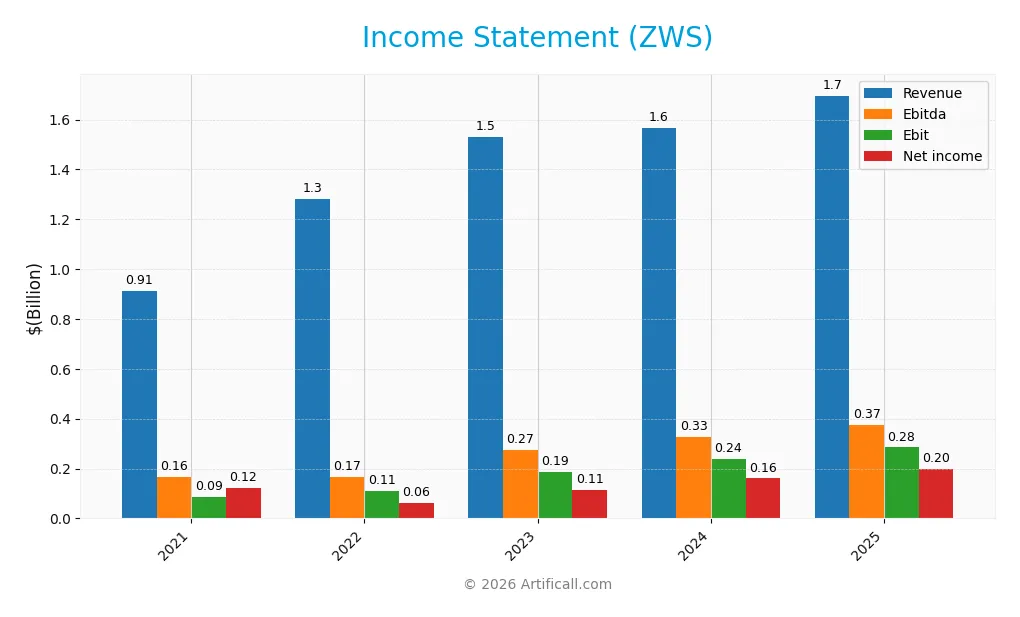

The table below presents Zurn Elkay Water Solutions Corporation’s key income statement figures for the fiscal years 2021 through 2025, all values in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 910.9M | 1.28B | 1.53B | 1.57B | 1.70B |

| Cost of Revenue | 537.7M | 816.3M | 882.4M | 859.5M | 989.8M |

| Operating Expenses | 266.2M | 358.4M | 456.7M | 462.4M | 417.6M |

| Gross Profit | 373.2M | 465.5M | 648.1M | 707.0M | 706.1M |

| EBITDA | 164.6M | 165.2M | 273.2M | 328.4M | 373.6M |

| EBIT | 87.1M | 110.7M | 185.3M | 240.1M | 284.9M |

| Interest Expense | 34.7M | 26.9M | 38.5M | 33.1M | 28.6M |

| Net Income | 120.9M | 61.7M | 112.7M | 160.2M | 198.0M |

| EPS | 1.00 | 0.41 | 0.65 | 0.93 | 1.14 |

| Filing Date | 2022-02-09 | 2023-02-14 | 2024-02-06 | 2025-02-10 | 2026-02-09 |

Income Statement Evolution

Zurn Elkay Water Solutions Corporation (ZWS) shows strong revenue growth, rising 86% from 2021 to 2025 with an 8.3% increase in 2025 alone. Net income also climbs significantly, up 64% over the period, supported by expanding EBIT margins improving to 16.8%. However, gross profit growth slightly lags, declining 0.13% in 2025 despite stable gross margins near 41.6%.

Is the Income Statement Favorable?

The 2025 income statement reflects generally favorable fundamentals. Revenue growth of 8.3% is backed by disciplined operating expense control, matching revenue increases. Net margin improves to 11.7%, indicating efficient capital allocation and cost management. Interest expenses remain low at 1.7% of revenue. Despite a minor dip in gross profit growth, the overall profitability metrics and EPS growth of 21.7% affirm strong operational leverage and financial health.

Financial Ratios

The table below summarizes key financial ratios for Zurn Elkay Water Solutions Corporation over the past five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 13% | 5% | 7% | 10% | 12% |

| ROE | 96% | 4% | 7% | 10% | 12% |

| ROIC | 12% | 3% | 6% | 8% | 9% |

| P/E | 37 | 52 | 45 | 40 | 40 |

| P/B | 35 | 2 | 3 | 4 | 5 |

| Current Ratio | 1.98 | 2.62 | 3.02 | 2.91 | 3.13 |

| Quick Ratio | 1.21 | 1.35 | 1.77 | 1.81 | 2.07 |

| D/E | 4.27 | 0.35 | 0.34 | 0.35 | 0.36 |

| Debt-to-Assets | 50% | 20% | 20% | 21% | 22% |

| Interest Coverage | 3.08 | 3.98 | 5.0 | 7.39 | 10.1 |

| Asset Turnover | 0.85 | 0.45 | 0.57 | 0.59 | 0.63 |

| Fixed Asset Turnover | 14.1 | 7.0 | 6.8 | 9.6 | 10.8 |

| Dividend Yield | 0.82% | 1.01% | 0.98% | 0.88% | 0.81% |

Evolution of Financial Ratios

From 2021 to 2025, Zurn Elkay Water Solutions Corporation’s Return on Equity (ROE) grew moderately, peaking at 12.35% in 2025, indicating improving profitability. The Current Ratio trended upward, reaching 3.13 in 2025, suggesting enhanced liquidity. The Debt-to-Equity Ratio declined sharply from over 4.2 in 2021 to 0.36 in 2025, reflecting a significant deleveraging effort.

Are the Financial Ratios Favorable?

In 2025, profitability ratios show mixed signals: a favorable net margin of 11.68% contrasts with a neutral ROE and ROIC near 9%. Liquidity appears mixed; the quick ratio is strong at 2.07, but the higher current ratio score is unfavorable, hinting at possible inefficiency. Leverage metrics, including debt-to-equity at 0.36 and interest coverage near 10, are favorable. Market valuation ratios such as P/E at 39.6 and P/B at 4.89 are unfavorable, while asset turnover is neutral. Overall, the financial ratios are slightly favorable.

Shareholder Return Policy

Zurn Elkay Water Solutions Corporation maintains a consistent dividend policy with a payout ratio near 32%, a steady dividend per share increase, and a modest yield around 0.8%. The company supports distributions through strong free cash flow coverage and moderate share buybacks.

This balanced approach aligns dividend payments and buybacks with cash generation, reducing risks of unsustainable payouts. It appears designed to sustain shareholder value over the long term without compromising financial flexibility.

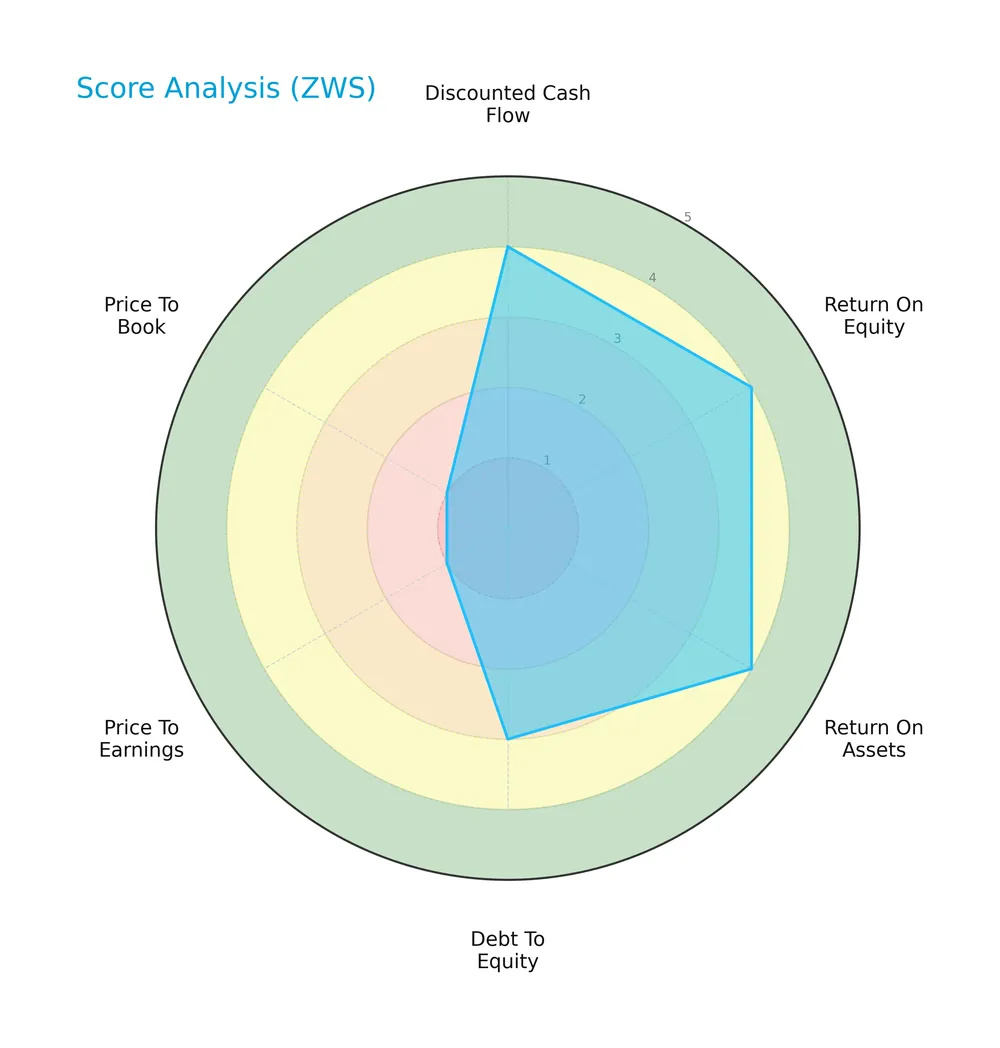

Score analysis

The radar chart below illustrates Zurn Elkay Water Solutions Corporation’s key financial scores across several valuation and performance metrics:

The company scores favorably on discounted cash flow, return on equity, and return on assets at 4 each. Debt-to-equity is moderate at 3. However, valuation metrics price-to-earnings and price-to-book lag significantly, both scoring 1, indicating potential market undervaluation or caution.

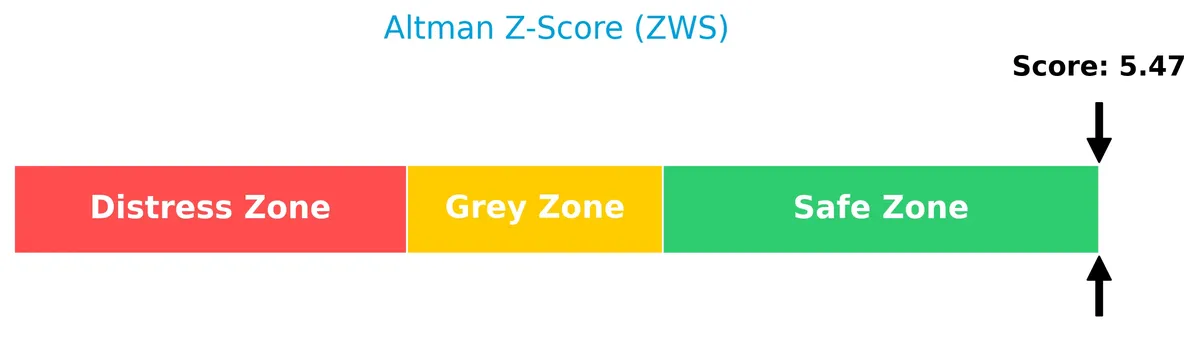

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company well within the safe zone, signaling a low risk of bankruptcy and sound financial stability:

Is the company in good financial health?

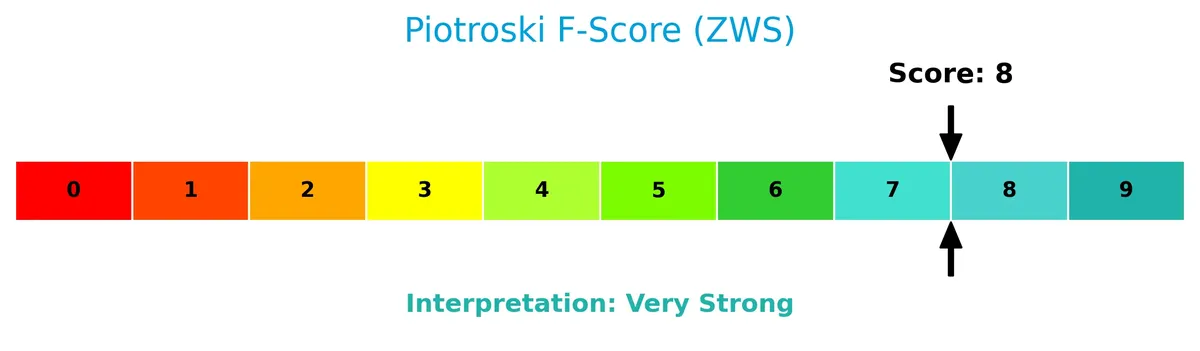

The Piotroski Score diagram highlights the company’s strong financial health and operational efficiency:

With a Piotroski Score of 8, Zurn Elkay Water Solutions demonstrates very strong fundamentals, suggesting robust profitability, solid leverage management, and efficient asset utilization.

Competitive Landscape & Sector Positioning

This analysis examines Zurn Elkay Water Solutions Corporation’s strategic positioning, revenue segments, and key products in the industrial pollution and treatment controls sector. I will assess whether ZWS holds a competitive advantage against its main industry competitors.

Strategic Positioning

Zurn Elkay Water Solutions concentrates primarily on water system solutions with a product portfolio spanning plumbing, drainage, and stainless steel fixtures. Its revenue derives predominantly from the United States, with limited diversification into Canada and other regions, reflecting a focused geographic footprint.

Revenue by Segment

This pie chart illustrates Zurn Elkay Water Solutions Corporation’s revenue distribution by product segment for the full year 2025, highlighting the company’s segment concentration.

In 2025, revenue consolidates into a single reported segment totaling 1.7B USD, a shift from prior years where “Process & Motion Control” and “Water Management” segments separately generated roughly 1.36B and 0.71B respectively in 2019. Historically, “Process & Motion Control” dominated revenue with steady growth, while “Water Management” showed moderate fluctuations. The 2025 data suggests strategic segment aggregation or reporting change, increasing concentration risk but simplifying revenue exposure.

Key Products & Brands

The company’s core offerings span multiple water system and plumbing product lines, detailed below:

| Product | Description |

|---|---|

| Zurn Brand | Finish plumbing, drainage, interceptors, water control, backflow, fire protection, PEX fittings, repair parts. |

| World Dryer Brand | Hand dryers, hair dryers, and baby changing stations. |

| Just Manufacturing Brand | Stainless steel sinks, ADA commercial sinks, faucets, bubblers, drains, and related stainless steel fixtures for diverse markets. |

Zurn Elkay Water Solutions provides comprehensive water system solutions focused on quality, safety, and conservation. Its brands serve commercial, educational, healthcare, hospitality, and government sectors.

Main Competitors

There are 89 competitors in this sector; the table lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| GE Aerospace | 338B |

| Caterpillar Inc. | 280B |

| RTX Corporation | 251B |

| The Boeing Company | 171B |

| Union Pacific Corporation | 138B |

| Eaton Corporation plc | 127B |

| Deere & Company | 126B |

| Honeywell International Inc. | 124B |

| Lockheed Martin Corporation | 116B |

| Parker-Hannifin Corporation | 114B |

Zurn Elkay Water Solutions Corporation is not ranked among the top 10 competitors by market cap. Its scale is significantly below the leader, GE Aerospace, and it falls below both the average market cap of the top 10 (179B) and the sector median (36B). The absence of data on its proximity to the nearest competitor above highlights a notable gap in market capitalization.

Comparisons with competitors

Check out how we compare the company to its competitors:

Aucun article trouvé pour ces critères.

Does ZWS have a competitive advantage?

Zurn Elkay Water Solutions Corporation currently does not demonstrate a competitive advantage. Its return on invested capital (ROIC) falls below its weighted average cost of capital (WACC), indicating value destruction and a declining profitability trend.

Looking ahead, the company’s growth in revenue and earnings suggests potential opportunities in expanding its water system solutions across diverse non-residential sectors. Continued innovation in plumbing and water conservation products may support future market development.

SWOT Analysis

This SWOT analysis highlights Zurn Elkay Water Solutions Corporation’s core competitive position and strategic challenges.

Strengths

- strong revenue growth over 5 years

- robust net margin of 11.7%

- low debt-to-assets at 21.7%

Weaknesses

- declining ROIC trend signals weakening profitability

- high PE and PB ratios suggest overvaluation

- limited dividend yield at 0.8%

Opportunities

- expanding U.S. market with $1.55B revenue

- growing demand for water conservation solutions

- potential to improve international presence

Threats

- rising raw material costs impacting margins

- competitive industrial pollution controls sector

- regulatory changes on water safety standards

Zurn Elkay’s strengths in revenue growth and solid margins support a resilient business model. However, deteriorating ROIC and valuation concerns require cautious capital allocation. The company should leverage U.S. market expansion and innovation while managing margin pressures and regulatory risks.

Stock Price Action Analysis

The weekly stock chart for ZWS illustrates price movements and volume trends over the last 12 months, highlighting key support and resistance levels:

Trend Analysis

Over the past year, ZWS stock gained 58.8%, confirming a bullish trend with accelerating momentum. Price volatility remains moderate with a 6.27 standard deviation. The stock peaked at 52.78 and bottomed at 29.08, reflecting strong upward momentum.

Volume Analysis

In the last three months, volume is decreasing despite slight buyer dominance at 54.94%. Buyer volume totals 29.2M versus 23.9M seller volume, indicating cautious investor interest with a modestly positive sentiment but reduced market participation.

Target Prices

Analysts expect Zurn Elkay Water Solutions Corporation to trade between $49 and $59, with a consensus target price near $54.86.

| Target Low | Target High | Consensus |

|---|---|---|

| 49 | 59 | 54.86 |

This range reflects moderate optimism, suggesting upside potential aligned with sector performance benchmarks.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback relevant to Zurn Elkay Water Solutions Corporation’s market perception.

Stock Grades

Here are the latest verified stock grades for Zurn Elkay Water Solutions Corporation from recognized analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Maintain | Outperform | 2026-02-06 |

| RBC Capital | Maintain | Sector Perform | 2026-02-05 |

| Oppenheimer | Maintain | Outperform | 2025-09-17 |

| Stifel | Maintain | Buy | 2025-09-12 |

| Stifel | Maintain | Buy | 2025-07-31 |

| Stifel | Maintain | Buy | 2025-07-21 |

| Stifel | Maintain | Buy | 2025-04-24 |

| Baird | Maintain | Neutral | 2025-04-24 |

| Stifel | Upgrade | Buy | 2025-04-16 |

| Goldman Sachs | Maintain | Neutral | 2025-04-02 |

The grades indicate consistent confidence from Stifel and Oppenheimer, favoring a Buy to Outperform stance. However, the consensus remains cautious with multiple Hold and Neutral ratings, reflecting some market reservations.

Consumer Opinions

Consumers of Zurn Elkay Water Solutions Corporation express a mix of appreciation and frustration, reflecting the company’s complex market position.

| Positive Reviews | Negative Reviews |

|---|---|

| “Durable products that last years.” | “Customer service response times lag.” |

| “Innovative water solutions enhance efficiency.” | “Pricing feels steep compared to competitors.” |

| “Installation guides are clear and helpful.” | “Delivery delays have become frequent lately.” |

Overall, customers praise ZWS for product durability and innovation, but they consistently flag issues with customer service and pricing. These weaknesses could impact long-term loyalty if unaddressed.

Risk Analysis

Below is a summary table of key risks facing Zurn Elkay Water Solutions Corporation, highlighting probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated P/E (39.6) and P/B (4.89) ratios suggest overvaluation. | High | High |

| Liquidity Risk | Current ratio at 3.13 is labeled unfavorable despite seeming strong; may indicate inefficient asset use. | Medium | Medium |

| Market Risk | Beta of 0.794 implies lower volatility but exposes to sector cyclicality. | Medium | Medium |

| Interest Rate Risk | Moderate debt with low D/E (0.36) and strong interest coverage (9.96) reduces refinancing risk. | Low | Low |

| Operational Risk | Exposure to industrial pollution controls sector sensitive to regulatory changes. | Medium | Medium |

The most pressing risk is valuation. The stock trades at a premium well above industry norms, raising concerns of a price correction. Despite solid financial health—evidenced by a safe Altman Z-score (5.47) and very strong Piotroski score (8)—investors should weigh these valuation risks carefully. Liquidity inefficiencies warrant monitoring, as they may pressure working capital during downturns.

Should You Buy Zurn Elkay Water Solutions Corporation?

Zurn Elkay Water Solutions Corporation appears to be a moderately profitable company with a slightly unfavorable moat, reflecting declining value creation amid improving operational efficiency. Supported by a manageable leverage profile and a very favorable B rating, the investment case suggests cautious optimism.

Strength & Efficiency Pillars

Zurn Elkay Water Solutions Corporation demonstrates solid operational efficiency with a net margin of 11.68% and a return on equity of 12.35%. Its ROIC stands at 8.95%, comfortably above the WACC of 7.24%, signaling the company remains a value creator. The firm’s interest expense is low at 1.69%, supporting healthy profitability. Despite a slight decline in ROIC, the company maintains favorable margins and strong cash flow generation, underpinned by a very strong Piotroski score of 8.

Weaknesses and Drawbacks

ZWS’s valuation metrics raise caution. The price-to-earnings ratio at 39.6 and price-to-book at 4.89 suggest a premium valuation, potentially limiting upside. The current ratio of 3.13, though seemingly strong, is flagged as unfavorable here, possibly indicating inefficient asset use or liquidity misalignment. Additionally, the dividend yield at 0.81% is low, which might disappoint income-focused investors. These factors, combined with moderate debt-to-equity of 0.36, imply some financial leverage risk amid market expectations.

Our Final Verdict about Zurn Elkay Water Solutions Corporation

The company’s financial health is strong, supported by a safe zone Altman Z-Score of 5.47 and robust operational metrics. Despite a bullish long-term trend and a slightly buyer-dominant recent period, the premium valuation metrics suggest a cautious stance. ZWS may appear attractive for long-term exposure, but investors might consider waiting for a more favorable entry point amid current market pricing.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Zurn Elkay Water Solutions Cor (NYSE:ZWS) Hits New 12-Month High – Still a Buy? – MarketBeat (Feb 10, 2026)

- Decoding Zurn Elkay Water Solutions Corp (ZWS): A Strategic SWOT Insight – GuruFocus (Feb 10, 2026)

- A Look At Zurn Elkay Water Solutions (ZWS) Valuation After Record Results Dividend Hike And Buybacks – Yahoo Finance (Feb 06, 2026)

- 5 Revealing Analyst Questions From Zurn Elkay’s Q4 Earnings Call – Finviz (Feb 10, 2026)

- Assessing Zurn Elkay Water Solutions (ZWS) Valuation After Strong Recent Share Price Momentum – simplywall.st (Feb 09, 2026)

For more information about Zurn Elkay Water Solutions Corporation, please visit the official website: zurnwatersolutions.com