Home > Analyses > Healthcare > Zimmer Biomet Holdings, Inc.

Zimmer Biomet transforms musculoskeletal healthcare by engineering advanced orthopedic and reconstructive solutions that restore mobility and improve lives globally. The company commands a leading position with its comprehensive portfolio spanning knee and hip replacements, spine devices, and dental implants. Known for rigorous innovation and quality, Zimmer Biomet shapes surgical outcomes and patient recovery. As healthcare demands evolve, I question whether its robust fundamentals still support premium valuation and sustainable growth going forward.

Table of contents

Business Model & Company Overview

Zimmer Biomet Holdings, Inc., founded in 1927 and headquartered in Warsaw, Indiana, stands as a leader in the musculoskeletal healthcare industry. It delivers a cohesive ecosystem of orthopaedic reconstructive and surgical products, including knee, hip, spine, trauma, and dental solutions. Its broad portfolio targets surgeons and healthcare providers worldwide, uniting innovation with deep clinical expertise.

The company’s revenue engine balances durable medical devices with emerging robotic and biologic technologies. Zimmer Biomet serves diverse markets in the Americas, Europe, the Middle East, Africa, and Asia Pacific, securing recurring demand through comprehensive service offerings. Its established global footprint and integrated product suite form a robust economic moat, positioning it as a key shaper of orthopaedic care’s future.

Financial Performance & Fundamental Metrics

I analyze Zimmer Biomet Holdings, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

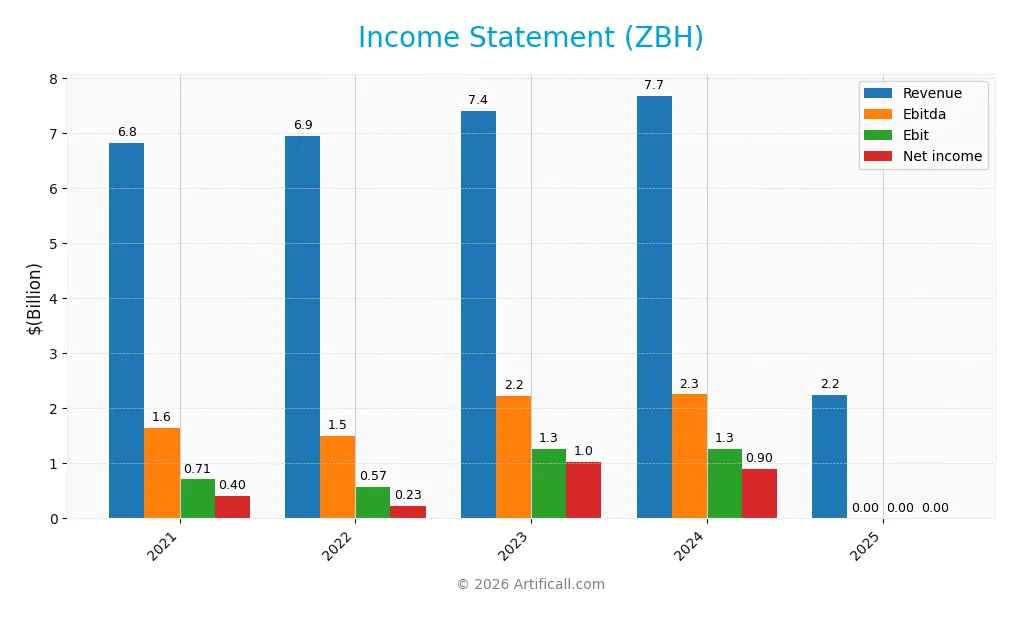

The table below presents Zimmer Biomet Holdings, Inc.’s key income statement figures for fiscal years 2021 through 2025, in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 6.83B | 6.94B | 7.39B | 7.68B | 2.24B |

| Cost of Revenue | 1.96B | 2.02B | 2.08B | 2.19B | 970M |

| Operating Expenses | 4.01B | 4.22B | 4.03B | 4.20B | 0 |

| Gross Profit | 4.87B | 4.92B | 5.31B | 5.49B | 1.27B |

| EBITDA | 1.65B | 1.49B | 2.22B | 2.25B | 0 |

| EBIT | 707M | 568M | 1.27B | 1.25B | 0 |

| Interest Expense | 208M | 165M | 201M | 218M | 0 |

| Net Income | 402M | 231M | 1.02B | 904M | 0 |

| EPS | 1.93 | 1.10 | 4.91 | 4.45 | 0 |

| Filing Date | 2022-02-25 | 2023-02-24 | 2024-02-23 | 2025-02-25 | 2026-02-10 |

Income Statement Evolution

Zimmer Biomet’s revenue fell sharply, dropping 67% from 2021 to 2025, with a steep 71% decline in the last year. Gross margin remained relatively stable at 56.8%, indicating consistent cost control on production. However, net income and EBIT margins deteriorated to zero in 2025, signaling a collapse in profitability despite stable gross profit ratios.

Is the Income Statement Favorable?

The 2025 income statement shows unfavorable fundamentals. Revenue plunged to $2.2B from $7.7B in 2024, with net income reported at zero. EBIT margin also dropped to zero, reflecting operational losses or reporting gaps. While cost containment is evident in gross margin, the absence of positive net income and EBIT raises risks. Overall, the income statement currently signals financial strain.

Financial Ratios

The following table summarizes key financial ratios for Zimmer Biomet Holdings, Inc. over the last five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 5.9% | 3.3% | 13.8% | 11.8% | 0% |

| ROE | 3.2% | 1.9% | 8.2% | 7.2% | 0% |

| ROIC | 3.6% | 2.6% | 6.3% | 5.7% | 0% |

| P/E | 64.0 | 115.5 | 24.8 | 23.7 | 0 |

| P/B | 2.0 | 2.2 | 2.0 | 1.7 | 0 |

| Current Ratio | 1.41 | 1.88 | 1.61 | 1.91 | 0 |

| Quick Ratio | 0.79 | 0.97 | 0.78 | 0.99 | 0 |

| D/E | 0.56 | 0.47 | 0.46 | 0.50 | 0 |

| Debt-to-Assets | 30.1% | 27.0% | 26.8% | 29.0% | 0% |

| Interest Coverage | 4.1 | 4.2 | 6.4 | 5.9 | 0 |

| Asset Turnover | 0.29 | 0.33 | 0.34 | 0.36 | 0 |

| Fixed Asset Turnover | 3.72 | 3.71 | 3.59 | 3.75 | 0 |

| Dividend Yield | 0.78% | 0.75% | 0.79% | 0.91% | 0% |

Evolution of Financial Ratios

Zimmer Biomet’s Return on Equity (ROE) showed moderate improvement from 3.2% in 2021 to 8.2% in 2023, then dropped to zero in 2025. The Current Ratio fluctuated around 1.4 to 1.9 before falling to zero in 2025, indicating liquidity concerns. Debt-to-Equity remained stable near 0.5, reflecting consistent leverage management. Profitability peaked in 2023 before deteriorating sharply by 2025.

Are the Financial Ratios Favorable?

The 2025 ratios present a challenging picture: profitability metrics such as net margin and ROE are unfavorable, while liquidity ratios like current and quick ratios are also weak. However, leverage ratios, including debt-to-equity and debt-to-assets, remain favorable, suggesting controlled financial risk. Market valuation ratios appear positive, but overall, the majority of key ratios indicate an unfavorable financial condition in 2025.

Shareholder Return Policy

Zimmer Biomet Holdings, Inc. maintained a consistent dividend payout ratio near 20% in 2024, with an annual dividend yield below 1%. The company covers dividends comfortably through free cash flow and supplements returns with share buybacks, indicating balanced capital allocation.

This approach supports sustainable shareholder value by prioritizing steady income and buybacks. The modest payout ratio reduces risk of unsustainable distributions, while buybacks enhance capital efficiency, aligning with long-term value creation amid sector cyclicality.

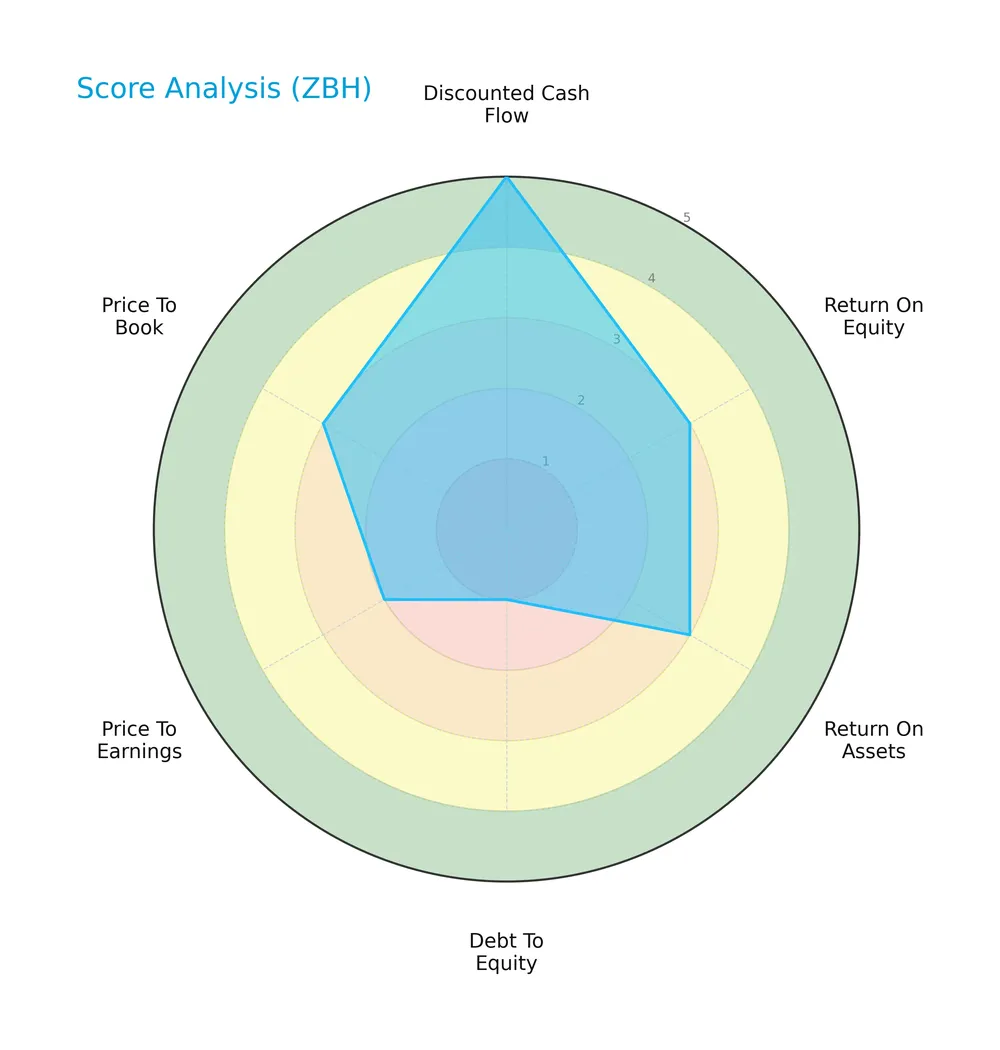

Score analysis

Below is a radar chart summarizing Zimmer Biomet Holdings, Inc.’s key financial scores for a comprehensive performance overview:

The company shows a very favorable discounted cash flow score of 5, indicating strong intrinsic value. Return on equity and assets score moderately at 3, reflecting average profitability. Debt to equity scores very unfavorably at 1, signaling high leverage risk. Price to earnings at 2 and price to book at 3 suggest mixed valuation metrics.

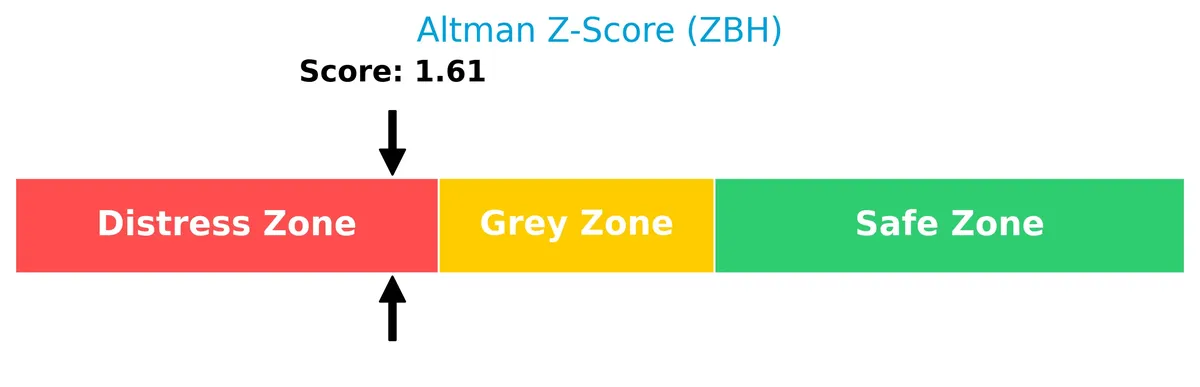

Analysis of the company’s bankruptcy risk

Zimmer Biomet’s Altman Z-Score places it in the distress zone, indicating a significant risk of financial distress and potential bankruptcy:

Is the company in good financial health?

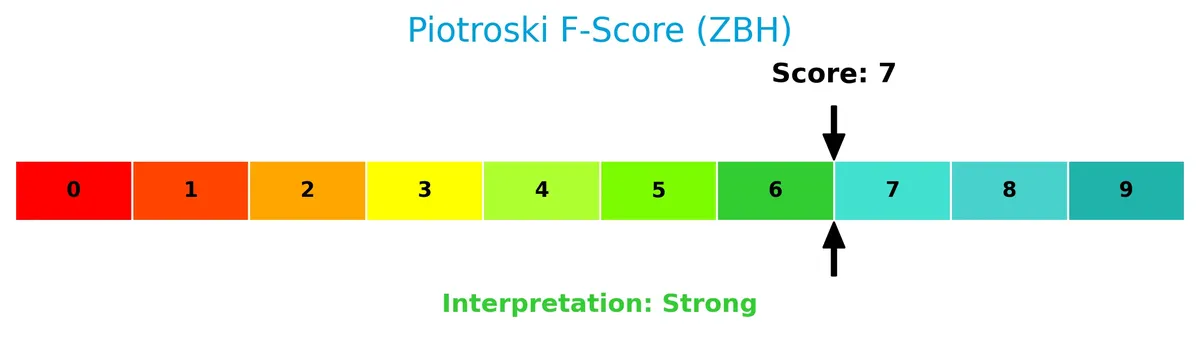

The Piotroski Score diagram illustrates Zimmer Biomet’s strong financial health based on nine fundamental criteria:

A score of 7 denotes robust financial strength, suggesting effective profitability, liquidity, and operational efficiency despite some risks flagged by leverage metrics.

Competitive Landscape & Sector Positioning

This section examines Zimmer Biomet Holdings, Inc.’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether Zimmer Biomet holds a competitive advantage in the medical devices industry.

Strategic Positioning

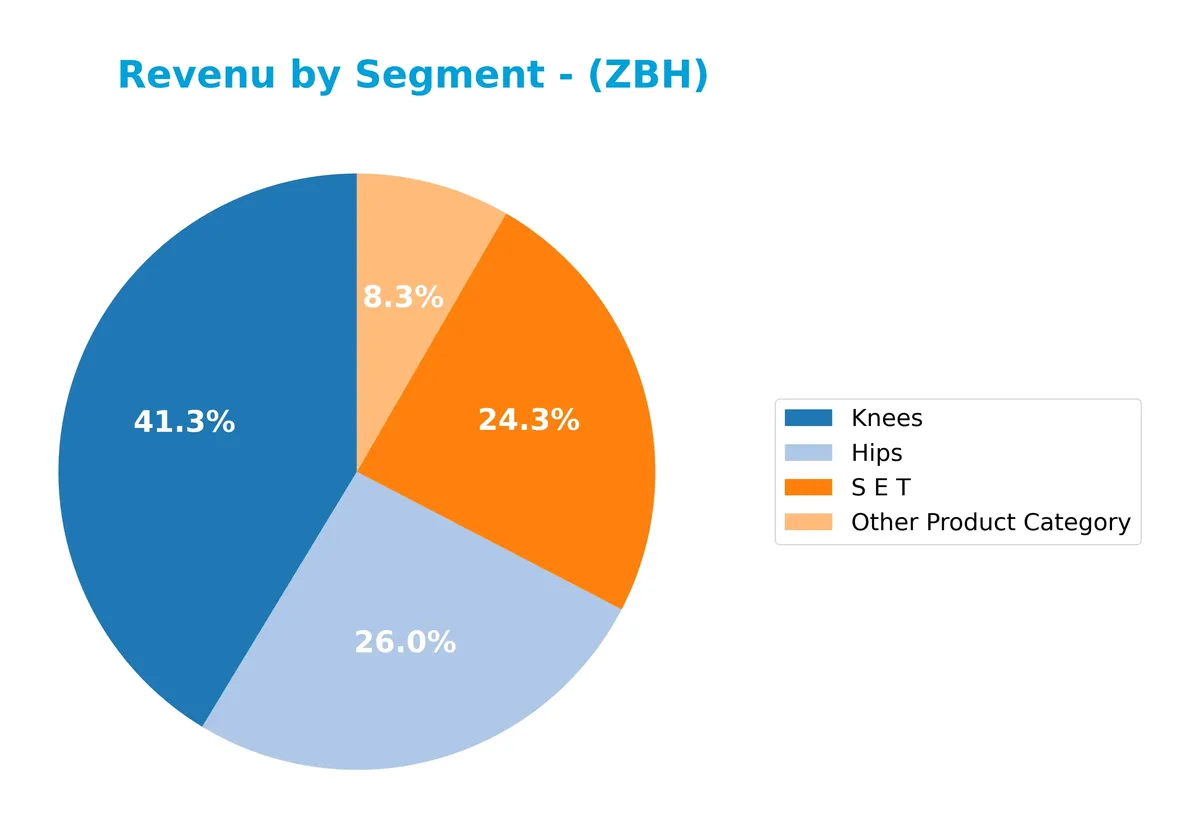

Zimmer Biomet maintains a broad product portfolio centered on orthopaedic reconstructive solutions, including hips, knees, S.E.T., and other categories, with steady revenue growth. Geographically, it operates globally, generating the majority of revenue in the Americas, followed by EMEA and Asia Pacific regions.

Revenue by Segment

This pie chart illustrates Zimmer Biomet Holdings, Inc.’s revenue distribution by product segment for the fiscal year 2024, highlighting the company’s core business drivers.

In 2024, Knees led revenue at 3.17B, followed by Hips with 2B, and S E T at 1.87B. The Other Product Category contributed 640M. Knees consistently dominates, reflecting strong market demand. Hips showed steady growth, while S E T also expanded, indicating diversification. The steady rise in key segments suggests Zimmer Biomet is managing concentration risk well while capitalizing on orthopedic demand.

Key Products & Brands

Zimmer Biomet’s revenue streams are diversified across several orthopedic and surgical product categories as follows:

| Product | Description |

|---|---|

| Hips | Orthopaedic reconstructive hip products designed to treat bone and joint disorders in the hip region. |

| Knees | Orthopaedic reconstructive knee products serving joint repair and replacement needs. |

| S E T | Sports medicine, biologics, foot and ankle, extremities, and trauma products for musculoskeletal healthcare. |

| Other Product Category | Includes spine devices, face and skull reconstruction products, dental implants, bone cement, and surgical robotics. |

Zimmer Biomet generates most revenue from knees and hips, reflecting its leadership in reconstructive orthopaedics. The S E T segment supports growth with specialized musculoskeletal solutions. Other categories broaden the company’s product portfolio in surgical and dental markets.

Main Competitors

There are 10 key competitors in the Medical Devices industry. Below is a table of the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Abbott Laboratories | 216B |

| Boston Scientific Corporation | 140B |

| Stryker Corporation | 133B |

| Medtronic plc | 123B |

| Edwards Lifesciences Corporation | 50B |

| DexCom, Inc. | 26B |

| STERIS plc | 25B |

| Insulet Corporation | 20B |

| Zimmer Biomet Holdings, Inc. | 18B |

| Align Technology, Inc. | 11B |

Zimmer Biomet ranks 9th among its peers, with a market cap just 8.38% that of the leader, Abbott Laboratories. The company sits below both the average top 10 market cap of 76B and the sector median of 38B. It holds a 9.88% gap above its next competitor, Align Technology, indicating a modest buffer in scale within the lower tier of this competitive group.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ZBH have a competitive advantage?

Zimmer Biomet Holdings, Inc. shows no clear competitive advantage based on available data. The company faces unfavorable trends in revenue, net margin, and ROIC, signaling challenges in value creation.

Future outlook includes potential growth from its diverse orthopedic and dental product lines across Americas, EMEA, and Asia Pacific. Expansion in surgical robotics and biologics may offer new market opportunities.

SWOT Analysis

This analysis highlights Zimmer Biomet’s key internal and external factors shaping its competitive position and strategic options.

Strengths

- diverse musculoskeletal product portfolio

- global market presence with strong Americas sales

- experienced management team

Weaknesses

- declining revenue and net income over 5 years

- unfavorable profitability metrics (zero net margin, ROIC)

- weak liquidity ratios posing financial risk

Opportunities

- expanding demand for orthopedic and reconstructive devices

- innovation in robotic and surgical technologies

- growth potential in Asia Pacific and EMEA markets

Threats

- intense competition in medical devices sector

- regulatory and reimbursement challenges

- economic downturns reducing elective surgeries

Zimmer Biomet faces significant profitability and growth challenges despite strong brand and market reach. Strategic focus on innovation and regional expansion is critical to offset financial weaknesses and external threats.

Stock Price Action Analysis

The weekly stock chart below illustrates Zimmer Biomet Holdings, Inc.’s price movement over the past 12 months:

Trend Analysis

Over the past 12 months, ZBH’s stock price declined by 28.14%, indicating a clear bearish trend. The stock shows deceleration in its downward momentum, with a high of 131.98 and a low of 86.6. Volatility remains elevated, with a standard deviation of 9.88.

Volume Analysis

Trading volume has been increasing overall, totaling 1B shares, with buyers accounting for 50.48%. However, in the recent three months, seller volume slightly dominates at 56.65%, suggesting cautious investor sentiment and modest selling pressure.

Target Prices

Analysts set a clear target consensus for Zimmer Biomet Holdings, Inc., reflecting moderate optimism.

| Target Low | Target High | Consensus |

|---|---|---|

| 86 | 130 | 108 |

The target range from 86 to 130 suggests cautious upside potential. The consensus at 108 indicates expectations slightly above current trading levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Zimmer Biomet Holdings, Inc.’s analyst ratings and consumer feedback to provide balanced insights.

Stock Grades

The latest company grades from recognized analysts reveal a stable but cautious outlook for Zimmer Biomet Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2026-02-10 |

| Needham | Maintain | Hold | 2026-02-10 |

| UBS | Maintain | Sell | 2026-01-28 |

| Bernstein | Maintain | Market Perform | 2026-01-09 |

| BTIG | Maintain | Buy | 2026-01-08 |

| Evercore ISI Group | Upgrade | Outperform | 2026-01-05 |

| Baird | Downgrade | Neutral | 2025-12-16 |

| Citigroup | Maintain | Neutral | 2025-12-11 |

| Canaccord Genuity | Maintain | Hold | 2025-11-10 |

| UBS | Maintain | Sell | 2025-11-06 |

Analyst sentiment shows diversity, with a cluster around Hold and Neutral grades, and a few upgrades and downgrades reflecting mixed confidence. The consensus remains Hold, signaling moderate market expectations.

Consumer Opinions

Zimmer Biomet Holdings, Inc. generates a mix of strong praise and pointed criticism from its user base, reflecting the complexity of its product and service delivery.

| Positive Reviews | Negative Reviews |

|---|---|

| “Exceptional product quality and durability in orthopedic implants.” | “Customer service response times are often slow.” |

| “Innovative solutions that improve patient recovery outcomes.” | “Prices are higher compared to competitors.” |

| “Reliable and consistent supply chain, reducing surgery delays.” | “Some products have compatibility issues with older systems.” |

Overall, consumers consistently value Zimmer Biomet’s product innovation and reliability. However, service delays and pricing remain recurrent concerns, signaling areas for potential operational improvement.

Risk Analysis

The following table outlines key risks Zimmer Biomet Holdings, Inc. faces, with their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score in distress zone signals elevated bankruptcy risk amid weak profitability metrics | High | High |

| Profitability | Zero net margin and ROE indicate challenges generating returns, pressuring shareholder value | High | Moderate |

| Liquidity | Unfavorable current and quick ratios highlight possible short-term cash flow constraints | Medium | Moderate |

| Debt Management | Very unfavorable debt-to-equity score suggests high leverage risk despite favorable debt-to-assets | Medium | High |

| Market Volatility | Beta of 0.608 shows lower sensitivity to market swings but may limit upside during bull markets | Low | Low |

Zimmer Biomet’s most pressing risks lie in financial distress signs from its Altman Z-Score and profitability struggles. Weak margins and liquidity constraints could hamper growth. However, a strong Piotroski score of 7 reflects operational resilience worth monitoring closely.

Should You Buy Zimmer Biomet Holdings, Inc.?

Zimmer Biomet Holdings, Inc. appears to be a company with moderate profitability and operational efficiency, yet its competitive moat could be seen as eroding due to declining returns on invested capital. Despite a manageable liquidity profile, the firm’s elevated leverage profile and Altman Z-score in the distress zone suggest material financial risks. The overall rating of B reflects a very favorable valuation stance but calls for cautious interpretation given the mixed fundamentals and leverage concerns.

Strength & Efficiency Pillars

Zimmer Biomet Holdings, Inc. shows operational resilience with a strong gross margin of 56.77%, highlighting efficient core business activities. Despite a net margin and ROE of 0%, the company manages interest expenses well, indicating effective cost control in financing. However, the absence of a reported ROIC and WACC prevents confirming value creation status. The strong Piotroski Score of 7 suggests solid financial strength in operational metrics, yet profitability remains a concern.

Weaknesses and Drawbacks

Zimmer Biomet is in financial distress, with an Altman Z-Score of 1.61, signaling high bankruptcy risk. This solvency red flag overshadows any operational positives. The company faces severe revenue and profit declines, with a 70.78% drop in revenue and a complete erosion of net income over one year. Valuation metrics are unfavorable, reflecting market skepticism. Additionally, a very unfavorable debt-to-equity score and weak liquidity ratios raise alarms about balance sheet stability.

Our Final Verdict about Zimmer Biomet Holdings, Inc.

Despite some operational strengths, Zimmer Biomet’s financial distress, as indicated by its Altman Z-Score of 1.61, makes the investment profile highly speculative. The significant solvency risk outweighs favorable Piotroski signals and gross margin efficiency. Investors focused on capital preservation may find the risk profile too high, suggesting extreme caution or avoidance until financial health improves.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Zimmer Biomet Announces Fourth Quarter and Full-Year 2025 Financial Results – PR Newswire (Feb 10, 2026)

- ZIMMER BIOMET HOLDINGS ($ZBH) Releases Q4 2025 Earnings – Quiver Quantitative (Feb 10, 2026)

- Zimmer: Q4 Earnings Snapshot – kens5.com (Feb 10, 2026)

- Zimmer Biomet (NYSE:ZBH) Beats Q4 CY2025 Sales Expectations – Finviz (Feb 10, 2026)

- BTIG Reiterates Buy Rating on Zimmer Biomet (ZBH) with $112 PT | – GuruFocus (Feb 10, 2026)

For more information about Zimmer Biomet Holdings, Inc., please visit the official website: zimmerbiomet.com