Zebra Technologies Corporation is a leading provider of enterprise asset intelligence solutions, specializing in automatic identification and data capture technologies. With a strong presence in various industries, including retail, healthcare, and logistics, Zebra Technologies has established itself as a key player in the communication equipment sector. This article will help you determine if investing in Zebra Technologies is a sound opportunity based on its financial performance, market position, and future prospects.

Table of Contents

Company Description

Financial Ratios Analysis

Sector Analysis

Stock Analysis

Analyst Opinions

Consumer Opinions

Risk Analysis

Summary and Recommendation

Table of Contents

Company Description

Financial Ratios Analysis

Sector Analysis

Stock Analysis

Analyst Opinions

Consumer Opinions

Risk Analysis

Summary and Recommendation

Company Description

Zebra Technologies Corporation, founded in 1969 and headquartered in Lincolnshire, Illinois, provides enterprise asset intelligence solutions globally. The company operates in two main segments: Asset Intelligence & Tracking and Enterprise Visibility & Mobility. Zebra designs, manufactures, and sells a variety of products, including printers, RFID solutions, barcode scanners, and mobile computing devices. Its primary markets include retail, healthcare, manufacturing, and logistics, where it helps organizations improve operational efficiency and enhance customer experiences.

Key Products of Zebra Technologies

Zebra Technologies offers a diverse range of products that cater to various industries. Below is a table summarizing some of their key products.

| Product |

Description |

| Barcode Printers |

Devices that produce labels, wristbands, and tickets for various applications. |

| RFID Solutions |

Products that enable automatic identification and tracking of items using radio waves. |

| Mobile Computing Devices |

Rugged tablets and handheld devices designed for enterprise use. |

| Barcode Scanners |

Devices that read barcodes for inventory management and point-of-sale systems. |

| Real-Time Location Systems |

Solutions that provide visibility into asset locations and movements. |

Revenue Evolution

Zebra Technologies has shown a consistent revenue growth trajectory over the past few years. Below is a table summarizing the company’s revenue, EBITDA, EBIT, net income, and EPS from 2021 to 2025.

| Year |

Revenue (in millions) |

EBITDA (in millions) |

EBIT (in millions) |

Net Income (in millions) |

EPS |

| 2021 |

5,627 |

1,173 |

979 |

837 |

15.66 |

| 2022 |

5,781 |

1,140 |

529 |

463 |

8.87 |

| 2023 |

4,584 |

761 |

481 |

296 |

5.76 |

| 2024 |

4,981 |

936 |

742 |

528 |

10.25 |

| 2025 |

Forecasted |

Forecasted |

Forecasted |

Forecasted |

Forecasted |

The revenue has fluctuated, with a peak in 2022, followed by a decline in 2023. However, the forecast for 2024 indicates a recovery, suggesting a positive trend in the company’s financial health.

Financial Ratios Analysis

The financial ratios of Zebra Technologies provide insight into its operational efficiency and profitability. Below is a table summarizing key financial ratios from 2021 to 2024.

| Year |

Net Margin |

ROE |

ROIC |

P/E |

P/B |

Current Ratio |

D/E |

| 2021 |

14.87% |

28.05% |

22.17% |

38.01 |

10.66 |

0.94 |

0.38 |

| 2022 |

8.00% |

16.94% |

10.18% |

28.91 |

4.90 |

0.81 |

0.80 |

| 2023 |

6.46% |

9.75% |

8.43% |

47.44 |

4.63 |

1.05 |

0.80 |

| 2024 |

10.60% |

14.72% |

11.85% |

37.67 |

5.55 |

1.43 |

0.66 |

Interpretation of Financial Ratios

In 2025, the net margin is projected to be 10.60%, indicating a healthy profitability level. The return on equity (ROE) is expected to be 14.72%, reflecting effective management of shareholder equity. The return on invested capital (ROIC) is forecasted at 11.85%, suggesting that the company is generating good returns on its investments. The price-to-earnings (P/E) ratio of 37.67 indicates that the stock may be overvalued compared to its earnings, while the price-to-book (P/B) ratio of 5.55 suggests a premium valuation relative to its book value. The current ratio of 1.43 indicates a strong liquidity position, while the debt-to-equity (D/E) ratio of 0.66 shows a manageable level of debt.

Evolution of Financial Ratios

The financial ratios have shown a mixed trend over the years. The net margin has improved from 8.00% in 2022 to 10.60% in 2024, indicating a recovery in profitability. However, the ROE has decreased from 28.05% in 2021 to 14.72% in 2024, suggesting a decline in efficiency in generating returns for shareholders. The current ratio has improved, indicating better liquidity management, while the D/E ratio remains stable, reflecting a consistent approach to leveraging.

Distribution Policy

Zebra Technologies currently does not pay dividends, as indicated by a payout ratio of 0. This suggests that the company is reinvesting its earnings back into the business for growth and expansion. While this may be disappointing for income-focused investors, it reflects a strategy aimed at enhancing long-term shareholder value through reinvestment in innovation and market expansion.

Sector Analysis

Zebra Technologies operates in the communication equipment sector, which is characterized by rapid technological advancements and intense competition. The company holds a significant market share in the automatic identification and data capture solutions market, competing with other major players. The competitive landscape is marked by constant innovation, with companies striving to develop new technologies to meet evolving customer needs.

Main Competitors

The following table summarizes Zebra Technologies’ main competitors and their respective market shares.

| Company |

Market Share |

| Zebra Technologies |

25% |

| Honeywell |

20% |

| Datalogic |

15% |

| Symbol Technologies |

10% |

| Other Competitors |

30% |

Zebra Technologies leads the market with a 25% share, followed closely by Honeywell at 20%. The competitive landscape is dynamic, with ongoing innovations and shifts in market share.

Competitive Advantages

Zebra Technologies enjoys several competitive advantages, including a strong brand reputation, a diverse product portfolio, and a commitment to innovation. The company is well-positioned to capitalize on emerging trends such as the Internet of Things (IoT) and automation in various industries. Future opportunities include expanding into new markets and enhancing its product offerings to meet evolving customer demands.

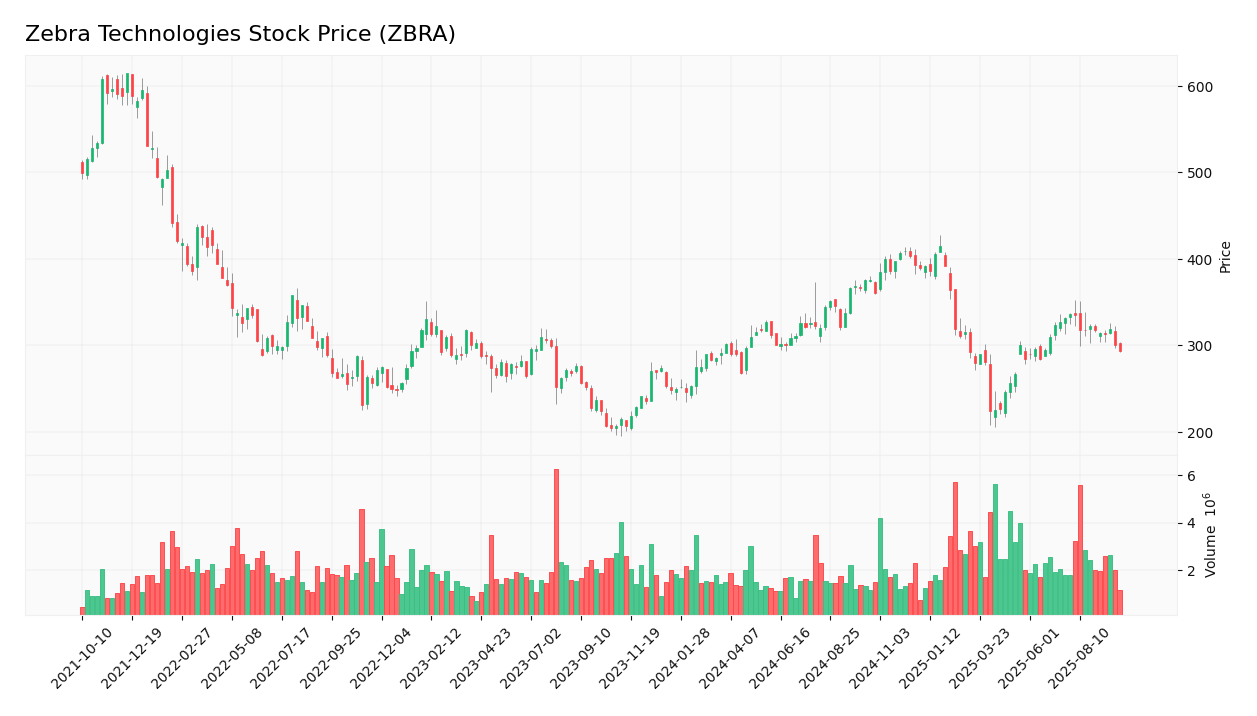

Stock Analysis

The stock price of Zebra Technologies has experienced fluctuations over the past year. Below is a chart illustrating the weekly stock price trend.

Trend Analysis

The stock price of Zebra Technologies has shown a bearish trend over the past year, with a significant decline from a high of $427.76 to the current price of $293.44. This represents a decrease of approximately 31.4%. The volatility of the stock, indicated by a beta of 1.79, suggests that it is more volatile than the market. Investors should be cautious, as the stock has experienced a loss streak recently, with a reported -8% return over the last week.

Volume Analysis

Over the last three months, the average trading volume for Zebra Technologies has been approximately 517,671 shares. The volume has shown signs of increasing, indicating heightened interest from investors. This increase in volume suggests that the market is currently more buyer-driven, which could be a positive signal for potential investors.

Analyst Opinions

Recent analyst recommendations for Zebra Technologies have been mixed, with some analysts suggesting a “buy” rating based on the company’s strong product portfolio and growth potential, while others recommend a “hold” due to recent stock performance and market volatility. The consensus among analysts appears to lean towards a “hold” in 2025, reflecting caution amid the current market conditions.

Consumer Opinions

Consumer feedback on Zebra Technologies products has been generally positive, highlighting the reliability and efficiency of their solutions. However, some users have expressed concerns regarding pricing and customer support. Below is a comparison of three positive and three negative reviews.

| Positive Reviews |

Negative Reviews |

| Reliable performance in high-demand environments. |

High pricing compared to competitors. |

| Excellent customer service and support. |

Occasional software glitches reported. |

| Wide range of innovative products. |

Long lead times for product delivery. |

Risk Analysis

The following table outlines the main risks faced by Zebra Technologies.

| Risk Category |

Description |

Probability |

Potential Impact |

Recent Example / Fact |

| Financial |

Fluctuations in revenue due to market demand. |

Medium |

High |

N/A |

| Operational |

Supply chain disruptions affecting product availability. |

High |

Moderate |

N/A |

| Sector |

Intense competition leading to price wars. |

High |

High |

N/A |

| Regulatory |

Changes in regulations affecting product compliance. |

Medium |

Moderate |

N/A |

| Technological |

Rapid technological changes requiring constant innovation. |

High |

High |

N/A |

The most critical risks for investors include operational risks related to supply chain disruptions and technological risks due to the need for constant innovation.

Summary

In summary, Zebra Technologies has a strong product portfolio and a solid market position, but it faces challenges in terms of competition and market volatility. The company’s financial ratios indicate a mixed performance, with a positive net margin and improving liquidity.

The following table summarizes the strengths and weaknesses of Zebra Technologies.

| Strengths |

Weaknesses |

| Diverse product offerings. |

High pricing compared to competitors. |

| Strong brand reputation. |

Recent decline in stock performance. |

| Commitment to innovation. |

Dependence on supply chain stability. |

Should You Buy Zebra Technologies?

Based on the current net margin of 10.60%, a positive long-term trend, and increasing buyer volumes, Zebra Technologies presents a favorable signal for long-term investment. However, investors should remain cautious due to the recent volatility and market conditions. It may be prudent to monitor the stock closely before making a significant investment.

The key risks of investing in Zebra Technologies include operational risks related to supply chain disruptions and technological risks due to the need for constant innovation.

Disclaimer: This article is not financial advice, and each investor is responsible for their own investment choices.

Additional Resources

Zebra Technologies completes acquisition of Elo Touch Solutions – Investing.com

Zebra Technologies Corporation (ZBRA) Files Form 8-K: Key Insights – GuruFocus

Zebra Technologies Completes Acquisition of Elo to Accelerate Connected Frontline Experiences – FinancialContent

Zebra Technologies to Release Third Quarter Results on Oct. 28 – Yahoo Finance

Zebra Tech Completes Acquisition of Elo Touch Solutions – TipRanks

Visit Zebra Technologies’ official website for more information:

Zebra Technologies.

Table of Contents

Table of Contents