Home > Analyses > Consumer Cyclical > Yum! Brands, Inc.

Yum! Brands shapes the global fast-food landscape by serving millions daily through iconic names like KFC, Taco Bell, and Pizza Hut. It dominates the quick-service restaurant sector with a proven formula of innovation, quality, and aggressive international expansion. I’ve observed that Yum! consistently adapts to evolving consumer tastes while maintaining strong brand loyalty. The key question now: does Yum!’s robust footprint and operational strength still justify its premium market valuation and growth outlook?

Table of contents

Business Model & Company Overview

Yum! Brands, Inc. stands as a global leader in the quick service restaurant industry, founded in 1997 and headquartered in Louisville, Kentucky. It operates a powerful ecosystem of iconic brands—KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill—each specializing in distinct food segments like chicken, pizza, and Mexican-style offerings. This multi-brand strategy fuels its dominant market position across roughly 157 countries and territories, with over 53K units worldwide.

The company’s revenue engine balances franchising with direct operations, leveraging a mix of real estate, brand licensing, and recurring royalty streams. Its presence spans the Americas, Europe, and Asia, enabling geographic diversification and growth. Yum!’s economic moat lies in its extensive global footprint and brand portfolio, which together shape the future of quick service dining through scalable, repeatable consumer experiences.

Financial Performance & Fundamental Metrics

I analyze Yum! Brands, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its operational efficiency and shareholder value creation.

Income Statement

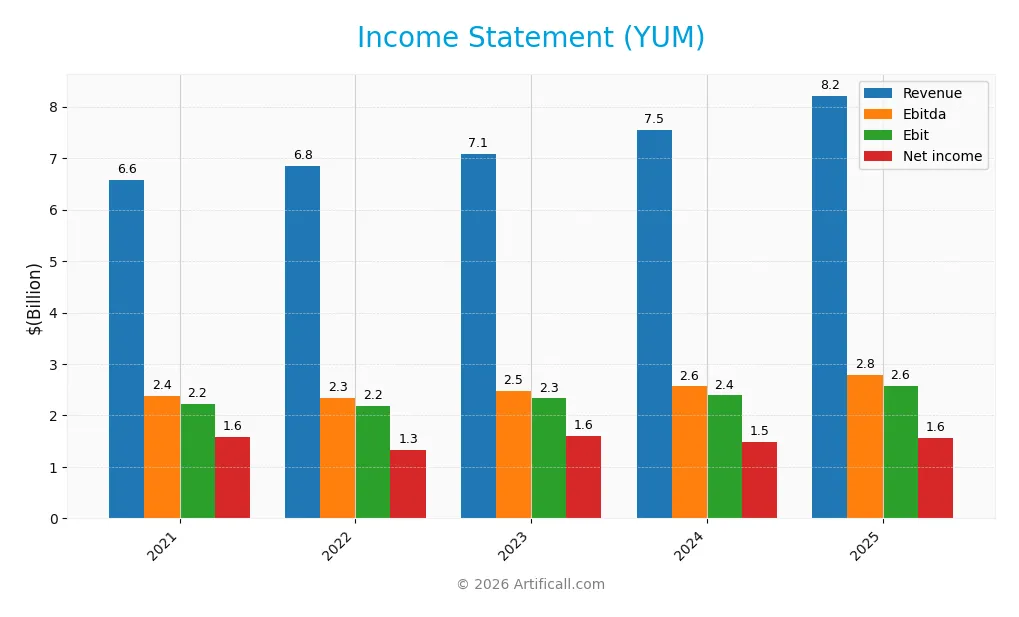

The table below presents Yum! Brands, Inc.’s key income statement metrics for fiscal years 2021 through 2025, expressed in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 6.58B | 6.84B | 7.08B | 7.55B | 8.21B |

| Cost of Revenue | 3.42B | 3.54B | 3.58B | 3.97B | 4.42B |

| Operating Expenses | 1.03B | 1.12B | 1.18B | 1.18B | 1.26B |

| Gross Profit | 3.17B | 3.31B | 3.50B | 3.58B | 3.79B |

| EBITDA | 2.38B | 2.34B | 2.48B | 2.56B | 2.79B |

| EBIT | 2.22B | 2.19B | 2.33B | 2.39B | 2.58B |

| Interest Expense | 544M | 527M | 513M | 489M | 500M |

| Net Income | 1.58B | 1.33B | 1.60B | 1.49B | 1.56B |

| EPS | 5.30 | 4.63 | 5.68 | 5.28 | 5.59 |

| Filing Date | 2022-02-23 | 2023-02-27 | 2024-02-20 | 2025-02-19 | 2026-02-04 |

Income Statement Evolution

Yum! Brands’ revenue grew steadily from $6.58B in 2021 to $8.21B in 2025, a 25% rise over five years. Gross profit and EBIT margins remained favorable, at 46.2% and 31.4% respectively in 2025, reflecting consistent cost control. However, net margin declined overall, indicating pressure on bottom-line profitability despite top-line growth.

Is the Income Statement Favorable?

In 2025, Yum! Brands reported $1.56B net income on $8.21B revenue, with an 18.98% net margin rated favorable. EBIT margin held strong at 31.4%, while interest expense represented a manageable 6.1% of revenue. Despite a slight 3.6% net margin decline year-over-year, earnings per share rose 6.5%, indicating solid core profitability with some margin compression risk.

Financial Ratios

The table below summarizes key financial ratios for Yum! Brands, Inc. over the last five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 24% | 19% | 23% | 20% | 19% |

| ROE | -19% | -15% | -20% | -19% | -21% |

| ROIC | 43% | 37% | 40% | 34% | 28% |

| P/E | 26.2 | 27.6 | 23.0 | 25.5 | 27.0 |

| P/B | -4.9 | -4.1 | -4.7 | -4.9 | -5.7 |

| Current Ratio | 1.08 | 0.97 | 1.26 | 1.47 | 1.35 |

| Quick Ratio | 1.08 | 0.97 | 1.26 | 1.47 | 1.35 |

| D/E | -1.45 | -1.43 | -1.53 | -1.61 | -1.63 |

| Debt-to-Assets | 2.03 | 2.17 | 1.93 | 1.83 | 1.45 |

| Interest Coverage | 3.93 | 4.15 | 4.52 | 4.91 | 5.06 |

| Asset Turnover | 1.10 | 1.17 | 1.14 | 1.12 | 1.00 |

| Fixed Asset Turnover | 3.27 | 3.58 | 3.61 | 3.45 | 5.12 |

| Dividend Yield | 1.44% | 1.77% | 1.85% | 1.99% | 1.88% |

Evolution of Financial Ratios

From 2021 to 2025, Yum! Brands’ Return on Equity (ROE) remained negative, declining to -21.3% in 2025, signaling deteriorating shareholder returns. The current ratio fluctuated moderately, ending at 1.35, indicating consistent liquidity. The debt-to-equity ratio stayed negative, reflecting complex capital structure dynamics, while profitability margins softened slightly but stayed robust overall.

Are the Financial Ratios Fovorable?

In 2025, Yum! Brands shows mixed signals: profitability metrics like net margin (19%) and return on invested capital (28.3%) are favorable, outperforming typical sector thresholds. Liquidity ratios are neutral to positive with a 1.35 current ratio and a quick ratio deemed favorable. However, high debt-to-assets (145.3%) and a negative debt-to-equity ratio present financial leverage concerns. Market multiples like P/E appear unfavorable, while asset turnover and interest coverage ratios are strong. Overall, 64% of ratios favor a positive view, balanced by notable risks.

Shareholder Return Policy

Yum! Brands maintains a dividend payout ratio near 50%, with a steady dividend per share increase from $2.00 in 2021 to $2.84 in 2025. The annual dividend yield hovers around 1.8%, supported by free cash flow coverage and moderate share buyback activity.

This consistent distribution policy, balanced with capital expenditures, indicates a disciplined approach to shareholder returns. It supports sustainable long-term value creation, though investors should monitor payout stability amid evolving market conditions.

Score analysis

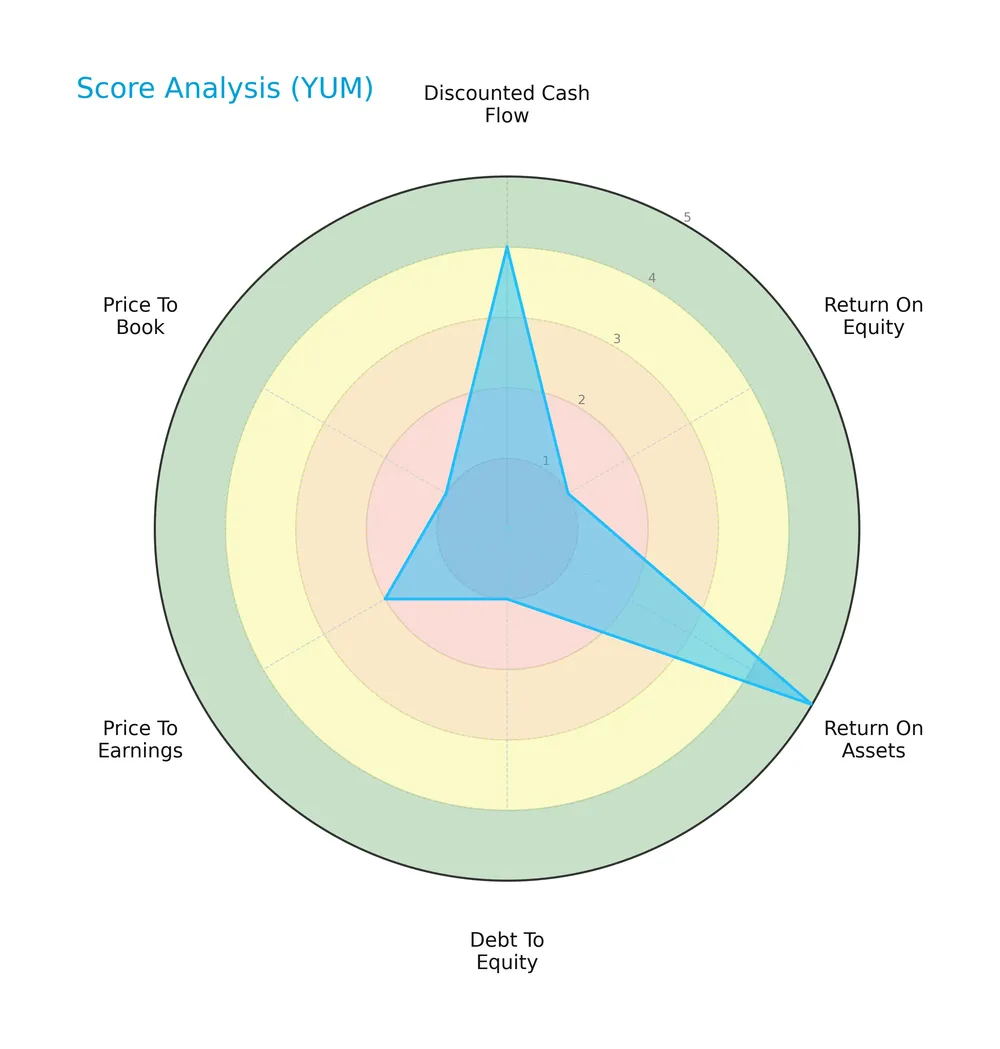

The radar chart below illustrates Yum! Brands’ key financial scores across valuation and profitability metrics:

Yum! Brands shows a mixed profile: strong discounted cash flow (4) and return on assets (5) contrast sharply with weak return on equity (1), debt to equity (1), price to earnings (2), and price to book (1) scores.

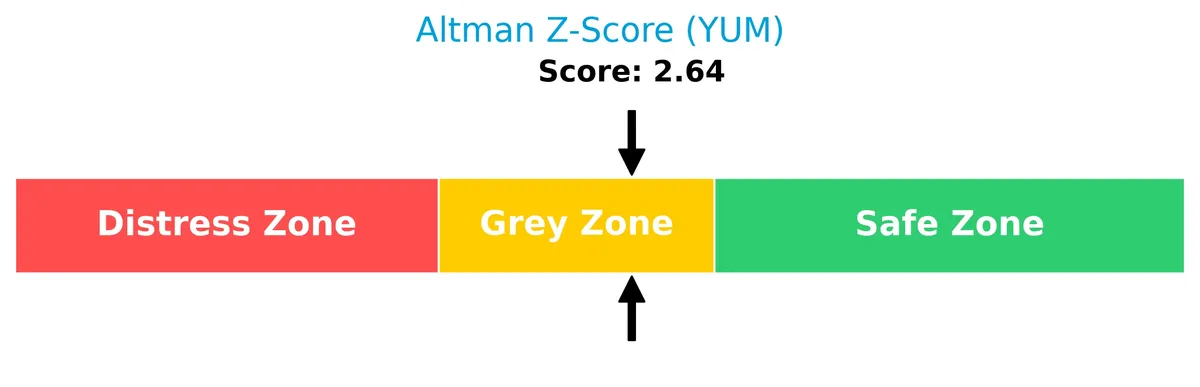

Analysis of the company’s bankruptcy risk

Yum! Brands’ Altman Z-Score places it in the grey zone, indicating a moderate risk of bankruptcy but no immediate distress:

Is the company in good financial health?

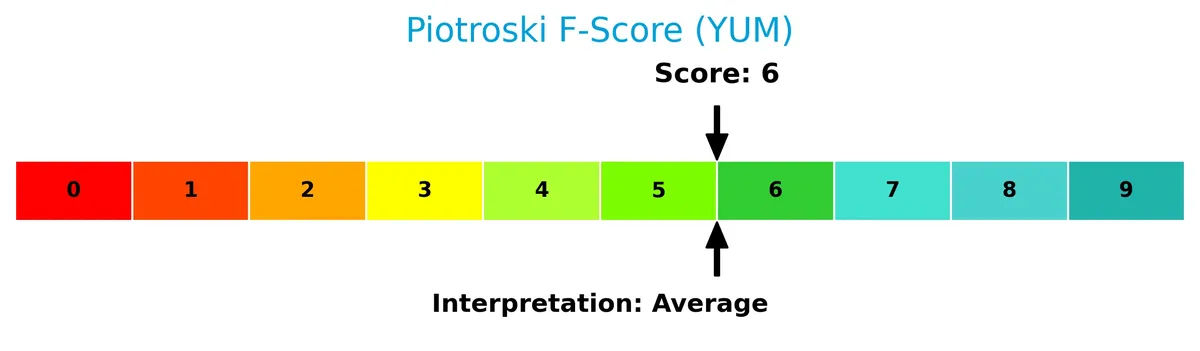

The Piotroski Score diagram highlights Yum! Brands’ financial strength based on nine criteria:

With a Piotroski Score of 6, Yum! Brands demonstrates average financial health, suggesting moderate operational efficiency and profitability but room for improvement.

Competitive Landscape & Sector Positioning

This analysis covers Yum! Brands’ strategic positioning, revenue by segment, key products, and main competitors. I will assess whether Yum! Brands holds a competitive advantage within the restaurant sector.

Strategic Positioning

Yum! Brands maintains a diversified portfolio across four global divisions: KFC, Taco Bell, Pizza Hut, and Habit Burger Grill. It operates in approximately 157 countries, balancing geographic reach with varied product categories in quick service restaurants, reflecting a broad strategic footprint.

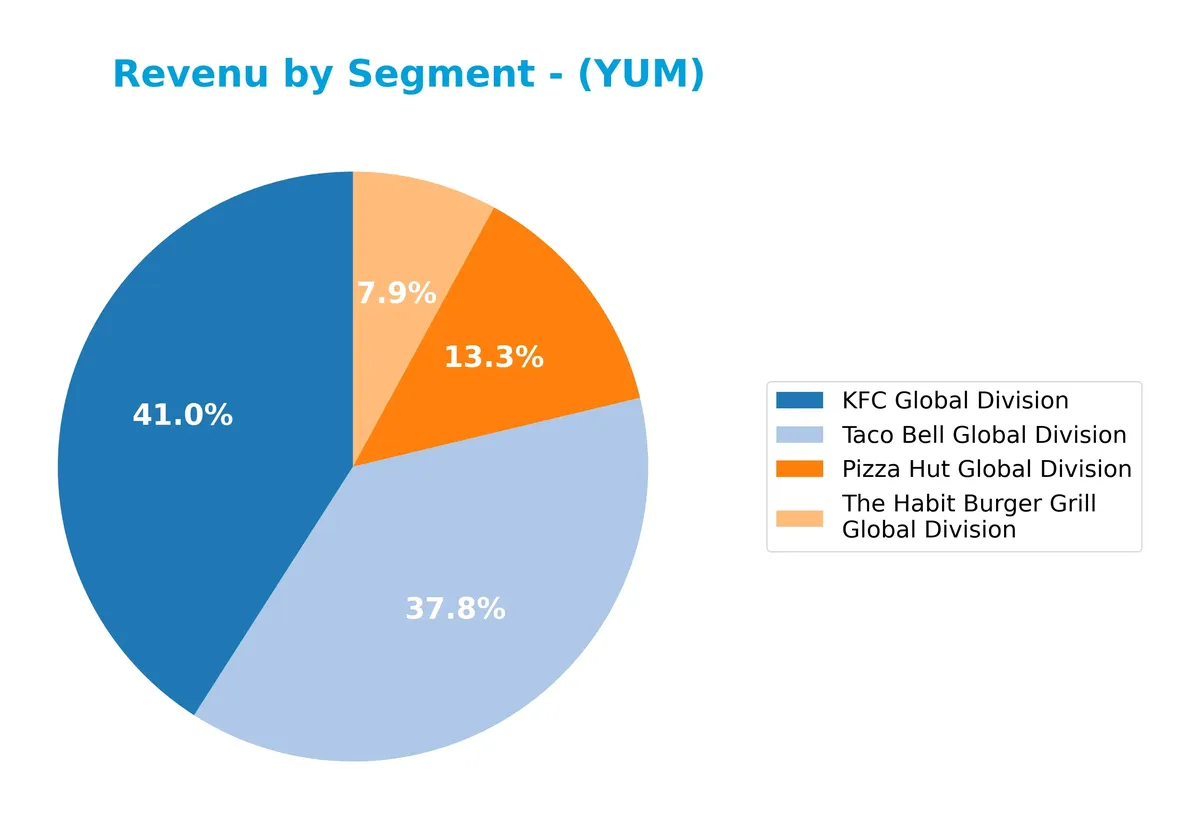

Revenue by Segment

This pie chart depicts Yum! Brands’ revenue distribution by its global divisions for the fiscal year 2024, highlighting the relative contribution of each segment.

KFC remains the dominant revenue driver at $3.1B, followed closely by Taco Bell at $2.9B. Pizza Hut contributes $1.0B, while The Habit Burger Grill adds $600M. The data shows steady growth in KFC and Taco Bell segments, with Pizza Hut stable and Habit expanding modestly, reflecting a balanced portfolio with moderate concentration risk in the top two divisions.

Key Products & Brands

Yum! Brands operates four main restaurant divisions generating significant global revenue:

| Product | Description |

|---|---|

| KFC Global Division | Specializes in chicken-based quick service restaurants, operating over 26,900 units worldwide. |

| Pizza Hut Global Division | Focuses on pizza and related food products, with more than 18,300 units internationally. |

| Taco Bell Global Division | Offers Mexican-style food, including tacos and burritos, with nearly 7,800 locations globally. |

| The Habit Burger Grill Global Division | Provides made-to-order chargrilled burgers and sandwiches, with over 300 units globally. |

Yum! Brands dominates the quick service restaurant industry through diverse, globally recognized brands. Each division targets distinct food categories, fueling steady revenue growth and geographic expansion.

Main Competitors

There are 6 main competitors in the Restaurants industry; below is a list of the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| McDonald’s Corporation | 217B |

| Starbucks Corporation | 95.5B |

| Chipotle Mexican Grill, Inc. | 50.6B |

| Yum! Brands, Inc. | 41.8B |

| Darden Restaurants, Inc. | 21.8B |

| Domino’s Pizza, Inc. | 14.4B |

Yum! Brands ranks 4th among its 6 competitors. Its market cap is just 21% of the leader, McDonald’s, and it sits below both the average top-10 market cap (73.5B) and the sector median (46.2B). Yum! maintains a 12% market cap premium over its closest rival above, indicating a modest but meaningful gap.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does YUM have a competitive advantage?

Yum! Brands presents a competitive advantage, evidenced by a robust ROIC exceeding WACC by 22%, signaling consistent value creation despite a declining ROIC trend. Its global footprint spans 157 countries with strong brand recognition across KFC, Pizza Hut, Taco Bell, and Habit Burger Grill.

Looking ahead, Yum! Brands can leverage new market opportunities and product innovations within its diverse segments to sustain growth. Continued expansion and adaptation to consumer preferences remain key to offsetting the recent erosion in profitability.

SWOT Analysis

This analysis highlights Yum! Brands’ core strengths, weaknesses, opportunities, and threats to guide strategic decisions.

Strengths

- Strong global brand portfolio

- High gross and EBIT margins (~46% and 31%)

- ROIC well above WACC (28% vs 6%)

Weaknesses

- Declining ROIC trend

- Negative net margin growth over period

- Elevated debt-to-assets ratio (145%)

Opportunities

- Expansion in emerging markets

- Innovation in menu and delivery options

- Leverage digital ordering trends

Threats

- Intense competition in quick service

- Rising input costs pressure margins

- Economic downturn risks reduce consumer spending

Yum! Brands maintains solid profitability and a valuable brand moat but faces profitability erosion and leverage risks. The company must focus on operational efficiency and debt management while capitalizing on growth in emerging markets and digital innovation.

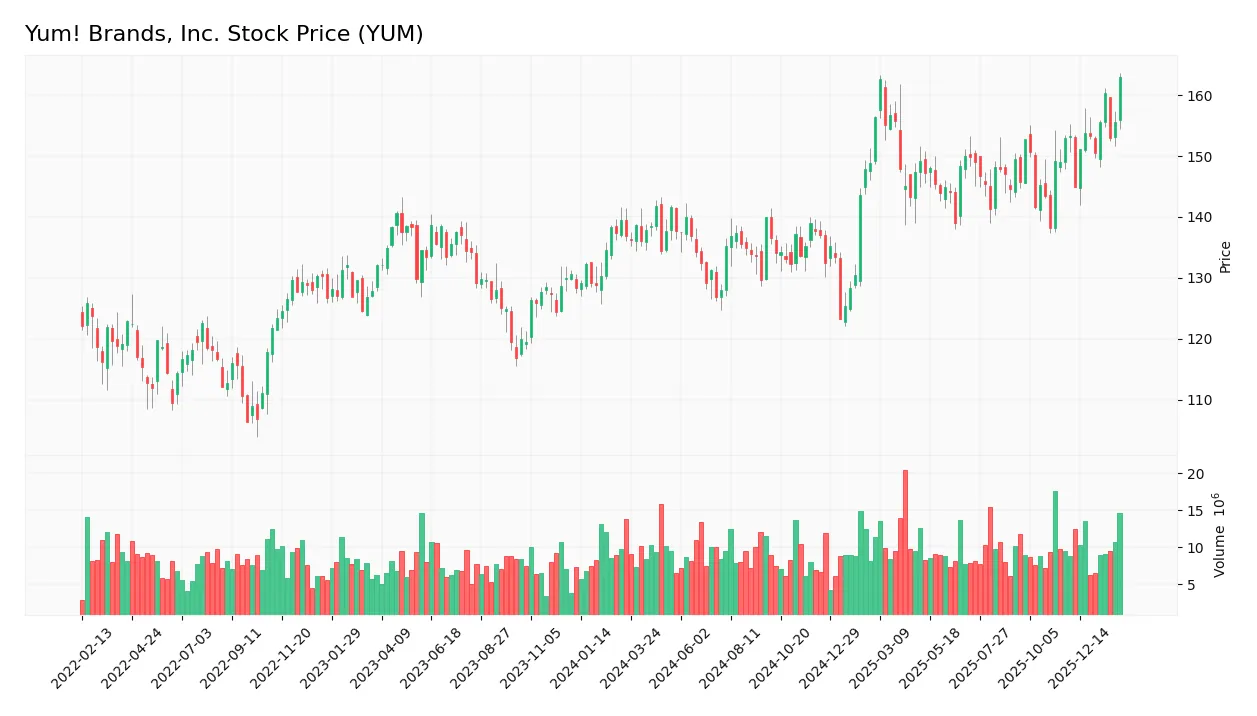

Stock Price Action Analysis

The weekly stock chart of Yum! Brands, Inc. displays price movements over the past 12 months with notable volatility and clear directional shifts:

Trend Analysis

Over the past 12 months, Yum! Brands’ stock rose 19.07%, indicating a bullish trend with accelerating momentum. The price ranged from a low of 123.25 to a high of 162.93, reflecting strong upward movement supported by an 8.64 volatility measure.

Volume Analysis

Trading volume has increased, with the recent three months showing strong buyer dominance at 71.23%. This signals heightened investor interest and confidence, contrasting the nearly balanced buyer-seller split over the full period.

Target Prices

Analysts set a clear target consensus for Yum! Brands, Inc., reflecting confidence in its growth prospects.

| Target Low | Target High | Consensus |

|---|---|---|

| 158 | 185 | 170.85 |

The consensus target price of 170.85 suggests moderate upside potential from current levels, indicating steady confidence among analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide insights into Yum! Brands, Inc.’s market perception.

Stock Grades

Here is the latest verified grading summary for Yum! Brands, Inc. from recognized analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Buy | 2026-02-05 |

| Wells Fargo | Maintain | Equal Weight | 2026-02-05 |

| Citigroup | Maintain | Neutral | 2026-02-05 |

| Citigroup | Maintain | Neutral | 2026-01-22 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-20 |

| Gordon Haskett | Upgrade | Buy | 2026-01-08 |

| Barclays | Maintain | Overweight | 2026-01-07 |

| Oppenheimer | Downgrade | Perform | 2026-01-07 |

| TD Cowen | Upgrade | Buy | 2025-11-17 |

| Evercore ISI Group | Upgrade | Outperform | 2025-11-05 |

The consensus shows a broad range of opinions, with several upgrades to Buy and Outperform. Most analysts maintain neutral or in-line ratings, reflecting a cautious but generally positive stance on Yum! Brands.

Consumer Opinions

Consumer sentiment around Yum! Brands, Inc. reflects a mix of appreciation for its global reach and some concerns about consistency.

| Positive Reviews | Negative Reviews |

|---|---|

| “Consistently delivers flavorful menu items worldwide.” | “Service quality varies significantly by location.” |

| “Great value deals and frequent promotions.” | “Some outlets experience long wait times during peak hours.” |

| “Innovative menu adaptations for local tastes.” | “Nutrition information can be unclear or lacking detail.” |

Overall, customers praise Yum! Brands for its diverse, affordable offerings and local menu innovation. However, inconsistent service and occasional operational delays remain notable weaknesses.

Risk Analysis

The following table summarizes key risks facing Yum! Brands, Inc. as of 2026:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | Debt to assets ratio at 145.3% indicates heavy leverage risk. | High | High |

| Profitability | Negative ROE (-21.28%) signals poor returns to equity holders. | Medium | High |

| Valuation | Elevated P/E ratio (26.98) suggests overvaluation risk. | Medium | Medium |

| Liquidity | Current ratio at 1.35 is neutral but warrants monitoring. | Low | Medium |

| Bankruptcy Risk | Altman Z-score in grey zone (2.64) implies moderate distress risk. | Medium | High |

| Market Volatility | Beta of 0.657 indicates below-market volatility exposure. | Low | Low |

Yum! Brands faces significant risks from its excessive leverage and negative ROE, despite strong operational metrics like ROIC. The grey zone Altman Z-score confirms moderate financial distress potential. Investors should weigh these risks carefully against the company’s favorable cash generation and stable brand portfolio.

Should You Buy Yum! Brands, Inc.?

Yum! Brands appears to be creating value with robust operational efficiency despite a declining ROIC trend. Its leverage profile is substantial, reflecting financial risks. While profitability is solid, the overall B- rating suggests a very favorable yet cautious investment profile.

Strength & Efficiency Pillars

Yum! Brands, Inc. sustains operational excellence with a gross margin of 46.17% and an EBIT margin of 31.4%, underscoring strong profitability. Its net margin stands solid at 18.98%, reflecting efficient cost control. Despite a negative ROE of -21.28%, the company’s ROIC of 28.26% comfortably exceeds its WACC of 6.16%, marking it as a clear value creator. This suggests Yum! Brands effectively deploys capital to generate returns above its cost of capital, a critical long-term advantage.

Weaknesses and Drawbacks

The company resides in the Altman Z-Score grey zone at 2.64, signaling moderate financial risk, though not distress. This caution tempers optimism given Yum!’s unfavorable valuation metrics, including a high P/E of 26.98 and a negative P/B of -5.74, indicating market skepticism or possible accounting distortions. Additionally, a debt-to-assets ratio of 145.3% flags elevated leverage, which could pressure liquidity. While the current ratio of 1.35 is neutral, these structural concerns may weigh on investor confidence amid rising market volatility.

Our Final Verdict about Yum! Brands, Inc.

Yum! Brands presents a fundamentally sound profile characterized by strong profitability and value creation. The bullish overall stock trend and recent strong buyer dominance suggest positive market sentiment. However, the grey zone Altman Z-Score and elevated leverage warrant caution. Despite long-term operational strength, these risks suggest a wait-and-see approach may be prudent for investors seeking a safer entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Yum! Brands Q4 Earnings Call Highlights – Yahoo Finance (Feb 07, 2026)

- Insider Sell: Aaron Powell Sells 12,000 Shares of Yum Brands Inc (YUM) – GuruFocus (Feb 06, 2026)

- Yum Brands reports Q4, year-end results; Pizza Hut to close 250 units – QSR Web (Feb 05, 2026)

- Yum Brands CEO Aaron Powell sells $1.94 million in stock – Investing.com (Feb 06, 2026)

- Yum! Brands tops same-store sales expectations as Taco Bell does the heavy lifting (YUM:NYSE) – Seeking Alpha (Feb 04, 2026)

For more information about Yum! Brands, Inc., please visit the official website: yum.com