Home > Analyses > Utilities > Xcel Energy Inc.

Xcel Energy powers millions of homes and businesses across eight U.S. states, shaping the daily lives of consumers through reliable electricity and natural gas. Renowned for integrating renewable sources with traditional energy, Xcel leads the regulated utilities sector in innovation and sustainability. Its diverse energy mix and strong customer base highlight a resilient business model. Yet, I ask: does Xcel’s current valuation fully reflect its growth prospects amid the energy transition?

Table of contents

Business Model & Company Overview

Xcel Energy Inc., founded in 1909 and headquartered in Minneapolis, Minnesota, stands as a leader in the regulated electric industry. It operates a comprehensive energy ecosystem that includes generation, transmission, and distribution of electricity and natural gas. Serving 3.7M electricity and 2.1M natural gas customers, Xcel integrates diverse energy sources such as coal, nuclear, and renewables into a cohesive, reliable infrastructure across multiple US states.

The company’s revenue engine balances regulated electric utility with natural gas operations, providing stable, recurring cash flows. Xcel’s presence spans key markets in the Midwest and Southwest, including Colorado, Texas, and Michigan. Its strategic investments in pipeline infrastructure and renewable generation facilities strengthen its competitive advantage. This solid foundation underpins a durable economic moat, shaping the future of sustainable energy delivery.

Financial Performance & Fundamental Metrics

I analyze Xcel Energy Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value creation.

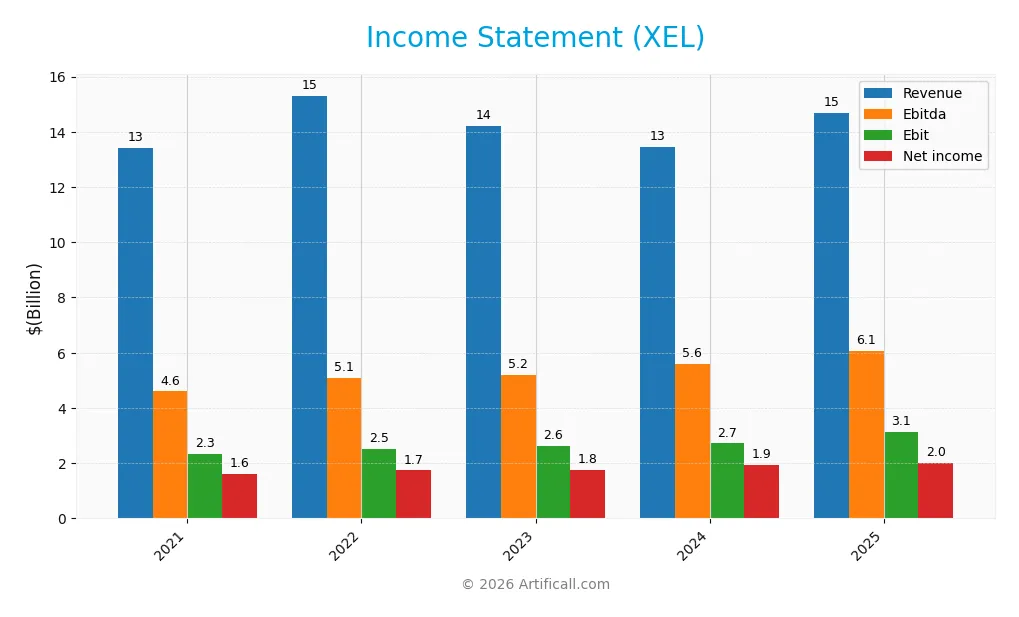

Income Statement

The table below presents Xcel Energy Inc.’s key income statement figures for fiscal years 2021 through 2025 in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 13.43B | 15.31B | 14.21B | 13.44B | 14.67B |

| Cost of Revenue | 8.17B | 9.45B | 8.23B | 7.29B | 11.10B |

| Operating Expenses | 3.06B | 3.43B | 3.50B | 3.76B | 0.69B |

| Gross Profit | 5.26B | 5.86B | 5.98B | 6.15B | 3.57B |

| EBITDA | 4.60B | 5.08B | 5.20B | 5.59B | 6.07B |

| EBIT | 2.34B | 2.53B | 2.63B | 2.72B | 3.12B |

| Interest Expense | 816M | 925M | 1.00B | 1.18B | 1.34B |

| Net Income | 1.60B | 1.74B | 1.77B | 1.94B | 2.02B |

| EPS | 2.96 | 3.17 | 3.21 | 3.44 | 3.44 |

| Filing Date | 2022-02-23 | 2023-02-23 | 2024-02-21 | 2025-02-27 | 2026-02-02 |

Income Statement Evolution

Xcel Energy’s revenue grew steadily by 9.2% over 2021-2025, with a 9.1% increase from 2024 to 2025. Net income also rose 26.4% overall, despite a 4.5% decline in net margin last year. Gross profit fell sharply by 42% in 2025, indicating margin pressure, but EBIT margin and net margin improved over the full period.

Is the Income Statement Favorable?

In 2025, revenue reached $14.7B, up 9.1%, supported by disciplined operating expense growth. The EBIT margin stood at a favorable 21.2%, while net margin was solid at 13.8%. Interest expenses remain neutral at 9.2% of revenue. Despite a one-year drop in gross profit and EPS, the overall fundamentals appear generally favorable, reflecting consistent profitability and margin resilience.

Financial Ratios

The table below summarizes key financial ratios for Xcel Energy Inc. (XEL) from 2021 to 2025, reflecting profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 12% | 11% | 12% | 14% | 14% |

| ROE | 10% | 10% | 10% | 10% | 0% |

| ROIC | 4.0% | 4.2% | 4.1% | 3.6% | 0% |

| P/E | 22.8 | 22.1 | 19.3 | 19.6 | 21.5 |

| P/B | 2.3 | 2.3 | 1.9 | 1.9 | 0 |

| Current Ratio | 0.84 | 0.85 | 0.72 | 0.67 | 0 |

| Quick Ratio | 0.72 | 0.71 | 0.59 | 0.57 | 0 |

| D/E | 1.58 | 1.56 | 1.56 | 1.55 | 0 |

| Debt-to-Assets | 43% | 43% | 43% | 43% | 0% |

| Interest Coverage | 2.70 | 2.62 | 2.47 | 2.02 | 2.14 |

| Asset Turnover | 0.23 | 0.25 | 0.22 | 0.19 | 0 |

| Fixed Asset Turnover | 0.29 | 0.31 | 0.27 | 0.23 | 0 |

| Dividend Yield | 2.6% | 2.6% | 3.2% | 3.1% | 3.8% |

Note: Zero values indicate data unreported or unavailable for 2025.

Evolution of Financial Ratios

Xcel Energy’s Return on Equity (ROE) data is unavailable for 2025, indicating a lack of reported profitability metrics. Current Ratio and Debt-to-Equity Ratio data were also missing for 2025, breaking trend analysis. Profitability, measured by net profit margin, remained stable at approximately 13.8%, signaling consistent earnings despite incomplete ratio data.

Are the Financial Ratios Favorable?

In 2025, net margin and dividend yield stand out as favorable at 13.76% and 3.83%, respectively. Price-to-earnings ratio is neutral at 21.48, reflecting market valuation in line with sector norms. However, the absence of liquidity ratios and asset turnover metrics, combined with low interest coverage at 2.32, point to concerns. Overall, the ratio profile is slightly unfavorable with 42.86% unfavorable metrics.

Shareholder Return Policy

Xcel Energy maintains a dividend payout ratio around 60-82%, with dividend per share steadily rising to $2.83 in 2025. The dividend yield stands near 3.8%, supported by consistent net income, though free cash flow coverage is not explicitly reported.

The company also engages in share buybacks, complementing its dividend strategy. This balanced approach reflects a commitment to returning capital while managing growth investments. Overall, the policy appears aligned with sustainable long-term shareholder value creation.

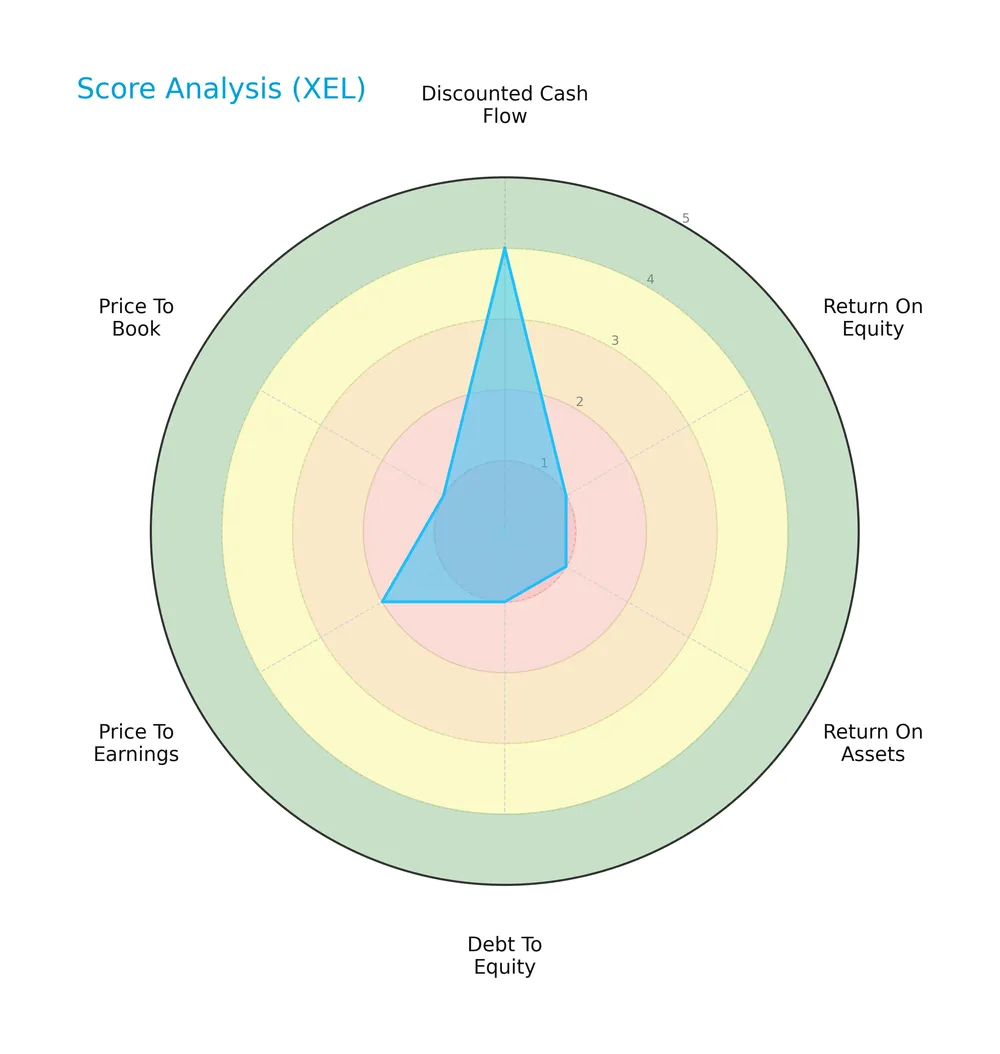

Score analysis

The radar chart below presents a comprehensive overview of Xcel Energy Inc.’s key financial scores:

Xcel Energy scores well on discounted cash flow with a 4 (favorable). However, returns on equity and assets, debt-to-equity, and price-to-book ratios all score 1, indicating significant weaknesses. The price-to-earnings score is 2, reflecting an unfavorable valuation.

Is the company in good financial health?

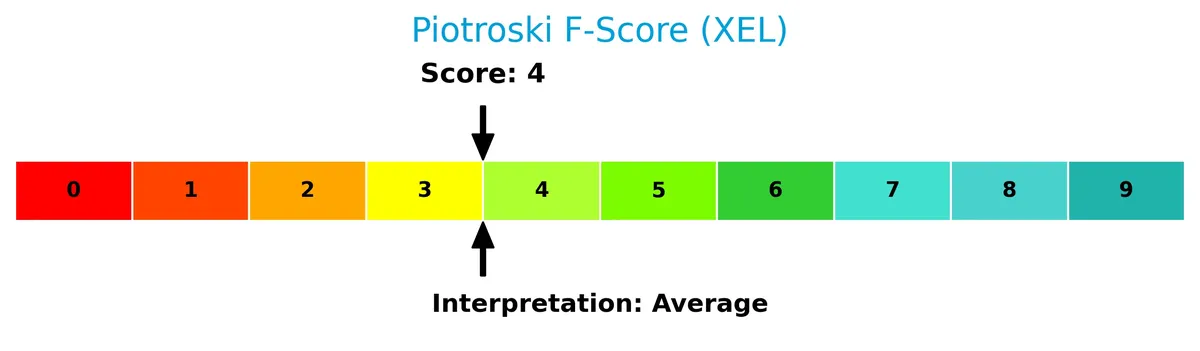

The Piotroski diagram illustrates the company’s current financial health based on nine fundamental criteria:

With a Piotroski Score of 4, Xcel Energy demonstrates average financial strength. This suggests the company has some positive fundamentals but also notable areas needing improvement to enhance its financial resilience.

Competitive Landscape & Sector Positioning

This section analyzes Xcel Energy Inc.’s strategic positioning, revenue by segment, key products, and main competitors. I will assess whether Xcel Energy holds a competitive advantage in the regulated electric utility sector.

Strategic Positioning

Xcel Energy Inc. concentrates primarily on regulated electric and natural gas utilities, with electric revenues reaching $22.3B in 2024, nearly five times natural gas at $4.5B. Its geographic footprint spans eight US states, serving 3.7M electricity and 2.1M gas customers.

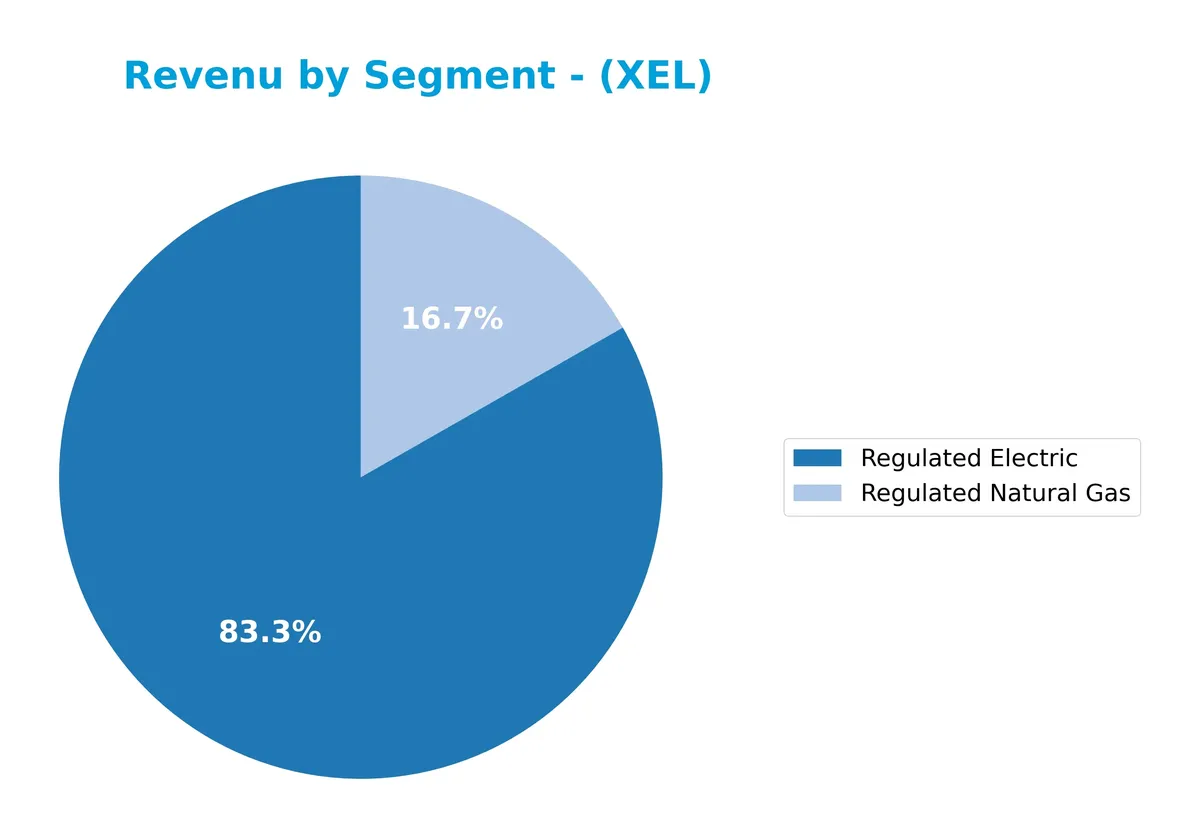

Revenue by Segment

This pie chart breaks down Xcel Energy Inc.’s revenue by segment for fiscal year 2024, highlighting contributions from regulated electric and natural gas operations.

In 2024, regulated electric revenue surged to $22.3B, nearly doubling from 2023’s $11.4B. Regulated natural gas also grew strongly to $4.5B from $2.6B. This sharp acceleration reflects a strategic shift or acquisition impact, concentrating revenue heavily in regulated utilities. Other segments are no longer material, signaling focused core operations but also potential concentration risk if market conditions shift.

Key Products & Brands

The table below outlines Xcel Energy Inc.’s main product lines and brand descriptions:

| Product | Description |

|---|---|

| Regulated Electric | Generates, purchases, transmits, distributes, and sells electricity across multiple energy sources. |

| Regulated Natural Gas | Purchases, transports, distributes, and sells natural gas to retail customers; operates pipelines. |

| Other Segments | Includes development and leasing of natural gas pipelines, storage, compression facilities, and rentals. |

Xcel Energy’s core revenue drivers remain regulated electric and natural gas utilities. The company steadily expanded its electric segment, reflecting its broad energy generation mix and regional service footprint.

Main Competitors

Xcel Energy Inc. faces competition from 23 companies, with the top 10 leaders by market capitalization listed below:

| Competitor | Market Cap. |

|---|---|

| NextEra Energy, Inc. | 169B |

| The Southern Company | 96B |

| Duke Energy Corporation | 91B |

| American Electric Power Company, Inc. | 62B |

| Dominion Energy, Inc. | 51B |

| Exelon Corporation | 44B |

| Xcel Energy Inc. | 44B |

| Entergy Corporation | 42B |

| Public Service Enterprise Group Incorporated | 40B |

| Consolidated Edison, Inc. | 36B |

Xcel Energy ranks 7th among these competitors. Its market cap is about 27% of the leader, NextEra Energy. The company sits below the average market cap of the top 10 (67.5B) but above the sector median (34B). The narrow 1.15% gap with the next competitor above shows a tight race in this tier.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does XEL have a competitive advantage?

Xcel Energy Inc. shows a favorable income statement with strong net and EBIT margins, supporting operational efficiency in a regulated electric utility sector. However, the absence of ROIC versus WACC data and a declining ROIC trend raise questions about sustainable competitive advantage.

Looking ahead, Xcel’s diverse energy sources and presence across multiple states provide growth opportunities in renewable generation and natural gas infrastructure. This expansion could enhance its market position amid evolving energy demands.

SWOT Analysis

This SWOT analysis highlights Xcel Energy’s core competitive factors and challenges to inform strategic positioning.

Strengths

- diversified energy mix

- strong regulated utility footprint

- stable dividend yield of 3.8%

Weaknesses

- declining ROIC trend

- unfavorable liquidity ratios

- below-average profitability metrics

Opportunities

- expanding renewable energy investments

- growing customer base in multiple states

- regulatory support for clean energy

Threats

- volatile commodity prices

- regulatory risks and policy changes

- competition from distributed energy resources

Xcel Energy leverages a solid regulated business and renewables growth but must address profitability and liquidity weaknesses. Strategic focus on operational efficiency and capital discipline is critical to navigate regulatory and market risks.

Stock Price Action Analysis

The weekly stock chart displays Xcel Energy Inc.’s price evolution, highlighting key movements and volatility patterns over the past 12 months:

Trend Analysis

Over the past 12 months, XEL’s stock price rose 46%, indicating a strong bullish trend despite decelerating momentum. The price fluctuated between 52 and 82, with an 8.2% volatility. However, recently (Nov 2025–Feb 2026), the price declined 4.7%, showing a short-term bearish slope of -0.36.

Volume Analysis

Total trading volume increased, with buyers accounting for 57.2% of 2.4B shares overall. Yet, in the recent three months, sellers dominated at 66.7%, with volume rising. This shift suggests growing market caution and increased selling pressure despite broader buyer strength.

Target Prices

Analysts set a solid target consensus for Xcel Energy Inc., signaling moderate upside potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 81 | 95 | 88 |

The target range from 81 to 95 suggests analysts expect steady growth with limited volatility. The consensus of 88 indicates a balanced outlook on the stock’s near-term valuation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback trends related to Xcel Energy Inc. (XEL).

Stock Grades

Here are the latest verified stock grades for Xcel Energy Inc. from major financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-15 |

| UBS | Maintain | Neutral | 2025-12-17 |

| Keybanc | Maintain | Overweight | 2025-12-12 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| Barclays | Maintain | Overweight | 2025-11-05 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Mizuho | Maintain | Outperform | 2025-10-27 |

| Jefferies | Maintain | Buy | 2025-10-16 |

| BMO Capital | Maintain | Outperform | 2025-10-15 |

The consensus grades show a stable outlook with multiple firms maintaining overweight or buy ratings. Neutral ratings from UBS indicate some caution, but the overall trend favors a positive stance.

Consumer Opinions

Consumer sentiment around Xcel Energy Inc. reflects a mix of appreciation for reliability and concerns about pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| “Consistently reliable service with minimal outages.” | “Electricity rates have increased noticeably.” |

| “Customer support is helpful and responsive.” | “Billing can be confusing and sometimes inaccurate.” |

| “Strong commitment to renewable energy initiatives.” | “Slow response to outage repairs in rural areas.” |

Overall, customers praise Xcel Energy’s dependable service and green energy efforts. However, rising costs and billing issues remain persistent pain points.

Risk Analysis

Below is a summary table of key risks affecting Xcel Energy Inc., focusing on likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Regulatory Risk | Changes in environmental laws could increase compliance costs significantly | Medium | High |

| Financial Health | Weak profitability metrics and poor return ratios signal operational stress | High | Medium |

| Market Risk | Low beta (0.48) suggests limited stock volatility but also limited growth | Low | Low |

| Debt Management | Favorable debt ratios but interest coverage at 2.32 limits financial flexibility | Medium | Medium |

| Operational Risk | Dependence on diverse energy sources carries transition and cost risks | Medium | Medium |

Xcel’s most pressing risks stem from financial health and regulatory pressures. The company’s zero ROE and ROIC highlight struggles in capital efficiency. Regulatory shifts toward renewables could stress margins but also offer growth if managed well. Interest coverage near 2.3 raises caution amid rising rates.

Should You Buy Xcel Energy Inc.?

Xcel Energy Inc. appears to be experiencing declining operational efficiency with a weakening return on invested capital and an eroding moat. Despite significant leverage and a challenging debt profile, the company holds a cautious C rating, suggesting a mixed financial health profile.

Strength & Efficiency Pillars

Xcel Energy Inc. demonstrates solid operational margins with a gross margin of 24.3% and an EBIT margin of 21.24%. The net margin stands favorably at 13.76%, signaling effective cost control and profitable core operations. Despite unavailable ROIC data, the company sustains revenue growth of 9.14% over one year and 9.22% across 2021-2025, supporting a 26.36% net income growth overall. These metrics reflect operational resilience amid sector cyclicality, although capital efficiency measures require further clarity.

Weaknesses and Drawbacks

Xcel Energy faces notable challenges. The Altman Z-Score is unavailable, limiting solvency insight, which raises caution. Profitability ratios such as ROE and ROIC are both 0% or unfavorable, indicating weak capital returns. Valuation metrics like P/E at 21.48 and a favorable P/B of 0 appear inconsistent but suggest mixed market perceptions. Liquidity ratios (current and quick ratios) are missing or unfavorable, posing short-term financial risk. Recent market behavior is seller-dominant with only 33.32% buyer volume, indicating pressure on the stock price.

Our Final Verdict about Xcel Energy Inc.

Given the absence of a definitive Altman Z-Score, solvency risk cannot be fully assessed, injecting uncertainty into the profile. Despite favorable income margins and a bullish overall stock trend (+45.99%), recent seller dominance advises caution. The company may appear operationally sound but carries moderate financial and market risks. Investors could consider a wait-and-see stance until liquidity and capital efficiency metrics clarify, especially for conservative capital.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Xcel Energy outlines plan to contract 6 GW of data center capacity by end of 2027 while reaffirming 6%-8% long-term EPS growth – MSN (Feb 06, 2026)

- How Xcel–NextEra Data Center Power Alliance At Xcel Energy (XEL) Has Changed Its Investment Story – Yahoo Finance (Feb 06, 2026)

- Xcel Energy Inc. (NASDAQ:XEL) Q4 2025 Earnings Call Transcript – Insider Monkey (Feb 06, 2026)

- Xcel Energy Inc (XEL) Q4 2025 Earnings Call Highlights: Strong E – GuruFocus (Feb 05, 2026)

- Xcel Energy and NextEra Energy Agree to Deliver Generation Solutions and Enable Large Load Across Xcel Energy’s Service Territories – Business Wire (Feb 04, 2026)

For more information about Xcel Energy Inc., please visit the official website: xcelenergy.com