Home > Analyses > Consumer Cyclical > Wynn Resorts, Limited

Wynn Resorts transforms luxury entertainment with sprawling casinos and lavish resorts that define the high-end gaming experience. It commands prestige through iconic properties like Wynn Palace in Macau and Encore Boston Harbor, blending innovation with unmatched service quality. As the leisure sector navigates economic cycles and evolving consumer tastes, I question whether Wynn’s premium positioning and growth strategies still justify its substantial market valuation. This analysis probes its future earnings power and risk profile.

Table of contents

Business Model & Company Overview

Wynn Resorts, Limited, founded in 2002 and headquartered in Las Vegas, NV, commands a dominant position in the Gambling, Resorts & Casinos industry. Its integrated resorts combine luxury hotels, extensive casino floors, high-end retail, and entertainment venues. This cohesive ecosystem delivers a premium guest experience across its flagship properties in Las Vegas, Macau, Boston, and beyond.

Wynn’s revenue engine balances gaming operations with hospitality and leisure services, including spas, fine dining, and convention spaces. The company leverages its global footprint across the Americas, Asia, and North America to capture diverse clientele. Its competitive advantage rests on unmatched brand prestige and scale, creating a formidable economic moat in a capital-intensive, experience-driven sector.

Financial Performance & Fundamental Metrics

I analyze Wynn Resorts’ income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder returns.

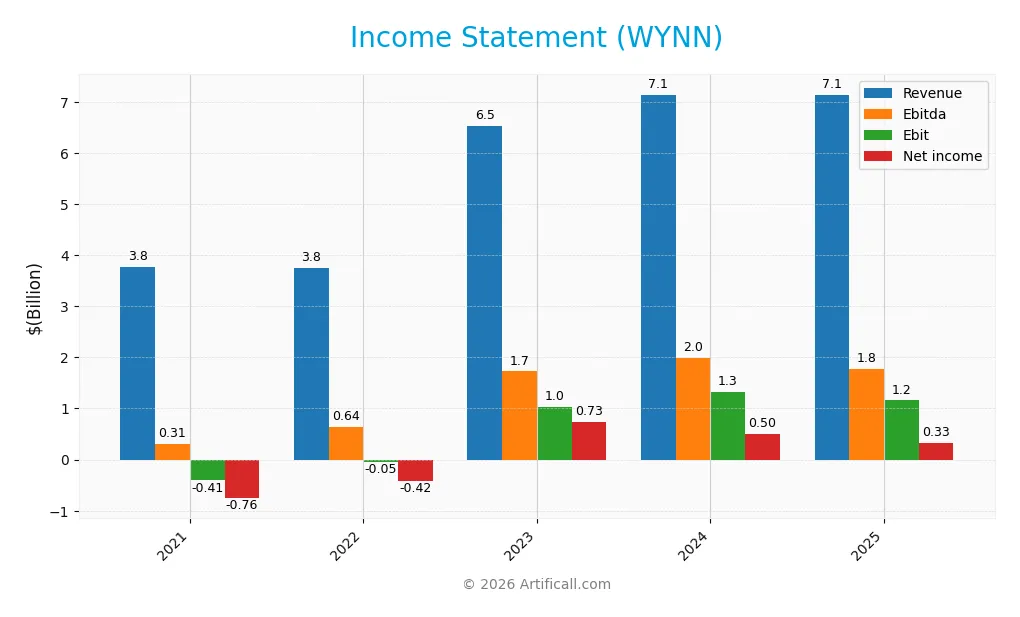

Income Statement

This table summarizes Wynn Resorts, Limited’s key income statement metrics for fiscal years 2021 through 2025, providing a clear view of revenue, expenses, and profits.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 3.76B | 3.76B | 6.53B | 7.13B | 7.14B |

| Cost of Revenue | 2.56B | 2.39B | 3.71B | 4.03B | 4.80B |

| Operating Expenses | 1.60B | 1.47B | 1.98B | 1.97B | 1.18B |

| Gross Profit | 1.21B | 1.37B | 2.82B | 3.10B | 2.34B |

| EBITDA | 310M | 643M | 1.72B | 1.99B | 1.78B |

| EBIT | -406M | -49M | 1.04B | 1.33B | 1.16B |

| Interest Expense | 606M | 651M | 752M | 688M | 626M |

| Net Income | -756M | -424M | 713M | 480M | 327M |

| EPS | -6.64 | -3.73 | 6.49 | 4.56 | 3.16 |

| Filing Date | 2022-02-28 | 2023-02-27 | 2024-02-23 | 2025-02-13 | 2026-02-12 |

Income Statement Evolution

Wynn Resorts’ revenue grew 89.65% from 2021 to 2025, but growth slowed to 0.14% in the latest year. Gross profit declined 24.67% year-over-year, compressing margins despite a stable gross margin of 32.73%. EBIT margin remains favorable at 16.21%, although EBIT fell 13.13% last year, indicating margin pressure.

Is the Income Statement Favorable?

The 2025 income statement shows mixed signals. Revenue and operating expenses both grew modestly, maintaining operational stability. However, net income dropped 34.77%, pulling net margin down to 4.59%. Interest expense at 8.76% of revenue is neutral. Overall, fundamentals show a favorable trend over the period but recent declines suggest caution.

Financial Ratios

The table below summarizes key financial ratios for Wynn Resorts, Limited from 2021 through 2025, highlighting profitability, liquidity, leverage, and market valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -20.1% | -11.3% | 11.0% | 7.0% | 4.6% |

| ROE | 3.52 | 0.56 | -2.90 | -2.24 | 0.00 |

| ROIC | -3.49% | -0.83% | 6.72% | 9.81% | 0.00 |

| P/E | -12.8 | -22.1 | 14.0 | 18.9 | 38.1 |

| P/B | -45.1 | -12.5 | -40.8 | -42.3 | 0.0 |

| Current Ratio | 2.23 | 2.22 | 1.93 | 1.90 | 0.0 |

| Quick Ratio | 2.18 | 2.19 | 1.89 | 1.85 | 0.0 |

| D/E | -56.2 | -18.3 | -53.2 | -54.3 | 0.0 |

| Debt-to-Assets | 0.96 | 1.02 | 0.96 | 0.94 | 0.0 |

| Interest Coverage | -0.65 | -0.15 | 1.12 | 1.65 | 1.85 |

| Asset Turnover | 0.30 | 0.28 | 0.47 | 0.55 | 0.0 |

| Fixed Asset Turnover | 0.41 | 0.43 | 0.77 | 0.86 | 0.0 |

| Dividend Yield | 0.02% | 0.02% | 0.83% | 1.47% | 0.83% |

Evolution of Financial Ratios

Wynn Resorts’ Return on Equity (ROE) remained weak, showing no recovery through 2025. The Current Ratio data is absent for 2025 but hovered near 2.0 in prior years, indicating stable liquidity before the last year. Debt-to-Equity Ratio remains at zero in 2025, a notable shift from deeply negative figures previously, signaling a structural change or data gap. Profitability margins declined in 2025, reflecting reduced operational efficiency.

Are the Financial Ratios Favorable?

The 2025 ratios paint a challenging picture. Profitability is weak with a net margin of 4.59% deemed unfavorable. Liquidity ratios are missing, raising caution on short-term financial health. Leverage metrics, including debt-to-equity and debt-to-assets, appear favorable but likely reflect incomplete data. Interest coverage at 1.85x is low, signaling tight capacity to service debt. The price-earnings ratio at 38.12 is high relative to sector norms, suggesting valuation concerns. Overall, the majority of ratios are unfavorable, cautioning investors on financial stability.

Shareholder Return Policy

Wynn Resorts maintains a dividend payout ratio around 28-32%, with dividend per share rising from $0.01 in 2021 to $1 in 2025. Dividend yields ranged from 0.8% to 1.5%, supported by moderate payout coverage and no explicit share buyback data.

The policy reflects cautious distribution amid fluctuating profitability and leverage levels. This measured approach balances shareholder returns with reinvestment needs, supporting sustainable long-term value creation without risking overextension in payouts.

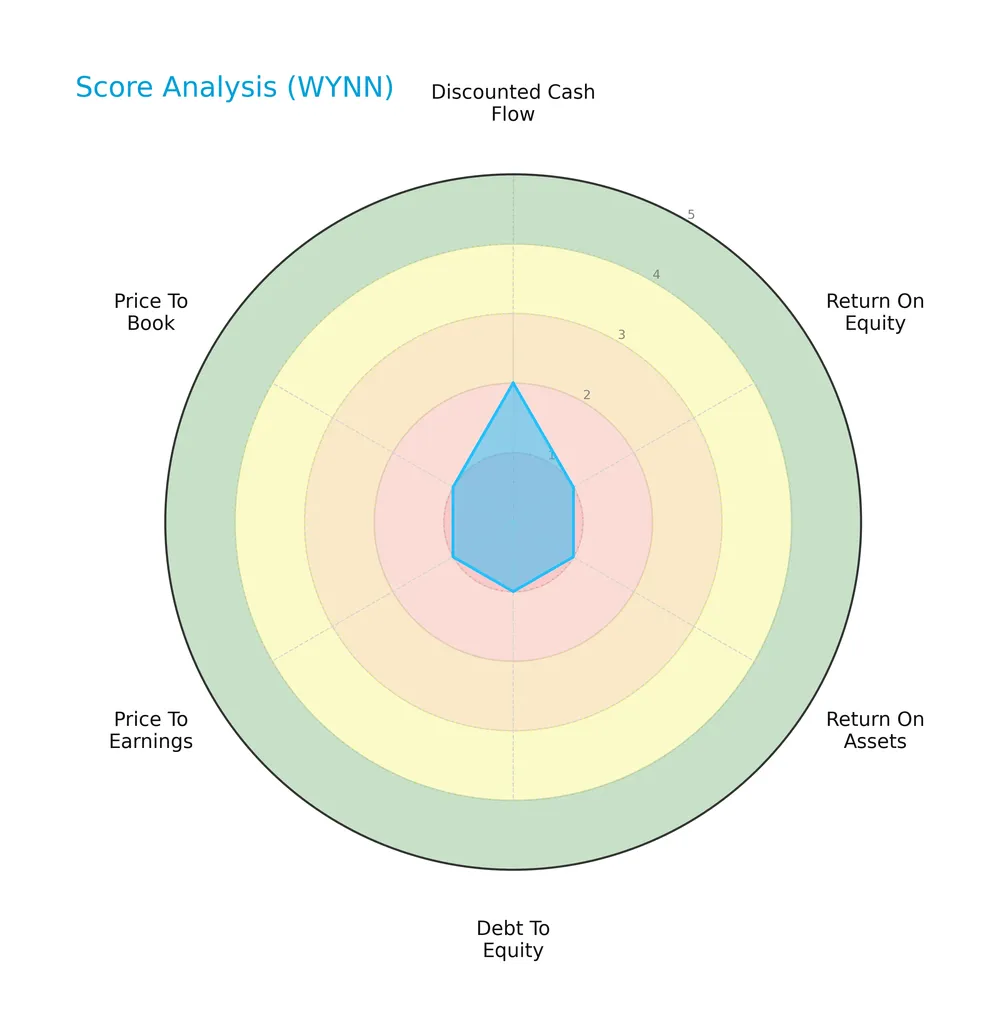

Score analysis

Here is an overview of Wynn Resorts, Limited’s key financial scores captured in this radar chart:

Wynn shows very unfavorable scores across most metrics. Its discounted cash flow score is slightly better but still unfavorable. Return on equity, assets, debt to equity, price to earnings, and price to book ratios all score very poorly, indicating weak financial fundamentals.

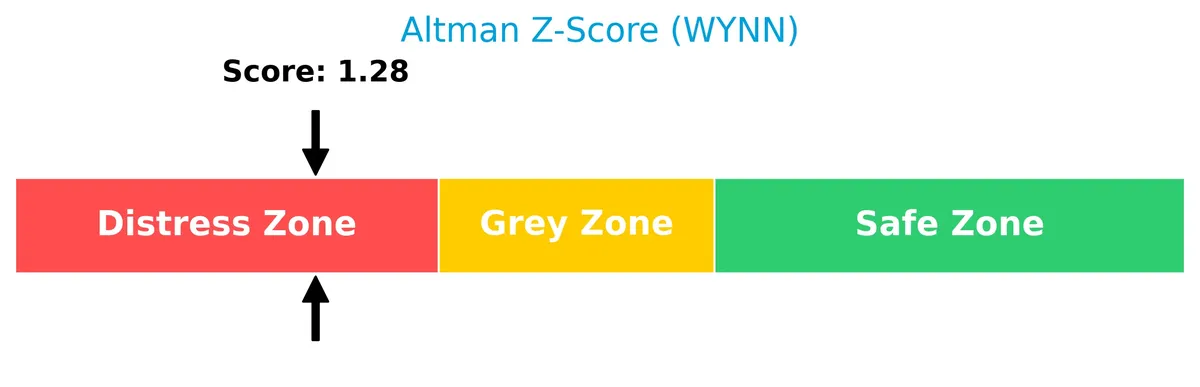

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Wynn Resorts in the distress zone, signaling a high risk of financial distress and potential bankruptcy:

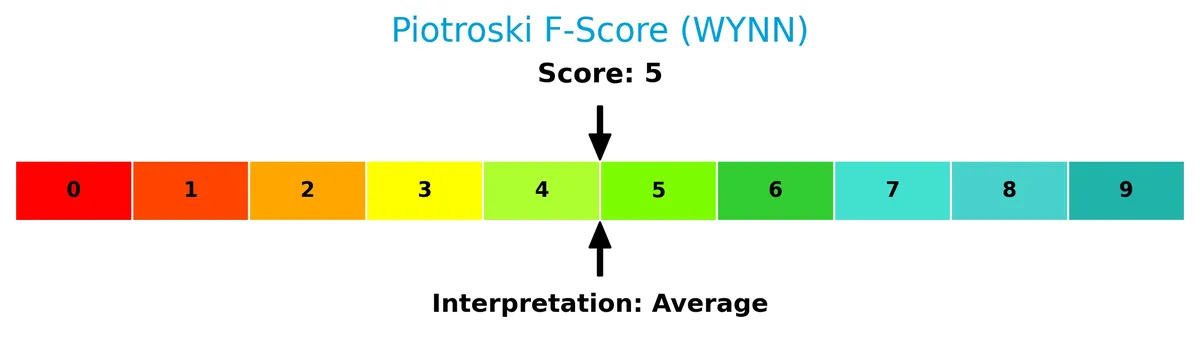

Is the company in good financial health?

The Piotroski Score diagram summarizes Wynn’s middling financial health status:

With a Piotroski Score of 5, Wynn Resorts demonstrates average financial strength. This suggests moderate operational and profitability metrics, but not enough to classify the company as financially robust.

Competitive Landscape & Sector Positioning

This section examines Wynn Resorts’ strategic positioning, revenue segments, key products, and main competitors. I will assess whether Wynn Resorts holds a competitive advantage within the gambling, resorts, and casinos sector.

Strategic Positioning

Wynn Resorts concentrates on integrated resorts with a diversified product mix spanning casino, occupancy, food and beverage, and entertainment. Geographically, it operates primarily in Macau, Las Vegas, and Boston, balancing exposure between mature and growing gaming markets.

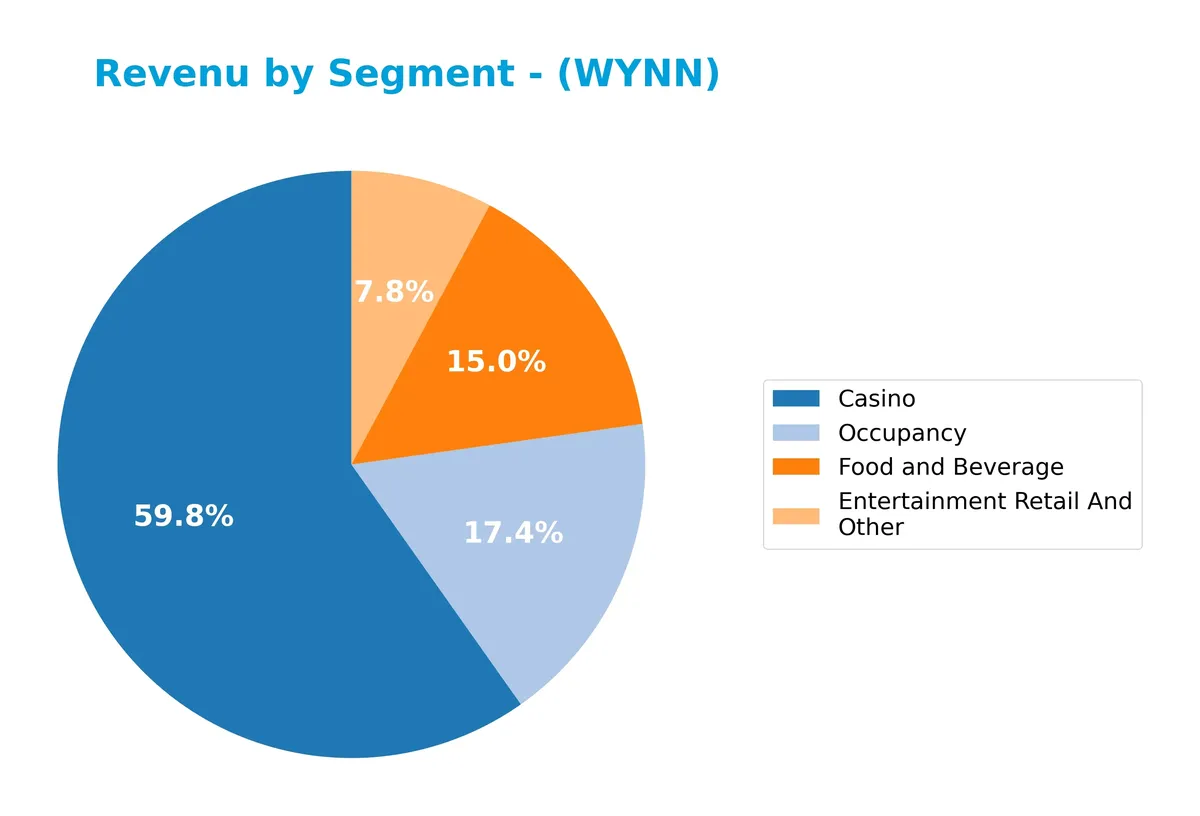

Revenue by Segment

This pie chart illustrates Wynn Resorts’ revenue breakdown by key segments for the fiscal year 2024, highlighting the relative size of each business line.

Casino revenue leads significantly at 4.26B, driving the core business with steady growth from 3.72B in 2023. Occupancy and Food & Beverage contribute 1.24B and 1.07B respectively, showing consistent expansion. Entertainment Retail and Other lags at 555M but remains stable. The 2024 data reflects an accelerating recovery post-pandemic, with growing concentration in Casino and Occupancy segments.

Key Products & Brands

Wynn Resorts offers a diversified portfolio of integrated resort services and luxury hospitality experiences:

| Product | Description |

|---|---|

| Casino | Large-scale casino operations featuring thousands of slot machines, table games, poker rooms, and private salons. |

| Occupancy | Luxury hotel accommodations across multiple towers with thousands of guest rooms, suites, and villas. |

| Food and Beverage | Extensive dining options with numerous restaurants, bars, and nightclubs within resort properties. |

| Entertainment, Retail & Other | Meeting and convention spaces, retail outlets, theaters, nightclubs, spas, pools, and unique attractions. |

Wynn Resorts leads with integrated resorts combining gaming, hospitality, and entertainment. Casinos generate the bulk of revenue, supported by upscale lodging and diverse amenities. This multi-segment approach targets high-end and mass-market clientele.

Main Competitors

There are 3 competitors in total, with the table below listing the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Las Vegas Sands Corp. | 44.1B |

| Wynn Resorts, Limited | 12.7B |

| MGM Resorts International | 10.0B |

Wynn Resorts ranks 2nd among its three main competitors. Its market cap is 27% of the top player, Las Vegas Sands Corp. The company sits below both the average market cap of the top 10 competitors (22.3B) and the sector median (12.7B). It is 274% smaller than the leader but maintains a 18% lead over the next competitor below.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does WYNN have a competitive advantage?

Wynn Resorts presents signs of competitive strength with growing ROIC over 2021-2025, though ROIC compared to WACC is unavailable. The company sustains favorable gross and EBIT margins, reflecting operational efficiency in a competitive sector.

Looking ahead, Wynn leverages its diversified resort footprint across Macau, Las Vegas, Boston, and its luxury offerings. Expansion in gaming capacity and premium amenities creates opportunities to capture market share and revenue growth in evolving gambling and leisure markets.

SWOT Analysis

This analysis highlights Wynn Resorts’ core competitive position and risks to guide strategic decisions.

Strengths

- Strong brand in luxury resort and casino space

- Diverse geographic footprint with Macau, Las Vegas, Boston

- Growing ROIC trend indicating improving capital efficiency

Weaknesses

- Weak liquidity ratios signal short-term financial stress

- Negative recent net margin and EPS growth

- Low Altman Z-Score points to financial distress risk

Opportunities

- Expansion in Asia gaming market with Macau recovery

- Rising demand for premium integrated resorts post-pandemic

- Potential to optimize asset utilization and reduce costs

Threats

- Regulatory risks in Macau and US gaming markets

- Economic downturns reduce discretionary spending

- Intense competition from other global casino operators

Wynn Resorts combines powerful brand assets with geographic diversification but faces liquidity and profitability challenges. Strategic focus should prioritize strengthening the balance sheet and capitalizing on Asia market growth while managing regulatory and economic risks.

Stock Price Action Analysis

The weekly stock chart for Wynn Resorts, Limited illustrates price movements and key levels over the past 100 weeks:

Trend Analysis

Over the past 12 months, WYNN’s stock price increased by 13.51%, indicating a bullish trend. The price peaked at 129.52 and bottomed at 70.09, with volatility measured by a 16.17 standard deviation. However, recent months show a deceleration in upward momentum.

Volume Analysis

Trading volumes over the last three months reveal a seller-driven market, with sellers accounting for 70.37% of activity. Volume is decreasing, signaling subdued investor participation and potential caution among market participants.

Target Prices

Analysts set a clear target consensus for Wynn Resorts, Limited, reflecting moderate upside potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 133 | 155 | 145.22 |

The target range from 133 to 155 suggests cautious optimism. The consensus of 145.22 indicates steady growth expectations relative to current price levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews analyst grades and consumer feedback to provide a balanced view of Wynn Resorts, Limited’s performance.

Stock Grades

Here are the latest verified stock grades for Wynn Resorts, Limited from several reputable firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Macquarie | Maintain | Outperform | 2026-02-13 |

| Stifel | Maintain | Buy | 2026-02-13 |

| Wells Fargo | Maintain | Overweight | 2026-02-13 |

| Morgan Stanley | Maintain | Overweight | 2026-01-16 |

| UBS | Maintain | Buy | 2026-01-16 |

| Barclays | Maintain | Overweight | 2026-01-16 |

| JP Morgan | Maintain | Overweight | 2025-12-08 |

| Macquarie | Maintain | Outperform | 2025-12-08 |

| Stifel | Maintain | Buy | 2025-12-08 |

| Jefferies | Maintain | Buy | 2025-12-08 |

The consensus reflects a stable “Buy” sentiment with no recent downgrades. Most firms maintain positive ratings, indicating confidence in Wynn Resorts’ outlook.

Consumer Opinions

Wynn Resorts consistently sparks strong reactions from its clientele, reflecting its premium positioning in luxury hospitality.

| Positive Reviews | Negative Reviews |

|---|---|

| Exceptional service with attentive staff. | Premium pricing feels steep for some guests. |

| Luxurious accommodations and ambiance. | Occasional delays in reservation handling. |

| Wide variety of high-quality dining options. | Limited non-gaming entertainment choices. |

Overall, consumers praise Wynn Resorts for its luxury experience and outstanding service. However, pricing and service speed present recurring concerns that could impact broader appeal.

Risk Analysis

The table below summarizes key risks facing Wynn Resorts, Limited, highlighting likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Low Altman Z-Score (1.28) signals distress zone, indicating bankruptcy risk | High | Very High |

| Profitability | Unfavorable net margin (4.59%) and zero ROE suggest weak earnings | High | High |

| Liquidity | Current and quick ratios at zero indicate severe short-term liquidity risks | High | High |

| Valuation | Elevated P/E of 38.12 implies overvaluation relative to industry benchmarks | Medium | Medium |

| Debt Management | Favorable debt-to-equity but low interest coverage (1.85) signals risk | Medium | High |

| Market Volatility | Beta near 1.01 suggests stock closely tracks market fluctuations | Medium | Medium |

Wynn’s most pressing risk is financial distress, underscored by a low Altman Z-Score and weak profitability metrics. Liquidity issues compound vulnerability, especially in economic downturns. Elevated valuation multiples heighten downside risk if earnings fail to improve. Investors must weigh these factors carefully.

Should You Buy Wynn Resorts, Limited?

Wynn Resorts appears to be navigating a challenging financial landscape with improving operational efficiency but a leverage profile that remains substantial. While its growing ROIC suggests emerging value creation, the overall D+ rating and distress zone Altman Z-Score indicate persistent financial risks.

Strength & Efficiency Pillars

Wynn Resorts maintains operational resilience with a solid gross margin of 32.73% and an EBIT margin of 16.21%, both flagged as favorable. These figures reflect disciplined cost management despite industry pressures. However, profitability metrics such as net margin (4.59%), ROE (0%), and ROIC (0%) remain weak or neutral. The absence of a WACC figure and a ROIC of zero prevent confirming value creation, indicating limited capital efficiency. Thus, operational margins show strength, but value creation is not currently evident.

Weaknesses and Drawbacks

The company is in financial distress, as indicated by an Altman Z-Score of 1.28, well below the 1.8 distress threshold, signalling a high bankruptcy risk. This solvency concern overrides other considerations. Compounding risks, Wynn’s P/E ratio stands at an elevated 38.12, implying a premium valuation that is hard to justify given weak profitability. Liquidity ratios such as current and quick ratios are unfavorable or unavailable, further stressing short-term financial health. Recent trading trends also show seller dominance at 70.37%, increasing near-term volatility risk.

Our Final Verdict about Wynn Resorts, Limited

Despite some favorable operational margins and a bullish long-term trend, Wynn Resorts faces substantial financial distress with its Altman Z-Score in the distress zone. This solvency risk renders the investment profile highly speculative. The recent seller dominance and weak profitability suggest that cautious investors may find this profile too risky for conservative capital, despite underlying business strengths.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Wynn Resorts, Limited Reports Fourth Quarter and Year End 2025 Results – PR Newswire (Feb 12, 2026)

- Do Wall Street Analysts Like Wynn Resorts Stock? – Barchart.com (Feb 13, 2026)

- Prospera Financial Services Inc Boosts Stock Position in Wynn Resorts, Limited $WYNN – MarketBeat (Feb 13, 2026)

- Wynn Resorts Q4 Earnings Miss Estimates, Revenues Up Y/Y – Zacks Investment Research (Feb 13, 2026)

- Wynn Resorts, Limited (NASDAQ:WYNN) Q4 2025 Earnings Call Transcript – Insider Monkey (Feb 13, 2026)

For more information about Wynn Resorts, Limited, please visit the official website: wynnresorts.com