Home > Analyses > Financial Services > Willis Towers Watson Public Limited Company

Willis Towers Watson shapes the global insurance brokerage and consulting landscape by delivering tailored risk management and employee benefit solutions that touch millions of lives daily. As a leader in advisory services, it excels in combining data-driven insights with innovative technology across health, wealth, and risk management sectors. Renowned for its comprehensive expertise and market influence, the company stands at a pivotal juncture—does its solid foundation support sustained growth and justify its premium valuation in an evolving financial ecosystem?

Table of contents

Business Model & Company Overview

Willis Towers Watson Public Limited Company, founded in 1828 and headquartered in London, stands as a dominant player in the insurance brokerage and advisory sector. Its integrated ecosystem delivers comprehensive solutions across health, wealth, career, risk, and broking services, aiming to optimize client outcomes through consulting, data, and technology. This long-established firm leverages nearly two centuries of expertise to serve a global client base with tailored risk and benefits management.

The company’s revenue engine balances advisory and brokerage fees with recurring services spanning actuarial, investment consulting, and benefits outsourcing. It operates strategically across the Americas, Europe, and Asia, capitalizing on diverse markets to drive growth. Willis Towers Watson’s robust blend of software, consulting, and risk management services creates a powerful economic moat, positioning it to shape the future landscape of financial and insurance advisory globally.

Financial Performance & Fundamental Metrics

This analysis reviews Willis Towers Watson’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

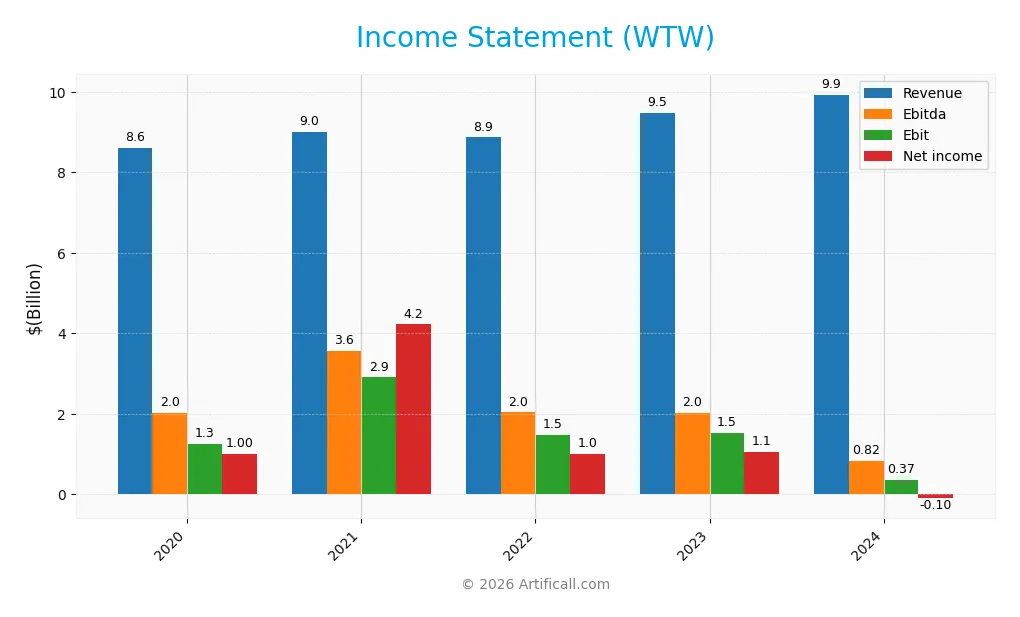

The table below summarizes Willis Towers Watson Public Limited Company’s key income statement figures for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 8.6B | 9.0B | 8.9B | 9.5B | 9.9B |

| Cost of Revenue | 5.2B | 5.3B | 5.1B | 5.3B | 5.5B |

| Operating Expenses | 2.6B | 1.5B | 2.6B | 2.8B | 3.8B |

| Gross Profit | 3.5B | 3.7B | 3.8B | 4.1B | 4.4B |

| EBITDA | 2.0B | 3.6B | 2.0B | 2.0B | 0.8B |

| EBIT | 1.3B | 2.9B | 1.5B | 1.5B | 0.4B |

| Interest Expense | 244M | 211M | 208M | 235M | 263M |

| Net Income | 996M | 4.2B | 1.0B | 1.1B | -98M |

| EPS | 7.68 | 15.02 | 9.00 | 10.05 | -0.96 |

| Filing Date | 2021-02-23 | 2022-02-24 | 2023-02-24 | 2024-02-22 | 2025-02-25 |

Income Statement Evolution

From 2020 to 2024, Willis Towers Watson’s revenue showed a favorable overall growth of 15.26%, with a neutral 4.71% increase in the last year. Gross profit grew favorably by 6.98% year-on-year, supporting a stable gross margin of 44.59%. However, EBIT and net income declined significantly, with EBIT falling 75.76% and net margin turning negative at -0.99%, reflecting deteriorating profitability and margin compression.

Is the Income Statement Favorable?

The 2024 income statement reveals mixed fundamentals. Despite steady revenue and gross margin, operating expenses rose proportionally with revenue, negatively impacting EBIT, which dropped sharply to a 3.7% margin, classified as neutral. Interest expenses remain favorable at 2.65% of revenue. However, the net income loss of -98M USD and negative EPS of -0.96 indicate unfavorable bottom-line performance, contributing to the overall unfavorable income statement assessment.

Financial Ratios

The following table summarizes key financial ratios for Willis Towers Watson Public Limited Company (WTW) over the last five fiscal years:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 11.56% | 46.92% | 11.38% | 11.13% | -0.99% |

| ROE | 9.21% | 31.84% | 10.07% | 11.08% | -1.23% |

| ROIC | 3.19% | 8.39% | 5.74% | 6.59% | -3.49% |

| P/E | 27.50 | 7.20 | 27.15 | 24.01 | -326.03 |

| P/B | 2.53 | 2.29 | 2.73 | 2.66 | 4.02 |

| Current Ratio | 1.05 | 1.26 | 1.07 | 1.06 | 1.20 |

| Quick Ratio | 1.05 | 1.26 | 1.07 | 1.06 | 1.20 |

| D/E | 0.62 | 0.41 | 0.55 | 0.62 | 0.75 |

| Debt-to-Assets | 17.45% | 15.69% | 17.25% | 20.42% | 21.43% |

| Interest Coverage | 3.52 | 10.44 | 5.66 | 5.81 | 2.38 |

| Asset Turnover | 0.22 | 0.26 | 0.28 | 0.33 | 0.36 |

| Fixed Asset Turnover | 4.50 | 5.73 | 6.80 | 7.38 | 8.66 |

| Dividend Yield | 1.26% | 1.23% | 1.35% | 1.39% | 1.11% |

Evolution of Financial Ratios

Over the period leading to 2024, Willis Towers Watson’s Return on Equity (ROE) declined, turning negative at -1.23%, indicating a drop in profitability. The Current Ratio improved slightly to 1.2, reflecting stable liquidity. Meanwhile, the Debt-to-Equity Ratio increased moderately to 0.75, suggesting a cautious rise in leverage. Overall, profitability showed significant weakening by 2024.

Are the Financial Ratios Fovorable?

In 2024, the company’s profitability ratios, including net margin (-0.99%) and ROE (-1.23%), were unfavorable, signaling operational challenges. Liquidity ratios showed mixed signals, with a neutral Current Ratio but a favorable Quick Ratio of 1.2. Leverage metrics such as Debt-to-Assets (21.43%) were favorable, yet interest coverage remained weak. Efficiency was hindered by a low asset turnover (0.36). The global assessment points to a slightly unfavorable financial position.

Shareholder Return Policy

Willis Towers Watson maintains a consistent dividend payout with a ratio near 33% in recent years and a yield around 1.1%. The dividend per share has slightly increased, supported by solid free cash flow coverage above 80%. The company also engages in share buybacks, complementing its cash returns.

Despite a recent net loss in 2024, WTW’s dividend policy appears designed to balance shareholder income and capital retention. Continued free cash flow backing and controlled payout suggest a sustainable approach, although the 2024 net margin dip warrants monitoring for long-term value preservation.

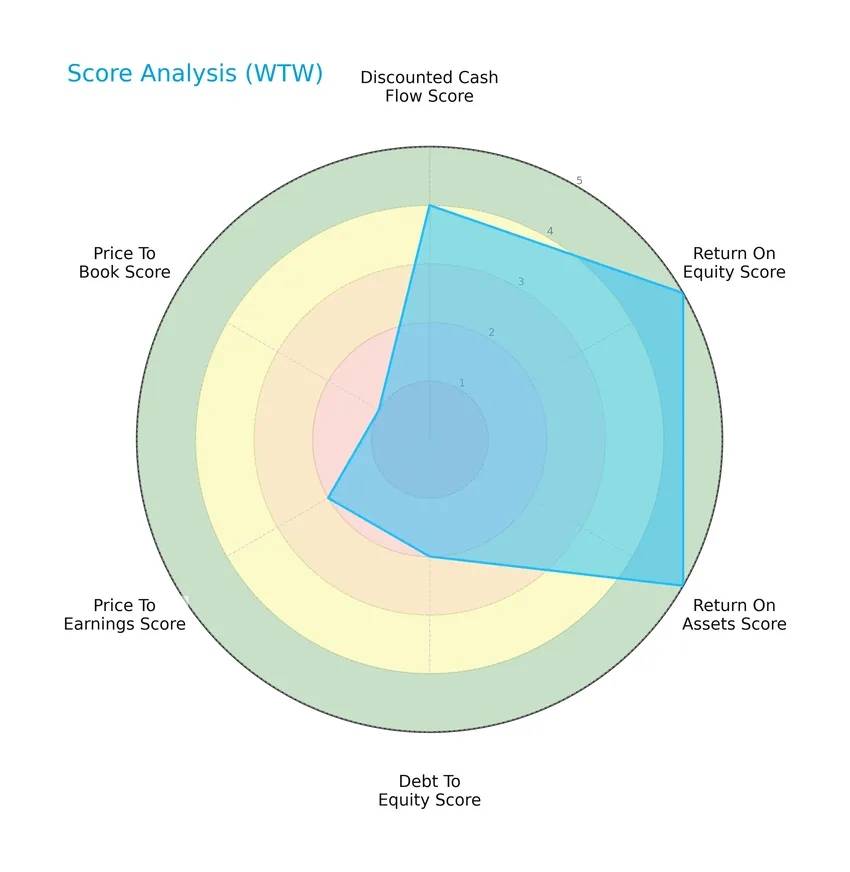

Score analysis

The following radar chart illustrates key financial scores for Willis Towers Watson Public Limited Company:

The company shows strong returns on equity and assets with scores of 5 each, indicating efficient profitability. Discounted cash flow is favorable at 4, while debt-to-equity and price-to-earnings scores are moderate at 2. The price-to-book ratio is notably weak with a score of 1.

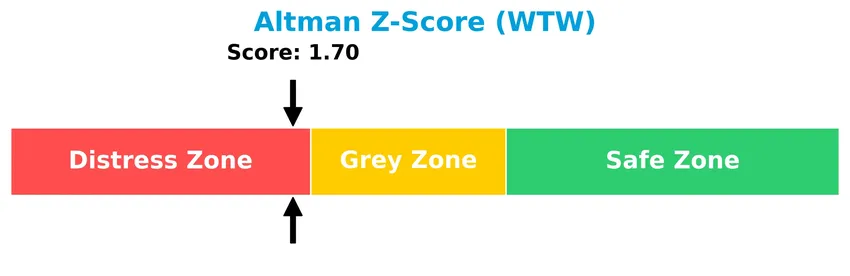

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company in the distress zone, signaling a higher risk of financial distress and potential bankruptcy:

Is the company in good financial health?

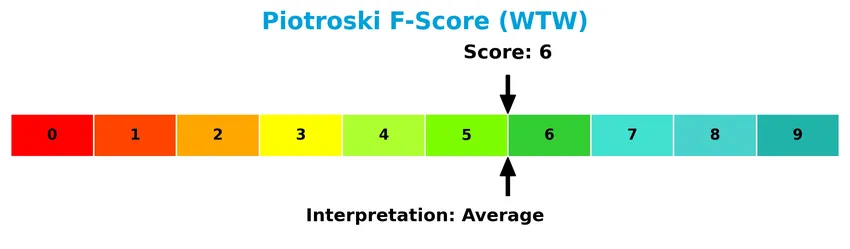

The Piotroski Score diagram provides insight into the company’s financial strength based on nine criteria:

With a Piotroski Score of 6, the company exhibits average financial health, reflecting a moderate level of operational efficiency and profitability.

Competitive Landscape & Sector Positioning

This sector analysis will examine Willis Towers Watson’s strategic positioning, revenue segments, key products, and main competitors. I will also assess whether the company holds a competitive advantage over its peers.

Strategic Positioning

Willis Towers Watson operates a diversified product portfolio, with a primary focus on Health, Wealth and Career ($5.8B) and Risk and Broking ($4.1B) segments in 2024. Geographically, it has significant exposure to the United States ($5.1B), the United Kingdom ($1.9B), Ireland ($131M), and other regions ($2.8B), reflecting a broad international footprint.

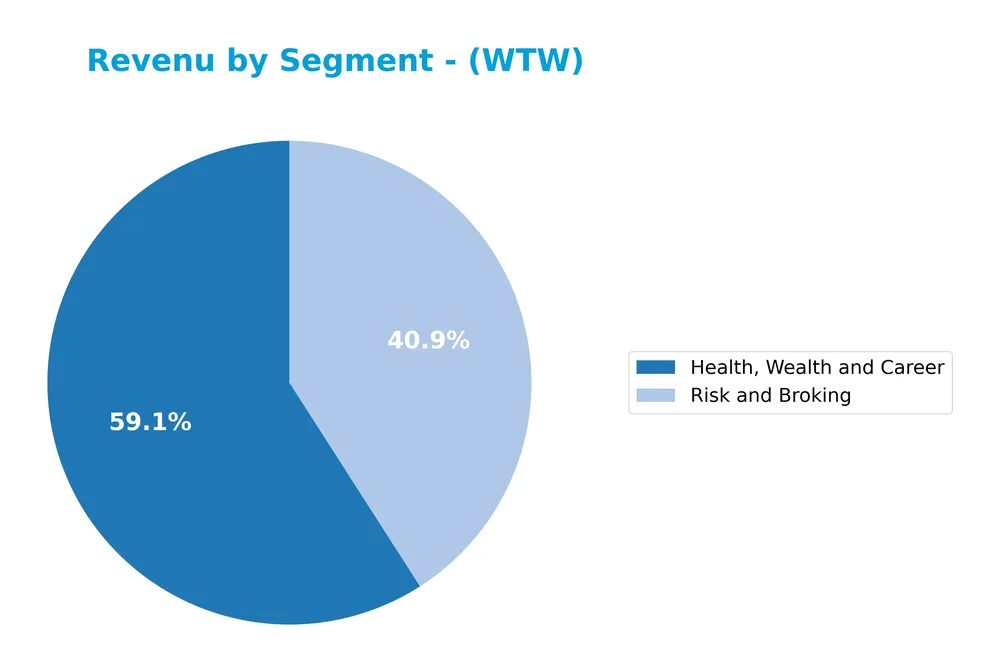

Revenue by Segment

This pie chart illustrates the revenue distribution of Willis Towers Watson Public Limited Company by segment for the fiscal year 2024.

In 2024, Willis Towers Watson’s revenue was primarily driven by the “Health, Wealth and Career” segment, generating $5.85B, followed by “Risk and Broking” at $4.05B. Both segments showed steady growth compared to 2023, reflecting a balanced expansion in core business areas. The increasing concentration in these two segments highlights their critical role in the company’s portfolio, with no other segments contributing significantly in the latest year.

Key Products & Brands

The following table outlines Willis Towers Watson’s primary products and service segments:

| Product | Description |

|---|---|

| Health, Wealth and Career | Provides actuarial support, plan design, administration services for pension and retirement plans, health and group benefits, benefits outsourcing, and talent management solutions. |

| Risk and Broking | Offers risk advice, insurance brokerage, consulting in property and casualty, aerospace, construction, and marine sectors, along with investment consulting and capital management services. |

Willis Towers Watson focuses on two main segments: Health, Wealth and Career, which covers employee benefits and talent management, and Risk and Broking, which includes insurance brokerage and risk consulting services. Both segments have shown consistent revenue growth in recent years.

Main Competitors

There are 6 competitors in the Insurance – Brokers industry, with the table below listing the top 6 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Marsh & McLennan Companies, Inc. | 89.8B |

| Aon plc | 74.4B |

| Arthur J. Gallagher & Co. | 65.7B |

| Willis Towers Watson Public Limited Company | 32.3B |

| Brown & Brown, Inc. | 26.5B |

| Erie Indemnity Company | 12.8B |

Willis Towers Watson ranks 4th among its 6 competitors, with a market cap approximately 35.1% of the leader, Marsh & McLennan. It is positioned below both the average market cap of the top 10 competitors (50.3B) and the median of the sector (49.0B). The company holds a significant gap of +108.77% to its next competitor above, Arthur J. Gallagher & Co., highlighting a notable scale difference in this competitive landscape.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does WTW have a competitive advantage?

Willis Towers Watson Public Limited Company does not currently present a competitive advantage, as it is shedding value with a negative ROIC compared to WACC and a declining profitability trend over the 2020-2024 period. The company’s income statement evaluation is unfavorable overall, marked by negative net margins and deteriorating earnings per share.

Looking ahead, WTW operates globally with significant revenues from the United States, United Kingdom, and Rest of World segments, presenting opportunities to expand its advisory, broking, and risk management services. However, recent financial performance challenges and value destruction indicate cautious monitoring of future product launches and market expansion.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting Willis Towers Watson Public Limited Company to guide investment decisions.

Strengths

- Strong global presence with diversified revenue streams

- Favorable gross margin at 44.59%

- Solid brand reputation and long history since 1828

Weaknesses

- Declining profitability with negative net margin (-0.99%)

- Unfavorable ROIC indicating value destruction

- High price-to-book ratio at 4.02 signaling potential overvaluation

Opportunities

- Growing demand for risk management and advisory services

- Expansion in emerging markets and digital solutions

- Increasing corporate focus on employee benefits and health programs

Threats

- Intense competition in insurance brokerage and consulting

- Regulatory changes impacting financial services

- Economic downturns reducing corporate spending on advisory

Overall, Willis Towers Watson benefits from a strong market position and solid operational margins but faces significant challenges with profitability and value creation. Strategic focus should be on improving operational efficiency and leveraging growth opportunities in digital and emerging markets while managing competitive and regulatory risks.

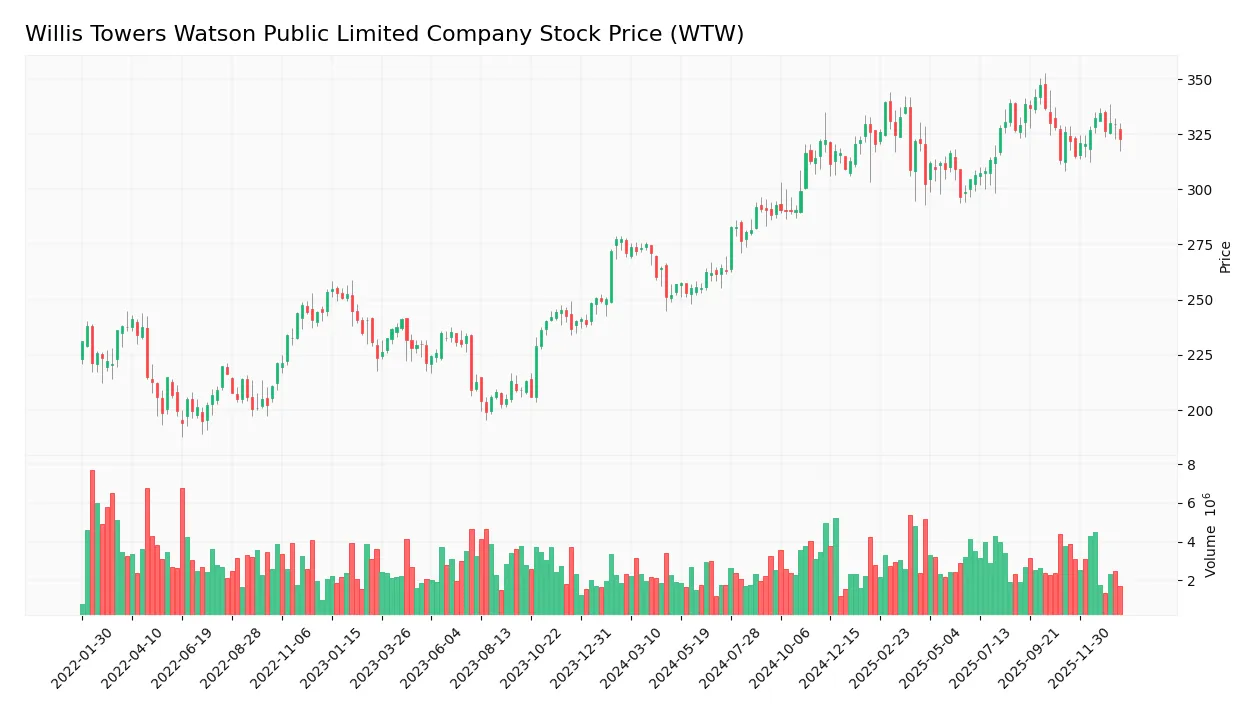

Stock Price Action Analysis

The weekly stock chart for Willis Towers Watson Public Limited Company (WTW) illustrates price movements, volatility, and volume trends over the last 12 months:

Trend Analysis

Over the past 12 months, WTW’s stock price increased by 19.04%, indicating a bullish trend. The trend shows deceleration despite reaching a high of 347.14 and a low of 250.95. The overall volatility is significant, with a standard deviation of 26.29, suggesting notable price fluctuations throughout the period.

Volume Analysis

Trading volume for WTW is increasing, with a total of 328.7M shares traded and buyer volume representing 58.48%. In the recent period (Nov 2025 to Jan 2026), buyer dominance remains slight at 55.11%, reflecting steady but cautious buying interest and moderate market participation.

Target Prices

The consensus target prices for Willis Towers Watson Public Limited Company (WTW) indicate a positive outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 398 | 318 | 367.22 |

Analysts expect the stock price to trade between 318 and 398, with a consensus target of approximately 367, reflecting moderate optimism in its future performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section presents an overview of ratings and consumer feedback regarding Willis Towers Watson Public Limited Company (WTW).

Stock Grades

The latest grades for Willis Towers Watson Public Limited Company from reputable analysts are as follows:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-14 |

| Wells Fargo | Maintain | Overweight | 2026-01-13 |

| Barclays | Maintain | Underweight | 2026-01-08 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-07 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-06 |

The consensus shows a generally positive outlook with a majority of buy ratings, though there is some divergence as indicated by the underweight grade from Barclays and neutral from Cantor Fitzgerald, reflecting a balanced range of analyst opinions.

Consumer Opinions

Consumers generally appreciate Willis Towers Watson for its expertise but express concerns about service consistency.

| Positive Reviews | Negative Reviews |

|---|---|

| “WTW offers insightful risk management solutions.” | “Customer support response times can be slow.” |

| “Their consulting services are highly professional.” | “Pricing feels a bit steep for small businesses.” |

| “Strong global presence and knowledgeable staff.” | “Some reports took longer than expected.” |

Overall, clients praise Willis Towers Watson for its industry knowledge and professional approach but often mention delays in service and higher costs as areas needing improvement.

Risk Analysis

Below is a summary table presenting key risks for Willis Towers Watson Public Limited Company based on recent financial and market data:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score at 1.7 indicates distress zone, signaling potential bankruptcy risk | Medium | High |

| Profitability | Negative net margin (-0.99%) and ROE (-1.23%) reflect ongoing profitability challenges | High | High |

| Market Valuation | Unfavorable price-to-book ratio (4.02) may indicate overvaluation and investor caution | Medium | Medium |

| Liquidity & Debt | Moderate debt-to-equity (0.75) and interest coverage (1.4) suggest some financial strain | Medium | Medium |

| Operational Risk | Low asset turnover (0.36) impacts efficiency and revenue generation | Medium | Medium |

| Market Volatility | Beta of 0.635 implies lower volatility but also potential sensitivity to economic downturns | Low | Medium |

The most critical risks for WTW are its financial distress signals and sustained unprofitability, despite a favorable weighted average cost of capital. The Altman Z-Score below 1.8 and negative profitability ratios highlight vulnerability that investors should carefully monitor.

Should You Buy Willis Towers Watson Public Limited Company?

Willis Towers Watson appears to be experiencing eroding operational efficiency and a deteriorating competitive moat, with a leverage profile that could be seen as substantial. Despite these challenges, its overall B+ rating suggests moderate value creation, warranting cautious analytical interpretation.

Strength & Efficiency Pillars

Willis Towers Watson Public Limited Company exhibits pockets of financial resilience, particularly in liquidity and asset management. The quick ratio stands at a healthy 1.2, indicating sufficient short-term liquidity, while a fixed asset turnover of 8.66 reflects efficient utilization of fixed assets. The company’s weighted average cost of capital (WACC) is 6.28%, which is favorable; however, the return on invested capital (ROIC) is negative at -3.49%, signaling value erosion rather than creation. Profitability metrics such as net margin (-0.99%) and return on equity (-1.23%) remain unfavorable, with an Altman Z-Score of 1.70 placing the firm in the distress zone, highlighting concerns over financial stability.

Weaknesses and Drawbacks

Key valuation and leverage indicators raise caution. The price-to-book ratio is elevated at 4.02, a very unfavorable sign that the stock might be overvalued relative to its book value. Despite a moderate debt-to-equity ratio of 0.75, interest coverage is low at 1.4, suggesting limited ability to meet interest obligations comfortably. Additionally, profitability has sharply declined, with net margin and earnings per share shrinking over 100% in the last year. Market activity shows a bullish trend overall, but the recent price dip of -0.99% coupled with a moderate seller presence tempers near-term optimism.

Our Verdict about Willis Towers Watson Public Limited Company

The company’s long-term fundamental profile appears unfavorable given persistent profitability challenges and financial distress signals. Nevertheless, the stock shows a bullish overall price trend with slight buyer dominance in recent months. This suggests Willis Towers Watson may appear attractive to certain investors seeking exposure but might require a cautious, wait-and-see approach due to fundamental weaknesses and valuation concerns.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Willis Towers Watson Public Limited Company’s (NASDAQ:WTW) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock? – Yahoo Finance (Jan 01, 2026)

- Willis Towers Watson: A Steady Play With Light Top-Line Growth (NASDAQ:WTW) – Seeking Alpha (Jan 05, 2026)

- Willis Towers Watson Public : Salary budgets have stabilized as employers focus on pay strategy for 2026 – marketscreener.com (Jan 21, 2026)

- Willis Towers Watson Earnings Preview: What to Expect – Barchart.com (Jan 06, 2026)

- Willis Towers Watson Stock Prediction: Where Analysts See the Stock Going by 2027 – TIKR.com (Nov 07, 2025)

For more information about Willis Towers Watson Public Limited Company, please visit the official website: willistowerswatson.com