Home > Analyses > Consumer Cyclical > Williams-Sonoma, Inc.

Williams-Sonoma, Inc. transforms everyday living spaces into personalized sanctuaries through its diverse portfolio of premium home products. As a dominant force in specialty retail, it excels with flagship brands like Williams Sonoma, Pottery Barn, and West Elm, renowned for innovation, quality, and style. With a global footprint and a cutting-edge omnichannel approach, the company shapes the future of home living. But does its current market valuation reflect sustainable growth and solid fundamentals? Let’s explore.

Table of contents

Business Model & Company Overview

Williams-Sonoma, Inc., founded in 1956 and headquartered in San Francisco, operates as a leading omni-channel specialty retailer in the home goods sector. Its ecosystem spans cookware, furniture, home decor, and lifestyle brands such as Williams Sonoma, Pottery Barn, and West Elm, creating a cohesive offering that caters to diverse home needs. With 544 stores across North America, Australia, and the UK, plus e-commerce reach in the Middle East and Asia, it maintains a significant footprint in specialty retail.

The company’s revenue engine balances physical retail and digital channels, combining direct sales of premium goods with innovative technologies like 3-D imaging and augmented reality. This hybrid model leverages recurring customer engagement across the Americas, Europe, and Asia, supporting steady growth. Williams-Sonoma’s robust competitive advantage lies in its strong brand portfolio and integrated customer experience, securing its role as a key shaper of the evolving home retail landscape.

Financial Performance & Fundamental Metrics

In this section, I analyze Williams-Sonoma, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and shareholder returns.

Income Statement

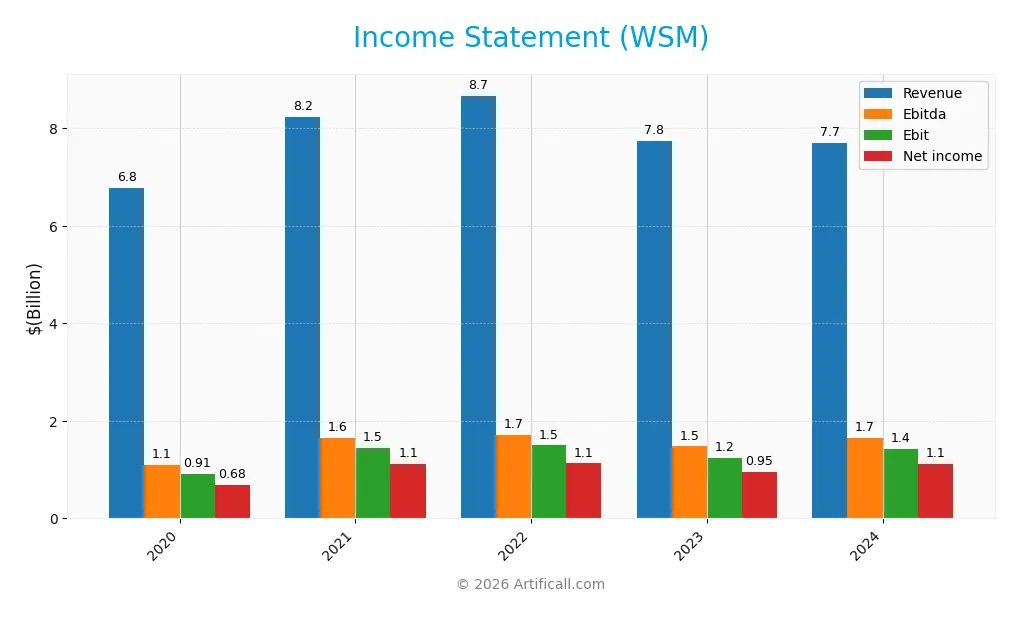

Below is the Income Statement for Williams-Sonoma, Inc. (WSM) over the last five fiscal years, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 6.78B | 8.25B | 8.67B | 7.75B | 7.71B |

| Cost of Revenue | 4.15B | 4.61B | 5.00B | 4.45B | 4.13B |

| Operating Expenses | 1.73B | 2.18B | 2.18B | 2.06B | 2.15B |

| Gross Profit | 2.64B | 3.63B | 3.68B | 3.30B | 3.58B |

| EBITDA | 1.10B | 1.65B | 1.71B | 1.48B | 1.66B |

| EBIT | 911M | 1.45B | 1.50B | 1.24B | 1.43B |

| Interest Expense | 16M | 2M | 0 | 0 | 0 |

| Net Income | 681M | 1.13B | 1.13B | 950M | 1.13B |

| EPS | 4.41 | 7.58 | 8.29 | 7.35 | 8.91 |

| Filing Date | 2021-03-30 | 2022-03-28 | 2023-03-24 | 2024-03-20 | 2025-03-27 |

Income Statement Evolution

Williams-Sonoma, Inc. showed a slight revenue decline of 0.5% in the most recent fiscal year, yet gross profit increased by 8.44%, indicating improved cost management. Over the 2020-2024 period, revenue grew by 13.69% and net income surged 65.3%, with net margins expanding 45.4%. EBIT margin remained favorable at 18.55%, reflecting stable operational efficiency despite minor revenue fluctuations.

Is the Income Statement Favorable?

The 2024 income statement reveals solid fundamentals: a net margin of 14.59% and zero interest expense, both favorable. EBIT grew 14.95% year-over-year, contributing to a 19.08% net margin improvement and a 20.74% increase in EPS. Operating expenses slightly decreased relative to revenue by 0.5%, but overall income statement metrics remain positive, supporting a generally favorable financial position.

Financial Ratios

The following table presents key financial ratios for Williams-Sonoma, Inc. over the last five fiscal years, illustrating profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 10.0% | 13.7% | 13.0% | 12.3% | 14.6% |

| ROE | 41.2% | 67.7% | 66.3% | 44.6% | 52.5% |

| ROIC | 20.9% | 36.7% | 34.6% | 25.6% | 29.9% |

| P/E | 14.2 | 10.6 | 8.1 | 13.1 | 23.7 |

| P/B | 5.87 | 7.16 | 5.40 | 5.87 | 12.5 |

| Current Ratio | 1.34 | 1.31 | 1.24 | 1.45 | 1.44 |

| Quick Ratio | 0.79 | 0.61 | 0.35 | 0.78 | 0.74 |

| D/E | 0.93 | 0.77 | 0.85 | 0.65 | 0.63 |

| Debt-to-Assets | 33% | 28% | 31% | 26% | 25% |

| Interest Coverage | 56.1 | 779.2 | 0.0* | 0.0* | 0.0* |

| Asset Turnover | 1.46 | 1.78 | 1.86 | 1.47 | 1.45 |

| Fixed Asset Turnover | 3.46 | 4.02 | 3.69 | 3.46 | 3.49 |

| Dividend Yield | 1.63% | 1.57% | 2.37% | 1.86% | 1.05% |

*Interest Coverage reported as zero in recent years data.

Evolution of Financial Ratios

Over the period, Williams-Sonoma, Inc. showed a generally improving profitability trend with Return on Equity (ROE) rising to 52.52% in 2024, indicating efficient equity use. The Current Ratio remained stable around 1.44, reflecting consistent liquidity. The Debt-to-Equity ratio decreased slightly to 0.63, suggesting moderate leverage and improved financial stability.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (14.59%), ROE (52.52%), and return on invested capital (29.89%) were favorable, signaling strong earnings and capital efficiency. Liquidity ratios were mixed: the Current Ratio was neutral at 1.44, but the Quick Ratio was unfavorable at 0.74. Leverage was neutral with a debt-to-equity ratio of 0.63 and a favorable debt-to-assets ratio of 25.41%. Market valuation ratios showed neutrality or unfavorable status, with a P/E of 23.71 (neutral) and a high P/B of 12.45 (unfavorable). Overall, the financial ratios present a slightly favorable profile.

Shareholder Return Policy

Williams-Sonoma, Inc. maintains a consistent dividend payout ratio around 24-25%, with dividend per share steadily increasing from $1.02 in 2020 to $2.22 in 2024. The annual dividend yield hovers near 1-2%, supported by free cash flow coverage exceeding 80%, indicating prudent distribution relative to cash generation.

The company also engages in share buybacks, complementing its dividend policy. This balanced approach appears designed to sustain shareholder returns without jeopardizing financial flexibility, suggesting a sustainable long-term value creation strategy aligned with its cash flow capacity.

Score analysis

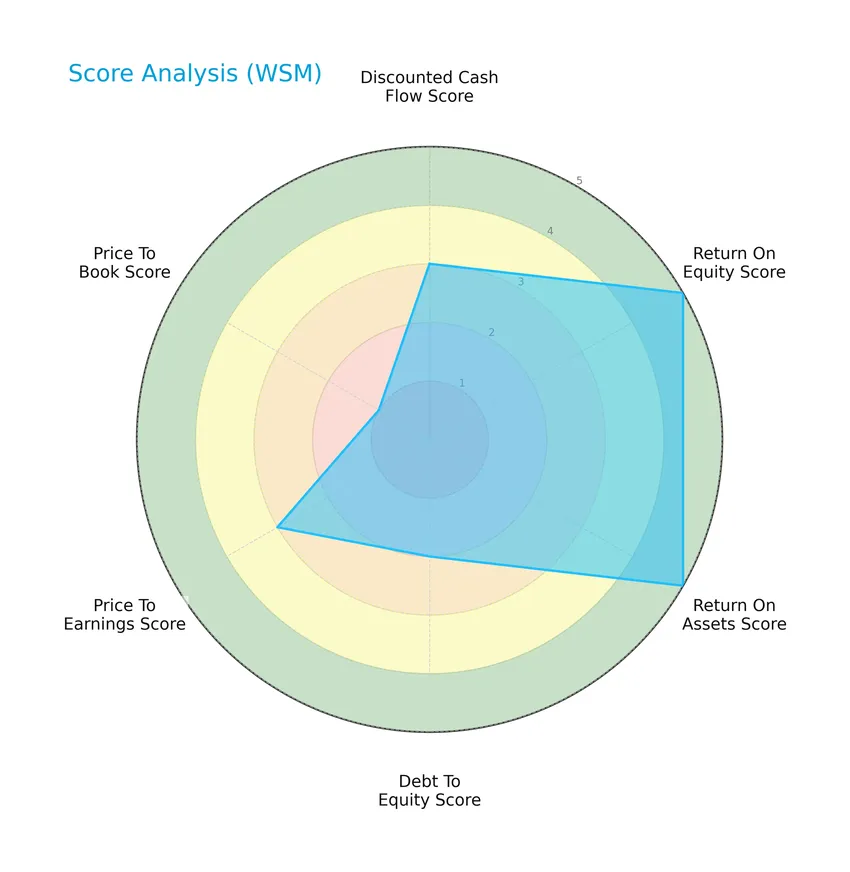

The following radar chart presents a comprehensive overview of Williams-Sonoma, Inc.’s key financial scores and valuation metrics:

Williams-Sonoma shows very favorable profitability with high scores in return on equity (5) and return on assets (5). The discounted cash flow and price-to-earnings ratios are moderate (both 3), while debt-to-equity is somewhat moderate (2). The price-to-book score is very unfavorable at 1, indicating potential valuation concerns.

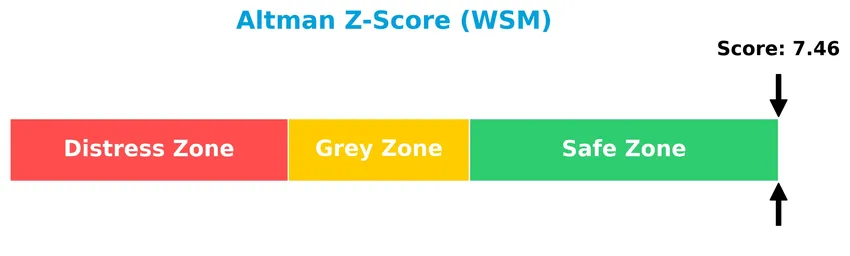

Analysis of the company’s bankruptcy risk

Williams-Sonoma’s Altman Z-Score places the company well within the safe zone, indicating a low probability of bankruptcy risk:

Is the company in good financial health?

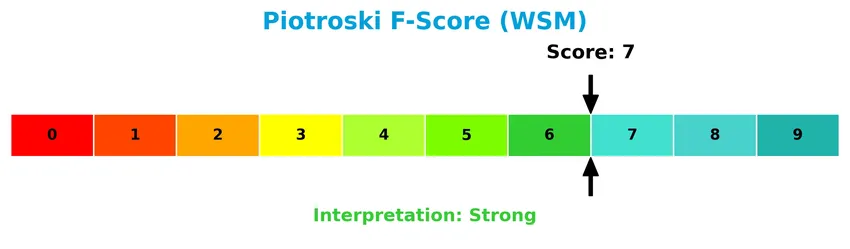

The Piotroski Score diagram below illustrates Williams-Sonoma’s solid financial condition:

With a Piotroski Score of 7, Williams-Sonoma demonstrates strong financial health, reflecting good profitability, efficient asset use, and sound leverage levels. This score suggests the company is financially robust.

Competitive Landscape & Sector Positioning

This sector analysis will explore Williams-Sonoma, Inc.’s strategic positioning, revenue breakdown, key products, competitors, and competitive advantages. I will assess whether Williams-Sonoma holds a competitive edge over its main industry rivals.

Strategic Positioning

Williams-Sonoma, Inc. maintains a diversified product portfolio spanning cookware, home furnishings, and decor across multiple brands like Pottery Barn and West Elm. Geographically, it operates 544 stores primarily in North America, with presence in Australia, the UK, and e-commerce reach in several international markets.

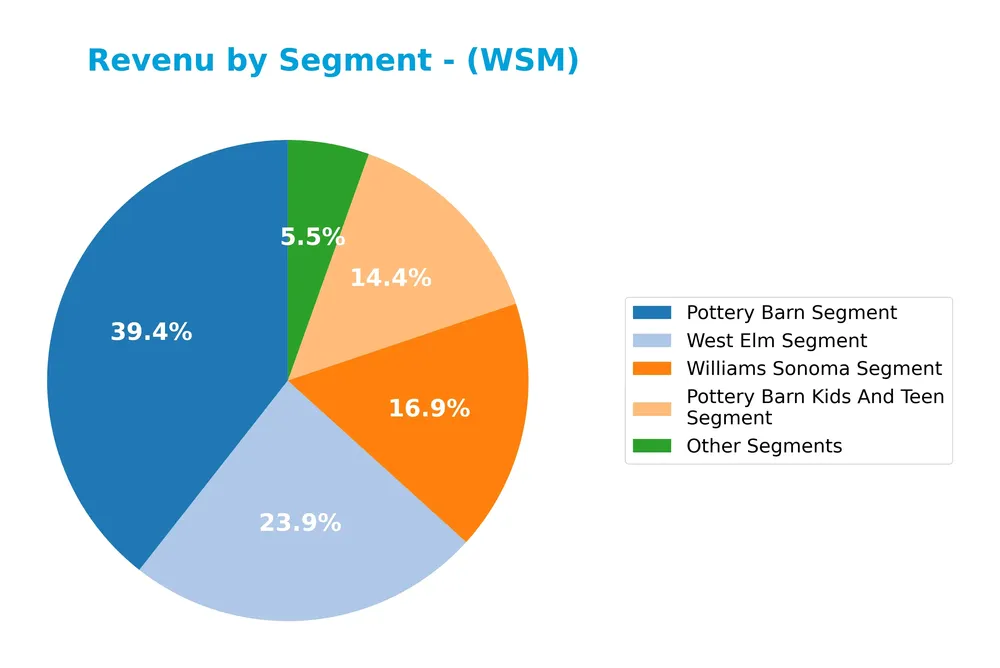

Revenue by Segment

The pie chart illustrates Williams-Sonoma, Inc.’s revenue distribution by product segment for the fiscal year 2024, highlighting the contribution of each major business unit.

In 2024, Pottery Barn remains the dominant segment with $3B in revenue, followed by West Elm at $1.8B and Williams Sonoma at $1.3B. Pottery Barn Kids and Teen contributes $1.1B, while Other Segments add $421M. Compared to 2023, Pottery Barn’s revenue declined slightly, while Pottery Barn Kids and Teen and Williams Sonoma showed steady growth. The revenue concentration in Pottery Barn suggests some dependency, though diversification across segments helps mitigate risk.

Key Products & Brands

The table below details Williams-Sonoma, Inc.’s main products and brands with their respective descriptions:

| Product | Description |

|---|---|

| Williams Sonoma Segment | Cooking, dining, entertaining products including cookware, tools, electrics, cutlery, tabletop. |

| Pottery Barn Segment | Home furnishings, furniture, bedding, lighting, rugs, table essentials, and decorative accessories. |

| West Elm Segment | Home decor products focusing on modern style and sustainable design. |

| Pottery Barn Kids And Teen Segment | Kids accessories under Pottery Barn Kids; organic bedding and multi-purpose furniture under Pottery Barn Teen. |

| Rejuvenation Brand | Made-to-order lighting, hardware, furniture, and home decor inspired by history. |

| Mark and Graham Brand | Women’s and men’s accessories, travel, entertaining and bar items, home decor, and seasonal products. |

| Other Segments | Includes additional specialty retail products not detailed in main segments. |

Williams-Sonoma, Inc. operates multiple specialty retail brands that cover a broad range of home-related products, from cookware and furniture to home decor and accessories, distributed through e-commerce, catalogs, and physical stores worldwide.

Main Competitors

Williams-Sonoma, Inc. faces competition from 10 major players in the Specialty Retail industry; here are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amazon.com, Inc. | 2.42T |

| Alibaba Group Holding Limited | 340B |

| PDD Holdings Inc. | 159B |

| MercadoLibre, Inc. | 102B |

| eBay Inc. | 39.4B |

| Ulta Beauty, Inc. | 27.8B |

| Tractor Supply Company | 26.9B |

| Williams-Sonoma, Inc. | 23.0B |

| Genuine Parts Company | 17.2B |

| Best Buy Co., Inc. | 14.5B |

Williams-Sonoma ranks 8th among its top 10 competitors with a market cap approximately 1.01% that of the leader, Amazon.com. The company is positioned below both the average market cap of the top 10 (317B) and the sector median (33.6B). It maintains a 10.15% market cap gap over the next competitor above, Tractor Supply Company, indicating moderate distance from its closest rival.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does WSM have a competitive advantage?

Williams-Sonoma, Inc. presents a very favorable competitive advantage, demonstrated by a strong ROIC exceeding its WACC by nearly 19%, alongside a growing ROIC trend of 43%. This indicates efficient capital use and sustained value creation with increasing profitability.

Looking ahead, Williams-Sonoma’s omni-channel retail presence across multiple brands and international markets, combined with its augmented reality platform, positions it well to leverage new product innovations and expand its footprint in home furnishings and décor globally.

SWOT Analysis

This SWOT analysis identifies key internal and external factors affecting Williams-Sonoma, Inc., to guide investment decisions.

Strengths

- strong gross margin at 46.45%

- high ROE of 52.52%

- durable competitive advantage with growing ROIC

Weaknesses

- slight recent revenue decline (-0.5%)

- high price-to-book ratio (12.45)

- unfavorable quick ratio (0.74)

Opportunities

- expansion in international markets

- growth in e-commerce and omni-channel retail

- product diversification across premium home brands

Threats

- intense specialty retail competition

- economic downturns impacting discretionary spending

- rising supply chain and raw material costs

Overall, Williams-Sonoma demonstrates robust profitability and competitive positioning, but investors should watch its recent revenue softness and elevated valuation metrics. Strategic focus on international growth and digital channels can capitalize on market opportunities while managing economic and cost pressures.

Stock Price Action Analysis

The following weekly stock chart illustrates Williams-Sonoma, Inc.’s price movements and key fluctuations over the last 12 months:

Trend Analysis

Over the past year, Williams-Sonoma, Inc. (WSM) stock appreciated by 72.84%, indicating a strong bullish trend with acceleration. The price ranged from a low of 117.45 to a high of 214.6, reflecting significant volatility with a standard deviation of 24.91. Recent months show a moderate 3.83% gain with a slightly upward slope of 1.97.

Volume Analysis

In the past three months, trading volume has been decreasing overall. Buyer volume slightly dominates at 53.26%, suggesting modest buyer-driven activity. This mild buyer dominance amid falling volume points to cautious investor sentiment with reduced market participation.

Target Prices

The current analyst consensus for Williams-Sonoma, Inc. (WSM) shows a positive outlook with a solid range of target prices.

| Target High | Target Low | Consensus |

|---|---|---|

| 230 | 175 | 205.75 |

Analysts anticipate the stock to trade between $175 and $230, with a consensus target near $206, reflecting moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback to assess Williams-Sonoma, Inc.’s market perception.

Stock Grades

The following table presents the latest verified stock grades for Williams-Sonoma, Inc. from reputable grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Buy | 2026-01-20 |

| Evercore ISI Group | Maintain | In Line | 2025-12-23 |

| RBC Capital | Maintain | Outperform | 2025-11-21 |

| Telsey Advisory Group | Maintain | Outperform | 2025-11-20 |

| TD Cowen | Maintain | Buy | 2025-11-20 |

| Citigroup | Maintain | Neutral | 2025-11-20 |

| UBS | Maintain | Neutral | 2025-11-20 |

| Telsey Advisory Group | Maintain | Outperform | 2025-11-19 |

| Telsey Advisory Group | Maintain | Outperform | 2025-11-14 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-11 |

The grades show a consistent pattern of maintaining current ratings, with a majority clustered around Buy and Outperform, while a significant portion of analysts prefer a more cautious Neutral or Hold stance. This indicates a balanced market view with moderate confidence in Williams-Sonoma’s prospects.

Consumer Opinions

Consumers have mixed but generally positive sentiments about Williams-Sonoma, Inc., reflecting its strong brand presence and product quality.

| Positive Reviews | Negative Reviews |

|---|---|

| High-quality kitchenware with elegant designs. | Some products are priced higher than competitors. |

| Excellent customer service with responsive support. | Occasional delays in shipping during peak seasons. |

| Durable and reliable products that last long. | Limited variety in certain product categories. |

Overall, customers appreciate Williams-Sonoma’s product durability and customer service, though some express concerns about pricing and product availability, suggesting careful consideration of value versus cost.

Risk Analysis

Below is a summary table outlining key risks for Williams-Sonoma, Inc., highlighting their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | High beta of 1.58 indicates stock price is sensitive to market fluctuations. | High | Moderate |

| Valuation Risk | Unfavorable price-to-book ratio (12.45) suggests possible overvaluation. | Moderate | High |

| Liquidity Risk | Quick ratio at 0.74 signals potential short-term liquidity constraints. | Moderate | Moderate |

| Competitive Risk | Specialty retail industry faces intense competition and shifting consumer trends. | High | High |

| Economic Cyclicality | As a consumer cyclical stock, demand is vulnerable during economic downturns. | Moderate | High |

| Operational Risk | Dependence on omni-channel retail and international presence may increase complexity. | Moderate | Moderate |

Williams-Sonoma’s most pressing risks stem from its high market volatility and competitive pressures in specialty retail. Despite strong profitability and a safe Altman Z-Score (7.46), investors should monitor valuation concerns and liquidity metrics carefully to manage downside risk.

Should You Buy Williams-Sonoma, Inc.?

Williams-Sonoma, Inc. appears to be delivering robust profitability with a durable competitive moat, supported by a growing ROIC well above its WACC. While its leverage profile seems manageable, the overall B+ rating suggests a very favorable but cautiously moderate investment profile.

Strength & Efficiency Pillars

Williams-Sonoma, Inc. exhibits robust profitability with a net margin of 14.59% and an impressive return on equity (ROE) of 52.52%. Its return on invested capital (ROIC) stands at 29.89%, significantly exceeding the weighted average cost of capital (WACC) of 10.9%, confirming the company as a clear value creator. Financial health is solid, supported by a strong Altman Z-score of 7.46, well within the safe zone, and a Piotroski score of 7, indicating strong financial strength. These factors underscore a durable competitive advantage with increasing profitability.

Weaknesses and Drawbacks

Despite favorable profitability, Williams-Sonoma carries certain valuation risks. The price-to-book (P/B) ratio is notably high at 12.45, flagged as very unfavorable, suggesting a premium valuation that may limit upside potential. The price-to-earnings (P/E) ratio at 23.71 is moderate but indicates investors are paying a premium relative to earnings. Liquidity ratios show mixed signals; the quick ratio is low at 0.74, considered unfavorable, which may indicate short-term liquidity challenges. The debt-to-equity ratio is moderate at 0.63, reflecting manageable leverage but warranting close monitoring.

Our Verdict about Williams-Sonoma, Inc.

Williams-Sonoma’s long-term fundamentals are favorable, supported by strong profitability, value creation, and financial stability. The bullish overall stock trend, coupled with a slightly buyer-dominant recent period, suggests cautious optimism. This profile may appear attractive for long-term exposure, yet the elevated valuation multiples and liquidity nuances suggest investors could consider a measured entry to manage risk effectively.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- What to expect from Williams-Sonoma’s Q4 2025 earnings report – MSN (Jan 25, 2026)

- Investors Heavily Search Williams-Sonoma, Inc. (WSM): Here is What You Need to Know – Yahoo Finance (Jan 21, 2026)

- Williams-Sonoma: Fundamentally, It’s Durable, But It’s Quite Pricey (NYSE:WSM) – Seeking Alpha (Jan 23, 2026)

- 38,372 Shares in Williams-Sonoma, Inc. $WSM Purchased by Rakuten Investment Management Inc. – MarketBeat (Jan 22, 2026)

- What Can Investors Anticipate in Williams-Sonoma’s Fourth Quarter 2025 Earnings Release – Bitget (Jan 22, 2026)

For more information about Williams-Sonoma, Inc., please visit the official website: williams-sonomainc.com