Home > Analyses > Industrials > Westinghouse Air Brake Technologies Corporation

Westinghouse Air Brake Technologies Corporation powers the movement of goods and people across continents daily. This industrial titan shapes the railroad and transit sectors with cutting-edge braking systems, locomotives, and rail electronics. Renowned for innovation and reliability, WAB’s technology keeps supply chains and urban transit flowing smoothly worldwide. As market dynamics shift, I’m keen to explore whether WAB’s robust fundamentals support its premium valuation and future growth prospects.

Table of contents

Business Model & Company Overview

Westinghouse Air Brake Technologies Corporation, founded in 1869 and headquartered in Pittsburgh, Pennsylvania, stands as a leading force in the railroads industry. It orchestrates a comprehensive ecosystem of technology-based equipment and services that serve freight rail and passenger transit sectors globally. Its offerings span from braking systems to electronics and HVAC solutions, integrating components essential for rail safety and efficiency.

The company’s revenue engine balances manufacturing and servicing of freight and transit rail components, including locomotives, braking products, and railway electronics. It captures value across the Americas, Europe, and Asia by providing both new equipment and refurbishment services. This diverse portfolio, coupled with deep industry expertise, cements its durable economic moat and influence over the future of rail transportation.

Financial Performance & Fundamental Metrics

I analyze Westinghouse Air Brake Technologies Corporation’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

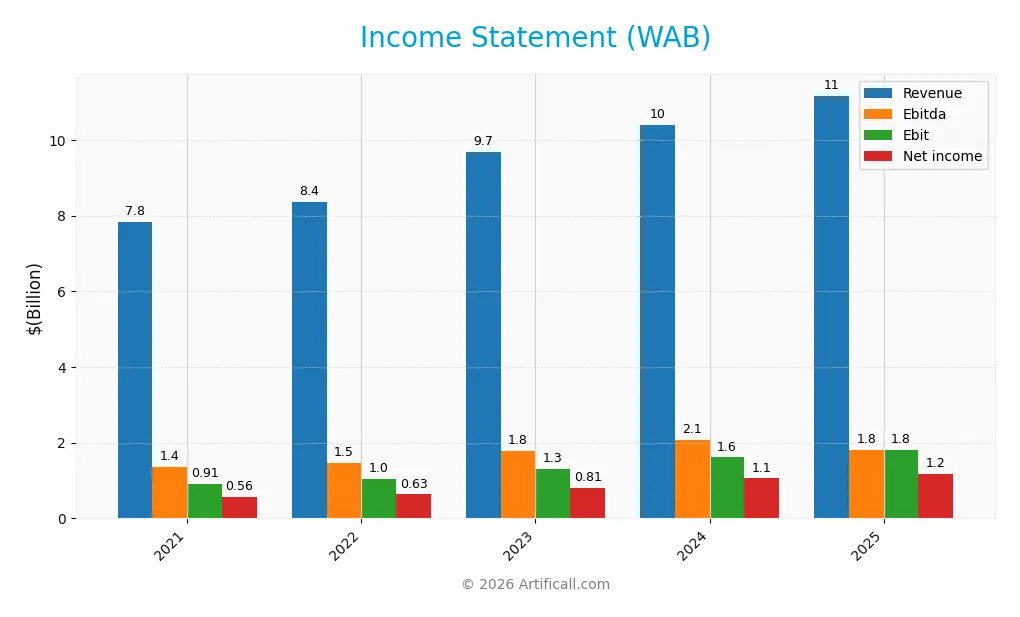

The table summarizes Westinghouse Air Brake Technologies Corporation’s annual income statement data for fiscal years 2021 through 2025 in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 7.82B | 8.36B | 9.68B | 10.39B | 11.17B |

| Cost of Revenue | 5.45B | 5.82B | 6.73B | 7.02B | 7.36B |

| Operating Expenses | 1.49B | 1.53B | 1.68B | 1.76B | 1.49B |

| Gross Profit | 2.37B | 2.54B | 2.94B | 3.37B | 3.81B |

| EBITDA | 1.36B | 1.47B | 1.79B | 2.07B | 1.81B |

| EBIT | 914M | 1.04B | 1.31B | 1.61B | 1.81B |

| Interest Expense | 177M | 186M | 218M | 201M | 225M |

| Net Income | 558M | 633M | 815M | 1.06B | 1.17B |

| EPS | 2.96 | 3.47 | 4.56 | 6.05 | 6.86 |

| Filing Date | 2022-02-17 | 2023-02-15 | 2024-02-14 | 2025-02-12 | 2026-02-13 |

Income Statement Evolution

Westinghouse Air Brake Technologies’ revenue grew steadily from $7.8B in 2021 to $11.2B in 2025, a 43% increase over five years. Net income more than doubled, rising 110% to $1.17B in 2025. Margins improved notably, with gross margin reaching 34%, EBIT margin 16%, and net margin 10.5%, reflecting enhanced operational efficiency and cost control.

Is the Income Statement Favorable?

In 2025, fundamentals appear favorable with a 7.5% revenue increase and 13% growth in gross profit and EBIT. Operating expenses rose proportionally, preserving margin gains. Interest expense remains low at 2% of revenue, supporting net margin stability. EPS climbed 13%, indicating effective capital allocation and profitability improvements despite modest net margin growth.

Financial Ratios

The following table summarizes key financial ratios for Westinghouse Air Brake Technologies Corporation (WAB) over the last five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 7.1% | 7.6% | 8.4% | 10.2% | 10.5% |

| ROE | 5.5% | 6.3% | 7.8% | 10.5% | 10.5% |

| ROIC | 4.3% | 5.0% | 6.1% | 7.9% | 7.4% |

| P/E | 31.0 | 28.7 | 27.8 | 31.3 | 31.1 |

| P/B | 1.7 | 1.8 | 2.2 | 3.3 | 3.3 |

| Current Ratio | 1.32 | 1.25 | 1.20 | 1.30 | 1.11 |

| Quick Ratio | 0.74 | 0.66 | 0.63 | 0.69 | 0.57 |

| D/E | 0.40 | 0.40 | 0.39 | 0.42 | 0.50 |

| Debt-to-Assets | 22.0% | 21.6% | 21.4% | 22.9% | 25.1% |

| Interest Coverage | 4.9x | 5.4x | 5.8x | 8.0x | 8.0x |

| Asset Turnover | 0.42 | 0.45 | 0.51 | 0.56 | 0.51 |

| Fixed Asset Turnover | 5.23 | 5.85 | 6.52 | 7.18 | 6.91 |

| Dividend Yield | 0.53% | 0.61% | 0.54% | 0.42% | 0.47% |

Evolution of Financial Ratios

Westinghouse Air Brake’s Return on Equity (ROE) improved steadily from 5.5% in 2021 to about 10.5% in 2025, showing enhanced profitability. The Current Ratio declined from 1.32 in 2021 to 1.11 in 2025, indicating tighter liquidity. The Debt-to-Equity Ratio rose moderately from 0.40 to 0.50, reflecting a cautious increase in leverage.

Are the Financial Ratios Fovorable?

In 2025, profitability metrics such as net margin (10.5%) and interest coverage (8.0x) appear favorable, supporting earnings strength. Liquidity ratios are mixed; the current ratio is neutral at 1.11, but the quick ratio is unfavorable at 0.57, signaling some short-term liquidity risk. Leverage ratios including debt-to-equity (0.5) and debt-to-assets (25%) are favorable, reflecting prudent capital structure. Market valuation ratios like P/E (31.1) and P/B (3.27) are unfavorable, indicating a premium valuation. Overall, the financial ratios suggest a slightly favorable profile.

Shareholder Return Policy

Westinghouse Air Brake Technologies Corporation maintains a consistent dividend policy, with a payout ratio around 14-17% and a stable dividend per share increasing annually from $0.49 in 2021 to $1 in 2025. The dividend yield ranges between 0.47% and 0.61%, supported by free cash flow coverage exceeding dividend payments and capital expenditure.

The company does not report share buybacks, focusing on sustainable dividends backed by solid operating cash flow and manageable debt levels. This approach aligns with steady shareholder returns while preserving financial flexibility for long-term value creation.

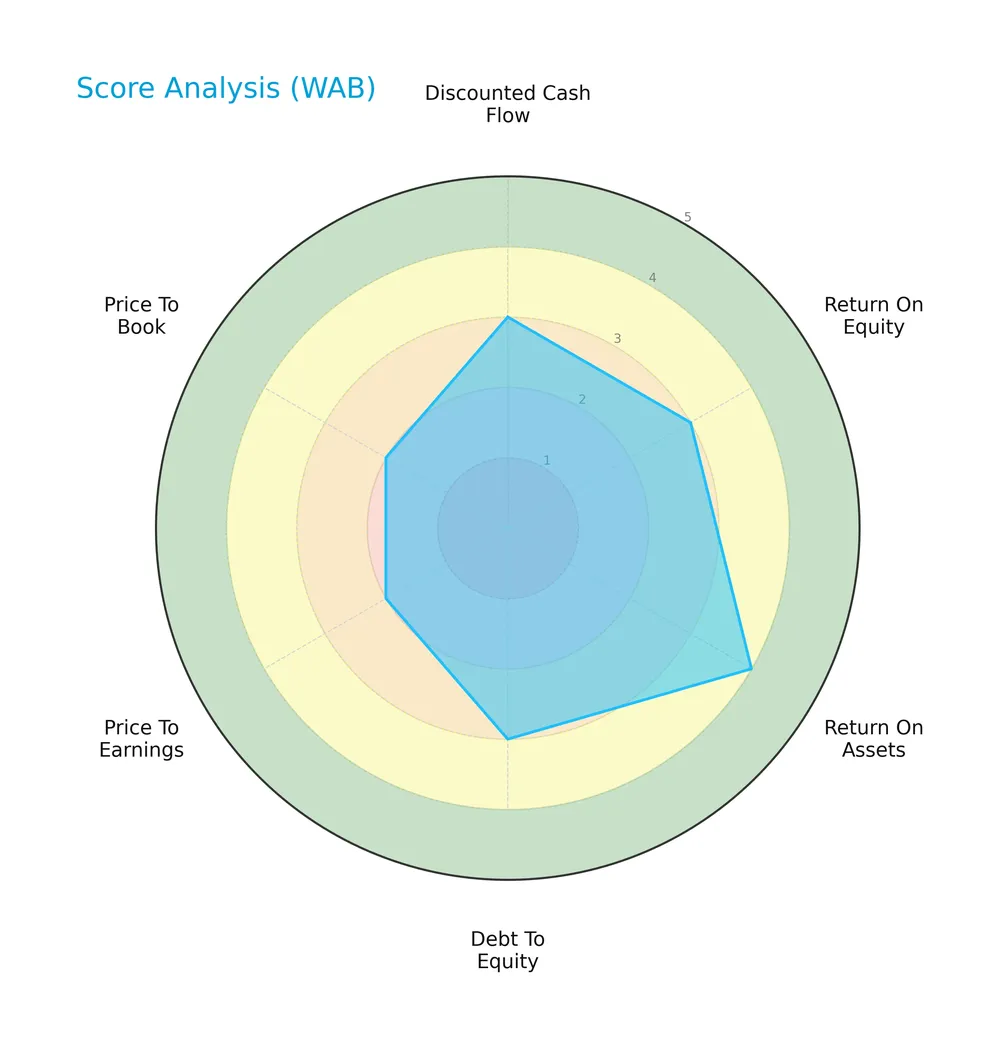

Score analysis

The radar chart below presents a comprehensive overview of Westinghouse Air Brake Technologies Corporation’s key financial scores:

The company scores moderately on discounted cash flow, return on equity, and debt to equity, with a favorable return on assets. However, price-to-earnings and price-to-book ratios reflect less favorable valuations compared to sector benchmarks.

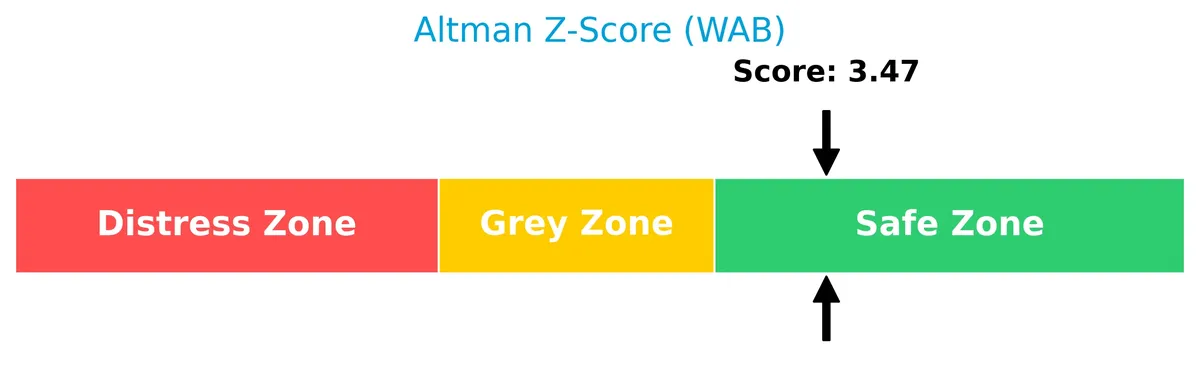

Analysis of the company’s bankruptcy risk

Westinghouse Air Brake Technologies Corporation’s Altman Z-Score places it securely in the safe zone, indicating a low risk of bankruptcy:

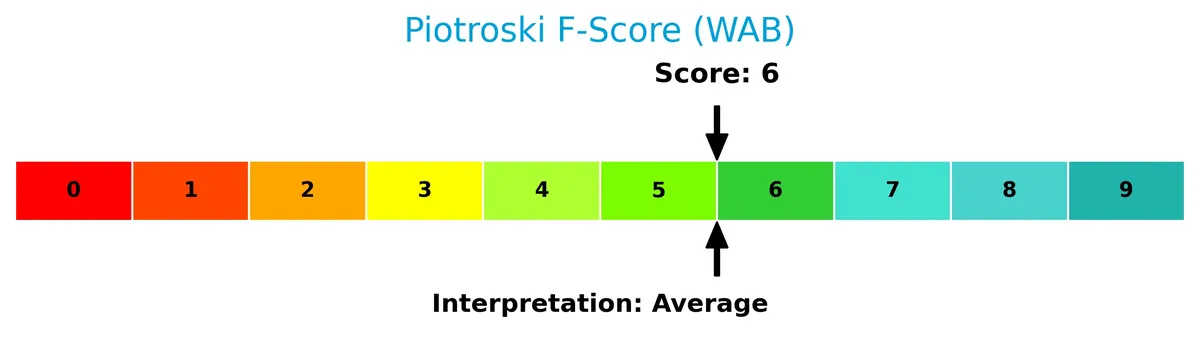

Is the company in good financial health?

This diagram illustrates the company’s Piotroski Score, assessing its financial strength:

With a Piotroski Score of 6, the company demonstrates average financial health. It shows solid fundamentals but does not yet rank among the strongest firms in terms of profitability and efficiency.

Competitive Landscape & Sector Positioning

This analysis explores Westinghouse Air Brake Technologies Corporation’s sector positioning, revenue streams, and product lines. I will assess whether WAB maintains a competitive advantage over its main industry rivals.

Strategic Positioning

Westinghouse Air Brake Technologies operates a diversified product portfolio with two main segments: Freight ($8B) and Transit ($3.1B) in 2025. Its geographic exposure spans North America, Europe, Asia, and other global markets, with the U.S. as the dominant revenue source ($5.37B).

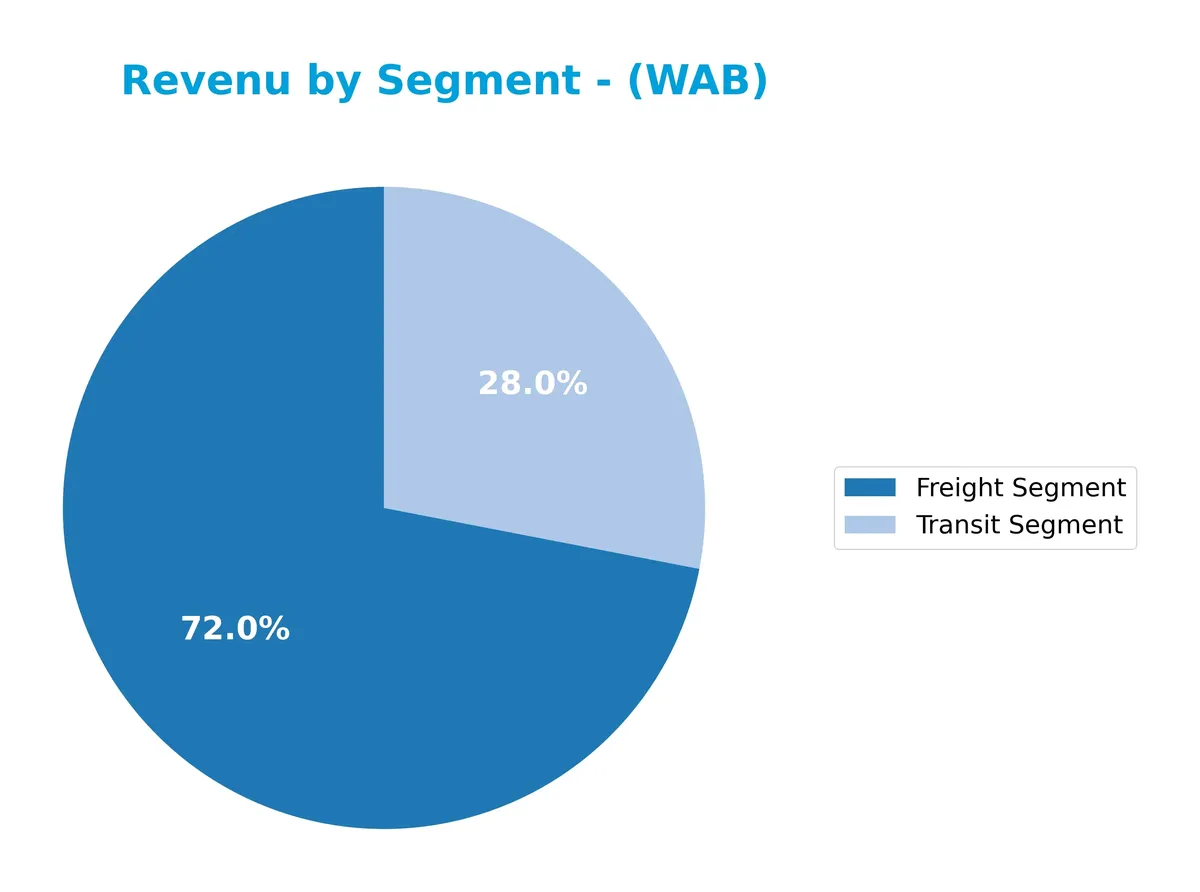

Revenue by Segment

This pie chart illustrates Westinghouse Air Brake Technologies Corporation’s revenue distribution between Freight and Transit segments for fiscal year 2025.

The Freight Segment dominates with $8B in revenue, significantly outpacing Transit’s $3.1B. Freight revenue shows steady growth since 2011, reflecting strong industrial demand. Transit revenue also grows but at a slower pace, indicating possible market saturation. The 2025 data highlights the business’s increasing reliance on Freight, signaling concentration risk but also a clear growth driver.

Key Products & Brands

Below is a summary of Westinghouse Air Brake Technologies Corporation’s main products and brands by segment:

| Product | Description |

|---|---|

| Freight Segment | Manufactures and services components for freight cars and locomotives, including braking equipment, electronics, cooling systems, and locomotive rebuilds. Serves railroads, leasing companies, and OEMs. |

| Transit Segment | Produces and services components for passenger transit vehicles, including braking systems, HVAC, doors, platform screen doors, and accessibility equipment. Serves public transit authorities and manufacturers. |

Westinghouse Air Brake Technologies operates two core segments: Freight and Transit. Both segments focus on technology-driven railway and transit equipment, supporting a broad customer base from freight railroads to municipal transit authorities.

Main Competitors

There are 4 main competitors in the Railroads industry; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Union Pacific Corporation | 138B |

| CSX Corporation | 67.5B |

| Norfolk Southern Corporation | 64.6B |

| Westinghouse Air Brake Technologies Corporation | 37B |

Westinghouse Air Brake Technologies ranks 4th among its competitors. Its market cap is 31.82% that of Union Pacific, the sector leader. The company sits below both the average market cap of the top 10 (77B) and the sector median (66B). It trails its nearest competitor, Norfolk Southern, by a significant 47.53%.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does WAB have a competitive advantage?

Westinghouse Air Brake Technologies Corporation shows a slightly unfavorable moat, with ROIC below WACC, indicating it is currently shedding value despite growing profitability. The company’s income statement remains strong, with favorable margins and solid revenue growth over recent years.

Looking ahead, WAB’s diverse product portfolio spans freight and transit segments, serving global markets including the U.S., India, and Europe. Opportunities lie in expanding railway electronics, locomotive modernization, and transit vehicle services, which may support future value creation despite current challenges.

SWOT Analysis

This SWOT analysis highlights Westinghouse Air Brake Technologies Corporation’s core competitive position and strategic challenges.

Strengths

- Strong global presence with diversified geographic revenue

- Favorable gross and net margins above industry averages

- Robust growth in EPS and net income over five years

Weaknesses

- Slightly unfavorable moat due to ROIC below WACC

- High P/E and P/B ratios signal expensive valuation

- Low quick ratio indicates liquidity risk

Opportunities

- Expansion in emerging markets like India and China

- Growing demand for advanced rail safety technologies

- Increasing transit infrastructure investments worldwide

Threats

- Intense competition in rail equipment manufacturing

- Economic slowdown impacting freight and transit budgets

- Regulatory changes in environmental and safety standards

Westinghouse Air Brake displays solid profitability and growth but faces valuation and liquidity concerns. The company must leverage global opportunities while managing risks from competition and market cycles to sustain value creation.

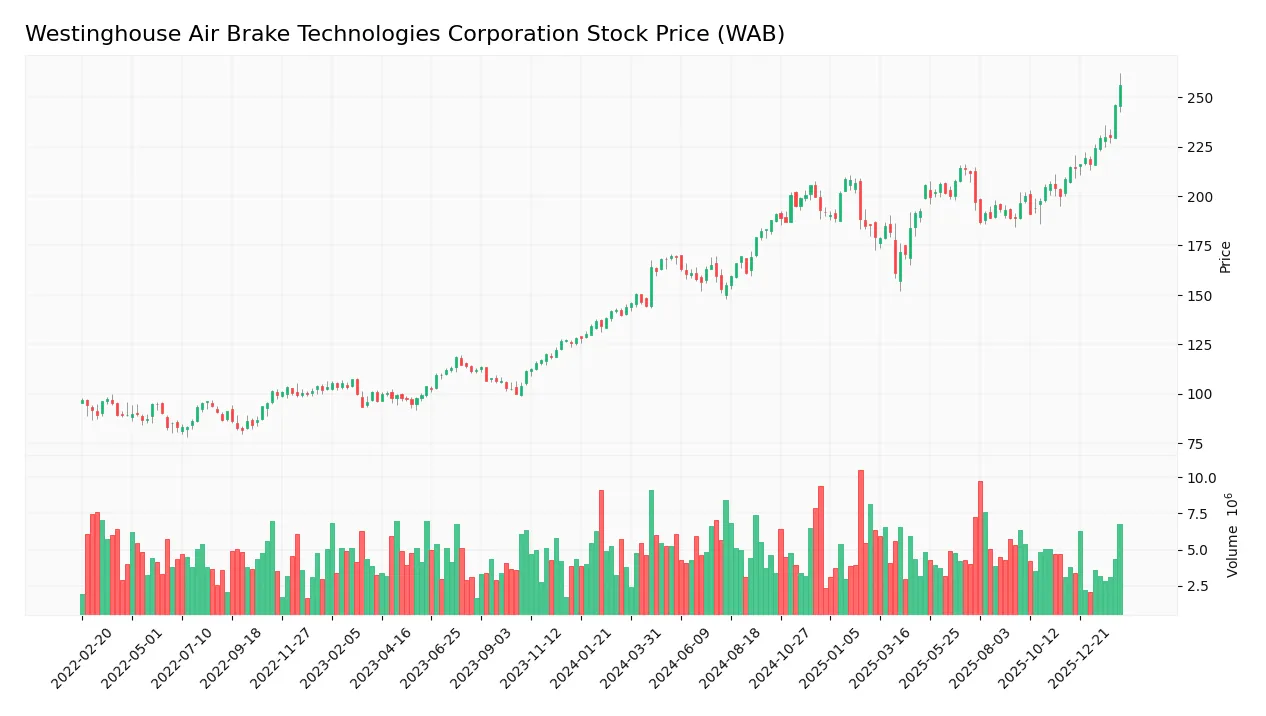

Stock Price Action Analysis

The weekly stock chart below illustrates Westinghouse Air Brake Technologies Corporation’s price movements over the past 100 weeks:

Trend Analysis

Over the past 100 weeks, WAB’s stock gained 78.09%, indicating a strong bullish trend with acceleration. The price ranged from a low of 143.78 to a high of 256.06, with volatility reflected by a 22.53 standard deviation. Recent months show a 22.78% rise with continued upward momentum.

Volume Analysis

Trading volume totals 594M shares, with buyers accounting for 55.1%, but volume is decreasing overall. In the recent period, buyer dominance surged to 87.8%, signaling strong investor demand and heightened market participation despite lower volume.

Target Prices

Analysts set a confident price consensus for Westinghouse Air Brake Technologies Corporation (WAB).

| Target Low | Target High | Consensus |

|---|---|---|

| 221 | 308 | 267.6 |

The target range from 221 to 308 indicates solid upside potential, with a consensus near 268 signaling bullish market expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst grades and consumer feedback to provide a comprehensive view of Westinghouse Air Brake Technologies Corporation.

Stock Grades

Here are the latest stock grades for Westinghouse Air Brake Technologies Corporation from leading analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-02-13 |

| Keybanc | Maintain | Overweight | 2026-02-12 |

| Citigroup | Maintain | Buy | 2026-02-12 |

| Stephens & Co. | Maintain | Overweight | 2026-02-12 |

| Susquehanna | Maintain | Positive | 2026-01-26 |

| JP Morgan | Maintain | Neutral | 2026-01-14 |

| Morgan Stanley | Maintain | Overweight | 2026-01-12 |

| Citigroup | Maintain | Buy | 2026-01-09 |

| Wolfe Research | Upgrade | Outperform | 2026-01-08 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-17 |

Most analysts maintain a positive stance, favoring overweight or buy ratings, with Wolfe Research notably upgrading to outperform. The consensus remains a buy, reflecting steady confidence among top-tier firms.

Consumer Opinions

Westinghouse Air Brake Technologies Corporation (WAB) consistently draws strong opinions from its user base, reflecting its market impact and operational challenges.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable performance in critical safety systems | Occasional delays in customer support |

| Robust product durability under harsh conditions | Pricing perceived as higher than competitors |

| Strong technical expertise and innovation | Complexity of product installation |

Overall, consumers praise WAB for its durable and reliable safety products, essential in transport sectors. However, recurring concerns include customer service responsiveness and premium pricing, which may affect smaller clients’ satisfaction.

Risk Analysis

Below is a summary table outlining key risks associated with Westinghouse Air Brake Technologies Corporation (WAB):

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated P/E (31.11) and P/B (3.27) ratios suggest overvaluation | Medium | High |

| Liquidity Risk | Low quick ratio (0.57) indicates potential short-term liquidity concerns | Medium | Medium |

| Market Volatility | Beta near 1.0 implies sensitivity to market swings | High | Medium |

| Operational Risk | Rail industry cyclicality and capital intensity may pressure margins | Medium | Medium |

| Financial Health | Altman Z-Score (3.47) in safe zone, but Piotroski score of 6 is only average | Low | Low |

| Dividend Yield | Low dividend yield (0.47%) could deter income-focused investors | Low | Low |

The most pressing risks are valuation and liquidity. The stock trades above typical sector multiples, signaling stretched expectations. Additionally, the quick ratio under 1.0 flags tight short-term liquidity, warranting caution. Market sensitivity remains elevated due to the beta around 1.0, exposing WAB to broader economic shifts. Operational risks persist given the capital-intensive railroad sector and evolving technologies. However, the firm’s Altman Z-Score confirms financial stability, mitigating bankruptcy risk. Investors should weigh these factors carefully before allocating capital.

Should You Buy Westinghouse Air Brake Technologies Corporation?

Westinghouse Air Brake Technologies appears to present a profile of improving profitability alongside a slightly unfavorable moat, as it currently destroys value despite growing returns. Supported by a manageable leverage profile and a very favorable B rating, the company’s overall financial health could be seen as cautiously moderate.

Strength & Efficiency Pillars

Westinghouse Air Brake Technologies Corporation shows solid operational efficiency with a net margin of 10.48% and a stable return on equity of 10.5%. The company’s ROIC stands at 7.38%, slightly below its WACC of 7.8%, indicating mild value erosion rather than creation. However, its growing ROIC trend of 70.9% suggests improving profitability. Favorable gross margin at 34.08% and EBIT margin of 16.16% highlight strong cost controls and operational leverage.

Weaknesses and Drawbacks

Valuation metrics pose concerns with a high P/E of 31.11 and P/B of 3.27, reflecting a premium that may pressure future returns. Liquidity ratios show some weakness; the quick ratio is low at 0.57, signaling limited short-term asset coverage. While debt-to-equity at 0.5 and interest coverage of 8.02 are favorable, the moderate current ratio of 1.11 calls for cautious monitoring. These factors combined with moderate Piotroski score of 6 suggest risks amid premium valuation.

Our Final Verdict about Westinghouse Air Brake Technologies Corporation

Westinghouse Air Brake Technologies Corporation presents a fundamentally solid profile supported by improving profitability and a secure solvency position (Altman Z-Score 3.47, safe zone). Despite its bullish long-term trend and strong buyer dominance of 87.81% recently, the premium valuation and moderate liquidity suggest a cautious stance. The profile may appear attractive for long-term exposure but warrants a prudent wait-and-see approach for optimal entry.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Is The Strong Multi Year Rally In Westinghouse Air Brake Technologies (WAB) Still Justified – simplywall.st (Feb 13, 2026)

- What Makes Westinghouse Air Brake Technologies (WAB) a Strong Momentum Stock: Buy Now? – Yahoo Finance (Feb 13, 2026)

- Expert Outlook: Westinghouse Air Brake Through The Eyes Of 10 Analysts – Benzinga (Feb 13, 2026)

- Westinghouse Air Brake Technologies Corporation (NYSE:WAB) Q4 2025 earnings call transcript – MSN (Feb 11, 2026)

- If You Invested $100 In Westinghouse Air Brake Stock 20 Years Ago, You Would Have This Much Today – Sahm (Feb 12, 2026)

For more information about Westinghouse Air Brake Technologies Corporation, please visit the official website: wabteccorp.com