Home > Analyses > Utilities > WEC Energy Group, Inc.

WEC Energy Group, Inc. powers millions of homes and businesses through a vast network of electricity and natural gas services, seamlessly integrating traditional and renewable energy sources. As a stalwart in the regulated electric utility sector, WEC is renowned for its reliable infrastructure and commitment to innovation in energy distribution. With a strong presence across multiple states and a diversified energy portfolio, the question remains: does WEC’s solid foundation and growth strategy still justify its current market valuation for investors seeking steady returns?

Table of contents

Business Model & Company Overview

WEC Energy Group, Inc., founded in 1981 and headquartered in Milwaukee, Wisconsin, stands as a dominant player in the regulated electric sector. Its ecosystem integrates regulated natural gas, electricity, and renewable energy services across multiple segments, including Wisconsin, Illinois, and other states, blending traditional and renewable energy sources such as coal, natural gas, wind, and solar. This diversified portfolio supports a mission centered on reliable energy provision and infrastructure.

The company’s revenue engine balances regulated electric transmission and natural gas distribution with non-utility energy infrastructure, creating stable cash flows from recurring services and asset management. Its strategic footprint spans key U.S. regions, leveraging over 35,800 miles of overhead lines and 50,900 miles of gas mains. This extensive network forms a significant economic moat, positioning WEC Energy Group to shape the future of energy distribution in America.

Financial Performance & Fundamental Metrics

I will analyze WEC Energy Group, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment appeal.

Income Statement

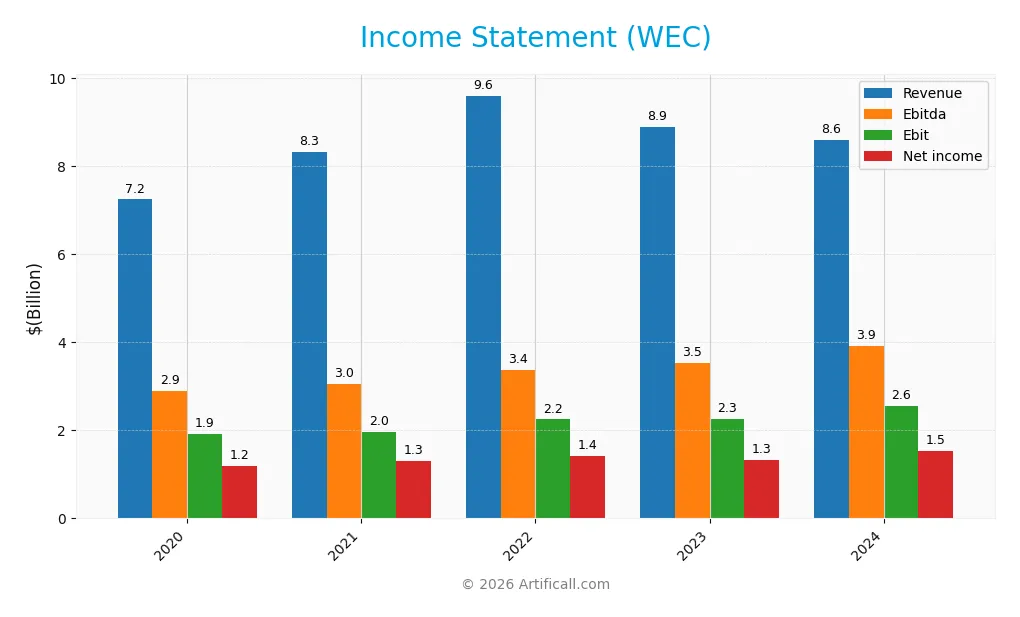

Below is the income statement for WEC Energy Group, Inc. covering fiscal years 2020 through 2024, presenting key financial metrics in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 7.24B | 8.32B | 9.60B | 8.89B | 8.60B |

| Cost of Revenue | 4.35B | 5.32B | 6.30B | 5.29B | 4.81B |

| Operating Expenses | 1.18B | 1.28B | 1.38B | 1.69B | 1.63B |

| Gross Profit | 2.89B | 3.00B | 3.30B | 3.60B | 3.79B |

| EBITDA | 2.90B | 3.04B | 3.37B | 3.53B | 3.92B |

| EBIT | 1.92B | 1.97B | 2.25B | 2.26B | 2.56B |

| Interest Expense | 494M | 471M | 515M | 727M | 815M |

| Net Income | 1.20B | 1.30B | 1.41B | 1.33B | 1.53B |

| EPS | 3.80 | 4.12 | 4.46 | 4.22 | 4.81 |

| Filing Date | 2021-02-25 | 2022-02-24 | 2023-02-23 | 2024-02-22 | 2025-02-21 |

Income Statement Evolution

From 2020 to 2024, WEC Energy Group’s revenue grew by 18.8%, although it declined by 3.3% in the last year. Net income increased by 27.3% over the period, supported by an 18.6% rise in net margin in the most recent year. Margins improved overall, with gross margin reaching 44.0% and EBIT margin near 29.8%, reflecting enhanced profitability despite recent revenue softness.

Is the Income Statement Favorable?

The 2024 income statement shows favorable fundamentals with a 17.8% net margin and solid EPS growth of 14.5% year-over-year. EBIT expanded by 13.2% while operating expenses declined proportionally with revenue, supporting margin gains. Interest expense remains neutral at 9.5% of revenue. Overall, 85.7% of income statement metrics are favorable, indicating strong operational performance and profitability.

Financial Ratios

The table below presents key financial ratios for WEC Energy Group, Inc. over the fiscal years 2020 to 2024, providing insights into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 16.6% | 15.7% | 14.7% | 15.0% | 17.8% |

| ROE | 11.4% | 11.9% | 12.4% | 11.3% | 12.3% |

| ROIC | 4.0% | 4.0% | 3.9% | 3.9% | 4.1% |

| P/E | 24.2 | 23.5 | 21.0 | 19.9 | 19.5 |

| P/B | 2.76 | 2.80 | 2.59 | 2.26 | 2.39 |

| Current Ratio | 0.50 | 0.71 | 0.69 | 0.55 | 0.60 |

| Quick Ratio | 0.37 | 0.54 | 0.52 | 0.40 | 0.43 |

| D/E | 1.36 | 1.42 | 1.52 | 1.60 | 1.64 |

| Debt-to-Assets | 38.6% | 40.0% | 41.5% | 42.8% | 42.9% |

| Interest Coverage | 3.46 | 3.64 | 3.74 | 2.62 | 2.64 |

| Asset Turnover | 0.20 | 0.21 | 0.23 | 0.20 | 0.18 |

| Fixed Asset Turnover | 0.28 | 0.31 | 0.33 | 0.28 | 0.25 |

| Dividend Yield | 2.7% | 2.8% | 3.1% | 3.7% | 3.6% |

Evolution of Financial Ratios

From 2020 to 2024, WEC Energy Group’s Return on Equity (ROE) showed modest fluctuations, peaking near 12.3% in 2024, indicating relative stability in shareholder returns. The Current Ratio remained below 1.0 throughout, declining slightly to 0.6 in 2024, suggesting persistent liquidity constraints. The Debt-to-Equity Ratio increased steadily, reaching 1.64 in 2024, reflecting a rising leverage trend impacting financial risk.

Are the Financial Ratios Favorable?

In 2024, profitability metrics like net margin (17.77%) are favorable, while ROE (12.3%) and market multiples such as P/E (19.46) and P/B (2.39) are neutral. Liquidity ratios, including current (0.6) and quick ratio (0.43), are unfavorable, indicating limited short-term asset coverage. Leverage ratios show mixed signals: debt-to-equity (1.64) is unfavorable, but debt-to-assets (42.92%) and interest coverage (3.14) are neutral. Asset turnover ratios are also unfavorable. Overall, the financial ratios present a slightly unfavorable picture.

Shareholder Return Policy

WEC Energy Group maintains a consistent dividend policy with a payout ratio near 69%, supported by a dividend yield of approximately 3.55% in 2024, showing a steady increase in dividend per share over recent years. Share buybacks are not explicitly mentioned in the data, and dividend coverage by free cash flow remains moderate, indicating some risk if cash generation weakens.

The company balances dividends with capital expenditures, as the dividend and capex coverage ratio stands below 1, suggesting careful cash allocation. This distribution approach appears aligned with sustainable shareholder value creation, but investors should monitor free cash flow trends to assess long-term payout sustainability.

Score analysis

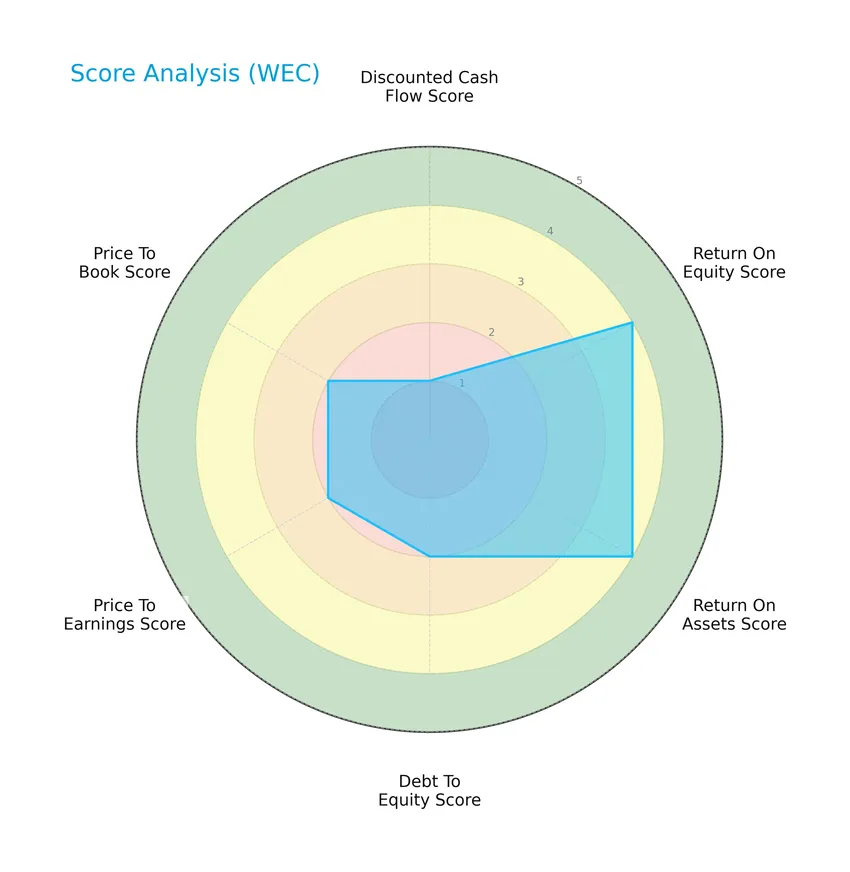

Below is a radar chart illustrating WEC Energy Group, Inc.’s key financial scores for a comprehensive evaluation:

The company shows strong returns on equity and assets with scores of 4 each, but a low discounted cash flow score of 1. Debt-to-equity, price-to-earnings, and price-to-book ratios are moderate with scores of 2, reflecting balanced but cautious financial metrics.

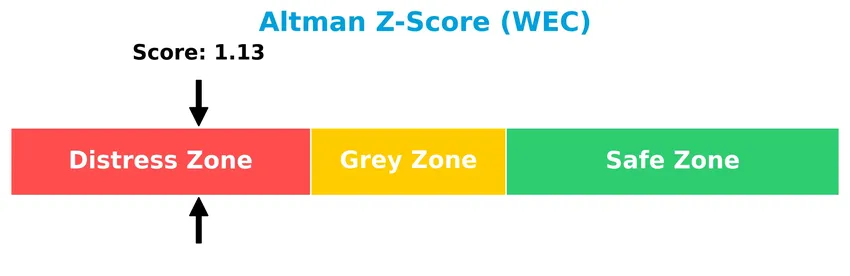

Analysis of the company’s bankruptcy risk

WEC Energy Group, Inc. currently falls within the distress zone according to its Altman Z-Score, indicating a higher risk of financial distress and potential bankruptcy:

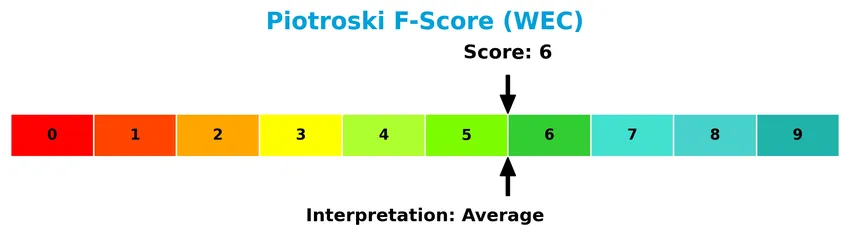

Is the company in good financial health?

The following Piotroski diagram presents the company’s financial health based on multiple criteria:

With a Piotroski Score of 6, WEC Energy Group, Inc. demonstrates average financial strength, suggesting moderate operational efficiency and profitability but leaving some room for improvement in financial health.

Competitive Landscape & Sector Positioning

This sector analysis will examine WEC Energy Group, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether WEC holds a competitive advantage over its peers in the regulated electric utilities industry.

Strategic Positioning

WEC Energy Group maintains a geographically concentrated portfolio primarily in Wisconsin and Illinois, generating over 7.9B USD combined in 2024. Its business spans regulated electric, natural gas, and renewable energy services, with a growing focus on non-utility energy infrastructure, reflecting moderate diversification within the U.S. utilities sector.

Revenue by Segment

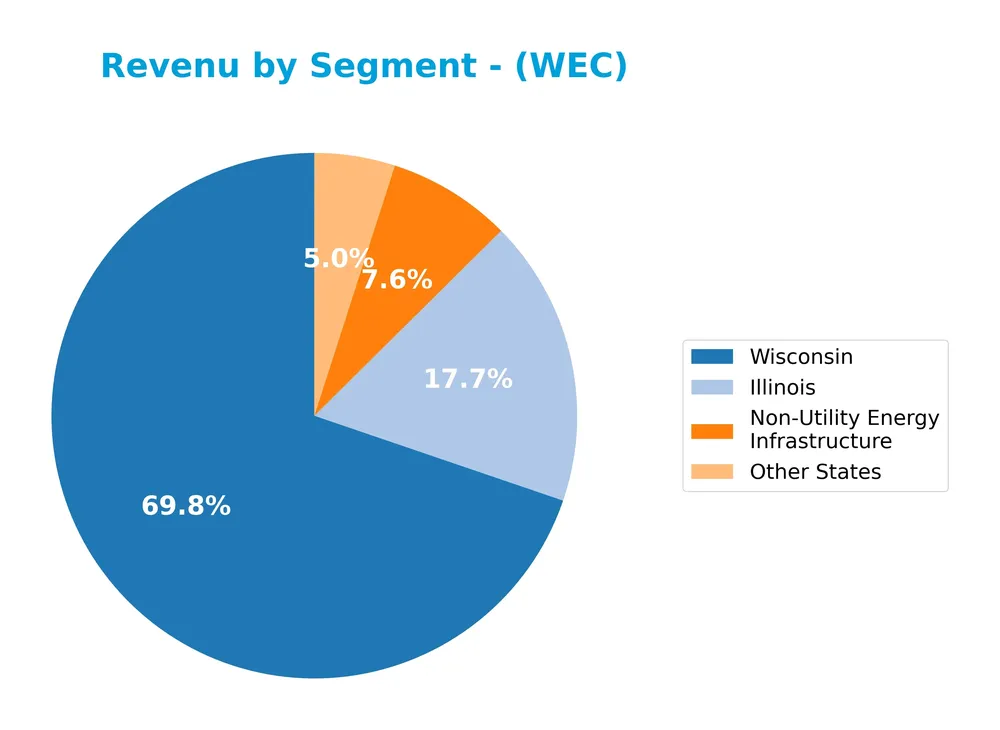

This pie chart displays WEC Energy Group, Inc.’s revenue distribution by geographic and business segments for the fiscal year 2024.

In 2024, Wisconsin remains the dominant segment with $6.33B in revenue, continuing to drive the company’s overall performance despite a slight decline from previous years. Illinois generated $1.6B, showing moderate stability, while Non-Utility Energy Infrastructure contributed $691M, reflecting steady growth. Revenue from Other States decreased to $450M, indicating some contraction. The segment concentration around Wisconsin suggests a regional focus with some exposure risks.

Key Products & Brands

The table below details WEC Energy Group’s main products and brand segments along with their operational descriptions:

| Product | Description |

|---|---|

| Wisconsin | Regulated natural gas and electricity services, including generation and distribution in Wisconsin. |

| Illinois | Regulated electric and natural gas services operating in Illinois. |

| Other States | Energy services including regulated electricity and natural gas operations outside Wisconsin and Illinois. |

| Non-Utility Energy Infrastructure | Renewable and nonregulated energy services, including generation from wind, solar, biomass, and other sources. |

WEC Energy Group’s key products encompass regulated electric and gas utilities primarily in Wisconsin and Illinois, along with renewable and nonregulated energy infrastructure services across other regions. These segments reflect the company’s diverse energy portfolio and geographic footprint.

Main Competitors

There are 23 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NextEra Energy, Inc. | 169B |

| The Southern Company | 96B |

| Duke Energy Corporation | 91B |

| American Electric Power Company, Inc. | 62B |

| Dominion Energy, Inc. | 51B |

| Exelon Corporation | 44B |

| Xcel Energy Inc. | 44B |

| Entergy Corporation | 42B |

| Public Service Enterprise Group Incorporated | 40B |

| Consolidated Edison, Inc. | 36B |

WEC Energy Group, Inc. ranks 12th among 23 competitors in the regulated electric utilities sector. Its market cap is approximately 21% of the leader, NextEra Energy, Inc. WEC is positioned below the average market cap of the top 10 competitors (67.5B) but remains above the sector median of 34B. The company maintains a narrow 0.76% gap from the next competitor above it, highlighting a competitive position.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does WEC have a competitive advantage?

WEC Energy Group, Inc. currently does not present a strong competitive advantage as it is shedding value with a negative spread between ROIC and WACC, despite a growing ROIC trend. The overall moat status is slightly unfavorable, indicating some challenges in sustaining excess returns.

Looking ahead, WEC’s diverse energy portfolio including regulated natural gas, electricity, and renewable services across multiple states, along with growth in profitability metrics, may provide opportunities to improve efficiency and expand its market presence in the evolving utility sector.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors influencing WEC Energy Group, Inc.’s strategic positioning and investment potential.

Strengths

- Strong regulated utility base in Wisconsin and Illinois

- Favorable gross and net margins (~44% and ~18%)

- Reliable dividend yield of 3.55%

Weaknesses

- Declining revenue growth in recent year (-3.3%)

- Unfavorable liquidity ratios (current ratio 0.6)

- High debt-to-equity ratio (1.64)

Opportunities

- Expansion in renewable and non-utility energy infrastructure

- Growing profitability trend despite value destruction

- Potential for operational efficiency improvements

Threats

- Regulatory risks in utility sector

- Market competition and energy price volatility

- Financial distress risk indicated by Altman Z-Score in distress zone

WEC Energy Group’s strengths lie in its regulated market presence and solid profitability, but recent revenue softness and financial leverage pose risks. The company’s strategy should focus on leveraging renewable energy growth and improving liquidity to mitigate financial vulnerabilities.

Stock Price Action Analysis

The upcoming weekly stock chart for WEC Energy Group, Inc. illustrates the price movements and volatility over the past 12 months:

Trend Analysis

Over the past year, WEC’s stock price increased by 39.18%, indicating a bullish trend with a deceleration phase. The highest price reached 116.84 and the lowest was 77.85, with a standard deviation of 11.19. In the recent 11-week period, the price declined by 3.34%, showing a slight bearish trend with a standard deviation of 3.15.

Volume Analysis

In the last three months, trading volumes have been increasing with buyer dominance at 62.22%. Buyer volume of 72.2M exceeds seller volume of 43.8M, suggesting strong investor interest and positive market participation amid recent price softness.

Target Prices

Analysts present a positive target consensus for WEC Energy Group, Inc., reflecting moderate growth expectations.

| Target High | Target Low | Consensus |

|---|---|---|

| 136 | 105 | 121.44 |

The target prices suggest analysts expect WEC’s stock to trade between 105 and 136, with an average consensus near 121, indicating a cautiously optimistic outlook.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding WEC Energy Group, Inc. to gauge market sentiment.

Stock Grades

Here is a summary of the latest stock grades for WEC Energy Group, Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-22 |

| Wells Fargo | Maintain | Overweight | 2026-01-20 |

| JP Morgan | Maintain | Neutral | 2026-01-15 |

| B of A Securities | Maintain | Neutral | 2025-12-31 |

| UBS | Maintain | Neutral | 2025-12-17 |

| Barclays | Maintain | Equal Weight | 2025-12-16 |

| Keybanc | Maintain | Overweight | 2025-12-12 |

| JP Morgan | Maintain | Neutral | 2025-12-11 |

| Scotiabank | Maintain | Sector Outperform | 2025-10-31 |

| Barclays | Maintain | Equal Weight | 2025-10-21 |

The overall trend shows a stable outlook with most analysts maintaining neutral or equal weight ratings, while a few maintain overweight or sector outperform positions. The consensus remains cautious with a predominant hold stance.

Consumer Opinions

Consumers generally express a mixed but insightful sentiment about WEC Energy Group, Inc., reflecting both appreciation and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable energy supply with minimal outages. | Customer service can be slow to respond. |

| Competitive pricing compared to regional peers. | Billing system occasionally confusing. |

| Strong commitment to renewable energy projects. | Limited communication during service disruptions. |

Overall, consumers value WEC Energy Group’s dependable energy delivery and green initiatives but frequently note issues with customer support responsiveness and billing clarity.

Risk Analysis

Below is a table summarizing the main risks associated with investing in WEC Energy Group, Inc., considering their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Stability | Altman Z-Score at 1.13 indicates financial distress with increased bankruptcy risk | High | High |

| Liquidity Risk | Low current ratio (0.6) and quick ratio (0.43) suggest potential short-term liquidity issues | Medium | Medium |

| Leverage Risk | Debt-to-equity ratio at 1.64 reflects relatively high debt, raising financial risk | Medium | Medium |

| Operational Risk | Unfavorable asset turnover ratios indicate inefficiencies in asset utilization | Medium | Medium |

| Regulatory Risk | As a regulated electric utility, subject to changing government policies and environmental laws | Medium | High |

| Market Risk | Beta of 0.573 implies moderate sensitivity to market fluctuations | Low | Medium |

The most pressing risk is WEC’s financial distress reflected by its low Altman Z-Score, signaling caution despite favorable net margins. Additionally, regulatory changes could heavily impact operations, while liquidity and leverage metrics warrant careful monitoring.

Should You Buy WEC Energy Group, Inc.?

WEC Energy Group, Inc. appears to be showing improving profitability amid a slightly unfavorable moat, suggesting value destruction despite rising returns. While the leverage profile is substantial and current liquidity tight, the overall B- rating indicates a very favorable but cautious investment profile.

Strength & Efficiency Pillars

WEC Energy Group, Inc. displays solid profitability with a net margin of 17.77% and a return on equity (ROE) of 12.3%, reflecting moderate efficiency in generating shareholder returns. However, its return on invested capital (ROIC) stands at 4.14%, below the weighted average cost of capital (WACC) at 5.39%, indicating the company is currently shedding value rather than creating it. Financial health metrics are mixed: the Altman Z-score of 1.13 places the company in the distress zone, signaling financial vulnerability, while a Piotroski score of 6 suggests average operational strength.

Weaknesses and Drawbacks

The company faces notable risks, particularly in liquidity and leverage. A current ratio of 0.6 and quick ratio of 0.43 highlight potential short-term solvency issues, while a debt-to-equity ratio of 1.64 points to significant leverage that could pressure financial flexibility. Valuation multiples are moderate with a P/E of 19.46 and P/B of 2.39, which may reflect investor caution given the company’s inability to create value at the capital level. Furthermore, asset turnover ratios are low (0.18), suggesting inefficiencies in asset utilization.

Our Verdict about WEC Energy Group, Inc.

The long-term fundamental profile appears mixed, with profitability supporting moderate confidence but financial health and value creation metrics raising caution. Despite a bullish overall stock trend and buyer dominance in the recent period, the company’s inability to exceed its cost of capital and liquidity concerns might suggest a wait-and-see approach. This balanced outlook indicates WEC Energy Group could present selective opportunities but may require careful monitoring before committing to long-term exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- WEC Energy Group, Inc. $WEC Shares Acquired by Baillie Gifford & Co. – MarketBeat (Jan 25, 2026)

- If EPS Growth Is Important To You, WEC Energy Group (NYSE:WEC) Presents An Opportunity – Yahoo Finance (Jan 23, 2026)

- WEC Energy Group chairman Gale Klappa to retire from board after more than 22 years – biztimes.com (Jan 23, 2026)

- WEC Energy Group (NYSE:WEC) Is Increasing Its Dividend To $0.9525 – simplywall.st (Jan 23, 2026)

- WEC Energy Group raises quarterly dividend by 6.7 percent – Investing.com (Jan 22, 2026)

For more information about WEC Energy Group, Inc., please visit the official website: wecenergygroup.com