Home > Analyses > Industrials > Watts Water Technologies, Inc.

Watts Water Technologies, Inc. orchestrates the invisible flow of water and energy in millions of buildings worldwide. Its advanced valves, heating systems, and smart controls define industry standards in fluid management and conservation. Renowned for innovation and quality, Watts commands significant influence across commercial and residential markets. As 2026 unfolds, I ask: does Watts’ robust legacy and product breadth still translate into compelling growth and valuation upside for investors?

Table of contents

Business Model & Company Overview

Watts Water Technologies, Inc., founded in 1874 and headquartered in North Andover, MA, dominates the industrial machinery sector. It delivers a cohesive ecosystem of products managing fluid and energy flow in commercial and residential buildings. Its portfolio spans flow control, heating, ventilation, and water quality solutions, creating a comprehensive platform for building efficiency.

The company’s revenue engine balances hardware sales with smart systems and recurring service solutions. Watts commands strategic markets across the Americas, Europe, and Asia-Pacific, serving wholesale distributors, OEMs, and retail chains. Its competitive advantage lies in integrating advanced flow control with energy conservation, securing a durable economic moat and shaping the future of building infrastructure.

Financial Performance & Fundamental Metrics

I analyze Watts Water Technologies, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

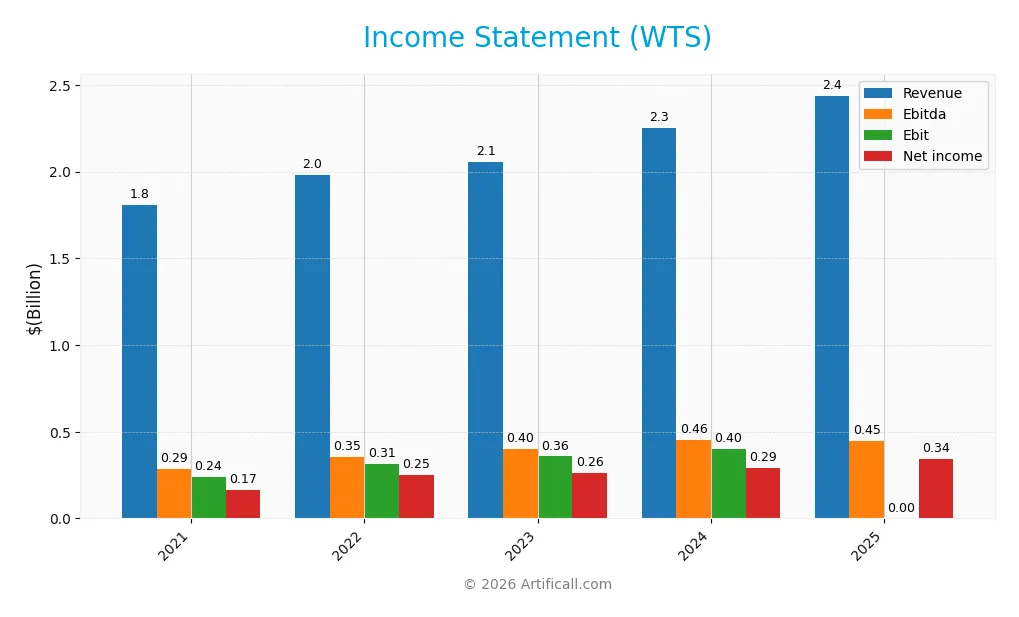

Income Statement

The table below presents Watts Water Technologies, Inc.’s income statement figures from 2021 to 2025 in USD. It shows key profitability metrics and earnings per share (EPS).

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 1.81B | 1.98B | 2.06B | 2.25B | 2.44B |

| Cost of Revenue | 1.04B | 1.11B | 1.10B | 1.19B | 1.23B |

| Operating Expenses | 528M | 559M | 610M | 672M | 734M |

| Gross Profit | 767M | 874M | 961M | 1.06B | 1.21B |

| EBITDA | 286M | 354M | 401M | 455M | 448M |

| EBIT | 240M | 315M | 358M | 401M | 0 |

| Interest Expense | 6.3M | 7.0M | 8.2M | 14.7M | 10.8M |

| Net Income | 166M | 252M | 262M | 291M | 341M |

| EPS | 4.90 | 7.51 | 7.85 | 8.69 | 10.17 |

| Filing Date | 2022-02-22 | 2023-02-21 | 2024-02-21 | 2025-02-18 | 2026-02-11 |

Income Statement Evolution

Watts Water Technologies’ revenue rose 35% from 2021 to 2025, with a one-year growth of 8.3%. Net income more than doubled over five years, driven by a 52.6% net margin increase. Gross margin improved to 49.5%, reflecting efficiency gains, while EBIT margin fell to zero in 2025, signaling operating profitability challenges despite top-line strength.

Is the Income Statement Favorable?

In 2025, Watts Water posted $2.44B revenue and $341M net income, yielding a 14% net margin, favorable versus industry norms. EBITDA stood at $448M, but EBIT dropped to zero, indicating rising operating expenses offsetting gross profits. Interest expense remained low at 0.44% of revenue, supporting financial stability. Overall, fundamentals appear solid but warrant close monitoring of operating profitability.

Financial Ratios

This table summarizes key financial ratios for Watts Water Technologies, Inc. over the last five fiscal years, providing insight into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 9.2% | 12.7% | 12.7% | 12.9% | 14.0% |

| ROE | 14.1% | 19.3% | 17.3% | 17.1% | N/A |

| ROIC | 11.7% | 16.6% | 13.8% | 14.9% | N/A |

| P/E | 39.6 | 19.5 | 26.5 | 23.4 | 27.1 |

| P/B | 5.6 | 3.8 | 4.6 | 4.0 | 0 |

| Current Ratio | 2.1 | 2.5 | 2.6 | 2.6 | 0 |

| Quick Ratio | 1.2 | 1.5 | 1.6 | 1.7 | 0 |

| D/E | 0.12 | 0.11 | 0.20 | 0.12 | 0 |

| Debt-to-Assets | 7.6% | 7.6% | 12.9% | 8.2% | 0 |

| Interest Coverage | 38.0 | 45.0 | 42.8 | 26.6 | 41.5 |

| Asset Turnover | 1.0 | 1.0 | 0.9 | 0.9 | 0 |

| Fixed Asset Turnover | 9.0 | 10.1 | 8.3 | 8.8 | 0 |

| Dividend Yield | 0.5% | 0.8% | 0.7% | 0.8% | 0.7% |

*Note: N/A indicates data not provided for 2025 in respective metrics.*

Evolution of Financial Ratios

Watts Water Technologies’ Return on Equity (ROE) exhibited a decline to 0% in 2025 from a steady 14-19% range in prior years, signaling deteriorating profitability. The Current Ratio dropped to zero in 2025 after remaining above 2.1, indicating potential liquidity concerns. Debt-to-Equity remained at zero in 2025, reflecting a notable reduction or absence of leverage compared to modest levels earlier.

Are the Financial Ratios Fovorable?

In 2025, profitability shows mixed signals: net profit margin at a favorable 13.98% contrasts with an unfavorable ROE and ROIC of zero, suggesting inefficiencies in capital use. Liquidity ratios are unavailable, flagged unfavorable, raising concerns. Leverage ratios like debt-to-equity and debt-to-assets are favorable at zero, indicating minimal debt risk. Market valuation ratios such as P/E (27.13) and dividend yield (0.72%) rate unfavorable. Overall, the ratios suggest an unfavorable financial profile in 2025.

Shareholder Return Policy

Watts Water Technologies, Inc. pays a consistent dividend with a payout ratio around 19.6% in 2025 and a dividend yield near 0.72%. The dividend per share has steadily increased from $1.01 in 2021 to $2.00 in 2025, supported by strong free cash flow coverage and moderate capital expenditures.

The company also maintains share buybacks, complementing its dividend policy. This balanced approach suggests disciplined capital allocation aimed at sustainable long-term shareholder value creation, without overextending distributions or compromising financial flexibility.

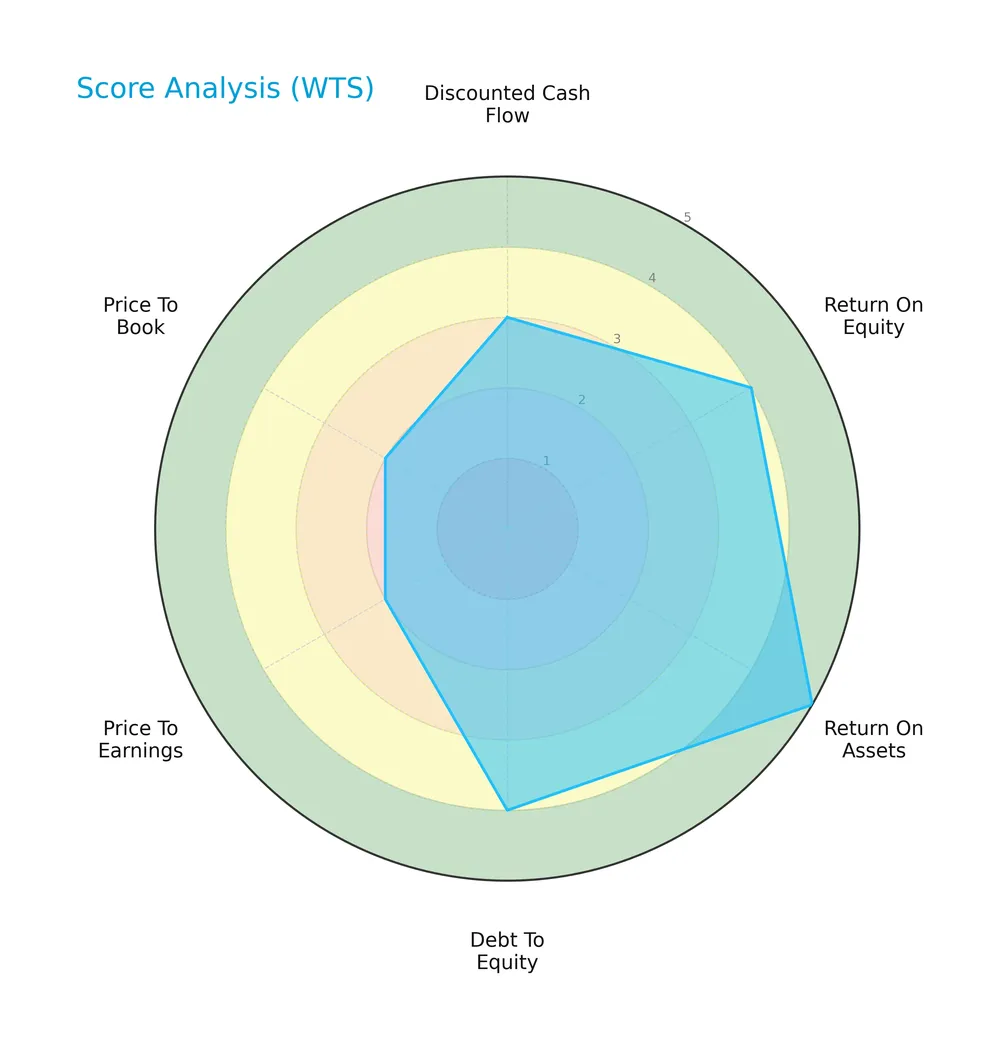

Score analysis

The following radar chart presents Watts Water Technologies, Inc.’s key financial metric scores for a comprehensive overview:

The company scores favorably in return on equity (4) and debt to equity (4), with a very favorable return on assets score (5). However, valuation metrics price to earnings (2) and price to book (2) remain unfavorable, while discounted cash flow is moderate (3).

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates Watts Water Technologies, Inc. is in the safe zone, reflecting low bankruptcy risk and strong financial stability:

Is the company in good financial health?

This Piotroski diagram highlights the company’s financial health based on nine key criteria:

With a Piotroski Score of 5, the company demonstrates average financial strength, suggesting moderate operational efficiency and stability.

Competitive Landscape & Sector Positioning

This section analyzes Watts Water Technologies, Inc.’s strategic positioning, revenue streams, key products, and main competitors. I will assess whether Watts holds a competitive advantage over its industry peers.

Strategic Positioning

Watts Water Technologies concentrates on fluid and energy management products with a diversified portfolio spanning flow control, HVAC and gas, water quality, and drainage solutions. Its geographic exposure is broad, with dominant sales in the Americas, followed by Europe and APMEA regions.

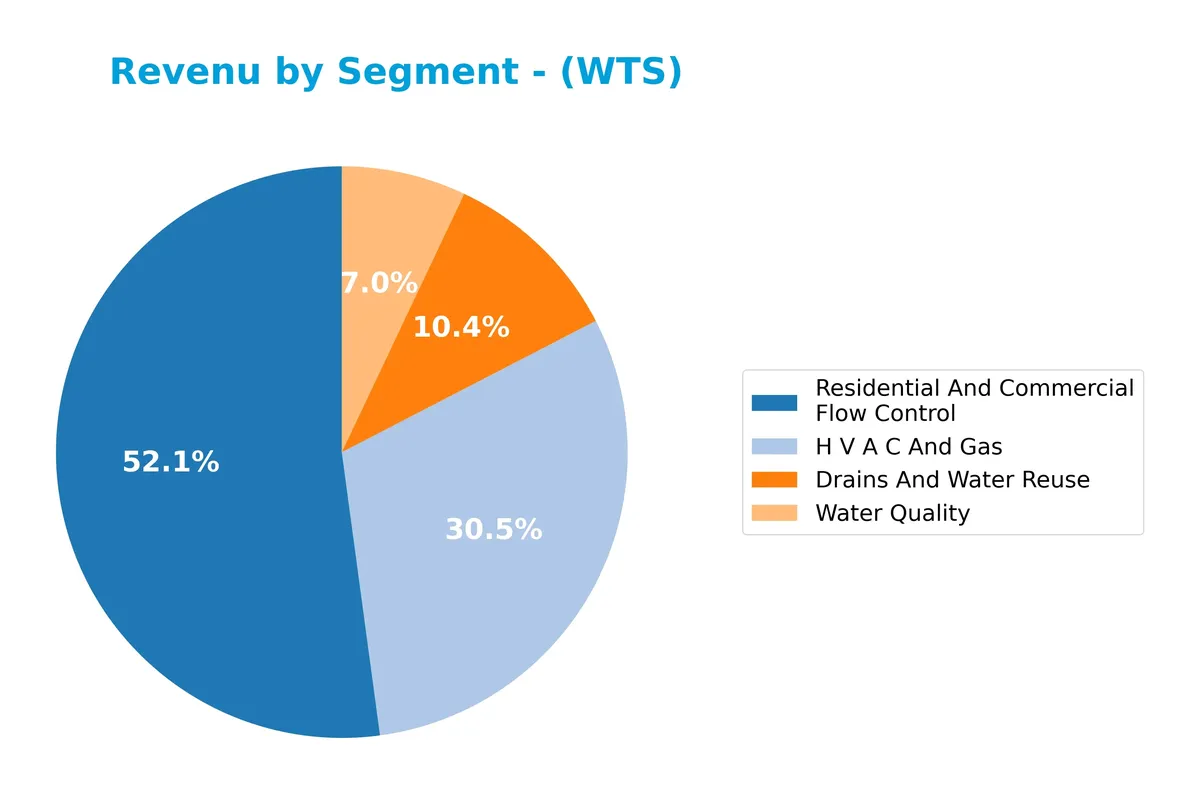

Revenue by Segment

This pie chart breaks down Watts Water Technologies, Inc.’s revenue by segment for the fiscal year 2020, highlighting the company’s diverse product distribution.

In 2020, Residential and Commercial Flow Control dominates with $786.5M, driving the bulk of revenue despite a slight decline from previous years. HVAC and Gas follows at $459.6M, showing moderate contraction since 2019. Drains and Water Reuse and Water Quality generate smaller, stable contributions at $156.3M and $106.2M respectively. The data reveals a concentration risk in the Flow Control segment amid a general revenue slowdown.

Key Products & Brands

The table below details Watts Water Technologies’ core products and brands across major market segments:

| Product | Description |

|---|---|

| Residential and Commercial Flow Control | Includes backflow preventers, water pressure regulators, temperature and pressure relief valves, and thermostatic mixing valves. |

| HVAC and Gas | Offers boilers, water heaters, hydronic and electric heating systems, hydronic pump groups, and flexible stainless steel connectors. |

| Drains and Water Reuse | Comprises drainage products and engineered rainwater harvesting solutions for commercial, industrial, marine, and residential use. |

| Water Quality | Features point-of-use and point-of-entry water filtration, conditioning, and scale prevention systems for commercial and residential applications. |

| IntelliStation Smart Mixing System | Provides smart mixing systems for water management under the IntelliStation brand. |

Watts Water Technologies serves diverse fluid and energy management needs through specialized flow control, HVAC, drainage, and water quality products. Its portfolio spans residential to industrial markets globally.

Main Competitors

There are 24 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Eaton Corporation plc | 127B |

| Parker-Hannifin Corporation | 114B |

| Howmet Aerospace Inc. | 85B |

| Emerson Electric Co. | 76B |

| Illinois Tool Works Inc. | 73B |

| Cummins Inc. | 72B |

| AMETEK, Inc. | 48B |

| Roper Technologies, Inc. | 47B |

| Rockwell Automation, Inc. | 45B |

| Symbotic Inc. | 36B |

Watts Water Technologies, Inc. ranks below the top 10 competitors with a relative market cap to the leader at 0, indicating a much smaller scale than Eaton Corporation. The company is positioned below both the average market cap of the top 10 competitors (72B) and the sector’s median market cap (32B). The lack of data on distances to adjacent competitors suggests a significant gap in market capitalization compared to rivals.

Comparisons with competitors

Check out how we compare the company to its competitors:

Aucun article trouvé pour ces critères.

Does Watts Water Technologies have a competitive advantage?

Watts Water Technologies shows favorable income growth and solid gross margins but lacks available data on ROIC versus WACC, limiting assessment of sustainable competitive advantage. The company’s broad geographic reach and diverse product lines support steady revenue expansion in key Americas and APMEA markets.

Looking ahead, Watts leverages innovation with smart mixing systems and enhanced water conservation solutions targeting commercial and residential sectors globally. Continued product development and geographic expansion offer opportunities to strengthen market presence despite unclear moat metrics.

SWOT Analysis

This SWOT analysis highlights Watts Water Technologies’ core competitive position and key challenges to guide strategic decisions.

Strengths

- Strong global footprint with diversified geographic revenue

- Robust revenue growth of 8.3% in 2025

- Solid net margin near 14% indicating profitability

Weaknesses

- Declining EBIT with 0% margin signals operational pressure

- Unfavorable liquidity ratios raise short-term risk concerns

- Average Piotroski score (5) limits financial strength confidence

Opportunities

- Expansion in emerging APMEA markets growing rapidly

- Increasing demand for water conservation and smart systems

- Potential to improve operational efficiency and margins

Threats

- Rising raw material and energy costs compress margins

- Intense competition in industrial machinery sector

- Economic cycles affecting construction and infrastructure spend

Watts Water Technologies benefits from steady revenue growth and profitability but faces operational efficiency challenges. The firm must leverage global expansion and innovation while addressing margin pressures to sustain its competitive edge.

Stock Price Action Analysis

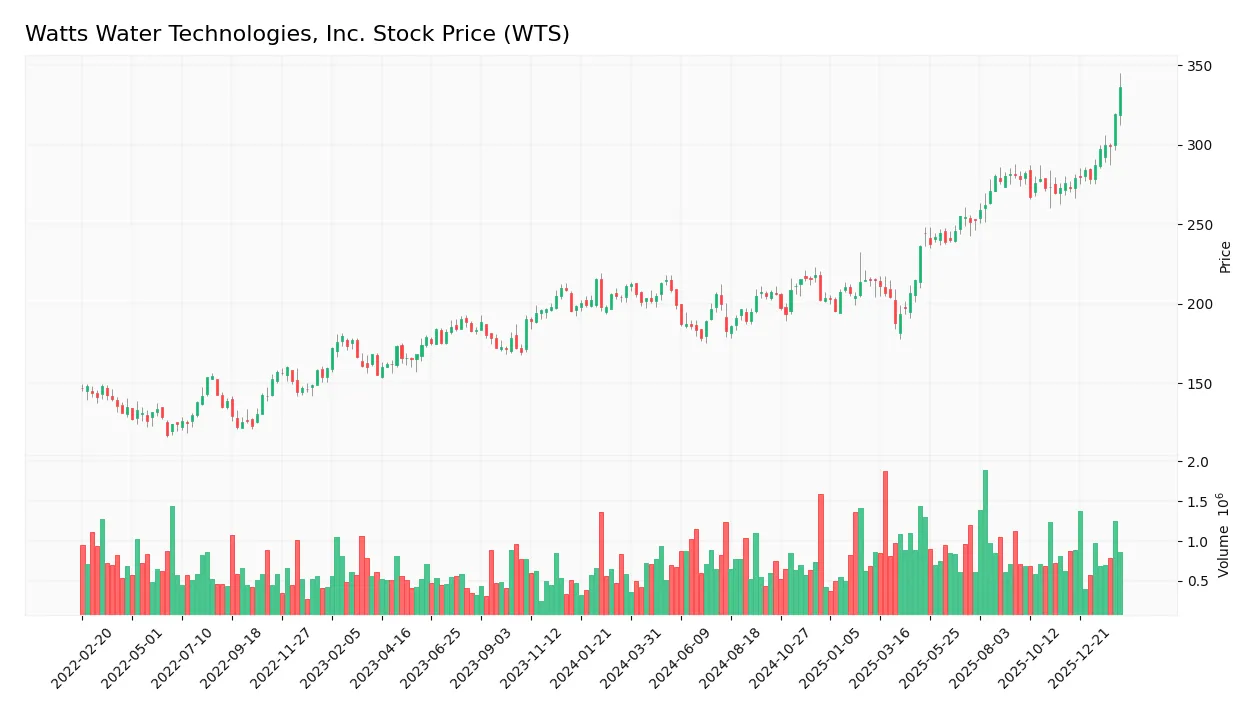

The following weekly chart illustrates Watts Water Technologies, Inc.’s stock price behavior over the past 12 months, highlighting key movements and volatility:

Trend Analysis

Over the past 12 months, WTS’s stock price rose by 59.37%, indicating a bullish trend with clear acceleration. The stock fluctuated between a low of 178.26 and a high of 336.18, reflecting significant volatility with a 37.26 standard deviation.

Volume Analysis

Trading volume increased steadily, totaling 94.5M shares, with buyers accounting for 58.14% overall. Recent activity shows strong buyer dominance at 77.65%, suggesting robust investor confidence and heightened market participation.

Target Prices

Analysts set a clear target consensus for Watts Water Technologies, Inc.

| Target Low | Target High | Consensus |

|---|---|---|

| 275 | 460 | 337 |

The target prices indicate moderate optimism, with analysts expecting a potential upside from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst grades and consumer feedback to provide insights on Watts Water Technologies, Inc. (WTS).

Stock Grades

Here is a summary of recent analyst grades from recognized financial institutions for Watts Water Technologies, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Upgrade | Overweight | 2026-01-21 |

| Keybanc | Maintain | Overweight | 2026-02-12 |

| Barclays | Maintain | Equal Weight | 2025-11-07 |

| Stifel | Upgrade | Buy | 2025-04-16 |

| Stifel | Maintain | Buy | 2025-06-18 |

| Stifel | Maintain | Buy | 2025-07-21 |

| Stifel | Maintain | Buy | 2025-08-08 |

| Stifel | Maintain | Hold | 2025-02-12 |

| Stifel | Maintain | Hold | 2024-12-11 |

| Goldman Sachs | Maintain | Neutral | 2025-02-12 |

The overall trend shows a shift toward positive sentiment, particularly with Keybanc’s upgrade to Overweight and Stifel’s multiple Buy ratings. However, Hold and Neutral ratings persist, reflecting some analyst caution.

Consumer Opinions

Customer sentiment around Watts Water Technologies, Inc. reflects a mix of strong product satisfaction and concerns over service consistency.

| Positive Reviews | Negative Reviews |

|---|---|

| Products are durable and reliable. | Customer service response times are slow. |

| Innovative water management solutions. | Installation instructions can be unclear. |

| Good value for price and energy savings. | Limited availability of replacement parts. |

Overall, consumers praise Watts Water’s product quality and innovation. However, recurring complaints about customer support and part availability could impact brand loyalty if unaddressed.

Risk Analysis

Below is a summary table highlighting key risks to consider when evaluating Watts Water Technologies, Inc.:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Price-to-earnings ratio at 27.13 is high relative to industry norms, signaling potential overvaluation. | Medium | Medium |

| Liquidity Risk | Current and quick ratios are reported as zero, indicating potential short-term liquidity concerns. | High | High |

| Profitability Risk | Return on equity and return on invested capital stand at zero, raising questions about capital efficiency. | Medium | High |

| Interest Coverage | Interest coverage ratio is zero, signaling vulnerability to rising interest rates or debt servicing issues. | Medium | High |

| Dividend Yield | Dividend yield is low at 0.72%, which may disappoint income-focused investors. | Low | Low |

The most pressing risks stem from liquidity and profitability metrics. The zero current and quick ratios flag a red liquidity signal, uncommon for a company of its market cap (11.2B) and beta (1.25). This could pose challenges if market conditions tighten or cash flow deteriorates. Meanwhile, zero returns on equity and invested capital suggest inefficiencies in capital allocation despite favorable net margins near 14%. Watts Water’s strong Altman Z-Score (9.76) implies low bankruptcy risk, but the average Piotroski score of 5 reflects moderate operational strength. Investors should watch liquidity closely while weighing valuation risks in this industrial machinery sector.

Should You Buy Watts Water Technologies, Inc.?

Watts Water Technologies appears to be a profitable company with improving operational efficiency and a manageable leverage profile. While its competitive moat is unclear due to declining ROIC trends, the overall A- rating and strong Altman Z-Score suggest a financially stable profile worth monitoring.

Strength & Efficiency Pillars

Watts Water Technologies, Inc. shows solid operational strength with a robust gross margin of 49.46% and a healthy net margin of 13.98%. The company’s revenue and net income have grown impressively by 34.78% and 105.67% respectively over the period 2021-2025. Despite unavailable ROIC and WACC data, the consistent profitability and average Piotroski score of 5 suggest steady value creation. The Altman Z-Score at 9.76 firmly places Watts in the safe zone, underscoring its financial stability.

Weaknesses and Drawbacks

The company faces valuation challenges, with an elevated P/E ratio of 27.13 signaling a premium valuation that could limit upside. Liquidity also raises concerns; unfavorable current and quick ratios hint at potential short-term cash flow constraints. Additionally, a weak interest coverage ratio points to vulnerability in meeting debt obligations if earnings fluctuate. While debt-to-equity remains favorable, these factors collectively suggest cautious monitoring of leverage and market sentiment is warranted.

Our Final Verdict about Watts Water Technologies, Inc.

Watts Water Technologies presents a fundamentally sound profile backed by strong profitability and a secure solvency position. The bullish long-term stock trend, coupled with dominant buyer activity at 77.65% recently, suggests positive momentum. However, valuation premiums and liquidity concerns advise a measured approach. This profile might appear attractive for long-term exposure but could benefit from patience for a more optimal entry point amid market fluctuations.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Why Are Watts Water Technologies (WTS) Shares Soaring Today – Yahoo Finance (Feb 12, 2026)

- ProShare Advisors LLC Has $7.83 Million Holdings in Watts Water Technologies, Inc. $WTS – MarketBeat (Feb 12, 2026)

- Watts Water Technologies, Inc. Seeks Acquisitions – marketscreener.com (Feb 12, 2026)

- Quarterly payout from Watts Water: 52 cents a share in March – Stock Titan (Feb 09, 2026)

- Watts Water Technologies Reports Record Fourth Quarter and Full Year 2025 Results – TradingView (Feb 11, 2026)

For more information about Watts Water Technologies, Inc., please visit the official website: watts.com