Home > Analyses > Healthcare > Waters Corporation

Waters Corporation drives innovation at the heart of scientific discovery and healthcare. It pioneers precision measurement with industry-leading liquid chromatography and mass spectrometry systems. Trusted worldwide, Waters empowers breakthroughs in drug development, environmental safety, and material science. Its blend of cutting-edge technology and robust service sets a high bar in diagnostics and research. The key question remains: do Waters’ fundamentals justify its premium market valuation and growth prospects in 2026?

Table of contents

Business Model & Company Overview

Waters Corporation, founded in 1958 and headquartered in Milford, Massachusetts, dominates the Medical – Diagnostics & Research sector. It delivers a cohesive ecosystem of high and ultra-performance liquid chromatography and mass spectrometry systems. These tools support drug discovery, clinical trials, and environmental testing, forming the backbone of its core mission to advance analytical science worldwide.

The company’s revenue engine balances instrument sales with consumables and post-warranty service plans, creating a recurring revenue stream. Its footprint spans Asia, the Americas, and Europe, serving pharmaceuticals, life sciences, and industrial markets. Waters’ competitive advantage lies in its integrated product and software solutions, which create significant barriers to entry and position it as a key innovator shaping the future of analytical measurement.

Financial Performance & Fundamental Metrics

I will analyze Waters Corporation’s income statement, key financial ratios, and dividend payout policy to assess its financial health and shareholder value.

Income Statement

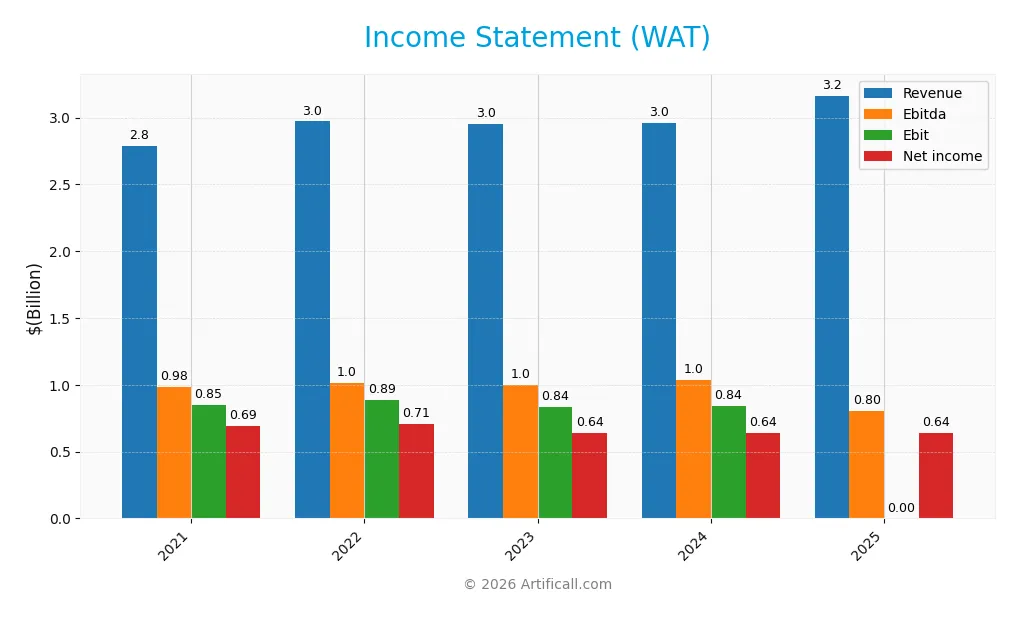

The table below presents Waters Corporation’s key income statement figures for fiscal years 2021 to 2025, reflecting revenue, expenses, and profitability metrics in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 2.79B | 2.97B | 2.96B | 2.96B | 3.17B |

| Cost of Revenue | 1.16B | 1.25B | 1.20B | 1.20B | 1.29B |

| Operating Expenses | 808M | 850M | 944M | 932M | 1.03B |

| Gross Profit | 1.63B | 1.72B | 1.76B | 1.76B | 1.88B |

| EBITDA | 983M | 1.02B | 1.00B | 1.04B | 803M |

| EBIT | 851M | 887M | 835M | 845M | N/A |

| Interest Expense | 45M | 49M | 99M | 90M | 51M |

| Net Income | 693M | 708M | 642M | 638M | 643M |

| EPS | 11.25 | 11.80 | 10.87 | 10.75 | 10.80 |

| Filing Date | 2022-02-24 | 2023-02-27 | 2024-02-27 | 2025-02-25 | 2026-02-09 |

Income Statement Evolution

Waters Corporation’s revenue increased by 7.0% in 2025, maintaining a steady growth trend of 13.6% over five years. Gross profit rose 6.7% last year, supporting a solid gross margin near 59%. However, net income declined by 7.3% over the period, and net margin contracted by over 18%, reflecting margin pressures despite revenue gains.

Is the Income Statement Favorable?

In 2025, Waters reported a 20.3% net margin, which remains favorable relative to industry norms. Yet, the EBIT margin fell to zero, signaling operating income challenges. Interest expense is well controlled at 1.6% of revenue. Overall, the income statement shows mixed fundamentals with solid revenue growth but weakening profitability and operating efficiency.

Financial Ratios

The table below summarizes key financial ratios for Waters Corporation (WAT) over the last five fiscal years, providing insight into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 24.87% | 23.81% | 21.72% | 21.56% | 20.30% |

| ROE | 188.50% | 140.29% | 55.83% | 34.88% | 0 |

| ROIC | 28.91% | 28.68% | 18.22% | 18.43% | 0 |

| P/E | 33.11 | 29.03 | 30.28 | 34.51 | 35.17 |

| P/B | 62.42 | 40.73 | 16.91 | 12.04 | 0 |

| Current Ratio | 2.39 | 2.24 | 2.22 | 2.11 | 0 |

| Quick Ratio | 1.87 | 1.66 | 1.57 | 1.51 | 0 |

| D/E | 4.36 | 3.30 | 2.12 | 0.93 | 0 |

| Debt-to-Assets | 51.74% | 50.69% | 52.78% | 37.38% | 0 |

| Interest Coverage | 18.29 | 17.90 | 8.27 | 9.21 | -15.81 |

| Asset Turnover | 0.90 | 0.91 | 0.64 | 0.65 | 0 |

| Fixed Asset Turnover | 4.40 | 4.44 | 4.09 | 4.08 | 0 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Waters Corporation’s Return on Equity (ROE) and Current Ratio have shown a declining trend, reaching zero in 2025, indicating weakening profitability and liquidity. The Debt-to-Equity Ratio dropped to zero in 2025 from a high of 4.36 in 2021, signaling a significant reduction or absence of reported debt. Profitability margins remained relatively stable until 2024 but declined notably in 2025.

Are the Financial Ratios Favorable?

The 2025 ratios present a challenging picture: net margin is favorable at 20.3%, but ROE, ROIC, and liquidity ratios (current and quick) are unfavorable or unavailable. Debt-related ratios appear favorable due to zero values, possibly reflecting no leverage. Market valuation metrics like P/E at 35.17 are unfavorable, and interest coverage is negative, highlighting financial stress. Overall, the ratios lean toward unfavorable in 2025.

Shareholder Return Policy

Waters Corporation does not pay dividends, reflecting a strategy likely focused on reinvestment or growth. The company maintains free cash flow, with no dividend payout, and does not disclose share buyback activity in the data provided.

This approach suggests prioritizing capital allocation toward operational needs or expansion rather than direct shareholder distributions. Such a policy may support sustainable long-term value creation if aligned with effective growth investments and financial discipline.

Score analysis

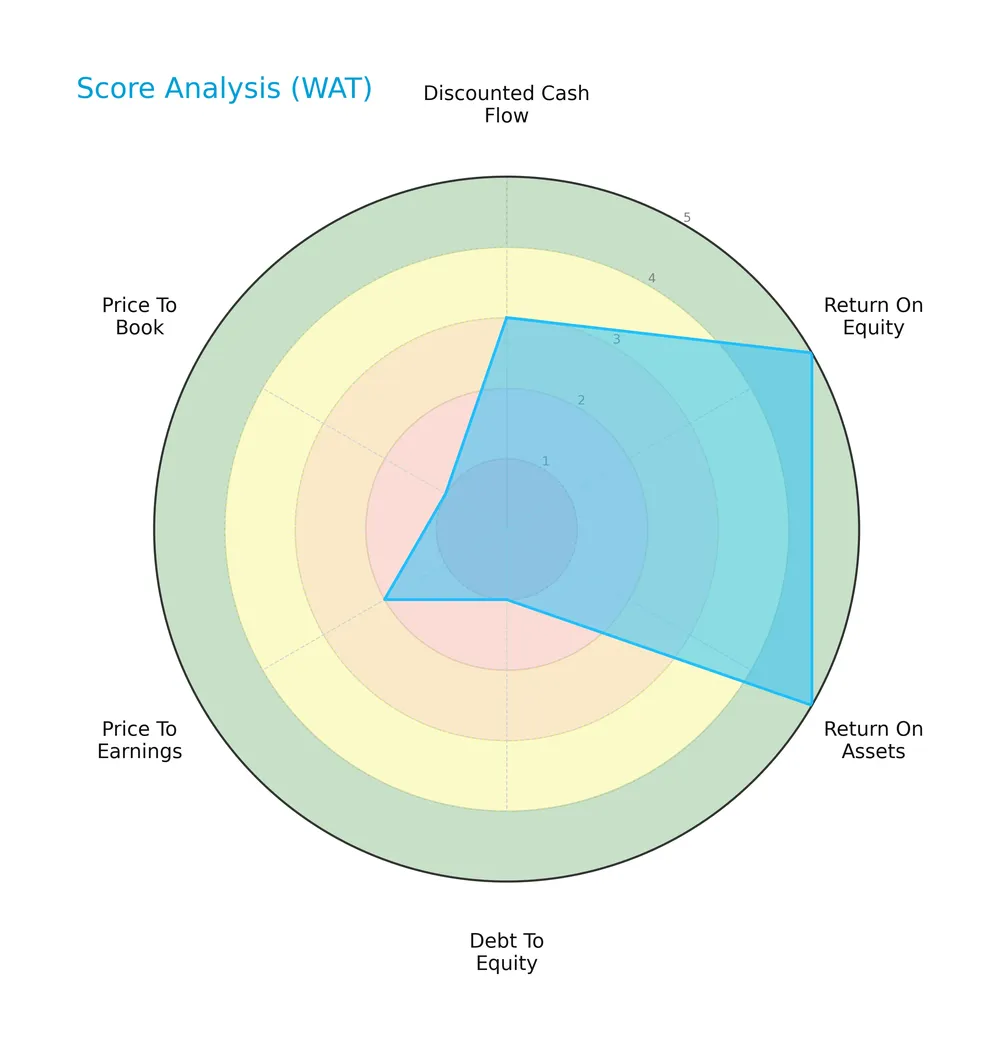

Here is a radar chart summarizing key financial scores for Waters Corporation:

Waters shows very strong profitability with top scores in ROE and ROA. However, its debt-to-equity, P/E, and P/B ratios score poorly, signaling leverage and valuation concerns amid moderate DCF results.

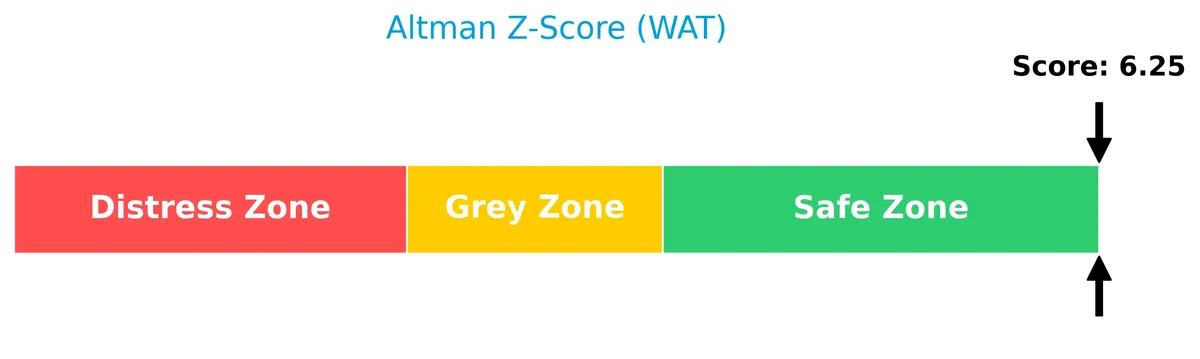

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Waters well within the safe zone, indicating a low risk of financial distress and bankruptcy:

Is the company in good financial health?

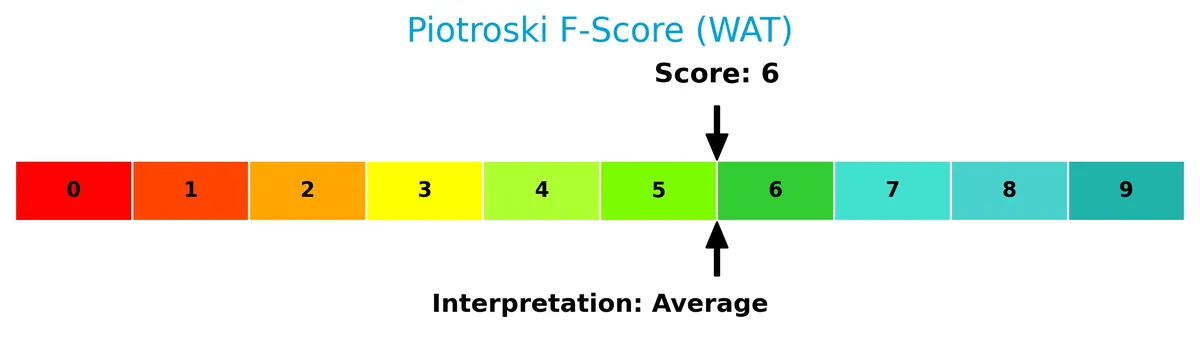

The Piotroski Score diagram illustrates Waters’ financial strength based on nine key criteria:

With a score of 6, Waters demonstrates average financial health, reflecting solid but not exceptional operational and balance sheet fundamentals.

Competitive Landscape & Sector Positioning

This section analyzes Waters Corporation’s strategic positioning, revenue segments, key products, and main competitors. I will evaluate whether Waters holds a competitive advantage over its peers in the medical diagnostics and research sector.

Strategic Positioning

Waters Corporation maintains a diversified product portfolio across two segments: Waters and TA, with significant sales in instrument systems and services. Geographically, it balances revenue across Americas (1.12B), Asia Pacific (970M), and Europe (873M), reflecting broad international exposure in medical diagnostics and research.

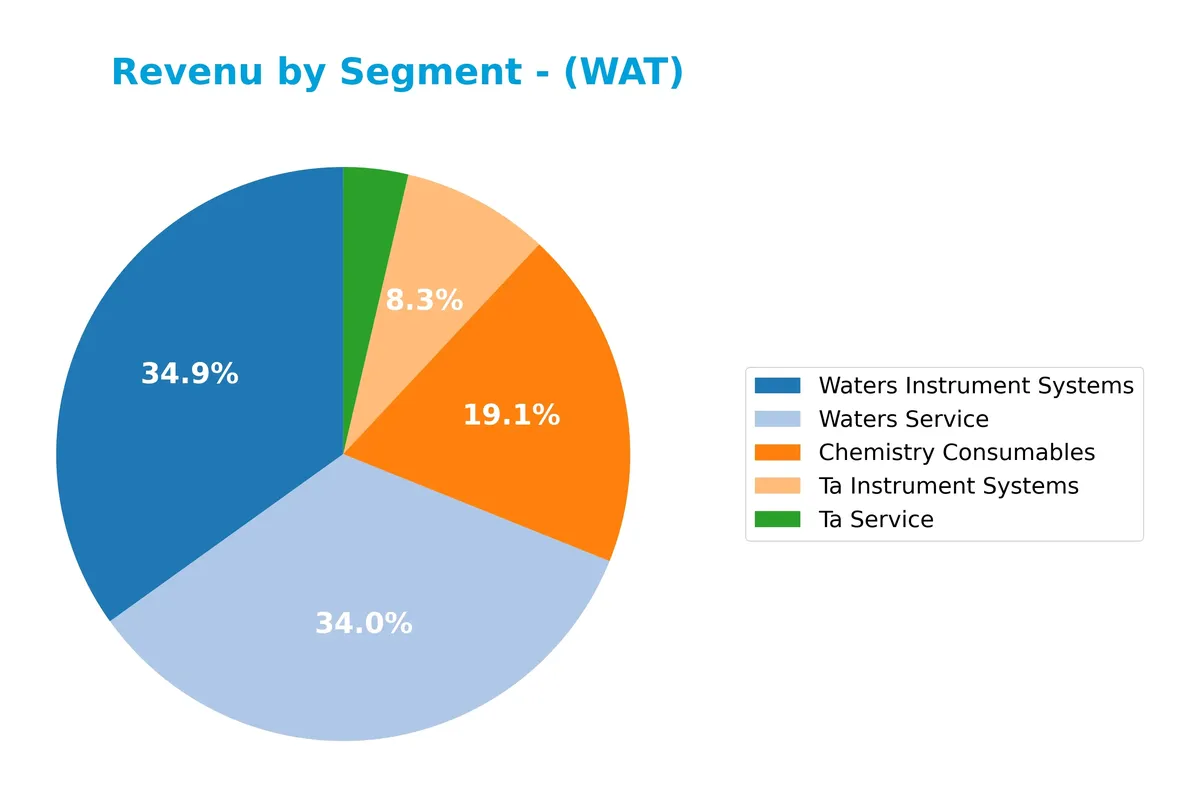

Revenue by Segment

The pie chart illustrates Waters Corporation’s revenue distribution by product segment for the fiscal year 2024. It highlights the relative size and contribution of each segment to total sales.

Waters Instrument Systems leads the portfolio with $1.03B in revenue, closely followed by Waters Service at $1.01B. Chemistry Consumables holds a solid $565M position, while Ta Instrument Systems and Ta Service contribute $246M and $108M, respectively. The 2024 figures show a slight slowdown in Waters Instrument Systems compared to prior years, while service segments demonstrate steady growth, indicating increasing reliance on recurring revenue streams.

Key Products & Brands

This table outlines Waters Corporation’s primary products and brands along with their key descriptions:

| Product | Description |

|---|---|

| Waters Instrument Systems | High and ultra-performance liquid chromatography and mass spectrometry (MS) technology systems used in drug discovery and analysis. |

| Waters Service | Post-warranty service plans and support products for Waters’ instrumentation. |

| TA Instrument Systems | Thermal analysis, rheometry, and calorimetry instruments for industrial and life science research applications. |

| TA Service | Service and support for TA instrument systems. |

| Chemistry Consumables | Chromatography columns and other consumable products interfacing with Waters and third-party instruments. |

Waters Corporation’s product portfolio centers on advanced analytical instruments and consumables. Their offerings support pharmaceutical, environmental, and industrial research with a balanced mix of system sales and recurring service revenues.

Main Competitors

There are 11 competitors in total. The table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Thermo Fisher Scientific Inc. | 225B |

| Danaher Corporation | 165B |

| IDEXX Laboratories, Inc. | 53.5B |

| Agilent Technologies, Inc. | 39.1B |

| IQVIA Holdings Inc. | 38.4B |

| Mettler-Toledo International Inc. | 28.8B |

| Waters Corporation | 22.7B |

| Quest Diagnostics Incorporated | 19.4B |

| Revvity, Inc. | 11.6B |

| Charles River Laboratories International, Inc. | 10.0B |

Waters Corporation ranks 7th among its peers in the Medical – Diagnostics & Research industry. Its market cap stands at 8.67% of the sector leader, Thermo Fisher Scientific. Waters is positioned below both the average market cap of the top 10 competitors (61.3B) and the sector median (28.8B). The company enjoys a 48% market cap premium over its closest rival above, highlighting a moderate gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does WAT have a competitive advantage?

Waters Corporation operates in specialized analytical workflow solutions with a broad geographic presence and strong gross margins near 60%. However, declining ROIC trends and an unfavorable EBIT margin suggest challenges in sustaining a competitive moat.

Looking ahead, Waters targets growth through expanding its product offerings in chromatography and mass spectrometry, alongside software integration and service plans. These areas present opportunities in drug discovery, environmental testing, and industrial applications across Asia, the Americas, and Europe.

SWOT Analysis

This analysis highlights Waters Corporation’s core strategic factors to guide investment decisions.

Strengths

- strong market position in medical diagnostics

- diversified geographic revenue

- favorable gross and net margins

Weaknesses

- declining ROIC trend

- unfavorable EBIT margin

- weak liquidity ratios

Opportunities

- growth in Asia-Pacific healthcare market

- innovation in chromatography and mass spectrometry

- expanding service and software offerings

Threats

- rising operational expenses

- competitive pressure in analytical instruments

- regulatory and reimbursement risks

Waters Corporation leverages robust market presence and margins but faces operational challenges and declining returns on capital. Strategic focus on innovation and geographic expansion is critical to offset margin pressures and competitive threats.

Stock Price Action Analysis

The weekly stock chart displays Waters Corporation’s price movement over the last 12 months, highlighting key highs and lows:

Trend Analysis

Over the past 12 months, WAT’s stock price declined by 5.84%, indicating a bearish trend. The trend shows deceleration despite a high volatility level of 34.1. The stock reached a high of 415.48 and dropped to a low of 281.2, reflecting significant price swings.

Volume Analysis

Trading volume has been increasing overall, with buyers accounting for 53.47% of total volume, suggesting buyer-driven activity. However, in the recent three months, sellers dominated with only 34.3% buyer volume, indicating a shift toward selling pressure and cautious investor sentiment.

Target Prices

Analysts set a robust target consensus for Waters Corporation, reflecting confidence in its growth prospects.

| Target Low | Target High | Consensus |

|---|---|---|

| 363 | 480 | 410.13 |

The target range indicates bullish sentiment, with analysts expecting the stock to appreciate significantly from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback to evaluate Waters Corporation’s market perception.

Stock Grades

Here are the latest verified grades from leading financial institutions for Waters Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-02-10 |

| Guggenheim | Maintain | Buy | 2026-02-10 |

| B of A Securities | Maintain | Neutral | 2026-02-10 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-15 |

| Wolfe Research | Upgrade | Outperform | 2025-12-10 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| JP Morgan | Maintain | Neutral | 2025-10-09 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-05 |

| Deutsche Bank | Maintain | Hold | 2025-08-05 |

Grades show a prevailing cautious stance, with most firms maintaining neutral or hold ratings. Wolfe Research’s upgrade to outperform stands out as a notable exception.

Consumer Opinions

Consumer sentiment around Waters Corporation reflects a blend of admiration for product quality and concerns about customer service responsiveness.

| Positive Reviews | Negative Reviews |

|---|---|

| High accuracy and reliability of instruments | Slow customer support response times |

| Innovative technology that improves lab efficiency | Complex software interface for beginners |

| Durable equipment with long lifespan | Expensive maintenance and repair costs |

Overall, consumers praise Waters Corporation for its cutting-edge, reliable lab instruments. However, recurring complaints about customer support delays and software complexity suggest areas needing improvement.

Risk Analysis

Below is a summary table outlining key risks facing Waters Corporation along with their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | Elevated P/E ratio of 35.17 suggests stretched valuation compared to sector benchmarks. | Medium | High |

| Liquidity | Current and quick ratios are reported as zero, indicating potential short-term liquidity risk. | High | Medium |

| Profitability | Zero ROE and ROIC highlight concerns about capital efficiency and returns on invested capital. | Medium | High |

| Debt Management | Favorable debt-to-equity ratio but very unfavorable debt scores indicate possible leverage issues. | Low | Medium |

| Interest Coverage | Negative interest coverage exposes risk in servicing debt during downturns. | Medium | High |

| Operational Risks | Asset turnover metrics at zero point to inefficiencies in asset utilization. | Medium | Medium |

| Dividend Policy | No dividends paid, which may deter income-focused investors. | Low | Low |

The most pressing risks are liquidity shortfalls and poor profitability metrics. Waters’ zero current and quick ratios may signal cash flow constraints. Additionally, its elevated P/E ratio raises concerns about valuation risk amid economic shifts. Despite a strong Altman Z-Score placing it in the safe zone, investors should monitor operational efficiency and debt servicing capabilities closely.

Should You Buy Waters Corporation?

Waters Corporation appears to be a profitable entity with robust value creation and operational efficiency. Despite a declining ROIC trend suggesting an eroding moat, its manageable leverage profile supports a solid rating of B, indicating a moderate investment profile worth monitoring.

Strength & Efficiency Pillars

Waters Corporation operates with a solid gross margin of 59.28% and maintains a favorable net margin of 20.3%, underscoring its operational efficiency. Despite a lack of available ROIC data, the Altman Z-Score of 6.25 places the company safely away from bankruptcy risk, reinforcing financial stability. Return on equity, however, is reported as zero, signaling caution in shareholder returns. Overall, Waters demonstrates strong profitability but leaves value creation undetermined due to unavailable WACC and ROIC metrics.

Weaknesses and Drawbacks

Waters Corporation faces significant valuation and leverage challenges. Its price-to-earnings ratio is elevated at 35.17, indicating a premium that may not justify current earnings. The company’s price-to-book ratio is unavailable but marked as favorable, which requires further scrutiny. Liquidity ratios such as current and quick ratios are absent and flagged unfavorable, raising concerns over short-term solvency. Additionally, interest coverage is negative, suggesting difficulty in meeting debt obligations. Recent market trends show a seller-dominant environment with only 34.3% buyer volume, amplifying near-term pressure.

Our Final Verdict about Waters Corporation

Waters Corporation presents a mixed profile. The strong Altman Z-Score of 6.25 confirms low bankruptcy risk, supporting a fundamentally safe investment base. However, bearish price trends and recent seller dominance suggest caution. Despite operational strength, the premium valuation and weak liquidity metrics might warrant a wait-and-see approach for a more favorable entry point. This profile might appeal to investors seeking long-term exposure but requires vigilance given current market dynamics.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- BD Completes Combination of Biosciences & Diagnostic Solutions Business with Waters Corporation – Becton Dickinson (Feb 09, 2026)

- Waters Corporation (WAT) Shares Fall 14.5% Following FY2026 Guidance Despite Q4 Beat – AlphaStreet News – (Feb 10, 2026)

- The Measurement Giant Reimagined: A Deep Dive into Waters Corporation (WAT) in 2026 – FinancialContent (Feb 10, 2026)

- Waters Corporation (WAT): Guggenheim Reiterates ‘Buy’ Rating wit – GuruFocus (Feb 10, 2026)

- Waters stock drops more than 10% on deal-close day as newly acquired BD business arrives softer than modeled – R&D World (Feb 09, 2026)

For more information about Waters Corporation, please visit the official website: waters.com