Home > Analyses > Communication Services > Warner Bros. Discovery, Inc.

Warner Bros. Discovery, Inc. captivates global audiences by bringing some of the most beloved franchises and iconic content to life across film, television, and streaming platforms. As a dominant force in entertainment, it commands an impressive portfolio including HBO, DC, and Warner Bros. Games, blending innovation with deep-rooted storytelling excellence. With evolving consumer habits and fierce competition in streaming, I explore whether Warner Bros. Discovery’s current fundamentals support its market valuation and future growth ambitions.

Table of contents

Business Model & Company Overview

Warner Bros. Discovery, Inc., founded in 2008 and headquartered in New York City, stands as a dominant force in the global entertainment industry. Its ecosystem integrates studios, networks, and direct-to-consumer platforms, delivering a diverse portfolio of content that spans film, television, streaming, and gaming. This core mission unites iconic brands like HBO, DC, and Warner Bros. Games under one roof, creating a powerful media and entertainment conglomerate.

The company’s revenue engine balances content creation with distribution, leveraging studios for theatrical releases and licensing, networks for broad television reach, and direct-to-consumer services for premium streaming. Its strategic presence across the Americas, Europe, and Asia supports a multi-platform approach that fuels recurring subscription income alongside traditional advertising. This multi-faceted model cultivates a robust economic moat, positioning Warner Bros. Discovery as a key architect in shaping the future of global entertainment.

Financial Performance & Fundamental Metrics

In this section, I analyze Warner Bros. Discovery, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its underlying financial health.

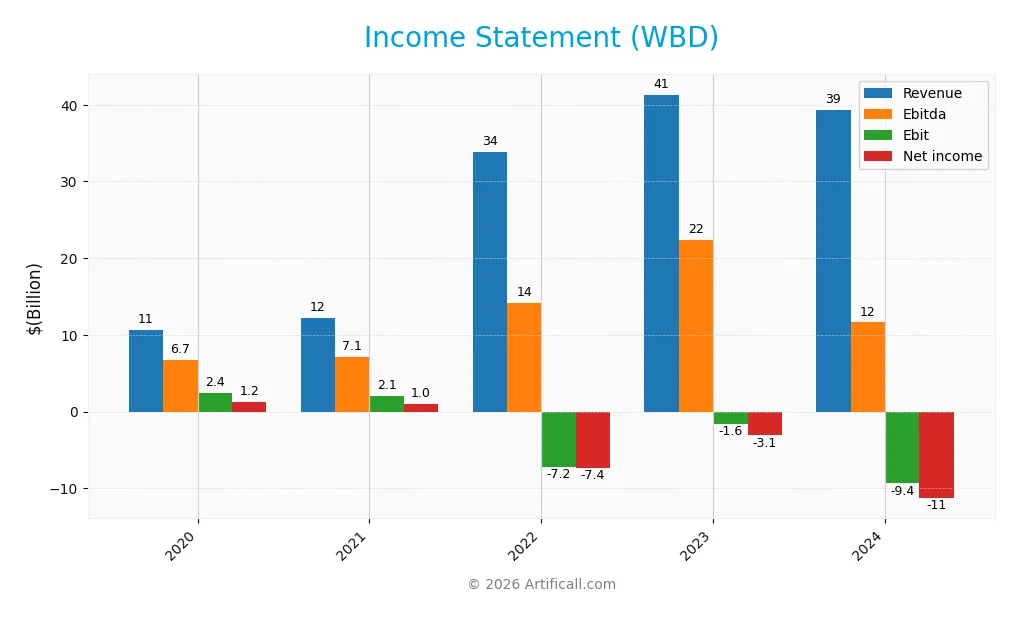

Income Statement

The table below summarizes Warner Bros. Discovery, Inc.’s key income statement figures for the fiscal years 2020 through 2024, providing insight into its revenue, expenses, and profitability trends.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 10.7B | 12.2B | 33.8B | 41.3B | 39.3B |

| Cost of Revenue | 3.9B | 4.6B | 20.4B | 24.5B | 23.0B |

| Operating Expenses | 4.3B | 5.6B | 20.7B | 18.3B | 26.4B |

| Gross Profit | 6.8B | 7.6B | 13.4B | 16.8B | 16.4B |

| EBITDA | 6.7B | 7.1B | 14.2B | 22.4B | 11.6B |

| EBIT | 2.4B | 2.1B | -7.2B | -1.6B | -9.4B |

| Interest Expense | 692M | 633M | 1.8B | 2.2B | 2.0B |

| Net Income | 1.2B | 1.0B | -7.4B | -3.1B | -11.3B |

| EPS | 1.82 | 1.55 | -3.82 | -1.28 | -4.62 |

| Filing Date | 2021-02-22 | 2022-02-24 | 2023-02-24 | 2024-02-23 | 2025-02-27 |

Income Statement Evolution

From 2020 to 2024, Warner Bros. Discovery’s revenue showed overall growth of 268%, but declined by nearly 5% in the last year. Gross profit followed a similar pattern, with a slight decrease of 2.6% recently. Margins deteriorated notably: the gross margin remains relatively favorable at 41.6%, but EBIT and net margins worsened significantly, reflecting rising costs and expenses.

Is the Income Statement Favorable?

The 2024 income statement reveals a challenging profitability profile with an EBIT margin of -23.8% and a net margin of -28.8%, both considered unfavorable. Interest expenses are neutral at about 5.1% of revenue, but net income declined sharply by over 1000% across the period, driven by higher operating expenses and depreciation. Overall, fundamental profitability metrics suggest an unfavorable financial position for the company.

Financial Ratios

The table below presents key financial ratios for Warner Bros. Discovery, Inc. (WBD) over the fiscal years 2020 to 2024, offering a snapshot of profitability, liquidity, leverage, and market valuation:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 11% | 8% | -22% | -8% | -29% |

| ROE | 12% | 9% | -16% | -7% | -33% |

| ROIC | 6% | 5% | -5% | -1% | -11% |

| P/E | 12.6 | 11.9 | -2.5 | -8.9 | -2.3 |

| P/B | 1.47 | 1.03 | 0.39 | 0.61 | 0.76 |

| Current Ratio | 1.99 | 2.10 | 0.93 | 0.93 | 0.89 |

| Quick Ratio | 1.99 | 2.10 | 0.93 | 0.93 | 0.89 |

| D/E | 1.47 | 1.27 | 1.04 | 0.97 | 1.16 |

| Debt-to-Assets | 45% | 43% | 37% | 36% | 38% |

| Interest Coverage | 3.63 | 3.18 | -4.15 | -0.70 | -4.97 |

| Asset Turnover | 0.31 | 0.35 | 0.25 | 0.34 | 0.38 |

| Fixed Asset Turnover | 8.85 | 9.13 | 6.38 | 6.94 | 6.46 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Evolution of Financial Ratios

Warner Bros. Discovery’s Return on Equity (ROE) declined sharply from positive territory in 2020 and 2021 to -33.23% in 2024, signaling deteriorating profitability. The Current Ratio trended downward from 2.10 in 2021 to 0.89 in 2024, indicating weakening liquidity. The Debt-to-Equity Ratio remained elevated, increasing slightly to 1.16 in 2024, suggesting sustained leverage levels.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (-28.77%) and ROE (-33.23%) were unfavorable, reflecting operational challenges. Liquidity is weak with a current ratio of 0.89, while the quick ratio is neutral at the same level. Leverage remains high with a debt-to-equity ratio of 1.16, which is unfavorable. Market valuation metrics like price-to-earnings (PE) at -2.29 and price-to-book (PB) at 0.76 are favorable. Overall, most ratios reflect an unfavorable financial position.

Shareholder Return Policy

Warner Bros. Discovery, Inc. has not paid dividends in recent years, reflecting its negative net income and possible focus on reinvestment or restructuring. Despite no dividend payouts, the company does not currently engage in share buybacks either, which limits direct cash returns to shareholders.

This approach may align with a strategy prioritizing operational recovery and long-term value creation, though the absence of distributions and buybacks requires careful monitoring. The sustainability of shareholder value depends on future profitability improvements and capital allocation decisions.

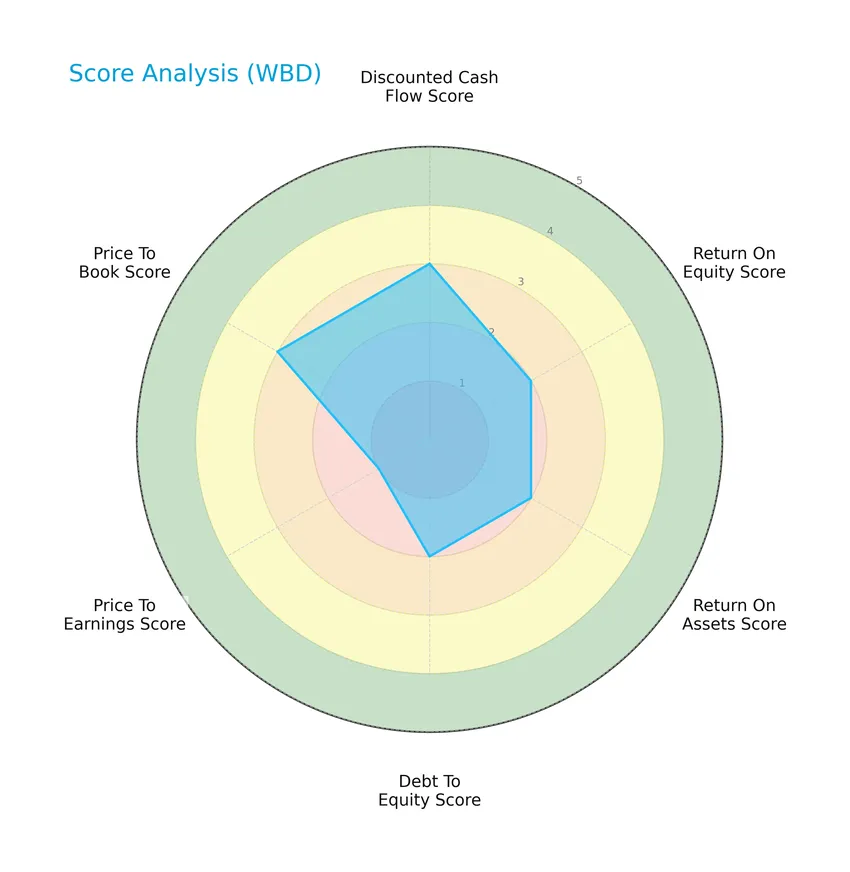

Score analysis

Here is a radar chart summarizing the key financial scores for Warner Bros. Discovery, Inc.:

The company shows moderate scores for discounted cash flow, return on equity, return on assets, debt to equity, and price to book ratios, while the price to earnings score is very unfavorable, reflecting some valuation concerns.

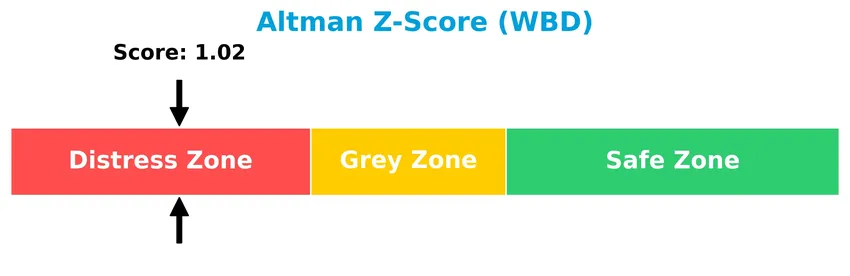

Analysis of the company’s bankruptcy risk

Warner Bros. Discovery, Inc. is currently positioned in the distress zone based on its Altman Z-Score, indicating a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

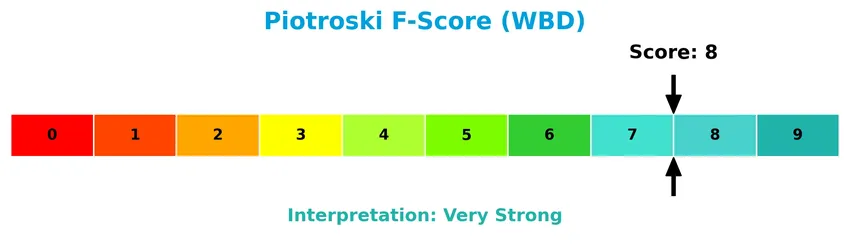

The Piotroski Score diagram offers insight into Warner Bros. Discovery, Inc.’s financial strength and operational efficiency:

With a very strong Piotroski Score of 8, the company demonstrates robust financial health, suggesting solid profitability, liquidity, and operational efficiency despite some valuation and bankruptcy risk concerns.

Competitive Landscape & Sector Positioning

This sector analysis will explore Warner Bros. Discovery, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT elements. I will assess whether the company holds a competitive advantage over its industry peers.

Strategic Positioning

Warner Bros. Discovery, Inc. maintains a diversified product portfolio across Studios, Network, and DTC segments, generating revenues from advertising, distribution, and content licensing. Geographically, it has a strong US presence with $26.4B revenue in 2024, complemented by $12.9B from non-US markets.

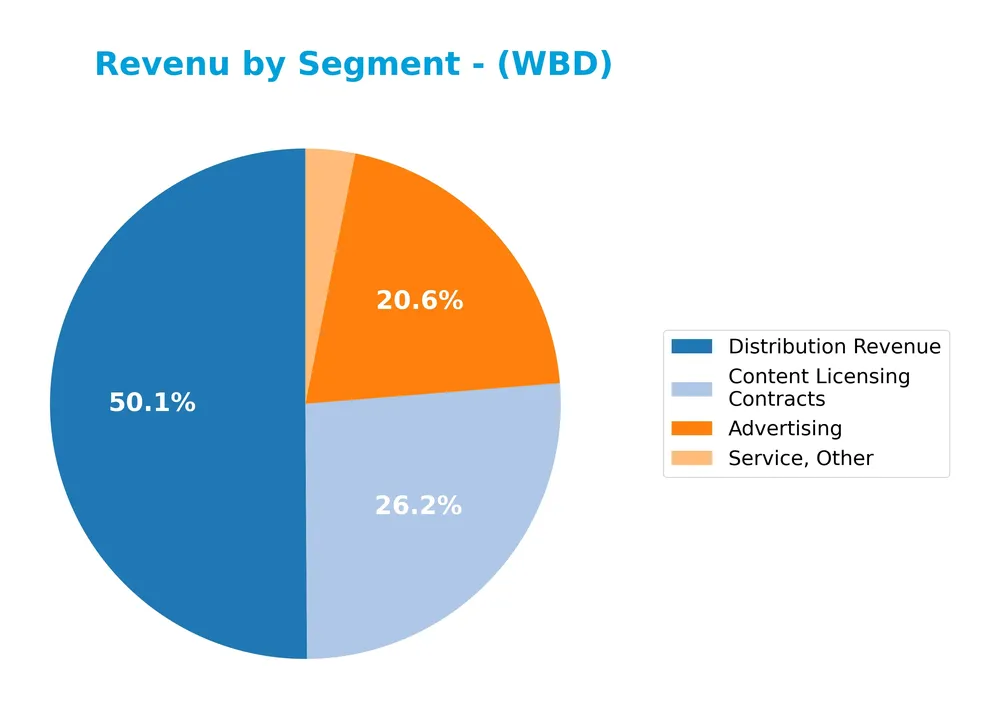

Revenue by Segment

This pie chart illustrates Warner Bros. Discovery, Inc.’s revenue distribution by segment for the fiscal year 2024. It highlights key sources of income across its business lines.

In 2024, Distribution Revenue led the business with $19.7B, followed by Advertising at $8.1B and Content Licensing Contracts at $10.3B. The Service, Other segment contributed $1.2B, showing steady but smaller scale revenue. Compared to prior years, Distribution Revenue remains the dominant segment, while Advertising and Content Licensing have slightly contracted, signaling a potential shift or concentration risk towards distribution channels.

Key Products & Brands

Below is a summary of Warner Bros. Discovery, Inc.’s key products and brands contributing to its revenue streams:

| Product | Description |

|---|---|

| Advertising | Revenue generated from advertising sales across Warner Bros. Discovery’s media properties. |

| Distribution Revenue | Income from distributing films, TV programs, and related content to third parties and internal networks. |

| Content Licensing Contracts | Revenue from licensing content to networks, third parties, and streaming services. |

| Service, Other | Miscellaneous service revenues including streaming, home entertainment, and interactive gaming. |

| Warner Bros. Motion Picture Group | Produces and releases feature films for theaters and other platforms. |

| Warner Bros. Television Group | Produces and licenses television programs for networks and third parties. |

| DC | Brand encompassing superhero franchises like Batman, Superman, and Wonder Woman. |

| HBO, HBO Max, Max | Premium pay-TV and streaming services offering original and licensed content. |

| Discovery Channel, discovery+ | Television networks and streaming services focusing on factual and lifestyle content. |

| CNN | International news network. |

| HGTV, Food Network, TLC, OWN | Lifestyle and entertainment television networks. |

| TNT Sports, TBS | Sports and general entertainment television networks. |

| Warner Bros. Games | Interactive gaming division producing content related to key franchises. |

| Franchises | Includes Harry Potter, Game of Thrones, The Lord of the Rings, Looney Tunes, Hanna-Barbera. |

Warner Bros. Discovery’s revenue derives from diversified media content, including film production, television networks, streaming services, and licensing of iconic brands and franchises across entertainment and gaming sectors.

Main Competitors

There are 8 competitors in total within the Entertainment industry; below is a table of the top 8 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Netflix, Inc. | 385.5B |

| Warner Bros. Discovery, Inc. | 70.6B |

| Live Nation Entertainment, Inc. | 33.7B |

| Fox Corporation | 33.3B |

| TKO Group Holdings, Inc. | 16.9B |

| News Corporation | 16.6B |

| News Corporation | 14.8B |

| Paramount Skydance Corporation Class B Common Stock | 14.1B |

Warner Bros. Discovery ranks 2nd among its 8 competitors, with a market cap approximately 18.4% of the leader, Netflix. It is positioned below the average market cap of the top 10 competitors (73.2B) but above the median market cap for the sector (25.1B). The company shows a significant gap of +444.2% to the next competitor above, indicating a strong but distant second position.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does WBD have a competitive advantage?

Warner Bros. Discovery, Inc. does not currently present a competitive advantage, as indicated by its very unfavorable moat status, declining ROIC trend, and consistent value destruction with ROIC far below its WACC. The company’s profitability metrics, including unfavorable EBIT and net margins, further reflect challenges in efficient capital use.

Looking ahead, Warner Bros. Discovery’s extensive portfolio of content and brands across film, television, streaming, and gaming offers potential growth opportunities in expanding direct-to-consumer services and international markets, despite recent revenue declines and profitability pressures.

SWOT Analysis

This SWOT analysis highlights Warner Bros. Discovery, Inc.’s key internal and external factors to inform strategic investment decisions.

Strengths

- Strong global content portfolio

- Leading streaming platforms HBO Max and discovery+

- Diverse revenue streams across studios, networks, and DTC

Weaknesses

- Negative net and EBIT margins

- Declining profitability and revenue recently

- High debt levels and weak liquidity ratios

Opportunities

- Expansion in international markets

- Growth in streaming and digital content demand

- Leveraging franchises for new content and gaming

Threats

- Intense competition in streaming and media

- Rapid technological change disrupting media consumption

- Economic downturns impacting advertising and subscriber growth

Warner Bros. Discovery benefits from a powerful brand and diverse media assets but faces profitability challenges and high leverage. The company’s strategy should focus on operational efficiency, debt reduction, and capitalizing on global streaming growth while managing competitive and economic risks carefully.

Stock Price Action Analysis

The following weekly stock chart illustrates Warner Bros. Discovery, Inc.’s price movements over the past 100 weeks, highlighting key fluctuations and trend developments:

Trend Analysis

Over the past 100 weeks, WBD’s stock price increased by 229.64%, indicating a bullish trend with clear acceleration. The price ranged from a low of 7.03 to a high of 29.98, supported by a volatility measure of 6.23. Recent price action over the last 12 weeks shows a 26.07% gain with a moderate slope of 0.64 and lower volatility at 2.6.

Volume Analysis

Trading volume has been increasing, with a total of 21.5B shares traded, and buyers accounting for 60.4% of activity overall. In the recent 12-week period, buyer dominance strengthened to 74.44%, reflecting strongly buyer-driven market participation and suggesting growing investor confidence and engagement.

Target Prices

Analysts present a clear target consensus for Warner Bros. Discovery, Inc. (WBD).

| Target High | Target Low | Consensus |

|---|---|---|

| 32 | 16 | 25.5 |

The target prices suggest moderate upside potential with a consensus around 25.5, reflecting cautious optimism among analysts for WBD’s future performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to Warner Bros. Discovery, Inc. (WBD).

Stock Grades

The latest verified grades for Warner Bros. Discovery, Inc. reflect mixed views from several reputable analysts as follows:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2026-01-15 |

| Guggenheim | Maintain | Neutral | 2026-01-14 |

| Seaport Global | Downgrade | Neutral | 2025-12-09 |

| Benchmark | Maintain | Buy | 2025-12-08 |

| Barrington Research | Downgrade | Market Perform | 2025-12-05 |

| Barrington Research | Maintain | Outperform | 2025-11-14 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

| Rothschild & Co | Upgrade | Buy | 2025-10-30 |

| Barrington Research | Maintain | Outperform | 2025-10-28 |

| Argus Research | Upgrade | Buy | 2025-10-28 |

Overall, the grades show a balance between buy and hold ratings, with some recent downgrades and upgrades indicating cautious optimism but no consensus shift. The consensus remains at a hold position among analysts.

Consumer Opinions

Consumers have mixed feelings about Warner Bros. Discovery, Inc., reflecting both appreciation for its diverse content and concerns about recent management changes.

| Positive Reviews | Negative Reviews |

|---|---|

| Rich and diverse entertainment portfolio. | Frequent changes in streaming service plans. |

| High-quality original productions. | Customer support can be slow or unresponsive. |

| Competitive pricing compared to competitors. | Some content availability issues reported. |

Overall, consumers value Warner Bros. Discovery’s vast content library and production quality, but recurring complaints focus on service consistency and customer support responsiveness.

Risk Analysis

Below is a concise overview of key risks facing Warner Bros. Discovery, Inc., highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative net margin (-28.77%) and ROE (-33.23%) indicate ongoing profitability challenges. | High | High |

| Liquidity Risk | Current ratio at 0.89 suggests limited short-term liquidity, potentially impacting operations. | Medium | Medium |

| Leverage Risk | Debt-to-equity ratio of 1.16 and interest coverage negative at -4.65 raise concerns over debt load. | High | High |

| Market Volatility | Beta of 1.572 implies stock price is more volatile than the market, increasing investment risk. | High | Medium |

| Dividend Risk | No dividend payouts, which may deter income-focused investors and affect investor sentiment. | Medium | Low |

| Bankruptcy Risk | Altman Z-Score of 1.02 places the company in the distress zone, signaling elevated bankruptcy risk. | Medium | High |

The most pressing risks are financial distress and leverage issues, with the Altman Z-Score indicating a significant risk of bankruptcy. Despite a strong Piotroski Score (8), ongoing losses and weak liquidity warrant caution for investors.

Should You Buy Warner Bros. Discovery, Inc.?

Warner Bros. Discovery appears to be experiencing deteriorating profitability with a very unfavorable competitive moat, as value creation seems to be declining. Despite a substantial leverage profile reflected in a distress zone Altman Z-Score, its Piotroski Score suggests strong financial strength. The overall rating could be seen as C+, indicating moderate risk and cautious operational efficiency.

Strength & Efficiency Pillars

Warner Bros. Discovery, Inc. exhibits pockets of financial resilience, most notably reflected in a very strong Piotroski score of 8, signaling robust operational and financial health. The company maintains a favorable gross margin of 41.58%, evidencing effective cost control on production. Additionally, its price-to-earnings (P/E) ratio of -2.29 and price-to-book (P/B) ratio of 0.76 suggest undervaluation relative to book value. However, the Altman Z-Score at 1.02 places WBD in the distress zone, indicating financial vulnerability. Notably, the return on invested capital (ROIC) of -10.96% falls below the weighted average cost of capital (WACC) at 8.68%, confirming that the company is currently shedding value rather than creating it.

Weaknesses and Drawbacks

The financial outlook for WBD is challenged by significant profitability and liquidity concerns. A negative net margin of -28.77% and return on equity (ROE) of -33.23% highlight ongoing profitability struggles. The company’s leverage is notable, with a debt-to-equity ratio of 1.16 and an interest coverage ratio of -4.65, indicating difficulty servicing debt obligations. Liquidity is constrained, as reflected by a current ratio of 0.89, below the safe threshold of 1.0. Additionally, recent revenue contraction of -4.84% and sustained declines in earnings per share compound near-term risks. These factors collectively signal heightened financial stress and operational inefficiency.

Our Verdict about Warner Bros. Discovery, Inc.

Warner Bros. Discovery, Inc.’s long-term fundamental profile appears unfavorable due to persistent profitability deficits and value destruction. Nevertheless, the bullish overall price trend, supported by strong buyer dominance (74.44%) in the recent period, suggests renewed market interest. Despite this positive technical momentum, the company’s financial fragility and declining returns indicate that investors might consider a wait-and-see approach for a more favorable entry point before committing to long-term exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Netflix and Warner Bros. Discovery Amend Agreement to All-Cash Transaction – Netflix – Overview (Jan 20, 2026)

- Warner Bros. Discovery: Time To Consider An Exit Strategy (Rating Downgrade) (NASDAQ:WBD) – Seeking Alpha (Jan 23, 2026)

- Universal Beteiligungs und Servicegesellschaft mbH Cuts Stake in Warner Bros. Discovery, Inc. $WBD – MarketBeat (Jan 23, 2026)

- Warner Bros. Discovery (WBD) Stock Moves -1.19%: What You Should Know – Yahoo Finance (Jan 20, 2026)

- Netflix, Warner Bros Discovery Amend Agreement To All-Cash Offer: Here’s What WBD Shareholders Will Get – Stocktwits (Jan 22, 2026)

For more information about Warner Bros. Discovery, Inc., please visit the official website: ir.wbd.com