Home > Analyses > Industrials > W.W. Grainger, Inc.

W.W. Grainger, Inc. powers the backbone of countless industries by delivering essential maintenance, repair, and operating supplies. Its vast product range and innovative inventory solutions set a high bar in industrial distribution. With decades of market influence and a reputation for reliability, Grainger shapes how businesses maintain operational efficiency. As the industrial landscape evolves, I ask: does Grainger’s robust foundation still justify its premium valuation and growth outlook?

Table of contents

Business Model & Company Overview

W.W. Grainger, Inc., founded in 1927 and headquartered in Lake Forest, Illinois, dominates the industrial distribution sector. It delivers a comprehensive ecosystem of maintenance, repair, and operating (MRO) products and services, spanning safety supplies, material handling, plumbing, and metalworking tools. This broad portfolio serves businesses, government entities, and institutions with tailored solutions through both personal and digital channels.

The company’s revenue engine balances direct sales with inventory management and technical support services, creating recurring value. It maintains a strategic footprint across the Americas, Europe, and Asia, leveraging its High-Touch Solutions and Endless Assortment segments. Grainger’s entrenched customer relationships and integrated service model form a robust economic moat, shaping the future of industrial supply distribution.

Financial Performance & Fundamental Metrics

I will analyze W.W. Grainger, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and shareholder returns.

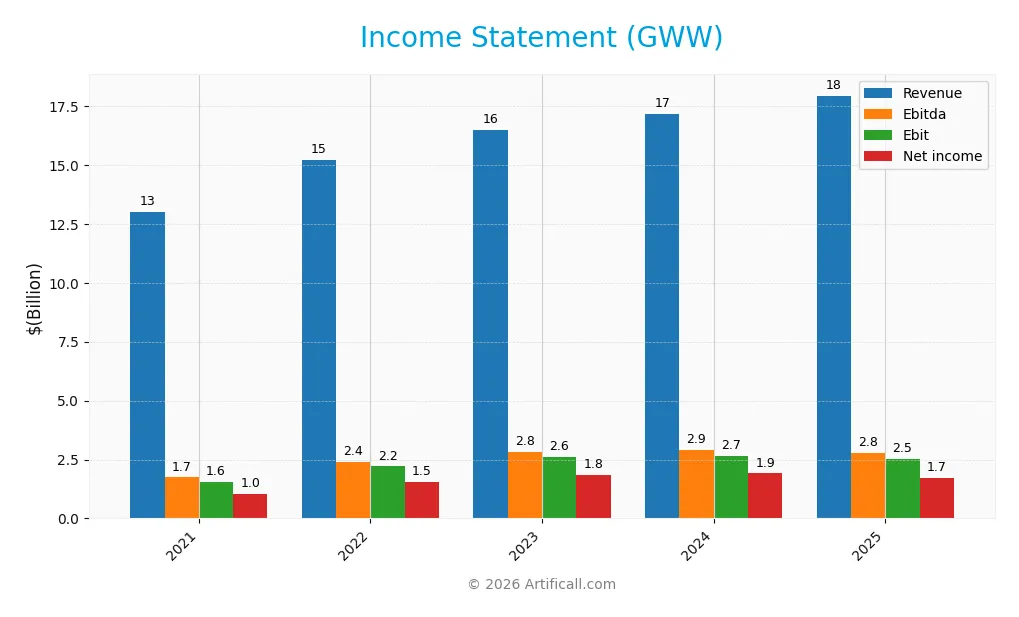

Income Statement

The table below summarizes W.W. Grainger, Inc.’s key income statement line items for fiscal years 2021 through 2025, reported in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 13.0B | 15.2B | 16.5B | 17.2B | 17.9B |

| Cost of Revenue | 8.3B | 9.4B | 10.0B | 10.5B | 10.9B |

| Operating Expenses | 3.2B | 3.6B | 3.9B | 4.1B | 4.3B |

| Gross Profit | 4.7B | 5.8B | 6.5B | 6.7B | 7.0B |

| EBITDA | 1.7B | 2.4B | 2.8B | 2.9B | 2.8B |

| EBIT | 1.6B | 2.2B | 2.6B | 2.7B | 2.5B |

| Interest Expense | 87M | 93M | 93M | 77M | 81M |

| Net Income | 1.0B | 1.5B | 1.8B | 1.9B | 1.7B |

| EPS | 20.1 | 30.4 | 36.6 | 39.0 | 35.5 |

| Filing Date | 2022-02-23 | 2023-02-21 | 2024-02-22 | 2025-02-20 | 2026-02-03 |

Income Statement Evolution

From 2021 to 2025, W.W. Grainger’s revenue rose 38% to $17.9B, reflecting steady growth. Net income increased 64%, reaching $1.7B. Gross margin held firm near 39%, while EBIT margin softened slightly to 14%. However, net margin contracted in the last year, indicating margin pressure despite rising top-line figures.

Is the Income Statement Favorable?

In 2025, revenue grew 4.5% year-over-year, but EBIT and net income declined 5.6% and 14.5%, respectively, signaling operational challenges. Operating expenses rose proportionally with revenue, squeezing profitability. Despite this, margins remain healthy versus industry peers, and interest expense is well contained. Overall, fundamentals appear favorable but warrant monitoring for margin contraction risks.

Financial Ratios

Below is a summary table of key financial ratios for W.W. Grainger, Inc. from 2021 to 2025, providing insight into profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 8.0% | 10.2% | 11.1% | 11.1% | 9.5% |

| ROE | 55.7% | 63.4% | 58.7% | 56.8% | 41.2% |

| ROIC | 22.6% | 29.3% | 30.4% | 28.6% | 24.3% |

| P/E | 25.8 | 18.3 | 22.6 | 27.0 | 28.3 |

| P/B | 14.4 | 11.6 | 13.3 | 15.3 | 11.7 |

| Current Ratio | 2.63 | 2.48 | 2.88 | 2.49 | 2.83 |

| Quick Ratio | 1.40 | 1.36 | 1.64 | 1.49 | 1.59 |

| D/E | 1.47 | 1.11 | 0.88 | 0.95 | 0.76 |

| Debt-to-Assets | 41.9% | 35.6% | 33.8% | 36.1% | 35.3% |

| Interest Coverage | 17.8x | 23.8x | 27.6x | 34.2x | 30.8x |

| Asset Turnover | 1.98 | 2.01 | 2.02 | 1.94 | 2.00 |

| Fixed Asset Turnover | 7.17 | 8.33 | 7.90 | 7.47 | 6.87 |

| Dividend Yield | 1.33% | 1.31% | 0.95% | 0.82% | 0.97% |

Evolution of Financial Ratios

Return on Equity (ROE) peaked in 2022 at 63.4% before gradually declining to 41.2% in 2025, indicating reduced profitability momentum. The Current Ratio improved from 2.48 in 2022 to 2.83 in 2025, reflecting enhanced liquidity. Debt-to-Equity Ratio decreased from 1.11 in 2022 to 0.76 in 2025, showing a slight deleveraging trend.

Are the Financial Ratios Favorable?

In 2025, profitability remains strong with ROE at 41.2% and ROIC at 24.3%, both favorable versus typical industry benchmarks. Liquidity is solid, supported by a Current Ratio of 2.83 and Quick Ratio of 1.59. Leverage is neutral with a Debt-to-Equity of 0.76. Valuation multiples like P/E at 28.3 and P/B at 11.7 appear stretched, while dividend yield is low at 0.97%. Overall, ratios are slightly favorable with prudent risk considerations.

Shareholder Return Policy

W.W. Grainger, Inc. maintains a dividend payout ratio near 27%, with annual dividend per share rising steadily from $6.88 in 2021 to $9.75 in 2025. The dividend yield hovers around 1%, supported by robust free cash flow coverage, indicating sustainable distributions.

The company also engages in share buybacks, complementing its cash returns to shareholders. This balanced approach of dividends and buybacks aligns with preserving long-term value. However, the relatively moderate yield and payout ratio suggest cautious capital allocation amid market conditions.

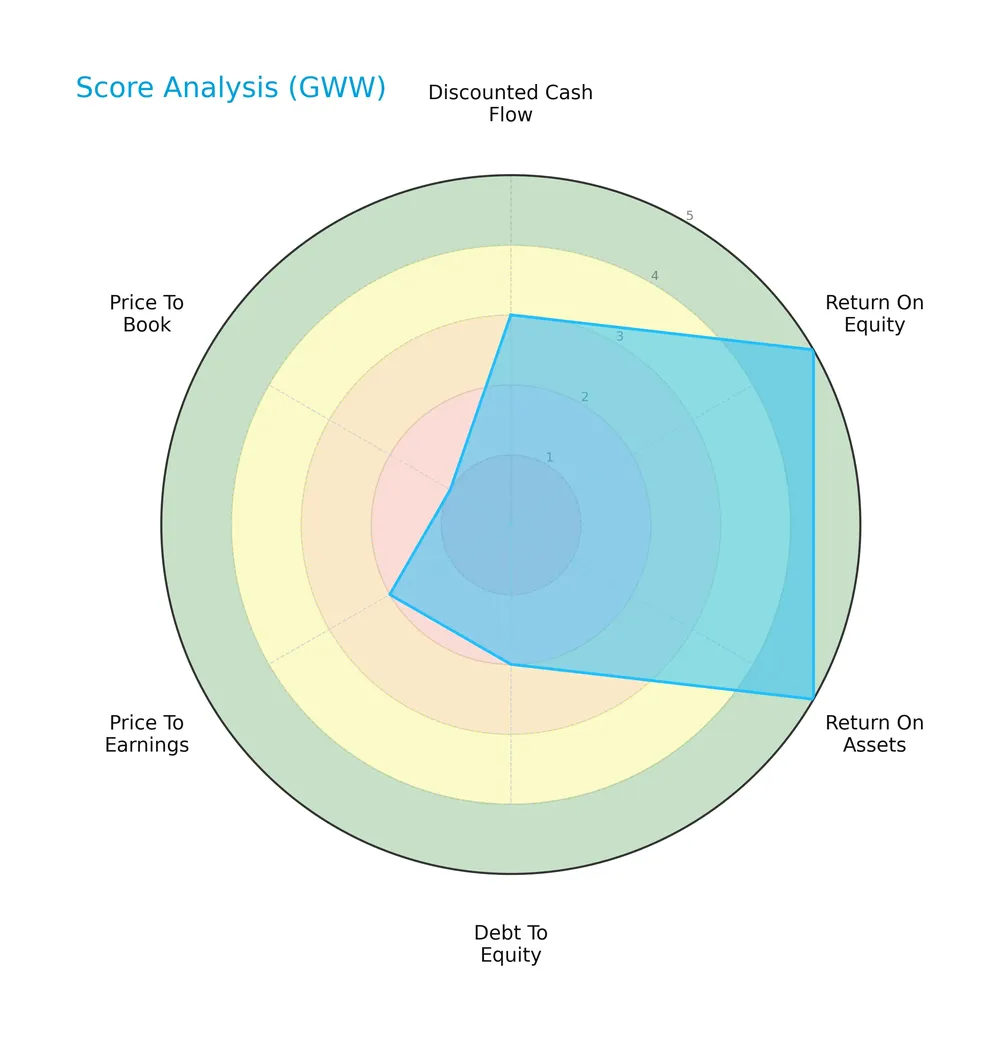

Score analysis

The radar chart below displays key financial scores for W.W. Grainger, Inc., highlighting valuation, profitability, and leverage metrics:

W.W. Grainger scores very favorably on return on equity and assets, reflecting strong operational efficiency. However, its debt-to-equity and price-to-earnings scores are moderate, while price-to-book is notably weak, indicating valuation concerns.

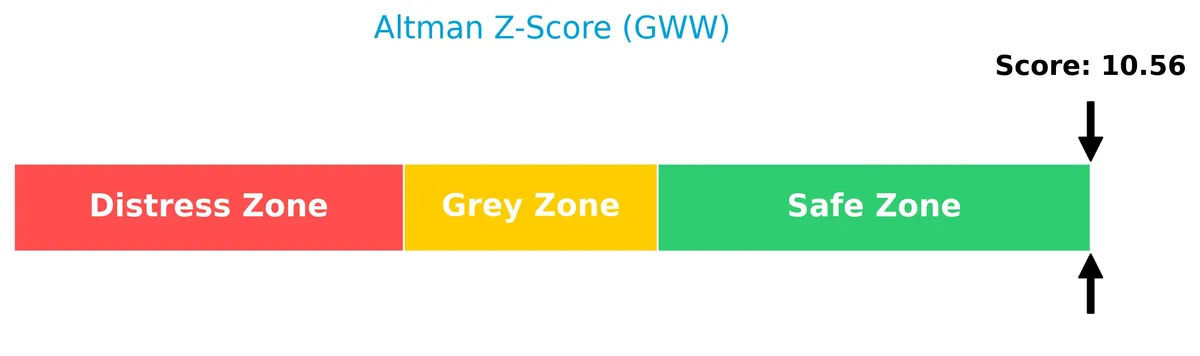

Analysis of the company’s bankruptcy risk

W.W. Grainger’s Altman Z-Score places it firmly in the safe zone, signaling a very low risk of bankruptcy in the near term:

Is the company in good financial health?

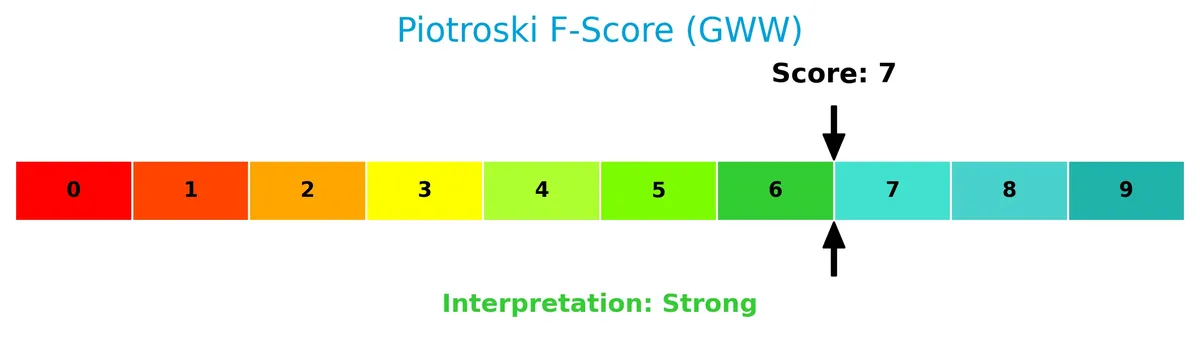

The Piotroski F-Score diagram below illustrates W.W. Grainger’s solid financial condition based on nine accounting criteria:

With a Piotroski score of 7, W.W. Grainger demonstrates strong financial health, suggesting effective profitability, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

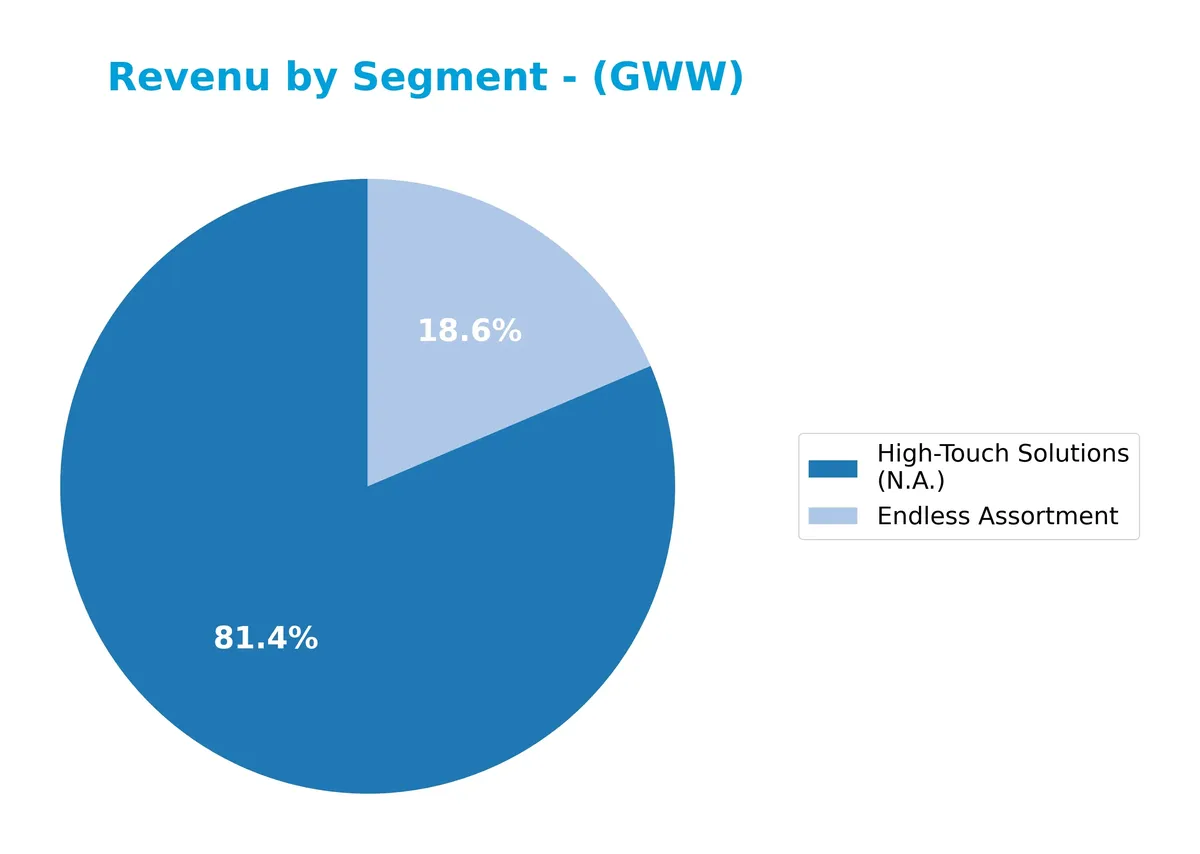

This analysis examines W.W. Grainger, Inc.’s strategic positioning within the industrial distribution sector. It covers revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Grainger holds a sustainable edge over its rivals.

Strategic Positioning

W.W. Grainger concentrates heavily on industrial distribution with two segments: High-Touch Solutions N.A. (13.7B in 2024) and Endless Assortment (3.1B). The U.S. dominates geographically at 13.9B, with limited but steady international exposure, including Japan and Canada.

Revenue by Segment

This pie chart displays W.W. Grainger, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting key business drivers in U.S. industrial supply.

High-Touch Solutions (N.A.) dominates revenue with $13.7B in 2024, reflecting steady growth since 2021. Endless Assortment contributes $3.1B, also trending upward. The shift away from “Other Businesses” post-2019 signals consolidation in core segments. The 2024 acceleration in High-Touch Solutions underscores Grainger’s focus on personalized service and complex customer needs, reinforcing its moat in industrial supply.

Key Products & Brands

The table below details W.W. Grainger, Inc.’s primary product segments and their descriptions:

| Product | Description |

|---|---|

| High-Touch Solutions (N.A.) | Distributes maintenance, repair, and operating (MRO) products and services in North America. |

| Endless Assortment | Offers a broad range of MRO products through electronic and ecommerce channels internationally. |

| Safety and Security Supplies | Includes products related to workplace safety and security. |

| Material Handling & Storage Equipment | Equipment for handling and storing materials across various industries. |

| Pumps and Plumbing Equipment | Supplies pumps and plumbing-related products. |

| Cleaning and Maintenance Supplies | Products for cleaning and maintaining facilities and equipment. |

| Metalworking and Hand Tools | Tools used for metalworking and general hand tool applications. |

| Inventory Management and Technical Support Services | Services supporting inventory optimization and technical assistance. |

W.W. Grainger operates mainly through two segments: High-Touch Solutions, generating $13.7B in 2024 revenue, and Endless Assortment with $3.1B. The company offers a comprehensive mix of MRO products supported by inventory and technical services.

Main Competitors

There are 3 competitors in total; the table below lists the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| W.W. Grainger, Inc. | 47.7B |

| Fastenal Company | 46.4B |

| Pool Corporation | 8.6B |

W.W. Grainger, Inc. ranks 1st among its competitors with a market cap 18% above the closest rival. It stands above both the average market cap of the top 10 and the sector median. The company maintains a 21.45% lead over the next competitor below, confirming its dominant position in Industrial Distribution.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does GWW have a competitive advantage?

W.W. Grainger, Inc. demonstrates a sustainable competitive advantage with a very favorable moat. Its ROIC exceeds WACC by 15.5%, indicating efficient capital use and consistent value creation.

Looking ahead, GWW’s strong presence across the U.S., Japan, Canada, and other markets supports growth opportunities. Its broad MRO product range and technical services position it well for expanding customer demand.

SWOT Analysis

This analysis highlights W.W. Grainger, Inc.’s key internal strengths and weaknesses alongside external opportunities and threats shaping its strategic outlook.

Strengths

- Strong moat with ROIC well above WACC

- Robust operating margins near 14%

- Leading market position in MRO distribution

Weaknesses

- Slowing EBIT and net margin growth recently

- High valuation multiples (PE 28.3, PB 11.7)

- Dividend yield under 1%, less appealing for income investors

Opportunities

- Expanding international footprint especially in Japan and Canada

- Increasing demand for e-commerce and inventory management solutions

- Potential to leverage technology for operational efficiencies

Threats

- Intense competition in industrial distribution sector

- Economic sensitivity impacting capital expenditures

- Supply chain disruptions and inflationary pressures

W.W. Grainger’s durable competitive advantage and solid profitability support a confident growth outlook. However, recent margin pressures and high valuation require cautious monitoring. The company must capitalize on digital transformation to sustain its leadership amid rising industry risks.

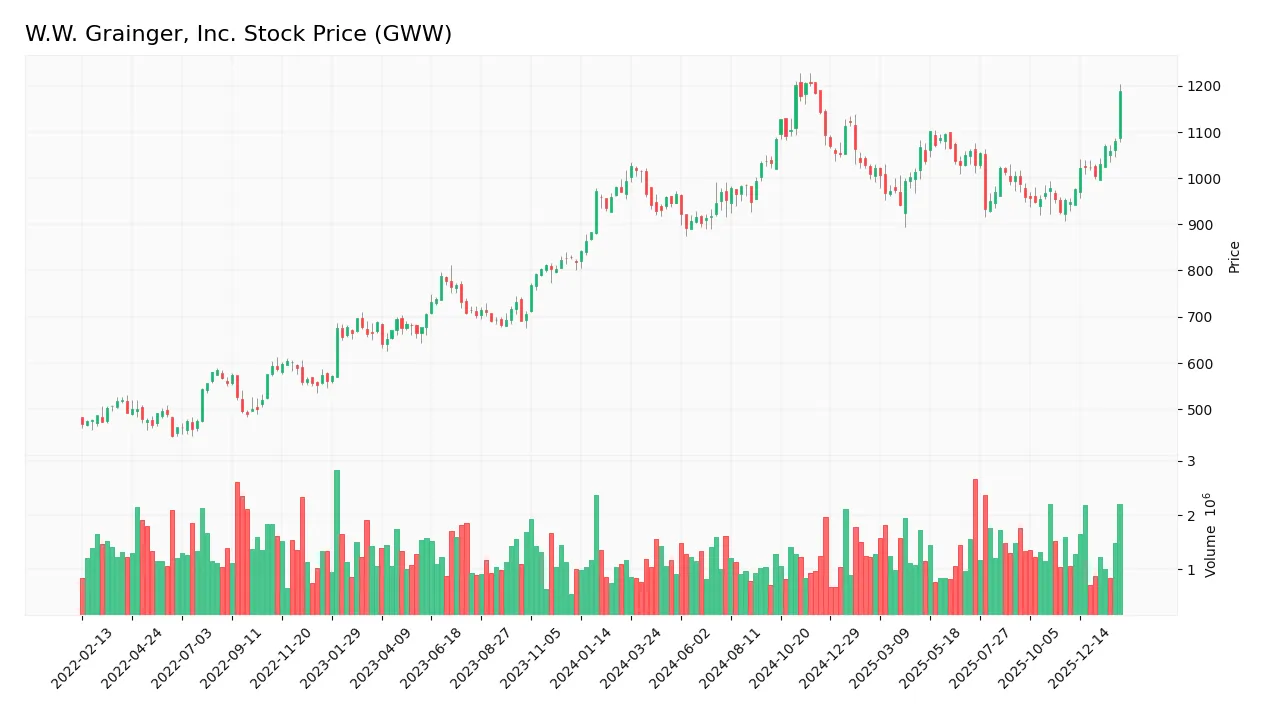

Stock Price Action Analysis

The weekly stock chart for W.W. Grainger, Inc. (GWW) highlights price movements and volatility over the past 12 months:

Trend Analysis

Over the past 12 months, GWW’s stock price rose 19.49%, indicating a bullish trend with price acceleration. The stock swung between a low of 892.25 and a high of 1206.65. Volatility remains elevated, with a standard deviation of 72.03, reflecting significant price fluctuations.

Volume Analysis

Trading volume increased, totaling 151.7M shares with buyers controlling 55.44%. In the recent three months, buyer dominance strengthened to 78.37%, driven by 12.6M buyer shares versus 3.5M seller shares. This suggests strong investor interest and positive market participation.

Target Prices

Analysts set a strong target consensus reflecting confidence in W.W. Grainger, Inc.’s outlook.

| Target Low | Target High | Consensus |

|---|---|---|

| 1,044 | 1,300 | 1,163 |

The target range indicates an upside potential of roughly 12-25% from current levels, signaling positive analyst sentiment.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide a comprehensive view of W.W. Grainger, Inc.’s market perception.

Stock Grades

Here are the latest verified stock grades for W.W. Grainger, Inc. from top-tier analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Upgrade | Outperform | 2026-01-27 |

| Oppenheimer | Maintain | Outperform | 2026-02-04 |

| JP Morgan | Maintain | Neutral | 2026-01-16 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-25 |

| Barclays | Maintain | Underweight | 2025-11-07 |

| RBC Capital | Maintain | Sector Perform | 2025-11-03 |

| RBC Capital | Maintain | Sector Perform | 2025-10-16 |

| JP Morgan | Maintain | Neutral | 2025-10-15 |

| JP Morgan | Maintain | Neutral | 2025-09-04 |

| Loop Capital | Maintain | Hold | 2025-08-04 |

The consensus remains cautious with a “Hold” rating, reflecting diverse views that range from Outperform to Underweight. Stability in ratings and few upgrades suggest measured confidence amid sector dynamics.

Consumer Opinions

W.W. Grainger, Inc. receives a mixed but generally favorable reception from its customer base, reflecting its strong presence in industrial supply.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable product availability and fast shipping. | Pricing often higher than competitors. |

| Excellent customer service with knowledgeable reps. | Website navigation can be confusing. |

| Wide product selection meeting diverse needs. | Occasional delays in order fulfillment. |

Overall, consumers praise Grainger for its reliability and service quality. However, pricing and occasional operational hiccups remain areas for improvement.

Risk Analysis

Below is a detailed table outlining key risks for W.W. Grainger, Inc., with their probabilities and potential impacts:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated P/E (28.3) and high P/B (11.7) ratios suggest overvaluation. | Medium | High |

| Dividend Yield Risk | Low dividend yield (0.97%) may disappoint income-focused investors. | Medium | Medium |

| Debt Risk | Moderate debt-to-equity ratio (0.76) and debt-to-assets (35.3%). | Low | Medium |

| Market Volatility | Beta of 1.11 indicates sensitivity to market swings. | Medium | Medium |

| Competitive Pressure | Industrial distribution is competitive, pressuring margins (9.5%). | Medium | Medium |

The most significant risks are valuation and market volatility. The stock trades near its 52-week high, raising caution on price sustainability. While profitability metrics remain strong, the premium valuation relative to peers warrants prudence.

Should You Buy W.W. Grainger, Inc.?

W.W. Grainger, Inc. appears to be a robust operator with a durable moat supported by growing ROIC above WACC, indicating strong value creation. Despite moderate leverage and mixed valuation scores, the company’s overall B+ rating suggests a very favorable financial profile.

Strength & Efficiency Pillars

W.W. Grainger, Inc. exhibits robust profitability with a return on equity of 41.2% and a net margin of 9.51%. Its return on invested capital stands at 24.26%, well above the weighted average cost of capital at 8.73%, confirming the company is a clear value creator. Financial health is solid, supported by a strong Altman Z-Score of 10.56, placing it safely away from bankruptcy risk, and a Piotroski score of 7, indicating strong operational fundamentals.

Weaknesses and Drawbacks

Valuation metrics raise caution, with a high P/E ratio of 28.33 and a steep P/B ratio of 11.67, suggesting the stock trades at a significant premium. This elevated valuation could limit upside potential. Leverage is moderate with a debt-to-equity ratio of 0.76, which is manageable but worth monitoring. Dividend yield is low at 0.97%, potentially deterring income-focused investors, while some recent margin compressions and unfavorable earnings growth trends raise near-term profitability concerns.

Our Verdict about W.W. Grainger, Inc.

The company’s long-term fundamentals appear favorable, anchored by strong profitability and a sustainable competitive advantage. Its bullish overall trend and recent strong buyer dominance might suggest a growth trajectory. This profile might appear attractive for long-term exposure, especially for investors prioritizing value creation and financial resilience, despite premium valuation and short-term earnings headwinds.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Principal Financial Group Inc. Lowers Position in W.W. Grainger, Inc. $GWW – MarketBeat (Feb 05, 2026)

- Is It Smart To Buy W.W. Grainger, Inc. (NYSE:GWW) Before It Goes Ex-Dividend? – Yahoo Finance (Feb 04, 2026)

- Dividend Aristocrats In Focus: W.W. Grainger – Sure Dividend (Feb 04, 2026)

- What makes WW Grainger (GWW) an investment bet? – MSN (Feb 03, 2026)

- W.W. Grainger Inc (GWW) Q4 2025 Earnings Call Highlights: Navigating Growth Amidst Challenges – GuruFocus (Feb 03, 2026)

For more information about W.W. Grainger, Inc., please visit the official website: grainger.com