Home > Analyses > Basic Materials > Vulcan Materials Company

Vulcan Materials Company builds the foundation beneath America’s roads, bridges, and buildings. As the largest producer of construction aggregates in the U.S., it dominates markets with crushed stone, sand, gravel, asphalt, and concrete. Vulcan’s reputation for quality and operational scale supports infrastructure growth nationwide. Yet, as market dynamics shift, I ask: does Vulcan’s current valuation reflect its capacity to sustain long-term growth and generate shareholder value?

Table of contents

Business Model & Company Overview

Vulcan Materials Company, founded in 1909 and headquartered in Birmingham, Alabama, dominates the US construction materials sector. It integrates four core segments—Aggregates, Asphalt, Concrete, and Calcium—into a cohesive ecosystem supplying essential inputs for infrastructure, housing, and industrial projects. This comprehensive offering underpins its market leadership in construction supplies.

Its revenue engine balances heavy reliance on crushed stone, sand, and gravel with growth from asphalt and ready-mixed concrete sales across key states in the Americas. Calcium products diversify its footprint into animal feed and plastics. Vulcan’s deep regional presence and integrated product suite create a formidable economic moat, positioning it as a critical driver of America’s built environment.

Financial Performance & Fundamental Metrics

I will analyze Vulcan Materials Company’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder returns.

Income Statement

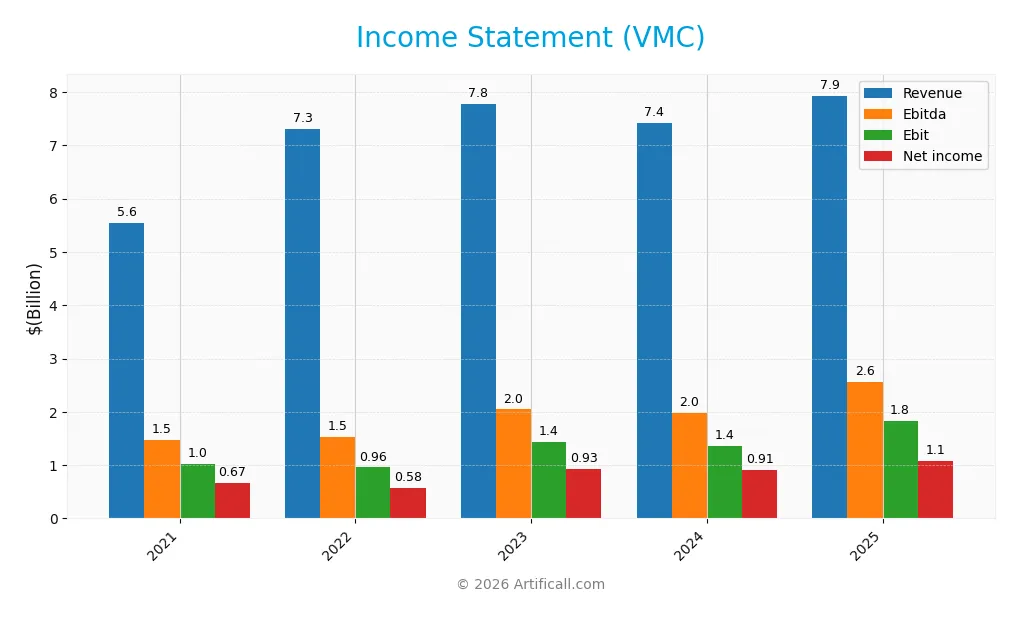

The table below presents Vulcan Materials Company’s key income statement figures for fiscal years 2021 through 2025, reflecting revenue and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 5.55B | 7.32B | 7.78B | 7.42B | 7.93B |

| Cost of Revenue | 4.18B | 5.76B | 5.83B | 5.42B | 5.77B |

| Operating Expenses | 363M | 606M | 521M | 635M | 574M |

| Gross Profit | 1.37B | 1.56B | 1.95B | 2.00B | 2.17B |

| EBITDA | 1.47B | 1.53B | 2.04B | 1.98B | 2.56B |

| EBIT | 1.02B | 957M | 1.44B | 1.36B | 1.82B |

| Interest Expense | 149M | 169M | 196M | 191M | 467M |

| Net Income | 671M | 576M | 933M | 912M | 1.08B |

| EPS | 5.05 | 4.33 | 7.02 | 6.89 | 8.15 |

| Filing Date | 2022-02-25 | 2023-02-24 | 2024-02-22 | 2025-02-20 | 2026-02-17 |

Income Statement Evolution

Vulcan Materials Company’s revenue rose 43% from 2021 to 2025, with a 7% increase from 2024 to 2025. Net income grew 61% over five years, driven by improving net margins up 13%. Gross margin stabilized near 27%, while EBIT margin improved to 23%, reflecting better operational efficiency amid steady cost management.

Is the Income Statement Favorable?

In 2025, VMC reported $7.93B revenue and $1.08B net income, yielding a 13.6% net margin. EBIT margin was strong at 23%, supported by $2.56B EBITDA and controlled operating expenses. Interest expense represented 5.9% of revenue, a neutral factor. Overall, fundamentals appear favorable, with solid profitability and margin expansion underpinning growth.

Financial Ratios

The following table summarizes key financial ratios for Vulcan Materials Company (VMC) over the last five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 12.1% | 7.9% | 12.0% | 12.3% | 13.6% |

| ROE | 10.2% | 8.3% | 12.5% | 11.2% | 12.7% |

| ROIC | 6.0% | 5.4% | 7.9% | 6.6% | 8.0% |

| P/E | 41.1 | 40.5 | 32.4 | 37.3 | 34.8 |

| P/B | 4.21 | 3.36 | 4.03 | 4.19 | 4.41 |

| Current Ratio | 2.20 | 1.99 | 3.17 | 1.83 | 2.69 |

| Quick Ratio | 1.52 | 1.38 | 2.39 | 1.28 | 1.97 |

| D/E | 0.69 | 0.65 | 0.59 | 0.72 | 0.57 |

| Debt-to-Assets | 33.1% | 31.8% | 30.1% | 34.1% | 29.2% |

| Interest Coverage | 6.8 | 5.6 | 7.3 | 7.1 | 3.4 |

| Asset Turnover | 0.41 | 0.51 | 0.53 | 0.43 | 0.48 |

| Fixed Asset Turnover | 0.89 | 1.10 | 1.16 | 0.83 | 0.53 |

| Dividend Yield | 0.71% | 0.91% | 0.76% | 0.72% | 0.69% |

All ratios are expressed in decimal or percentage form where appropriate.

Evolution of Financial Ratios

From 2021 to 2025, Vulcan Materials’ Return on Equity (ROE) rose steadily from 10.2% to 12.7%, reflecting improved profitability. The Current Ratio fluctuated but showed an overall increase, ending at 2.69 in 2025, indicating stronger short-term liquidity. The Debt-to-Equity Ratio declined from 0.69 to 0.57, signaling a moderate reduction in leverage and enhanced financial stability.

Are the Financial Ratios Fovorable?

In 2025, profitability metrics like net margin at 13.6% are favorable, while ROE and return on invested capital remain neutral, aligning closely with the company’s weighted average cost of capital (8.5%). Liquidity ratios, including a current ratio of 2.69 and quick ratio of 1.97, rate favorably. However, valuation multiples such as price-to-earnings (34.8) and price-to-book (4.41) appear unfavorable, alongside efficiency ratios like asset turnover which are weak. Overall, the ratio profile is slightly unfavorable.

Shareholder Return Policy

Vulcan Materials Company maintains a consistent dividend payout ratio near 24%, with dividends per share rising from $1.48 in 2021 to $1.97 in 2025. The annual yield hovers around 0.7%, supported by free cash flow coverage above 60%, while the company also engages in share buybacks.

This balanced approach suggests a commitment to returning cash without compromising reinvestment needs. The payout and repurchase strategy appears prudent, supporting sustainable long-term shareholder value amid stable profitability and robust cash flow generation.

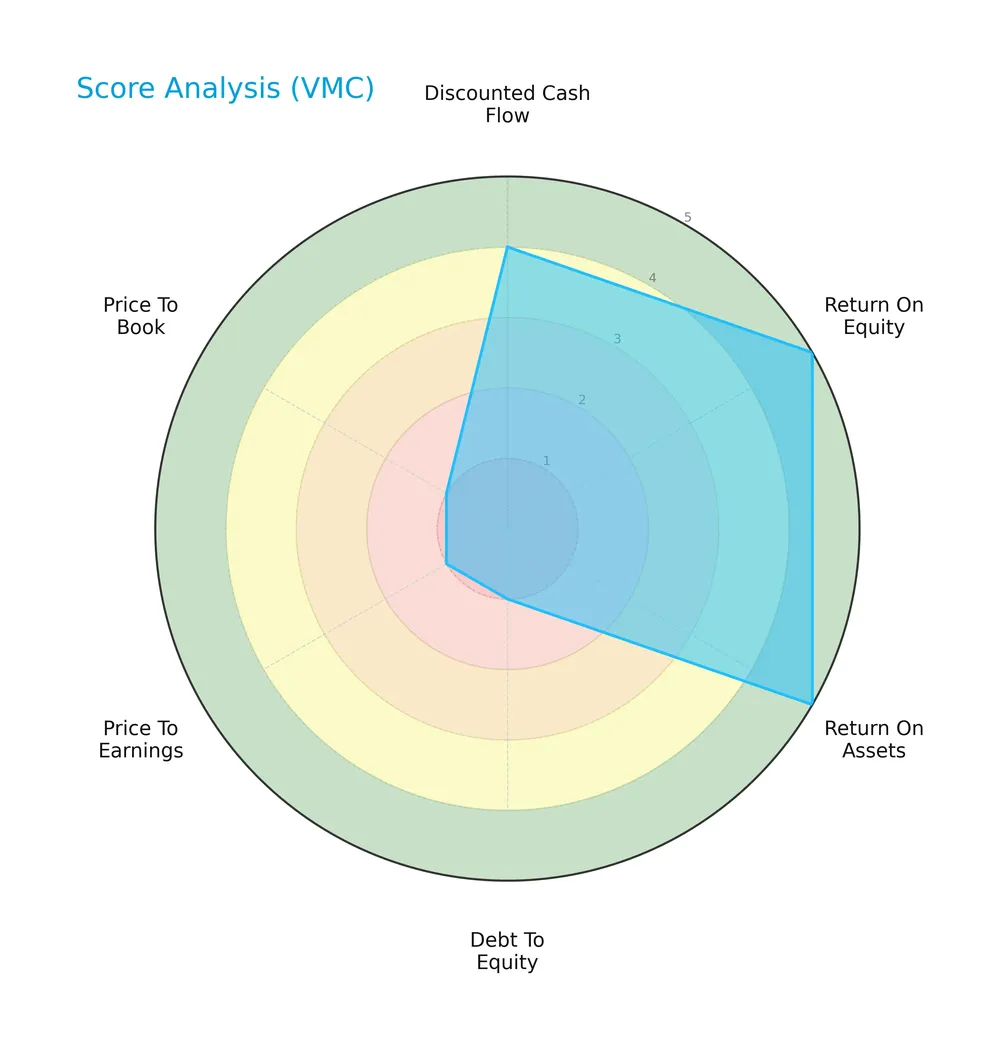

Score analysis

The following radar chart illustrates Vulcan Materials Company’s key financial scores across valuation, profitability, and leverage metrics:

VMC scores very favorably on profitability with top marks in return on equity and assets. Its discounted cash flow is favorable. However, debt-to-equity, price-to-earnings, and price-to-book scores remain very unfavorable, indicating valuation and leverage concerns.

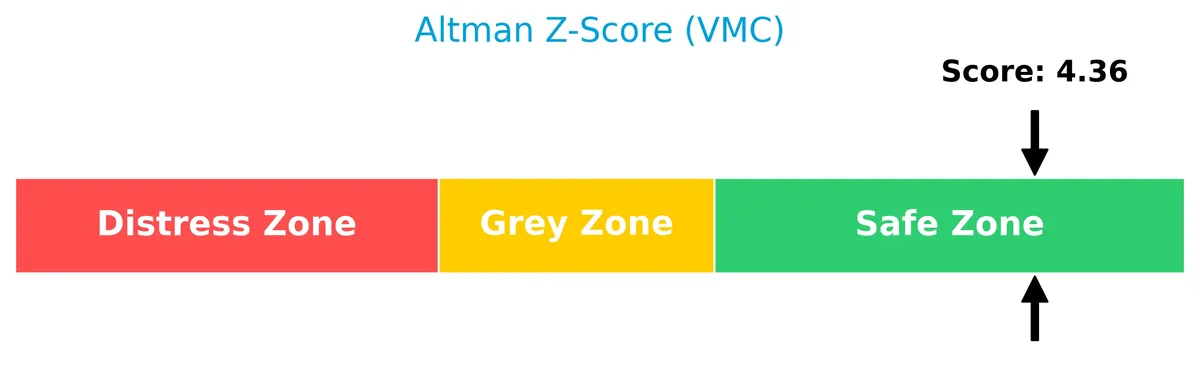

Analysis of the company’s bankruptcy risk

Vulcan Materials Company’s Altman Z-Score places it securely in the safe zone, signaling a low risk of bankruptcy:

Is the company in good financial health?

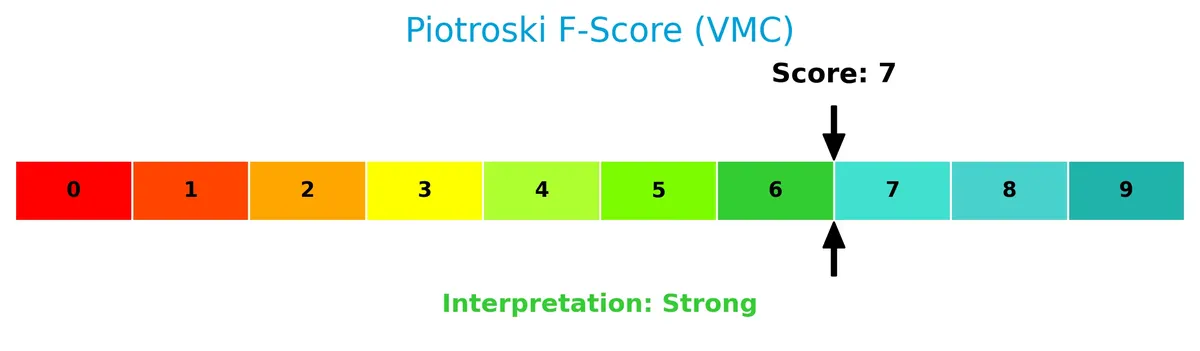

The Piotroski Score diagram highlights the company’s strong financial condition based on profitability, leverage, and efficiency factors:

With a score of 7, VMC demonstrates strong financial health, suggesting robust operational performance and prudent capital management.

Competitive Landscape & Sector Positioning

This sector analysis examines Vulcan Materials Company’s strategic positioning, revenue segments, and key products. I will assess whether VMC holds a competitive advantage over its main competitors.

Strategic Positioning

Vulcan Materials Company concentrates its portfolio on construction materials, primarily aggregates, asphalt, and concrete. It operates mainly across three U.S. regions: Gulf Coast, East, and West, with minimal international exposure. This geographic focus supports scale and operational efficiency in core markets.

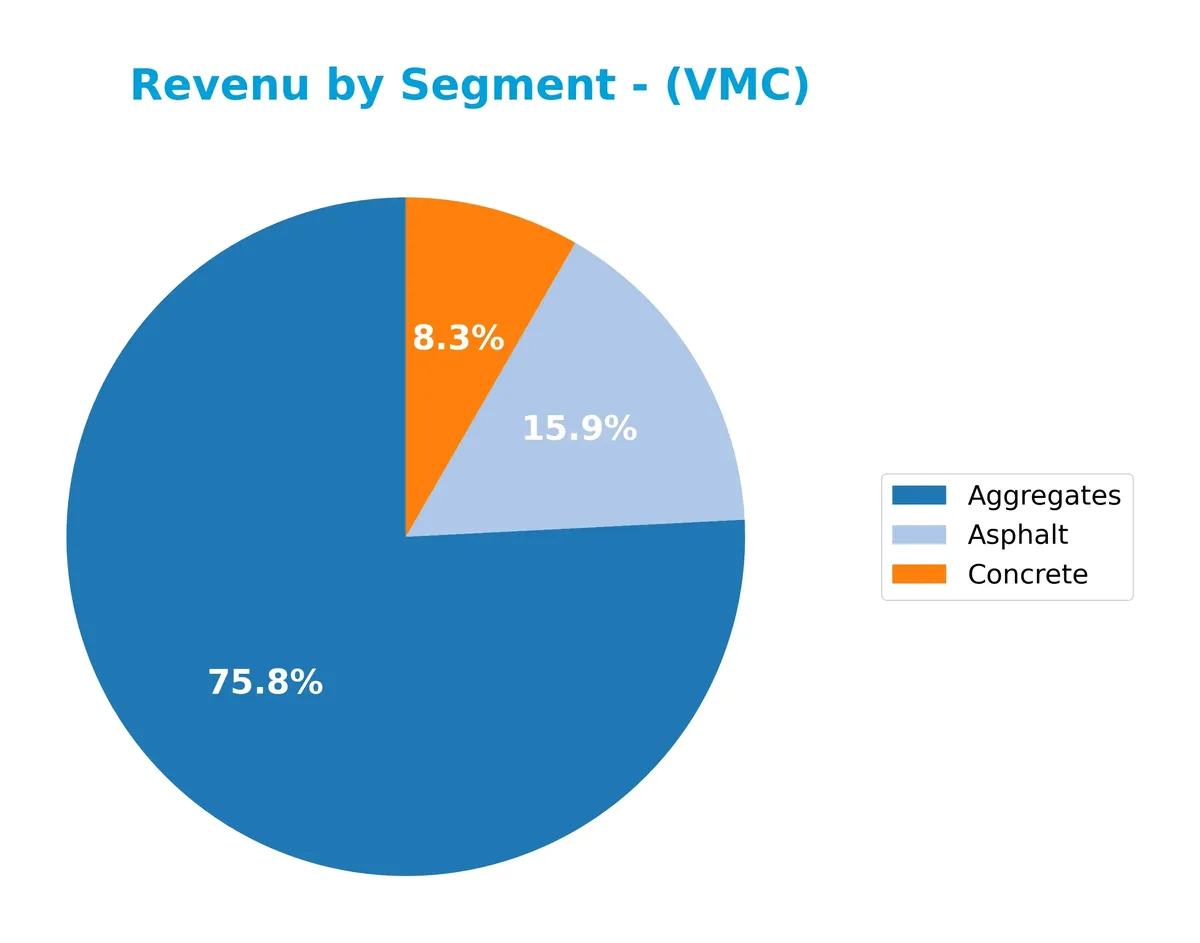

Revenue by Segment

This pie chart illustrates Vulcan Materials Company’s revenue distribution by product segment for the fiscal year 2024, highlighting the relative size of Aggregates, Asphalt, and Concrete revenues.

Aggregates dominate Vulcan’s revenue at $5.95B in 2024, showing steady growth from prior years and reinforcing its moat in raw materials. Asphalt and Concrete contribute $1.25B and $654M respectively, with Asphalt gaining traction while Concrete revenue declined notably from 2023’s $1.25B. The shift suggests rising concentration in Aggregates and Asphalt, signaling potential exposure if market demand shifts or raw material costs rise.

Key Products & Brands

Vulcan Materials Company generates revenue from several core construction materials and related products:

| Product | Description |

|---|---|

| Aggregates | Crushed stone, sand, gravel, and related products used in highways, streets, housing, and commercial construction. |

| Asphalt | Asphalt mix and paving services in select U.S. states including Alabama, Arizona, and Texas. |

| Concrete | Ready-mixed concrete supplied across multiple states including California, New York, and Texas. |

| Calcium | Calcium products for animal feed, plastics, and water treatment industries. |

Vulcan’s business centers on aggregates, which drive the majority of its revenue. Asphalt and concrete segments support regional infrastructure projects. Calcium products represent a smaller, specialized niche within its portfolio.

Main Competitors

The Basic Materials sector features 3 competitors, with the table below listing the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| CRH plc | 84.8B |

| Vulcan Materials Company | 38.7B |

| Martin Marietta Materials, Inc. | 38.3B |

Vulcan Materials Company ranks 2nd among its three main competitors. Its market cap is 47.12% of the leader CRH plc. The company sits below the average market cap of the top 10 but above the sector median. It holds a significant 112.23% gap over its closest rival, Martin Marietta Materials, highlighting a strong middle position in this competitive landscape.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does VMC have a competitive advantage?

Vulcan Materials Company currently lacks a strong competitive advantage, as its ROIC falls below WACC, indicating value destruction despite improving profitability. The company operates in a capital-intensive industry with moderate economic moats.

Looking ahead, VMC could leverage growth in key U.S. regions like the Gulf Coast and East to expand its aggregates and concrete segments. Opportunities may arise from infrastructure investments and product diversification, supporting its ongoing ROIC improvement.

SWOT Analysis

This analysis highlights Vulcan Materials Company’s internal strengths and weaknesses alongside external opportunities and threats.

Strengths

- strong market position in U.S. aggregates

- consistent revenue and net income growth

- favorable gross and EBIT margins

Weaknesses

- high valuation multiples (PE and PB)

- below WACC ROIC indicating value destruction

- asset turnover below industry benchmarks

Opportunities

- infrastructure spending boost

- expansion in high-growth regions

- diversification in calcium products

Threats

- economic cycle sensitivity

- rising input costs and inflation

- regulatory and environmental pressures

Vulcan shows solid operational performance with growth potential from infrastructure demand. However, valuation and capital efficiency raise caution. Strategic focus should balance expansion with improving capital returns.

Stock Price Action Analysis

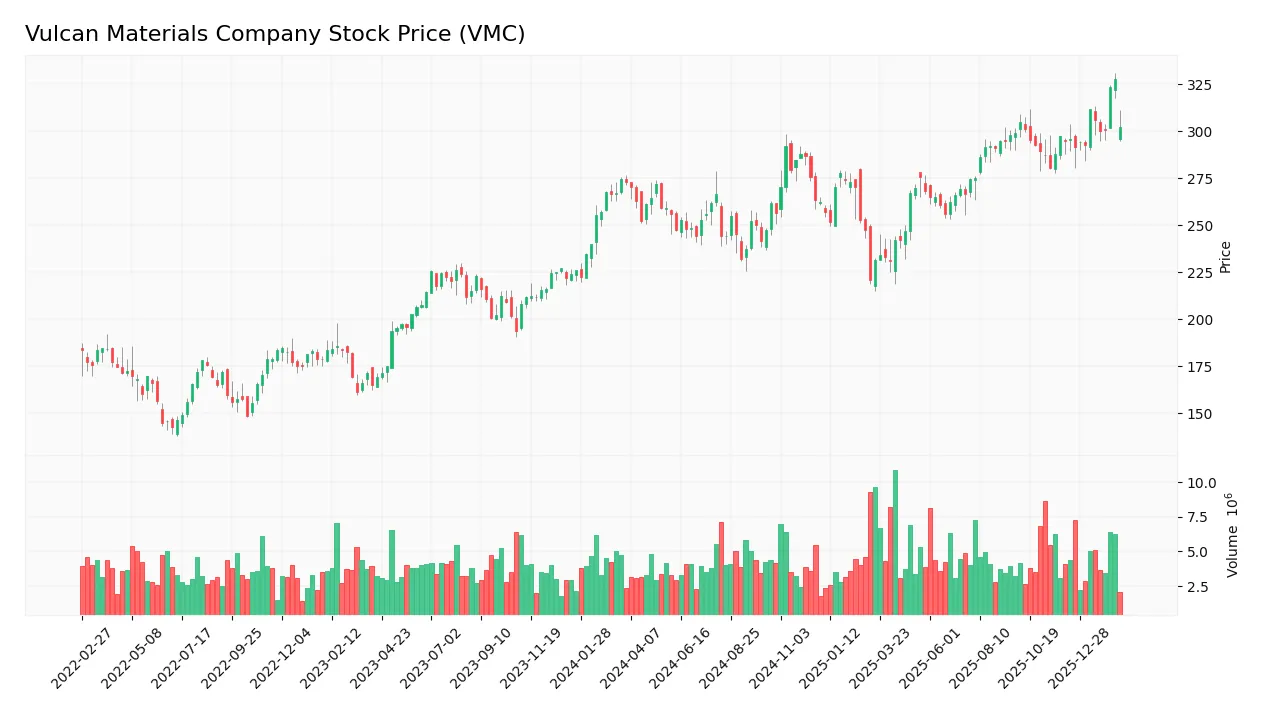

The weekly stock chart displays Vulcan Materials Company’s price movements and volatility over the past 12 months:

Trend Analysis

Over the past 12 months, VMC’s stock price increased by 10.74%, indicating a bullish trend with accelerating momentum. The price ranged from a low of 220.9 to a high of 327.65. The standard deviation of 22.19 signals notable price volatility during this period.

Volume Analysis

Trading volume has increased, with buyers accounting for 56% of total activity year-to-date, suggesting buyer-driven momentum. In the recent three months, buyer dominance softened to 52.5%, reflecting a neutral buyer behavior and balanced market participation.

Target Prices

Analysts show a bullish consensus for Vulcan Materials Company in 2026.

| Target Low | Target High | Consensus |

|---|---|---|

| 317 | 330 | 323.5 |

The target range suggests moderate upside potential, reflecting confidence in VMC’s market position and growth prospects.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Vulcan Materials Company’s recent analyst grades alongside consumer feedback to gauge market sentiment.

Stock Grades

Here is the latest verified grading summary for Vulcan Materials Company from established financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-29 |

| DA Davidson | Downgrade | Neutral | 2026-01-14 |

| Citigroup | Maintain | Buy | 2026-01-08 |

| DA Davidson | Maintain | Buy | 2025-11-04 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| RBC Capital | Maintain | Sector Perform | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-21 |

| Raymond James | Maintain | Outperform | 2025-10-21 |

| Barclays | Maintain | Overweight | 2025-10-20 |

| JP Morgan | Maintain | Overweight | 2025-08-26 |

The consensus reveals a predominance of buy and overweight ratings, although recent activity shows a slight shift toward neutral and equal weight grades. This suggests a cautious stance amid generally positive sentiment.

Consumer Opinions

Vulcan Materials Company sparks varied reactions, reflecting its pivotal role in construction and infrastructure.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable supply chain ensures timely delivery | Some customers cite occasional pricing hikes |

| High-quality aggregates improve project durability | Customer service response times can lag |

| Strong environmental compliance praised | Limited product variety in certain regions |

Overall, consumers appreciate Vulcan’s consistent product quality and environmental efforts. However, pricing concerns and service delays emerge as common drawbacks. These insights suggest Vulcan maintains strong fundamentals but must address customer experience gaps.

Risk Analysis

Below is a summary of key risks facing Vulcan Materials Company, highlighting likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | High beta (1.07) exposes stock to sharp price swings | Medium | High |

| Valuation Risk | Elevated P/E (34.8) and P/B (4.41) ratios suggest overvaluation | High | Medium |

| Operational | Unfavorable asset turnover ratios highlight efficiency issues | Medium | Medium |

| Leverage | Moderate debt-to-equity (0.57) with weak debt score signals risk | Medium | Medium |

| Dividend | Low yield (0.69%) limits income appeal in volatile markets | Low | Low |

| Economic Cycle | Construction materials sensitive to infrastructure spending | High | High |

I observe that valuation risk and economic cyclicality dominate Vulcan’s risk profile. The company trades at a premium despite neutral ROIC versus WACC, exposing investors to multiple compression in downturns. Construction demand remains volatile due to government spending shifts. Asset turnover inefficiencies could pressure margins if volume weakens. The Altman Z-score (4.36) and Piotroski score (7) provide comfort on financial stability but do not negate cyclical headwinds. Prudence requires monitoring macro trends closely.

Should You Buy Vulcan Materials Company?

Vulcan Materials Company appears to exhibit improving profitability and operational efficiency, supported by a growing ROIC despite a slightly unfavorable moat indicating value destruction. Its leverage profile is substantial, reflecting notable debt concerns, while an overall B rating suggests a very favorable but cautious investment profile.

Strength & Efficiency Pillars

Vulcan Materials Company exhibits solid operational efficiency with a net margin of 13.63% and a robust EBIT margin of 22.97%. The company maintains a respectable ROE of 12.68%, reflecting effective equity utilization. Despite a neutral ROIC at 8.02%, it trails slightly below the WACC of 8.52%, indicating the company is currently shedding value rather than creating it. However, a strong Piotroski score of 7 signals healthy financial fundamentals and operational improvement.

Weaknesses and Drawbacks

Vulcan’s valuation presents notable risks, with a high P/E of 34.81 and a P/B of 4.41, suggesting the stock trades at a premium that may limit upside. Asset turnover ratios remain weak (0.48), hinting at inefficient asset use relative to peers. The dividend yield is low at 0.69%, which might disappoint income-focused investors. While leverage levels are moderate (Debt-to-Equity 0.57), the slight unfavorable ratio profile and neutral interest coverage at 3.9 warrant cautious monitoring.

Our Final Verdict about Vulcan Materials Company

Vulcan Materials Company maintains a safe solvency profile, supported by a strong Altman Z-Score of 4.36 and solid financial health. Despite a bullish long-term technical trend and increasing volume dominance by buyers (55.99%), the neutral ROIC vs. WACC and elevated valuation metrics suggest the stock may appear fairly priced or slightly stretched. Investors might see potential but should consider waiting for more favorable valuation or operational signals before increasing exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Why Vulcan Materials (VMC) Shares Are Trading Lower Today – Finviz (Feb 18, 2026)

- Vulcan Materials slides after Q4 earnings miss and softer-than-expected 2026 outlook – Quiver Quantitative (Feb 17, 2026)

- Vulcan Stock Down as Q4 Earnings & Revenues Miss Estimates – Yahoo Finance (Feb 17, 2026)

- Vulcan Materials (NYSE:VMC) Misses Q4 CY2025 Revenue Estimates, Stock Drops – The Globe and Mail (Feb 17, 2026)

- Earnings Summary: Highlights of Vulcan Materials Company’s Q4 FY25 report – AlphaStreet News (Feb 17, 2026)

For more information about Vulcan Materials Company, please visit the official website: vulcanmaterials.com