Home > Analyses > Real Estate > VICI Properties Inc.

VICI Properties Inc. transforms the landscape of gaming and entertainment real estate, owning iconic destinations like Caesars Palace that millions experience firsthand. As a leading diversified REIT, VICI boasts a vast and geographically varied portfolio of premier gaming facilities, hotels, and entertainment venues. Renowned for its innovative approach and high-quality assets, the company sets the standard in experiential real estate. The question now is whether VICI’s solid fundamentals continue to support its strong market position and growth prospects.

Table of contents

Business Model & Company Overview

VICI Properties Inc., founded in 2018 and headquartered in New York City, stands as a dominant player in the experiential real estate sector. The company owns a vast, diversified portfolio of premier gaming, hospitality, and entertainment destinations, including the iconic Caesars Palace. With 29 gaming facilities totaling over 48M sq ft, roughly 19,200 hotel rooms, and 200+ restaurants and nightclubs, VICI’s assets form a cohesive ecosystem focused on delivering high-quality, immersive experiences.

The company’s revenue engine relies primarily on leasing its properties to top-tier gaming and hospitality operators across the Americas, Europe, and Asia. This recurring lease income balances VICI’s portfolio, which includes championship golf courses and undeveloped land near the Las Vegas Strip. Its broad geographic footprint and strategic partnerships underpin a robust economic moat, positioning VICI Properties as a key architect in shaping the future of experiential real estate.

Financial Performance & Fundamental Metrics

In this section, I will analyze VICI Properties Inc.’s income statement, key financial ratios, and dividend payout policy to assess its fundamental strength.

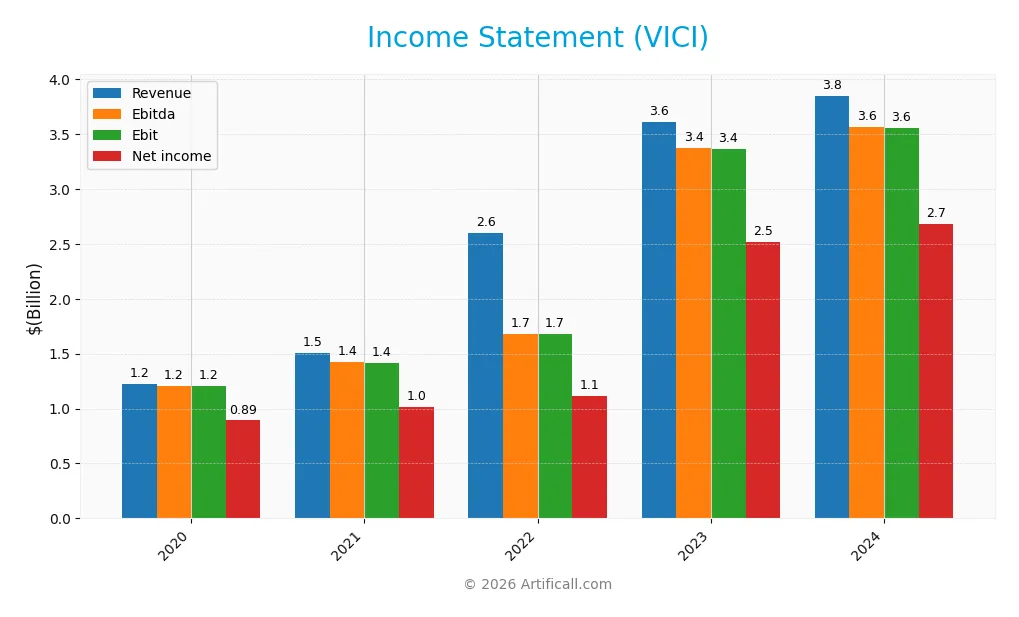

Income Statement

The table below presents VICI Properties Inc.’s key income statement figures for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 1.23B | 1.51B | 2.60B | 3.61B | 3.85B |

| Cost of Revenue | 33.4M | 20.8M | 22.6M | 27.1M | 26.9M |

| Operating Expenses | 279M | 44.5M | 946M | 240M | 277M |

| Gross Profit | 1.19B | 1.49B | 2.58B | 3.58B | 3.82B |

| EBITDA | 1.21B | 1.42B | 1.68B | 3.37B | 3.56B |

| EBIT | 1.21B | 1.42B | 1.68B | 3.37B | 3.56B |

| Interest Expense | 309M | 392M | 540M | 818M | 826M |

| Net Income | 892M | 1.01B | 1.12B | 2.51B | 2.68B |

| EPS | 1.76 | 1.80 | 1.27 | 2.48 | 2.56 |

| Filing Date | 2021-02-18 | 2022-02-23 | 2023-02-23 | 2024-02-22 | 2025-02-20 |

Income Statement Evolution

From 2020 to 2024, VICI Properties Inc. experienced strong revenue growth of 214%, reaching $3.85B in 2024. Net income also surged by 200% over the period, totaling $2.68B in 2024. Gross and EBIT margins remained robust and favorable at 99.3% and 92.4% respectively, although net margin saw a slight decline of 4.35% overall, indicating minor pressure on profitability despite top-line gains.

Is the Income Statement Favorable?

The 2024 income statement shows generally favorable fundamentals, with revenue growth of 6.57% and net income rising to $2.68B. Gross profit and EBIT improved by 6.62% and 5.66%, supporting strong operational efficiency. However, operating expenses grew at the same pace as revenue, which is unfavorable, and interest expenses remain relatively high at 21.46% of revenue. Overall, 64% of income statement metrics are positive, reflecting a solid but cautiously balanced financial position.

Financial Ratios

The following table presents key financial ratios for VICI Properties Inc. over the fiscal years 2020 to 2024, reflecting profitability, liquidity, leverage, and market valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 73% | 67% | 43% | 70% | 70% |

| ROE | 9.5% | 8.4% | 5.1% | 10.0% | 10.1% |

| ROIC | 5.5% | 8.3% | 4.4% | 7.7% | 7.9% |

| P/E | 14.5 | 16.8 | 25.4 | 12.9 | 11.4 |

| P/B | 1.37 | 1.40 | 1.30 | 1.28 | 1.15 |

| Current Ratio | 8.9 | 10.0 | 29.0 | 28.2 | 27.9 |

| Quick Ratio | 8.9 | 10.0 | 29.0 | 28.2 | 27.9 |

| D/E | 0.75 | 0.41 | 0.66 | 0.70 | 0.67 |

| Debt-to-Assets | 41% | 28% | 39% | 40% | 39% |

| Interest Coverage | 3.0 | 3.7 | 3.0 | 4.1 | 4.3 |

| Asset Turnover | 0.07 | 0.09 | 0.07 | 0.08 | 0.08 |

| Fixed Asset Turnover | 3.37 | 4.20 | 2.97 | 3.79 | 3.98 |

| Dividend Yield | 4.7% | 4.5% | 4.3% | 4.9% | 5.7% |

Evolution of Financial Ratios

From 2020 to 2024, VICI Properties Inc. showed relative stability in profitability with net profit margins consistently high around 69%-72%, peaking in 2024 at nearly 70%. Return on Equity (ROE) hovered near 10%, indicating moderate efficiency in generating shareholder returns. The Current Ratio remained very elevated, above 8 and spiking to nearly 28 by 2024, while the Debt-to-Equity ratio rose from 0.41 in 2021 to about 0.67 in 2024, reflecting a gradual increase in leverage.

Are the Financial Ratios Favorable?

In 2024, VICI’s profitability ratios are generally favorable, with a strong net margin of 69.6% and a weighted average cost of capital (WACC) at 6.26%. The price-to-earnings and price-to-book ratios also indicate favorable market valuation levels. Liquidity appears mixed: the Current Ratio is unfavorably high at 27.92, suggesting excess short-term assets, but the Quick Ratio is favorable. Leverage metrics like Debt-to-Equity and interest coverage are neutral, while asset turnover is unfavorable, contrasting with a favorable fixed asset turnover. Overall, the financial ratios present a slightly favorable profile.

Shareholder Return Policy

VICI Properties Inc. consistently pays dividends, with a payout ratio around 65%, a dividend yield near 5.7%, and steadily increasing dividend per share up to $1.67 in 2024. Dividend payments are well covered by free cash flow, and the company maintains share buyback programs, supporting balanced shareholder returns.

The dividend policy, combined with share repurchases, aligns with sustainable long-term value creation, as distributions remain covered by operating cash flow and capital expenditures. This approach reflects prudent risk management, avoiding overextension in distributions or excessive buybacks.

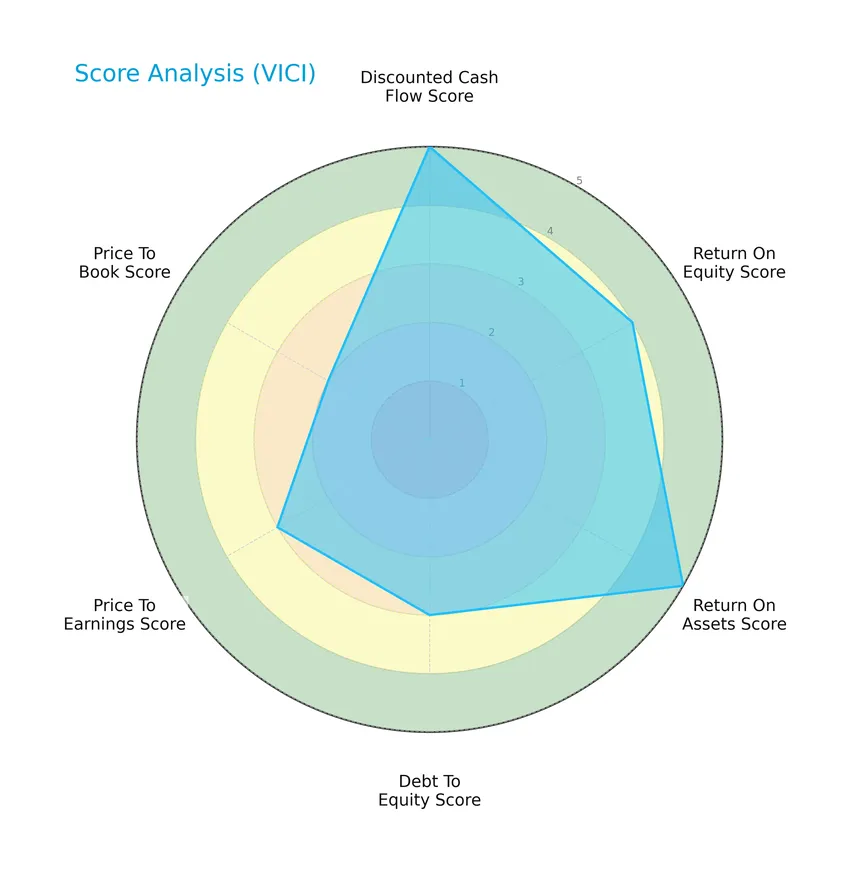

Score analysis

Here is a radar chart presenting key financial scores to evaluate the company’s performance across multiple metrics:

VICI Properties Inc. shows very favorable scores in discounted cash flow and return on assets, favorable return on equity, and moderate scores in debt to equity, price to earnings, and price to book ratios. This mix reflects solid profitability with some caution on valuation and leverage.

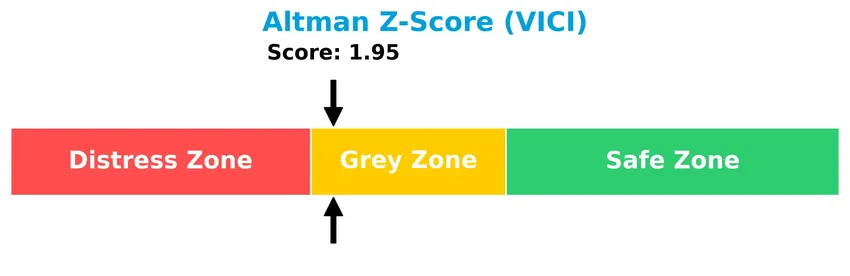

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company in the grey zone, indicating a moderate risk of bankruptcy and a need for careful monitoring of financial health:

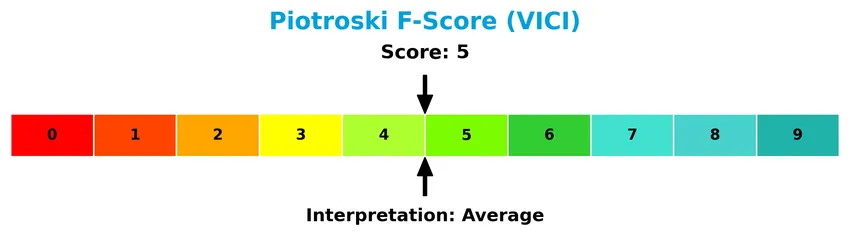

Is the company in good financial health?

The following Piotroski diagram illustrates the company’s financial strength based on nine accounting criteria:

With a Piotroski Score of 5, VICI Properties Inc. demonstrates average financial health. This suggests neither strong nor weak fundamentals, positioning the company in a neutral zone regarding financial stability.

Competitive Landscape & Sector Positioning

This section provides a detailed sector analysis of VICI Properties Inc., covering its strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether VICI Properties holds a competitive advantage over its peers in the diversified REIT sector.

Strategic Positioning

VICI Properties Inc. maintains a concentrated product portfolio focused exclusively on experiential real estate, primarily gaming, hospitality, and entertainment venues across the US. Its geographically diverse portfolio includes 29 gaming facilities, 19,200 hotel rooms, and related amenities, leased to leading industry operators.

Revenue by Segment

This pie chart illustrates the revenue generated by VICI Properties Inc. from its Real Property Business Segment over the fiscal years 2017 to 2021.

The Real Property Business Segment is the sole revenue driver for VICI, showing significant growth from $181M in 2017 to $1.48B in 2021. This steady increase reflects successful expansion and asset acquisitions. The most recent year, 2021, continued this upward trend, indicating a strong and concentrated revenue base in real estate without diversification into other segments.

Key Products & Brands

The following table outlines VICI Properties Inc.’s main products and brands within its real estate portfolio:

| Product | Description |

|---|---|

| Gaming Facilities Portfolio | 29 market-leading gaming properties totaling over 48M sq. ft., including Caesars Palace. |

| Hotel Rooms | Approximately 19,200 hotel rooms across its diverse property portfolio. |

| Restaurants, Bars & Nightclubs | More than 200 food and entertainment venues located within its properties. |

| Leased Properties | Properties leased to top operators like Caesars Entertainment, Century Casinos, Hard Rock, JACK, Penn National. |

| Golf Courses | Ownership of four championship golf courses. |

| Undeveloped Land | 34 acres adjacent to the Las Vegas Strip reserved for future development. |

VICI Properties focuses on experiential real estate, mainly in gaming and hospitality, with a geographically diverse portfolio leased to leading industry operators.

Main Competitors

There are 31 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Welltower Inc. | 128.3B |

| Prologis, Inc. | 119.7B |

| American Tower Corporation | 81.8B |

| Equinix, Inc. | 74.5B |

| Simon Property Group, Inc. | 60.1B |

| Digital Realty Trust, Inc. | 53.3B |

| Realty Income Corporation | 52.7B |

| CBRE Group, Inc. | 47.7B |

| Public Storage | 45.3B |

| Crown Castle Inc. | 38.6B |

VICI Properties Inc. ranks 12th among 31 competitors, with a market cap approximately 23.78% that of the leader, Welltower Inc. The company is positioned below the average market cap of the top 10 competitors (70.2B) but above the median market cap of the sector (24.6B). VICI maintains a 12.16% gap above its nearest competitor, indicating a moderate lead within its peer group.

Comparisons with competitors

Check out how we compare the company to its competitors:

Aucun article trouvé pour ces critères.

Does VICI have a competitive advantage?

VICI Properties Inc. currently does not demonstrate a clear competitive advantage, as its ROIC falls below its WACC, indicating value shedding. However, its growing ROIC trend suggests improving profitability, leading to a slightly favorable moat status.

Looking ahead, VICI’s diverse portfolio of 29 gaming and hospitality properties, including iconic assets like Caesars Palace, supports potential growth. Opportunities may arise from leveraging its national footprint and undeveloped land near the Las Vegas Strip to enhance its experiential real estate offerings.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting VICI Properties Inc., guiding strategic investment decisions.

Strengths

- Market-leading gaming and hospitality portfolio

- High gross margin at 99.3%

- Favorable net margin of 69.59%

Weaknesses

- Elevated interest expense at 21.46%

- Moderate debt-to-equity ratio of 0.67

- Current ratio unusually high at 27.92

Opportunities

- Expansion with undeveloped land near Las Vegas Strip

- Growing ROIC trend indicates improving profitability

- Strong dividend yield around 5.73%

Threats

- Exposure to gaming industry cyclicality

- Rising interest rates could increase debt costs

- Competitive pressure from other REITs and operators

Overall, VICI Properties demonstrates strong profitability and a high-quality asset base with solid growth prospects in experiential real estate. However, careful management of debt and interest costs is critical to mitigate financial risks and maintain its favorable position.

Stock Price Action Analysis

The weekly stock chart for VICI Properties Inc. over the past 12 months highlights key price movements and volatility patterns:

Trend Analysis

Over the past 12 months, VICI’s stock price declined by 3.52%, indicating a bearish trend. The trend shows a deceleration in downward momentum, with a standard deviation of 1.84. The highest price was 33.96, and the lowest was 27.7, reflecting moderate volatility within this range.

Volume Analysis

Trading volumes over the last three months show a slightly seller-dominant activity, with buyer volume at 277M versus seller volume at 365M. Volume has been increasing overall, suggesting heightened market participation but cautious investor sentiment leaning toward selling pressure.

Target Prices

The consensus target prices for VICI Properties Inc. indicate modest upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 36 | 30 | 32.8 |

Analysts generally expect VICI’s share price to trade between $30 and $36, with a consensus around $32.8, suggesting moderate growth prospects.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews analyst ratings and consumer feedback to provide a balanced view of VICI Properties Inc.’s market perception.

Stock Grades

Here is a summary of the latest verified stock grades for VICI Properties Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2025-12-17 |

| Barclays | Maintain | Overweight | 2025-12-03 |

| Evercore ISI Group | Downgrade | In Line | 2025-12-01 |

| Goldman Sachs | Maintain | Buy | 2025-11-28 |

| Wells Fargo | Downgrade | Equal Weight | 2025-11-18 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-06 |

| Stifel | Maintain | Buy | 2025-10-31 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-31 |

| Barclays | Maintain | Overweight | 2025-10-20 |

| Evercore ISI Group | Maintain | Outperform | 2025-09-15 |

Most grades remain positive with a consensus around “Buy” or equivalent, although a few downgrades to more neutral ratings indicate some caution among analysts. The overall trend suggests stable investor confidence with minor reservations.

Consumer Opinions

Consumer sentiment around VICI Properties Inc. reflects a mix of appreciation for its strong portfolio and cautiousness about market volatility.

| Positive Reviews | Negative Reviews |

|---|---|

| “VICI offers solid dividend yields, making it attractive for income investors.” | “The stock can be volatile, especially during economic downturns affecting retail and gaming sectors.” |

| “Their extensive real estate holdings in prime locations provide long-term value.” | “Some tenants face challenges, which could impact rental income stability.” |

| “Management demonstrates a clear strategy focused on growth and diversification.” | “Limited growth opportunities compared to more aggressive REITs.” |

Overall, consumers value VICI’s reliable income and prime asset base but express concerns about sector sensitivity and moderate growth prospects. Investors should weigh these factors carefully.

Risk Analysis

Below is a summary of the key risks associated with investing in VICI Properties Inc., highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Exposure to economic downturns affecting consumer spending on gaming and hospitality sectors. | Medium | High |

| Tenant Concentration Risk | Heavy reliance on Caesars Entertainment and a few major tenants for rental income. | High | High |

| Interest Rate Risk | Rising interest rates could increase borrowing costs and reduce property valuations. | Medium | Medium |

| Liquidity Risk | Unfavorable current ratio indicates potential difficulties in meeting short-term obligations. | Medium | Medium |

| Operational Risk | Dependence on tenant operators’ operational success and regulatory environment changes. | Medium | Medium |

| Bankruptcy Risk | Altman Z-Score in grey zone signals moderate financial distress risk. | Low | High |

The most significant risks for VICI are tenant concentration and market exposure, given its dependence on a few large tenants in a cyclical industry. Although financials are generally stable, the Altman Z-Score in the grey zone and liquidity concerns warrant cautious monitoring.

Should You Buy VICI Properties Inc.?

VICI Properties Inc. appears to show improving profitability with a slightly favorable moat, supported by growing ROIC despite shedding value. The debt profile could be seen as moderate, while its overall rating suggests a very favorable investment profile with balanced risk considerations.

Strength & Efficiency Pillars

VICI Properties Inc. showcases solid profitability with a net margin of 69.59%, underscoring its operational efficiency. While its return on equity stands at a moderate 10.09%, the return on invested capital (ROIC) at 7.9% exceeds the weighted average cost of capital (WACC) of 6.26%, confirming the company as a value creator. Financial health indicators present a mixed but stable picture: the Altman Z-Score at 1.95 places VICI in the grey zone, while the Piotroski Score of 5 suggests average financial robustness. These metrics collectively reflect an improving profitability trend and reasonable financial stability.

Weaknesses and Drawbacks

Despite favorable valuation metrics such as a P/E of 11.41 and a P/B of 1.15, which indicate a fairly valued stock, certain liquidity and operational concerns persist. The current ratio is alarmingly high at 27.92, an unfavorable signal that may reflect inefficient asset utilization or excess short-term assets. Additionally, the company faces a slight seller dominance with buyers comprising only 43.15% in the recent period, contributing to a bearish stock trend with a price decline of 5.93% over the last quarter. Moreover, interest expenses remain elevated at 21.46%, posing a potential risk to net profitability.

Our Verdict about VICI Properties Inc.

VICI Properties Inc. presents a fundamentally favorable profile with solid profitability and value creation, though tempered by moderate financial health scores and operational inefficiencies. Given the bearish overall trend and recent seller dominance, despite underlying strengths, the situation might suggest a wait-and-see approach for a more favorable entry point. The stock could appeal to investors seeking long-term exposure but who are mindful of near-term market pressures and liquidity concerns.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- VICI Properties Inc. Announces Tax Treatment of 2025 Distributions – Yahoo Finance (Jan 23, 2026)

- VICI Properties Inc. $VICI Holdings Decreased by Strs Ohio – MarketBeat (Jan 24, 2026)

- Maryland State Representatives, Nareit Meet at VICI’s MGM National Harbor – Nareit (Jan 22, 2026)

- Palmetto Grain Brokerage – – Palmetto Grain Brokerage (Jan 19, 2026)

- VICI In A Rapidly Changing Gaming Environment (NYSE:VICI) – Seeking Alpha (Jan 08, 2026)

For more information about VICI Properties Inc., please visit the official website: viciproperties.com