Home > Analyses > Healthcare > Viatris Inc.

Viatris Inc. transforms healthcare by delivering a broad portfolio of essential medicines that touch millions of lives worldwide every day. As a key player in the specialty and generic drug manufacturing industry, Viatris combines global reach with innovation across prescription brands, biosimilars, and complex generics. Renowned for its commitment to quality and accessibility, the company shapes patient care in diverse therapeutic areas. The critical question for investors now is whether Viatris’s robust fundamentals and market presence continue to support its growth potential and valuation in a competitive landscape.

Table of contents

Business Model & Company Overview

Viatris Inc., founded in 1961 and headquartered in Canonsburg, Pennsylvania, stands as a leading player in the specialty and generic drug manufacturing sector. Its comprehensive ecosystem spans prescription brand drugs, generics, complex generics, biosimilars, and active pharmaceutical ingredients (APIs), addressing a broad spectrum of therapeutic needs. The company’s portfolio integrates multiple delivery forms, from oral solid doses to injectables, underscoring its mission to improve global health through accessible medication.

The company’s revenue engine balances product sales across developed and emerging markets worldwide, with significant exposure in the Americas, Europe, and Asia. Viatris generates value through a mix of branded and generic pharmaceuticals, biosimilars, and APIs, distributed via wholesalers, pharmacies, and specialty channels. Its extensive collaboration agreements further enrich its pipeline and market reach. This multifaceted model fortifies Viatris’s competitive advantage and cements its role in shaping the pharmaceutical industry’s future.

Financial Performance & Fundamental Metrics

This section examines Viatris Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

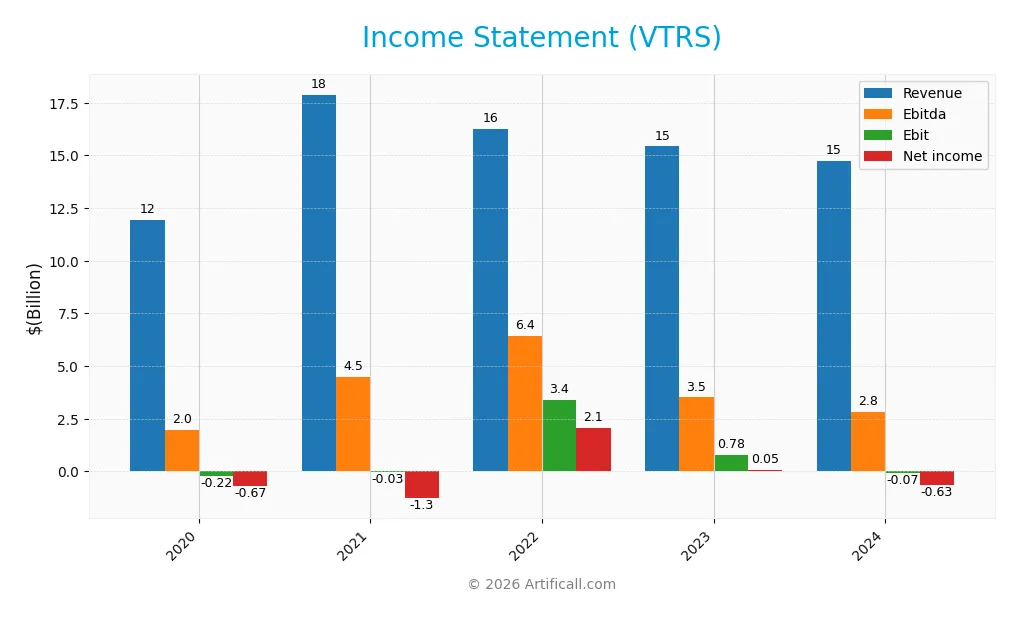

Income Statement

The table below presents Viatris Inc.’s key income statement figures for fiscal years 2020 through 2024, reflecting revenues, expenses, profits, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 11.95B | 17.89B | 16.26B | 15.43B | 14.74B |

| Cost of Revenue | 8.15B | 12.31B | 9.77B | 8.99B | 9.12B |

| Operating Expenses | 4.01B | 5.61B | 4.88B | 5.67B | 5.61B |

| Gross Profit | 3.80B | 5.58B | 6.50B | 6.44B | 5.62B |

| EBITDA | 1.99B | 4.48B | 6.43B | 3.52B | 2.82B |

| EBIT | -223M | -28M | 3.41B | 776M | -73M |

| Interest Expense | 498M | 636M | 592M | 573M | 550M |

| Net Income | -670M | -1.27B | 2.08B | 55M | -634M |

| EPS | -1.11 | -1.05 | 1.71 | 0.046 | -0.53 |

| Filing Date | 2021-03-01 | 2022-02-28 | 2023-02-27 | 2024-02-28 | 2025-02-27 |

Income Statement Evolution

From 2020 to 2024, Viatris Inc. experienced an overall revenue growth of 23.4%, yet revenue declined by 4.5% in the last year alone. Gross profit followed a similar trajectory, with a 12.7% drop in the most recent year. Margins showed mixed trends: the gross margin remained favorable at 38.2%, but EBIT and net margins turned unfavorable, reflecting rising costs and deteriorating profitability.

Is the Income Statement Favorable?

In 2024, Viatris reported revenue of $14.7B with a slight operating income of $10M but a negative net income of -$634M, representing a -4.3% net margin. Interest expense accounted for 3.7% of revenue, deemed favorable. However, earnings before interest and taxes, net margin, and EPS all declined sharply year-over-year. Overall, the fundamentals for the latest fiscal year are generally unfavorable, with profitability under pressure despite stable gross margins.

Financial Ratios

The following table presents key financial ratios for Viatris Inc. (VTRS) over the last five fiscal years, providing a snapshot of the company’s profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -5.61% | -7.10% | 12.78% | 0.35% | -4.30% |

| ROE | -2.92% | -6.19% | 9.86% | 0.27% | -3.40% |

| ROIC | -0.36% | -0.07% | 2.67% | 0.49% | 0.03% |

| P/E | -16.82 | -12.89 | 6.49 | 237.65 | -23.43 |

| P/B | 0.49 | 0.80 | 0.64 | 0.64 | 0.80 |

| Current Ratio | 1.22 | 1.10 | 1.58 | 1.67 | 1.65 |

| Quick Ratio | 0.70 | 0.70 | 1.05 | 1.22 | 0.98 |

| D/E | 1.14 | 1.14 | 0.93 | 0.90 | 0.77 |

| Debt-to-Assets | 42.50% | 42.59% | 39.04% | 38.53% | 34.47% |

| Interest Coverage | -0.42 | -0.05 | 2.73 | 1.34 | 0.02 |

| Asset Turnover | 0.19 | 0.33 | 0.33 | 0.32 | 0.36 |

| Fixed Asset Turnover | 3.16 | 5.14 | 4.95 | 5.13 | 5.05 |

| Dividend Yield | 0.00% | 2.44% | 4.31% | 4.43% | 3.87% |

Evolution of Financial Ratios

From 2020 to 2024, Viatris Inc. (VTRS) saw a decline in Return on Equity (ROE), shifting from negative to slightly less negative, ending at -3.4% in 2024. The Current Ratio improved steadily, reaching 1.65 in 2024, indicating better short-term liquidity. Debt-to-Equity Ratio decreased from about 1.14 in 2020 to 0.77 in 2024, reflecting reduced leverage. Profitability margins worsened notably, with net profit margin falling to -4.3% in 2024.

Are the Financial Ratios Favorable?

In 2024, Viatris exhibits mixed financial metrics: profitability ratios like net margin (-4.3%) and ROE (-3.4%) are unfavorable, while liquidity is generally solid with a Current Ratio of 1.65 (favorable) and Quick Ratio near 1 (neutral). Leverage ratios such as Debt-to-Equity (0.77) and Debt-to-Assets (34.47%) are neutral. Efficiency is weak with an asset turnover of 0.36 (unfavorable), though fixed asset turnover is strong at 5.05 (favorable). Market valuations, including Price-to-Book (0.8) and Dividend Yield (3.87%), are favorable, leading to a slightly favorable overall ratio assessment.

Shareholder Return Policy

Viatris Inc. maintains a consistent dividend payment with a yield around 3.9% in 2024, despite reporting a negative net profit margin. The dividend payout ratio is negative, indicating dividends exceed net income, supported partially by free cash flow. Share buybacks are not explicitly reported.

This distribution approach, with dividends sustained despite losses, may pose sustainability risks if free cash flow weakens. However, the current policy reflects a commitment to shareholder returns that could support long-term value if cash flow coverage remains stable.

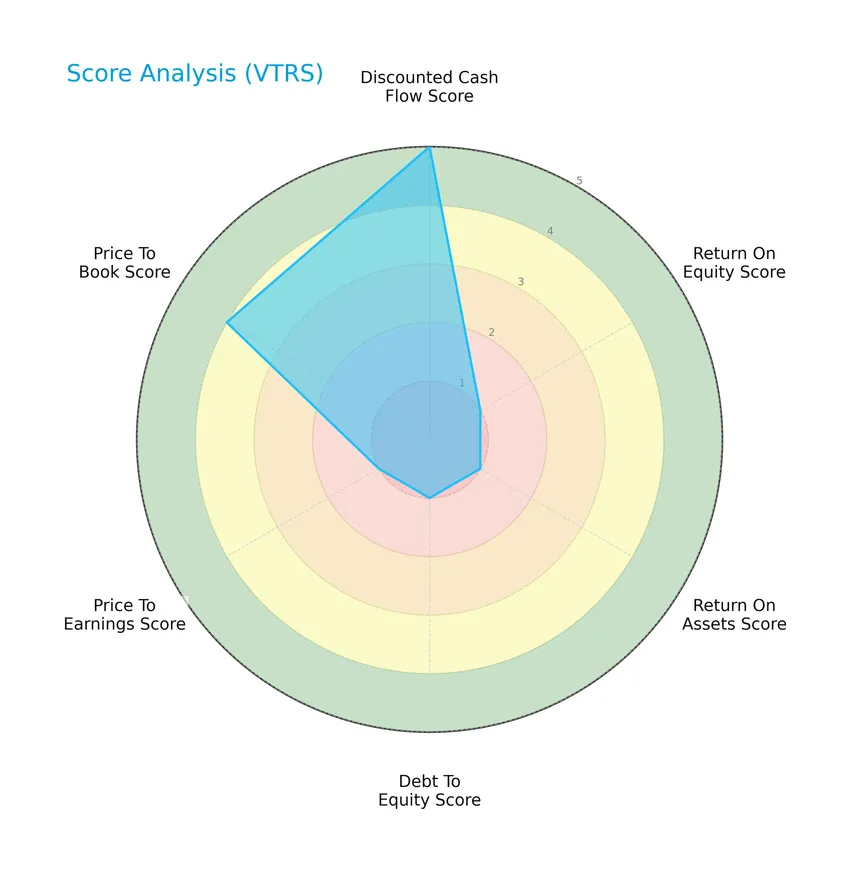

Score analysis

The following radar chart illustrates Viatris Inc.’s key financial scores across valuation, profitability, and leverage metrics:

Viatris shows a strong discounted cash flow score of 5, indicating favorable valuation by this method. However, profitability and leverage scores are very low at 1 for return on equity, return on assets, debt-to-equity, and price-to-earnings, reflecting significant financial challenges. The price-to-book score is relatively better at 4, suggesting some value appeal.

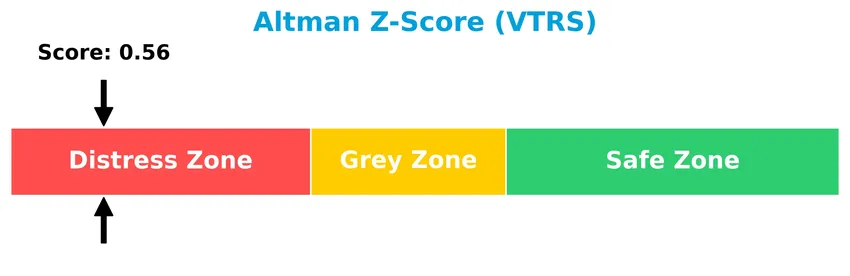

Analysis of the company’s bankruptcy risk

The Altman Z-Score positions Viatris well within the distress zone, signaling a high risk of bankruptcy and financial distress:

Is the company in good financial health?

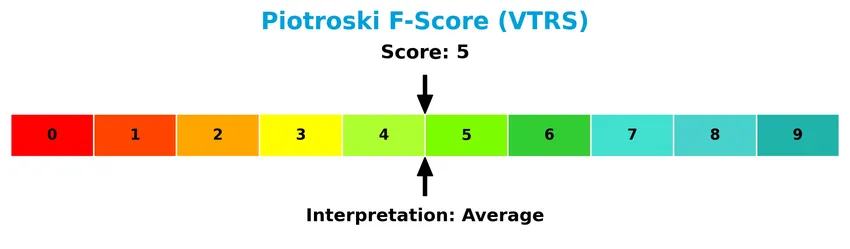

The Piotroski Score diagram below summarizes Viatris’s financial health based on nine accounting criteria:

With a Piotroski Score of 5, Viatris exhibits average financial strength, indicating moderate operational and financial stability without strongly positive or negative signals.

Competitive Landscape & Sector Positioning

This sector analysis will explore Viatris Inc.’s strategic positioning, revenue segmentation, key products, main competitors, and overall market context. I will examine whether Viatris holds a competitive advantage relative to its peers in the specialty and generic drug manufacturing industry.

Strategic Positioning

Viatris Inc. maintains a diversified product portfolio spanning brands, generics, complex generics, and biosimilars, with 2024 revenues of $9.2B and $5.5B in brands and generics respectively. Geographically, it operates globally across Developed Markets ($8.96B), Greater China, JANZ, and Emerging Markets, reflecting broad exposure.

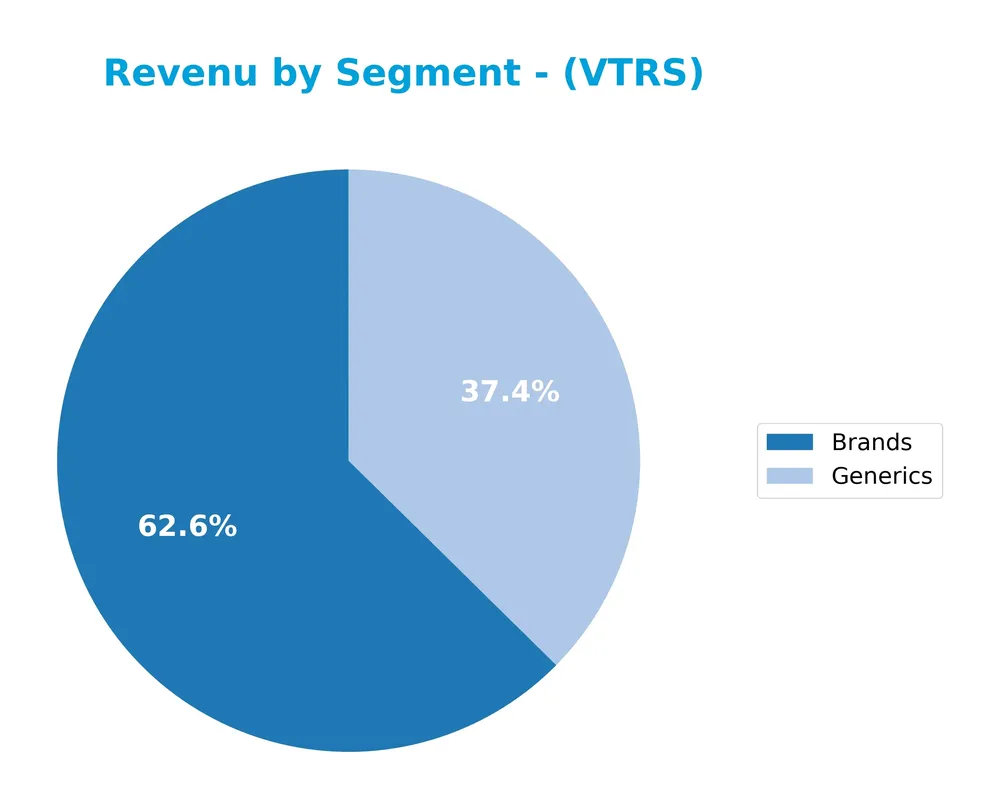

Revenue by Segment

This pie chart illustrates Viatris Inc.’s revenue distribution by product segment for the fiscal year 2024, highlighting the contributions of Brands and Generics.

In 2024, Brands remain the dominant revenue driver at 9.2B, though showing a decline from previous years, while Generics contribute 5.5B, relatively stable. The Complex GX and Biosimilars segment, notable in earlier years, was not reported in 2024, indicating a potential shift or consolidation in the company’s product focus. Overall, revenue concentration persists in Brands and Generics with a slight slowdown in the leading segment.

Key Products & Brands

The table below outlines Viatris Inc.’s key products and brands along with their descriptions:

| Product | Description |

|---|---|

| Prescription Brand Drugs | Includes well-known brands like Lyrica, Lipitor, Creon, Influvac, Wixela Inhub, EpiPen, Fraxiparine, Yupelri, Norvasc, Viagra, AMITIZA, Lipacreon, Effexor, Celebrex, and ARV medicines. |

| Generic Drugs | Broad portfolio of generic medications sold worldwide, contributing significant revenue. |

| Complex Generic Drugs & Biosimilars | Includes complex generics and biosimilars franchises such as Fulphila, Ogivri, Hulio, and SEMGLEE, targeting oncology, immunology, endocrinology, ophthalmology, and dermatology. |

| Active Pharmaceutical Ingredients (APIs) | Supplies APIs for antibacterial, CNS agents, antihistamines/antiasthmatics, cardiovascular, antivirals, antidiabetics, antifungals, and proton pump inhibitors. |

| Support Services | Diagnostic clinics, educational seminars, and digital tools aimed at helping patients manage their health. |

Viatris generates substantial revenue from its branded and generic drug portfolios, with growing contributions from complex generics and biosimilars. Its broad therapeutic coverage and global distribution support a diverse healthcare offering.

Main Competitors

There are 2 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Zoetis Inc. | 55.5B |

| Viatris Inc. | 14.4B |

Viatris Inc. ranks 2nd among its competitors in the Drug Manufacturers – Specialty & Generic industry. Its market cap is approximately 27.4% of the leader, Zoetis Inc. Viatris is positioned below both the average market cap of the top 10 competitors (34.9B) and the median market cap in the sector. The company shows a significant gap of +264.72% to the next competitor above it, indicating a substantial difference in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does VTRS have a competitive advantage?

Viatris Inc. currently does not present a strong competitive advantage, as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction despite a growing ROIC trend. Its global moat status is slightly unfavorable, reflecting ongoing challenges in efficiently generating excess returns.

Looking ahead, Viatris operates across diverse markets including Developed Markets, Greater China, JANZ, and Emerging Markets, offering a broad portfolio of prescription brands, generics, biosimilars, and APIs. The company’s collaborations and licensing agreements may provide opportunities to expand its biosimilars franchises and therapeutic areas, potentially enhancing future market presence.

SWOT Analysis

This SWOT analysis highlights Viatris Inc.’s key internal strengths and weaknesses alongside external opportunities and threats to guide strategic investment decisions.

Strengths

- diversified product portfolio

- global market presence

- strong dividend yield

Weaknesses

- declining revenue growth in recent year

- negative net margin and ROE

- interest coverage below 1

Opportunities

- expanding emerging markets segment

- growth in biosimilars and complex generics

- strategic collaborations and licensing agreements

Threats

- intense industry competition

- pricing pressures on generics

- regulatory and patent challenges

Overall, Viatris shows robust global reach and product diversity but faces profitability challenges and recent revenue declines. Its strategy should focus on leveraging growth in emerging markets and biosimilars while improving operational efficiency and managing regulatory risks carefully.

Stock Price Action Analysis

The weekly stock chart for Viatris Inc. (VTRS) illustrates price movements over the past 12 months, highlighting recent acceleration in the upward trend:

Trend Analysis

Over the past 12 months, VTRS stock gained 4.92%, indicating a bullish trend. The price range fluctuated between 7.54 and a high of 13.37, with a standard deviation of 1.4 showing moderate volatility. The trend shows clear acceleration, supported by recent gains of 30.53% since November 2025.

Volume Analysis

Trading volume has been increasing, totaling over 5.6B shares, with buyer volume slightly exceeding seller volume at 50.02%. In the recent period, buyer dominance rose sharply to 78.18%, reflecting strong buyer-driven activity and heightened market participation since November 2025.

Target Prices

The current analyst consensus for Viatris Inc. (VTRS) presents a moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 16 | 15 | 15.5 |

Analysts expect the stock to trade between $15 and $16, with a consensus target price of $15.5, indicating a relatively stable outlook in the near term.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding Viatris Inc. (VTRS).

Stock Grades

Here is a summary of recent verified stock grades for Viatris Inc. from reputable grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Upgrade | Buy | 2026-01-16 |

| Jefferies | Maintain | Buy | 2025-03-07 |

| Piper Sandler | Maintain | Neutral | 2025-03-05 |

| B of A Securities | Maintain | Underperform | 2025-02-28 |

| Barclays | Maintain | Underweight | 2025-02-28 |

| Piper Sandler | Maintain | Neutral | 2024-12-06 |

| Barclays | Maintain | Underweight | 2024-11-08 |

| Piper Sandler | Maintain | Neutral | 2024-03-28 |

| Piper Sandler | Maintain | Neutral | 2023-11-22 |

| B of A Securities | Downgrade | Underperform | 2023-10-23 |

The overall trend shows a predominantly neutral to cautious stance with recent upgrades by Argus Research and Jefferies signaling some renewed confidence, while B of A Securities and Barclays maintain a more conservative outlook.

Consumer Opinions

Consumer sentiment toward Viatris Inc. (VTRS) reveals a mix of appreciation for its product accessibility and concerns about service consistency.

| Positive Reviews | Negative Reviews |

|---|---|

| “Viatris offers affordable medications, which is a huge relief for many patients.” | “Customer service can be slow and unresponsive at times.” |

| “Wide availability of generic drugs helps manage healthcare costs effectively.” | “Some shipments were delayed, causing inconvenience.” |

| “The company’s commitment to global health is commendable.” | “Quality control issues occasionally impact product reliability.” |

Overall, consumers appreciate Viatris for its affordable and accessible pharmaceutical products but express concerns about customer service and occasional delays, indicating areas for operational improvement.

Risk Analysis

The following table summarizes key risks facing Viatris Inc., focusing on their likelihood and potential impact on the company’s performance:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Low profitability and negative returns on equity and assets indicate ongoing financial strain. | High | High |

| Bankruptcy Risk | Altman Z-Score in distress zone signals a significant risk of financial distress or bankruptcy. | Medium | High |

| Debt Management | Moderate debt-to-equity and debt-to-assets ratios, but poor interest coverage raises concerns. | Medium | Medium |

| Market Volatility | Beta below 1 suggests lower volatility, but sector-specific risks remain due to healthcare changes. | Medium | Medium |

| Regulatory Risks | Operating globally in pharmaceuticals exposes the company to stringent regulations and patent risks. | Medium | High |

| Competitive Pressure | Intense competition in specialty and generic drug markets may limit growth and margins. | High | Medium |

Financial risks are most prominent, with negative net margin (-4.3%) and ROE (-3.4%) underscoring profitability challenges. The Altman Z-Score of 0.56 places Viatris in the distress zone, highlighting bankruptcy risk. Investors should monitor debt servicing ability closely given the unfavorable interest coverage ratio (-0.13).

Should You Buy Viatris Inc.?

Viatris Inc. appears to be navigating a challenging leverage profile with substantial debt alongside improving operational efficiency, suggesting a slightly unfavorable yet evolving moat. While profitability metrics are weak, the overall rating of C+ indicates a moderate investment profile with significant risk considerations.

Strength & Efficiency Pillars

Viatris Inc. presents a mixed financial profile with some strengths offset by significant challenges. The company maintains a favorable weighted average cost of capital (WACC) at 5.41%, supported by a reasonable price-to-book ratio of 0.8 and a current ratio of 1.65, indicating sound liquidity. Dividend yield stands at a healthy 3.87%, and fixed asset turnover at 5.05 reflects operational efficiency in asset utilization. However, profitability metrics are disappointing, with a net margin of -4.3%, return on equity (ROE) at -3.4%, and return on invested capital (ROIC) near zero at 0.03%, all signaling weak earnings generation and value destruction.

Weaknesses and Drawbacks

The company faces notable headwinds, primarily on profitability and financial stability fronts. The Altman Z-Score of 0.56 places Viatris firmly in the distress zone, indicating a high bankruptcy risk. Interest coverage is negative at -0.13, raising concerns about the firm’s ability to service debt. Recent income statement trends are unfavorable, including a steep revenue decline of -4.46% year-over-year and a drastic net margin contraction of -1313.5%. Despite a favorable P/E ratio influenced by negative earnings, the very low ROE and ROIC alongside ongoing losses highlight significant operational and financial risks.

Our Verdict about Viatris Inc.

The long-term fundamental profile of Viatris Inc. may appear unfavorable given its persistent profitability struggles and financial distress indicators. However, the recent bullish technical trend, marked by strong buyer dominance of 78.18% and a 30.53% price increase since late 2025, suggests improving market sentiment. Despite these encouraging market dynamics, the considerable operational weaknesses and financial risks imply that investors might consider a cautious, wait-and-see approach before increasing exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Palmetto Grain Brokerage – – Palmetto Grain Brokerage (Jan 22, 2026)

- Viatris Expands Innovative Portfolio in Cardiovascular Diseases with the Company’s First Launch of Inpefa® (Sotagliflozin) for the Treatment of Heart Failure – PR Newswire (Jan 20, 2026)

- Viatris Reports Second Quarter 2025 Results and Reiterates 2025 Financial Guidance – Viatris (Aug 07, 2025)

- 3 Reasons to Sell VTRS and 1 Stock to Buy Instead – Finviz (Jan 21, 2026)

- Viatris Inc. (VTRS) Provides Updates on Four Recent Regulatory Milestones – Yahoo Finance (Jan 02, 2026)

For more information about Viatris Inc., please visit the official website: viatris.com