Home > Analyses > Technology > Veritone, Inc.

Veritone, Inc. transforms how industries harness artificial intelligence to unlock insights from vast, complex data sets. As a pioneer in AI infrastructure, Veritone’s flagship aiWARE platform powers advanced machine learning applications across media, government, and legal sectors, driving innovation and efficiency. Renowned for its cutting-edge technology and versatile solutions, the company shapes the future of AI-driven analytics. The key question now is whether Veritone’s growth trajectory and fundamentals can sustain its market valuation in a competitive landscape.

Table of contents

Business Model & Company Overview

Veritone, Inc., founded in 2014 and headquartered in Denver, Colorado, stands out in the Software – Infrastructure sector with its AI-driven ecosystem. Its core mission revolves around the aiWARE platform, an AI operating system that integrates machine learning and cognitive processes to extract valuable insights from vast data sets. This platform supports diverse applications, including transcription, language translation, and sentiment analysis, serving verticals like media, government, and legal sectors.

The company’s revenue engine is powered by a blend of software solutions and media advertising services, combining AI-powered analytics with campaign strategy and execution. With operations spanning the United States and the United Kingdom, Veritone leverages its presence in key global markets to fuel growth. Its competitive advantage lies in the seamless integration of AI capabilities across multiple industries, positioning it as a pivotal player shaping the future of data intelligence.

Financial Performance & Fundamental Metrics

This section analyzes Veritone, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and stability.

Income Statement

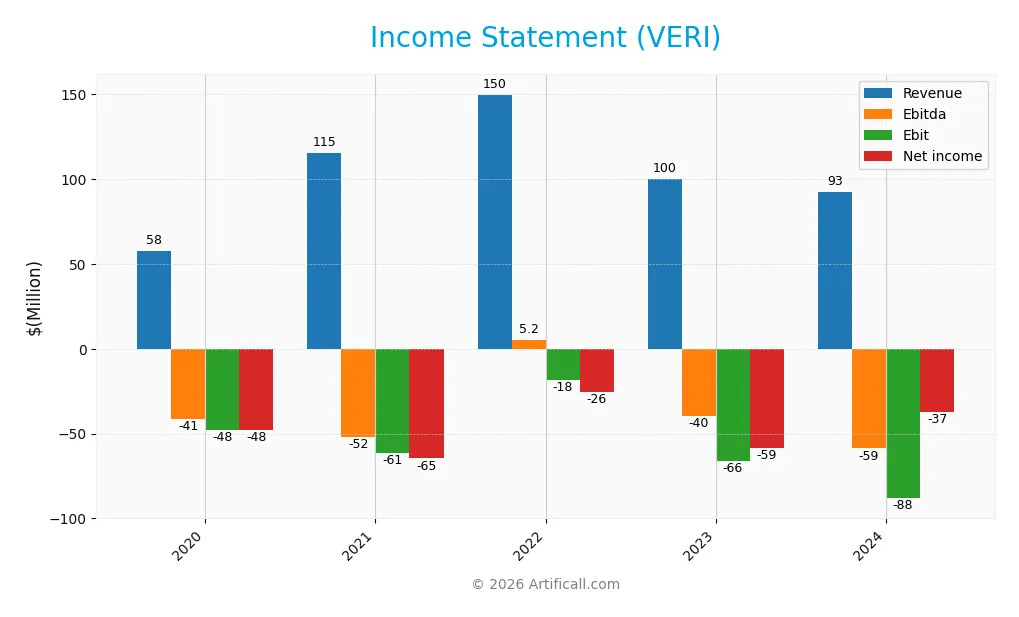

The table below presents the annual income statement of Veritone, Inc. (ticker: VERI) for fiscal years 2020 through 2024, showing key financial metrics in millions of USD where applicable.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 57.7M | 115.3M | 149.7M | 100.0M | 92.6M |

| Cost of Revenue | 15.7M | 22.1M | 27.4M | 27.8M | 27.3M |

| Operating Expenses | 89.7M | 154.5M | 160.3M | 171.8M | 153.6M |

| Gross Profit | 42.0M | 93.2M | 122.3M | 72.2M | 65.4M |

| EBITDA | -41.3M | -52.0M | 5.2M | -39.5M | -58.8M |

| EBIT | -47.7M | -61.4M | -18.4M | -66.3M | -88.1M |

| Interest Expense | 0 | 0.5M | 4.9M | 2.4M | 12.1M |

| Net Income | -47.9M | -64.7M | -25.6M | -58.6M | -37.4M |

| EPS | -1.73 | -1.94 | -0.71 | -1.59 | -0.98 |

| Filing Date | 2021-03-05 | 2022-03-17 | 2023-03-16 | 2024-04-01 | 2025-04-01 |

Income Statement Evolution

Veritone, Inc. experienced a 7.35% decline in revenue from 2023 to 2024, reversing previous growth trends, yet revenue rose 60.53% over the 2020-2024 period. Gross profit also fell 9.47% year-over-year, with a gross margin remaining favorable at 70.58%. However, EBIT and net margins were negative and deteriorated, reflecting elevated operating expenses and interest costs impacting profitability.

Is the Income Statement Favorable?

In 2024, despite a favorable gross margin of 70.58%, Veritone’s EBIT margin stood at an unfavorable -95.13%, driven by high operating expenses and a significant 13.03% interest expense ratio. The net margin was also negative at -40.36%, though it improved compared to prior years. Overall, 57.14% of income statement metrics were favorable, leading to a generally favorable global income statement opinion, tempered by persistent losses and cost pressures.

Financial Ratios

The following table presents key financial ratios for Veritone, Inc. over the fiscal years 2020 to 2024, providing a snapshot of profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -83% | -56% | -17% | -59% | -40% |

| ROE | -54% | -75% | -32% | -154% | -278% |

| ROIC | -53% | -19% | -16% | -49% | -58% |

| P/E | -16.4 | -11.6 | -7.47 | -1.14 | -3.34 |

| P/B | 8.9 | 8.65 | 2.39 | 1.75 | 9.27 |

| Current Ratio | 1.77 | 1.98 | 1.44 | 0.97 | 0.97 |

| Quick Ratio | 1.77 | 1.98 | 1.44 | 0.97 | 0.97 |

| D/E | 0 | 2.26 | 1.75 | 3.74 | 8.91 |

| Debt-to-Assets | 0 | 38% | 33% | 38% | 61% |

| Interest Coverage | 0 | -114 | -7.8 | -41 | -7.3 |

| Asset Turnover | 0.32 | 0.22 | 0.35 | 0.26 | 0.47 |

| Fixed Asset Turnover | 24.5 | 74.1 | 28.3 | 10.3 | 8.5 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2020 to 2024, Veritone, Inc.’s Return on Equity (ROE) deteriorated significantly, reaching -278% in 2024, indicating worsening profitability. The Current Ratio declined steadily from 1.77 in 2020 to 0.97 in 2024, signaling reduced liquidity. Meanwhile, the Debt-to-Equity Ratio rose sharply from 0 in 2020 to 8.91 in 2024, reflecting a substantial increase in leverage and financial risk.

Are the Financial Ratios Favorable?

In 2024, Veritone’s profitability ratios, including a net margin of -40.36% and ROE of -278%, are unfavorable, alongside a high weighted average cost of capital at 11.33%. Liquidity is weak with a current ratio below 1, while leverage is high with a debt-to-equity ratio of 8.91 and interest coverage negative at -7.3. Only the price-to-earnings ratio and fixed asset turnover show favorable signs, but overall, the financial ratios are very unfavorable.

Shareholder Return Policy

Veritone, Inc. (VERI) does not pay dividends, reflecting its consistent net losses and negative free cash flow per share over recent years. The company prioritizes reinvestment and growth initiatives, with no share buyback programs reported, indicating a focus on long-term value creation rather than immediate shareholder returns.

This approach aligns with VERI’s financial profile, as it continues operating at negative profit margins and maintains high leverage ratios. The absence of distributions supports capital preservation and potential future growth, but also signals ongoing operational challenges that may affect sustainable shareholder value in the near term.

Score analysis

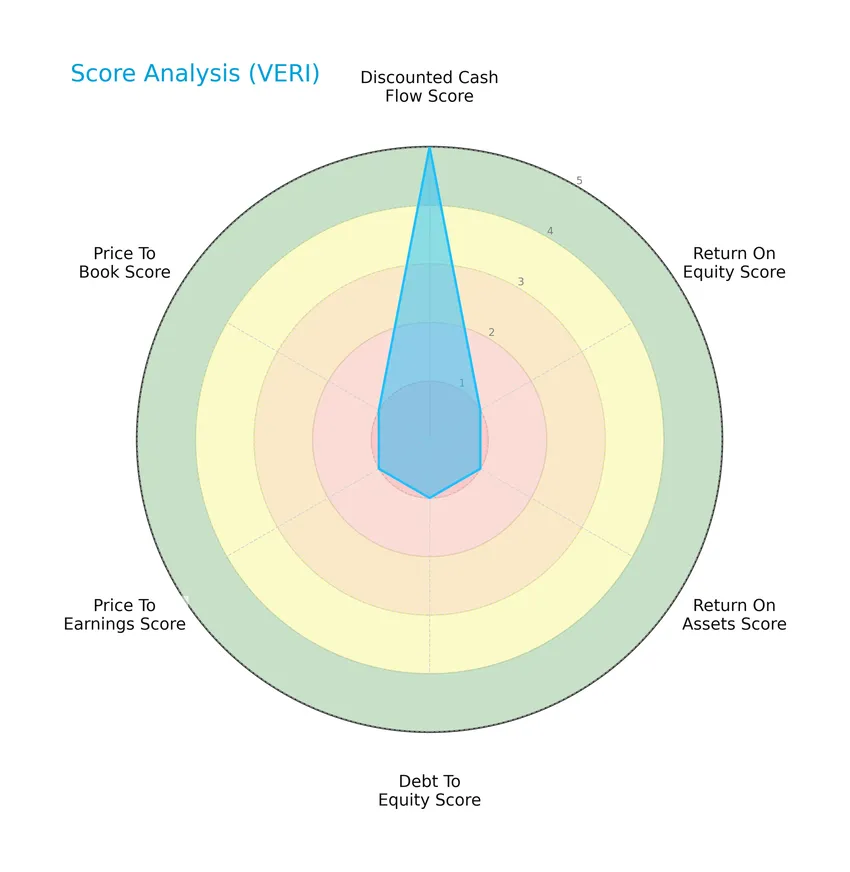

The following radar chart illustrates Veritone, Inc.’s key financial metric scores for a comprehensive evaluation:

Veritone’s discounted cash flow score is very favorable at 5, indicating good valuation prospects. However, the scores for return on equity, return on assets, debt to equity, price to earnings, and price to book are all very unfavorable at 1, reflecting weak profitability, high leverage, and poor market valuation metrics.

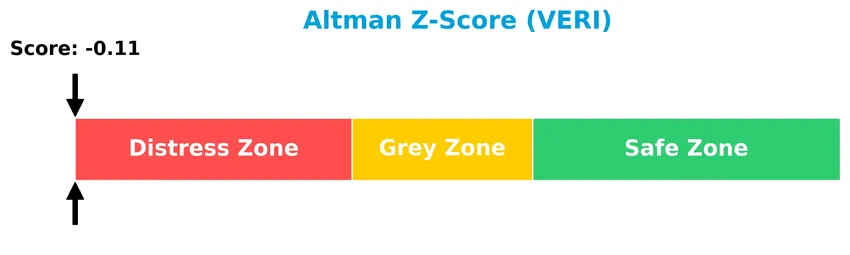

Analysis of the company’s bankruptcy risk

Veritone’s Altman Z-Score places it in the distress zone, signaling a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

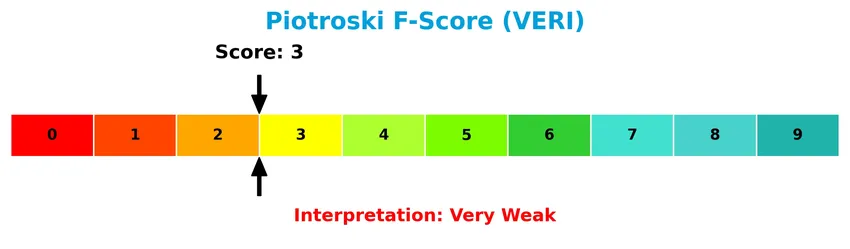

The Piotroski Score diagram below gives insights into Veritone’s financial strength and health:

With a Piotroski Score of 3, Veritone is classified as very weak, suggesting limited financial strength and potential operational challenges. This low score indicates the company struggles to demonstrate robust profitability, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This section analyzes Veritone, Inc.’s position within the technology sector, highlighting its strategic focus and market segments. I will assess whether Veritone holds a competitive advantage over its main competitors based on its offerings and market presence.

Strategic Positioning

Veritone, Inc. concentrates on AI-driven software infrastructure, primarily through its aiWARE platform and related managed services. Its revenue spans software products ($61M in 2024), managed services ($31.6M), and licensing ($19M), with operations focused in the US and UK, reflecting a specialized yet moderately diversified portfolio.

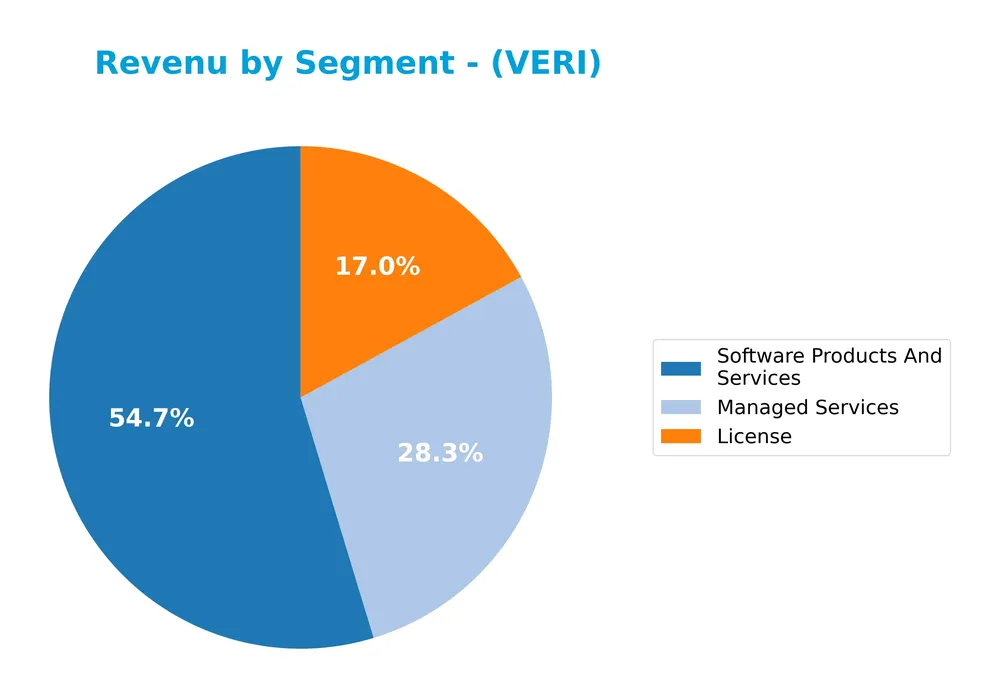

Revenue by Segment

This pie chart illustrates Veritone, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the contributions of License, Managed Services, and Software Products and Services.

In 2024, Software Products and Services led Veritone’s revenue at $61.1M, followed by Managed Services at $31.6M and License at $19.0M. Compared to 2023, there is a noticeable decline in Advertising revenue, which is absent in 2024, indicating a strategic shift away from this segment. The concentration on Software Products and Services and Managed Services suggests a focus on scalable, service-based offerings, though the decrease in License revenue signals some volatility in traditional revenue streams.

Key Products & Brands

The following table outlines Veritone, Inc.’s principal products and services generating revenue as of the latest fiscal periods:

| Product | Description |

|---|---|

| aiWARE Platform | An AI operating system using machine learning and cognitive processes for data insights, including transcription, recognition, and analysis. |

| Software Products and Services | Encompasses aiWARE solutions and related AI software offerings for various verticals such as media, government, and legal compliance. |

| Managed Services | Services that support AI platform deployment, integration, and ongoing management for clients. |

| Advertising Services | Media advertising agency offerings including media planning, buying, campaign messaging, clearance verification, and analytics. |

| License | Licensing of AI software products and technology solutions to clients. |

| Government and Regulated Entities | AI and software services tailored specifically for government and compliance sectors. |

Veritone’s product portfolio centers on its aiWARE AI platform, supplemented by managed services and advertising solutions. Licensing and government-focused offerings also contribute to its diverse revenue streams.

Main Competitors

There are 32 competitors in the Technology – Software Infrastructure sector, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Microsoft Corporation | 3.52T |

| Oracle Corporation | 553B |

| Palantir Technologies Inc. | 383B |

| Adobe Inc. | 140B |

| Palo Alto Networks, Inc. | 120B |

| CrowdStrike Holdings, Inc. | 113B |

| Synopsys, Inc. | 92B |

| Cloudflare, Inc. | 69B |

| Fortinet, Inc. | 59B |

| Block, Inc. | 40B |

Veritone, Inc. ranks 32nd among 32 competitors, with a market cap only 0.01% that of Microsoft Corporation, the sector leader. The company is positioned well below both the average market cap of the top 10 competitors (508B) and the sector median (19B). Its market cap is 66.58% smaller than the next closest competitor above it, indicating a significant gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does VERI have a competitive advantage?

Veritone, Inc. currently does not demonstrate a competitive advantage as it shows a very unfavorable moat status, with a ROIC significantly below its WACC and a declining trend in profitability. Despite a favorable gross margin of 70.58%, the company faces challenges with negative EBIT and net margins, indicating value destruction.

Looking ahead, Veritone operates in the AI software infrastructure sector with its aiWARE platform, serving diverse verticals such as media, government, and energy. The company’s future opportunities lie in expanding AI capabilities and market reach in the US and UK, potentially unlocking new revenue streams despite recent revenue declines.

SWOT Analysis

This SWOT analysis highlights Veritone, Inc.’s key internal and external factors to inform investment decisions.

Strengths

- Advanced AI platform with diverse cognitive capabilities

- Favorable gross margin at 70.58%

- Strong revenue growth over 5 years at 60.53%

Weaknesses

- Negative net margin at -40.36%

- High debt levels with debt-to-equity ratio of 8.91

- Distress zone Altman Z-Score indicating financial instability

Opportunities

- Expanding AI adoption across media, legal, and government sectors

- Potential to improve profitability through operational efficiencies

- Growing demand for AI-driven data insights and analytics

Threats

- Intense competition in AI and software infrastructure

- Volatile market conditions affecting tech stocks

- High financial leverage increases risk during downturns

Veritone’s strengths in AI technology and solid revenue growth are offset by ongoing profitability challenges and financial risk. Strategic focus should prioritize improving margins and managing debt while capitalizing on expanding AI market opportunities.

Stock Price Action Analysis

The weekly stock chart below illustrates Veritone, Inc.’s price movements and volatility over the past 100 weeks:

Trend Analysis

Over the past 12 months, Veritone, Inc. (VERI) experienced an 80.89% price increase, indicating a bullish trend with deceleration in momentum. The stock’s price ranged from a low of 1.3 to a high of 7.18, with a moderate volatility of 1.25 standard deviation.

Volume Analysis

In the last three months, trading volume has been increasing but seller-driven, with sellers accounting for 73% of volume. This shift suggests growing bearish sentiment and heightened market participation favoring selling pressure.

Target Prices

The consensus target price for Veritone, Inc. (VERI) reflects moderate optimism among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 10 | 9 | 9.5 |

Analysts expect the stock price to trade between $9 and $10, with a consensus target of $9.5, suggesting a cautious but positive outlook.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback regarding Veritone, Inc. to gauge market sentiment.

Stock Grades

Here is the latest overview of Veritone, Inc.’s stock grades from recognized financial analysts over recent months:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| D. Boral Capital | Maintain | Buy | 2025-12-09 |

| D. Boral Capital | Maintain | Buy | 2025-12-04 |

| Needham | Maintain | Buy | 2025-12-02 |

| D. Boral Capital | Maintain | Buy | 2025-12-02 |

| D. Boral Capital | Maintain | Buy | 2025-11-07 |

| D. Boral Capital | Maintain | Buy | 2025-10-28 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-20 |

| D. Boral Capital | Maintain | Buy | 2025-10-15 |

| D. Boral Capital | Maintain | Buy | 2025-09-24 |

| D. Boral Capital | Maintain | Buy | 2025-09-09 |

The grades consistently reflect a stable “Buy” rating from multiple firms, with no recent changes in recommendations. The consensus among analysts leans towards a positive outlook, supported by a majority buy sentiment alongside some hold positions.

Consumer Opinions

Veritone, Inc. (VERI) continues to evoke a mix of enthusiasm and caution among its user base, reflecting its evolving technology and market presence.

| Positive Reviews | Negative Reviews |

|---|---|

| Innovative AI solutions that enhance workflow efficiency. | Occasional software glitches impacting performance. |

| Responsive customer support with timely issue resolution. | Steep learning curve for new users. |

| Strong integration capabilities with various platforms. | Pricing can be high for small to mid-sized businesses. |

Overall, consumers appreciate Veritone’s cutting-edge AI technology and solid customer service but often cite software reliability and cost as areas needing improvement. This balance suggests a promising product with room for refinement.

Risk Analysis

Below is a table summarizing the key risks associated with investing in Veritone, Inc., including their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Stability | Negative net margin (-40.36%) and poor profitability metrics indicate ongoing financial distress. | High | High |

| Leverage Risk | Extremely high debt-to-equity ratio (8.91) and debt to assets (60.54%) raise solvency concerns. | High | High |

| Liquidity Risk | Current ratio below 1 (0.97) signals potential difficulties meeting short-term obligations. | Medium | Medium |

| Market Volatility | Beta of 2.05 implies high stock price volatility relative to the market. | High | Medium |

| Credit Risk | Interest coverage ratio is negative (-7.3), indicating challenges in covering interest expenses. | High | High |

| Valuation Concerns | Unfavorable price-to-book (9.27) and negative PE ratio reflect uncertain valuation. | Medium | Medium |

| Bankruptcy Risk | Altman Z-score in distress zone (-0.11) suggests a significant risk of bankruptcy. | High | Very High |

| Operational Risk | Low Piotroski score (3) reflects weak financial health and operational inefficiencies. | High | High |

The most critical risks stem from Veritone’s poor financial health, including high leverage, negative profitability, and a bankruptcy risk confirmed by its Altman Z-score in the distress zone. These factors highlight significant caution for investors despite the company’s presence in the growing AI sector.

Should You Buy Veritone, Inc.?

Veritone, Inc. appears to be facing substantial challenges with deteriorating profitability and a very unfavorable competitive moat characterized by value destruction. Despite manageable debt signals, the overall rating of C and distress-zone scores suggest a cautious analytical interpretation of its financial health.

Strength & Efficiency Pillars

Veritone, Inc. exhibits a mixed operational profile with a notably high gross margin of 70.58%, signaling strong core product profitability. However, profitability metrics such as net margin (-40.36%), ROE (-277.91%), and ROIC (-58.27%) are deeply unfavorable, indicating significant earnings losses and capital inefficiency. The company’s Altman Z-Score of -0.11 places it firmly in the distress zone, while a Piotroski score of 3 suggests very weak financial health. Importantly, ROIC at -58.27% falls well below the WACC of 11.33%, confirming that Veritone is currently destroying value rather than creating it.

Weaknesses and Drawbacks

Veritone faces substantial valuation and financial risks. Its price-to-book ratio stands at a steep 9.27, reflecting an expensive premium relative to book value, while the price-to-earnings ratio is negative but flagged as favorable only due to loss-making status, adding valuation ambiguity. Leverage is high with a debt-to-equity ratio of 8.91 and a debt-to-assets ratio of 60.54%, indicating significant financial risk and potential liquidity stress, compounded by a current ratio below 1. The recent seller dominance at 73% during the latest period, despite an overall bullish trend, signals short-term market pressure and investor caution.

Our Verdict about Veritone, Inc.

Veritone’s fundamental profile is unfavorable due to weak profitability, high leverage, and financial distress indicators. Although the overall long-term stock trend has been bullish with an 80.89% price increase, recent market behavior is seller-dominant, suggesting caution. Despite the company’s strong gross margin and operational potential, the current financial fragility and valuation concerns might warrant a wait-and-see approach before committing to long-term exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Veritone’s stock soars: A deep dive into the 53% surge – MSN (Jan 20, 2026)

- Needham Initiates ‘Buy’ Rating on Veritone Inc. (VERI) with a $10 Price Target – Yahoo Finance (Oct 28, 2025)

- What Veritone, Inc.’s (NASDAQ:VERI) 27% Share Price Gain Is Not Telling You – simplywall.st (Dec 21, 2025)

- Veritone Reports Strong Third Quarter 2025 Results – Business Wire (Nov 06, 2025)

- Veritone Inc (NASDAQ:VERI) Stock Falls Despite Q3 Earnings Beat – Chartmill (Nov 06, 2025)

For more information about Veritone, Inc., please visit the official website: veritone.com