Home > Analyses > Industrials > Veralto Corporation

Veralto Corporation transforms how industries safeguard water quality and product integrity worldwide. Its cutting-edge technologies—from precision water analytics to innovative packaging and color solutions—set the standard across municipal, pharmaceutical, and industrial sectors. Veralto’s dual-segment strategy, combining Water Quality and Product Quality & Innovation, drives both sustainability and efficiency. I’m keen to explore whether its robust market position and innovation pipeline justify the current valuation and promise sustainable growth ahead.

Table of contents

Business Model & Company Overview

Veralto Corporation, founded in 2022 and headquartered in Waltham, Massachusetts, commands a dominant position in pollution and treatment controls. It integrates water analytics, treatment, and innovative marking and coding solutions into a cohesive ecosystem. Its dual segments—Water Quality and Product Quality & Innovation—serve critical industrial and municipal needs worldwide, underpinning its industrial leadership.

Veralto’s revenue engine balances precision water treatment technologies and consumable products with software-driven digital asset and color management solutions. Its global footprint spans the Americas, Europe, and Asia, leveraging renowned brands like Hach, Trojan Technologies, and Pantone. This diversified model builds a robust economic moat by embedding the company deeply into essential industrial and environmental processes.

Financial Performance & Fundamental Metrics

I will analyze Veralto Corporation’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder returns.

Income Statement

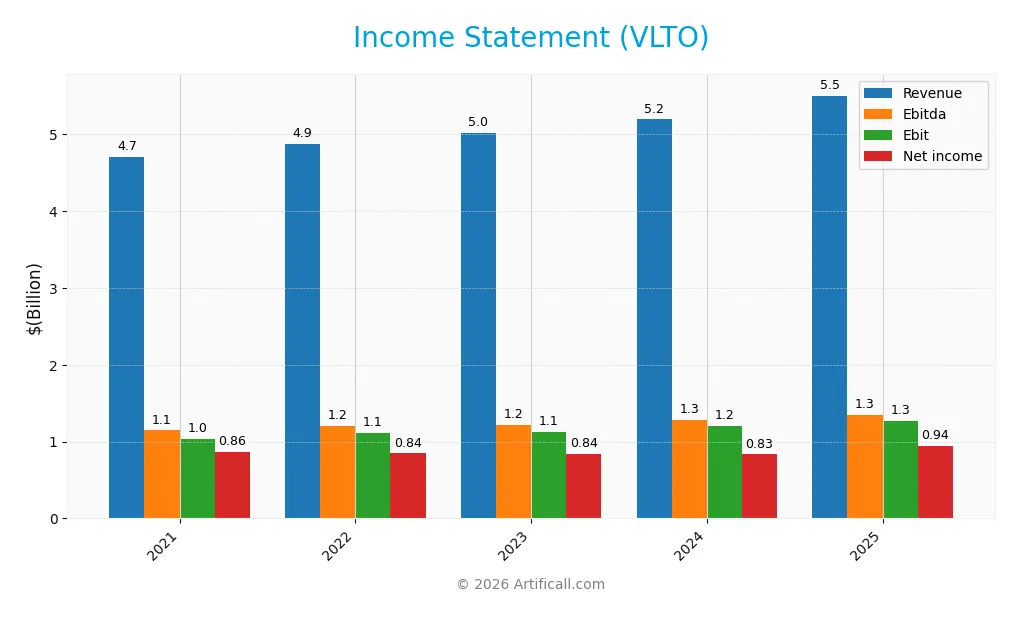

The table below summarizes Veralto Corporation’s key income statement metrics for the fiscal years 2021 through 2025, showing steady revenue growth and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 4.7B | 4.87B | 5.02B | 5.19B | 5.5B |

| Cost of Revenue | 1.99B | 2.11B | 2.12B | 2.09B | 2.2B |

| Operating Expenses | 1.67B | 1.65B | 1.76B | 1.90B | 2.02B |

| Gross Profit | 2.71B | 2.77B | 2.90B | 3.11B | 3.30B |

| EBITDA | 1.15B | 1.20B | 1.21B | 1.28B | 1.35B |

| EBIT | 1.04B | 1.11B | 1.13B | 1.20B | 1.27B |

| Interest Expense | 0 | 0 | 30M | 113M | 96M |

| Net Income | 861M | 845M | 839M | 833M | 940M |

| EPS | 3.50 | 3.43 | 3.41 | 3.37 | 3.79 |

| Filing Date | 2021-12-31 | 2022-12-31 | 2023-12-31 | 2025-02-25 | 2026-02-03 |

Income Statement Evolution

Veralto Corporation’s revenue rose steadily from $4.7B in 2021 to $5.5B in 2025, marking a 17% growth over five years. Net income also increased, reaching $940M in 2025, up 9% overall. Margins show mixed signals: gross margin remained favorable near 60%, while net margin declined slightly over the period, despite recent improvements.

Is the Income Statement Favorable?

In 2025, Veralto reported a 6% revenue increase and a 6.5% net margin growth, driven by effective cost control despite operating expenses growing in line with revenue. EBIT margin held strong at 23%, with interest expense low at 1.74% of revenue. Overall, fundamentals appear favorable, supported by solid earnings growth and margin stability.

Financial Ratios

The following table summarizes key financial ratios of Veralto Corporation (VLTO) over recent fiscal years for clear year-on-year comparison:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 18% | 17% | 17% | 16% | 17% |

| ROE | 27% | 26% | 61% | 41% | 30% |

| ROIC | 23% | 23% | 20% | 18% | 16% |

| P/E | 23.0 | 23.5 | 24.2 | 30.2 | 26.4 |

| P/B | 6.20 | 6.13 | 14.7 | 12.4 | 8.0 |

| Current Ratio | 1.07 | 1.14 | 1.64 | 1.92 | 1.67 |

| Quick Ratio | 0.79 | 0.83 | 1.40 | 1.69 | 1.52 |

| D/E | 0.04 | 0.04 | 2.01 | 1.36 | 0.86 |

| Debt-to-Assets | 2.8% | 2.5% | 48.8% | 43.2% | 34.7% |

| Interest Coverage | 0 | 0 | 38.0 | 10.7 | 13.3 |

| Asset Turnover | 0.97 | 1.01 | 0.88 | 0.81 | 0.72 |

| Fixed Asset Turnover | 18.1 | 19.7 | 19.2 | 19.4 | 18.7 |

| Dividend Yield | 0% | 0% | 0.11% | 0.35% | 0.44% |

Evolution of Financial Ratios

Veralto Corporation’s Return on Equity (ROE) showed notable volatility, peaking at 60.67% in 2023 before settling at 30.26% in 2025. The Current Ratio improved from 1.07 in 2021 to 1.67 in 2025, indicating better liquidity. Debt-to-Equity Ratio declined significantly from over 2.0 in 2023 to 0.86 in 2025, reflecting reduced leverage. Profitability remained relatively stable with net margins around 16-18%.

Are the Financial Ratios Favorable?

In 2025, Veralto posts favorable profitability metrics: a 17.08% net margin and a 30.26% ROE, supported by a 16.15% ROIC well above the 8.36% WACC, confirming efficient capital allocation. Liquidity ratios are strong, with a current ratio of 1.67 and quick ratio of 1.52. Leverage is neutral at a 0.86 debt-to-equity ratio. However, valuation ratios including P/E at 26.36 and P/B at 7.98 appear elevated, and the dividend yield is low at 0.44%, marking these as unfavorable. Overall, the ratio profile is slightly favorable.

Shareholder Return Policy

Veralto Corporation pays dividends with a payout ratio around 11.6% in 2025 and a dividend yield of 0.44%. The dividend per share has steadily increased from $0.09 in 2023 to $0.44 in 2025, supported by strong free cash flow coverage near 94%. Share buybacks are also part of the return strategy, complementing dividends.

This balanced approach indicates prudent capital allocation, avoiding excessive distributions or buybacks that could strain liquidity. The low payout ratio combined with consistent free cash flow coverage suggests the policy supports sustainable long-term shareholder value creation.

Score analysis

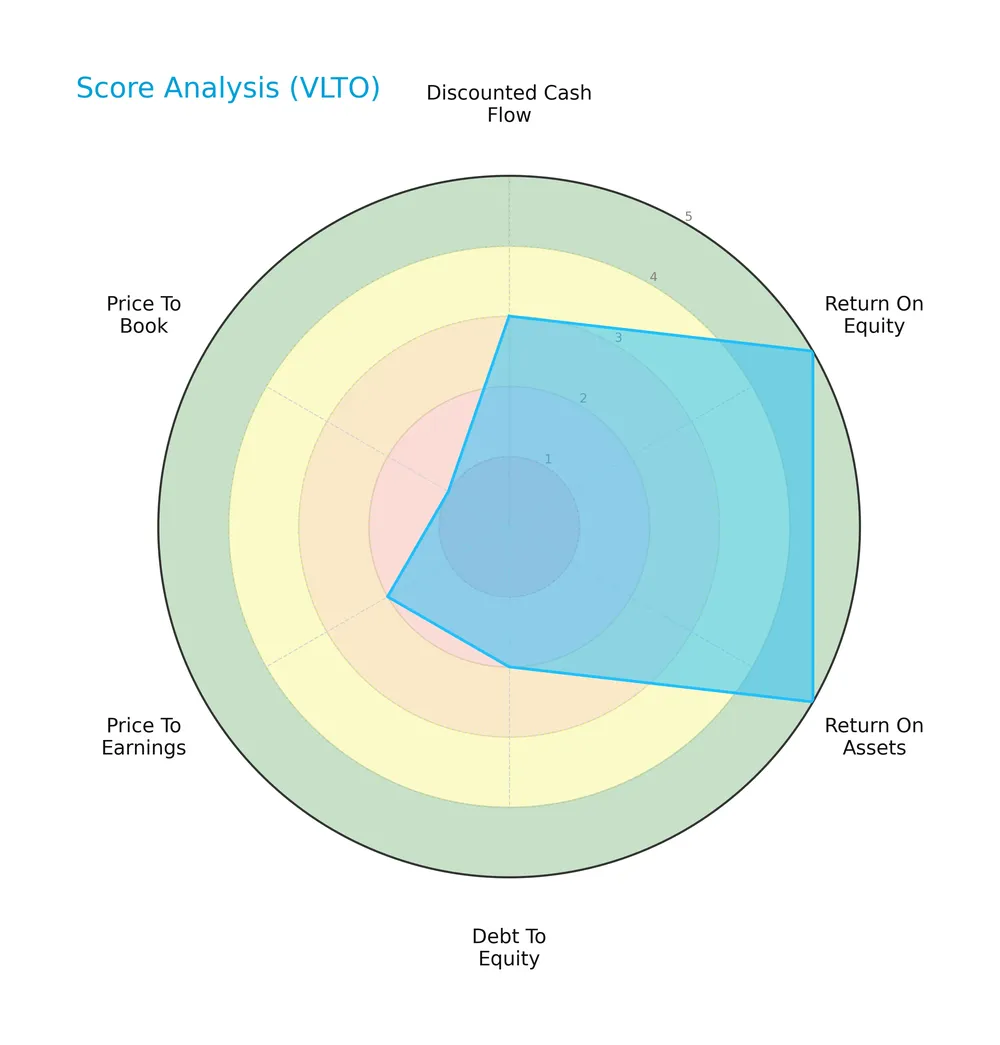

The following radar chart illustrates Veralto Corporation’s key valuation and financial performance scores:

Veralto shows very favorable returns on equity and assets, scoring 5 in both. However, its debt-to-equity, price-to-earnings, and price-to-book ratios score poorly, reflecting potential concerns on leverage and valuation.

Analysis of the company’s bankruptcy risk

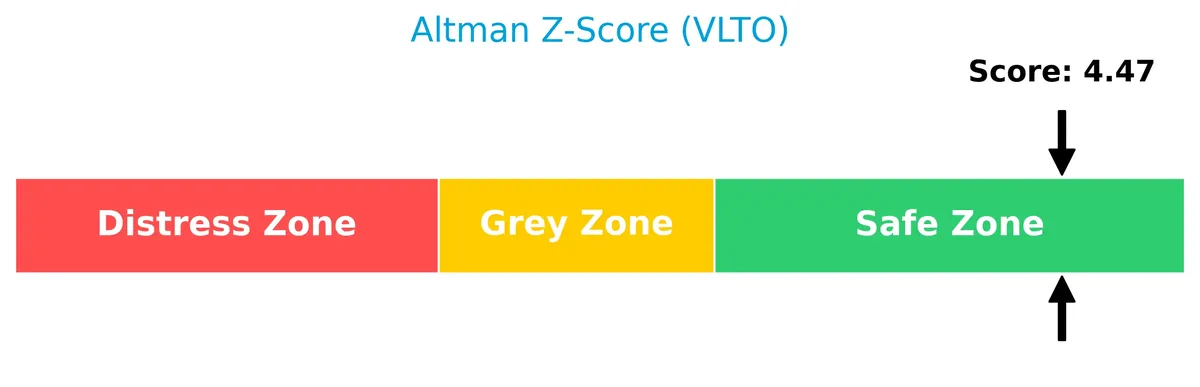

Veralto’s Altman Z-Score places it in the safe zone, indicating a low probability of bankruptcy risk:

Is the company in good financial health?

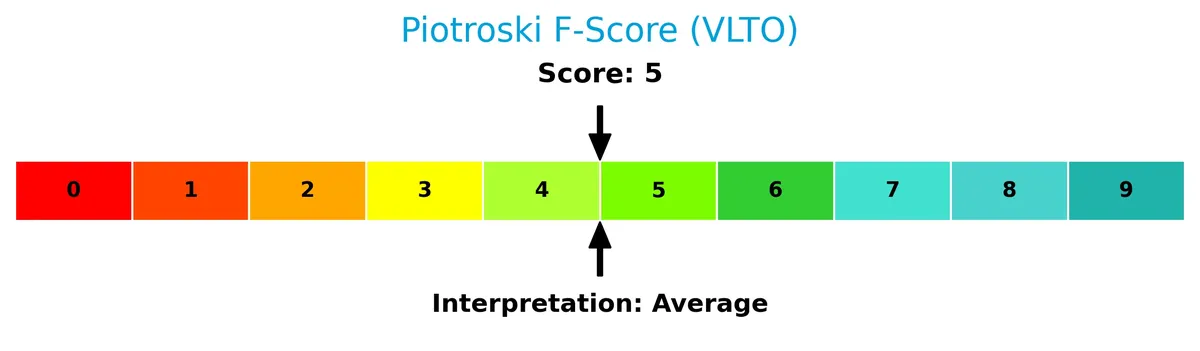

The Piotroski Score diagram highlights Veralto’s moderate financial strength based on nine key criteria:

With a score of 5, Veralto sits in an average financial health category, suggesting neither strong nor weak fundamentals at this time.

Competitive Landscape & Sector Positioning

This analysis explores Veralto Corporation’s strategic positioning within industrial pollution and treatment controls. It will cover revenue segmentation, key products, and main competitors. I will assess whether Veralto holds a competitive advantage over its sector peers.

Strategic Positioning

Veralto Corporation operates two core segments: Water Quality and Product Quality & Innovation, offering diversified solutions across water treatment and packaging industries. Its geographic revenue spans the US (2.3B), China (334M), Germany (266M), and others (2.3B), reflecting a balanced international footprint.

Revenue by Segment

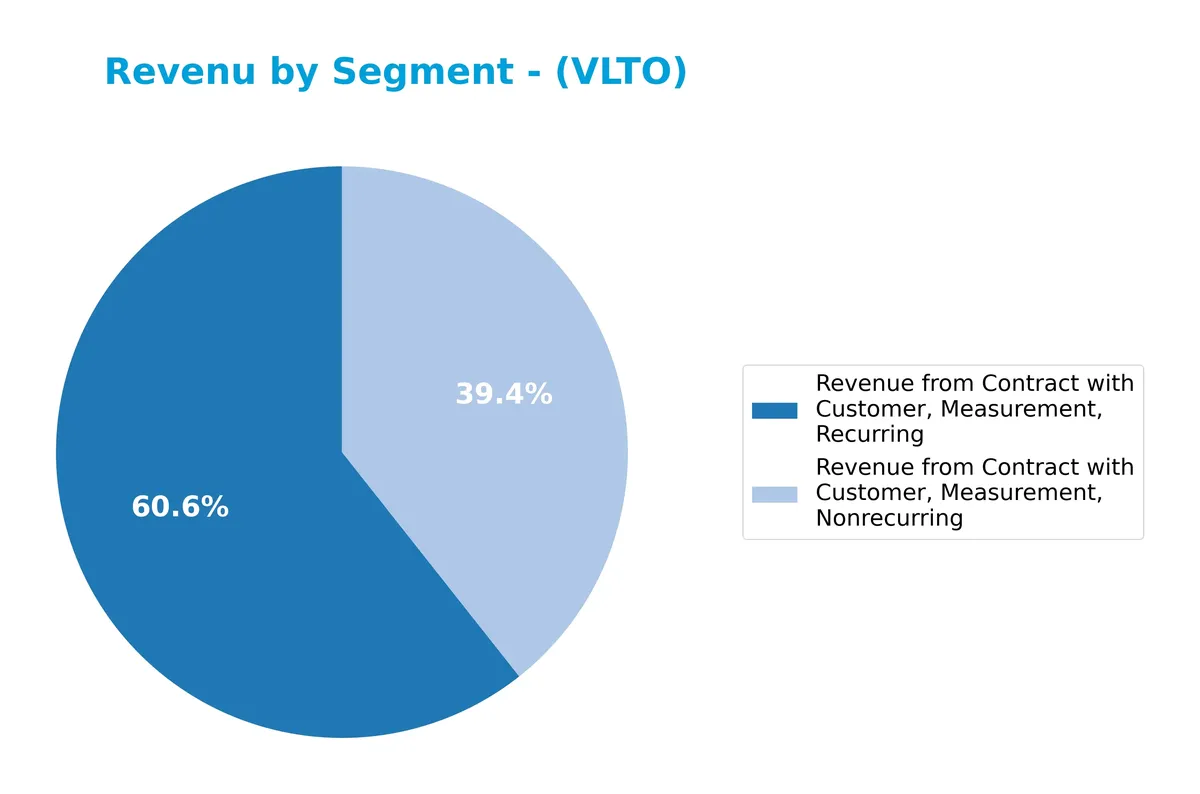

This pie chart illustrates Veralto Corporation’s revenue breakdown by segment for the full fiscal year 2024, highlighting the split between recurring and nonrecurring measurement contracts.

Veralto’s revenue heavily leans on recurring measurement contracts, generating 3.15B, compared to 2.04B from nonrecurring contracts. This imbalance suggests a stable income base with growth potential tied to recurring services. The strong contribution from recurring revenue reduces volatility, signaling a mature, subscription-like business model gaining traction in 2024.

Key Products & Brands

The following table details Veralto Corporation’s main products and brands by segment:

| Product | Description |

|---|---|

| Water Quality (WQ) Segment | Precision instrumentation and water treatment technologies for residential, commercial, municipal, industrial, and research applications. Includes chemical reagents, services, and digital solutions. Key brands: Hach, Trojan Technologies, ChemTreat. |

| Product Quality & Innovation (PQI) Segment | Marking and coding systems, inline printing, packaging design software, and color management solutions. Key brands: Videojet, Linx, Esko, X-Rite, Pantone. |

Veralto’s portfolio spans essential water analytics and treatment technologies alongside advanced marking, coding, and packaging solutions. The company serves diverse industries including municipal utilities, food and beverage, pharmaceutical, and industrial sectors.

Main Competitors

There are 89 competitors in the Industrials sector; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| GE Aerospace | 338B |

| Caterpillar Inc. | 280B |

| RTX Corporation | 251B |

| The Boeing Company | 171B |

| Union Pacific Corporation | 138B |

| Eaton Corporation plc | 127B |

| Deere & Company | 126B |

| Honeywell International Inc. | 124B |

| Lockheed Martin Corporation | 116B |

| Parker-Hannifin Corporation | 114B |

Veralto Corporation ranks 56th among 89 competitors, with a market cap at 6.65% of the leader, GE Aerospace. It sits below both the average market cap of the top 10 (179B) and the median sector cap (36B). The company has a 9.42% market cap gap to its next closest competitor above, indicating a moderate distance in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Aucun article trouvé pour ces critères.

Does Veralto have a competitive advantage?

Veralto shows a slight competitive advantage, creating value with ROIC exceeding WACC by 7.8%, supported by favorable margins and net income growth. However, its ROIC is declining, signaling potential margin pressure ahead.

Looking forward, Veralto’s diverse portfolio in water quality and product innovation positions it to tap new markets and grow through advanced water treatment and packaging technologies, expanding opportunities globally.

SWOT Analysis

This analysis highlights Veralto Corporation’s internal capabilities and external factors shaping its strategic outlook.

Strengths

- Strong ROE at 30%

- Robust net margin of 17%

- Diversified global revenue base

Weaknesses

- High P/B ratio signals overvaluation

- Declining ROIC trend

- Moderate Piotroski score of 5

Opportunities

- Expanding water treatment demand

- Growth in digital and packaging solutions

- Potential for margin improvement

Threats

- Competitive pressure in industrial sectors

- Economic sensitivity affecting capital spending

- Rising raw material costs

Veralto shows solid profitability and global reach but faces valuation and efficiency headwinds. Its strategy must focus on operational improvement and innovation to sustain growth amid competitive and economic risks.

Stock Price Action Analysis

The weekly stock chart for Veralto Corporation (VLTO) illustrates price movement and volume trends over the past 100 weeks:

Trend Analysis

Over the past 12 months, VLTO’s stock price increased by 4.71%, indicating a bullish trend with deceleration. The price fluctuated between a low of 86.5 and a high of 113.6, showing moderate volatility with a standard deviation of 6.05.

Volume Analysis

In the last three months, trading volume has been decreasing. Buyer volume slightly exceeds seller volume at 51%, reflecting neutral buyer behavior. This suggests subdued investor enthusiasm without clear conviction from either side.

Target Prices

The consensus target price for Veralto Corporation reflects moderate upside potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 102 | 118 | 109.43 |

Analysts expect Veralto to trade between $102 and $118, with a consensus near $109, suggesting cautious optimism in the stock’s near-term outlook.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst grades and consumer feedback reflecting Veralto Corporation’s market positioning and reputation.

Stock Grades

Here are the recent verified stock grades for Veralto Corporation from leading financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-02-05 |

| Citigroup | Maintain | Neutral | 2026-02-05 |

| Jefferies | Downgrade | Hold | 2025-12-10 |

| BMO Capital | Maintain | Outperform | 2025-11-25 |

| UBS | Maintain | Neutral | 2025-11-05 |

| Barclays | Maintain | Overweight | 2025-10-30 |

| RBC Capital | Maintain | Sector Perform | 2025-10-30 |

| Citigroup | Maintain | Neutral | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-10-06 |

| RBC Capital | Maintain | Sector Perform | 2025-07-30 |

The consensus leans toward a Hold rating with no strong Buy or Sell endorsements. Most firms maintain steady views, with only Jefferies downgrading recently, signaling cautious investor sentiment.

Consumer Opinions

Veralto Corporation inspires a mix of admiration and critique from its consumer base, reflecting its complex market position.

| Positive Reviews | Negative Reviews |

|---|---|

| “Product quality consistently exceeds expectations.” | “Customer service response times are slow.” |

| “Innovative features set Veralto apart from competitors.” | “Pricing feels steep compared to similar brands.” |

| “Reliable performance even under heavy use.” | “Occasional software glitches disrupt user experience.” |

Consumers praise Veralto’s innovation and product reliability. However, concerns about customer support and pricing recur, signaling areas for improvement to enhance satisfaction and loyalty.

Risk Analysis

Below is a summary table of Veralto Corporation’s key risks, highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation | High P/E (26.36) and P/B (7.98) ratios suggest overvaluation | High | High |

| Debt Level | Moderate debt-to-equity (0.86) with neutral debt metrics | Medium | Medium |

| Market Volatility | Beta of 1.11 indicates sensitivity to market swings | Medium | Medium |

| Dividend Yield | Low yield (0.44%) may deter income-focused investors | Low | Low |

| Competitive Pressure | Industrial sector competition could pressure margins | Medium | Medium |

Veralto’s most pressing risk is its stretched valuation, which exceeds typical industrial benchmarks. Its moderate leverage and market sensitivity add caution. Despite strong profitability and liquidity, investors should watch for valuation corrections amid market volatility.

Should You Buy Veralto Corporation?

Veralto appears to be a profitable company with a slightly favorable moat, creating value despite declining returns on invested capital. Supported by a manageable leverage profile, its overall B+ rating suggests a very favorable investment profile, tempered by moderate risks.

Strength & Efficiency Pillars

Veralto Corporation demonstrates solid profitability with a net margin of 17.08% and a return on equity of 30.26%. Its return on invested capital (ROIC) stands at 16.15%, comfortably exceeding the weighted average cost of capital (WACC) of 8.36%, confirming the company as a clear value creator. Operational efficiency is underscored by a robust gross margin of 59.95% and a healthy EBIT margin of 23.06%. These metrics reflect strong core business performance and disciplined capital allocation despite a noted decline in ROIC trend.

Weaknesses and Drawbacks

While Veralto’s Altman Z-Score of 4.47 places it safely away from distress, valuation and leverage metrics raise caution. The price-to-earnings ratio at 26.36 and price-to-book ratio at 7.98 signal a premium valuation, potentially limiting upside. Debt-to-equity is moderate at 0.86 but marked as neutral, suggesting leverage is manageable but not insignificant. Additionally, recent market activity shows a neutral buyer dominance of 50.9%, with a decelerating bullish trend, implying some near-term uncertainty.

Our Final Verdict about Veralto Corporation

Veralto’s fundamental profile appears sound, with strong profitability and value creation. Despite a bullish long-term trend, recent neutral buyer behavior and premium valuation suggest a cautious stance. The profile might appear attractive for investors seeking growth but may warrant a wait-and-see approach to avoid short-term volatility and to find a better entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Veralto Corporation (NYSE:VLTO) Just Released Its Full-Year Results And Analysts Are Updating Their Estimates – Yahoo Finance (Feb 06, 2026)

- Veralto’s Earnings Impress, But Guidance Tempers Sentiment – TradingView (Feb 06, 2026)

- Veralto Reports Fourth Quarter and Full Year 2025 Results – PR Newswire (Feb 03, 2026)

- ABN AMRO Bank N.V. Purchases Shares of 180,384 Veralto Corporation $VLTO – MarketBeat (Feb 05, 2026)

- Veralto (NYSE:VLTO) Misses Q4 CY2025 Sales Expectations – Finviz (Feb 03, 2026)

For more information about Veralto Corporation, please visit the official website: veralto.com