Home > Analyses > Healthcare > Universal Health Services, Inc.

Universal Health Services, Inc. (UHS) plays a vital role in shaping healthcare delivery across the United States and beyond, impacting millions through its extensive network of acute care hospitals and behavioral health facilities. Renowned for its leadership in medical care, UHS combines innovative treatment services with operational excellence, serving diverse patient needs from emergency care to specialized surgeries. As healthcare demands evolve, the question remains: does UHS’s current market position and financial health support sustained growth and investment appeal?

Table of contents

Business Model & Company Overview

Universal Health Services, Inc., founded in 1978 and headquartered in King of Prussia, Pennsylvania, stands as a dominant player in the healthcare sector. Through its subsidiaries, it operates a comprehensive ecosystem of 363 inpatient and 40 outpatient facilities across 39 states, Washington D.C., the UK, and Puerto Rico. Its core mission integrates acute care hospitals with behavioral health services, offering a wide range of medical treatments from surgery to pediatric care, creating a cohesive network of patient-centered healthcare.

The company’s revenue engine balances revenues from its Acute Care Hospital Services and Behavioral Health Care Services segments, complemented by commercial health insurance and management services. This diversified model leverages a strong presence in the Americas and Europe, driving consistent value creation. Universal Health Services’ scale, integrated care capabilities, and extensive market footprint form a robust economic moat, positioning it as a key architect in the future of healthcare delivery.

Financial Performance & Fundamental Metrics

In this section, I analyze Universal Health Services, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health.

Income Statement

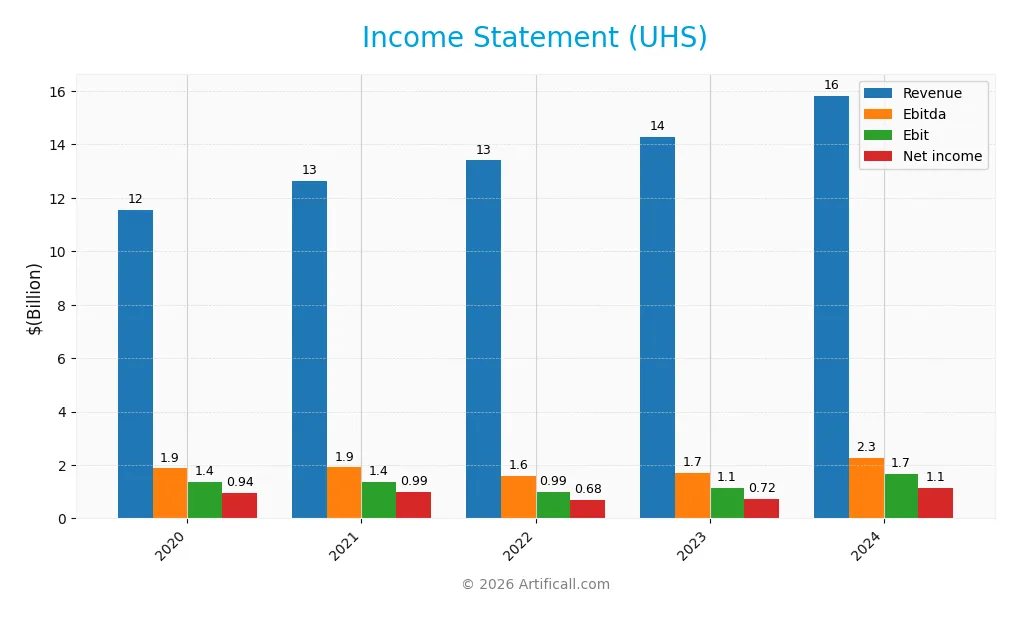

The following table presents Universal Health Services, Inc.’s key income statement figures for fiscal years 2020 through 2024 in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 11.56B | 12.64B | 13.40B | 14.28B | 15.83B |

| Cost of Revenue | 1.29B | 1.43B | 1.47B | 1.53B | 1.59B |

| Operating Expenses | 8.91B | 9.85B | 10.92B | 11.57B | 12.56B |

| Gross Profit | 10.27B | 11.21B | 11.93B | 12.75B | 14.24B |

| EBITDA | 1.87B | 1.91B | 1.58B | 1.71B | 2.27B |

| EBIT | 1.36B | 1.38B | 993M | 1.14B | 1.68B |

| Interest Expense | 109M | 85M | 127M | 207M | 188M |

| Net Income | 944M | 991M | 676M | 718M | 1.14B |

| EPS | 11.06 | 11.99 | 9.23 | 10.35 | 17.16 |

| Filing Date | 2021-02-25 | 2022-02-24 | 2023-02-27 | 2024-02-27 | 2025-02-26 |

Income Statement Evolution

Universal Health Services, Inc. saw its revenue grow by 10.82% from 2023 to 2024, continuing a favorable trend with a 36.93% increase over 2020-2024. Net income also increased by 43.57% in the last year and 20.99% over the full period. Despite strong growth, the net margin declined by 11.64% overall, while gross and EBIT margins remained favorable, reflecting stable profitability.

Is the Income Statement Favorable?

In 2024, UHS reported $15.8B revenue with a gross margin near 90%, an EBIT margin of 10.62%, and a net margin of 7.22%, all classified as favorable. Operating expenses grew proportionally with revenue, and interest expense was well controlled at 1.18% of revenue. The company’s fundamentals appear generally favorable, supported by strong EPS growth of 64.42% year-over-year and a positive global income statement evaluation of 92.86% favorable metrics.

Financial Ratios

The table below presents key financial ratios for Universal Health Services, Inc. (UHS) over the fiscal years 2020 to 2024, reflecting profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 8.2% | 7.8% | 5.0% | 5.0% | 7.2% |

| ROE | 15.0% | 16.3% | 11.4% | 11.7% | 17.1% |

| ROIC | 9.1% | 9.3% | 6.5% | 7.4% | 10.6% |

| P/E | 12.4 | 10.8 | 15.2 | 14.7 | 10.5 |

| P/B | 1.85 | 1.76 | 1.74 | 1.72 | 1.79 |

| Current Ratio | 1.32 | 1.14 | 1.33 | 1.40 | 1.27 |

| Quick Ratio | 1.25 | 1.04 | 1.21 | 1.29 | 1.17 |

| D/E | 0.66 | 0.75 | 0.89 | 0.87 | 0.74 |

| Debt-to-Assets | 31.1% | 34.8% | 39.1% | 38.4% | 34.2% |

| Interest Coverage | 12.5 | 16.0 | 7.9 | 5.7 | 9.0 |

| Asset Turnover | 0.86 | 0.97 | 0.99 | 1.02 | 1.09 |

| Fixed Asset Turnover | 2.02 | 2.03 | 2.10 | 2.18 | 2.26 |

| Dividend Yield | 0.15% | 0.62% | 0.57% | 0.53% | 0.45% |

Evolution of Financial Ratios

Universal Health Services, Inc. (UHS) showed a mixed trend in key financial ratios over recent years. Return on Equity (ROE) improved from 11.47% in 2022 to 17.13% in 2024, indicating rising profitability. The Current Ratio slightly declined from 1.40 in 2023 to 1.27 in 2024, reflecting a modest decrease in short-term liquidity. The Debt-to-Equity Ratio decreased from 0.87 to 0.74, signaling a reduction in leverage and improved financial stability.

Are the Financial Ratios Favorable?

In 2024, UHS’s profitability ratios such as ROE (17.13%) and Return on Invested Capital (10.55%) were favorable, supporting efficient capital use. Liquidity ratios were neutral to favorable, with a Current Ratio of 1.27 and a Quick Ratio of 1.17. Leverage metrics like Debt-to-Equity at 0.74 and Debt-to-Assets at 34.25% were neutral, while interest coverage at 8.96 was favorable, showing comfortable debt servicing. Market multiples were mostly neutral or favorable except for a relatively low dividend yield of 0.45%, deemed unfavorable. Overall, the financial ratios were slightly favorable.

Shareholder Return Policy

Universal Health Services, Inc. maintains a modest dividend payout ratio around 4.7% in 2024, with a stable dividend per share near $0.80 and a yield under 0.5%. Share buybacks are not explicitly detailed, suggesting a limited role in returns. Dividend payments are well covered by free cash flow, indicating prudent distribution.

The payout approach appears sustainable given consistent profitability and free cash flow levels, supporting long-term shareholder value. The low yield and payout ratio imply conservative capital allocation, balancing shareholder returns with operational reinvestment needs in a stable financial position.

Score analysis

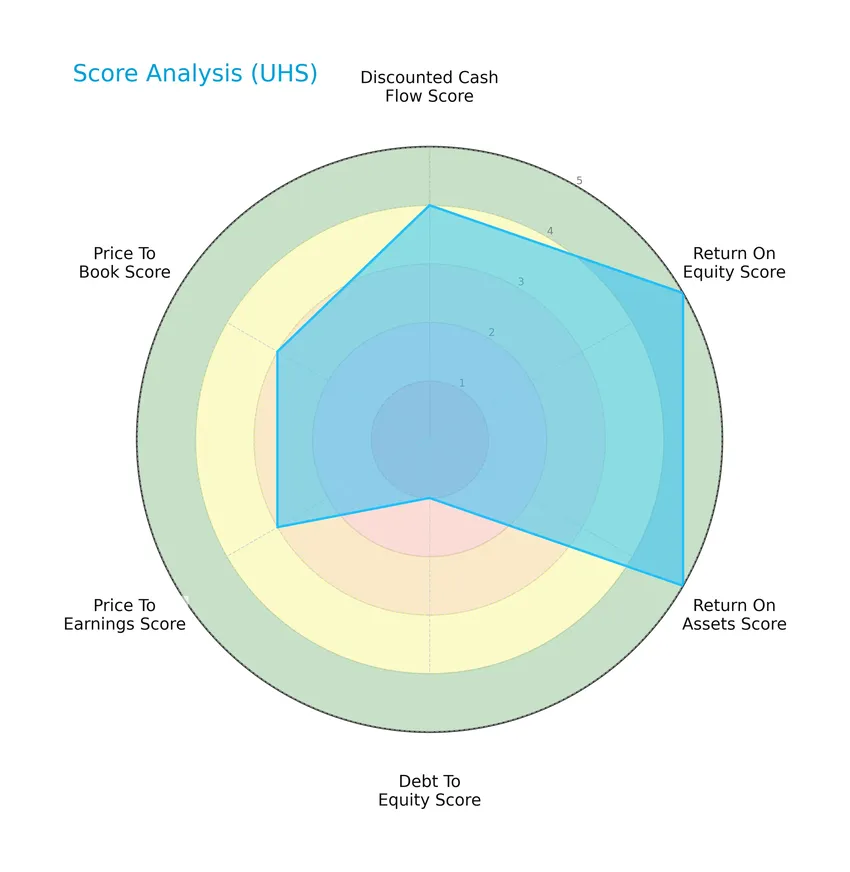

The radar chart below presents an overview of Universal Health Services, Inc.’s key financial scores for investor evaluation:

The company shows very favorable scores in return on equity and return on assets, both at 5, indicating strong profitability. The discounted cash flow score is favorable at 4, while price-to-earnings and price-to-book scores are moderate at 3 each. The debt-to-equity score is very unfavorable at 1, signaling high leverage concerns.

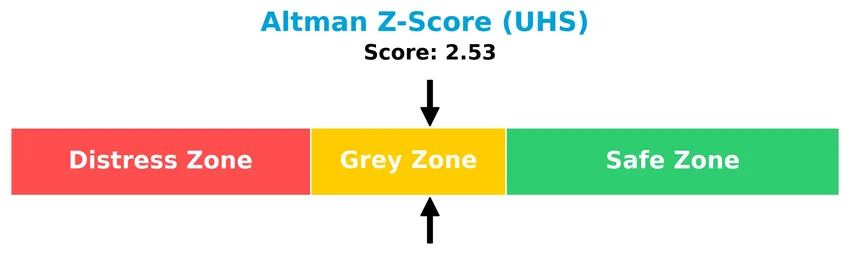

Analysis of the company’s bankruptcy risk

Universal Health Services, Inc. falls into the grey zone according to its Altman Z-Score, reflecting a moderate risk of bankruptcy:

Is the company in good financial health?

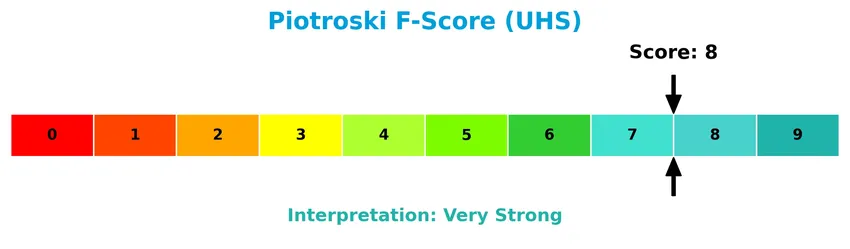

The following Piotroski diagram illustrates the company’s financial strength based on a comprehensive score assessment:

With a Piotroski Score of 8, Universal Health Services, Inc. demonstrates very strong financial health, suggesting solid profitability, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will examine Universal Health Services, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether the company holds a competitive advantage over its peers in the healthcare industry.

Strategic Positioning

Universal Health Services, Inc. maintains a concentrated healthcare portfolio focused on Acute Care Hospital Services and Behavioral Health Services, generating approximately $8.9B and $6.9B respectively in 2024. Its geographic exposure spans 39 US states, D.C., the UK, and Puerto Rico, reflecting moderate international diversification.

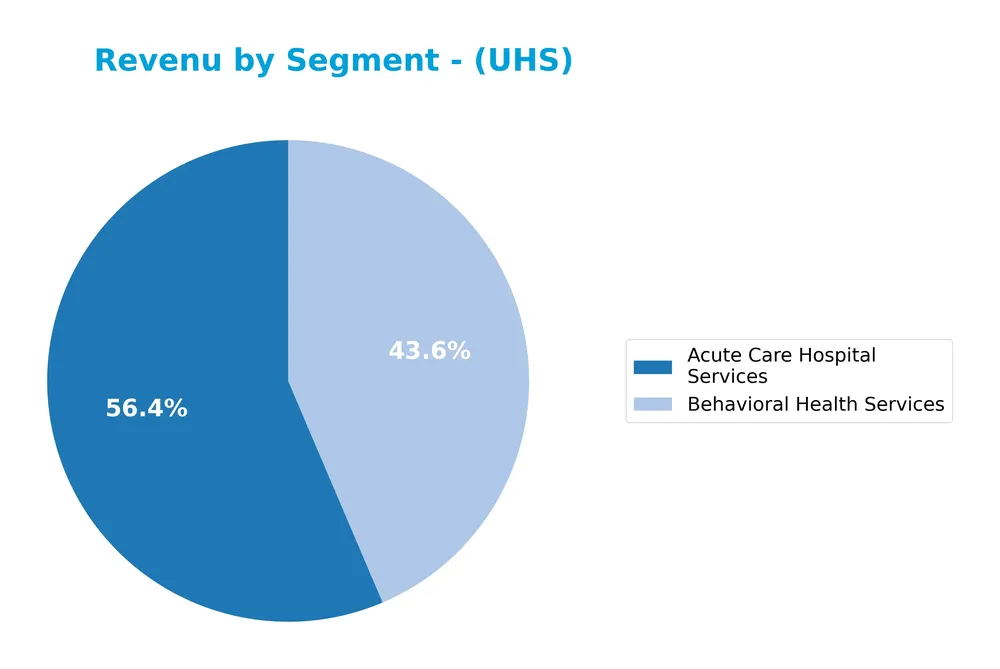

Revenue by Segment

This pie chart illustrates the revenue distribution of Universal Health Services, Inc. across its main business segments for the fiscal year 2024.

In 2024, Acute Care Hospital Services led with $8.9B in revenue, followed by Behavioral Health Services at $6.9B. Both segments showed steady growth compared to 2023, reflecting consistent demand. The concentration remains strong in these two segments, with Acute Care Hospital Services driving most of the business expansion. There is no significant revenue contribution from other segments in the latest year, indicating focused operations and limited diversification risk.

Key Products & Brands

The table below outlines Universal Health Services, Inc.’s main products and service segments:

| Product | Description |

|---|---|

| Acute Care Hospital Services | Operation of acute care hospitals offering general and specialty surgery, internal medicine, emergency room care, radiology, oncology, diagnostic and coronary care, pediatric and pharmacy services. |

| Behavioral Health Services | Management and operation of behavioral health care facilities providing mental health and substance abuse treatment services. |

| All Other Segments | Includes commercial health insurance services and various management services such as central purchasing, information systems, finance, facilities planning, and administrative services. |

Universal Health Services primarily generates revenue through acute care hospital services and behavioral health services, supplemented by other healthcare-related management and insurance services.

Main Competitors

There are 4 competitors in the Healthcare Medical – Care Facilities sector; below is the list of the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| HCA Healthcare, Inc. | 114B |

| Universal Health Services, Inc. | 14.2B |

| Solventum Corporation | 13.7B |

| DaVita Inc. | 8.1B |

Universal Health Services, Inc. ranks 2nd among its 4 competitors with a market cap at 11.58% of the leader, HCA Healthcare, Inc. The company is positioned below both the average market cap of the top 10 (37.5B) and the median market cap in its sector (13.9B). It holds a significant 763.5% market cap gap above its nearest competitor, highlighting a substantial lead over Solventum Corporation.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does UHS have a competitive advantage?

Universal Health Services, Inc. presents a very favorable competitive advantage, demonstrated by a ROIC exceeding WACC by 2.48% and a growing ROIC trend of 16.27%, indicating efficient capital use and value creation. The company’s favorable income statement metrics and strong revenue growth further support its position as a durable value creator in the healthcare sector.

Looking ahead, UHS’s operations across acute care hospitals and behavioral health services, with a broad geographic footprint including 363 inpatient and 40 outpatient facilities, position it well to capitalize on expanding healthcare demand. Opportunities exist in leveraging management services and commercial health insurance offerings to enhance operational efficiency and market reach.

SWOT Analysis

This SWOT analysis highlights key internal and external factors influencing Universal Health Services, Inc. to guide strategic investment decisions.

Strengths

- Strong market position with 363 inpatient facilities

- Favorable income growth and profitability metrics

- Durable competitive advantage with growing ROIC

Weaknesses

- Moderate debt-to-equity concerns

- Dividend yield lower than industry peers

- Net margin growth slightly unfavorable over long term

Opportunities

- Expansion in behavioral health services

- Increasing demand for acute care and specialty services

- Opportunities to leverage technology for operational efficiency

Threats

- Regulatory changes impacting healthcare reimbursement

- Intense competition in healthcare sector

- Economic downturns affecting patient volumes and margins

Overall, UHS demonstrates robust strengths and favorable financial performance, supporting a strategy focused on growth and operational efficiency. However, attention to debt management and regulatory risks is essential to sustain long-term value.

Stock Price Action Analysis

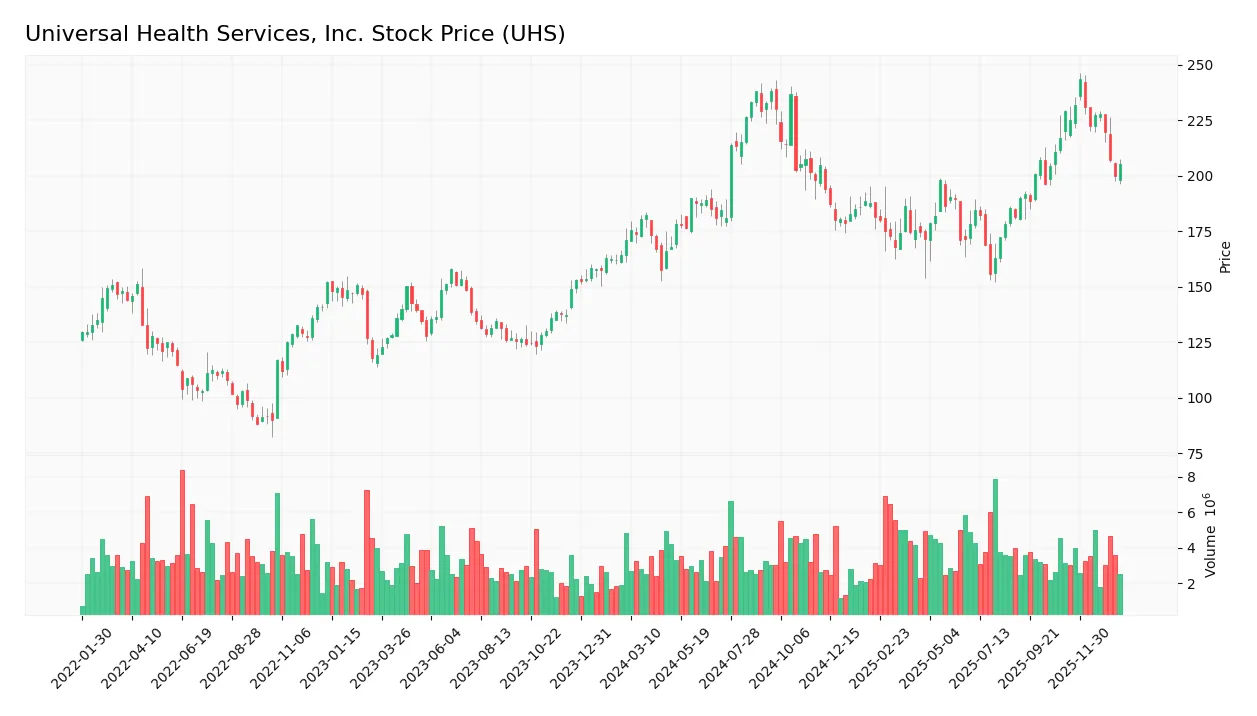

The weekly stock chart below illustrates Universal Health Services, Inc.’s price movements over the past 12 months, highlighting key highs, lows, and recent volatility trends:

Trend Analysis

Over the past 12 months, UHS stock price increased by 19.85%, indicating a bullish trend overall. The price showed a deceleration in momentum, with a high of 243.63 and a low of 155.6. Recent weeks (since November 2025) experienced a -10.53% decline, marking a short-term bearish correction within the longer bullish context.

Volume Analysis

In the last three months, trading volume has been increasing overall, with total buyer volume at 18.9M and seller volume at 21.0M, reflecting a slight seller dominance (47.3% buyer share). This neutral buyer behavior suggests cautious investor sentiment and balanced market participation amid recent price weakness.

Target Prices

The consensus target prices for Universal Health Services, Inc. (UHS) indicate a moderately optimistic outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 274 | 203 | 241.4 |

Analysts expect UHS shares to trade between 203 and 274, with a consensus target around 241, suggesting potential upside from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback related to Universal Health Services, Inc. (UHS).

Stock Grades

Here is a summary of recent stock grades for Universal Health Services, Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-22 |

| Wells Fargo | Downgrade | Equal Weight | 2026-01-07 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Guggenheim | Maintain | Buy | 2025-12-02 |

| Wells Fargo | Maintain | Overweight | 2025-11-13 |

| RBC Capital | Maintain | Sector Perform | 2025-10-30 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-29 |

| Guggenheim | Maintain | Buy | 2025-10-29 |

| UBS | Maintain | Buy | 2025-10-29 |

| Barclays | Maintain | Overweight | 2025-10-28 |

The overall trend shows a predominance of hold to buy ratings, with some recent downgrades from overweight to equal weight by Wells Fargo. The consensus remains cautious, reflecting a balanced view on the stock’s near-term prospects.

Consumer Opinions

Universal Health Services, Inc. has garnered mixed consumer sentiment, reflecting a blend of appreciation for care quality and concerns over administrative issues.

| Positive Reviews | Negative Reviews |

|---|---|

| “Staff showed great compassion and professionalism during my stay.” | “Long waiting times for appointments and delayed responses.” |

| “Facilities were clean and well-maintained, making recovery comfortable.” | “Billing errors caused confusion and stress.” |

| “Doctors and nurses were attentive and communicated clearly.” | “Limited availability of specialists in certain locations.” |

Overall, consumers frequently praise the professionalism and care quality at UHS facilities, while recurring complaints focus on administrative delays and billing challenges.

Risk Analysis

Below is a summary table presenting key risk categories affecting Universal Health Services, Inc. and their likelihood and potential impact on investment value:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | Elevated debt-to-equity ratio signals higher financial risk despite strong coverage ratio. | Medium | High |

| Market Volatility | Beta of 1.28 suggests above-average stock price fluctuations relative to the market. | High | Medium |

| Regulatory Risk | Healthcare sector subject to stringent regulations and policy changes impacting operations. | Medium | High |

| Dividend Yield | Low yield of 0.45% may deter income-focused investors, affecting stock demand. | High | Low |

| Operational Risk | Managing 363 inpatient and 40 outpatient facilities involves complexity and execution risk. | Medium | Medium |

The most significant risks for UHS currently stem from its moderate financial leverage combined with the regulatory environment in healthcare, which could affect profitability and cash flow stability. Although the Altman Z-score places the company in the grey zone, its very strong Piotroski score and favorable return on equity support resilience. Investors should monitor debt levels and regulatory developments closely.

Should You Buy Universal Health Services, Inc.?

Universal Health Services, Inc. appears to have robust profitability and a durable competitive moat supported by growing ROIC, suggesting strong value creation and operational efficiency. Despite a very unfavorable leverage profile, the company’s overall rating is A-, indicating a favorable investment case tempered by debt concerns.

Strength & Efficiency Pillars

Universal Health Services, Inc. (UHS) exhibits solid profitability and value creation metrics. The company posts a favorable return on equity of 17.13% and a return on invested capital (ROIC) of 10.55%, which notably exceeds its weighted average cost of capital (WACC) at 8.07%, confirming UHS as a clear value creator. Its Piotroski score of 8 reflects very strong financial health, while the Altman Z-score of 2.53 places it in the grey zone, suggesting moderate bankruptcy risk but overall financial stability. Robust margins and a rising ROIC trend further underscore a durable competitive advantage.

Weaknesses and Drawbacks

Despite its strengths, UHS faces several headwinds. The company’s debt-to-equity score is very unfavorable, indicating leverage concerns that could pressure financial flexibility. While the price-to-earnings (10.46) and price-to-book (1.79) ratios are moderate to favorable, a low dividend yield of 0.45% is an unfavorable signal for income-focused investors. Recent market activity shows a seller dominance of 52.7% over the latest period, contributing to a 10.53% price decline, which may reflect short-term market pressure or investor caution.

Our Verdict about Universal Health Services, Inc.

The long-term fundamental profile of UHS is favorable, bolstered by strong profitability, value creation, and financial health scores. However, despite a bullish overall stock trend with a 19.85% price increase, recent seller dominance and a negative price slope suggest a wait-and-see approach might be prudent for investors seeking an optimal entry point. The profile could appeal to those prioritizing durable growth but may appear riskier amid near-term market headwinds.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Universal Health Services earnings preview: What to expect – MSN (Jan 24, 2026)

- Envestnet Portfolio Solutions Inc. Boosts Stock Holdings in Universal Health Services, Inc. $UHS – MarketBeat (Jan 24, 2026)

- Universal Health Services Earnings Preview: What to Expect – Barchart.com (Jan 21, 2026)

- Here is Why Growth Investors Should Buy Universal Health Services (UHS) Now – Yahoo Finance (Jan 16, 2026)

- Universal Health Services beats quarterly profit estimates on higher medical care demand – Reuters (Jul 29, 2025)

For more information about Universal Health Services, Inc., please visit the official website: uhs.com