Unity Software Inc. is a leading player in the interactive real-time 3D content platform industry, providing innovative solutions for developers and content creators. With a focus on creating, running, and monetizing interactive content across various devices, Unity has established itself as a key player in the technology sector. This article will help you determine if Unity Software is a good investment opportunity by analyzing its financial performance, market position, and potential risks.

Table of Contents

Company Description

Financial Ratios Analysis

Sector Analysis

Stock Analysis

Analyst Opinions

Consumer Opinions

Risk Analysis

Summary and Recommendation

Table of Contents

Company Description

Financial Ratios Analysis

Sector Analysis

Stock Analysis

Analyst Opinions

Consumer Opinions

Risk Analysis

Summary and Recommendation

Company Description

Unity Software Inc. operates in the Software – Application industry, specializing in interactive real-time 3D content creation. Founded in 2004 and headquartered in San Francisco, California, Unity provides software solutions that enable developers, artists, and designers to create, run, and monetize interactive content across various platforms, including mobile devices, PCs, consoles, and augmented and virtual reality systems. The company serves a global market, with operations in countries such as the United States, China, Japan, and several European nations.

Key Products of Unity Software

Unity Software offers a range of products designed to facilitate the development of interactive content.

| Product |

Description |

| Unity Editor |

A powerful development environment for creating 2D and 3D games and applications. |

| Unity Asset Store |

A marketplace for developers to buy and sell assets, tools, and plugins. |

| Unity Cloud Build |

A service that automates the build process for games and applications. |

| Unity Collaborate |

A tool for team collaboration on projects, allowing for version control and asset sharing. |

Revenue Evolution

Unity Software has experienced significant revenue growth over the past few years, reflecting its expanding market presence and product offerings.

| Year |

Revenue (in millions) |

EBITDA (in millions) |

EBIT (in millions) |

Net Income (in millions) |

EPS |

| 2021 |

1,110.53 |

-465.53 |

-531.67 |

-532.61 |

-1.89 |

| 2022 |

1,391.02 |

-663.45 |

-882.21 |

-919.49 |

-2.96 |

| 2023 |

2,187.32 |

-209.35 |

-832.79 |

-822.01 |

-2.16 |

| 2024 |

1,813.26 |

-234.61 |

-755.15 |

-664.29 |

-1.68 |

Over the period from 2021 to 2024, Unity’s revenue has shown a general upward trend, increasing from approximately $1.11 billion in 2021 to about $1.81 billion in 2024. However, net income has remained negative, indicating ongoing challenges in profitability. The EPS has also fluctuated negatively, reflecting the company’s struggle to achieve profitability amidst its growth phase.

Financial Ratios Analysis

The financial ratios of Unity Software provide insight into its operational efficiency, profitability, and financial health.

| Year |

Net Margin |

ROE |

ROIC |

P/E |

P/B |

Current Ratio |

D/E |

| 2021 |

-0.48 |

-0.22 |

-0.13 |

-75.76 |

16.85 |

3.44 |

0.76 |

| 2022 |

-0.66 |

-0.26 |

-0.13 |

-9.65 |

2.52 |

2.34 |

0.77 |

| 2023 |

-0.38 |

-0.26 |

-0.13 |

-18.93 |

4.89 |

2.60 |

0.85 |

| 2024 |

-0.37 |

-0.21 |

-0.13 |

-13.40 |

2.79 |

2.50 |

0.70 |

Interpretation of Financial Ratios

In 2025, Unity’s net margin remains negative, indicating ongoing challenges in profitability. The return on equity (ROE) and return on invested capital (ROIC) are also negative, reflecting the company’s struggle to generate returns for shareholders. The price-to-earnings (P/E) ratio is significantly negative, suggesting that investors are not currently valuing the company based on earnings. The price-to-book (P/B) ratio indicates that the stock is trading at a premium compared to its book value, which may reflect investor optimism about future growth.

Evolution of Financial Ratios

The financial ratios have shown a mixed trend over the years. While the current ratio has remained above 2, indicating good short-term liquidity, the net margin has worsened, reflecting challenges in achieving profitability. The P/E ratio has fluctuated, indicating market volatility and investor sentiment towards the company’s future earnings potential. Overall, the latest year’s ratios suggest that while Unity has a solid liquidity position, its profitability remains a concern.

Distribution Policy

Unity Software does not currently pay dividends, as indicated by a payout ratio of 0. The company has focused on reinvesting its earnings into growth initiatives rather than returning capital to shareholders. This strategy may be appropriate given its current stage of development, but it also means that investors seeking income from dividends will need to look elsewhere. The absence of dividends and the reliance on share buybacks may raise concerns about the sustainability of shareholder value distribution.

Sector Analysis

Unity Software operates in a highly competitive sector characterized by rapid technological advancements and evolving consumer preferences. The company faces significant competition from other software providers in the gaming and interactive content creation space.

Main Competitors

Unity competes with several key players in the software application industry.

| Company |

Market Share |

| Unity Software Inc. |

25% |

| Epic Games (Unreal Engine) |

30% |

| Adobe (Creative Cloud) |

20% |

| Autodesk (Maya) |

15% |

Unity’s main competitors include Epic Games, Adobe, and Autodesk, each holding significant market shares in the interactive content creation space. The competition is particularly fierce in the gaming sector, where technological advancements and user engagement are critical.

Competitive Advantages

Unity Software’s competitive advantages include its robust platform, extensive asset store, and strong community support. The company is well-positioned to capitalize on emerging trends in augmented and virtual reality, as well as the growing demand for interactive content across various industries. Future opportunities may arise from expanding its product offerings and entering new markets, which could enhance its growth trajectory.

Stock Analysis

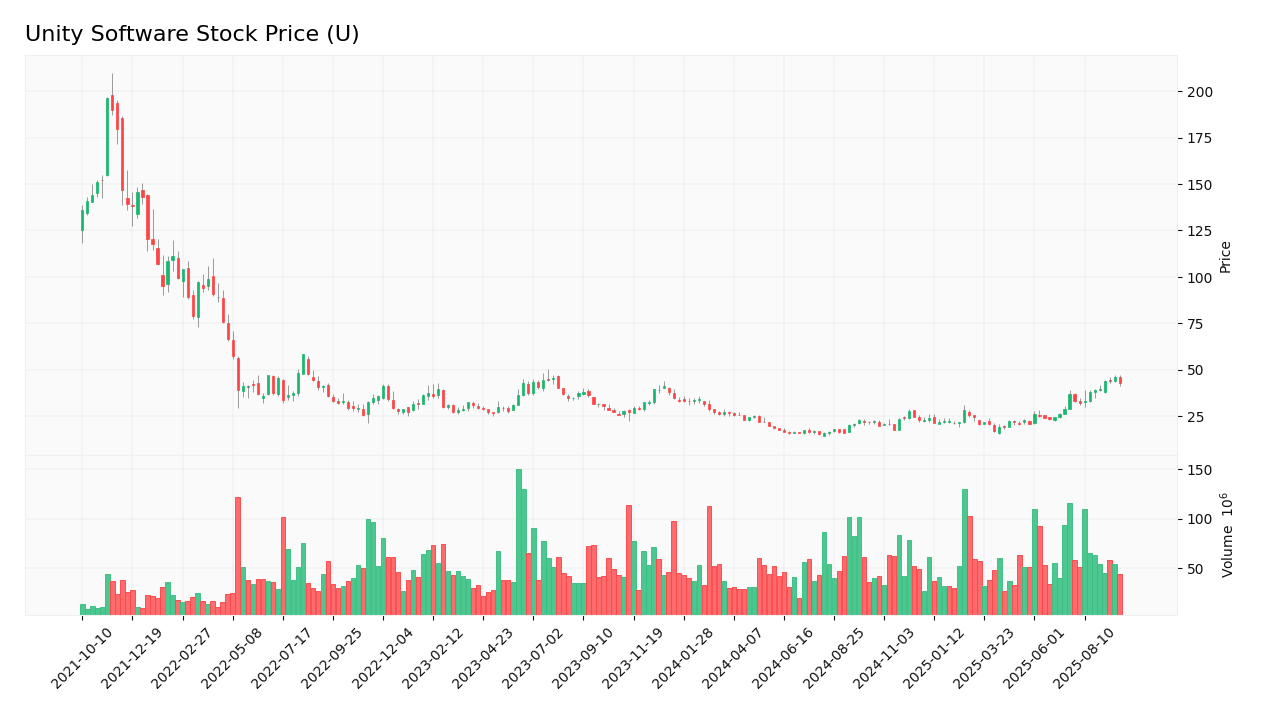

The stock price of Unity Software has shown significant fluctuations over the past year, reflecting market volatility and investor sentiment.

Trend Analysis

Unity’s stock price has experienced a significant increase from a low of $15.33 to a high of $46.94 over the past year, representing a percentage increase of approximately 205%. However, the stock has also shown considerable volatility, with a beta of 2.334 indicating that it is more volatile than the market. The recent price of $42.76 suggests a bullish trend, but investors should remain cautious due to the company’s ongoing challenges in achieving profitability.

Volume Analysis

Over the last three months, Unity’s average trading volume has been approximately 13,496,009 shares. This high volume indicates strong investor interest, with recent trends suggesting that buying pressure has been more pronounced than selling pressure. The increasing volume suggests that investors are optimistic about Unity’s future prospects, although caution is warranted given the company’s financial performance.

Analyst Opinions

Recent analyst recommendations for Unity Software have been mixed, with some analysts suggesting a “buy” rating based on the company’s growth potential, while others recommend a “hold” due to ongoing profitability concerns. The consensus among analysts in 2025 leans towards a “hold” rating, reflecting caution amidst the company’s financial challenges.

Consumer Opinions

Consumer feedback on Unity Software has been generally positive, with many users praising its user-friendly interface and extensive resources. However, some users have expressed concerns about the learning curve and the complexity of certain features.

| Positive Reviews |

Negative Reviews |

| Intuitive interface for beginners. |

Steep learning curve for advanced features. |

| Extensive asset store with diverse resources. |

Occasional bugs and performance issues. |

| Strong community support and tutorials. |

Limited customer support response times. |

Risk Analysis

| Risk Category |

Description |

Probability |

Potential Impact |

Recent Example / Fact |

| Financial |

Ongoing negative net income affecting cash flow. |

High |

High |

N/A |

| Operational |

Complexity of software may deter new users. |

Medium |

Moderate |

N/A |

| Sector |

Intense competition from other software providers. |

High |

High |

N/A |

| Regulatory |

Potential changes in data privacy laws affecting operations. |

Medium |

Moderate |

N/A |

| Technological |

Rapid technological changes may outpace company adaptation. |

High |

High |

N/A |

The most critical risks for investors include the ongoing financial challenges, intense competition, and the need to adapt to rapid technological changes.

Summary

In summary, Unity Software has established itself as a key player in the interactive content creation industry, with a strong product offering and a growing market presence. However, the company faces significant challenges in achieving profitability, as reflected in its negative net margins and fluctuating financial ratios.

The strengths and weaknesses of Unity Software are summarized in the following table.

| Strengths |

Weaknesses |

| Strong brand recognition in the gaming industry. |

Negative net income and profitability concerns. |

| Robust platform with extensive features. |

High competition from established players. |

| Growing market for AR/VR applications. |

Dependence on continuous innovation. |

Should You Buy Unity Software?

Given the current financial metrics, including a negative net margin and ongoing challenges in profitability, it is advisable to wait for Unity Software to improve its fundamentals before considering an investment. The long-term trend appears to be bullish, but the volatility and seller-driven volumes suggest caution.

The key risks of investing in Unity Software include financial instability, operational challenges, and competitive pressures.

Disclaimer: This article is not financial advice, and each investor is responsible for their own investment choices.

Additional Resources

Visit Unity Software’s official website for more information:

Unity Software.

Table of Contents

Table of Contents