Home > Analyses > Healthcare > UnitedHealth Group Incorporated

UnitedHealth Group transforms healthcare delivery for millions across the United States every day. It commands the healthcare plans industry with its flagship UnitedHealthcare services and the innovative Optum platform, which integrates care, data, and pharmacy services. Renowned for operational scale and cutting-edge technology, UnitedHealth shapes patient outcomes and cost management. The critical question now: do its robust fundamentals still justify its premium valuation and growth prospects in a rapidly evolving healthcare landscape?

Table of contents

Business Model & Company Overview

UnitedHealth Group Incorporated, founded in 1977 and headquartered in Eden Prairie, MN, stands as a dominant leader in the medical healthcare plans industry. The company integrates diverse services across UnitedHealthcare and Optum segments into a cohesive ecosystem, addressing a broad spectrum of health needs—from individual plans to specialized pharmacy and health management solutions. With 400K employees, it commands a vast footprint in the US healthcare landscape.

Its revenue engine balances consumer-oriented health benefit plans with advanced software, advisory, and pharmacy care services. UnitedHealth’s strategic presence spans the Americas, leveraging scale and technology to serve employers, governments, and individuals. This broad platform creates a powerful economic moat, positioning the company to shape healthcare’s future through integrated, data-driven care delivery.

Financial Performance & Fundamental Metrics

I will analyze UnitedHealth Group Incorporated’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

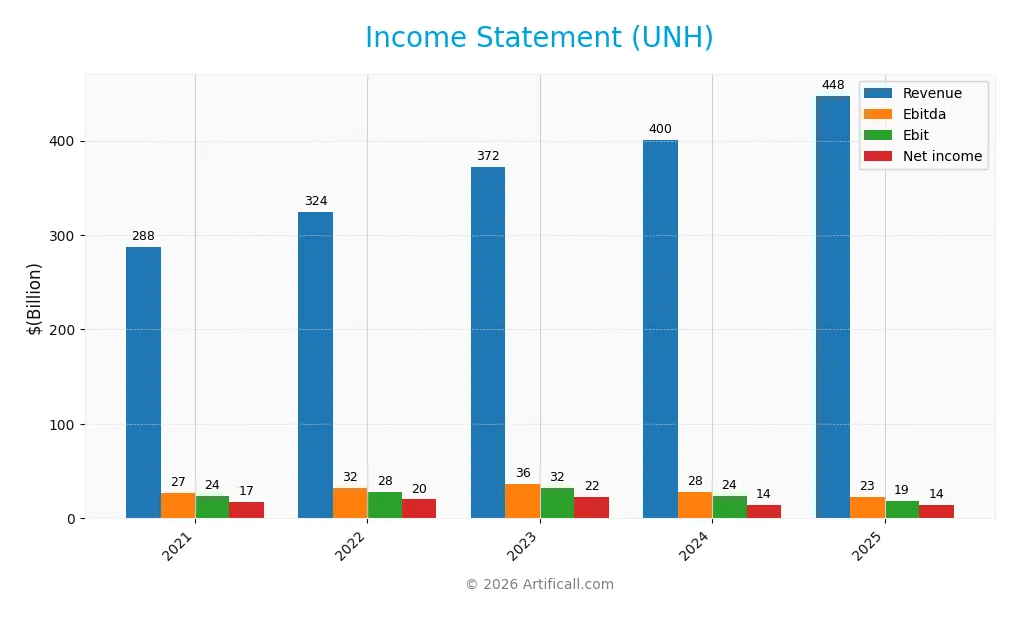

The table below presents UnitedHealth Group’s key income statement figures for fiscal years 2021 through 2025, highlighting revenue trends and profitability metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 288B | 324B | 372B | 400B | 448B |

| Cost of Revenue | 218B | 245B | 281B | 311B | 365B |

| Operating Expenses | 45.7B | 51.2B | 58.6B | 57.1B | 63.9B |

| Gross Profit | 69.7B | 79.6B | 91.0B | 89.4B | 82.9B |

| EBITDA | 27.1B | 31.8B | 36.3B | 28.1B | 23.1B |

| EBIT | 24.0B | 28.4B | 32.4B | 24.0B | 18.7B |

| Interest Expense | 1.66B | 2.09B | 3.25B | 3.91B | 4.00B |

| Net Income | 17.3B | 20.1B | 22.4B | 14.4B | 14.2B |

| EPS | 18.33 | 21.54 | 24.12 | 15.64 | 15.66 |

| Filing Date | 2022-02-15 | 2023-02-24 | 2023-12-31 | 2025-02-27 | 2026-01-27 |

Income Statement Evolution

UnitedHealth Group’s revenue rose sharply by 11.8% in 2025, continuing a strong five-year growth of 55.6%. However, gross profit declined by 7.3% last year, squeezing margins. EBIT and net margin both contracted significantly, reflecting rising operating expenses matching revenue growth, which compressed profitability despite stable gross margins near 18.5%.

Is the Income Statement Favorable?

The 2025 income statement shows mixed fundamentals. Revenue growth remains robust and interest expenses are well-controlled at 0.9% of revenue, a favorable aspect. Yet, falling gross profit and EBIT margins, alongside a 11.7% net margin decline, indicate operational challenges. Overall, the income statement’s weaker profitability and margin erosion signal an unfavorable performance for the year.

Financial Ratios

The table below presents key financial ratios for UnitedHealth Group Incorporated (UNH) over the last five fiscal years, illustrating profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 6.0% | 6.2% | 6.0% | 3.6% | 3.2% |

| ROE | 24.1% | 25.9% | 25.2% | 15.5% | 14.2% |

| ROIC | 13.9% | 14.0% | 14.3% | 12.3% | 9.4% |

| P/E | 27.4 | 24.6 | 21.8 | 32.6 | 21.1 |

| P/B | 6.6 | 6.4 | 5.5 | 5.1 | 3.0 |

| Current Ratio | 0.79 | 0.77 | 0.79 | 0.83 | 0.79 |

| Quick Ratio | 0.79 | 0.77 | 0.79 | 0.83 | 0.79 |

| D/E | 0.64 | 0.74 | 0.76 | 0.83 | 0.78 |

| Debt-to-Assets | 21.7% | 23.5% | 24.6% | 25.8% | 25.3% |

| Interest Coverage | 14.4 | 13.6 | 10.0 | 8.3 | 4.7 |

| Asset Turnover | 1.36 | 1.32 | 1.36 | 1.34 | 1.45 |

| Fixed Asset Turnover | 32.1 | 32.0 | 32.5 | 37.9 | 0.0 |

| Dividend Yield | 1.12% | 1.21% | 1.38% | 1.60% | 4.60% |

Evolution of Financial Ratios

UnitedHealth’s Return on Equity (ROE) showed a downward trend from above 25% in 2022-2023 to 14.2% in 2025. The Current Ratio remained consistently below 1, indicating ongoing liquidity constraints. Debt-to-Equity hovered near 0.78 in 2025, reflecting stable leverage. Profitability margins declined steadily, with net profit margin dropping to 3.18%.

Are the Financial Ratios Fovorable?

In 2025, profitability ratios like net margin (3.18%) and price-to-book (3.0) are unfavorable, signaling margin pressure and valuation concerns. Liquidity ratios (current and quick) below 1 also raise red flags. Neutral statuses for ROE (14.2%), ROIC (9.45%), and interest coverage ratio (4.67) suggest moderate operational efficiency and debt service capacity. Favorable metrics include debt-to-assets (25.3%), asset turnover (1.45), and dividend yield (4.6%), yet the overall ratio profile remains slightly unfavorable.

Shareholder Return Policy

UnitedHealth Group maintains a consistent dividend policy with a payout ratio near 97% in 2025 and a 4.6% dividend yield, supported by free cash flow coverage of approximately 84%. The company also engages in share buybacks, balancing distributions with capital expenditures.

This approach reflects a mature capital allocation strategy, where dividends and buybacks coexist to sustain shareholder value. However, the high payout ratio warrants monitoring for potential pressure on cash flow during economic downturns, emphasizing the need for prudent financial management.

Score analysis

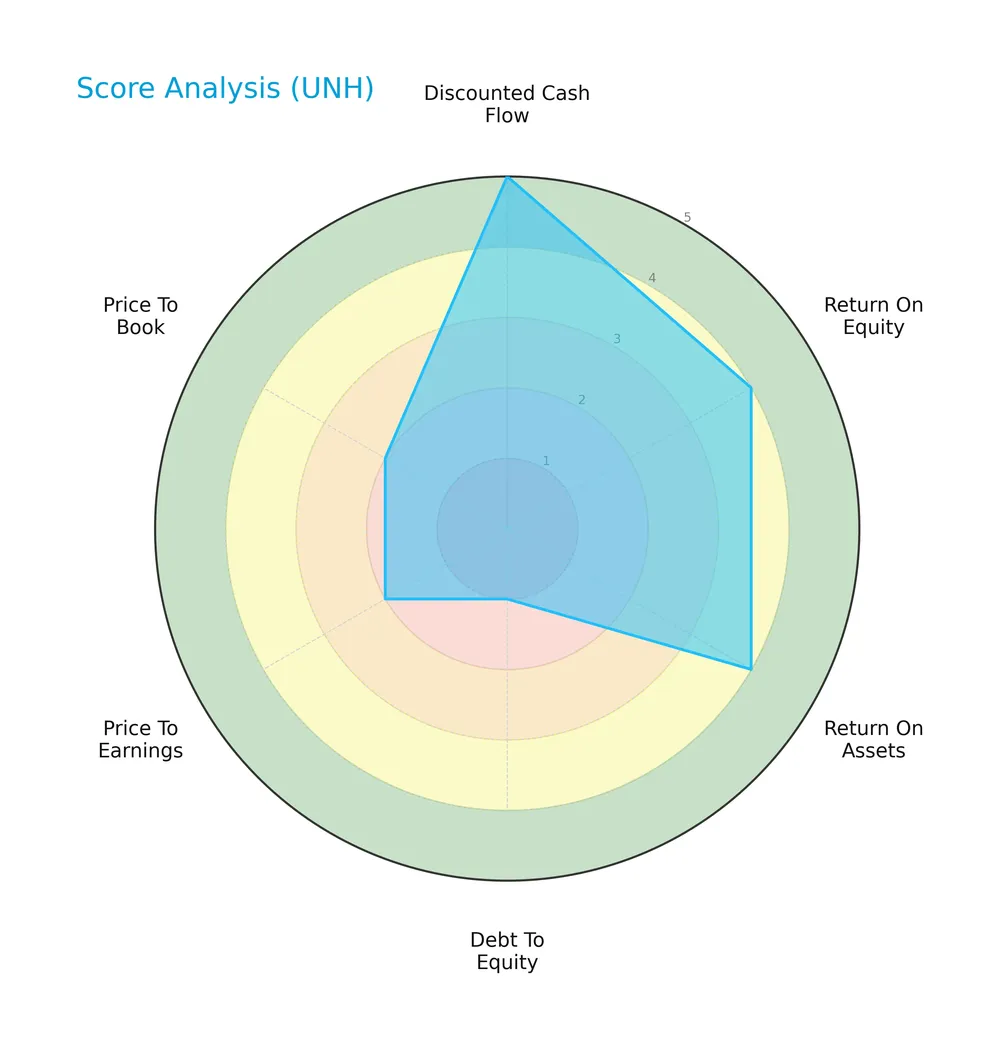

The radar chart below illustrates UnitedHealth Group’s key financial performance scores across essential valuation and profitability metrics:

UnitedHealth shows a very favorable discounted cash flow score of 5 and favorable returns on equity and assets at 4 each. However, its debt-to-equity score is very unfavorable at 1, while valuation multiples scores for price-to-earnings and price-to-book stand at 2, indicating some valuation concerns.

Analysis of the company’s bankruptcy risk

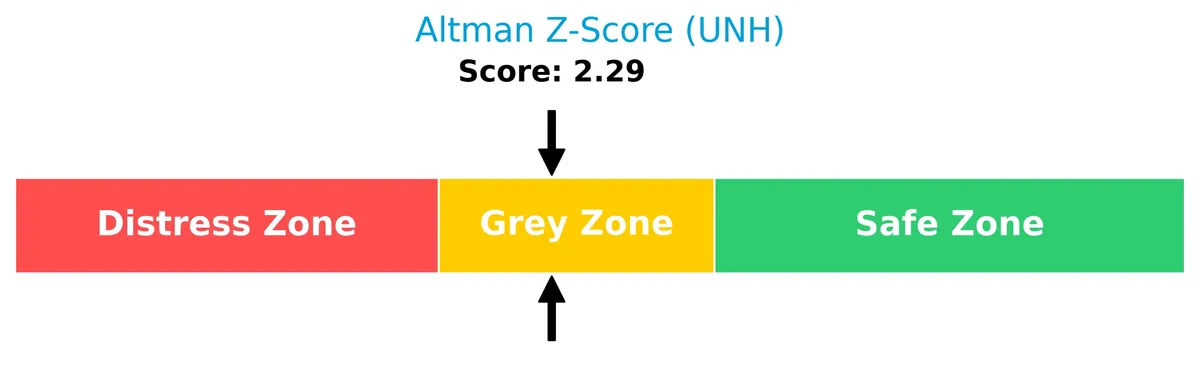

The Altman Z-Score places UnitedHealth Group in the grey zone, signaling a moderate risk of financial distress and potential bankruptcy:

Is the company in good financial health?

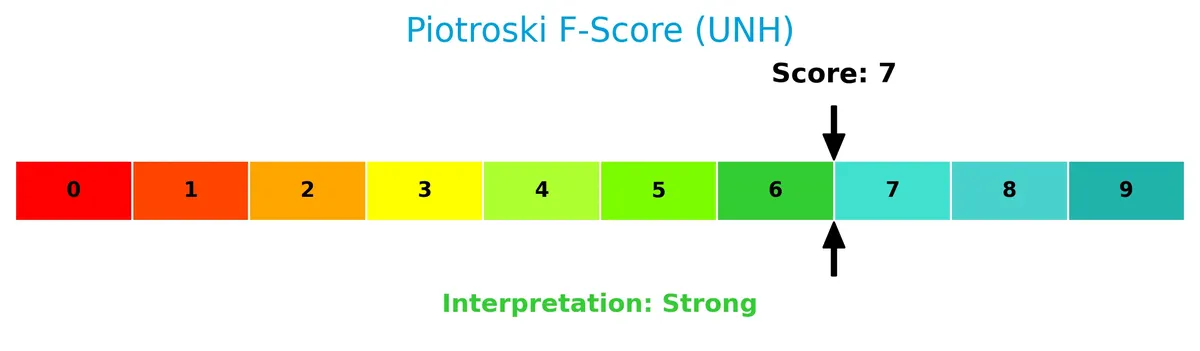

The following Piotroski diagram summarizes UnitedHealth Group’s financial strength based on nine key criteria:

With a strong Piotroski Score of 7, UnitedHealth demonstrates robust financial health, reflecting solid profitability, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis explores UnitedHealth Group Incorporated’s strategic positioning, revenue segments, and product offerings. I will examine its main competitors and assess its competitive advantages. The goal is to determine if UnitedHealth holds a sustainable edge over rivals.

Strategic Positioning

UnitedHealth Group operates a diversified product portfolio across four segments: UnitedHealthcare, OptumHealth, OptumInsight, and OptumRx. Its revenues span health plans, care delivery, pharmacy services, and healthcare technology, reflecting broad vertical integration within the U.S. healthcare sector.

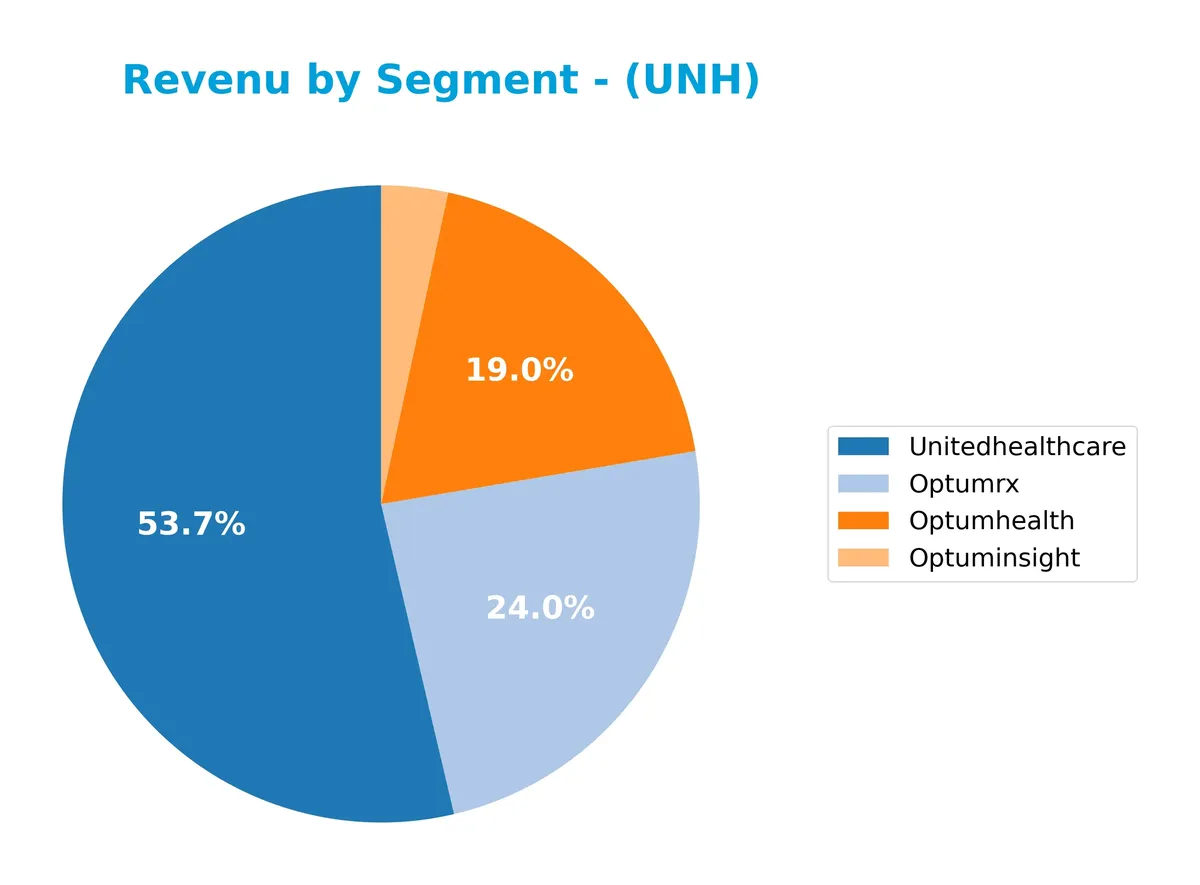

Revenue by Segment

The pie chart displays UnitedHealth Group’s revenue distribution by segment for the fiscal year 2024, highlighting the relative contribution of each business unit.

UnitedHealthcare remains the dominant revenue driver at 298B, reflecting its core insurance business strength. OptumRx leads within Optum segments at 133B, showing robust pharmacy services growth. OptumHealth also expanded sharply to 105B, indicating rising demand for health services. OptumInsight, though smaller at 19B, supports data and analytics. The 2024 figures show accelerated growth in Optum units, suggesting diversification beyond insurance.

Key Products & Brands

UnitedHealth Group’s revenue streams span four main segments, each serving distinct healthcare needs:

| Product | Description |

|---|---|

| UnitedHealthcare | Consumer-oriented health benefit plans and services for employers, individuals, Medicaid, and seniors. |

| Optum Health | Networks of care providers, health management, care delivery, consumer engagement, and financial services. |

| Optum Insight | Software, information products, consulting, and managed services for hospitals, physicians, and governments. |

| Optum Rx | Pharmacy care services including retail contracting, home delivery, specialty pharmacy, and drug management. |

UnitedHealth Group diversifies its offerings across health plans, care delivery, data analytics, and pharmacy services. This multi-segment approach addresses a broad spectrum of healthcare needs and clients.

Main Competitors

The Healthcare sector for Medical – Healthcare Plans includes 7 competitors, with the top 7 leaders by market capitalization listed below:

| Competitor | Market Cap. |

|---|---|

| UnitedHealth Group Incorporated | 305B |

| CVS Health Corporation | 102B |

| Elevance Health Inc. | 79B |

| Cigna Corporation | 75B |

| Humana Inc. | 32B |

| Centene Corporation | 21B |

| Molina Healthcare, Inc. | 9.7B |

UnitedHealth Group ranks 1st among its 7 competitors, with a market cap 3x larger than the next closest rival, CVS Health. It stands above both the average top 10 market cap (~88.8B) and the sector median (~74.6B). The gap to the next competitor below is significant at -146%, highlighting UnitedHealth’s dominant scale in this industry.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does UNH have a competitive advantage?

UnitedHealth Group demonstrates a slight competitive advantage by creating value with a ROIC 4.1% above its WACC, signaling efficient capital use despite declining profitability. Its healthcare plans and diversified services support steady revenue growth, yet margin pressures persist.

Looking ahead, UNH’s multi-segment operations—including Optum’s technology-driven health services and pharmacy care—position it to exploit evolving healthcare markets. Continued innovation and expansion in consumer-oriented and government programs offer meaningful opportunities amid industry challenges.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting UnitedHealth Group’s strategic outlook.

Strengths

- strong market position

- diversified healthcare segments

- favorable debt-to-assets ratio

Weaknesses

- declining ROIC trend

- unfavorable net margin

- weak current and quick ratios

Opportunities

- growth in healthcare technology

- expansion of Optum services

- aging population needs

Threats

- regulatory risks

- rising healthcare costs

- competitive pressure from peers

UnitedHealth Group boasts a robust market presence and diverse business lines but faces margin pressures and liquidity concerns. Its strategy must focus on operational efficiency and innovation to capitalize on healthcare trends while managing regulatory and cost risks.

Stock Price Action Analysis

The coming weekly stock chart displays UnitedHealth Group’s price movements over the past 100 weeks, highlighting key highs and lows with significant volatility:

Trend Analysis

Over the past 12 months, UnitedHealth Group’s stock declined by 43.64%, signaling a bearish trend with accelerating downside momentum. The price dropped from a high of 615.81 to a low of 237.77, accompanied by high volatility (std dev 110.79), confirming sustained selling pressure.

Volume Analysis

In the last three months, trading volume has increased but shows slight seller dominance with buyers at 41.05%. This rising volume amid selling pressure suggests cautious investor sentiment and potential distribution rather than accumulation.

Target Prices

Analysts set a confident target consensus for UnitedHealth Group at $385.38.

| Target Low | Target High | Consensus |

|---|---|---|

| 327 | 444 | 385.38 |

The target range from $327 to $444 reflects solid growth expectations, with consensus suggesting a robust upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding UnitedHealth Group Incorporated’s market performance and service quality.

Stock Grades

The following table summarizes recent verified analyst grades for UnitedHealth Group Incorporated:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2026-02-05 |

| JP Morgan | Maintain | Overweight | 2026-02-02 |

| Truist Securities | Maintain | Buy | 2026-02-02 |

| Barclays | Maintain | Overweight | 2026-01-30 |

| Wells Fargo | Maintain | Overweight | 2026-01-30 |

| Jefferies | Maintain | Buy | 2026-01-28 |

| RBC Capital | Maintain | Outperform | 2026-01-28 |

| Oppenheimer | Maintain | Outperform | 2026-01-28 |

| Leerink Partners | Maintain | Outperform | 2026-01-28 |

| UBS | Maintain | Buy | 2026-01-28 |

The consensus strongly favors UnitedHealth Group with consistent “Buy” and “Outperform” ratings across major banks. Analysts have uniformly maintained positive views without downgrades, reflecting stable confidence in the stock’s outlook.

Consumer Opinions

UnitedHealth Group consistently earns praise for its comprehensive healthcare solutions, but some consumers express concerns over service complexity and costs.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent customer service and fast claims processing.” | “Confusing billing statements cause frustration.” |

| “Wide network of providers and reliable coverage.” | “Premiums and out-of-pocket costs are high.” |

| “User-friendly mobile app enhances accessibility.” | “Long wait times for some specialist appointments.” |

Overall, consumers appreciate UnitedHealth’s extensive network and efficient service. However, billing transparency and affordability remain common pain points.

Risk Analysis

Below is a table summarizing the key risks UnitedHealth Group faces, categorized by type, with their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Current and quick ratios stand at 0.79, signaling liquidity constraints that may pressure operations. | Medium | High |

| Valuation | Price-to-book at 3.0 and price-to-earnings at 21.12 suggest possible overvaluation risk. | Medium | Medium |

| Leverage | Debt-to-equity is very unfavorable, indicating higher financial risk despite moderate debt-to-assets. | Medium | Medium |

| Profitability | Net margin at 3.18% is unfavorable, which could limit reinvestment and dividend growth. | Medium | Medium |

| Market Volatility | Beta of 0.415 implies lower volatility but exposes the stock to sector-specific healthcare policy risks. | Low | Medium |

| Bankruptcy Risk | Altman Z-Score is 2.29, placing the company in the grey zone—moderate risk of financial distress. | Low | High |

Liquidity issues are the most pressing, given the weak current and quick ratios below 1. This raises red flags during economic downturns or unexpected cash demands. The moderate Altman Z-Score signals some financial vulnerability. Investors should watch valuation carefully, as premium multiples might compress in a market correction.

Should You Buy UnitedHealth Group Incorporated?

UnitedHealth Group appears to be delivering robust profitability with strong value creation despite a declining ROIC trend suggesting slight erosion in its competitive moat. Its leverage profile could be seen as substantial, reflecting a cautious debt situation. The overall rating of B+ indicates a very favorable but nuanced financial health profile.

Strength & Efficiency Pillars

UnitedHealth Group Incorporated maintains operational resilience with a net margin of 3.18% and a return on equity of 14.21%, reflecting modest profitability. The company’s return on invested capital (ROIC) stands at 9.45%, comfortably above its weighted average cost of capital (WACC) of 5.33%, confirming it as a value creator. Despite a slight decline in ROIC trends, UnitedHealth sustains efficient capital allocation and solid asset turnover at 1.45, underscoring disciplined operational execution.

Weaknesses and Drawbacks

UnitedHealth faces moderate financial risk, positioned in the Altman Z-Score grey zone at 2.29, signaling some solvency caution. The valuation metrics show elevated risk: a price-to-book ratio of 3.0 and a price-to-earnings ratio of 21.12 suggest a premium valuation that may limit upside. Liquidity is a concern, with a current ratio of 0.79 well below the safe threshold of 1.0, exposing the firm to short-term funding pressures. Recent market action is slightly seller dominant at 41.05% buyer volume, indicating near-term headwinds.

Our Final Verdict about UnitedHealth Group Incorporated

UnitedHealth Group Incorporated presents a fundamentally sound profile with value creation and stable profitability. However, the Altman Z-Score’s grey zone reading advises prudence, as solvency risks remain non-negligible. Despite long-term strength, recent bearish price trends and weaker liquidity metrics suggest a wait-and-see approach might be prudent. This profile could appeal to investors seeking exposure in healthcare but may appear too risky for conservative capital at present.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- UnitedHealth’s Q4 Beat Can’t Stop the Slide: Should You Let Go Now? – Yahoo Finance (Feb 05, 2026)

- UnitedHealth: Riding On Value-Based Care Through Optum (NYSE:UNH) – Seeking Alpha (Feb 05, 2026)

- UnitedHealth Group Just Received More Bad News. Here’s What Investors Should Know. – Yahoo Finance (Feb 04, 2026)

- UnitedHealth Group Incorporated (UNH): A Bull Case Theory – Yahoo Finance (Feb 04, 2026)

- UnitedHealth: Buy The Dip As Multiple Factors Could Drive Strong Long-Term Returns – Seeking Alpha (Feb 04, 2026)

For more information about UnitedHealth Group Incorporated, please visit the official website: unitedhealthgroup.com