Home > Analyses > Consumer Defensive > Unilever PLC

Unilever PLC touches billions of lives daily through its diverse range of household and personal care products, shaping routines and enhancing comfort worldwide. As a giant in fast-moving consumer goods, Unilever commands a formidable presence with iconic brands spanning beauty, food, and home care, celebrated for innovation and quality. With a legacy dating back over a century, the question remains: does Unilever’s current market position and growth outlook still justify its premium valuation for today’s investor?

Table of contents

Business Model & Company Overview

Unilever PLC, founded in 1894 and headquartered in London, stands as a global leader in the fast-moving consumer goods sector. Its cohesive ecosystem spans Beauty & Personal Care, Foods & Refreshment, and Home Care segments, delivering trusted brands like Dove, Knorr, and Ben & Jerry’s. This diverse portfolio underpins its mission to improve daily living through quality products that touch millions worldwide.

The company’s revenue engine balances strong recurring sales from personal care and food products with a strategic presence across the Americas, Europe, and Asia. With a market cap of $146B and 115,964 employees, Unilever leverages its extensive brand portfolio and global reach to sustain a robust competitive edge. Its deep-rooted brand loyalty and innovation create a formidable economic moat shaping the industry’s future.

Financial Performance & Fundamental Metrics

This section reviews Unilever PLC’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

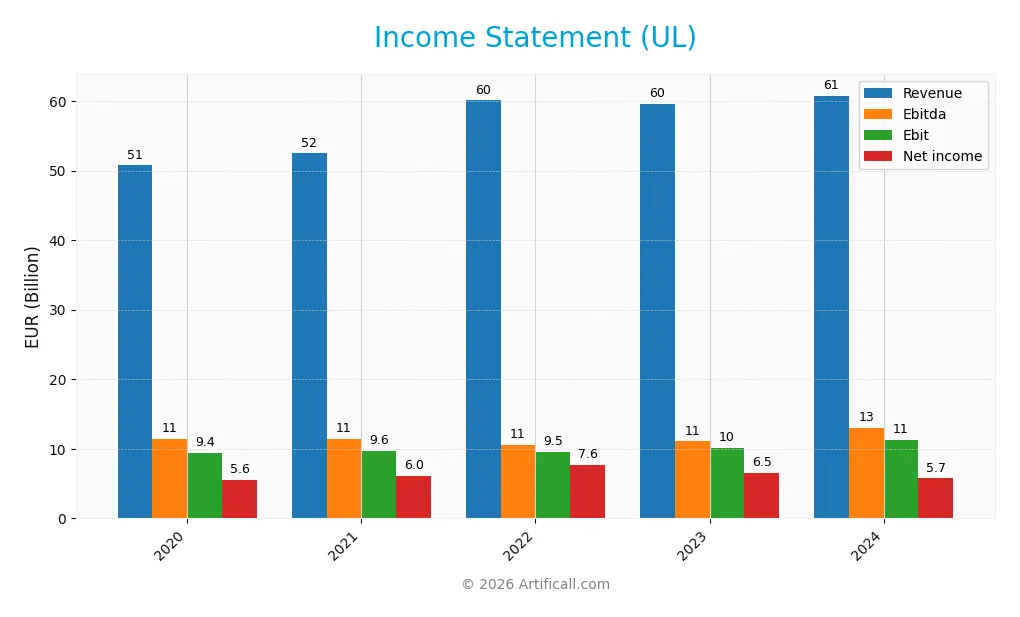

The table below presents Unilever PLC’s key income statement figures for fiscal years 2020 through 2024, reported in euros (EUR).

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 50.7B | 52.4B | 60.1B | 59.6B | 60.8B |

| Cost of Revenue | 28.7B | 30.3B | 35.9B | 34.4B | 0 |

| Operating Expenses | 13.7B | 13.5B | 13.4B | 15.4B | 51.4B |

| Gross Profit | 22.0B | 22.2B | 24.2B | 25.2B | 60.8B |

| EBITDA | 11.4B | 11.4B | 10.6B | 11.1B | 13.0B |

| EBIT | 9.4B | 9.6B | 9.5B | 10.1B | 11.3B |

| Interest Expense | 703M | 498M | 789M | 1.1B | 1.1B |

| Net Income | 5.6B | 6.0B | 7.6B | 6.5B | 5.7B |

| EPS | 2.13 | 2.33 | 3.00 | 2.58 | 2.30 |

| Filing Date | 2021-03-10 | 2022-03-09 | 2023-03-13 | 2024-03-14 | 2025-03-13 |

Income Statement Evolution

From 2020 to 2024, Unilever PLC’s revenue increased by 19.79% overall, showing a generally favorable growth trend despite a 1.94% revenue decline in the last year. Net income exhibited a modest overall rise of 2.92%, while net margin declined by 14.08%, indicating margin pressure. Gross profit surged significantly last year, improving margins, and EBIT margin remained favorable at 18.52%.

Is the Income Statement Favorable?

In 2024, Unilever reported revenue of €60.8B and net income of €5.74B, with an EPS of €2.30, down 10.55% from 2023. The company maintained a strong gross margin of 100% and an EBIT margin of 18.52%, reflecting efficient operations. However, net margin and EPS decreased, signaling some profitability challenges. Overall, the income statement fundamentals are assessed as favorable given the balance of strong margins and solid operating income.

Financial Ratios

The table below presents key financial ratios for Unilever PLC over the fiscal years 2020 to 2024, reflecting profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 11.0% | 11.5% | 12.7% | 10.9% | 9.5% |

| ROE | 36.6% | 35.4% | 40.2% | 35.8% | 28.7% |

| ROIC | 12.3% | 11.7% | 14.8% | 13.2% | 11.1% |

| P/E | 26.2 | 23.0 | 17.7 | 19.3 | 26.9 |

| P/B | 9.6 | 8.1 | 7.1 | 6.9 | 7.7 |

| Current Ratio | 0.78 | 0.70 | 0.75 | 0.76 | 0.76 |

| Quick Ratio | 0.57 | 0.51 | 0.52 | 0.54 | 0.56 |

| D/E | 1.75 | 1.73 | 1.50 | 1.58 | 1.53 |

| Debt-to-Assets | 39.6% | 39.5% | 36.5% | 38.0% | 38.4% |

| Interest Coverage | 11.8 | 17.5 | 13.6 | 9.1 | 8.4 |

| Asset Turnover | 0.75 | 0.70 | 0.77 | 0.79 | 0.76 |

| Fixed Asset Turnover | 4.80 | 5.07 | 5.58 | 5.57 | 5.21 |

| Dividend Yield | 2.9% | 3.2% | 3.2% | 3.5% | 2.8% |

Evolution of Financial Ratios

Unilever PLC’s Return on Equity (ROE) showed a positive trend, reaching 28.73% in 2024, indicating an improvement in profitability. The Current Ratio remained consistently below 1, around 0.76 in 2024, suggesting stable but low liquidity. The Debt-to-Equity Ratio held steady above 1.5, reflecting a consistent leverage level without significant change in financial risk.

Are the Financial Ratios Favorable?

In 2024, Unilever’s profitability ratios such as ROE (28.73%) and Return on Invested Capital (11.12%) are favorable, supported by a solid interest coverage ratio of 10.06. Liquidity ratios like the Current Ratio (0.76) and Quick Ratio (0.56) are unfavorable, indicating tight short-term liquidity. Valuation multiples, including P/E (26.93) and Price-to-Book (7.74), are also unfavorable. Overall, the financial ratios are slightly favorable, with 42.86% favorable, 35.71% unfavorable, and 21.43% neutral metrics.

Shareholder Return Policy

Unilever PLC maintains a consistent dividend policy with a payout ratio around 75%, offering a dividend yield near 2.8% in 2024. Dividends per share have shown a steady increase, supported by free cash flow coverage above 80%, indicating a balanced approach to distributions. The company also engages in share buybacks, complementing its return to shareholders.

This policy reflects a stable distribution strategy aligned with sustainable long-term value creation. While the relatively high payout ratio warrants monitoring for potential pressure on cash resources, the combination of dividends and buybacks appears well-supported by operating cash flow and free cash flow metrics.

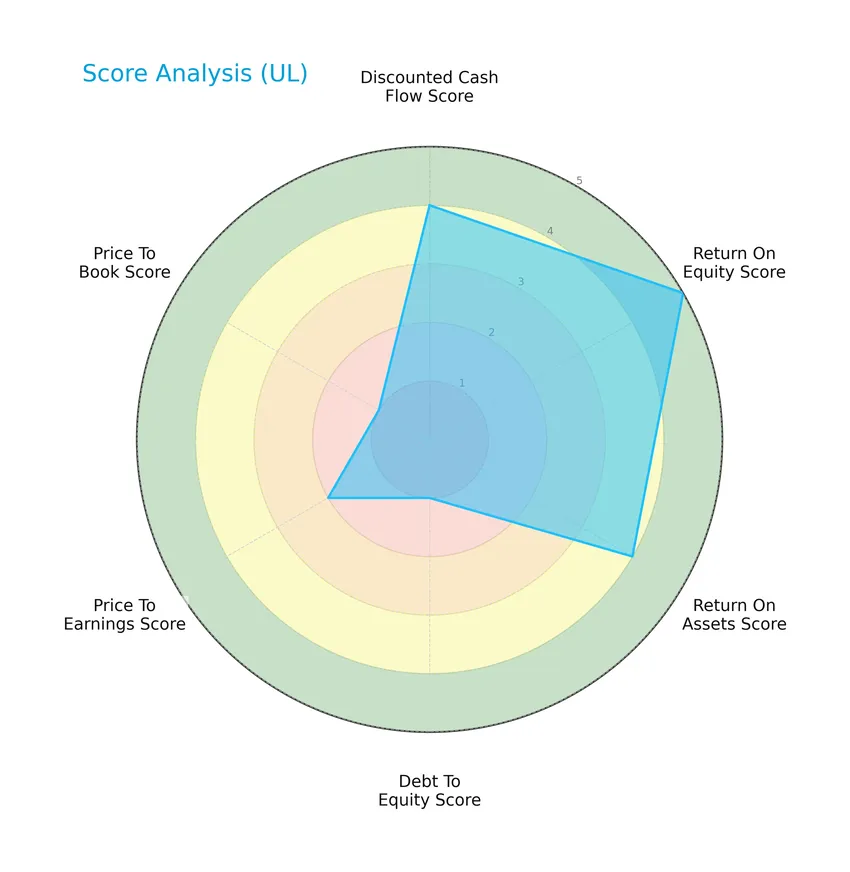

Score analysis

The following radar chart presents Unilever PLC’s key financial scores for a comprehensive overview:

Unilever shows strong profitability with high scores in discounted cash flow (4), return on equity (5), and return on assets (4). However, leverage and valuation metrics are weaker, with debt-to-equity (1) and price-to-book (1) scores notably unfavorable, while the price-to-earnings score is moderate (2).

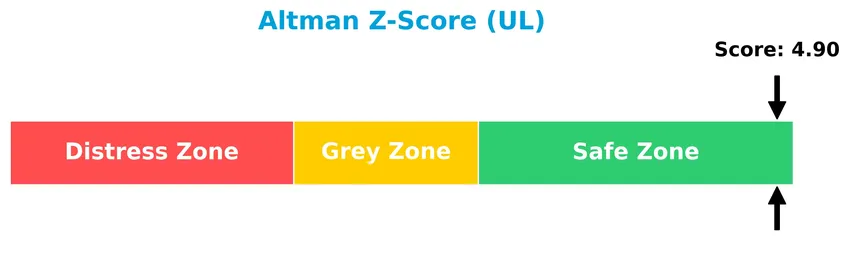

Analysis of the company’s bankruptcy risk

Unilever’s Altman Z-Score indicates a low risk of bankruptcy, placing the company comfortably in the safe zone:

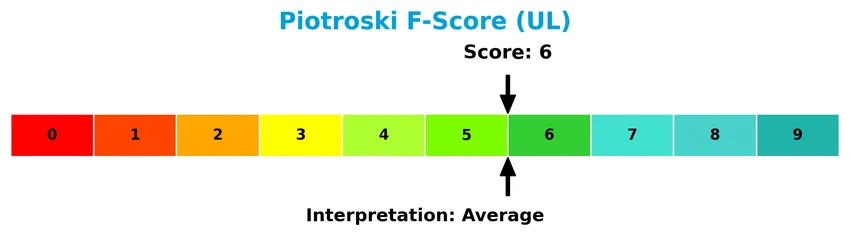

Is the company in good financial health?

The Piotroski Score diagram below illustrates Unilever’s average financial health status based on nine key criteria:

With a Piotroski Score of 6, Unilever demonstrates moderate financial strength, suggesting a stable but not exceptional financial condition relative to its peers.

Competitive Landscape & Sector Positioning

This sector analysis will explore Unilever PLC’s strategic positioning, revenue breakdown, key products, and main competitors. I will assess whether Unilever holds a competitive advantage over its peers in the household and personal products industry.

Strategic Positioning

Unilever PLC maintains a diversified product portfolio across Beauty & Personal Care, Foods & Refreshment, and Home Care segments, with a broad geographic footprint spanning Europe, Americas, Asia Pacific, Africa, and Latin America. This multi-segment and multi-region exposure supports resilience and growth opportunities.

Key Products & Brands

Below is an overview of Unilever PLC’s key products and brands across its main business segments:

| Product | Description |

|---|---|

| Beauty & Personal Care | Skin care, hair care, deodorants, and skin cleansing products under brands like Dove, Lifebuoy, Lux, Rexona, Sunsilk, Axe, and Vaseline. |

| Foods & Refreshment | Ice cream, soups, bouillons, seasonings, mayonnaise, ketchups, and tea, including Ben & Jerry’s, Knorr, Magnum, Wall’s, Bango, Hellmann’s, and the Vegetarian Butcher. |

| Home Care | Fabric solutions and various cleaning products marketed under Domestos, OMO, Seventh Generation, Cif, and Comfort. |

| Health & Wellness | Nutritional supplements and wellness brands such as Equilibra, OLLY, Liquid I.V., SmartyPants, and Onnit. |

Unilever’s diverse portfolio spans essential consumer goods in personal care, food, home care, and wellness, supported by globally recognized brands.

Main Competitors

There are 17 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Procter & Gamble Company | 331.3B |

| Unilever PLC | 143.2B |

| Colgate-Palmolive Company | 62.6B |

| The Estée Lauder Companies Inc. | 38.5B |

| Kimberly-Clark Corporation | 33.7B |

| Kenvue Inc. | 33.2B |

| Church & Dwight Co., Inc. | 20.2B |

| The Clorox Company | 12.3B |

| e.l.f. Beauty, Inc. | 4.3B |

| Inter Parfums, Inc. | 2.7B |

Unilever PLC ranks 2nd among its 17 competitors, with a market cap approximately 44% that of the sector leader, The Procter & Gamble Company. It is positioned above both the average market cap of the top 10 competitors (68.2B) and the median market cap of the sector (4.3B). The company enjoys a significant gap of +126.64% to the next competitor above, underscoring its strong standing in the Household & Personal Products industry.

Does Unilever PLC have a competitive advantage?

Unilever PLC presents a competitive advantage as it consistently creates value, with a ROIC exceeding its WACC by 6.6%, reflecting efficient use of invested capital despite a declining ROIC trend. Its favorable income statement metrics, including an 18.5% EBIT margin and 9.45% net margin, support its profitability and operational strength.

Looking forward, Unilever’s diverse product portfolio across Beauty & Personal Care, Foods & Refreshment, and Home Care segments, combined with geographic revenue growth in Americas and Latin America, positions it to capitalize on new market opportunities and product innovations. However, investors should note the mixed growth signals in revenue and net margin trends.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights Unilever PLC’s key internal strengths and weaknesses alongside external opportunities and threats to guide informed investment decisions.

Strengths

- Strong global brand portfolio

- Favorable profitability margins

- Solid ROE of 28.73%

Weaknesses

- Declining net margin growth

- Elevated debt-to-equity ratio (1.53)

- Unfavorable liquidity ratios (current and quick)

Opportunities

- Expansion in emerging markets (Asia Pacific, Latin America)

- Growing demand for sustainable products

- Innovation in health and wellness categories

Threats

- Intense competition in consumer goods

- Currency fluctuations impacting revenue

- Rising input costs and inflation pressures

Unilever’s strong brand presence and profitability create a robust platform, but attention to margin erosion and leverage is needed. Growth opportunities in emerging markets and sustainability trends are promising, while competitive and macroeconomic risks require cautious strategic management.

Stock Price Action Analysis

The weekly stock chart below illustrates Unilever PLC’s price movements over the past 12 months, highlighting key trend shifts and volatility:

Trend Analysis

Over the past 12 months, Unilever PLC’s stock price increased by 21.05%, indicating a bullish trend with deceleration in momentum. The price ranged from a low of 52.66 to a high of 73.69, with a volatility measure of 4.77%. However, recent data from November 2025 to January 2026 shows a slight bearish reversal with a 3.21% decline and reduced volatility of 1.53%.

Volume Analysis

Trading volumes have been increasing overall, with total volume reaching 1.34B shares. Buyer activity accounts for 57.74% of this volume, reflecting buyer dominance. In the recent period from November 2025 to January 2026, buyers remain slightly dominant at 54.41%, suggesting cautious but sustained investor interest amidst the recent price pullback.

Target Prices

The consensus target prices for Unilever PLC reflect moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 71 | 60.1 | 65.55 |

Analysts expect Unilever’s stock to trade within this range, indicating a cautiously optimistic outlook for the medium term.

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding Unilever PLC’s market performance and products.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

The latest grades for Unilever PLC from recognized financial institutions show a mix of upgrades and downgrades over recent years:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Erste Group | Downgrade | Hold | 2024-11-19 |

| B of A Securities | Upgrade | Buy | 2024-08-22 |

| JP Morgan | Upgrade | Overweight | 2024-05-23 |

| Argus Research | Maintain | Buy | 2024-05-08 |

| Morgan Stanley | Downgrade | Underweight | 2024-02-27 |

| Bernstein | Upgrade | Market Perform | 2022-03-14 |

| Bernstein | Upgrade | Market Perform | 2022-03-13 |

| Bernstein | Upgrade | Market Perform | 2021-11-01 |

| Bernstein | Upgrade | Market Perform | 2021-10-31 |

| Deutsche Bank | Downgrade | Hold | 2021-09-16 |

The overall trend reveals a balance between cautious downgrades and optimistic upgrades, with a consensus consensus rating of Hold reflecting mixed sentiment among analysts.

Consumer Opinions

Unilever PLC continues to garner a diverse range of consumer sentiments, reflecting its broad product portfolio and global reach.

| Positive Reviews | Negative Reviews |

|---|---|

| Consistently high product quality across brands. | Some products perceived as overpriced. |

| Strong commitment to sustainability and ethics. | Occasional issues with product availability. |

| Wide variety of choices catering to different needs. | Packaging waste concerns raised by eco-conscious buyers. |

Overall, consumers appreciate Unilever’s quality and sustainability efforts, though price sensitivity and packaging impact remain areas for improvement.

Risk Analysis

Below is a summary table outlining the key risks associated with investing in Unilever PLC, focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | High debt-to-equity ratio (1.53) may increase financial risk during downturns | Medium | High |

| Valuation | Elevated price-to-book (7.74) and price-to-earnings ratio (26.93) suggest overvaluation risk | Medium | Medium |

| Liquidity | Low current ratio (0.76) and quick ratio (0.56) indicate potential short-term liquidity concerns | Medium | Medium |

| Market Volatility | Low beta (0.223) implies limited stock price sensitivity to market swings | Low | Low |

| Operational | Dependence on consumer demand and supply chain disruptions in personal care and food sectors | Medium | Medium |

The most significant risks stem from Unilever’s relatively high financial leverage and stretched liquidity ratios, which could amplify vulnerabilities in economic downturns. However, its strong Altman Z-Score (4.9) places it in a safe zone for bankruptcy risk. Investors should weigh these factors carefully against the company’s solid profitability and dividend yield.

Should You Buy Unilever PLC?

Unilever PLC appears to be a company with robust profitability and a slightly favorable competitive moat, evidenced by consistent value creation despite a declining return on invested capital. While its leverage profile could be seen as substantial, the overall financial rating suggests a very favorable standing with moderate operational efficiency.

Strength & Efficiency Pillars

Unilever PLC exhibits a robust financial foundation with a return on equity (ROE) of 28.73% and a return on invested capital (ROIC) of 11.12%, comfortably exceeding its weighted average cost of capital (WACC) at 4.5%, confirming the company as a clear value creator. Its Altman Z-Score of 4.90 places it securely in the safe zone, signaling low bankruptcy risk, while a Piotroski score of 6 reflects average but stable financial health. Margins remain solid with an EBIT margin of 18.52% and a net margin of 9.45%, underlining operational efficiency and profitability.

Weaknesses and Drawbacks

Despite these strengths, Unilever faces notable valuation and liquidity concerns. The price-to-earnings (P/E) ratio stands elevated at 26.93, suggesting a premium valuation that may limit upside potential. More critically, the price-to-book (P/B) ratio is an unfavorable 7.74, indicating the stock is expensive relative to its book value. Leverage is a significant risk, with a debt-to-equity ratio of 1.53 and current and quick ratios below 1 at 0.76 and 0.56 respectively, pointing to potential short-term liquidity constraints. These factors warrant caution amid decelerating stock price momentum.

Our Verdict about Unilever PLC

Unilever’s fundamental profile appears favorable given its value-creating capacity and financial stability. The overall bullish stock trend, combined with slightly buyer-dominant recent trading (54.41% buyer volume), suggests ongoing investor interest. However, the recent mild price decline of 3.21% and deceleration in momentum may invite a wait-and-see approach for more attractive entry points. In sum, the company could represent a viable long-term exposure but may benefit from improved valuation and liquidity conditions before committing heavily.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- BNP Paribas Downgrades Unilever PLC (UL) from Outperform to Neutral – Yahoo Finance (Jan 14, 2026)

- Unilever (UL) Subsidiary Awards $1.6M Contract to SemiCab – GuruFocus (Jan 21, 2026)

- Unilever (UL) corrects voting rights figure to 2,180,690,335 shares – Stock Titan (Jan 08, 2026)

- Unilever’s Magnum Spin-Off Makes It A Less Bloated, More Predictable Stock (NYSE:UL) – Seeking Alpha (Jan 06, 2026)

- Oakmark International Fund Picked Unilever PLC (UL) Despite Mixed Growth Drivers – Yahoo Finance (Jan 15, 2026)

For more information about Unilever PLC, please visit the official website: unilever.com