Home > Analyses > Consumer Cyclical > Ulta Beauty, Inc.

Ulta Beauty, Inc. transforms the beauty experience for millions across the United States, blending retail with personalized salon services to create a unique destination. As a dominant player in specialty retail, Ulta offers an extensive range of cosmetics, skincare, and haircare products alongside professional salon treatments, earning a reputation for innovation and quality. With a strong market presence and continuous growth, the key question remains: does Ulta’s current valuation truly reflect its future potential in an evolving beauty landscape?

Table of contents

Business Model & Company Overview

Ulta Beauty, Inc., founded in 1990 and headquartered in Bolingbrook, Illinois, stands as a dominant player in the specialty retail sector across the United States. With 1,308 stores nationwide, it offers a comprehensive ecosystem of beauty products and services, including cosmetics, skincare, haircare, and salon treatments. This integrated approach caters to a broad consumer base seeking both products and professional beauty services under one roof.

The company’s revenue engine balances retail sales of branded and private label products with recurring salon services, leveraging digital channels alongside its physical presence. Ulta’s strategic footprint spans all 50 states, supported by a robust e-commerce platform. Its competitive advantage lies in this seamless omnichannel model, creating strong customer loyalty and a resilient economic moat that continues to shape the future of beauty retailing.

Financial Performance & Fundamental Metrics

This section provides a fundamental analysis of Ulta Beauty, Inc., focusing on its income statement, key financial ratios, and dividend payout policy.

Income Statement

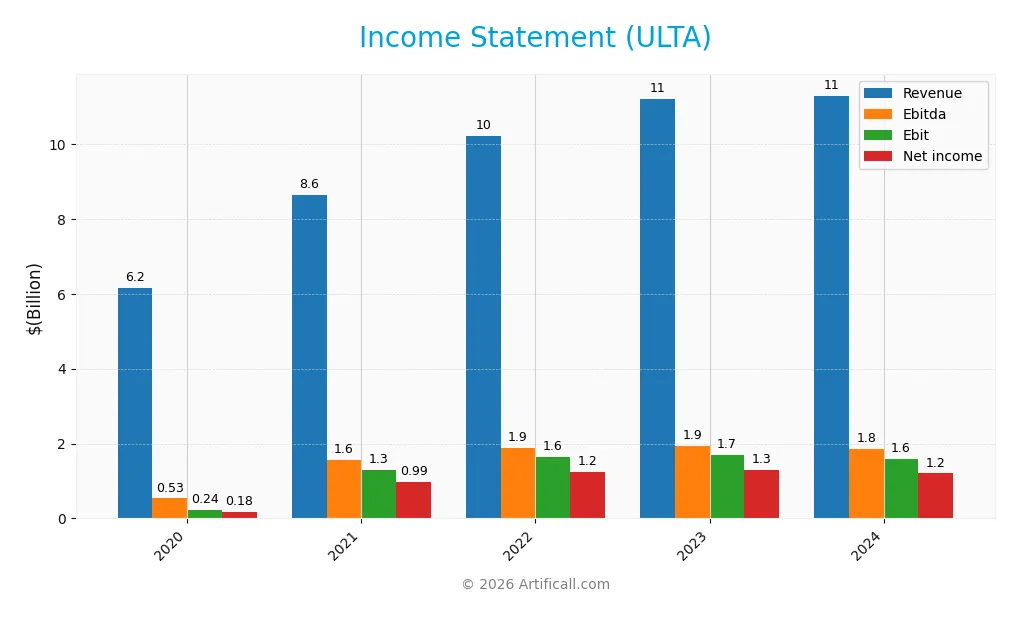

The table below presents Ulta Beauty, Inc.’s key income statement figures for fiscal years 2020 through 2024, illustrating trends in revenue, profit, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 6.15B | 8.63B | 10.21B | 11.21B | 11.30B |

| Cost of Revenue | 4.20B | 5.26B | 6.16B | 6.83B | 6.91B |

| Operating Expenses | 1.64B | 2.12B | 2.40B | 2.69B | 2.81B |

| Gross Profit | 1.95B | 3.37B | 4.04B | 4.38B | 4.39B |

| EBITDA | 535M | 1.57B | 1.88B | 1.94B | 1.85B |

| EBIT | 237M | 1.30B | 1.64B | 1.70B | 1.58B |

| Interest Expense | 5.74M | 1.66M | 0 | 0 | 0 |

| Net Income | 176M | 986M | 1.24B | 1.29B | 1.20B |

| EPS | 3.12 | 18.09 | 24.17 | 26.18 | 25.44 |

| Filing Date | 2021-03-26 | 2022-03-25 | 2023-03-24 | 2024-03-26 | 2025-03-27 |

Income Statement Evolution

Ulta Beauty’s revenue demonstrated strong growth of 83.61% from 2020 to 2024, with net income surging 583.09% over the same period. However, recent growth slowed, with revenue increasing only 0.79% year-over-year and net income declining 7.69%. Margins remain generally stable and favorable, with a gross margin near 39% and an EBIT margin around 14%, although 2024 showed slight margin compression relative to prior years.

Is the Income Statement Favorable?

In 2024, Ulta Beauty reported $11.3B in revenue and $1.2B in net income, yielding a net margin of 10.63%, consistent with favorable historical margins. Despite slight declines in EBIT and EPS compared to 2023, the fundamentals remain solid, supported by zero interest expense and a strong gross profit of $4.4B. The overall income statement quality is assessed as favorable, reflecting sound profitability and efficient cost management, though recent growth softness warrants monitoring.

Financial Ratios

The following table presents key financial ratios for Ulta Beauty, Inc. over the fiscal years 2020 to 2024, reflecting profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 2.9% | 11.4% | 12.2% | 11.5% | 10.6% |

| ROE | 8.8% | 64.2% | 63.4% | 56.6% | 48.3% |

| ROIC | 6.0% | 27.3% | 31.4% | 29.6% | 26.6% |

| P/E | 90.4 | 20.1 | 21.3 | 19.2 | 16.2 |

| P/B | 8.0 | 12.9 | 13.5 | 10.9 | 7.8 |

| Current Ratio | 1.87 | 1.46 | 1.61 | 1.71 | 1.70 |

| Quick Ratio | 1.00 | 0.50 | 0.66 | 0.66 | 0.60 |

| D/E | 0.95 | 1.20 | 0.97 | 0.84 | 0.77 |

| Debt-to-Assets | 37.3% | 38.8% | 35.4% | 33.5% | 32.0% |

| Interest Coverage | 55.0 | 752.0 | 0 | 0 | 0 |

| Asset Turnover | 1.21 | 1.81 | 1.90 | 1.96 | 1.88 |

| Fixed Asset Turnover | 2.46 | 3.60 | 3.97 | 4.07 | 3.96 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Evolution of Financial Ratios

Over recent years, Ulta Beauty’s Return on Equity (ROE) has shown a downward trend from a peak of 63.4% in 2022 to 48.3% in 2024, indicating some moderation in profitability. The Current Ratio remained relatively stable around 1.7, reflecting consistent short-term liquidity. The Debt-to-Equity ratio declined from 1.20 in 2021 to 0.77 in 2024, showing a reduction in leverage and a more conservative capital structure.

Are the Financial Ratios Favorable?

In 2024, Ulta Beauty’s profitability metrics, including a 10.6% net margin and 48.3% ROE, are favorable, demonstrating efficient earnings generation. Liquidity is mixed: the Current Ratio at 1.7 is favorable, while the Quick Ratio at 0.6 is unfavorable, suggesting reliance on inventory. Leverage ratios are neutral, with a Debt-to-Equity of 0.77 and debt-to-assets at 32%. Market valuation shows a neutral P/E of 16.2 but an unfavorable high Price-to-Book of 7.82. Overall, 57% of ratios are favorable, supporting a generally positive financial profile.

Shareholder Return Policy

Ulta Beauty, Inc. does not pay dividends, reflecting a strategy focused on reinvestment rather than shareholder cash distribution. The company’s dividend payout ratio remains at 0%, and no dividend yield is reported, indicating prioritization of growth or operational funding over direct returns.

Despite the absence of dividends, there is no mention of share buyback programs, suggesting limited capital return initiatives. This approach may support sustainable long-term value creation if reinvestments drive profitability and growth, as indicated by stable net profit margins and free cash flow metrics.

Score analysis

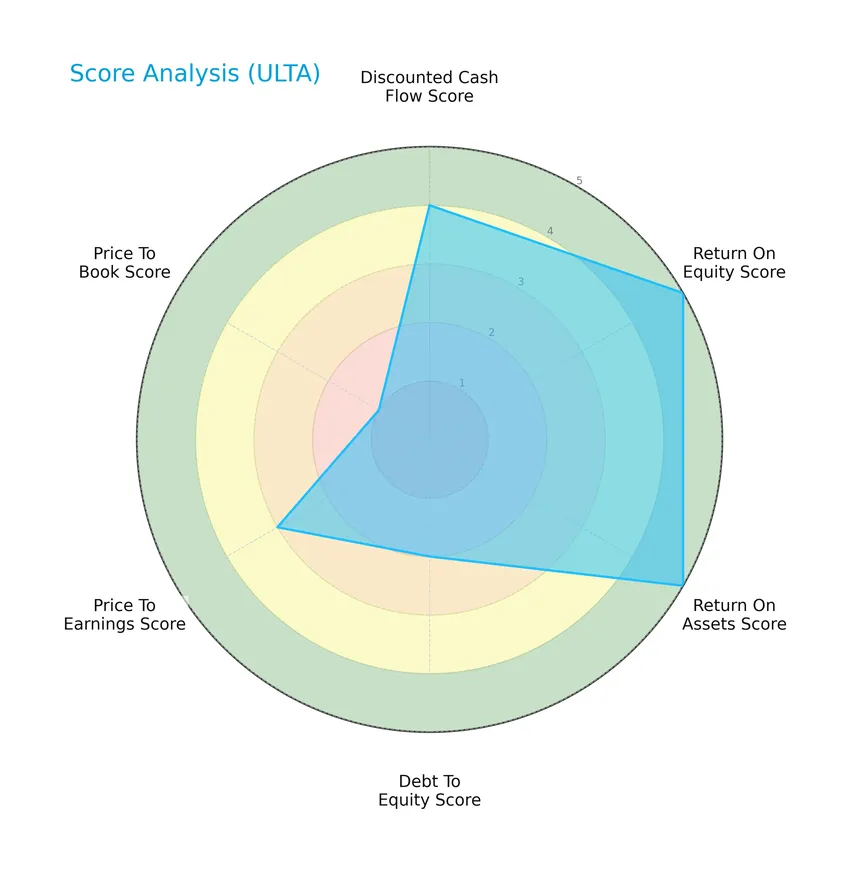

The radar chart below provides an overview of Ulta Beauty, Inc.’s key financial scores across various valuation and profitability metrics:

Ulta’s scores indicate strong profitability with very favorable returns on equity and assets at 5 each. The discounted cash flow score is favorable at 4, while leverage and valuation metrics show moderate to unfavorable scores, with debt-to-equity at 2, price-to-earnings at 3, and price-to-book notably low at 1.

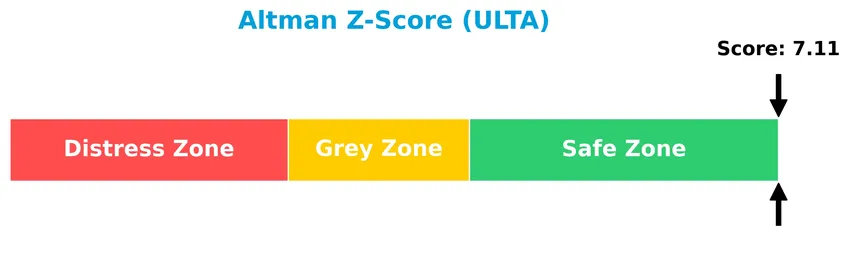

Analysis of the company’s bankruptcy risk

Ulta Beauty, Inc. is positioned well within the safe zone according to its Altman Z-Score, indicating a low probability of bankruptcy:

Is the company in good financial health?

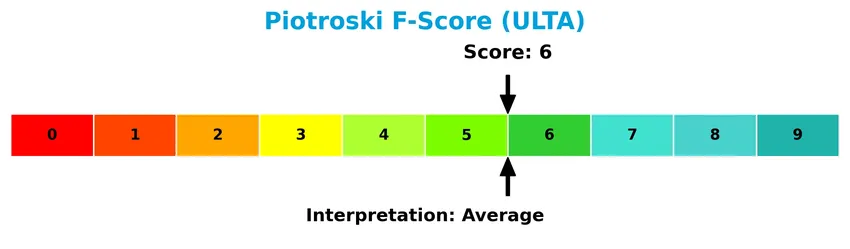

The Piotroski Score chart below illustrates Ulta’s financial strength using nine key criteria:

With a Piotroski Score of 6, Ulta demonstrates an average financial health status, reflecting moderate strength in profitability, leverage, liquidity, and efficiency factors.

Competitive Landscape & Sector Positioning

This sector analysis will examine Ulta Beauty, Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Ulta Beauty holds a competitive edge over its rivals in the specialty retail industry.

Strategic Positioning

Ulta Beauty, Inc. concentrates its operations within the United States, operating 1,308 stores across all 50 states and online channels, focusing on beauty products and salon services. Its product portfolio spans cosmetics, skincare, haircare, and salon services, with a growing e-commerce segment supplementing physical retail.

Revenue by Segment

This pie chart displays Ulta Beauty, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the contribution from gift card breakage.

In 2024, the only reported segment revenue available is from gift card breakage, amounting to 24.3M USD. Historical data shows growth in this segment over recent years, indicating a steady increase in non-product revenue streams. However, the absence of detailed product and service segment data for 2024 limits insight into core business drivers, which traditionally include product sales and salon services. This concentration on gift card breakage suggests a need for cautious evaluation of segment diversity in the latest reporting.

Key Products & Brands

The following table outlines Ulta Beauty, Inc.’s main products and brands offered to consumers:

| Product | Description |

|---|---|

| Cosmetics | A range of makeup products including Ulta Beauty Collection branded cosmetics. |

| Fragrances | Perfumes and scents available in stores and online. |

| Skincare Products | Skin treatments and care items, including Ulta Beauty Collection skincare products. |

| Haircare Products | Hair shampoos, conditioners, and styling tools, including professional hair products. |

| Bath and Body Products | Bath essentials and body care items, including Ulta Beauty Collection bath products. |

| Salon Services | Professional services such as hair, skin, makeup, and brow treatments, plus nail services. |

| Private Label Products | Ulta Beauty branded cosmetics, skincare, bath products, and gift items. |

| E-Commerce Sales | Online sales channel via ulta.com and mobile applications. |

| Gift Card Breakage | Revenue from unredeemed portions of gift cards. |

Ulta Beauty’s product portfolio spans cosmetics, skincare, haircare, and salon services, supported by a strong private label presence and growing e-commerce sales. Gift card breakage contributes to ancillary revenue streams.

Main Competitors

There are 10 main competitors in the Specialty Retail industry; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amazon.com, Inc. | 2.42T |

| Alibaba Group Holding Limited | 340B |

| PDD Holdings Inc. | 159B |

| MercadoLibre, Inc. | 102B |

| eBay Inc. | 39.4B |

| Ulta Beauty, Inc. | 27.8B |

| Tractor Supply Company | 26.9B |

| Williams-Sonoma, Inc. | 23.0B |

| Genuine Parts Company | 17.2B |

| Best Buy Co., Inc. | 14.5B |

Ulta Beauty ranks 6th among its 10 main competitors, with a market cap approximately 1.27% that of the sector leader, Amazon.com. The company is positioned below both the average market cap of the top 10 competitors (317B) and the median market cap of the specialty retail sector (33.6B). Its market cap stands 27.92% below the next competitor above, eBay, indicating a notable gap with its closest rival.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ULTA have a competitive advantage?

Ulta Beauty, Inc. presents a durable competitive advantage, demonstrated by a very favorable moat status and a ROIC exceeding its WACC by over 19%, reflecting efficient capital use and value creation. The company’s growing ROIC trend further confirms increasing profitability and a strong economic moat in the specialty retail sector.

Looking ahead, Ulta Beauty’s extensive product range and services across 1,308 stores nationwide, combined with its private label offerings, position it well to capitalize on evolving beauty trends and consumer demand. Expansion opportunities in digital channels and new market segments could support sustained growth and enhance its competitive position.

SWOT Analysis

This SWOT analysis highlights the key strategic factors impacting Ulta Beauty, Inc., guiding investors in evaluating its market position and risks.

Strengths

- Strong profitability with 10.63% net margin

- Durable competitive advantage with growing ROIC

- Large market presence with 1,308 stores nationwide

Weaknesses

- Slowing recent revenue growth at 0.79%

- High price-to-book ratio at 7.82 indicating valuation concerns

- Low quick ratio at 0.6 suggesting liquidity constraints

Opportunities

- Expansion in e-commerce and mobile sales channels

- Growing demand for private label and branded beauty products

- Potential to increase salon service offerings and customer loyalty

Threats

- Intense competition in specialty retail and beauty sector

- Economic downturns impacting discretionary spending

- Rising operational costs affecting margins

Ulta Beauty exhibits solid financial health and competitive strength, supported by strong profitability and market reach. However, investors should monitor its recent growth slowdown and valuation metrics. Strategic focus on digital expansion and service differentiation is critical to mitigate competitive and economic risks.

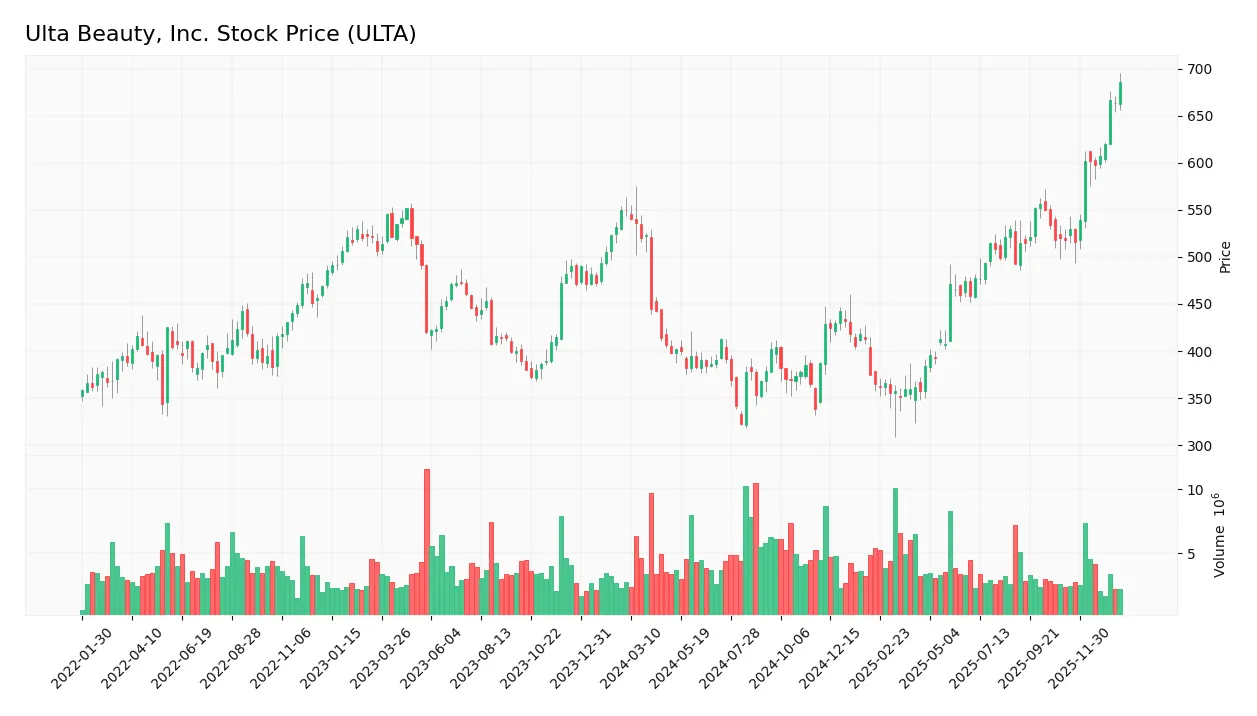

Stock Price Action Analysis

The weekly stock chart below illustrates Ulta Beauty, Inc.’s price movements over the past 12 months, highlighting key highs, lows, and recent acceleration trends:

Trend Analysis

Over the past 12 months, ULTA’s stock price increased by 24.75%, indicating a bullish trend with acceleration. The price ranged from a low of 322.17 to a high of 686.12, showing significant upward momentum. The standard deviation of 83.48 reflects notable price volatility during this period.

Volume Analysis

Trading volume over the last three months has been decreasing overall, with buyer volume dominating at 69.7%, signaling buyer-driven activity. This suggests strong investor interest despite lower market participation, indicating confidence in the stock’s upward movement during the recent period.

Target Prices

Analysts provide a clear consensus on Ulta Beauty’s target prices, reflecting optimism with a broad range.

| Target High | Target Low | Consensus |

|---|---|---|

| 790 | 425 | 683.07 |

The target prices indicate a generally positive outlook, with expectations that Ulta Beauty’s stock could reach as high as 790, while the consensus price stands near 683. This suggests confidence in the company’s growth potential despite some variability in analyst estimates.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback related to Ulta Beauty, Inc.’s market performance and product reception.

Stock Grades

Here is a concise overview of recent Ulta Beauty, Inc. stock grades from reputable financial analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Buy | 2026-01-21 |

| Raymond James | Upgrade | Strong Buy | 2026-01-21 |

| Oppenheimer | Maintain | Outperform | 2026-01-20 |

| Morgan Stanley | Maintain | Overweight | 2026-01-15 |

| B of A Securities | Maintain | Neutral | 2026-01-08 |

| UBS | Maintain | Buy | 2026-01-07 |

| Argus Research | Maintain | Buy | 2026-01-02 |

| Oppenheimer | Maintain | Outperform | 2025-12-10 |

| TD Cowen | Upgrade | Buy | 2025-12-08 |

| Morgan Stanley | Maintain | Overweight | 2025-12-08 |

The overall trend shows a predominance of Buy and Outperform ratings, with a notable upgrade to Strong Buy by Raymond James. Most firms maintain a positive stance, while only B of A Securities holds a Neutral view.

Consumer Opinions

Ulta Beauty, Inc. continues to evoke strong sentiments from its customer base, reflecting its impact in the beauty retail sector.

| Positive Reviews | Negative Reviews |

|---|---|

| Wide range of high-quality beauty products | Long wait times at checkout |

| Knowledgeable and friendly staff | Limited availability of some popular items |

| Attractive loyalty rewards program | Prices can be higher than competitors |

Overall, consumers appreciate Ulta Beauty’s extensive product selection and excellent customer service but express frustration over wait times and occasional stock shortages. Pricing is also a noted concern among budget-conscious shoppers.

Risk Analysis

Below is a table summarizing the key risks for Ulta Beauty, Inc., highlighting their likelihood and potential impact on investment decisions:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Exposure to consumer cyclical sector volatility impacting sales and profits | Medium | High |

| Valuation Risk | High price-to-book ratio (7.82) may indicate overvaluation | Medium | Medium |

| Liquidity Risk | Low quick ratio (0.6) suggests potential short-term liquidity constraints | Medium | Medium |

| Debt Risk | Moderate debt-to-equity ratio (0.77) with interest coverage infinite | Low | Medium |

| Dividend Risk | No dividend payout, possibly limiting income-focused investor appeal | High | Low |

| Competitive Risk | Intense competition in specialty retail beauty market | High | High |

The most significant risks for Ulta Beauty are market-related and competitive pressures, given its consumer cyclical nature and the crowded beauty retail space. Despite a strong Altman Z-score placing the company in a safe financial zone, investors should monitor valuation metrics and liquidity ratios closely to manage potential downside.

Should You Buy Ulta Beauty, Inc.?

Ulta Beauty, Inc. appears to be delivering robust profitability supported by a durable competitive moat with a growing ROIC, suggesting strong value creation. Despite a moderate leverage profile, the overall rating of A- indicates a very favorable financial health outlook.

Strength & Efficiency Pillars

Ulta Beauty, Inc. exhibits strong profitability and financial health, underlined by a net margin of 10.63% and a robust return on equity (ROE) of 48.27%. The company’s return on invested capital (ROIC) stands at 26.61%, significantly surpassing its weighted average cost of capital (WACC) of 7.59%, confirming its status as a clear value creator. Its Altman Z-score of 7.11 places it firmly in the safe zone, indicating low bankruptcy risk, while a Piotroski score of 6 reflects solid financial stability. These metrics collectively signal durable operational efficiency and competitive advantage.

Weaknesses and Drawbacks

Despite favorable fundamentals, Ulta Beauty faces valuation concerns, with a price-to-book (P/B) ratio of 7.82 flagged as very unfavorable, suggesting a premium market valuation that may limit upside. The price-to-earnings (P/E) ratio at 16.2 is neutral but warrants attention given the high P/B. Leverage metrics are moderate with a debt-to-equity ratio of 0.77, though the quick ratio at 0.6 is unfavorable, signaling potential liquidity constraints. Additionally, the absence of dividend yield may deter income-focused investors, presenting a risk in volatile market conditions.

Our Verdict about Ulta Beauty, Inc.

The company’s long-term fundamental profile appears favorable, anchored by strong profitability and healthy financial metrics. Coupled with a bullish overall stock trend and recent buyer dominance at 69.7%, this suggests investor confidence. The profile may appear attractive for long-term exposure, although the elevated valuation multiples and liquidity signals recommend a cautious approach. Investors could consider monitoring for valuation adjustments before increasing exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Here’s How Much a $1000 Investment in Ulta Beauty Made 10 Years Ago Would Be Worth Today – Nasdaq (Jan 22, 2026)

- Ulta Beauty expands in the Middle East with a store in the UAE (ULTA:NASDAQ) – Seeking Alpha (Jan 23, 2026)

- Earnings Preview: Anticipating Ulta Beauty’s Upcoming Results – Bitget (Jan 23, 2026)

- Ulta Beauty Boosts Middle East Expansion, Now Lands In Dubai – Benzinga (Jan 23, 2026)

- Ulta Beauty (ULTA) Advances While Market Declines: Some Information for Investors – Yahoo Finance (Jan 20, 2026)

For more information about Ulta Beauty, Inc., please visit the official website: ulta.com