Uber Technologies, Inc. revolutionizes how we navigate our daily lives by seamlessly connecting people with transportation, food, and delivery services across the globe. As a prominent player in the software application industry, Uber’s innovative solutions in mobility, delivery, and freight not only enhance convenience but also redefine urban living. With a reputation for quality and market influence, the question now is whether Uber’s fundamentals continue to justify its current market valuation and growth potential.

Table of contents

Company Description

Uber Technologies, Inc. is a leading player in the technology sector, specializing in application software that connects consumers with independent service providers across multiple markets, including the U.S., Canada, and Europe. Founded in 2009 and headquartered in San Francisco, CA, Uber operates primarily through three segments: Mobility, Delivery, and Freight. The Mobility segment focuses on ridesharing services, while Delivery encompasses meal and goods delivery. The Freight segment links shippers with carriers, providing transparent pricing and logistics support. As a pioneer in the gig economy, Uber continually shapes its industry through innovation and strategic partnerships, enhancing consumer convenience and service accessibility.

Fundamental Analysis

In this section, I will provide a comprehensive fundamental analysis of Uber Technologies, Inc., focusing on its income statement, financial ratios, and dividend payout policy.

Income Statement

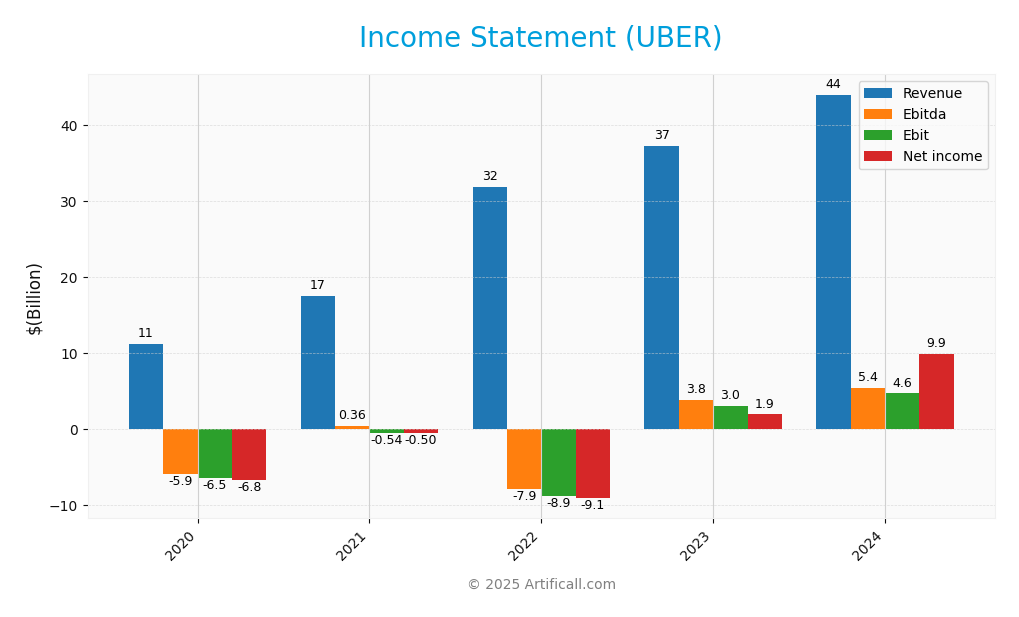

The following table summarizes the key components of Uber Technologies, Inc.’s income statement over the last five fiscal years, providing insights into revenue, expenses, and net income trends.

| Item | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 11.14B | 17.46B | 31.88B | 37.28B | 43.98B |

| Cost of Revenue | 5.15B | 9.35B | 19.66B | 22.46B | 26.65B |

| Operating Expenses | 10.85B | 11.94B | 14.05B | 13.71B | 14.53B |

| Gross Profit | 5.99B | 8.10B | 12.22B | 14.82B | 17.33B |

| EBITDA | -5.91B | 0.36B | -7.91B | 3.78B | 5.39B |

| EBIT | -6.49B | -0.54B | -8.86B | 2.95B | 4.65B |

| Interest Expense | 0.46B | 0.48B | 0.57B | 0.63B | 0.52B |

| Net Income | -6.76B | -0.50B | -9.14B | 1.89B | 9.86B |

| EPS | -3.85 | -0.26 | -4.64 | 0.90 | 4.71 |

| Filing Date | 2021-03-01 | 2022-02-24 | 2023-02-21 | 2024-02-15 | 2025-02-14 |

Interpretation of Income Statement

Over the fiscal years, Uber has shown significant revenue growth, rising from 11.14B in 2020 to 43.98B in 2024. Notably, the company achieved a substantial turnaround in net income, moving from losses in previous years to a healthy profit of 9.86B in 2024, indicating improved operational efficiency and cost management. The gross profit margin has also stabilized, reflecting a positive trend in profitability. However, while the latest year shows robust revenue growth, the rate of growth may indicate potential market saturation, necessitating careful monitoring of future performance and cost dynamics.

Financial Ratios

The following table summarizes the financial ratios for Uber Technologies, Inc. across the years provided.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -61.27% | -2.84% | -28.68% | 5.06% | 22.41% |

| ROE | -55.06% | -3.43% | -124.54% | 16.77% | 45.72% |

| ROIC | -17.25% | -6.77% | -7.56% | 3.40% | 16.35% |

| P/E | -13.24 | -159.99 | -5.34 | 66.42 | 12.82 |

| P/B | 7.29 | 5.49 | 6.64 | 11.14 | 5.86 |

| Current Ratio | 1.44 | 0.98 | 1.04 | 1.19 | 1.07 |

| Quick Ratio | 1.44 | 0.98 | 1.04 | 1.19 | 1.07 |

| D/E | 0.85 | 0.80 | 1.60 | 1.05 | – |

| Debt-to-Assets | 31.20% | 29.93% | 36.49% | 30.57% | 22.32% |

| Interest Coverage | -10.62 | -7.94 | -3.24 | 1.75 | 5.35 |

| Asset Turnover | 0.33 | 0.45 | 0.99 | 0.96 | – |

| Fixed Asset Turnover | 3.61 | 5.39 | 9.03 | 11.25 | 14.14 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

Analyzing Uber Technologies, Inc.’s financial ratios for FY 2024 reveals a mixed performance. The liquidity ratios indicate a current ratio of 1.067 and a quick ratio of 1.067, suggesting sufficient short-term assets to cover liabilities, although the cash ratio of 0.56 raises some concern about immediate liquidity. The solvency ratio stands at 0.368, which indicates a moderate level of leverage, but a debt-to-equity ratio of 0.530 suggests a conservative capital structure. Profitability ratios, including a net profit margin of 22.41%, show strong potential for profitability, although the ebitda margin at -10.69% indicates ongoing operational challenges. Overall, while liquidity and solvency appear manageable, the negative EBITDA warrants caution.

Evolution of Financial Ratios

Over the past five years, Uber’s financial ratios show significant improvement, particularly in profitability, with net profit margins climbing from negative figures in earlier years to a positive 22.41% in 2024. However, liquidity metrics have fluctuated, suggesting a need for ongoing monitoring of short-term financial health.

Distribution Policy

Uber Technologies, Inc. does not pay dividends, reflecting its ongoing reinvestment strategy aimed at expanding market share and fostering innovation. This approach is typical for high-growth companies like Uber, which prioritize R&D and acquisitions over immediate shareholder returns. However, Uber does engage in share buybacks, indicating a commitment to returning value to shareholders in a different form. Overall, this distribution strategy appears aligned with long-term value creation, balancing growth with shareholder interests.

Sector Analysis

Uber Technologies, Inc. operates in the software application industry, providing diverse services across mobility, delivery, and freight, facing competition from established players while leveraging its extensive technology platform.

Strategic Positioning

As of 2025, Uber Technologies, Inc. holds a substantial share in the ride-sharing and food delivery markets, thanks to its diverse service offerings across the Mobility, Delivery, and Freight segments. Its market capitalization stands at approximately $190B, reflecting strong investor confidence despite competitive pressures from rivals like Lyft and DoorDash. Technological disruptions, particularly in autonomous vehicles and delivery drones, pose ongoing challenges, yet Uber’s continued investment in innovation positions it well against these threats. Overall, I believe Uber’s adaptability and robust market presence make it a key player in the evolving landscape of technology-driven services.

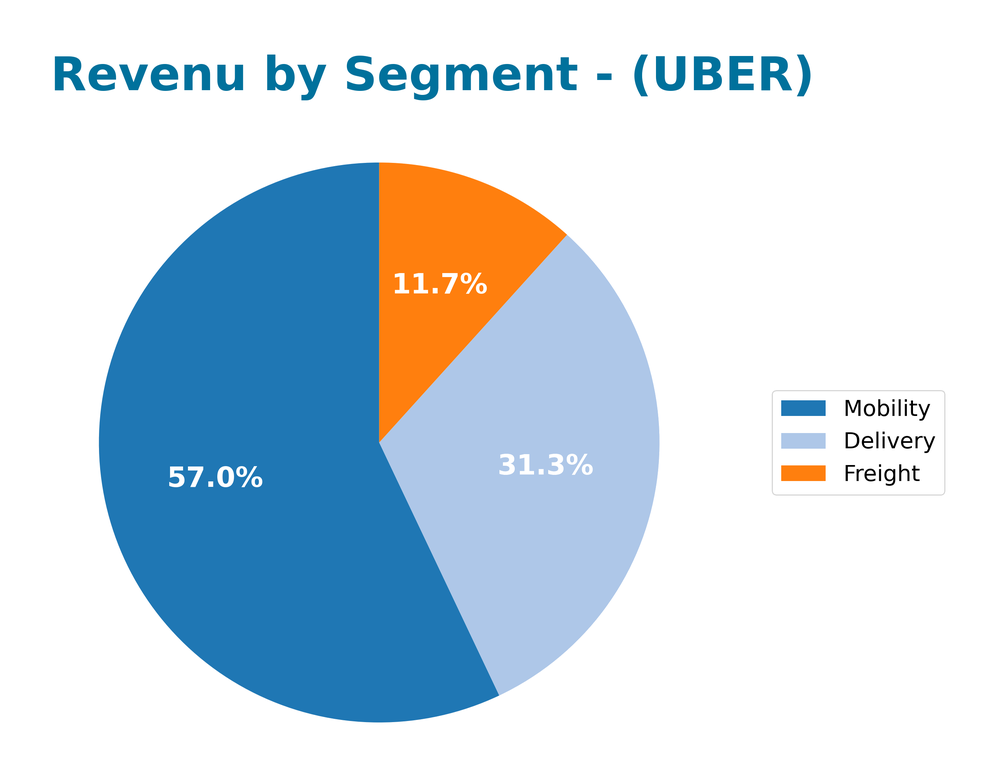

Revenue by Segment

The pie chart below illustrates Uber’s revenue distribution by segment for the fiscal year 2024, highlighting significant trends and shifts across its business lines.

In fiscal year 2024, Uber’s revenue segments show continued growth, with Mobility leading at $25.1B, followed by Delivery at $13.8B and Freight at $5.1B. Notably, the Delivery segment experienced a year-over-year growth of 12% from 2023, while Mobility’s growth accelerated to 27% compared to the previous year. This shift underscores the increasing demand for ride-sharing services. However, the Freight segment’s slight decline raises concerns about margin pressures and potential market saturation. Overall, while the company demonstrates robust growth, careful monitoring of segment performance is crucial for managing risks effectively.

Key Products

Uber Technologies, Inc. offers a diverse range of products that cater to various consumer needs. Below is a table summarizing their key offerings:

| Product | Description |

|---|---|

| Uber Rides | A ridesharing service connecting consumers with independent drivers for transportation in various vehicle types. |

| Uber Eats | A food delivery service that allows customers to order meals from local restaurants for home delivery or pickup. |

| Uber Freight | A logistics platform that connects shippers with carriers, providing transparent pricing and shipment booking services. |

| Uber Transit | A service that integrates public transportation options, allowing users to plan multi-modal journeys efficiently. |

| Uber Connect | A package delivery service enabling users to send items to friends or family within the same city. |

| Uber for Business | A platform designed for companies to manage employee transportation and delivery needs, streamlining travel logistics. |

These products reflect Uber’s strategy to diversify its offerings and maintain a competitive edge in the technology and transportation sectors.

Main Competitors

The competitive landscape for Uber Technologies, Inc. is characterized by several key players in the software and application sector. Below is a table of the main competitors, sorted by descending market capitalization:

| Company | Market Cap |

|---|---|

| Salesforce, Inc. | 249.1B |

| AppLovin Corporation | 233.9B |

| Applied Materials, Inc. | 213.5B |

| Shopify Inc. | 209.7B |

| Lam Research Corporation | 199.3B |

| Intuit Inc. | 187.5B |

| QUALCOMM Incorporated | 187.2B |

| ServiceNow, Inc. | 177.3B |

| Sony Group Corporation | 167.5B |

| Arista Networks, Inc. | 161.9B |

| Uber Technologies, Inc. | 189.7B |

The main competitors of Uber operate primarily in the North American market but have a global reach as well. Each company has its unique offerings and strengths, contributing to a dynamic competitive environment in the technology sector.

Competitive Advantages

Uber Technologies, Inc. possesses several competitive advantages that position it well for future growth. Its expansive technology platform integrates Mobility, Delivery, and Freight services, creating a robust ecosystem that enhances user experience. The company’s strong brand recognition and established user base of 31K employees provide a solid foundation for market expansion. Looking ahead, Uber’s focus on new product innovations, such as autonomous delivery systems and international market penetration, presents significant growth opportunities. As the demand for on-demand services continues to rise, Uber is well-equipped to capitalize on emerging trends.

SWOT Analysis

This SWOT analysis aims to evaluate Uber Technologies, Inc.’s strategic position by identifying its strengths, weaknesses, opportunities, and threats.

Strengths

- Strong brand recognition

- Diverse service offerings

- Global market presence

Weaknesses

- High operational costs

- Regulatory challenges

- Dependence on driver-partners

Opportunities

- Expansion into new markets

- Growth in delivery services

- Increased adoption of technology

Threats

- Intense competition

- Economic downturns

- Changing regulations

Overall, Uber’s strengths position it well for growth, but it must address its weaknesses while capitalizing on emerging opportunities to mitigate potential threats. Strategic focus on cost management and regulatory compliance will be crucial for sustained success.

Stock Analysis

Over the past year, Uber Technologies, Inc. (ticker: UBER) has experienced significant price movements, reflecting dynamic trading conditions that have shaped investor perspectives.

Trend Analysis

Analyzing UBER’s stock price over the past year, I observe a remarkable percentage change of +44.49%. This indicates a bullish trend, despite a recent downturn of -7.3% from September 21, 2025, to December 7, 2025. The highest price reached during this period was $98.51, while the lowest was $58.99. The trend shows signs of deceleration, with a standard deviation of 10.54, suggesting that while the stock has gained, the pace of increase is slowing down.

Volume Analysis

In the last three months, UBER’s total trading volume reached approximately 11.98B, with buyers accounting for 57.79% of this activity. However, the overall volume trend is decreasing. In the recent period, buyer volume was about 431.36M, compared to seller volume at 631.46M, indicating a slightly seller-dominant market with a buyer dominance percentage of 40.59%. This shift suggests that investor sentiment may be leaning towards caution, reflecting a potential hesitation in market participation.

Analyst Opinions

Recent analyst recommendations for Uber Technologies, Inc. (ticker: UBER) indicate a consensus rating of “Buy.” Analysts highlight a strong return on equity (score: 5) and return on assets (score: 5) as key strengths. However, the company faces challenges with its debt-to-equity ratio (score: 2) and discounted cash flow score (score: 1), which may impact future performance. Analysts such as those at Zacks Investment Research advocate for holding the stock, citing potential for growth despite current risks. Overall, the sentiment leans positively towards UBER in 2025.

Stock Grades

Uber Technologies, Inc. (UBER) has recently seen a shift in stock ratings, reflecting the evolving sentiment among analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Arete Research | Upgrade | Buy | 2025-12-03 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-05 |

| TD Cowen | Maintain | Buy | 2025-11-05 |

| Bernstein | Maintain | Outperform | 2025-11-05 |

| Truist Securities | Maintain | Buy | 2025-11-05 |

| Wells Fargo | Maintain | Overweight | 2025-11-05 |

| Guggenheim | Maintain | Buy | 2025-11-05 |

| DA Davidson | Maintain | Buy | 2025-11-05 |

| Barclays | Maintain | Overweight | 2025-11-05 |

| UBS | Maintain | Buy | 2025-11-05 |

Overall, the trend indicates a positive shift, with Arete Research upgrading its rating to “Buy,” while other firms maintain their favorable outlook on the stock, suggesting a strong confidence in Uber’s performance moving forward.

Target Prices

The current consensus among analysts for Uber Technologies, Inc. indicates a range of target prices.

| Target High | Target Low | Consensus |

|---|---|---|

| 140 | 106 | 116.06 |

Analysts expect Uber’s stock to have a consensus target price of approximately 116.06, with a potential high of 140 and a low of 106.

Consumer Opinions

Consumer sentiment towards Uber Technologies, Inc. reflects a mix of satisfaction and frustration, highlighting the company’s strong service offerings and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Uber’s app is user-friendly and efficient.” | “Surge pricing can be exorbitant at times.” |

| “Drivers are generally polite and professional.” | “I faced long wait times during peak hours.” |

| “Convenient options, especially for long trips.” | “Customer service response can be slow.” |

Overall, consumer feedback indicates that while users appreciate the app’s convenience and driver professionalism, they frequently express concerns about pricing strategies and customer service responsiveness.

Risk Analysis

In assessing Uber Technologies, Inc. (ticker: UBER), I’ve compiled a table of potential risks that could impact the company’s performance.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Regulatory | Increased scrutiny from regulators on gig economy | High | High |

| Competition | Growing competition from other ride-hailing services | Medium | High |

| Market Volatility | Fluctuations in consumer demand due to economic shifts | High | Medium |

| Technology | Cybersecurity threats compromising user data | Medium | High |

| Operational | Challenges in scaling operations internationally | Medium | Medium |

In summary, the most pressing risks for Uber include regulatory challenges and intense competition, both of which could significantly affect its market position and profitability.

Should You Buy Uber Technologies, Inc.?

Uber Technologies, Inc. (ticker: UBER) has demonstrated significant fluctuations in profitability, with a net income of 9.86B in 2024, but a projected EBITDA of -6.75B for 2025, indicating challenges in operational efficiency. The company’s WACC stands at 9.04%, while the return on invested capital (ROIC) is at 16.35%, suggesting value creation. However, with total debt of 11.44B and a debt-to-equity ratio of 0.053, Uber’s financial leverage remains manageable. Overall, the company currently holds a rating of B+, reflecting its potential for growth despite existing hurdles.

Favorable signals

I found several favorable signals for Uber Technologies, Inc. The company exhibits a strong revenue growth of 17.96% and a positive gross margin of 39.4%. Additionally, both the EBIT margin at 10.57% and net margin at 22.41% indicate healthy profitability. The impressive EPS growth of 424.14% further reflects robust performance. Financially, the ROIC of 16.35% exceeds the neutral WACC of 9.04%, suggesting value creation. Furthermore, the company maintains a favorable debt-to-assets ratio of 22.32% and solid interest coverage at 8.89.

Unfavorable signals

Despite the favorable signals, there are some unfavorable elements to consider. The price-to-book (PB) ratio stands at 5.86, indicating potential overvaluation. Additionally, the company does not offer any dividend yield, which may be a concern for income-focused investors. Lastly, recent seller volume has surpassed buyer volume, highlighting a trend of selling pressure in the market.

Conclusion

Considering the overall favorable income statement evaluation and the positive ratios, Uber might appear favorable for long-term investors. However, the negative recent trend and increased seller volume suggest waiting for buyers to return before making investment decisions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Uber Technologies, Inc. (UBER): A Bull Case Theory – Yahoo Finance (Dec 04, 2025)

- Uber Technologies, Inc. – Uber and Avride Launch Robotaxi Rides in Dallas – Uber Investor Relations (Dec 03, 2025)

- Here is What to Know Beyond Why Uber Technologies, Inc. (UBER) is a Trending Stock – Yahoo Finance (Dec 05, 2025)

- Uber – Britannica (Dec 03, 2025)

- Uber Technologies, Inc. $UBER Shares Acquired by M&T Bank Corp – MarketBeat (Dec 02, 2025)

For more information about Uber Technologies, Inc., please visit the official website: uber.com