Home > Analyses > Financial Services > U.S. Bancorp

U.S. Bancorp quietly powers the financial backbone for millions, shaping how communities and businesses access capital and manage wealth. As a leading regional bank, it excels in delivering a broad spectrum of services—from corporate lending to wealth management—backed by a robust network and innovative digital platforms. Renowned for its stability and customer-centric approach, the company stands at a crossroads: do its solid fundamentals and growth strategies still justify its current market valuation and future potential?

Table of contents

Business Model & Company Overview

U.S. Bancorp, founded in 1863 and headquartered in Minneapolis, Minnesota, is a leading regional bank with a vast network of 2,230 offices and 4,059 ATMs primarily across the Midwest and West. Its core mission revolves around delivering a cohesive financial ecosystem, encompassing Corporate and Commercial Banking, Consumer and Business Banking, Wealth Management, Investment Services, and Payment Services, serving individuals, businesses, and institutions.

The company’s revenue engine is diversified, balancing traditional lending and deposit products with recurring income from asset management, treasury, and capital markets services. U.S. Bancorp’s strategic footprint extends across the United States, leveraging digital platforms to support its extensive physical presence. This blend of comprehensive offerings and geographic reach builds a competitive advantage that solidifies its role in shaping the future of regional banking.

Financial Performance & Fundamental Metrics

In this section, I analyze U.S. Bancorp’s income statement, key financial ratios, and dividend payout policy to assess its investment appeal.

Income Statement

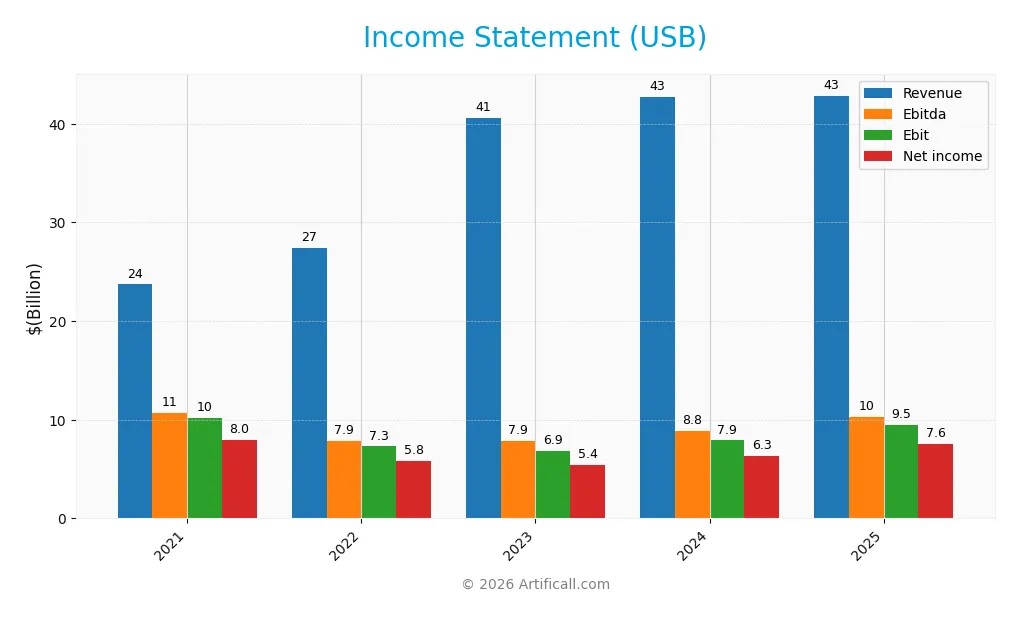

The following table presents U.S. Bancorp’s key income statement figures over the past five fiscal years, illustrating its revenue, expenses, profitability, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 23.7B | 27.4B | 40.6B | 42.7B | 42.9B |

| Cost of Revenue | -180M | 5.2B | 14.9B | 17.6B | 15.9B |

| Operating Expenses | 13.7B | 14.9B | 18.9B | 17.2B | 17.4B |

| Gross Profit | 23.9B | 22.2B | 25.7B | 25.1B | 26.9B |

| EBITDA | 10.7B | 7.9B | 7.9B | 8.8B | 10.3B |

| EBIT | 10.2B | 7.3B | 6.9B | 7.9B | 9.5B |

| Interest Expense | 993M | 3.2B | 12.6B | 15.4B | 14.3B |

| Net Income | 7.96B | 5.83B | 5.43B | 6.30B | 7.58B |

| EPS | 5.11 | 3.69 | 3.27 | 3.79 | 4.62 |

| Filing Date | 2022-02-22 | 2023-02-27 | 2024-02-20 | 2025-02-21 | 2026-01-20 |

Income Statement Evolution

U.S. Bancorp’s revenue grew significantly by 80.74% from 2021 to 2025, though growth slowed to 0.35% in the last year. Net income declined by 4.86% over the whole period, with a 19.85% rise in net margin in 2025, indicating improved profitability. Gross margin remained favorable at 62.83%, while net margin and EBIT margins were also strong, despite some margin compression overall.

Is the Income Statement Favorable?

In 2025, fundamentals appear generally favorable with a 22.2% EBIT margin and a 17.68% net margin, reflecting solid operational efficiency. Revenue growth was minimal at 0.35%, but EBIT and net income margins grew meaningfully year-over-year. Interest expense remains high at 33.41% of revenue, marking an unfavorable factor, yet overall income statement metrics suggest healthy profitability and a positive earnings per share trend.

Financial Ratios

The following table presents key financial ratios for U.S. Bancorp (USB) over the fiscal years 2021 to 2025, reflecting profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 34% | 21% | 13% | 15% | 18% |

| ROE | 14% | 11% | 10% | 11% | 12% |

| ROIC | 7% | 4% | 4% | 4% | 11% |

| P/E | 10.5 | 11.1 | 12.3 | 11.8 | 11.0 |

| P/B | 1.52 | 1.28 | 1.21 | 1.27 | 1.27 |

| Current Ratio | 0.37 | 0.24 | 0.26 | 0.28 | 2.73 |

| Quick Ratio | 0.37 | 0.24 | 0.26 | 0.28 | 2.73 |

| D/E | 0.80 | 1.40 | 1.21 | 1.26 | 1.20 |

| Debt-to-Assets | 7.7% | 10.1% | 10.6% | 10.8% | 11.3% |

| Interest Coverage | 10.2 | 2.3 | 0.54 | 0.51 | 0.66 |

| Asset Turnover | 0.041 | 0.041 | 0.061 | 0.063 | 0.062 |

| Fixed Asset Turnover | 7.18 | 7.10 | 11.2 | 12.0 | 11.4 |

| Dividend Yield | 3.5% | 4.7% | 5.0% | 4.6% | 3.8% |

Note: Ratios are rounded for clarity. Net Margin and Dividend Yield are expressed in percentages.

Evolution of Financial Ratios

Between 2021 and 2025, U.S. Bancorp’s Return on Equity (ROE) showed a gradual decline from 14.5% to 11.6%, indicating a slight slowdown in profitability growth. The Current Ratio improved markedly, rising from around 0.37 in 2021 to 2.73 in 2025, signaling enhanced short-term liquidity. Meanwhile, the Debt-to-Equity Ratio increased from 0.80 to 1.20, reflecting a higher reliance on debt financing over the period.

Are the Financial Ratios Favorable?

In 2025, U.S. Bancorp’s profitability metrics present a mixed picture: the net profit margin at 17.7% is favorable, while ROE at 11.6% is neutral and return on invested capital is unfavorable. Liquidity ratios such as the current and quick ratios stand at a strong 2.73, deemed favorable. Conversely, leverage indicators like the debt-to-equity ratio of 1.2 and interest coverage ratio of 0.66 are unfavorable. Market valuation metrics including price-to-earnings and price-to-book ratios are favorable, contributing to an overall favorable assessment with 57% of ratios positive.

Shareholder Return Policy

U.S. Bancorp maintains a consistent dividend payout with a payout ratio around 41-61% in recent years and a dividend per share rising to $2.02 in 2025, yielding approximately 3.8%. The company also engages in share buybacks, balancing distributions with free cash flow coverage to sustain payouts.

This policy reflects a moderate approach, supporting shareholder returns while managing risks of excessive repurchases or unsustainable dividends. The combination of dividends and buybacks appears aligned with preserving long-term value creation for investors.

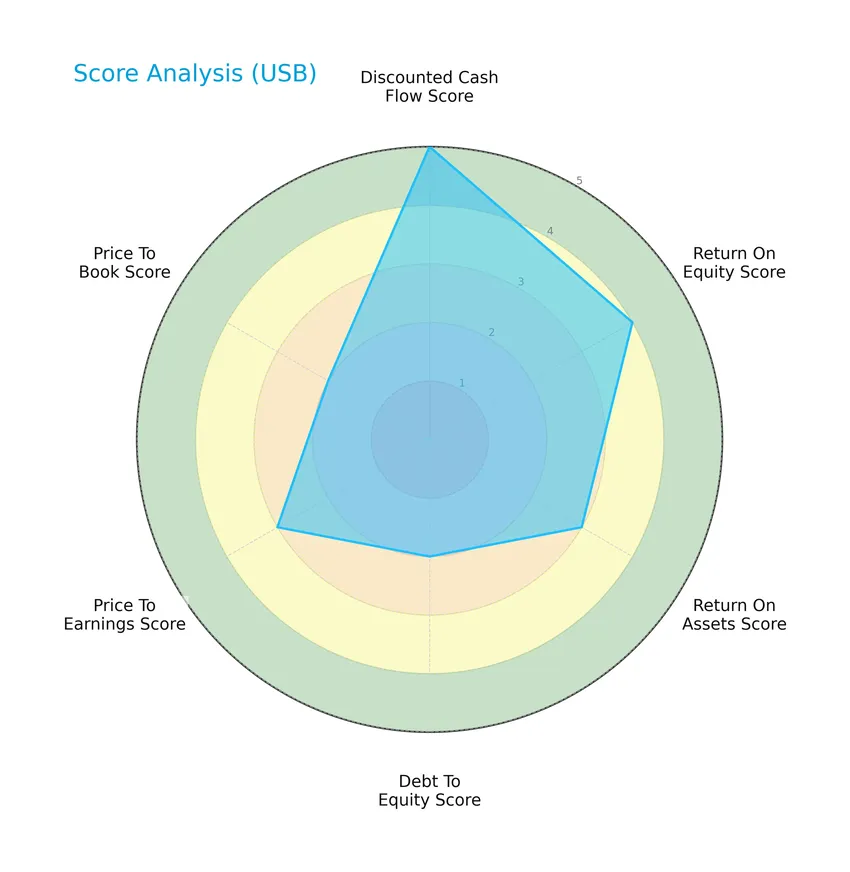

Score analysis

The following radar chart presents a comprehensive view of U.S. Bancorp’s key financial scores across valuation, profitability, and leverage metrics:

U.S. Bancorp shows a very favorable discounted cash flow score of 5, indicating strong intrinsic value. Return on equity is favorable at 4, while return on assets and price-to-earnings scores are moderate at 3. Debt-to-equity and price-to-book scores are moderate and somewhat lower at 2, reflecting cautious leverage and valuation metrics.

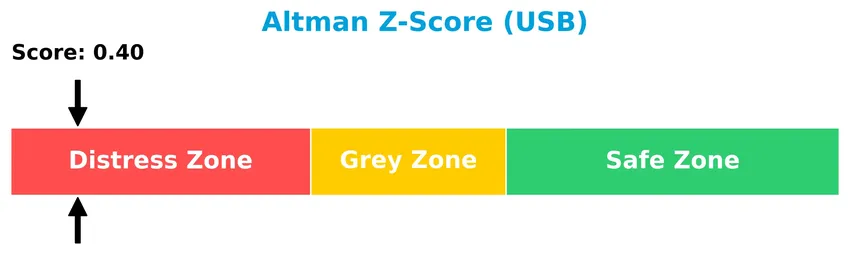

Analysis of the company’s bankruptcy risk

The Altman Z-Score places U.S. Bancorp in the distress zone, signaling a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

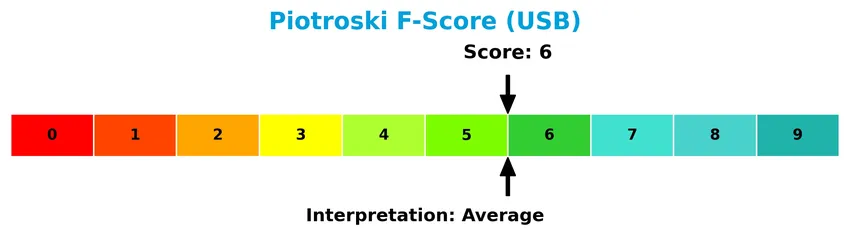

The Piotroski Score diagram illustrates U.S. Bancorp’s financial strength assessment based on nine criteria:

With a Piotroski Score of 6, U.S. Bancorp ranks in the average category, indicating moderate financial health but room for improvement in certain operational or profitability areas.

Competitive Landscape & Sector Positioning

This sector analysis examines U.S. Bancorp’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether U.S. Bancorp holds a competitive advantage over its regional banking peers.

Strategic Positioning

U.S. Bancorp maintains a diversified product portfolio across payment services, consumer and small business banking, and wealth management, generating over $32B combined revenue in 2024. Its geographic exposure is concentrated in the U.S., primarily in the Midwest and West regions, operating through 2,230 branches and 4,059 ATMs.

Revenue by Segment

The pie chart displays U.S. Bancorp’s revenue distribution by business segments for the fiscal year 2024, highlighting how each unit contributes to the overall income.

In 2024, Wealth Management and Investment Services led with $12.2B, showing strong growth and becoming the top revenue driver. Consumer and Small Business Banking and Payment Services were close, generating $9.3B and $9.2B respectively, indicating steady performance. Treasury and Corporate Support showed a loss of $1B, reflecting a notable setback. The trend suggests increasing concentration in wealth management alongside stable banking services, though risks persist in corporate support.

Key Products & Brands

The table below presents U.S. Bancorp’s primary products and services by segment:

| Product | Description |

|---|---|

| Payment Services | Includes merchant processing, corporate and purchasing card services, ATM processing, and payment-related solutions. |

| Consumer And Small Business Banking | Offers depository services like checking and savings accounts, lending products, credit cards, and lease financing. |

| Wealth Management And Investment Services | Provides asset management, fiduciary services, investment products, insurance, brokerage, and fund administration. |

| Treasury and Corporate Support | Comprises capital markets, treasury management, receivable lock-box collection, and corporate trust services. |

U.S. Bancorp’s key business lines span payment processing, retail and small business banking, wealth and investment management, and corporate treasury services, reflecting a diversified financial services portfolio.

Main Competitors

There are 9 competitors in total in the Banks – Regional industry; below are the top 9 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| U.S. Bancorp | 83.8B |

| The PNC Financial Services Group, Inc. | 82.9B |

| Truist Financial Corporation | 64.6B |

| Fifth Third Bancorp | 31.5B |

| M&T Bank Corporation | 31.4B |

| Huntington Bancshares Incorporated | 25.5B |

| Citizens Financial Group, Inc. | 25.5B |

| Regions Financial Corporation | 24.9B |

| KeyCorp | 22.9B |

U.S. Bancorp ranks 1st among its 9 competitors with a market cap 2.9% above the next largest player. It stands above both the average market cap of the top 10 competitors (43.7B) and the sector median (31.4B). The company maintains a clear lead, with a 3.98% market cap gap over the closest competitor below.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does USB have a competitive advantage?

U.S. Bancorp currently shows a slightly unfavorable competitive advantage, as it is shedding value with a negative spread between ROIC and WACC despite a growing ROIC trend. Its profitability metrics remain favorable, with a 22.2% EBIT margin and 17.68% net margin supporting operational strength.

Looking ahead, U.S. Bancorp’s diverse financial services and extensive branch and ATM network position it to leverage growth opportunities across corporate banking, wealth management, and digital channels. Continued improvement in returns on invested capital may enhance its competitive stance in regional banking markets.

SWOT Analysis

This SWOT analysis highlights U.S. Bancorp’s key strengths, weaknesses, opportunities, and threats to guide investment decisions.

Strengths

- strong gross margin at 62.83%

- favorable net margin of 17.68%

- stable dividend yield of 3.79%

Weaknesses

- high interest expense at 33.41%

- declining net income over 5 years

- Altman Z-Score in distress zone

Opportunities

- expanding wealth management and payment services

- digital banking growth potential

- favorable P/E ratio near 11

Threats

- rising interest rates increasing debt costs

- regulatory pressures on regional banks

- competition from fintech disruptors

Overall, U.S. Bancorp demonstrates solid profitability and dividend appeal but faces challenges with rising interest expenses and value destruction. Strategic focus on digital expansion and cost control is essential to mitigate risks and capitalize on growth opportunities.

Stock Price Action Analysis

The weekly stock chart for U.S. Bancorp (USB) displays price movements and volume trends over the most recent 12-week period:

Trend Analysis

Over the past 12 weeks, USB’s stock price increased by 33.92%, indicating a bullish trend with acceleration. The price ranged between a low of 36.83 and a high of 55.47, supported by a standard deviation of 4.23, reflecting moderate volatility during the period.

Volume Analysis

Trading volume over the last three months is increasing and strongly buyer-driven, with buyers accounting for 56.38% of total volume. In the recent 12-week span, buyer dominance rose to 75.64%, suggesting robust investor interest and heightened market participation favoring upward price momentum.

Target Prices

The consensus target prices for U.S. Bancorp indicate moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 65 | 50 | 58.13 |

Analysts expect the stock to trade between $50 and $65, with an average target around $58, reflecting cautious optimism in the near term.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to U.S. Bancorp (USB) performance and reputation.

Stock Grades

Here are the latest verified grades for U.S. Bancorp from established financial analysts as of early 2026:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Maintain | Buy | 2026-01-22 |

| DA Davidson | Maintain | Buy | 2026-01-21 |

| TD Cowen | Maintain | Buy | 2026-01-21 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2026-01-21 |

| RBC Capital | Maintain | Outperform | 2026-01-21 |

| Oppenheimer | Maintain | Outperform | 2026-01-21 |

| Truist Securities | Maintain | Hold | 2026-01-21 |

| Wolfe Research | Downgrade | Peer Perform | 2026-01-07 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Barclays | Maintain | Overweight | 2026-01-05 |

The grades show a predominantly positive sentiment with multiple firms maintaining Buy or Outperform ratings, while a few hold more neutral stances such as Hold or Market Perform. Wolfe Research’s downgrade to Peer Perform stands out as a cautionary note amid largely stable assessments.

Consumer Opinions

Consumer sentiment around U.S. Bancorp (USB) reflects a mix of appreciation for its service quality alongside concerns about fees and digital platform usability.

| Positive Reviews | Negative Reviews |

|---|---|

| Friendly and helpful customer service staff. | Mobile app occasionally crashes during peak hours. |

| Competitive interest rates on savings accounts. | Some fees are higher compared to competitors. |

| Convenient branch locations with extended hours. | Slow response times in resolving online issues. |

Overall, U.S. Bancorp is praised for its customer service and accessibility, but users often point out areas for improvement in digital experience and fee transparency.

Risk Analysis

Below is a summary table presenting key risks associated with U.S. Bancorp, highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Distress | Altman Z-Score of 0.40 places the company in the distress zone, signaling high bankruptcy risk. | High | High |

| Leverage Risk | Debt-to-equity ratio is unfavorable at 1.2, indicating higher financial leverage concerns. | Medium | Medium |

| Interest Coverage | Interest coverage ratio is low at 0.66, raising risk on ability to meet interest obligations. | Medium | High |

| Market Volatility | Beta of 1.09 suggests stock price volatility slightly above market average. | Medium | Medium |

| Operational Risk | Asset turnover is low (0.06), indicating inefficiencies in asset use which may affect profits. | Medium | Medium |

| Dividend Sustainability | Dividend yield at 3.79% is favorable but could be pressured by financial distress signals. | Medium | Medium |

The most pressing risk for U.S. Bancorp is its financial distress indication from the very low Altman Z-Score, signaling potential solvency issues despite a favorable net margin of 17.68%. Coupled with weak interest coverage and high leverage, investors should be cautious and monitor liquidity and debt management closely.

Should You Buy U.S. Bancorp?

U.S. Bancorp appears to offer moderate profitability with improving operational efficiency amid a slightly unfavorable moat marked by value destruction but rising returns. Despite a moderate leverage profile and a B+ rating suggesting a very favorable overall stance, risk indicators warrant cautious interpretation.

Strength & Efficiency Pillars

U.S. Bancorp exhibits solid profitability with a net margin of 17.68% and a favorable EBIT margin of 22.2%, underscoring efficient core operations. The company maintains a strong financial health profile, reflected in a robust current ratio of 2.73 and a Piotroski score of 6, indicating average but stable fundamentals. While the ROIC at 11.14% slightly trails the WACC of 11.64%, suggesting the company is currently shedding value, improving ROIC trends imply growing profitability potential. Altman Z-Score at 0.40 places it in the distress zone, cautioning on bankruptcy risk, though other metrics provide some balance.

Weaknesses and Drawbacks

Key concerns arise from leverage and coverage metrics: a debt-to-equity ratio of 1.2 and an interest coverage ratio of 0.66 highlight elevated financial risk and limited ability to service debt comfortably. Despite favorable P/E of 10.95 and P/B of 1.27 ratios indicating reasonable valuation, the Altman Z-Score signals distress, and asset turnover at 0.06 is notably low, reflecting inefficiency in asset utilization. Additionally, interest expense at 33.41% is unfavorable, potentially pressuring net income growth. These factors suggest short-term vulnerabilities despite stable revenue growth.

Our Verdict about U.S. Bancorp

The fundamental profile of U.S. Bancorp might appear cautiously favorable given its consistent profitability and improving ROIC trend. Coupled with a bullish overall stock trend and strong buyer dominance in recent months, the investment case could appeal to those with a tolerance for financial risk. However, the distressed Altman Z-Score and leverage concerns suggest a measured approach, implying that investors may want to monitor the company for signs of financial stabilization before committing fully.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- US Bancorp (USB) Gained Strong Buy from Raymond James Following BTIG Acquisition Announcement – Yahoo Finance (Jan 25, 2026)

- Envestnet Portfolio Solutions Inc. Reduces Stock Holdings in U.S. Bancorp $USB – MarketBeat (Jan 25, 2026)

- US Bancorp CEO warns of big hit to clients from Trump’s credit card cap – Reuters (Jan 20, 2026)

- U.S. Bancorp Expands Into Capital Markets With BTIG Deal And Valuation Upside – simplywall.st (Jan 25, 2026)

- U.S. Bancorp: A Solid Buy Case (NYSE:USB) – Seeking Alpha (Jan 20, 2026)

For more information about U.S. Bancorp, please visit the official website: usbank.com