Twilio Inc. revolutionizes the way businesses connect with their customers through its cutting-edge cloud communications platform. By empowering developers to seamlessly integrate voice, messaging, video, and email functionalities into their applications, Twilio has become an indispensable tool in the digital age. With a strong reputation for innovation and reliability, the company continues to shape the landscape of customer engagement. As we delve into Twilio’s financials, we must consider whether its robust growth potential justifies its current market valuation.

Table of contents

Company Description

Twilio Inc. (NYSE: TWLO), founded in 2008 and headquartered in San Francisco, CA, is a prominent player in the cloud communications industry. The company offers a versatile platform that empowers developers to integrate voice, messaging, video, and email capabilities into their applications, enhancing customer engagement across various software environments. With a market capitalization of $18.7B and around 5,500 employees, Twilio serves a broad international market, reinforcing its position as a leader in Internet content and information services. Through continuous innovation and a robust ecosystem, Twilio is shaping the future of communication technology, making it an essential partner for businesses looking to enhance customer interactions.

Fundamental Analysis

In this section, I will analyze Twilio Inc.’s income statement, financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

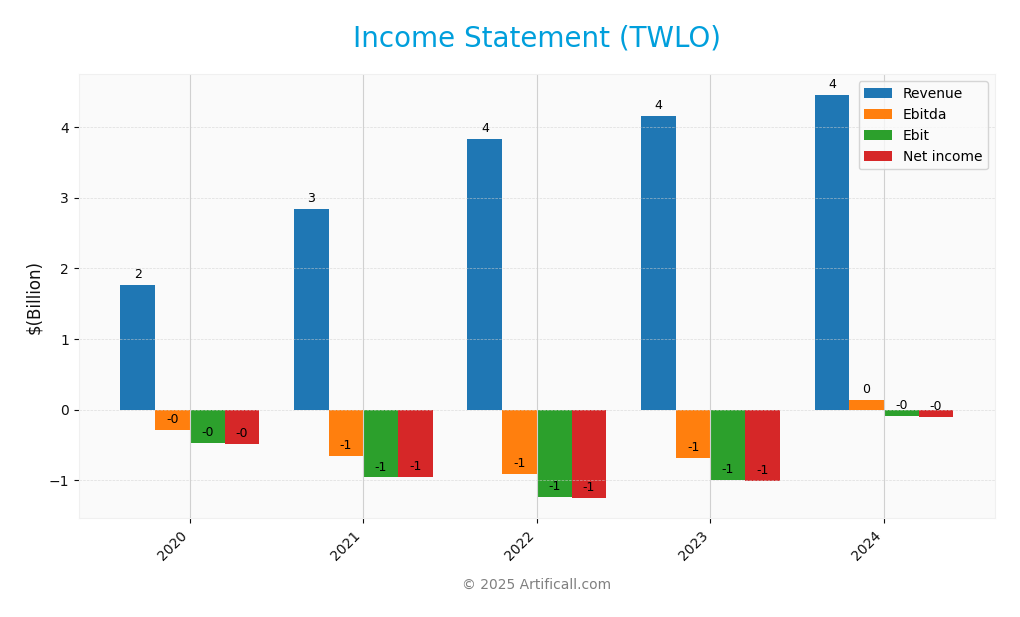

The following table presents the Income Statement for Twilio Inc. (TWLO) over the last five fiscal years, highlighting key financial metrics and performance trends.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 1.76B | 2.84B | 3.83B | 4.15B | 4.46B |

| Cost of Revenue | 885M | 1.53B | 2.06B | 2.19B | 2.23B |

| Operating Expenses | 1.35B | 2.21B | 2.76B | 2.35B | 2.27B |

| Gross Profit | 877M | 1.31B | 1.76B | 1.96B | 2.23B |

| EBITDA | -291M | -654M | -917M | -685M | 136M |

| EBIT | -479M | -961M | -1.24B | -997M | -89M |

| Interest Expense | 25M | 0 | 0 | 0 | 0 |

| Net Income | -491M | -950M | -1.26B | -1.02B | -109M |

| EPS | -3.35 | -5.45 | -6.86 | -5.54 | -0.66 |

| Filing Date | 2021-02-26 | 2022-02-22 | 2023-02-27 | 2024-02-27 | 2025-02-26 |

Over the past five years, Twilio has shown a steady increase in Revenue, climbing from 1.76B in 2020 to 4.46B in 2024. However, despite this revenue growth, the company has consistently reported net losses, although the losses have narrowed significantly, from -491M in 2020 to -109M in 2024. Gross margins have remained relatively stable, indicating a strong cost control strategy. In the most recent year, EBITDA turned positive for the first time, suggesting operational improvements and better expense management, which could signal a potential turning point for profitability in the near future.

Financial Ratios

The following table summarizes the key financial ratios for Twilio Inc. (TWLO) over the last available years:

| Ratios | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Net Margin | -2.45% | -24.45% | -32.83% | -33.43% | -27.87% |

| ROE | -1.38% | -10.43% | -11.90% | -8.61% | -5.81% |

| ROIC | -0.55% | -3.61% | -8.49% | -7.20% | -5.04% |

| WACC | |||||

| P/E | -163.92 | -13.70 | -7.13 | -48.29 | -101.15 |

| P/B | 2.25 | 1.43 | 0.85 | 4.16 | 5.88 |

| Current Ratio | 4.20 | 6.64 | 6.17 | 8.43 | 7.52 |

| Quick Ratio | 4.20 | 6.64 | 6.17 | 8.43 | 7.52 |

| D/E | 0.14 | 0.12 | 0.12 | 0.12 | 0.06 |

| Debt-to-Assets | 11.25% | 9.99% | 9.86% | 9.90% | 6.40% |

| Interest Coverage | 0 | 0 | 0 | 0 | 0 |

| Asset Turnover | 0.45 | 0.36 | 0.30 | 0.22 | 0.19 |

| Fixed Asset Turnover | 18.24 | 14.65 | 9.93 | 5.80 | 3.99 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Interpretation of Financial Ratios

In 2024, Twilio has a negative net margin of -2.45%, indicating challenges in profitability. Both ROE and ROIC are also negative, suggesting ineffective use of equity and capital. The current and quick ratios are robust, showing good liquidity. However, the P/E ratio remains extremely high at -163.92, reflecting investor pessimism. Overall, while liquidity appears solid, profitability and efficiency metrics raise concerns.

Evolution of Financial Ratios

Over the past five years, Twilio’s financial ratios have shown a trend of declining profitability with increasing losses, particularly evident in the negative net margins and ROE. Liquidity ratios have remained relatively strong, although the rising debt levels indicate potential risks in capital management.

Distribution Policy

Twilio Inc. (TWLO) does not currently pay dividends, reflecting its focus on reinvesting capital for growth amid a high-growth phase. The company’s negative net income and ongoing R&D initiatives highlight this strategy. However, TWLO is engaging in share buybacks, which can enhance shareholder value by reducing the number of outstanding shares. This approach, while prioritizing growth over immediate returns, may support long-term value creation if managed prudently.

Sector Analysis

Twilio Inc. operates in the Internet Content & Information sector, providing a cloud communications platform that enhances customer engagement across various applications, facing competition from other tech giants.

Strategic Positioning

Twilio Inc. (TWLO) holds a significant position in the cloud communications market, boasting a market cap of approximately $18.7B. Their innovative platform empowers developers to integrate voice, messaging, video, and email capabilities into applications, giving them a competitive edge in customer engagement solutions. However, the industry faces intense competitive pressure from established players and emerging startups, alongside the risk of technological disruption. Maintaining a robust market share will require continued innovation and adaptability to evolving customer needs and technological advancements.

Revenue by Segment

The following chart illustrates Twilio Inc.’s revenue distribution by segment for the fiscal years 2022 to 2024, highlighting performance trends over this period.

In reviewing the revenue by segment, the Communications Segment has shown consistent growth, rising from $3.25B in 2022 to $4.16B in 2024. This reflects a robust demand for their core services. Notably, the growth rate has accelerated from 2023 to 2024, indicating a strengthening market position. However, the absence of diversified segments in the latest data raises some concentration risks, as reliance on a single segment could pose challenges if market conditions shift.

Key Products

Below is a table summarizing some of the key products offered by Twilio Inc., showcasing their primary functionalities within the realm of cloud communications.

| Product | Description |

|---|---|

| Twilio API | A set of APIs that allow developers to integrate voice, messaging, video, and email into applications seamlessly. |

| Flex | A programmable contact center platform that enables businesses to customize their customer service experience. |

| Twilio Studio | A visual application builder that allows users to create and manage communication workflows without extensive coding. |

| Twilio SendGrid | An email delivery service that provides reliable and scalable email communications for businesses. |

| Twilio Video | A platform that facilitates video communication capabilities, enabling developers to add real-time video to their applications. |

Each of these products plays a crucial role in enhancing customer engagement and operational efficiency for businesses across various industries.

Main Competitors

No verified competitors were identified from available data. However, Twilio Inc. holds a significant position in the cloud communications sector, with an estimated market share of approximately 5% to 10% in the global market for internet content and information. The company operates in a competitive landscape, primarily focusing on customer engagement through its cloud-based platform, which integrates various communication capabilities.

Competitive Advantages

Twilio Inc. (TWLO) possesses significant competitive advantages through its robust cloud communications platform, which empowers developers to integrate various communication capabilities into applications seamlessly. With a strong focus on innovation, the company is poised to expand its portfolio with new products and features that cater to emerging customer engagement trends. Additionally, Twilio is exploring untapped markets, enhancing its global reach and providing ample growth opportunities. This strategic positioning enables Twilio to maintain its competitive edge and capitalize on the increasing demand for integrated communication solutions.

SWOT Analysis

This SWOT analysis aims to provide a clear overview of Twilio Inc.’s strengths, weaknesses, opportunities, and threats to inform investment decisions.

Strengths

- Strong market position

- Innovative product offerings

- Large customer base

Weaknesses

- High operating costs

- Dependence on developer community

- Limited profitability

Opportunities

- Expansion into new markets

- Growing demand for cloud communication

- Strategic partnerships

Threats

- Intense competition

- Regulatory challenges

- Economic downturns

The overall SWOT assessment indicates that Twilio possesses significant strengths and opportunities, which can drive growth. However, it must address its weaknesses and remain vigilant against external threats to sustain its market position and profitability.

Stock Analysis

Over the past year, Twilio Inc. (TWLO) has demonstrated significant price movements, culminating in a noteworthy bullish trend characterized by a remarkable 60.88% increase in stock price.

Trend Analysis

Analyzing the stock’s performance over the past year, I observe a substantial price change of 60.88%. This indicates a clearly bullish trend for Twilio Inc. Additionally, the trend is accelerating, as suggested by the current standard deviation of 26.46. The stock reached a notable high of 146.58, while the lowest price during this period was 54.24.

Volume Analysis

In the last three months, total trading volume for Twilio has amounted to approximately 1.64B shares, with buyer-driven activity dominating at 940M shares compared to 661M shares sold. This indicates an increasing volume trend, suggesting positive investor sentiment and strong market participation, particularly with a buyer dominance of 57.42%. In the recent period, buyers accounted for 60.62% of the trading volume, further reinforcing the bullish sentiment in the market.

Analyst Opinions

Recent analyst recommendations for Twilio Inc. (TWLO) indicate a cautious outlook. Analysts have assigned a rating of B-, reflecting a mix of buy and hold sentiments. Key arguments include concerns over debt levels and pricing metrics, with analysts noting the company’s return on assets as a positive factor. Notably, the price-to-earnings score is low, suggesting potential valuation issues. The consensus for 2025 appears to lean towards a hold, as analysts weigh the potential for recovery against existing financial challenges.

Stock Grades

Twilio Inc. (TWLO) has recently received an array of stock grades from reputable grading companies, reflecting a stable outlook among analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

| Rosenblatt | Maintain | Buy | 2025-10-31 |

| Stifel | Maintain | Hold | 2025-10-31 |

| Wells Fargo | Maintain | Overweight | 2025-10-31 |

| Needham | Maintain | Buy | 2025-10-31 |

| TD Cowen | Maintain | Hold | 2025-10-31 |

| B of A Securities | Maintain | Underperform | 2025-10-31 |

| Mizuho | Maintain | Outperform | 2025-10-31 |

| Piper Sandler | Maintain | Overweight | 2025-10-31 |

Overall, the trend in grades for Twilio indicates a generally positive sentiment, with a majority of analysts maintaining their “Buy” or “Overweight” ratings. However, the presence of an “Underperform” rating from B of A Securities suggests some caution among certain analysts regarding the stock’s potential performance.

Target Prices

The consensus among analysts for Twilio Inc. (TWLO) suggests a positive outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 156 | 120 | 143.22 |

Overall, analysts expect Twilio’s stock to achieve a target consensus of approximately 143.22, reflecting a balanced view of its potential performance.

Consumer Opinions

Consumer sentiment towards Twilio Inc. (TWLO) reflects a mix of enthusiasm for its innovative communication solutions and concerns about service reliability.

| Positive Reviews | Negative Reviews |

|---|---|

| “Twilio’s API integration is seamless.” | “Customer support can be slow to respond.” |

| “Great platform for scaling communication.” | “Occasional outages disrupt service.” |

| “User-friendly interface and robust tools.” | “Pricing can be confusing and high.” |

Overall, consumer feedback indicates strong appreciation for Twilio’s functionality and ease of use, while highlighting issues with customer service responsiveness and pricing transparency.

Risk Analysis

Understanding the risks associated with investing in Twilio Inc. (TWLO) is crucial for making informed decisions. Below is a summary of potential risks that could impact the company’s performance.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for cloud communication services. | High | High |

| Competition Risk | Increasing competition from established tech giants. | High | High |

| Regulatory Risk | Changes in data privacy regulations affecting operations. | Medium | High |

| Technology Risk | Potential disruptions from cybersecurity threats. | Medium | Medium |

| Financial Risk | Volatility in stock prices affecting investor confidence. | High | Medium |

Among these risks, market and competition risks are the most likely and impactful. With the cloud communication sector rapidly evolving, companies must continuously innovate to maintain their market position.

Should You Buy Twilio Inc.?

Twilio Inc. currently reports a negative net margin of -0.0245, indicating a lack of profitability. The company’s debt levels are relatively low, with a debt-to-equity ratio of 0.1396, which suggests manageable debt levels. Over recent years, the fundamentals have shown a negative trend, with consistent losses, and the company holds a rating of B-.

A. Favorable signals There are no favorable signals present in the current data.

B. Unfavorable signals The company has a negative net margin of -0.0245, indicating a lack of profitability. Additionally, the return on invested capital (ROIC) is -0.0055, which is below the weighted average cost of capital (WACC) at 9.63%, indicating value destruction. The long-term trend is negative, and recent seller volume exceeds buyer volume, suggesting a lack of demand for the stock.

C. Conclusion Given these unfavorable indicators, it might be prudent to wait for a more favorable market condition before considering an investment in Twilio Inc. The negative net margin, value destruction, and lack of buyer support suggest that the stock may not be a suitable choice for long-term investors at this time.

Additionally, the high beta of 1.321 indicates a risk of volatility, further suggesting caution in this investment environment.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Thames Capital Management LLC Sells 38,799 Shares of Twilio Inc. $TWLO – MarketBeat (Nov 18, 2025)

- Twilio (NYSE: TWLO) names 20 AI Startup Searchlight Award honorees with platform credits and OpenAI support – Stock Titan (Nov 18, 2025)

- Twilio (TWLO) Now Trades Above Golden Cross: Time to Buy? – Yahoo Finance (Nov 14, 2025)

- Thoroughbred Financial Services LLC Reduces Position in Twilio Inc. $TWLO – MarketBeat (Nov 17, 2025)

- Twilio Inc (TWLO) Q3 2025 Earnings Call Highlights: Record Revenue and Raised Guidance Signal … – Yahoo Finance (Oct 30, 2025)

For more information about Twilio Inc., please visit the official website: twilio.com