Home > Analyses > Financial Services > Truist Financial Corporation

Truist Financial Corporation shapes the financial landscape for millions across the Southeastern and Mid-Atlantic United States, influencing how individuals and businesses manage their assets and access credit. As a regional banking powerhouse, Truist commands a broad portfolio—from consumer banking and wealth management to corporate lending and insurance services—backed by a reputation for innovation and comprehensive market reach. As we explore its current fundamentals, the key question remains: does Truist’s robust presence still translate into compelling growth and valuation opportunities for investors in 2026?

Table of contents

Business Model & Company Overview

Truist Financial Corporation, founded in 1872 and headquartered in Charlotte, NC, stands as a dominant player in the regional banking sector. Its core mission centers on delivering a comprehensive ecosystem of banking, trust, and insurance services across the Southeastern and Mid-Atlantic United States. With 2,517 banking offices and a workforce of 37,529, Truist integrates consumer banking, wealth management, corporate banking, and insurance into a cohesive financial services platform.

The company’s revenue engine balances traditional deposit products and lending with a broad array of insurance, investment, and advisory services. Truist leverages its footprint in the Americas, complemented by strategic offerings in commercial finance and capital markets, to create diversified, recurring income streams. This multi-segment approach underpins a strong economic moat, positioning Truist to shape the future of regional financial services.

Financial Performance & Fundamental Metrics

This section provides an overview of Truist Financial Corporation’s income statement, key financial ratios, and dividend payout policy to aid investment decisions.

Income Statement

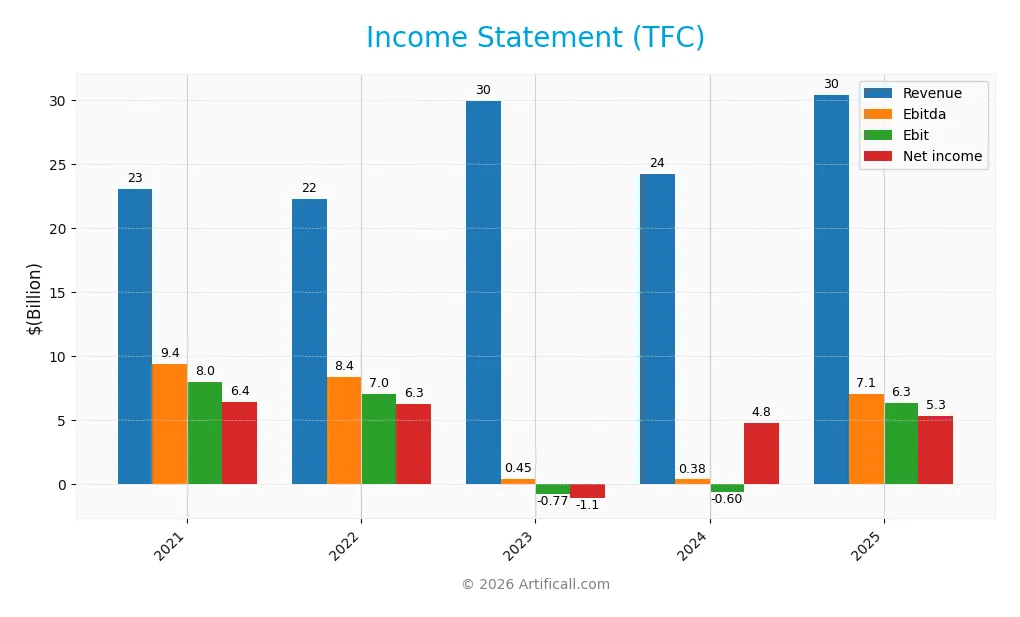

The table below presents Truist Financial Corporation’s key income statement figures for fiscal years 2021 through 2025, reflecting revenue, expenses, and earnings metrics in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 23.1B | 22.3B | 29.9B | 24.3B | 30.4B |

| Cost of Revenue | -45M | 3.1B | 12.0B | 12.8B | 11.5B |

| Operating Expenses | 15.1B | 12.2B | 18.7B | 12.0B | 12.6B |

| Gross Profit | 23.1B | 19.2B | 17.9B | 11.4B | 18.9B |

| EBITDA | 9.4B | 8.4B | 0.5B | 0.4B | 7.1B |

| EBIT | 8.0B | 7.0B | -0.8B | -0.6B | 6.3B |

| Interest Expense | 768M | 2.3B | 9.9B | 11.0B | 10.1B |

| Net Income | 6.4B | 6.3B | -1.1B | 4.8B | 5.3B |

| EPS | 4.51 | 4.46 | -1.09 | 3.36 | 3.86 |

| Filing Date | 2022-02-23 | 2023-02-28 | 2024-02-27 | 2025-02-25 | 2026-01-21 |

Income Statement Evolution

Truist Financial Corporation’s revenue showed a favorable overall growth of 31.97% from 2021 to 2025, with a strong 25.5% increase in the latest year. Gross profit growth was notably higher at 66% in the last year, reflecting improved efficiency. Despite this, net income declined by 17.59% over the entire period, and net margins diminished by 37.56%, indicating some margin compression despite revenue gains.

Is the Income Statement Favorable?

In 2025, Truist reported a net income of $5.31B with a net margin of 17.44%, considered favorable. EBITDA and EBIT margins also improved, with EBIT margin at 20.86%. However, interest expense remains a significant cost at 33.24% of income, which is unfavorable. Overall, the fundamentals appear favorable due to strong revenue and profit growth, though margin pressures and interest expenses warrant attention.

Financial Ratios

The table below presents key financial ratios for Truist Financial Corporation (TFC) over the last five fiscal years, providing an overview of profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 28% | 28.1% | -3.6% | 19.9% | 17.4% |

| ROE | 9.3% | 10.3% | -1.8% | 7.6% | 8.1% |

| ROIC | 5.2% | 4.1% | -0.5% | -0.03% | 3.6% |

| P/E | 12.2 | 9.1 | -45.1 | 12.0 | 11.8 |

| P/B | 1.13 | 0.94 | 0.83 | 0.91 | 0.96 |

| Current Ratio | 0.44 | 0.24 | 0.26 | 0.14 | 0.87 |

| Quick Ratio | 0.44 | 0.24 | 0.26 | 0.14 | 0.87 |

| D/E | 0.59 | 1.08 | 1.05 | 0.98 | 1.07 |

| Debt-to-Assets | 7.6% | 11.7% | 11.6% | 11.7% | 12.7% |

| Interest Coverage | 10.4 | 3.0 | -0.08 | -0.05 | 0.63 |

| Asset Turnover | 0.043 | 0.040 | 0.056 | 0.046 | 0.056 |

| Fixed Asset Turnover | 3.31 | 3.24 | 4.99 | 4.34 | 9.60 |

| Dividend Yield | 3.6% | 5.2% | 6.4% | 5.4% | 4.2% |

Evolution of Financial Ratios

From 2021 to 2025, Truist Financial Corporation’s Return on Equity (ROE) showed a generally declining trend, falling from 9.3% in 2021 to 8.1% in 2025, indicating reduced profitability. The Current Ratio remained below 1 throughout, reflecting persistent liquidity constraints, though improving slightly to 0.87 in 2025. The Debt-to-Equity Ratio increased from 0.59 in 2021 to 1.07 in 2025, signaling higher leverage. Profitability margins experienced volatility but showed recovery with a net margin of 17.4% in 2025.

Are the Financial Ratios Favorable?

In 2025, Truist exhibits a favorable net profit margin (17.44%), price-to-earnings ratio (11.75), price-to-book ratio (0.96), and dividend yield (4.23%). However, ROE (8.14%), return on invested capital (3.61%), current ratio (0.87), debt-to-equity ratio (1.07), interest coverage (0.63), and asset turnover (0.06) are unfavorable, indicating challenges in profitability, liquidity, leverage, and operational efficiency. The quick ratio is neutral. Overall, the financial ratios present a balanced view with equal proportions of favorable and unfavorable indicators, resulting in a neutral assessment.

Shareholder Return Policy

Truist Financial Corporation consistently pays dividends with a payout ratio near 50%, offering a stable dividend per share around $2.08 to $2.35 and an annual yield of approximately 4.2% to 6.3%. The dividend payouts appear covered by earnings, though free cash flow coverage data is limited.

The company does not report share buyback programs in the provided data. The steady dividend approach, supported by solid net profit margins and reasonable payout levels, suggests a policy aimed at sustainable long-term shareholder value without reliance on excessive repurchases.

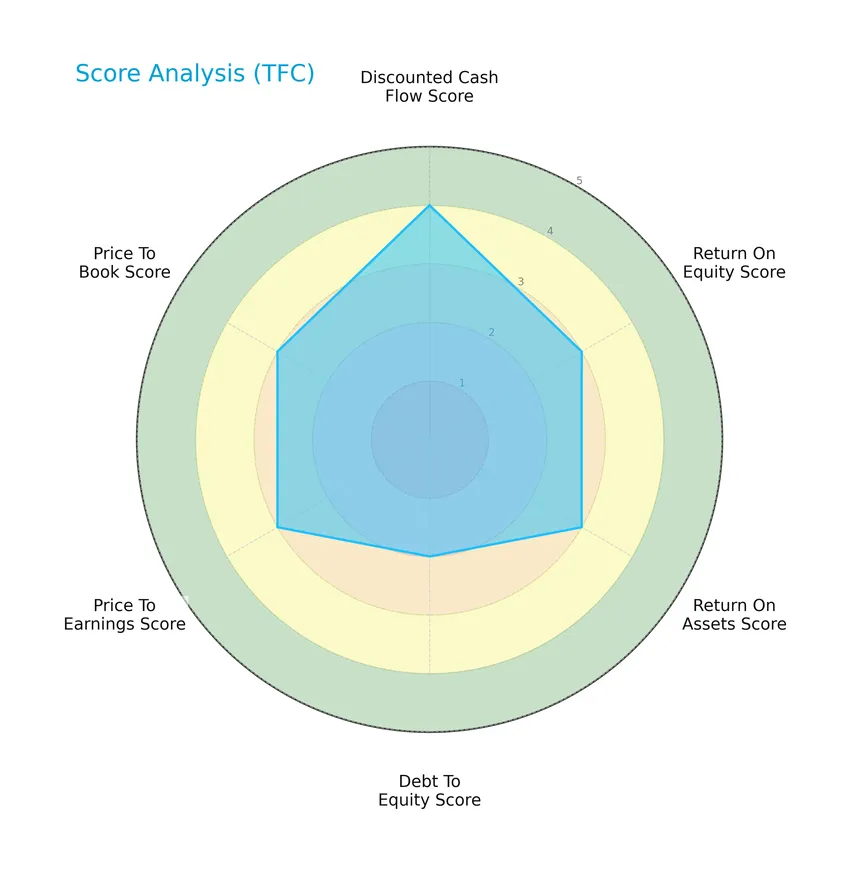

Score analysis

The following radar chart presents an overview of Truist Financial Corporation’s key financial scores for investor evaluation:

Truist Financial shows a favorable discounted cash flow score of 4, while return on equity, return on assets, price-to-earnings, and price-to-book scores hold moderate values of 3. The debt-to-equity score is slightly lower at 2, indicating moderate leverage concerns.

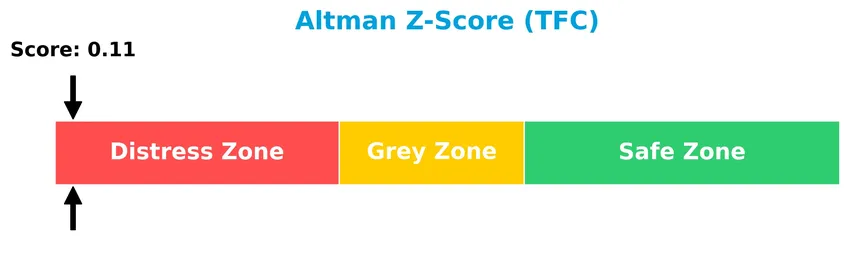

Analysis of the company’s bankruptcy risk

Truist Financial Corporation’s Altman Z-Score places it in the distress zone, indicating a high risk of financial distress and potential bankruptcy:

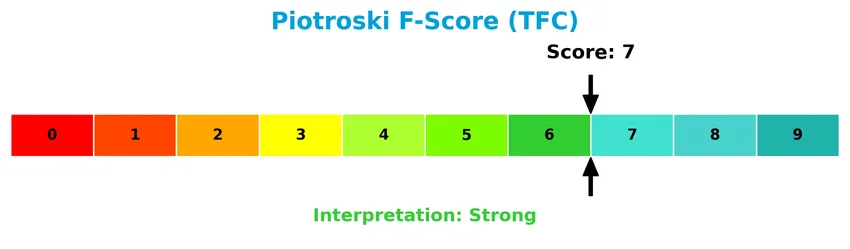

Is the company in good financial health?

The Piotroski Score diagram provides insight into Truist Financial’s financial strength based on nine key criteria:

With a Piotroski Score of 7, Truist Financial is classified as financially strong, reflecting solid profitability, liquidity, and operational efficiency metrics.

Competitive Landscape & Sector Positioning

This section examines Truist Financial Corporation’s strategic positioning, revenue segments, key products, and main competitors within the regional banking sector. I will assess whether Truist holds a competitive advantage over its peers based on these factors.

Strategic Positioning

Truist Financial Corporation focuses on regional banking primarily in the Southeastern and Mid-Atlantic US, with a diversified product portfolio spanning consumer banking, corporate banking, insurance, wealth management, and various lending services. Its operations are concentrated domestically, supported by 2,517 branches and a workforce of 37.5K employees.

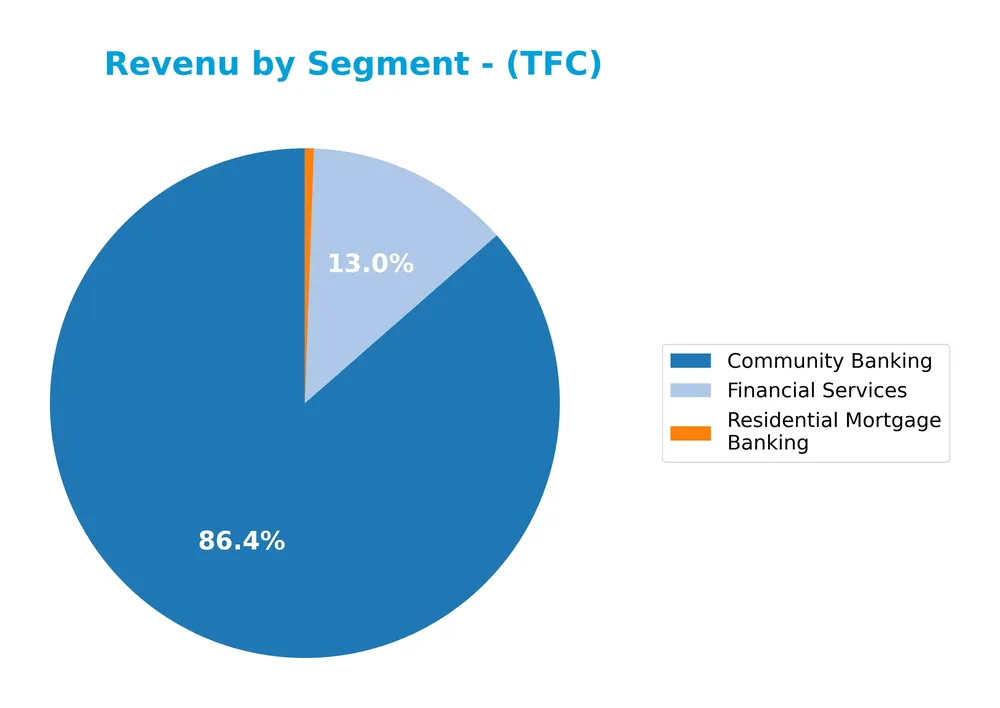

Revenue by Segment

This pie chart illustrates Truist Financial Corporation’s revenue distribution by segment for the fiscal year 2016, highlighting the main contributors to the company’s income.

In 2016, Community Banking was the dominant revenue segment with 153M USD, followed by Financial Services at 23M USD and a minimal contribution from Residential Mortgage Banking at 1M USD. Other segments like Dealer Financial Services and Insurance Services showed no revenue, and Other, Treasury & Corporate recorded a significant negative value, indicating costs or losses. The data reflects a concentration in Community Banking, with limited diversification and some financial pressure from non-operating segments.

Key Products & Brands

The table below presents Truist Financial Corporation’s main products and services across its business segments:

| Product | Description |

|---|---|

| Consumer Banking and Wealth | Includes deposit products such as noninterest-bearing checking, interest-bearing checking, savings, money market accounts, CDs, and IRAs. Also covers mobile/online banking, payment services, and wealth management/private banking. |

| Corporate and Commercial Banking | Encompasses commercial deposit and treasury services, small business lending, commercial middle market lending, mortgage warehouse lending, government finance, leasing, and supply chain financing. |

| Insurance Holdings | Offers property and casualty, life, health, employee benefits, workers compensation, professional liability, surety coverage, title, and other insurance products. |

| Financial Services | Provides funding, asset management, automobile lending, bankcard lending, consumer finance, home equity and mortgage lending, investment brokerage, and investment advisory services. |

| Other Treasury & Corporate | Involves association, capital market, institutional trust, insurance premium and commercial finance, international banking, private equity investment, commercial mortgage lending, retail and wholesale brokerage, securities underwriting. |

Truist Financial Corporation operates a broad suite of banking, lending, insurance, and financial services, serving both consumer and corporate clients primarily in the Southeastern and Mid-Atlantic U.S. Its diversified offerings span everyday banking to complex corporate finance solutions.

Main Competitors

There are 9 competitors in the sector, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| U.S. Bancorp | 83.8B |

| The PNC Financial Services Group, Inc. | 82.9B |

| Truist Financial Corporation | 64.6B |

| Fifth Third Bancorp | 31.5B |

| M&T Bank Corporation | 31.4B |

| Huntington Bancshares Incorporated | 25.5B |

| Citizens Financial Group, Inc. | 25.5B |

| Regions Financial Corporation | 24.9B |

| KeyCorp | 22.9B |

Truist Financial Corporation holds the 3rd position among its peers, with a market cap at 75.64% of the leader U.S. Bancorp. It stands above both the average market cap of the top 10 (43.7B) and the sector median (31.4B). The company maintains a 30.77% market cap advantage over its closest competitor above, highlighting a solid competitive position.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does TFC have a competitive advantage?

Truist Financial Corporation currently does not present a competitive advantage, as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction and declining profitability. The company’s ROIC trend over the 2021-2025 period is negative, reflecting a very unfavorable economic moat.

Looking forward, Truist operates across multiple financial segments including consumer banking, corporate banking, and insurance, with a broad product offering and geographic presence in the Southeastern and Mid-Atlantic US. Potential future opportunities may arise from expanding services such as mobile banking, wealth management, and commercial lending to capture evolving market demands.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors influencing Truist Financial Corporation’s strategic positioning and investment potential.

Strengths

- strong revenue growth 25.5% YoY

- favorable gross margin 62.21%

- solid dividend yield 4.23%

Weaknesses

- declining net margin over period

- unfavorable interest expense ratio 33.24%

- low ROIC 3.61% below WACC

Opportunities

- expansion in regional banking markets

- digital and mobile banking growth

- cross-selling insurance and wealth management

Threats

- rising interest expenses pressure profits

- intense regional banking competition

- financial distress risk (Altman Z-score in distress zone)

Truist’s strengths in revenue growth and profitability are tempered by rising costs and weakening returns on capital, signaling caution. The company’s strategy should focus on improving operational efficiency and managing interest expenses while leveraging digital banking and service diversification to capture growth opportunities and mitigate competitive and financial risks.

Stock Price Action Analysis

The weekly stock chart for Truist Financial Corporation (TFC) over the past 12 months shows notable price movements and trend developments:

Trend Analysis

Over the past 12 months, TFC’s stock price increased by 40.58%, indicating a bullish trend with acceleration. The highest price reached 50.62 and the lowest was 34.79. The standard deviation of 4.01 suggests moderate volatility during this period.

Volume Analysis

In the last three months, trading volume for TFC shows a decreasing trend, with buyer volume at 339M and seller volume at 129M, reflecting a strongly buyer-dominant market at 72.4%. This suggests sustained positive investor sentiment despite the lower overall volume.

Target Prices

The consensus target prices for Truist Financial Corporation (TFC) indicate a moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 58 | 50 | 54.38 |

Analysts expect TFC’s stock price to range between $50 and $58, with an average target near $54.4, reflecting cautious optimism in its future performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section presents an analysis of Truist Financial Corporation’s grades and feedback from both analysts and consumers.

Stock Grades

Here is the latest overview of Truist Financial Corporation’s stock ratings from leading grading firms as of early 2026:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Maintain | Buy | 2026-01-23 |

| TD Cowen | Maintain | Buy | 2026-01-22 |

| Piper Sandler | Maintain | Neutral | 2026-01-22 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Raymond James | Maintain | Outperform | 2026-01-07 |

| Evercore ISI Group | Upgrade | Outperform | 2026-01-06 |

| Barclays | Downgrade | Underweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-31 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-17 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2025-12-17 |

Most recent grades generally favor a buy or outperform stance, with Evercore ISI upgrading to Outperform and Barclays as a notable exception downgrading to Underweight. The consensus remains a Buy, reflecting moderate confidence among analysts.

Consumer Opinions

Consumer sentiment about Truist Financial Corporation (TFC) reflects a mix of satisfaction with customer service and concerns about digital platform usability.

| Positive Reviews | Negative Reviews |

|---|---|

| Friendly and knowledgeable staff make banking easy | Mobile app is sometimes slow and glitches occur |

| Competitive loan rates and clear explanations | Long wait times for customer support calls |

| Convenient branch locations with extended hours | Occasionally unclear fee structures |

| Helpful financial advice tailored to personal needs | Limited options for international wire transfers |

Overall, Truist receives praise for its customer service and competitive rates, but users frequently note issues with digital tools and customer support responsiveness as areas for improvement.

Risk Analysis

Below is a summary table highlighting key risks for Truist Financial Corporation (TFC), focusing on likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score indicates distress zone, signaling bankruptcy risk. | High | High |

| Profitability | ROE and ROIC remain unfavorable, limiting growth and returns. | Medium | Medium |

| Liquidity | Current ratio below 1 indicates potential short-term liquidity issues. | Medium | Medium |

| Debt Management | Debt-to-equity ratio is unfavorable, increasing financial leverage. | Medium | High |

| Market Volatility | Beta below 1 suggests lower volatility, but market downturns still risk. | Medium | Medium |

| Dividend Stability | Dividend yield favorable, but earnings pressure may affect payouts. | Medium | Medium |

The most critical risk is Truist’s financial distress warning from its low Altman Z-Score, indicating a significant bankruptcy risk. Despite a strong Piotroski score, weaknesses in return on equity and liquidity highlight caution for investors considering TFC.

Should You Buy Truist Financial Corporation?

Truist Financial Corporation appears to be navigating a challenging profile with moderate profitability and a very unfavorable moat marked by declining returns and value erosion. Despite a substantial leverage profile, its overall B+ rating suggests cautious value creation potential.

Strength & Efficiency Pillars

Truist Financial Corporation exhibits solid profitability with a favorable net margin of 17.44%, supported by a gross margin of 62.21% and an EBIT margin of 20.86%. The Piotroski score of 7 signals strong financial health, reflecting effective management of profitability, leverage, and liquidity. While the ROE stands at a modest 8.14% and the ROIC at 3.61%, both fall below the WACC of 9.16%, indicating the company is currently not a value creator. Nonetheless, the firm’s low debt-to-assets ratio of 12.75% and a dividend yield of 4.23% underscore financial resilience and shareholder value distribution.

Weaknesses and Drawbacks

Several financial stress signals present caution for investors. The Altman Z-Score of 0.11 places Truist in the distress zone, suggesting a high bankruptcy risk. Leverage metrics reflect vulnerabilities, with a debt-to-equity ratio of 1.07 and a weak interest coverage ratio of 0.63, pointing to potential challenges in meeting interest obligations. The current ratio of 0.87 also flags liquidity concerns. Additionally, the company’s ROIC underperforming WACC by over 5 percentage points signals value destruction. Despite a reasonable P/E of 11.75 and P/B of 0.96, the unfavorable net margin growth and declining EPS over the longer term add to the investment risk profile.

Our Verdict about Truist Financial Corporation

Truist Financial Corporation presents an unfavorable long-term fundamental profile due to financial distress signals and value erosion. However, the bullish overall stock trend and strong buyer dominance in the recent period might suggest market confidence. Despite this, the persistent weaknesses in profitability and liquidity metrics mean that the company may appear risky for immediate investment and could warrant a cautious, wait-and-see stance for a more opportune entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Jennison Associates LLC Increases Stock Position in Truist Financial Corporation $TFC – MarketBeat (Jan 24, 2026)

- Truist Financial Corp (TFC) Q4 2025 Earnings Call Highlights: Strong Net Income and Strategic … – Yahoo Finance (Jan 21, 2026)

- Truist Financial 2025 Earnings: Why The $10B Buyback Makes Me Skeptic (NYSE:TFC) – Seeking Alpha (Jan 22, 2026)

- TFC Q4 earnings beat despite Y/Y rise in expenses, stock dips – MSN (Jan 25, 2026)

- Truist announces new Head of Structured Credit – PR Newswire (Jan 15, 2026)

For more information about Truist Financial Corporation, please visit the official website: truist.com