Home > Analyses > Technology > Trimble Inc.

Trimble Inc. revolutionizes how professionals and field workers execute complex projects worldwide. Its advanced hardware and software solutions transform construction, agriculture, transportation, and geospatial industries. Known for cutting-edge innovation and precision, Trimble integrates 3D design, autonomous systems, and data analytics to boost efficiency and accuracy. As competition intensifies, I question whether Trimble’s strong market position and technology moat still justify its current valuation and growth outlook.

Table of contents

Business Model & Company Overview

Trimble Inc., founded in 1978 and headquartered in Westminster, CA, leads in technology solutions that empower professionals and field workers globally. Its ecosystem integrates software and hardware across construction, geospatial, agriculture, and transportation, forming a core business that streamlines complex workflows from design to asset management.

The company’s revenue engine balances precision hardware with recurring software and data services spanning the Americas, Europe, and Asia. Trimble’s broad portfolio includes 3D modeling, autonomous agriculture systems, and fleet management, creating a sticky customer base. This integrated approach constitutes a formidable competitive advantage that shapes industry standards and protects its market position.

Financial Performance & Fundamental Metrics

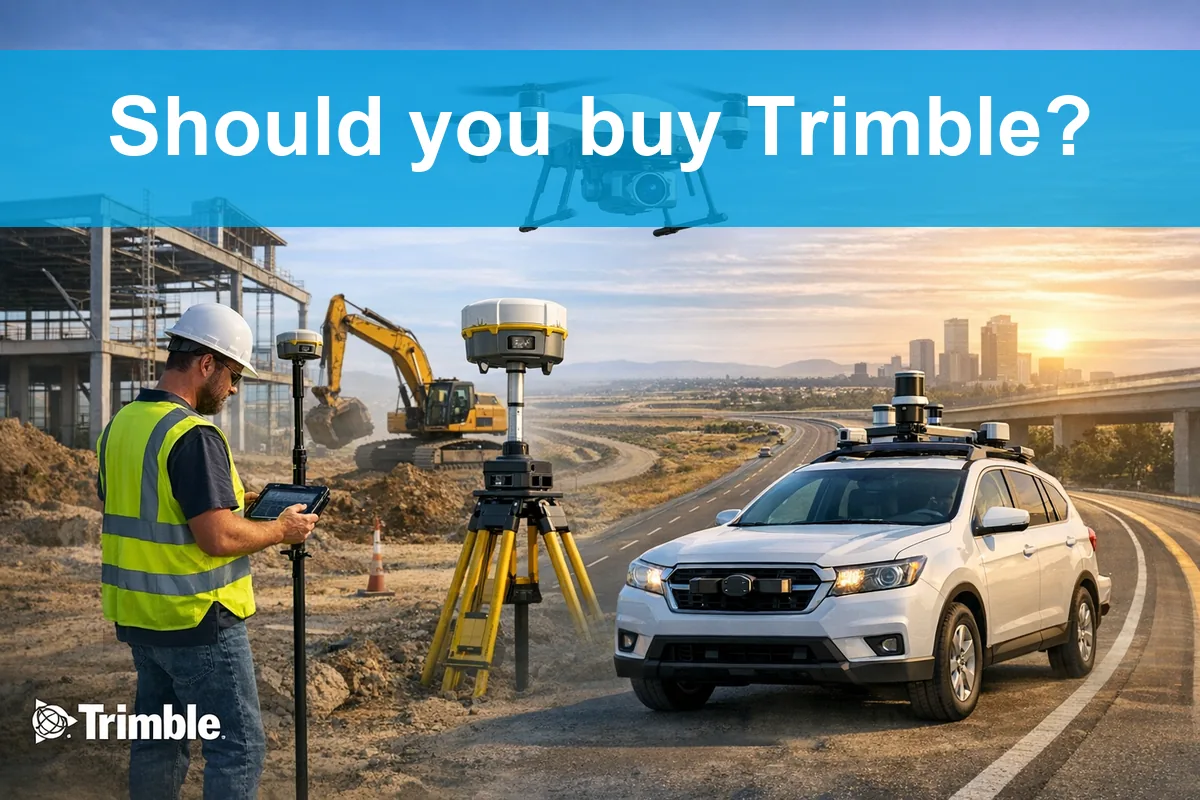

I analyze Trimble Inc.’s income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder return strategy.

Income Statement

The following table summarizes Trimble Inc.’s key income statement figures for fiscal years 2021 through 2025, reported in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 3.66B | 3.68B | 3.80B | 3.68B | 3.59B |

| Cost of Revenue | 1.62B | 1.57B | 1.47B | 1.29B | 1.14B |

| Operating Expenses | 1.47B | 1.59B | 1.88B | 1.94B | 1.84B |

| Gross Profit | 2.03B | 2.11B | 2.33B | 2.40B | 2.45B |

| EBITDA | 820M | 747M | 769M | 2.33B | 789M |

| EBIT | 640M | 576M | 518M | 2.10B | 610M |

| Interest Expense | 65M | 71M | 161M | 91M | 74M |

| Net Income | 493M | 450M | 311M | 1.50B | 424M |

| EPS | 1.96 | 1.81 | 1.26 | 6.13 | 1.77 |

| Filing Date | 2022-02-23 | 2023-02-17 | 2024-02-26 | 2025-04-25 | 2026-02-10 |

Income Statement Evolution

Trimble’s revenue declined slightly by 2.6% in the past year, continuing a mild downward trend over 2021-2025. Gross profit edged up 2.3%, supporting a stable gross margin near 68%. However, EBIT and net income margins weakened significantly, reflecting pressure on operating efficiency and profitability despite steady top-line figures.

Is the Income Statement Favorable?

In 2025, Trimble reported a net margin of 11.8% and an EBIT margin of 17%, both favorable compared to sector norms. Interest expense remained low at 2.1% of revenue, supporting operational leverage. Yet, the sharp declines in EBIT and net income growth over one year and the overall period indicate underlying challenges. The overall income statement assessment is unfavorable, cautioning on profitability sustainability.

Financial Ratios

The following table presents key financial ratios for Trimble Inc. from 2021 to 2025 to facilitate year-over-year performance comparison:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 13% | 12% | 8% | 41% | 12% |

| ROE | 12% | 11% | 7% | 26% | 7% |

| ROIC | 8% | 7% | 5% | 4% | 6% |

| P/E | 44.5 | 28.0 | 42.4 | 11.5 | 43.9 |

| P/B | 5.56 | 3.10 | 2.93 | 3.02 | 3.19 |

| Current Ratio | 1.22 | 1.04 | 1.00 | 1.27 | 1.09 |

| Quick Ratio | 0.91 | 0.76 | 0.87 | 1.16 | 0.96 |

| D/E | 0.36 | 0.40 | 0.71 | 0.26 | 0.24 |

| Debt-to-Assets | 20% | 22% | 33% | 16% | 15% |

| Interest Coverage | 8.58 | 7.19 | 2.79 | 5.08 | 8.17 |

| Asset Turnover | 0.52 | 0.51 | 0.40 | 0.39 | 0.39 |

| Fixed Asset Turnover | 9.78 | 10.81 | 11.63 | 11.81 | 19.62 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

All ratios are rounded to two decimals or nearest percentage for clarity.

Evolution of Financial Ratios

Trimble’s Return on Equity (ROE) declined from 26.18% in 2024 to 7.27% in 2025, signaling a slowdown in profitability. The Current Ratio dropped from 1.27 to 1.09, indicating slightly reduced liquidity. Debt-to-Equity fell significantly to 0.24, reflecting a more conservative leverage stance. Profitability margins fluctuated but remained mostly stable.

Are the Financial Ratios Fovorable?

In 2025, profitability is mixed: net margin is favorable at 11.82%, but ROE and WACC indicate challenges. Liquidity ratios hover near neutral, with a Current Ratio of 1.09 and Quick Ratio of 0.96. Leverage metrics, including Debt-to-Equity (0.24) and interest coverage (8.19), are positive. Asset turnover is weak at 0.39, and valuation multiples suggest overpricing. Overall, ratios appear slightly unfavorable.

Shareholder Return Policy

Trimble Inc. does not pay dividends, reflecting a reinvestment strategy likely focused on growth and R&D. The company’s free cash flow supports potential share buybacks, although no specific buyback program details are provided.

This approach aligns with long-term shareholder value creation if capital allocation sustains profitable growth. Absence of dividends signals prioritization of internal investments over immediate cash returns, which may suit investors seeking capital appreciation.

Score analysis

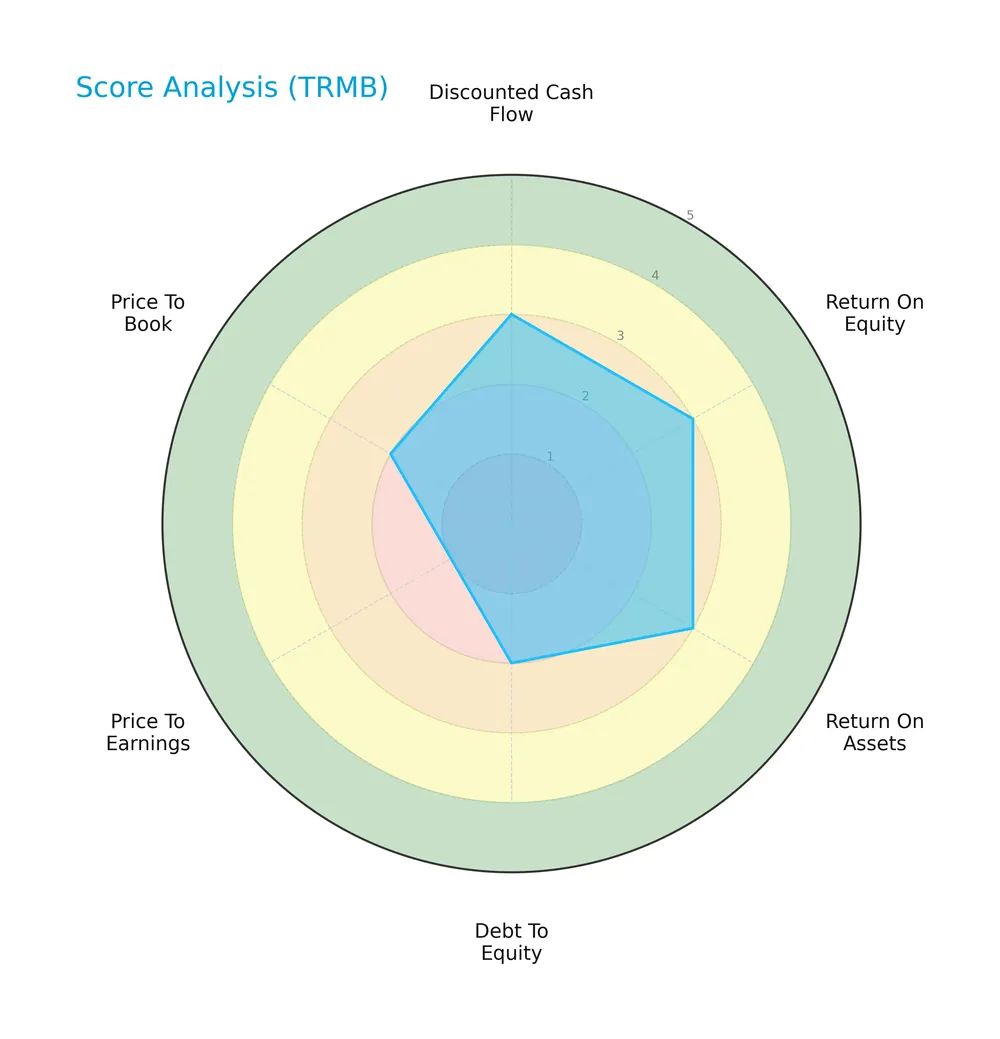

The following radar chart illustrates Trimble Inc.’s key financial scores across valuation, profitability, and leverage metrics:

Trimble shows moderate scores in discounted cash flow, ROE, and ROA at 3 each. Debt-to-equity and price-to-book scores are unfavorable at 2, while price-to-earnings is very unfavorable at 1, indicating valuation concerns.

Analysis of the company’s bankruptcy risk

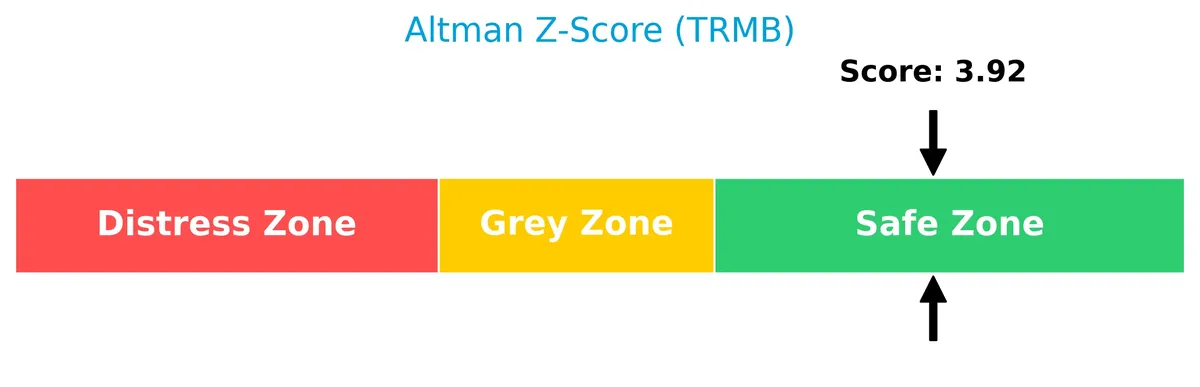

Trimble’s Altman Z-Score places it in the safe zone, reflecting a low risk of bankruptcy and solid financial stability:

Is the company in good financial health?

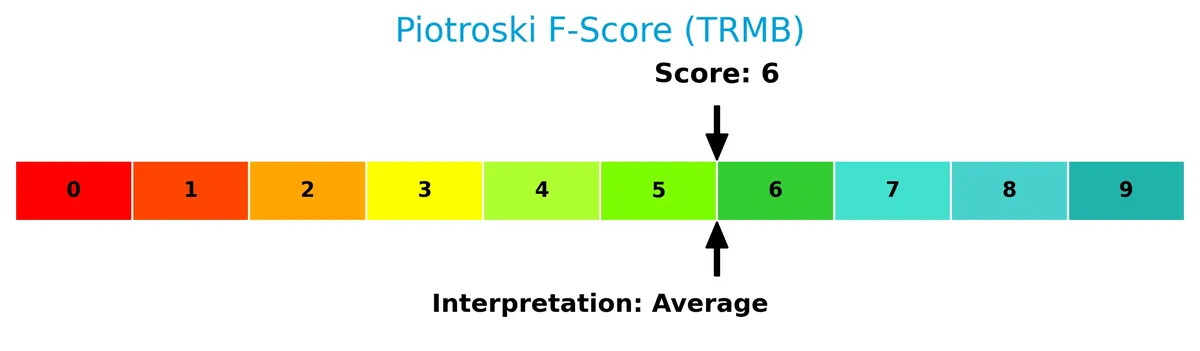

The Piotroski Score diagram highlights Trimble’s average financial health status based on profitability, leverage, and operational efficiency:

With a Piotroski score of 6, Trimble demonstrates moderate financial strength, suggesting reasonable but not exceptional operational and balance sheet quality.

Competitive Landscape & Sector Positioning

This sector analysis explores Trimble Inc.’s strategic positioning, revenue streams, key products, and main competitors. I will assess whether Trimble holds a competitive advantage within its industry.

Strategic Positioning

Trimble Inc. maintains a diversified product portfolio across Buildings and Infrastructure, Geospatial, Resources and Utilities, and Transportation segments. Geographically, it generates the majority of revenue from North America, followed by Europe and Asia Pacific, reflecting broad international exposure.

Revenue by Segment

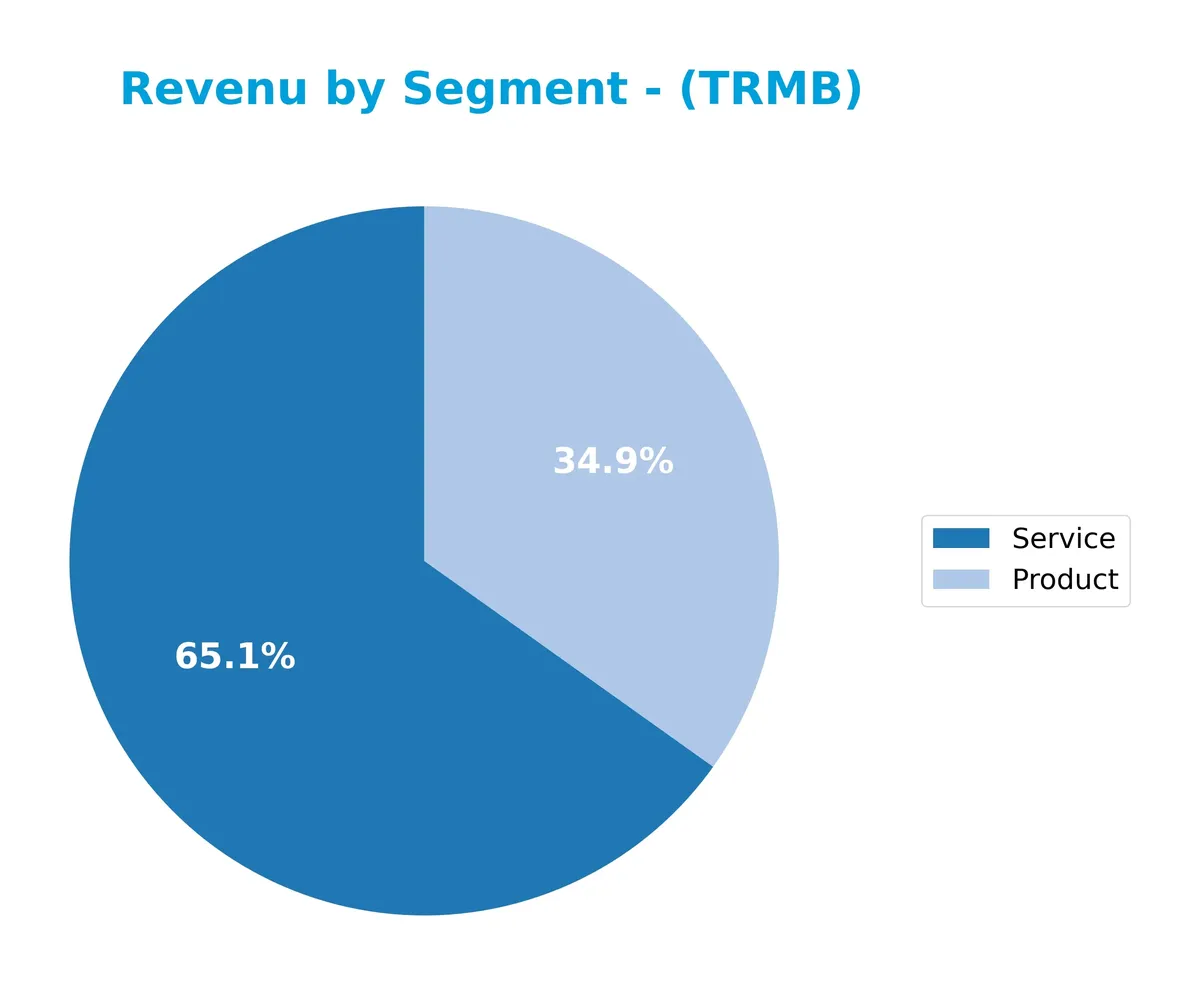

The pie chart depicts Trimble Inc.’s revenue breakdown by product and service segments for the fiscal year 2024, highlighting the company’s core business drivers.

In 2024, Services dominate with $2.4B, nearly doubling Product revenue at $1.3B. This marks a shift from prior years where Product revenues were higher. The increasing service concentration suggests a strategic pivot toward recurring revenue, enhancing stability but also concentrating risk. Investors should monitor this evolution closely as service margins and growth dynamics differ from product sales.

Key Products & Brands

Trimble Inc.’s main products and brands cover technology solutions across several industry sectors:

| Product | Description |

|---|---|

| Buildings and Infrastructure | Software and systems for construction design, equipment control, project management, and BIM. |

| Geospatial | Surveying products and geographic information systems. |

| Resources and Utilities | Precision agriculture technologies, including guidance, autonomous steering, and ag software. |

| Transportation | Fleet management, route optimization, safety, compliance, and supply chain communication tools. |

Trimble excels in integrating hardware and software across construction, agriculture, geospatial, and transportation sectors. This diversified portfolio supports professionals and field workers globally.

Main Competitors

Trimble Inc. faces competition from 20 companies in its sector; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amphenol Corporation | 171B |

| Corning Incorporated | 77.7B |

| TE Connectivity Ltd. | 68.6B |

| Sandisk Corporation | 40B |

| Garmin Ltd. | 38.9B |

| Keysight Technologies, Inc. | 35.5B |

| Celestica Inc. | 34B |

| Coherent, Inc. | 28.7B |

| Jabil Inc. | 25.7B |

| Teledyne Technologies Incorporated | 24.4B |

Trimble ranks 12th among 20 competitors, with a market cap just 9.6% the size of leader Amphenol Corporation. It stands below both the average market cap of the top 10 (54.4B) and the sector median (21.6B). Trimble is positioned 14.6% below its nearest competitor above, highlighting a moderate gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does TRMB have a competitive advantage?

Trimble Inc. does not present a competitive advantage, as its return on invested capital (ROIC) falls below its weighted average cost of capital (WACC) by 4.13%. The company’s ROIC has declined by over 20% in recent years, indicating sustained value destruction and decreasing profitability.

Looking ahead, Trimble targets growth through diversified technology solutions across construction, geospatial, agriculture, and transportation markets. Its broad portfolio includes software and hardware innovations designed to improve operational efficiency for professionals and field workers worldwide.

SWOT Analysis

This analysis highlights Trimble Inc.’s key internal and external factors shaping its strategic position.

Strengths

- strong gross margin at 68%

- favorable net margin near 12%

- diversified technology solutions across sectors

Weaknesses

- declining revenue growth over 5 years

- ROIC below WACC indicating value destruction

- high P/E and P/B ratios signaling overvaluation

Opportunities

- expanding precision agriculture and autonomous tech markets

- growing demand for integrated construction software

- potential geographic revenue growth outside North America

Threats

- intense competition in tech hardware and software

- economic sensitivity impacting infrastructure spending

- technological obsolescence risk

Trimble’s strengths in profitability and product diversity contrast with its concerning declining growth and value destruction. The company must leverage emerging tech opportunities while managing competitive and economic risks carefully.

Stock Price Action Analysis

The weekly stock chart below illustrates Trimble Inc.’s price movements over the past 12 months, highlighting key highs, lows, and trend shifts:

Trend Analysis

Over the past 12 months, TRMB’s stock price rose 7.29%, indicating a bullish trend with deceleration in momentum. The price ranged from a low of 50.86 to a high of 85.24, showing substantial volatility with a standard deviation of 9.66%. However, in the recent 2.5 months, the stock declined 15.4%, reflecting a short-term bearish trend with a moderate negative slope of -1.57.

Volume Analysis

In the last three months, trading volume has increased but shifted toward seller dominance, with sellers accounting for 63.68% of activity. This shift suggests growing selling pressure and cautious investor sentiment despite overall rising volume trends across the year.

Target Prices

Analysts set a consensus target price reflecting moderate upside potential for Trimble Inc.

| Target Low | Target High | Consensus |

|---|---|---|

| 94 | 102 | 98.2 |

The target range indicates steady confidence in Trimble’s growth prospects, with a consensus near $98 signaling measured optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback related to Trimble Inc. (TRMB) to assess market sentiment.

Stock Grades

Here are recent verified analyst grades for Trimble Inc. showing consensus and trends across reputable firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| Keybanc | Upgrade | Overweight | 2025-12-16 |

| Piper Sandler | Maintain | Overweight | 2025-11-07 |

| JP Morgan | Maintain | Overweight | 2025-09-19 |

| Oppenheimer | Maintain | Outperform | 2025-08-07 |

| Raymond James | Maintain | Outperform | 2025-08-07 |

| JP Morgan | Maintain | Overweight | 2025-08-07 |

| Oppenheimer | Maintain | Outperform | 2025-07-17 |

| JP Morgan | Maintain | Overweight | 2025-07-10 |

| JP Morgan | Maintain | Overweight | 2025-05-14 |

The grades consistently favor overweight or outperform ratings, indicating broad analyst confidence. Recent upgrades and stable maintenance of positive views suggest sustained optimism about Trimble’s market position.

Consumer Opinions

Consumers express a mix of admiration and frustration toward Trimble Inc., reflecting its complex market position.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative tech that improves field accuracy.” | “Customer service response times need improvement.” |

| “Reliable hardware for surveying tasks.” | “Software updates sometimes introduce bugs.” |

| “Strong integration with GIS platforms.” | “Pricing feels steep for small businesses.” |

Overall, users praise Trimble’s technological innovation and product reliability. However, recurring complaints about customer support and pricing suggest areas needing strategic attention.

Risk Analysis

Below is a summary table of key risks facing Trimble Inc. based on recent financial data and market conditions:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | High P/E (43.87) and P/B (3.19) ratios suggest overvaluation. | Medium | High |

| Profitability Risk | ROE (7.27%) below WACC (10.61%) signals weak return on equity. | High | Medium |

| Liquidity Risk | Current ratio (1.09) and quick ratio (0.96) near caution levels. | Medium | Medium |

| Market Volatility | Beta 1.576 indicates higher sensitivity to market swings. | High | Medium |

| Debt Management | Favorable debt ratios but Piotroski score (6) shows moderate risk. | Low | Low |

| Dividend Absence | No dividend yield reduces income attractiveness. | High | Low |

The most pressing risks are Trimble’s stretched valuation and weak ROE compared to its cost of capital, signaling potential earnings pressure. Its beta above 1.5 exposes shares to amplified market volatility, a concern in uncertain economic cycles. While liquidity is adequate, it warrants monitoring given tight margins.

Should You Buy Trimble Inc.?

Trimble Inc. appears to be a company with declining operational efficiency and a deteriorating competitive moat, as it is shedding value with decreasing ROIC. Despite a manageable leverage profile and a safe-zone Altman Z-score, the overall B- rating suggests moderate risks and cautious value creation.

Strength & Efficiency Pillars

Trimble Inc. maintains solid operational margins, boasting a gross margin of 68.32% and a net margin of 11.82%, reflecting operational efficiency. The company’s EBIT margin stands at a healthy 16.99%, illustrating effective cost control. However, its return on invested capital (6.48%) lags behind its weighted average cost of capital (10.61%), indicating that Trimble is currently not a value creator. While profitability is moderate, the firm’s low debt-to-equity ratio (0.24) supports financial flexibility.

Weaknesses and Drawbacks

Trimble faces valuation headwinds with a high price-to-earnings ratio of 43.87 and a price-to-book ratio of 3.19, signaling an expensive market premium. The company’s return on equity is weak at 7.27%, and asset turnover is low at 0.39, hinting at underutilized assets. Although the current ratio is neutral at 1.09, the recent seller-dominant trading behavior (36.32% buyer dominance) and a 15.4% price decline since late 2025 highlight short-term market pressures that could weigh on near-term performance.

Our Final Verdict about Trimble Inc.

Trimble’s financial profile is moderate but not compelling, given its inability to generate returns above its cost of capital and expensive valuation multiples. Despite a bullish long-term trend, recent seller dominance suggests caution. The stock might appear suitable for investors with a longer horizon but could warrant a wait-and-see approach for a more favorable entry point given current market dynamics and operational challenges.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Here’s What Key Metrics Tell Us About Trimble (TRMB) Q4 Earnings – Yahoo Finance (Feb 10, 2026)

- Trimble Inc (TRMB) Q4 2025 Earnings Call Highlights: Strong Revenue Growth and Strategic … By GuruFocus – Investing.com Canada (Feb 10, 2026)

- Trimble Inc. Reports Fourth Quarter and Full Year 2025 Results – TradingView (Feb 10, 2026)

- Earnings Flash (TRMB) Trimble Inc. Reports Q4 Revenue $969.8M, vs. FactSet Est of $950.0M – marketscreener.com (Feb 10, 2026)

- Trimble (TRMB) Forecasts 2026 Revenue and Earnings – GuruFocus (Feb 10, 2026)

For more information about Trimble Inc., please visit the official website: trimble.com