Home > Analyses > Consumer Cyclical > Tractor Supply Company

Tractor Supply Company powers rural America’s daily rhythms, supplying essential goods for farming, ranching, and outdoor living. It commands the specialty retail sector with over 2,000 stores and a diverse portfolio of trusted brands. Known for its strong community connection and consistent innovation, Tractor Supply blends tradition with modern retailing. As market dynamics evolve, I question whether its solid fundamentals can sustain growth and justify its current valuation in 2026.

Table of contents

Business Model & Company Overview

Tractor Supply Company, founded in 1938 and headquartered in Brentwood, Tennessee, stands as a leading rural lifestyle retailer in the U.S. Its ecosystem includes over 2,000 stores and a wide range of products supporting equine, livestock, pet care, hardware, and outdoor work needs. This extensive footprint, combined with trusted brand names, creates a cohesive mission to serve recreational farmers and rural communities with essential goods.

The company’s revenue engine balances retail sales from Tractor Supply and Petsense stores with growing e-commerce platforms. Its product mix spans seasonal items, workwear, and agricultural maintenance tools, tapping into diverse rural markets across 49 states. This multi-channel approach, supplemented by proprietary brands, fortifies its competitive advantage and builds a durable economic moat in specialty retail.

Financial Performance & Fundamental Metrics

I analyze Tractor Supply Company’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value creation.

Income Statement

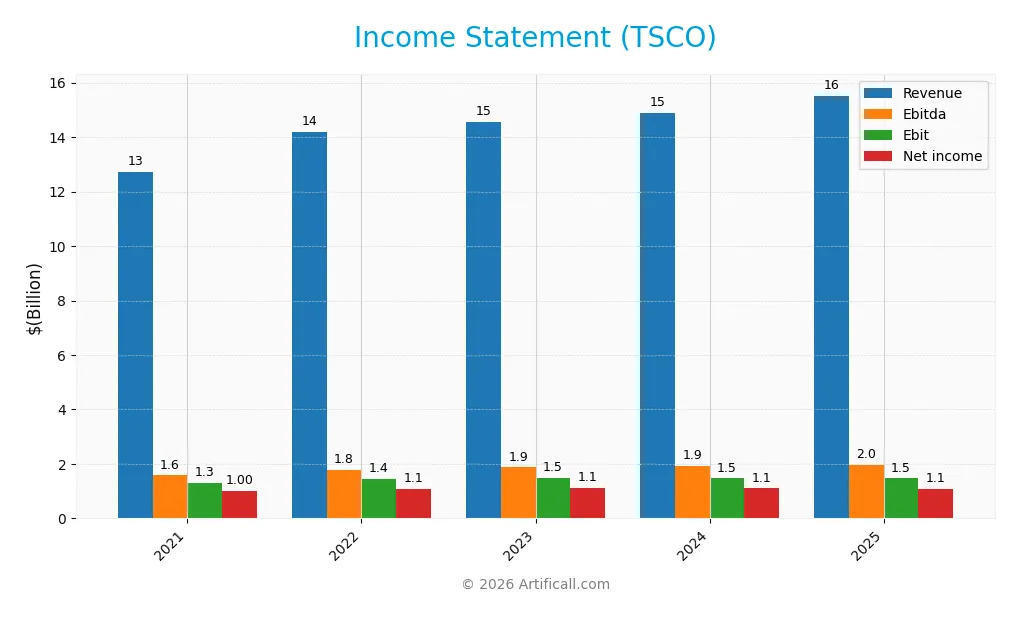

The table below summarizes Tractor Supply Company’s key income statement metrics for fiscal years 2021 through 2025, illustrating revenue growth and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 12.7B | 14.2B | 14.6B | 14.9B | 15.5B |

| Cost of Revenue | 8.3B | 9.2B | 9.3B | 9.5B | 10.4B |

| Operating Expenses | 3.2B | 3.5B | 3.7B | 3.9B | 3.7B |

| Gross Profit | 4.5B | 5.0B | 5.2B | 5.4B | 5.2B |

| EBITDA | 1.6B | 1.8B | 1.9B | 1.9B | 2.0B |

| EBIT | 1.3B | 1.4B | 1.5B | 1.5B | 1.5B |

| Interest Expense | 27M | 31M | 47M | 55M | 69M |

| Net Income | 997M | 1.1B | 1.1B | 1.1B | 1.1B |

| EPS | 1.74 | 1.96 | 2.03 | 2.05 | 2.07 |

| Filing Date | 2022-02-17 | 2023-02-23 | 2024-02-23 | 2025-02-20 | 2026-01-29 |

Income Statement Evolution

From 2021 to 2025, Tractor Supply Company’s revenue grew 22% overall, reaching $15.5B in 2025. Net income increased nearly 10% over this period, though net margin declined by almost 10%. Gross profit slipped slightly in the past year, impacting margins. Operating expenses rose in line with revenue, keeping EBIT margins stable near 9.5%.

Is the Income Statement Favorable?

In 2025, fundamentals remain broadly favorable despite some margin pressure. The gross margin at 33.2% and net margin at 7.1% signal solid profitability. EBIT margin is neutral at 9.5%, reflecting stable core operations. Interest expense is low, supporting earnings quality. However, recent declines in gross profit and net margin growth warrant cautious monitoring.

Financial Ratios

The table below summarizes key financial ratios for Tractor Supply Company (TSCO) over the past five fiscal years, providing insight into profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 7.8% | 7.7% | 7.6% | 7.4% | 7.1% |

| ROE | 49.8% | 53.3% | 51.5% | 48.5% | 42.5% |

| ROIC | 16.9% | 17.2% | 15.5% | 14.5% | 13.1% |

| P/E | 27.5 | 23.0 | 21.2 | 26.6 | 24.2 |

| P/B | 13.7 | 12.3 | 10.9 | 12.9 | 10.3 |

| Current Ratio | 1.57 | 1.33 | 1.50 | 1.43 | 1.34 |

| Quick Ratio | 0.51 | 0.19 | 0.28 | 0.20 | 0.16 |

| D/E (Debt-to-Equity) | 2.0 | 2.1 | 2.3 | 2.4 | 3.7 |

| Debt-to-Assets | 50.5% | 50.3% | 54.8% | 55.3% | 88.1% |

| Interest Coverage | 49.1x | 46.8x | 31.8x | 26.9x | 21.2x |

| Asset Turnover | 1.64 | 1.67 | 1.58 | 1.52 | 1.42 |

| Fixed Asset Turnover | 2.89 | 2.82 | 2.61 | 2.42 | 2.23 |

| Dividend Yield | 0.87% | 1.64% | 1.92% | 1.61% | 1.84% |

Evolution of Financial Ratios

Tractor Supply’s Return on Equity (ROE) peaked near 53% in 2022, then declined to 42.5% by 2025, signaling easing profitability. The Current Ratio steadily decreased from 1.57 in 2021 to 1.34 in 2025, indicating slightly reduced liquidity. Debt-to-Equity rose sharply from 1.96 in 2021 to 3.73 in 2025, reflecting increased leverage.

Are the Financial Ratios Fovorable?

In 2025, profitability is mixed: ROE and ROIC exceed the 6.14% WACC, marking strength, while net margin is neutral at 7.06%. Liquidity ratios are neutral or unfavorable, with a current ratio of 1.34 but a weak quick ratio at 0.16. Leverage is high, with debt-to-equity at 3.73 and debt-to-assets at 88.1%, both unfavorable. Asset turnover and interest coverage remain favorable, supporting operational efficiency and debt servicing. Overall, ratios tilt slightly favorable.

Shareholder Return Policy

Tractor Supply Company maintains a dividend payout ratio around 40-45%, with a stable dividend per share growth and a yield near 1.8%. Share buybacks are also part of the capital return strategy, supported by free cash flow coverage exceeding dividend payments plus capex.

This disciplined distribution approach balances shareholder returns with reinvestment needs. The dividend and buyback policy appears sustainable, aligning with steady profitability and cash flow margins, thus supporting long-term shareholder value creation without overextending financial leverage.

Score analysis

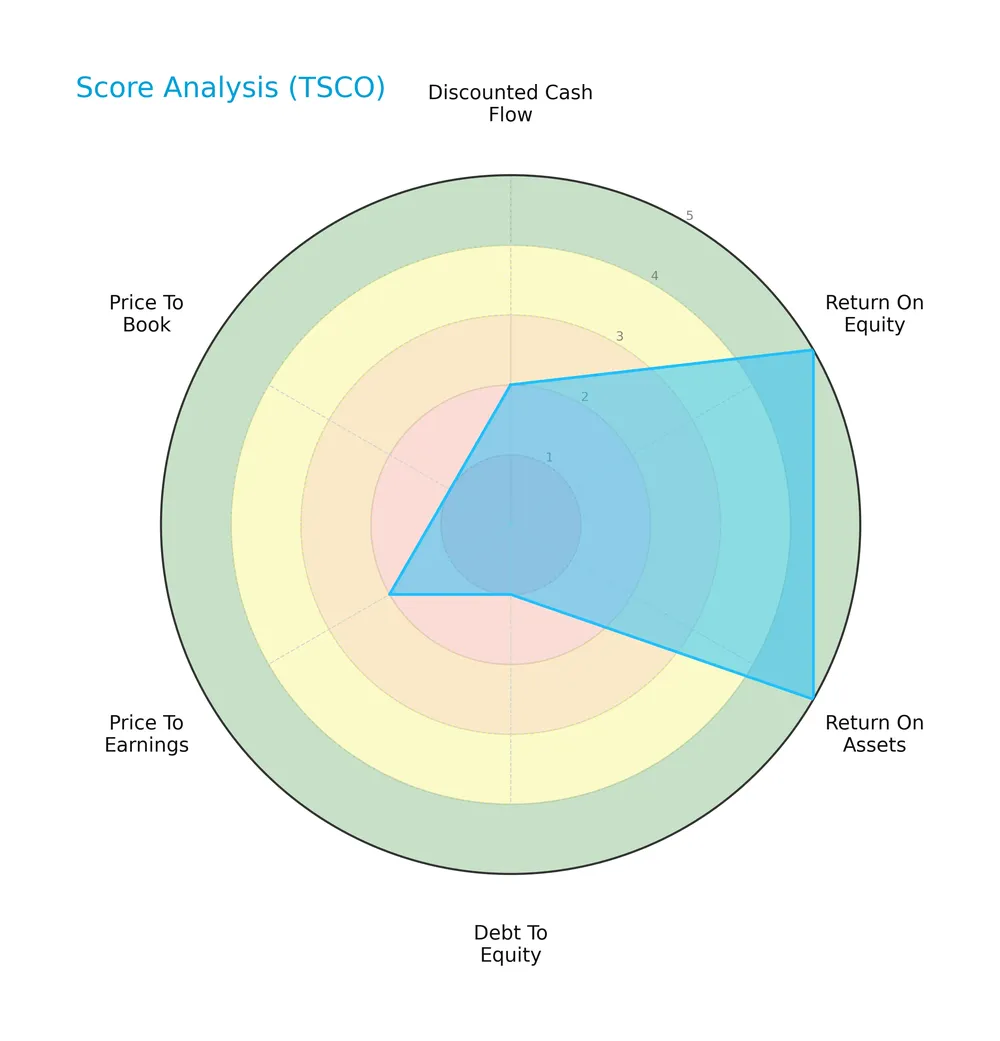

The following radar chart illustrates Tractor Supply Company’s key financial scores across valuation, profitability, and leverage metrics:

Tractor Supply shows strong returns with high scores in ROE and ROA at 5 each. However, valuation metrics like discounted cash flow, P/E, and P/B scores range from unfavorable to very unfavorable. The debt-to-equity score is very low at 1, indicating heavy leverage concerns.

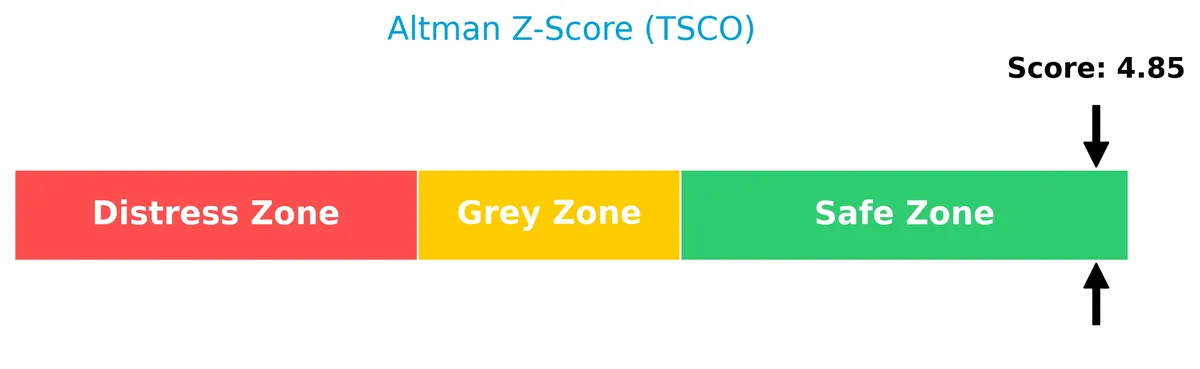

Analysis of the company’s bankruptcy risk

Tractor Supply’s Altman Z-Score places it confidently in the safe zone, signaling low bankruptcy risk and solid financial stability:

Is the company in good financial health?

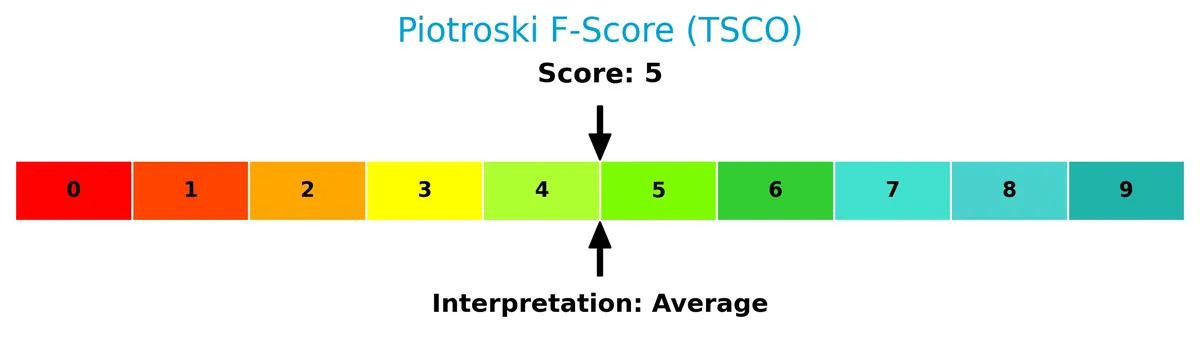

The Piotroski Score diagram highlights Tractor Supply’s financial health based on profitability, leverage, and efficiency criteria:

With a Piotroski Score of 5, Tractor Supply demonstrates average financial strength. This score suggests moderate stability but also room for improvement in operational efficiency and balance sheet quality.

Competitive Landscape & Sector Positioning

This analysis explores Tractor Supply Company’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether the company holds a competitive advantage over its peers.

Strategic Positioning

Tractor Supply Company concentrates on rural lifestyle retail, with a diversified product portfolio spanning livestock, pet, agriculture, clothing, hardware, and seasonal goods. It operates over 2,000 stores primarily in the US, focusing on serving recreational farmers and rural consumers under multiple brand names.

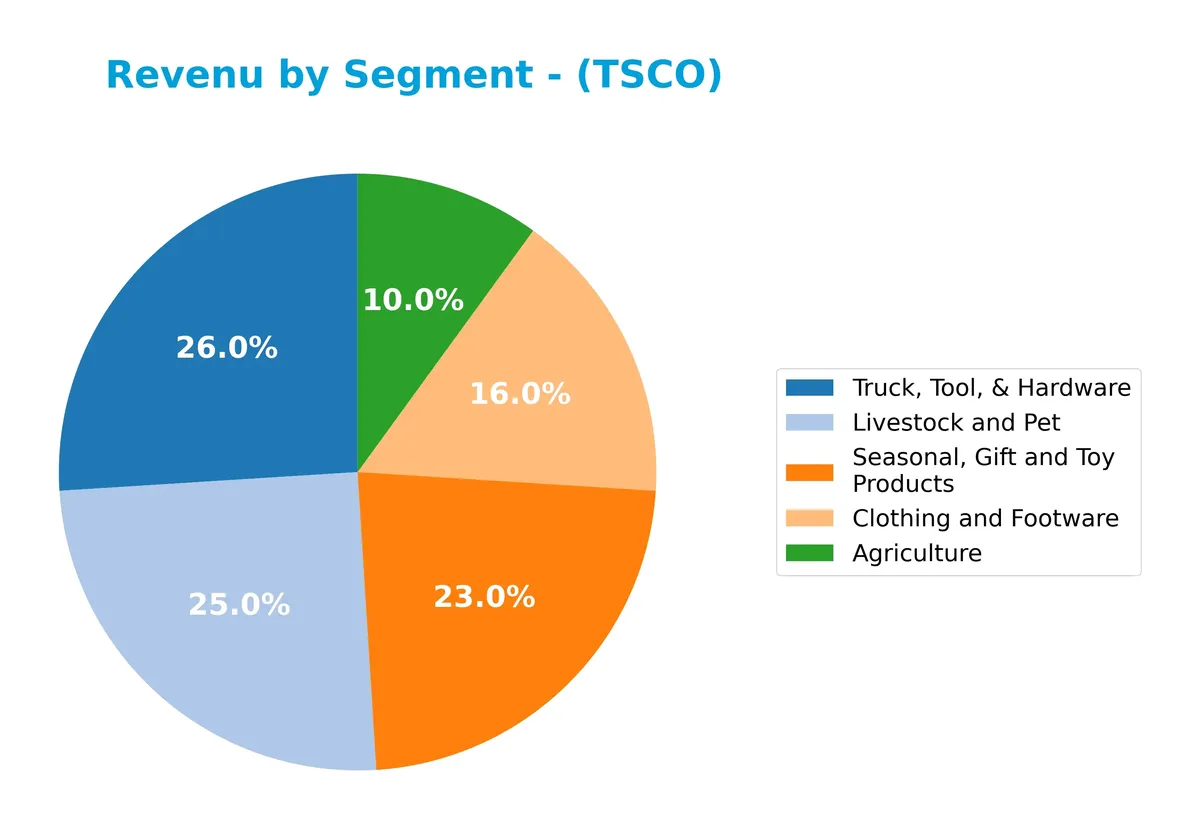

Revenue by Segment

This pie chart illustrates Tractor Supply Company’s revenue breakdown by product segment for the fiscal year 2024, highlighting the diverse sources of its sales.

In 2024, Truck, Tool, & Hardware leads revenue at 3.87B, followed closely by Seasonal, Gift and Toy Products at 3.42B and Livestock and Pet at 3.72B. Clothing and Footwear also contributes significantly with 2.38B. Agriculture, while smaller at 1.49B, shows steady growth over the years, indicating a balanced portfolio with no excessive concentration risk. Recent trends suggest steady expansion across all key segments.

Key Products & Brands

Tractor Supply Company’s product portfolio spans essential rural lifestyle categories, including proprietary and exclusive brands:

| Product | Description |

|---|---|

| Agriculture | Products for farming needs including equine, livestock, and small animal health, care, and growth. |

| Clothing and Footwear | Work and recreational apparel and footwear designed for outdoor and rural use. |

| Truck, Tool, & Hardware | Hardware, truck accessories, towing equipment, and tools for maintenance and repair. |

| Livestock and Pet | Supplies for pets and livestock, including food, health, and containment products. |

| Seasonal, Gift and Toy Products | Seasonal items like heating products, lawn and garden equipment, gifts, and toys. |

| Brands | Proprietary brands include 4health, Producer’s Pride, American Farmworks, Red Shed, and others. |

Tractor Supply’s diverse product range addresses broad rural lifestyle needs. Its proprietary brands enhance differentiation in a competitive specialty retail sector.

Main Competitors

The sector includes 10 main competitors, with the table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amazon.com, Inc. | 2.42T |

| Alibaba Group Holding Limited | 340B |

| PDD Holdings Inc. | 159B |

| MercadoLibre, Inc. | 102B |

| eBay Inc. | 39.4B |

| Ulta Beauty, Inc. | 27.8B |

| Tractor Supply Company | 26.9B |

| Williams-Sonoma, Inc. | 23.0B |

| Genuine Parts Company | 17.2B |

| Best Buy Co., Inc. | 14.5B |

Tractor Supply Company ranks 7th among its peers. Its market cap is just 1.21% of Amazon’s, the leader. The company sits below both the average market cap of the top 10 (317B) and the sector median (33.6B). It trails closely behind Ulta Beauty by about 5.4%, indicating a narrow gap with its nearest competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does TSCO have a competitive advantage?

Tractor Supply Company presents a slight competitive advantage with a ROIC exceeding its WACC by nearly 7%, indicating efficient capital use and value creation. However, its declining ROIC trend signals pressure on sustained profitability.

Looking ahead, TSCO’s broad product portfolio and multi-brand presence position it well for growth across rural lifestyle markets. Expansion opportunities in Petsense stores and online channels could bolster future revenue streams amid evolving consumer needs.

SWOT Analysis

This SWOT analysis highlights Tractor Supply Company’s core competitive positions and challenges to guide strategic decisions.

Strengths

- Strong brand presence in rural lifestyle retail

- Favorable ROE at 42.5% indicating efficient capital use

- Operating in a stable, niche market with loyal customers

Weaknesses

- High debt-to-equity ratio at 3.73 signals financial risk

- Declining ROIC trend warns of eroding profitability

- Weak quick ratio (0.16) raises liquidity concerns

Opportunities

- Expansion potential through e-commerce and Petsense growth

- Growing demand for agricultural and pet products

- Ability to leverage private label brands for margin improvement

Threats

- Intense competition from big-box and online retailers

- Economic downturns could reduce discretionary spending

- Rising interest rates increasing debt servicing costs

Tractor Supply demonstrates a robust market position but faces financial leverage and profitability pressures. Its strategy must focus on debt management and capitalizing on digital growth to sustain value creation.

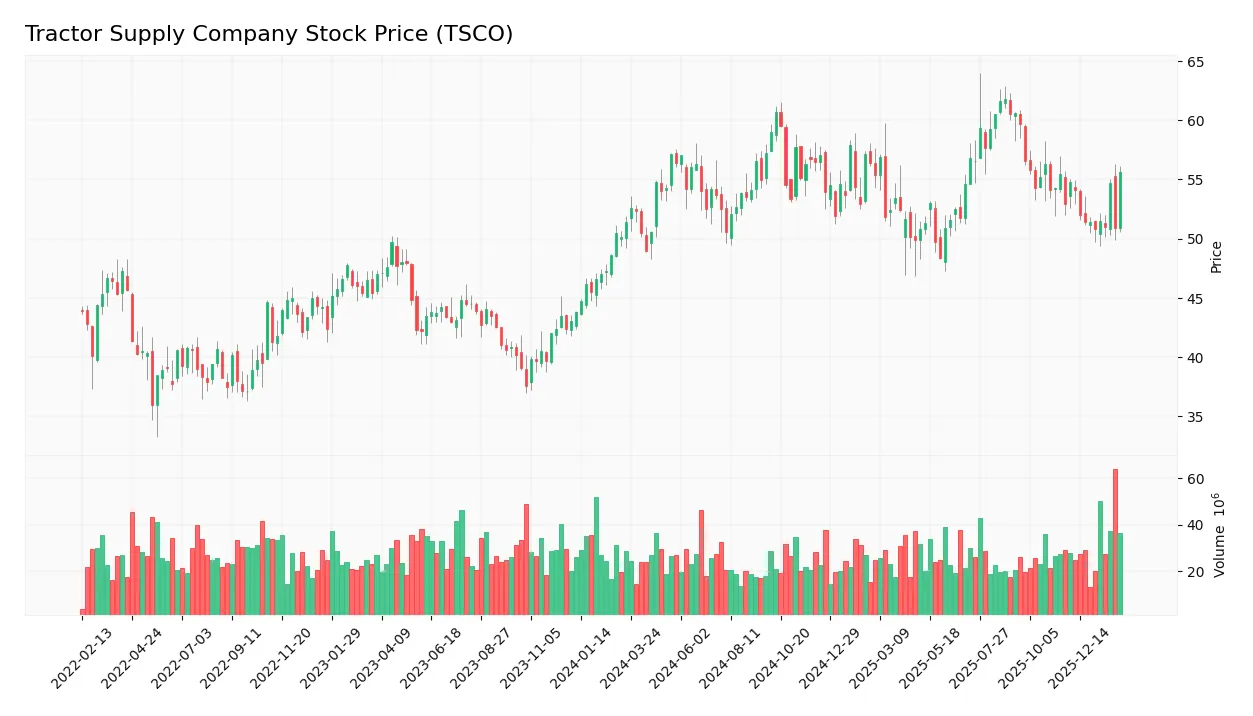

Stock Price Action Analysis

The weekly stock chart for Tractor Supply Company (TSCO) shows price movements and volume patterns over the past 12 months:

Trend Analysis

Over the past 12 months, TSCO’s stock price rose 8.13%, indicating a bullish trend. The price peaked at 61.76 and bottomed at 48.4. Volatility, measured by a 2.97 standard deviation, remains moderate. However, the trend shows signs of deceleration despite overall gains.

Volume Analysis

In the last three months, seller volume dominated at 60.66%, with buyer volume at 39.34%. Trading activity decreased in buyer participation, signaling seller-driven pressure. Despite an increasing volume trend overall, recent market sentiment appears cautious, reflecting weaker investor conviction.

Target Prices

Analysts set a clear consensus for Tractor Supply Company’s stock price range.

| Target Low | Target High | Consensus |

|---|---|---|

| 50 | 67 | 59 |

The target prices suggest moderate upside potential, reflecting confidence balanced with caution among analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews Tractor Supply Company’s analyst ratings and consumer feedback to assess market perceptions and sentiment.

Stock Grades

Here are the latest verified grades for Tractor Supply Company from reputable financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Maintain | Buy | 2026-02-02 |

| Telsey Advisory Group | Maintain | Outperform | 2026-01-30 |

| TD Cowen | Maintain | Hold | 2026-01-30 |

| JP Morgan | Maintain | Neutral | 2026-01-30 |

| Piper Sandler | Maintain | Overweight | 2026-01-30 |

| Mizuho | Maintain | Outperform | 2026-01-30 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-30 |

| Jefferies | Maintain | Buy | 2026-01-30 |

| Goldman Sachs | Maintain | Buy | 2026-01-30 |

| DA Davidson | Maintain | Buy | 2026-01-30 |

The overall trend reflects a positive tilt with multiple buy and outperform ratings. A minority of hold and neutral grades indicate some caution but no significant negative sentiment.

Consumer Opinions

Tractor Supply Company (TSCO) consistently wins praise for its customer-centric approach and product range.

| Positive Reviews | Negative Reviews |

|---|---|

| Wide variety of farming and ranch supplies | Limited store locations in urban areas |

| Helpful and knowledgeable staff | Occasional stock shortages on popular items |

| Competitive pricing on outdoor and pet products | Checkout lines can be long during peak seasons |

Consumers applaud TSCO’s expertise and product diversity but note room for improvement in inventory management and store accessibility. Overall, the brand resonates strongly with rural and suburban shoppers.

Risk Analysis

Below is a summary table highlighting key risks Tractor Supply Company faces in 2026:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Leverage Risk | Extremely high debt-to-assets ratio (88%) increases financial risk | High | High |

| Liquidity Risk | Low quick ratio (0.16) signals weak short-term liquidity | Medium | Medium |

| Valuation Risk | Unfavorable price-to-book ratio (10.27) suggests overvaluation | Medium | Medium |

| Market Cyclicality | Consumer cyclical sector exposure risks during economic downturns | Medium | Medium |

| Operational Risk | Dependence on rural lifestyle retail limits diversification | Low | Medium |

Leverage risk stands out as the most critical threat. Tractor Supply’s 88% debt-to-assets ratio far exceeds prudent levels, raising solvency concerns despite a strong Altman Z-score. Its weak quick ratio amplifies liquidity risk. Valuation remains stretched versus peers, warranting caution.

Should You Buy Tractor Supply Company?

Tractor Supply Company appears to be in a very favorable rating category with a slightly favorable moat, supported by solid value creation despite a declining ROIC trend. While profitability remains robust, its leverage profile could be seen as substantial, suggesting cautious operational efficiency assessment.

Strength & Efficiency Pillars

Tractor Supply Company exhibits solid profitability with a return on equity of 42.46% and a net margin of 7.06%. Its return on invested capital (13.11%) comfortably exceeds its weighted average cost of capital (6.14%), confirming the company as a clear value creator. Operational efficiency is reinforced by a favorable interest coverage ratio of 21.22 and asset turnover of 1.42. These metrics suggest Tractor Supply effectively converts capital into profit while maintaining manageable financing costs.

Weaknesses and Drawbacks

While Tractor Supply is financially stable with an Altman Z-Score of 4.85 placing it in the safe zone, several valuation and leverage concerns persist. The price-to-book ratio stands at an elevated 10.27, signaling an expensive market valuation relative to book value. Debt-to-equity ratio at 3.73 and a quick ratio of just 0.16 highlight considerable leverage and limited short-term liquidity, increasing vulnerability to credit tightening. Recent market activity shows seller dominance (39.34% buyers), indicating short-term selling pressure that could weigh on the stock.

Our Final Verdict about Tractor Supply Company

Tractor Supply Company presents a fundamentally sound profile with clear value creation and adequate financial safety. Despite a bullish long-term price trend, recent seller dominance suggests investors might adopt a cautious, wait-and-see stance for a more favorable entry. The company’s solid operational metrics could appeal to long-term investors, but elevated leverage and valuation warrant prudence.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Envestnet Asset Management Inc. Buys 60,035 Shares of Tractor Supply Company $TSCO – MarketBeat (Feb 06, 2026)

- Tractor Supply Company Donates 200K to Support Winter Storm Recovery – Wilson County Source (Feb 06, 2026)

- Should You Expect Increased Earnings Growth in Tractor Supply Company (TSCO)? – Yahoo Finance (Jan 19, 2026)

- Tractor Supply Company Declares Quarterly Dividend – Tractor Supply (Aug 07, 2025)

- Tractor Supply traffic soars ahead of massive winter storm (TSCO:NASDAQ) – Seeking Alpha (Jan 23, 2026)

For more information about Tractor Supply Company, please visit the official website: tractorsupply.com